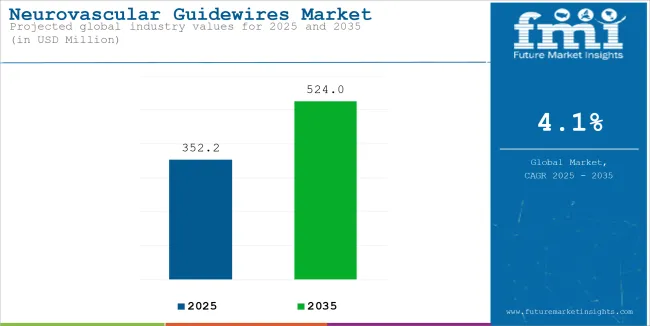

The global sales of neurovascular guidewires is estimated to be worth USD 352.2 million in 2025 and anticipated to reach a value of USD 524.0 million by 2035. Sales are projected to rise at a CAGR of 4.1% over the forecast period between 2025 and 2035. The revenue generated by neurovascular guidewires in 2024 was USD 339.4 million.

Neurovascular guidewires are medical tools to be used in procedures involving the delicate blood vessels in the brain and spinal cord. These thin, flexible wires help enable physicians for advancing catheters and other devices and provide precise control for treating conditions like aneurysms, arteriovenous malformations, and ischemic strokes.

These medical devices are made from materials like nitinol or stainless steel, and have hydrophilic or hydrophobic materials as a coat in order to help maneuver it without causing any kind of friction between the blood vessel and guidewires. Increased prevalence of neurovascular diseases due to old age, changing lifestyle, etc. is thus boosting the neurovascular guidewires market.

Global Neurovascular Guidewires Industry Analysis

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 339.4 million |

| Estimated Size, 2025 | USD 352.2 million |

| Projected Size, 2035 | USD 524.0 million |

| CAGR (2025 to 2035) | 4.1% |

This increased preference for minimal invasive procedures contributes to the rising neurovascular guidewires market. Minimally invasive procedures have revolutionized the neurovascular interventional field because they are considered safer and less traumatic compared with traditional open surgery.

Most procedures are conducted by utilizing advanced devices, including neurovascular guidewires, through which it becomes possible to advance accurately through the intricate vascular structure of the brain and spinal cord.

Patients prefer these techniques because they have shorter hospital stays, faster recovery times, and fewer post-operative complications such as pain and scarring. Healthcare providers also prefer minimally invasive approaches because they improve patient outcomes, reduce procedure times, and optimize resource utilization.

Neurovascular guidewires are the tools that permit these procedures since they offer control and flexibility, which are factors that enable better navigation through intricate anatomical structures. Hydrophilic coatings and shapeable tips are few new technologies in guidewires, making them very useful in surgeries that are conducted minimally invasive.

The increasing incidence of neurovascular diseases such as strokes and aneurysms, along with the growing consciousness of advanced medical treatments, contributes to the surging demand in the global scale. Moreover, demographic changes and prevalence of lifestyle conditions are also promoting the demand for safer and more minimally invasive treatment methods; hence, making minimally invasive techniques a fundamental driver in the market.

The global cytotoxic drugs market's compound annual growth rate (CAGR) for the first half of 2024 and 2025 is compared in the table below. This analysis provides important insights into the performance of the industry by highlighting significant shifts and trends in revenue generation.

The first half (H1) is the period from January to June, and the second half (H2) is July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.2%, followed by a slightly lower growth rate of 4.8% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 5.2% (2024 to 2034) |

| H2 | 4.8% (2024 to 2034) |

| H1 | 4.1% (2025 to 2035) |

| H2 | 3.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.1% in the first half and remain relatively moderate at 3.7% in the second half. In the first half (H1) the industry witnessed a decrease of 110 BPS while in the second half (H2), the industry witnessed a decrease of 110 BPS.

Rising prevalence of neurovascular disorders is driving the market growth

Increased prevalence of neurovascular diseases is among the primary growth contributors for neurovascular guidewires. Stroke, aneurysms, and AVMs are now increasingly diagnosed in association with aging population, sedentary lifestyle, increased hypertension rates, diabetes rates, and obesity.

The disorders often need immediate and accurate interventions to avoid complications that may prove fatal or result in permanent neurological damage.

Neurovascular guidewires is a primary tool for minimally invasive medical procedures, especially in endovascular coiling, stenting, and thrombectomy used in treating this condition, these guidewires are critical navigation tools to safely reach complex locations within the cerebrovascular architecture.

Neurovascular conditions diagnosed every year lead to a demand that is on par with improved capabilities of advanced flexible guidewires that also can provide superior flexibility, control, and safety of execution.

Further, advancements in imaging and diagnostic technologies have improved the detection of neurovascular disorders, thereby enabling earlier intervention and higher volumes of procedures. The better management of these conditions through healthcare systems would thus increase demand for reliable and efficient tools like neurovascular guidewires, a key driver for the expansion of this market.

Rising awareness campaigns for neurovascular disease is driving the industry growth

Increased neurovascular disease awareness campaigns act as a robust growth driver of the market. As governments, healthcare organizations, and advocacy groups increase efforts to raise awareness about stroke prevention and the early detection of neurovascular disorders, more individuals are seeking timely medical attention.

Thereby, most patients with high risk factors on ischemic stroke, aneurysm, or arteriovenous malformations get high rates of detection and treatment before progressing further.

The patients will have a higher chance to be treated with minimally invasive procedures, like endovascular thrombectomy or aneurysm coiling, where guidewires have significant functions. Guidewires are indispensable in such procedures, as they allow navigation at the submillimeter precision in the vascular pathway toward the target site, especially in delicate and complex neurovascular regions.

The increasing numbers of patients identified at earlier stages are fueling market growth, with greater demands on high-performance guidewires with improved flexibility, maneuverability, and precision.

Early interventions also increase patient outcomes with the help of cost cutting regarding long-term healthcare. This will also enhance the adoption rate for neurovascular guidewires in both developed and emerging markets.

Development of multi-functional guidewires act as an opportunity in the market

Multi-functional guidewires are an area of major opportunity in the neurovascular guidewires market. These advanced guidewires combine several functions such as navigation, therapeutic drug delivery, or facilitating thrombectomy in a single device. Thus, multi-functional guidewires can simplify the complexity of neurovascular procedures by being more efficient and reducing the need for multiple tools during surgery.

This has the effect of reducing procedure time, thereby limiting the time under anesthesia for the patient and ultimately enhancing safety overall.

Multi-function guidewires can also better improve patient outcome through precise and targeted delivery of treatments, such as clot-busting drugs directly to the site of a stroke or aneurysm. The innovation is especially valuable in emergency situations wherein time counts, and the ability to accomplish several functions in one step can make all the difference for the overall success of the procedure.

Moreover, these guidewires also simplify procedures, making it less complicated, which could consequently lower the chance of complications such as vessel damage or infection. As demand for minimally invasive, efficient and safe procedures continues to rise, the development of multi-functional guidewires presents an exciting opportunity for growth in the market.

High cost of advanced neurovascular guidewires may restrict market growth

Advanced neurovascular guidewires are also relatively costly and is the biggest restraint in the market. Special features such as a hydrophilic coating, shape memory alloys, or an advanced material like nitinol in guidewires cost more than a standard guidewire.

This enhances the guidewires' performance by making them flexible, maneuverable, and precise in handling challenging neurovascular procedures. However, their higher price points limit their accessibility, particularly in lower-income regions or healthcare settings with budget constraints.

This may not enable hospitals and clinics in less advanced settings around the world to introduce guidewires across the board because of their high price points, though they improve procedural outcome in comparison. Instead, they settle for less expensive and less effective alternatives, which may not meet the same standards of precision or safety in procedures.

Smaller healthcare providers or outpatient centers may also have financial constraints to stock and use advanced guidewires, thereby slowing the overall market penetration of these innovations. This high cost of advanced guidewires will therefore hinder the widespread adoption of cutting-edge neurovascular treatments, especially in cost-sensitive regions.

The global neurovascular guidewires industry recorded a CAGR of 3.5% during the historical period between 2020 and 2024. The growth of neurovascular guidewires industry was positive as it reached a value of USD 524.0 million in 2035 from USD 352.2 million in 2025.

Open procedures via large incisions were the traditional approaches in neurological surgery, aimed at accessing the brain or spinal cord. Such procedures involved significant tissue dissection, longer recovery periods, surgical site for infections, and greater postoperative pain. Commonly used techniques included craniotomy for the treatment of conditions such as brain tumors or aneurysms.

Compared with this, current advanced techniques are non-invasive techniques, using a neurovascular guidewire, an endoscope, and robotic help. These approaches use smaller and sometimes no skin incisions as such that the tissue trauma is minimized along with faster recovery times. With advanced imaging of MRI and CT scans, there is higher accuracy in these interventions. Minimally invasive methods have less damage, fewer complications, and early recovery of patients.

Neurovascular guidewires are increasing due to advancements in guidewire materials, particularly nitinol. Nitinol is a shape-memory alloy, offering superior flexibility and strength, including greater precision in navigating complex and tortuous vascular pathways.

After deformation, it returns to its original shape; therefore, there are few chances for performance alterations in cumbersome anatomical areas. These qualities increase the accuracy of neurovascular procedures, hence enhancing the possible success rates of such procedures and lessening the opportunity of complications.

Better patient outcomes through improved maneuverability and reliability offered by advanced materials, such as nitinol, can translate into quicker recovery times and reduced complications. Continued evolution of these materials will lead to the further advancement of minimally invasive neurovascular interventions, further driving the need for high-performance guidewires.

