The global N-Methyl Pyrrolidone (NMP) market is projected to expand steadily over the next decade, driven by rising demand from key end-use industries such as electronics, chemicals, pharmaceuticals, and paints and coatings. NMP, a highly versatile solvent, is valued for its excellent solvency, low volatility, and thermal stability.

These properties make it a preferred choice for applications including lithium-ion battery production, polymer processing, and surface coatings. With the increasing adoption of electric vehicles and the growing need for high-performance batteries, NMP demand is expected to see consistent growth.

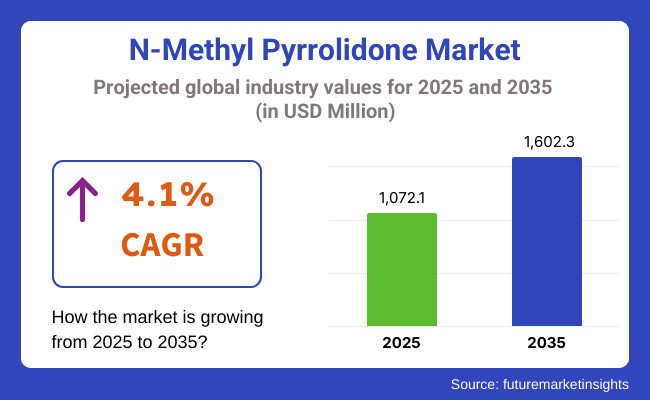

Additionally, ongoing research into eco-friendly and safer formulations is further shaping the market’s development through 2035. In 2025, the global NMP market was estimated at approximately USD 1,072.1 Million. By 2035, it is projected to grow to around USD 1,602.3 Million, reflecting a compound annual growth rate (CAGR) of 4.1%.

With a well-established electronics industry, sound lithium-ion battery production, and strong chemical manufacturers, North America continues to be an important market for NMP. Stable demand from advanced battery technologies and high-performance coatings is being particularly witnessed in the United States. Also, the region’s emphasis on sustainability and ongoing investments in cleaner battery chemistries are reshaping NMP consumption trends.

The other major market is Europe, which is known for its strict environmental rules and increasing investment in green technologies. Germany, France and the United Kingdom are already taking the lead in introducing NMP within battery manufacturing and specialty chemical production. Steady demand for NMP as a key solvent in battery production and other advanced applications is buoyed by the region's renewables focus and transition to EVs.

Asia-Pacific is projected to be the fastest-growing market for NMP due to rapid industrialization, increased consumer electronics demand, and growing electric vehicle production. NMP consumption is led by China, Japan, and South Korea countries that dominate the global lithium-ion battery supply chain.

Asia-Pacific will continue to be a dominating region for global NMP demand due to substantial investment in battery manufacturing capacity, as well as steady growth in the electronics and semiconductor industries.

Challenges

Stringent Environmental Regulations, Health Concerns, and Supply Chain Volatility

The global N-Methyl Pyrrolidone (NMP) Market is challenged by a number of impossibilities, among which the imposition of strict environmental and health regulations regarding the use of solvent-based chemicals is considered a major threat. Future regulations from bodies like EPA, REACH (EU), and OSHA restrict NMP use due to concerns over toxicity and VOC emissions, the later creating liability and compliance for manufacturers.

Supply chain volatility is another challenge, as NMP production is dependent on petrochemical-based raw materials sensitive to crude oil prices, geopolitical instability, and trade restrictions. Moreover, the limited accessibility of cleaner yet economical replacements complicates matters when industries attempt to extricate traditional solvents in favor of efficiency, such as in lithium-ion battery production, pharmaceuticals, and electronics.

Opportunities

Growth in EV Battery Production, Green Solvent Innovations, and AI-Driven Chemical Engineering

Despite this, the NMP Market is poised to grow substantially as it continues to propel EV battery production, the development of green solvents, and AI-powered chemical formulations, all of which will support the broader deceptive economy.

NMP is a common solvent in lithium-ion battery manufacturing for handling cathode material, which is important for global energy transition. The emergence of bio-derived and greener solvent substitutes also offers new possibilities in the realm of green chemistry for applications in sectors such as pharmaceuticals, coatings, petrochemical processing etc.

By delivering real-time insights into solvent usage and replenishment, AI-based chemical process optimization software is also helping to enhance waste recovery and enable efficient recycling for NMP applications across industries.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with EPA, REACH, and OSHA restrictions on hazardous solvent exposure. |

| Consumer Trends | Demand for NMP in lithium-ion battery production, pharmaceuticals, and industrial coatings. |

| Industry Adoption | High use in electronic component manufacturing, oil refining, and polymer coatings. |

| Supply Chain and Sourcing | Dependence on petroleum-derived raw materials and global chemical supply chains. |

| Market Competition | Dominated by petrochemical manufacturers, battery material suppliers, and pharmaceutical solvent producers. |

| Market Growth Drivers | Growth fueled by expansion of EV production, rising demand for high-performance solvents, and industrial processing needs. |

| Sustainability and Environmental Impact | Moderate adoption of low-VOC formulations and solvent recovery technologies. |

| Integration of Smart Technologies | Early adoption of AI-powered process optimization, machine learning-based chemical safety monitoring, and blockchain-based regulatory compliance. |

| Advancements in Chemical Engineering | Development of high-purity NMP for battery processing, pharmaceutical formulations, and coatings. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter carbon-neutral solvent mandates, AI-driven regulatory tracking, and sustainable chemical processing laws. |

| Consumer Trends | Growth in low-toxicity solvent alternatives, AI-optimized battery material processing, and sustainable industrial chemistry. |

| Industry Adoption | Expansion into bio-based solvents, AI-enhanced material engineering, and next-gen battery electrolyte formulations. |

| Supply Chain and Sourcing | Shift toward bio-based chemical production, circular economy solvent recovery, and AI-assisted supply chain tracking. |

| Market Competition | Entry of sustainable solvent startups, AI-powered material innovation firms, and green chemistry technology developers. |

| Market Growth Drivers | Accelerated by AI-driven chemical recycling, biodegradable solvent formulations, and lithium-ion battery innovation. |

| Sustainability and Environmental Impact | Large-scale shift toward zero-emission solvent production, bio-derived chemical synthesis, and AI-assisted green solvent development. |

| Integration of Smart Technologies | Expansion into real-time environmental impact tracking, AI-driven predictive chemical analytics, and smart chemical management systems. |

| Advancements in Chemical Engineering | Evolution toward self-regenerating solvents, AI-enhanced material sustainability modeling, and biodegradable solvent technology. |

The demand in the market is driven by rapid growth in the EV battery sector and semiconductor industry. Nevertheless, pressure from the regulators in terms of environmental and health concerns is driving investment in alternatives involving bio-based or safer solvents.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

A primary driver of growth of the NMP market in the UK is its use in the pharmaceutical, paints & coatings, and electronic component industries. The demand for NMP based battery solvent is principally influenced by the growing EV and renewable energy sectors. Nevertheless, stringent EU and UK controls on solvent emissions and worker safety are proving motivating factors in a move toward greener alternatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

The NMP market is steadily gaining traction across the European Union, backed by its applications in petrochemicals, polymers, and agrochemicals. However, growing concerns about NMP's environmental and health effects due to stringent REACH regulations has led most manufacturers to pursue low-toxicity and bio-based solvent innovations.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.1% |

The NMP market in Japan is showing slow growth, owing to the advancements made in the battery technology, electronics, and pharmaceutical industries. Its strong semiconductor and lithium-ion battery sectors are driving NMP usage. Also, sustainability initiatives are driving interest in green and low-hazard solvent formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

The NMP market is growing in South Korea owing to the rapid industrialization, increasing lithium-ion battery production, and growth in semiconductor manufacturing. Chinese EV battery families are the key drivers of NMP demand for electrolyte formulations in the country. And government incentives for clean energy and greener industrial chemicals are driving research into safer substitutes.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

NMP is a high-polarity aprotic solvent commonly used in manufacturing lithium-ion batteries, cleaning circuit boards, drug formulations, and polymer processing, thus becoming an important chemical in many industries and applications.

As investments in electronic device production increase, demand for energy storage solutions rises, and industrial cleaning applications expand, producers are shifting toward developing high-purity NMP formulations, compliance with regulatory requirements, and sustainability-driven solvent recovery technologies.

Based on Grade, the market is bifurcated into Standard, Electronics, Pharmaceutical, Others; Based on Application, the market is further segmented into Petrochemical Processing, Paints & Coatings, Industrial Cleaners, Electronics, Agrochemicals, Pharmaceuticals, Others.

NMP is a popular solvent for semiconductor processing, PCB cleaning, and lithium-ion battery that is why the electronics grade segment is the leader with the largest market share. NMP comes in various purities, but only high-purity NMP is able to provide the best conductivity, the smallest level of impurities, and the best dissolvable properties, thus high purity NMP is a key ingredient in high-end electronic manufacturing processes.

As demand for electric vehicles (EVs) rises, consumer electronics continue to advance rapidly, and semiconductor production expands, manufacturers are focusing on ultra-pure NMP formulations to meet the stringent requirements of industry-specific standards applicable to both chip fabrication and battery electrolyte solutions. Growth in global lithium-ion battery supply chains is driving demand for electronics-grade NMP even further as it is used in the processing of anode and cathode materials.

Significant growth is also being seen in the pharmaceutical grade segment, these properties lend themselves to drug formulation, active pharmaceutical ingredient (API) production and controlled-release drug delivery systems. It is an excellent solvent for topical, oral and injectable drug formulations and has great bioavailability properties with drug solubility characteristics.