Tier 1 companies are the industry leaders with 52.4% of the global industry. These companies stand out for having a large product portfolio and a high production capacity. These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. These companies frequently get involved in strategies such as acquisition and product launches. Prominent companies within tier 1 include Stryker, Medtronic and Boston Scientific Corporation.

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 31.4% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology.

The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include B. Braun, Cardinal Health Inc., Cook Medical Inc. and Smith+Nephew.

Compared to Tiers 1 and 2, Tier 3 companies offer cytotoxic drugs, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base. The companies such as Integra Corporation, Conmed Corporation, Terumo Corporation, and others falls under tier 3 category. They specialize in specific products and cater to niche markets, adding diversity to the industry.

The market analysis for cytotoxic drugs in various nations is covered in the section below. An analysis of important nations in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa of the world has been mentioned below. It is projected that the United States will maintain its leading position in North America through 2035, holding a value share of 81.7%. By 2035, China is expected to experience a CAGR of 5.4% in the Asia-Pacific region.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 3.7% |

| Germany | 3.3% |

| UK | 3.5% |

| France | 3.8% |

| China | 5.4% |

| South Korea | 4.9% |

| India | 5.7% |

Germany’s cytotoxic drugs market is poised to exhibit a CAGR of 3.3% between 2025 and 2035. The Germany holds highest market share in European market.

Germany's aggressive push toward the use of minimal invasive surgical practices is what driving neurovascular guidewires to a high scale. The country's advanced technology has promoted the adoption of less invasive neurovascular disorders treatment method, reducing recovery periods and risks of complications that would improve the prognosis and outcomes of patients.

Examples of endovascular treatments in neurovascular cases include aneurysm coiling, stenting, and endovascular thrombectomy for managing stroke, aneurysms, and AVMs, among others.

The requirement of these procedures involves precise navigation through the vascular system, thus necessitating the need for high-quality guidewires. Given that German healthcare providers remain committed to enhancing patient safety and efficiency, the need for neurovascular guidewires in support of such minimally invasive approaches continues to grow.

Advanced guidewires, created to be flexible and maneuverable within complex anatomical regions, represent a crucial determinant of improving procedural success. This would be because of the high standard of healthcare facilities and innovation focus in Germany. Therefore, its demand for neurovascular guidewires is growing in proportion to the preference for minimal invasive surgeries.

United States is anticipated to show a CAGR of 3.7% between 2025 and 2035.

Increasing ASCs in the United States has also become a prominent driver for neurovascular guidewires. Cost-effectiveness and shorter patient stay with efficient scheduling compared to a traditional hospital setup makes ASCs highly preferred for minimal-invasive neurovascular procedures.

Increasing outpatient treatment, especially for interventions such as thrombectomy, aneurysm coiling, and stenting, makes advanced guidewires a critical requirement for proper navigation.

ASCs have modern medical equipment, including superior neurovascular instruments, allowing safe and effective handling of complex interventions. Convenience and easy access to the ASCs has also expanded its patient population.

Value-based healthcare in the USA will focus on results and efficiency and will boost demand for guidewires in neurovascular interventions as well. This trend therefore underlines the influence of ASCs on neurovascular guidewires demand in the United States market.

China is anticipated to show a CAGR of 5.4% between 2025 and 2035.

Expansion of health care infrastructure in China, especially in rural regions, is another major growth factor for the neurovascular guidewires market. It should be noted that the presence of advanced treatment in medical setups was limited throughout rural China, but recently and because of government initiatives and expenditure, medical institutes have increased several folds in remote areas.

Currently, because many modern diagnostic as well as therapies are made widely available to more hospitals and rural clinics, the neurovascular-related procedures have greater demand especially involving strokes, aneurysm, and such other neurovascular diseases.

Advanced guidewires, such as those used in minimally invasive neurovascular procedures including thrombectomy and stenting, are used to precisely advance through the vascular system. More and more patients receive better healthcare, such as diagnostic attention, from areas in rural China, resulting in a greater number requiring these sophisticated therapies.

Reliable, precise guidewires supporting safe and effective procedures contribute to the growth of the market in China as more neurovascular care becomes available in underserved regions.

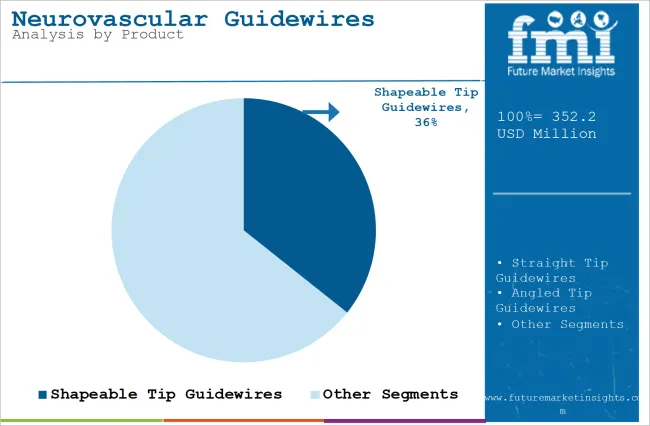

The section contains information about the leading segments in the industry. Based on product, the shapeable tip guidewires segment is expected to account for 35.7% of the global share in 2023.

| By Product | Shapeable Tip Guidewires |

|---|---|

| Value Share (2025) | 35.7% |

The shapeable tip guidewires segment is projected to be a dominating segment in terms of revenue, accounting for almost 35.7% of the market share in 2025.

Shapeable tip guidewires will most likely be predominant in the market since they offer higher flexibility and accuracy in guiding through complex neurovascular structures. Such guidewires are designed with a shaped tip of a contour that can easily fit the anatomy of any patient, facilitating a more controlled and accurate placement during procedures. This customization is more critical in neurovascular interventions, where precise navigation cannot be compromised to avoid complications and ensure successful outcomes.

The versatility of shapeable tip guidewires makes them suitable for a wide range of procedures, including thrombectomy, aneurysm coiling, and stenting, which require high levels of maneuverability in delicate areas of the brain and spinal cord. Their ability to adapt to different vascular pathways without causing trauma is a key advantage, making them the preferred choice for many healthcare providers. So, shapeable tip guidewires are likely to lead the market, followed by maximum use of effectiveness and broad applicability.

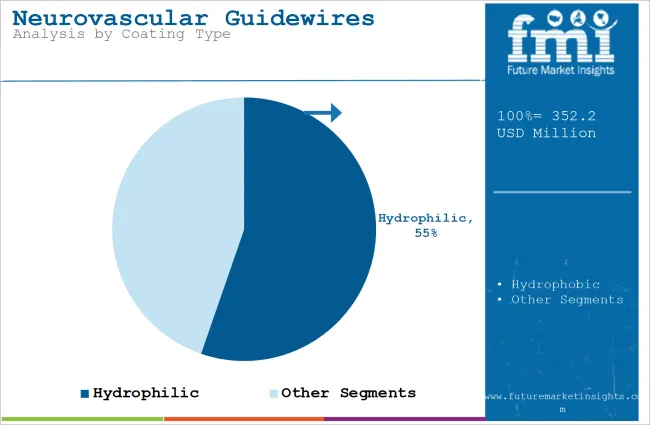

| By Coating Type | Hydrophilic |

|---|---|

| Value Share (2025) | 55.3% |

The hydrophilic segment will dominate the industry in terms of revenue, accounting for almost 55.3% of the market share in 2025.

The neurovascular guidewires hydrophilic guidewires segment is likely to dominate the market because of its superior benefits in navigating complex vascular pathways. A hydrophilic coating absorbs moisture, thereby bringing about a reduction in friction between the guidewire and vessel walls, which is vital in delicate neurovascular procedures. This coating enables a guidewire to smoothly pass through tortuous, narrow, and often inaccessible blood vessels within the brain and spinal cord, significantly reducing the risks of vessel damage or rupture.

Hydrophilic guidewires particularly reduce friction, making them useful for refining the precision and control in procedures such as thrombectomy, aneurysm coiling, and stenting. Since such procedures require high accuracy, using hydrophilic guidewires allows clinicians to maneuver through challenging anatomical areas more easily and safely. For this reason, hydrophilic guidewires are gaining ground and thereby becoming the gold standard for neurovascular interventions, thereby dominating the marketplace with resultant enhancement of overall procedural efficiency and, consequently, patient outcome.

Key market players in the neurovascular guidewires market adopt several growth strategies to maintain a competitive edge. These include product innovation, focusing on advanced materials like nitinol and hydrophilic coatings to improve guidewire performance. Companies also engage in strategic partnerships and acquisitions to expand their product portfolios and enhance market reach.

Geographical expansion is another strategy, with players targeting emerging markets to capitalize on the increasing demand for neurovascular treatments. Additionally, investing in research and development (R&D) to introduce next-generation guidewires and improve distribution channels are critical strategies for sustained growth.

Recent Industry Developments in Neurovascular Guidewires Market

In terms of product, the industry is divided into shapeable tip guidewires, straight tip guidewires, angled tip guidewires and round curve tip guidewires.

In terms of coating type, the industry is segregated into hydrophilic and hydrophobic

In terms of application, the industry is divided into arteriovenous malformations, intracranial and extra-cranial angioplasty, aneurysms, spine surgery and others.

In terms of end user, the industry is divided into hospitals, ambulatory surgical centers, specialty clinics, academic and research institutions, and others.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

Table 01: Diagnostic services reported with the CPT/HCPCS codes

Table 02: Global Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Product Type

Table 03: Global Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Coating Type

Table 04: Global Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Application

Table 05: Global Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Product Type

Table 06: Global Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Region

Table 07: North America Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Country

Table 08: North America Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Product Type

Table 09: North America Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Coating Type

Table 10: North America Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by End User

Table 11: North America Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Application

Table 12: Latin America Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Country

Table 13: Latin America Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Product Type

Table 14: Latin America Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Coating Type

Table 15: Latin America Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by End User

Table 16: Latin America Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Application

Table 17: Europe Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Country

Table 18: Europe Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Product Type

Table 19: Europe Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Coating Type

Table 20: Europe Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by End User

Table 21: Europe Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Application

Table 22: South Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Country

Table 23: South Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Product Type

Table 24: South Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Coating Type

Table 25: South Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by End User

Table 26: South Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Application

Table 27: East Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Country

Table 28: East Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Product Type

Table 29: East Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Coating Type

Table 30: East Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by End User

Table 31: East Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Application

Table 32: Oceania Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Country

Table 33: Oceania Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Product Type

Table 34: Oceania Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Coating Type

Table 35: Oceania Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by End User

Table 36: Oceania Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Application

Table 37: MEA Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Country

Table 38: MEA Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Product Type

Table 39: MEA Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Coating Type

Table 40: MEA Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by End User

Table 41: MEA Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Application

Table 42: China Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Product Type

Table 43: China Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Coating Type

Table 44: China Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by End User

Table 45: China Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Application

Table 46: India Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Product Type

Table 47: India Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Coating Type

Table 48: India Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by End User

Table 49: India Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Application

Table 50: Brazil Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Product Type

Table 51: Brazil Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Coating Type

Table 52: Brazil Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by End User

Table 53: Brazil Neurovascular Guidewires Market Value (US$ Mn) Analysis 2013-2021 and Forecast 2022-2028, by Application

Figure 01: Regional Average Pricing Analysis (US$) of Straight Tip Guidewires (2021)

Figure 02: Regional Average Pricing Analysis (US$) of Straight Tip Guidewires (2028)

Figure 03: Regional Average Pricing Analysis (US$) of Shapeable Tip Guidewires (2021)

Figure 04: Regional Average Pricing Analysis (US$) of Shapeable Tip Guidewires (2028)

Figure 05: Regional Average Pricing Analysis (US$) of Angled Tip Guidewires (2021)

Figure 06: Regional Average Pricing Analysis (US$) of Angled Tip Guidewires (2028)

Figure 07: Regional Average Pricing Analysis (US$) of Round Curve Tip Guidewires (2021)

Figure 08: Regional Average Pricing Analysis (US$) of Round Curve Tip Guidewires (2028)

Figure 09: Global Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 10: Global Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 11: Neurovascular Guidewires Market Absolute $ Opportunity, 2013–2028

Figure 12: Global Healthcare Expenditure in US$ Tn (2013–2020)

Figure 13: Global Neurovascular Guidewires Market Share Analysis (%), by Product Type, 2022 & 2028

Figure 14: Global Neurovascular Guidewires Market Y-o-Y Analysis (%), by Product Type, 2022-2028

Figure 15: Global Neurovascular Guidewires Market Attractiveness Analysis by Product Type, 2022-2028

Figure 16: Global Neurovascular Guidewires Market Share Analysis (%), by Coating Type, 2022 & 2028

Figure 17: Global Neurovascular Guidewires Market Y-o-Y Analysis (%), by Coating Type, 2022-2028

Figure 18: Global Neurovascular Guidewires Market Attractiveness Analysis by Coating Type, 2022-2028

Figure 19: Global Neurovascular Guidewires Market Share Analysis (%), by Application, 2022 & 2028

Figure 20: Global Neurovascular Guidewires Market Y-o-Y Analysis (%), by Application, 2022-2028

Figure 21: Global Neurovascular Guidewires Market Attractiveness Analysis by Product Type, 2022-2028

Figure 22: Global Neurovascular Guidewires Market Share Analysis (%), by End User, 2022 & 2028

Figure 23: Global Neurovascular Guidewires Market Y-o-Y Analysis (%), by End User, 2022-2028

Figure 24: Global Neurovascular Guidewires Market Attractiveness Analysis by Product Type, 2022-2028

Figure 25: Global Neurovascular Guidewires Market Share Analysis (%), by Region, 2022 & 2028

Figure 26: Global Neurovascular Guidewires Market Y-o-Y Analysis (%), by Region, 2022-2028

Figure 27: Global Neurovascular Guidewires Market Attractiveness Analysis by Region, 2022-2028

Figure 28: North America Neurovascular Guidewires Market Value Share, by Product Type (2022)

Figure 29: North America Neurovascular Guidewires Market Value Share, by Coating Type (2022)

Figure 30: North America Neurovascular Guidewires Market Value Share, by End User (2022)

Figure 31: North America Neurovascular Guidewires Market Value Share, by Country(2022)

Figure 32: North America Neurovascular Guidewires Market value analysis US$

Figure 33: North America Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 34: North America Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 35: U.S. Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 36: U.S. Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 37: Canada Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 38: Canada Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 39: North America Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Shapeable Tip Guidewires

Figure 40: North America Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Shapeable Tip Guidewires

Figure 41: North America Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Straight Tip Guidewires

Figure 42: North America Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Straight Tip Guidewires

Figure 43: North America Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Angled Tip Guidewires

Figure 44: North America Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Angled Tip Guidewires

Figure 45: North America Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Round Curve Tip Guidewires

Figure 46: North America Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Round Curve Tip Guidewires

Figure 47: North America Neurovascular Guidewires Market Attractiveness Analysis, by Product Type

Figure 48: North America Neurovascular Guidewires Market Attractiveness Analysis, by Coating Type

Figure 49: North America Neurovascular Guidewires Market Attractiveness Analysis, by Country

Figure 50: North America Neurovascular Guidewires Market Attractiveness Analysis, by End User

Figure 51: North America Neurovascular Guidewires Market Attractiveness Analysis, by Application

Figure 52: Latin America Neurovascular Guidewires Market Value Share, by Product Type (2022)

Figure 53: Latin America Neurovascular Guidewires Market Value Share, by Coating Type (2022)

Figure 54: Latin America Neurovascular Guidewires Market value analysis US$

Figure 55: Latin America Neurovascular Guidewires Market Value Share, by End User (2022)

Figure 56: Latin America Neurovascular Guidewires Market Value Share, by Country(2022)

Figure 57: Latin America Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 58: Latin America Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 59: Brazil Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 60: Brazil Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 61: Mexico Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 62: Mexico Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 63: Rest of Latin America Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 64: Rest of Latin America Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 65: Latin America Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Shapeable Tip Guidewires

Figure 66: Latin America Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Shapeable Tip Guidewires

Figure 67: Latin America Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Straight Tip Guidewires

Figure 68: Latin America Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Straight Tip Guidewires

Figure 69: Latin America Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Angled Tip Guidewires

Figure 70: Latin America Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Angled Tip Guidewires

Figure 71: Latin America Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Round Curve Tip Guidewires

Figure 72: Latin America Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Round Curve Tip Guidewires

Figure 73: Latin America Neurovascular Guidewires Market Attractiveness Analysis, by Product Type

Figure 74: Latin America Neurovascular Guidewires Market Attractiveness Analysis, by Coating Type

Figure 75: Latin America Neurovascular Guidewires Market Attractiveness Analysis, by Country

Figure 76: Latin America Neurovascular Guidewires Market Attractiveness Analysis, by End User

Figure 77: Latin America Neurovascular Guidewires Market Attractiveness Analysis, by Application

Figure 78: Europe Neurovascular Guidewires Market Value Share, by Product Type (2022)

Figure 79: Europe Neurovascular Guidewires Market Value Share, by Coating Type (2022)

Figure 80: Europe Neurovascular Guidewires Market value analysis US$

Figure 81: Europe Neurovascular Guidewires Market Value Share, by End User (2022)

Figure 82: Europe Neurovascular Guidewires Market Value Share, by Country(2022)

Figure 83: Europe Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 84: Europe Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 85: Germany Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 86: Germany Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 87: France Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 88: France Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 89: UK Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 90: UK Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 91: Italy Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 92: Italy Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 93: Spain Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 94: Spain Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 95: BENELUX Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 96: BENELUX Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 97: Russia Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 98: Russia Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 99: Rest of Europe Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 100: Rest of Europe Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 101: Europe Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Shapeable Tip Guidewires

Figure 102: Europe Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Shapeable Tip Guidewires

Figure 103: Europe Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Straight Tip Guidewires

Figure 104: Europe Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Straight Tip Guidewires

Figure 105: Europe Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Angled Tip Guidewires

Figure 106: Europe Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Angled Tip Guidewires

Figure 107: Europe Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Round Curve Tip Guidewires

Figure 108: Europe Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Round Curve Tip Guidewires

Figure 109: Europe Neurovascular Guidewires Market Attractiveness Analysis, by Product Type

Figure 110: Europe Neurovascular Guidewires Market Attractiveness Analysis, by Coating Type

Figure 111: Europe Neurovascular Guidewires Market Attractiveness Analysis, by Country

Figure 112: Europe Neurovascular Guidewires Market Attractiveness Analysis, by End User

Figure 113: Europe Neurovascular Guidewires Market Attractiveness Analysis, by Application

Figure 114: South Asia Neurovascular Guidewires Market Value Share, by Product Type (2022)

Figure 115: South Asia Neurovascular Guidewires Market Value Share, by Coating Type (2022)

Figure 116: South Asia Neurovascular Guidewires Market value analysis US$

Figure 117: South Asia Neurovascular Guidewires Market Value Share, by End User (2022)

Figure 118: South Asia Neurovascular Guidewires Market Value Share, by Country(2022)

Figure 119: South Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 120: South Asia Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 121: India Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 122: India Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 123: Thailand Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 124: Thailand Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 125: Indonesia Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 126: Indonesia Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 127: Malaysia Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 128: Malaysia Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 129: Rest of South Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 130: Rest of South Asia Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 131: South Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Shapeable Tip Guidewires

Figure 132: South Asia Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Shapeable Tip Guidewires

Figure 133: South Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Straight Tip Guidewires

Figure 134: South Asia Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Straight Tip Guidewires

Figure 135: South Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Angled Tip Guidewires

Figure 136: South Asia Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Angled Tip Guidewires

Figure 137: South Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Round Curve Tip Guidewires

Figure 138: South Asia Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Round Curve Tip Guidewires

Figure 139: South Asia Neurovascular Guidewires Market Attractiveness Analysis, by Product Type

Figure 140: South Asia Neurovascular Guidewires Market Attractiveness Analysis, by Coating Type

Figure 141: South Asia Neurovascular Guidewires Market Attractiveness Analysis, by Country

Figure 142: South Asia Neurovascular Guidewires Market Attractiveness Analysis, by End User

Figure 143: South Asia Neurovascular Guidewires Market Attractiveness Analysis, by Application

Figure 144: East Asia Neurovascular Guidewires Market Value Share, by Product Type (2022)

Figure 145: East Asia Neurovascular Guidewires Market Value Share, by Coating Type (2022)

Figure 146: East Asia Neurovascular Guidewires Market value analysis US$

Figure 147: East Asia Neurovascular Guidewires Market Value Share, by End User (2022)

Figure 148: East Asia Neurovascular Guidewires Market Value Share, by Country(2022)

Figure 149: East Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 150: East Asia Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 151: China Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 152: China Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 153: Japan Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 154: Japan Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 155: South Korea Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 156: South Korea Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 157: East Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Shapeable Tip Guidewires

Figure 158: East Asia Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Shapeable Tip Guidewires

Figure 159: East Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Straight Tip Guidewires

Figure 160: East Asia Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Straight Tip Guidewires

Figure 161: East Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Angled Tip Guidewires

Figure 162: East Asia Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Angled Tip Guidewires

Figure 163: East Asia Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Round Curve Tip Guidewires

Figure 164: East Asia Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Round Curve Tip Guidewires

Figure 165: East Asia Neurovascular Guidewires Market Attractiveness Analysis, by Product Type

Figure 166: East Asia Neurovascular Guidewires Market Attractiveness Analysis, by Coating Type

Figure 167: East Asia Neurovascular Guidewires Market Attractiveness Analysis, by Country

Figure 168: East Asia Neurovascular Guidewires Market Attractiveness Analysis, by End User

Figure 169: East Asia Neurovascular Guidewires Market Attractiveness Analysis, by Application

Figure 170: Oceania Neurovascular Guidewires Market Value Share, by Product Type (2022)

Figure 171: Oceania Neurovascular Guidewires Market Value Share, by Coating Type (2022)

Figure 172: Oceania Neurovascular Guidewires Market value analysis US$

Figure 173: Oceania Neurovascular Guidewires Market Value Share, by End User (2022)

Figure 174: Oceania Neurovascular Guidewires Market Value Share, by Country (2022)

Figure 175: Oceania Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 176: Oceania Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 177: Australia Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 178: Australia Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 179: New Zealand Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 180: New Zealand Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 181: Oceania Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Shapeable Tip Guidewires

Figure 182: Oceania Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Shapeable Tip Guidewires

Figure 183: Oceania Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Straight Tip Guidewires

Figure 184: Oceania Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Straight Tip Guidewires

Figure 185: Oceania Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Angled Tip Guidewires

Figure 186: Oceania Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Angled Tip Guidewires

Figure 187: Oceania Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Round Curve Tip Guidewires

Figure 188: Oceania Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Round Curve Tip Guidewires

Figure 189: Oceania Neurovascular Guidewires Market Attractiveness Analysis, by Product Type

Figure 190: Oceania Neurovascular Guidewires Market Attractiveness Analysis, by Coating Type

Figure 191: Oceania Neurovascular Guidewires Market Attractiveness Analysis, by Country

Figure 192: Oceania Neurovascular Guidewires Market Attractiveness Analysis, by End User

Figure 193: Oceania Neurovascular Guidewires Market Attractiveness Analysis, by Application

Figure 194: MEA Neurovascular Guidewires Market Value Share, by Product Type (2022)

Figure 195: MEA Neurovascular Guidewires Market Value Share, by Coating Type (2022)

Figure 196: MEA Neurovascular Guidewires Market value analysis US$

Figure 197: MEA Neurovascular Guidewires Market Value Share, by End User (2022)

Figure 198: MEA Neurovascular Guidewires Market Value Share, by Country (2022)

Figure 199: MEA Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 200: MEA Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 201: South Africa Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 202: South Africa Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 203: GCC countries Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 204: GCC countries Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 205: Rest of MEA Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 206: Rest of MEA Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 207: MEA Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Shapeable Tip Guidewires

Figure 208: MEA Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Shapeable Tip Guidewires

Figure 209: MEA Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Straight Tip Guidewires

Figure 210: MEA Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Straight Tip Guidewires

Figure 211: MEA Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Angled Tip Guidewires

Figure 212: MEA Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Angled Tip Guidewires

Figure 213: MEA Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Round Curve Tip Guidewires

Figure 214: MEA Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Round Curve Tip Guidewires

Figure 215: MEA Neurovascular Guidewires Market Attractiveness Analysis, by Product Type

Figure 216: MEA Neurovascular Guidewires Market Attractiveness Analysis, by Coating Type

Figure 217: MEA Neurovascular Guidewires Market Attractiveness Analysis, by Country

Figure 218: MEA Neurovascular Guidewires Market Attractiveness Analysis, by End User

Figure 219: MEA Neurovascular Guidewires Market Attractiveness Analysis, by Application

Figure 220: China Neurovascular Guidewires Market Value Share, by Product Type (2022)

Figure 221: China Neurovascular Guidewires Market Value Share, by Coating Type (2022)

Figure 222: China Neurovascular Guidewires Market value analysis US$

Figure 223: China Neurovascular Guidewires Market Value Share, by End User (2022)

Figure 224: China Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 225: China Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 226: China Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Shapeable Tip Guidewires

Figure 227: China Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Shapeable Tip Guidewires

Figure 228: China Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Straight Tip Guidewires

Figure 229: China Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Straight Tip Guidewires

Figure 230: China Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Angled Tip Guidewires

Figure 231: China Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Angled Tip Guidewires

Figure 232: China Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Round Curve Tip Guidewires

Figure 233: China Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Round Curve Tip Guidewires

Figure 234: China Neurovascular Guidewires Market Attractiveness Analysis, by Product Type

Figure 235: China Neurovascular Guidewires Market Attractiveness Analysis, by Coating Type

Figure 236: China Neurovascular Guidewires Market Attractiveness Analysis, by End User

Figure 237: China Neurovascular Guidewires Market Attractiveness Analysis, by Application

Figure 238: India Neurovascular Guidewires Market Value Share, by Product Type (2022)

Figure 239: India Neurovascular Guidewires Market Value Share, by Coating Type (2022)

Figure 240: India Neurovascular Guidewires Market value analysis US$

Figure 241: India Neurovascular Guidewires Market Value Share, by End User (2022)

Figure 242: India Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 243: India Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 244: India Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Shapeable Tip Guidewires

Figure 245: India Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Shapeable Tip Guidewires

Figure 246: India Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Straight Tip Guidewires

Figure 247: India Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Straight Tip Guidewires

Figure 248: India Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Angled Tip Guidewires

Figure 249: India Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Angled Tip Guidewires

Figure 250: India Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Round Curve Tip Guidewires

Figure 251: India Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Round Curve Tip Guidewires

Figure 252: India Neurovascular Guidewires Market Attractiveness Analysis, by Product Type

Figure 253: India Neurovascular Guidewires Market Attractiveness Analysis, by Coating Type

Figure 254: India Neurovascular Guidewires Market Attractiveness Analysis, by End User

Figure 255: India Neurovascular Guidewires Market Attractiveness Analysis, by Application

Figure 256: Brazil Neurovascular Guidewires Market Value Share, by Product Type (2022)

Figure 257: Brazil Neurovascular Guidewires Market Value Share, by Coating Type (2022)

Figure 258: Brazil Neurovascular Guidewires Market value analysis US$

Figure 259: Brazil Neurovascular Guidewires Market Value Share, by End User (2022)

Figure 260: Brazil Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021

Figure 261: Brazil Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 262: Brazil Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Shapeable Tip Guidewires

Figure 263: Brazil Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Shapeable Tip Guidewires

Figure 264: Brazil Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Straight Tip Guidewires

Figure 265: Brazil Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Straight Tip Guidewires

Figure 266: Brazil Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Angled Tip Guidewires

Figure 267: Brazil Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Angled Tip Guidewires

Figure 268: Brazil Neurovascular Guidewires Market Value (US$ Mn) Analysis, 2013–2021, by Round Curve Tip Guidewires

Figure 269: Brazil Neurovascular Guidewires Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028, by Round Curve Tip Guidewires

Figure 270: Brazil Neurovascular Guidewires Market Attractiveness Analysis, by Product Type

Figure 271: Brazil Neurovascular Guidewires Market Attractiveness Analysis, by Coating Type

Figure 272: Brazil Neurovascular Guidewires Market Attractiveness Analysis, by End User

Figure 273: Brazil Neurovascular Guidewires Market Attractiveness Analysis, by Application

The global cytotoxic drugs industry is projected to witness CAGR of 4.1% between 2025 and 2035.

The global cytotoxic drugs industry stood at USD 339.4 million in 2024.

The global cytotoxic drugs industry is anticipated to reach USD 524.0 million by 2035 end.

China is expected to show a CAGR of 5.4% in the assessment period.

The key players operating in the global cytotoxic drugs industry Stryker, Medtronic, Boston Scientific Corporation, B. Braun, Cardinal Health Inc., Cook Medical Inc., Smith+Nephew, Integra Corporation, Conmed Corporation, Terumo Corporation, and Others.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.