As a result of growing R&D in new drug delivery technologies, as well as increased manufacturing of generic drugs and growing requirement for biopharmaceutical formulations, adoption of pharmaceutical-grade NMP in drug production processes compliant with FDA and EU regulations is increasing.

NMP is used widely for extraction, refining, and gas treatment processes, thereby making Petrochemical Processing segment the largest segment for NMP Market. NMP is taken as an effective solvent for impurity removal, hydrocarbon separation, and lubricant production.

Now with an increasing energy demand globally, along with expanding petrochemical refineries, demand for NMP, particularly in the process of aromatic hydrocarbon recovery, desulfurization and lubricant base oil processing, is fueling due to increasing adoption of solvent-based extraction techniques. This is further boosting development of cleaner fuel technologies as well as advanced refining techniques, which is driving NMP-based petrochemical applications.

Electronics demand is also robust, including circuit board etching, capacitor film and lithium-ion battery electrolyte solutions. The NMP is a key solvent for preparing high-energy-density batteries, flexible display materials, and conductive polymers applications.

Demand for NMP-based semiconductor and battery processing solutions are expected to surge as world-wide investments in 5G infrastructure, next-generation consumer electronics, and sustainable battery technology increase.

The N-Methyl Pyrrolidone (NMP) market is expanding due to increasing demand for high-performance solvents in electronics, pharmaceuticals, petrochemicals, and lithium-ion battery production. Growth is driven by advancements in AI-powered chemical process optimization, stringent environmental regulations, and rising adoption in sustainable manufacturing.

Companies are focusing on high-purity NMP production, AI-assisted chemical recovery, and regulatory-compliant green alternatives to enhance solvent efficiency, sustainability, and industrial safety.

Market Share Analysis by Key Players & NMP Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 18-22% |

| LyondellBasell Industries N.V. | 12-16% |

| Ashland Global Holdings Inc. | 10-14% |

| Mitsubishi Chemical Corporation | 8-12% |

| Eastman Chemical Company | 5-9% |

| Other NMP Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Develops AI-optimized high-purity NMP for electronics, sustainable solvent recovery, and regulatory-compliant formulations. |

| LyondellBasell Industries N.V. | Specializes in NMP for polymer processing, AI-powered production efficiency, and eco-friendly solvent alternatives. |

| Ashland Global Holdings Inc. | Provides pharmaceutical-grade NMP, AI-enhanced chemical purification, and low-toxicity solvent solutions. |

| Mitsubishi Chemical Corporation | Focuses on high-performance NMP for lithium-ion batteries, AI-powered recycling processes, and industrial-scale NMP production. |

| Eastman Chemical Company | Offers AI-assisted NMP solvent recovery, specialty-grade NMP for coatings, and environmentally sustainable formulations. |

Key Market Insights

BASF SE (18-22%)

BASF leads the NMP market, offering AI-powered chemical purification, high-purity solvent production, and sustainable solvent recovery solutions.

LyondellBasell Industries N.V. (12-16%)

LyondellBasell specializes in polymer-grade NMP, ensuring AI-enhanced manufacturing efficiency and regulatory compliance in industrial applications.

Ashland Global Holdings Inc. (10-14%)

Ashland provides pharmaceutical-grade NMP, optimizing AI-assisted chemical stability, solvent recycling, and eco-friendly process development.

Mitsubishi Chemical Corporation (8-12%)

Mitsubishi focuses on NMP applications in lithium-ion batteries, integrating AI-driven process optimization and sustainable solvent management.

Eastman Chemical Company (5-9%)

Eastman develops high-performance NMP solvents, ensuring AI-assisted safety monitoring, industrial-grade purity, and sustainable solvent recovery innovations.

Other Key Players (30-40% Combined)

Several chemical manufacturers, solvent suppliers, and specialty material companies contribute to next-generation NMP innovations, AI-powered production advancements, and sustainable solvent alternatives. These include:

The overall market size for the n-methyl pyrrolidone (NMP) market was USD 1,072.1 Million in 2025.

The n-methyl pyrrolidone (NMP) market is expected to reach USD 1,602.3 Million in 2035.

Growth is driven by the rising demand in lithium-ion battery production, increasing use as a solvent in the pharmaceutical and petrochemical industries, and growing applications in paints, coatings, and electronics manufacturing.

The top 5 countries driving the development of the n-methyl pyrrolidone (NMP) market are the USA, China, Germany, Japan, and South Korea.

Electronics Grade and Petrochemical Processing are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 22: Europe Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 28: Asia Pacific Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 34: MEA Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Grade, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Grade, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Grade, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Grade, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 63: Europe Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Grade, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Grade, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Grade, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Grade, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 99: MEA Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Grade, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

N-Methyl-2-Pyrrolidone Market Trends – Size, Demand & Forecast 2024–2034

N-Ethyl-2-Pyrrolidone Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA