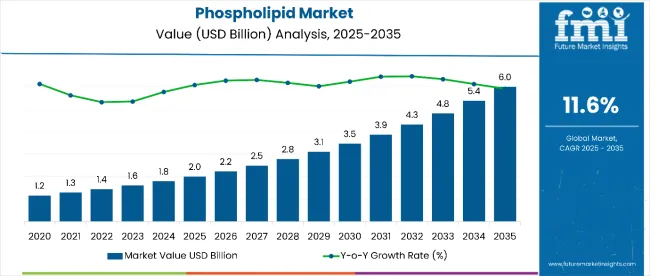

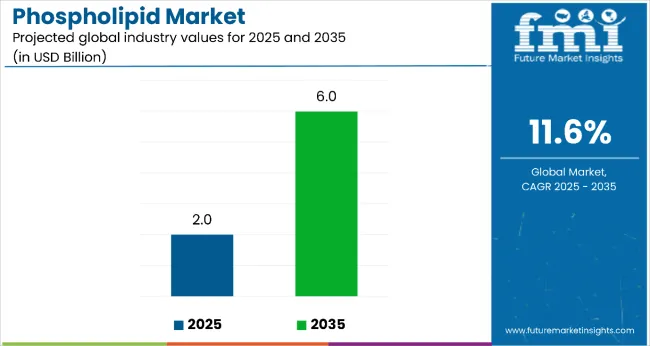

The phospholipid market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 6.0 billion by 2035, registering a compound annual growth rate (CAGR) of 11.6% over the forecast period. This represents an absolute dollar opportunity of USD 4.0 billion, reflecting nearly 3x growth across the decade.

Market expansion is expected to be driven by the rising demand for natural emulsifiers, advanced drug delivery systems, and functional food ingredients, particularly where biocompatibility and membrane stability are essential.

By 2030, the market is expected to reach approximately USD 3.5 billion, contributing USD 1.5 billion in incremental value during the first half of the forecast period. The remaining USD 2.5 billion will likely materialize in the second half, indicating a back-loaded growth pattern. Product innovation in liposomal formulations and nanoencapsulation technologies is accelerating adoption, given phospholipids’ ability to enhance bioavailability and support cell membrane integration.

Leading companies such as Cargill and Lipoid GmbH are strengthening their competitive positions through investments in extraction technologies and scalable production systems. Innovation-driven procurement strategies are enabling deeper penetration into pharmaceutical drug delivery, nutraceutical formulations, and premium cosmetic applications. Market performance will remain heavily dependent on regulatory compliance, stringent purity standards, and evolving sourcing benchmarks.

The phospholipid market holds approximately 42% share of the natural emulsifiers market, driven by its biocompatibility, membrane stability, and compatibility with pharmaceutical and nutraceutical applications. It accounts for around 35% of the functional lipids market, supported by its critical role in drug delivery systems and cellular membrane enhancement.

The market contributes nearly 28% to the specialty ingredients segment, particularly for liposomal formulations, dietary supplements, and cosmetic applications. It represents close to 24% of the pharmaceutical excipients market, where phospholipids are utilized for solubility improvement and controlled-release mechanisms. In the nutraceutical ingredients market, its share reaches about 32%, reflecting preference among manufacturers for bioactive compounds targeting cognitive health and cardiovascular wellness.

The market is undergoing a structural transformation driven by rising demand for natural and functional ingredients across pharmaceutical, nutraceutical, and cosmetic sectors. Advanced processing technologies such as enzymatic extraction and membrane filtration have improved purity, bioactivity, and stability, making phospholipids a compelling alternative to synthetic emulsifiers and drug carriers.

Manufacturers are introducing standardized grades and specialized formulations tailored for targeted applications in pharmaceuticals, nutraceuticals, and cosmetics, expanding beyond traditional food-based roles. Strategic partnerships between ingredient suppliers and pharmaceutical firms are accelerating adoption in advanced drug delivery platforms. Additionally, regulatory approvals and adherence to stringent quality certifications have enhanced global market access, supporting premium positioning strategies and reinforcing trust in high-purity phospholipid solutions.

Phospholipids offer proven biocompatibility, membrane integration properties, and superior emulsification capabilities, making them a preferred alternative to synthetic ingredients in pharmaceutical, nutraceutical, and cosmetic formulations. Increasing awareness of natural and functional ingredients is accelerating their adoption, particularly in drug delivery systems and cognitive health supplements.

Rising consumer preference for clean-label products, coupled with advancements in extraction and purification technologies, is enhancing product quality and expanding application scope. As pharmaceutical and nutraceutical industries continue to emphasize bioactive compounds and advanced delivery solutions, the market outlook remains strong. With both manufacturers and consumers prioritizing efficacy, natural origin, and safety, phospholipids are positioned to achieve significant growth across diverse end-use sectors.

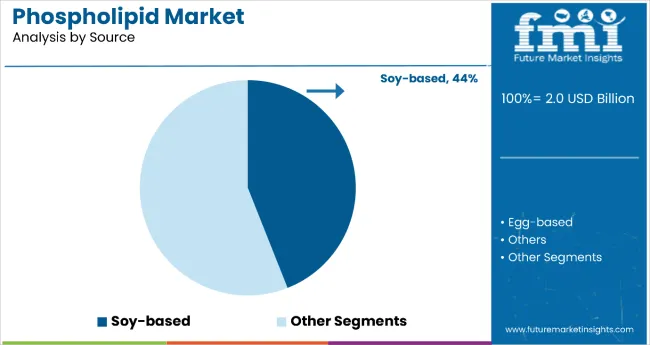

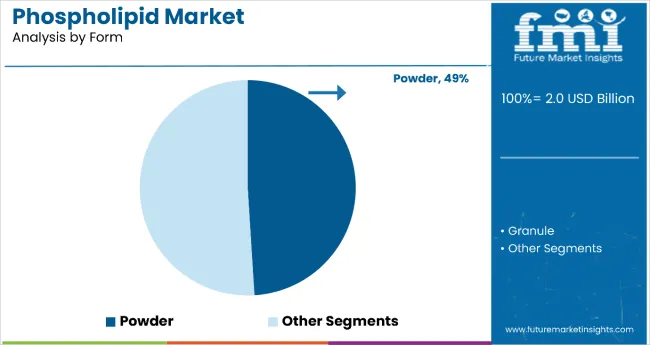

The market is segmented by source, form, application, and region. By source, the market includes soy, eggs, and others. Based on Form, the market is bifurcated into powder and granule. In terms of application, the market is divide into nutrition & supplements, pharmaceuticals, and others. Regionally, the market is classified into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The soy segment holds a leading 44.0% share in the source category, reflecting its abundant availability, cost-effectiveness, and well-established extraction processes. Soy-derived phospholipids are increasingly preferred due to their plant-based origin, non-GMO availability, and compliance with vegan and vegetarian dietary preferences.

The segment benefits from rising consumer demand for plant-based ingredients that align with sustainability and clean-label trends. Manufacturers are focusing on expanding organic and non-GMO soy phospholipid production capabilities, catering to both pharmaceutical and nutraceutical markets.

As regulatory standards for plant-based ingredients become more favorable and consumer awareness of sustainable sourcing increases, soy phospholipids' role as a preferred natural emulsifier and functional ingredient is expected to strengthen, supporting steady growth trajectory across global markets.

The powder segment dominates the form category with a 49.0% market share, driven by enhanced stability, longer shelf life, and superior handling characteristics in pharmaceutical and nutraceutical manufacturing. Powder phospholipids eliminate moisture-related degradation issues and provide consistent flowability for various formulation requirements.

The segment continues to benefit from pharmaceutical companies' preference for stable, standardized ingredients that support quality control and regulatory compliance. Innovations in spray-drying and microencapsulation technologies have made powder phospholipids more effective for specialized applications.

As the pharmaceutical and nutraceutical industries continue to prioritize ingredient stability and processing efficiency, powder phospholipids are expected to maintain strong demand within the broader functional ingredients landscape, particularly in drug delivery and supplement formulations.

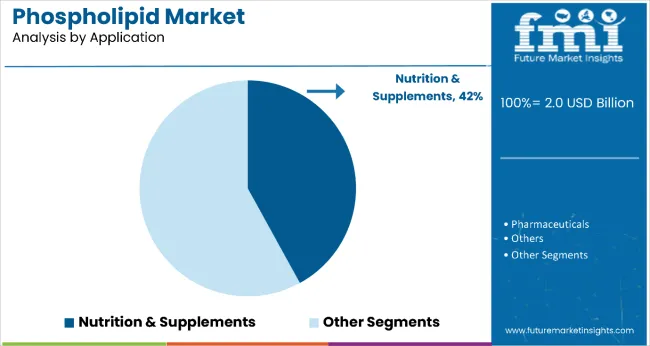

The nutrition and supplements segment accounts for 42% of the application category, reflecting the increasing demand for cognitive health supplements, cardiovascular wellness products, and functional food ingredients. Phospholipids are gaining popularity for their proven cell membrane support and bioavailability enhancement properties.

Manufacturers are enhancing application capabilities within this segment by incorporating specialized phospholipid complexes and standardized extracts, making them highly effective for both standalone supplements and fortified functional foods.

The segment's sustained adoption is supported by its compatibility with various delivery systems and proven health benefits. With increasing consumer awareness of cognitive health and preventive nutrition, phospholipids are positioned for continued market expansion across multiple nutraceutical and functional food applications.

From 2025 to 2035, pharmaceutical companies are adopting advanced drug delivery technologies to improve bioavailability, minimize side effects, and enhance therapeutic performance. This shift positions phospholipid suppliers providing high-purity, pharmaceutical-grade materials as strategic partners in next-generation drug formulations and targeted delivery systems. As pharmaceutical and nutraceutical sectors continue to expand, phospholipids are emerging as essential components in advanced applications, reinforcing their role in global healthcare innovation.

Rising Pharmaceutical Innovation Drives Phospholipid Market Growth

The steady increase in pharmaceutical R&D investments and the growing focus on advanced drug delivery systems are the primary growth drivers for the phospholipid market. In 2024, breakthroughs in liposomal delivery systems accelerated the incorporation of phospholipids in innovative drug formulations worldwide.

By 2025, manufacturers are expected to adopt bioavailability enhancers and membrane-targeting molecules to meet regulatory requirements and improve clinical outcomes. These developments confirm that sustained pharmaceutical innovation, rather than short-term demand fluctuations, is propelling market growth. Producers offering high-purity, pharmaceutical-grade phospholipids with proven biocompatibility are well-positioned to capture consistent demand from drug developers.

Regulatory Challenges and High Production Costs Limit Growth

Despite strong demand, the phospholipid market faces significant challenges due to high production costs and stringent regulatory requirements. Advanced extraction and purification processes increase operational expenses, making it difficult for smaller manufacturers to compete effectively.

In addition, global compliance frameworks governing pharmaceutical and nutraceutical formulations require rigorous testing and certification, extending product approval timelines. These factors, combined with volatility in raw material availability, create structural barriers to rapid market scalability. Companies lacking advanced technical capabilities or financial resources may find it challenging to maintain competitiveness in this evolving landscape.

Key Trends Shaping Phospholipid Market Evolution

The integration of nanotechnology with phospholipid-based carriers has become a defining trend, improving drug solubility and optimizing therapeutic performance. Liposomal platforms are gaining prominence in oncology treatments and chronic disease management, while cognitive health supplements are fueling nutraceutical demand. Growing interest in plant-based sourcing and clean-label formulations is influencing purchasing decisions across pharmaceutical and personal care sectors.

In parallel, technological improvements in enzyme-assisted extraction and membrane filtration are enhancing yield and quality, paving the way for wider applications in high-value markets such as advanced therapeutics, functional foods, and premium cosmetics.

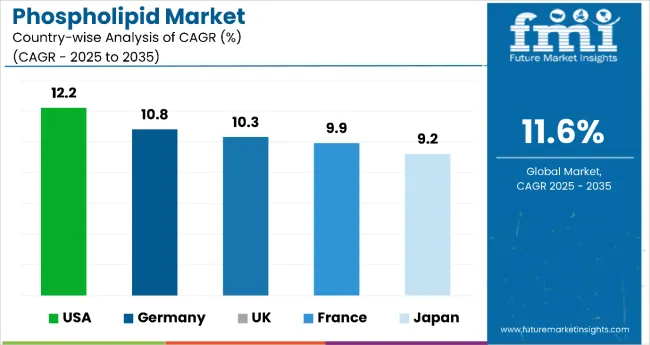

| Country | CAGR |

|---|---|

| USA | 12.2% |

| Germany | 10.8% |

| UK | 10.3% |

| France | 9.9% |

| Japan | 9.2% |

In the phospholipid market, the United States leads among developed economies with a CAGR of 12.2%, driven by strong pharmaceutical and nutraceutical demand. Germany follows at 10.8%, supported by biotechnology research and high-quality drug delivery applications. The United Kingdom posts a 10.3% CAGR, with growth fueled by innovation in functional health ingredients.

France sees a 9.9% CAGR, reflecting its focus on cognitive health and R&D-driven therapies. Japan, with a 9.2% CAGR, shows steady growth led by aging population needs and advanced pharmaceutical applications. All five countries demonstrate strong, innovation-led momentum in phospholipid adoption across health sectors.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA phospholipid market is projected to expand at a CAGR of 12.2%, driven by growing demand for advanced drug delivery systems and high-end nutraceuticals. USA based pharmaceutical giants are integrating phospholipids into liposomal formulations and nanoparticle-based therapies. The increasing prevalence of neurodegenerative and metabolic disorders is also fueling the adoption of phosphatidylcholine and phosphatidylserine-based products.

The phospholipid market in the UK is projected to grow at a CAGR of 10.3%, shaped by pharmaceutical innovation and increasing demand for functional health ingredients. British pharmaceutical companies are investing in phospholipid-based drug delivery systems to enhance therapeutic efficacy and ensure regulatory compliance. Nutraceutical firms are incorporating phospholipids into premium dietary supplements aimed at cognitive performance and healthy aging.

Revenue from phospholipids in Germany is anticipated to expand at a CAGR of 10.8%, driven by stringent pharmaceutical quality standards and advanced biotechnology research. Leading pharmaceutical companies are developing specialized phospholipid formulations for targeted drug delivery applications. A strong regulatory framework is supporting innovation in liposomal therapeutics and advanced drug carrier systems.

Phospholipid sales in France are expected to rise at a CAGR of 9.9%, supported by the country’s strong pharmaceutical sector and premium nutraceutical market. French companies are integrating phospholipids into innovative drug formulations and high-end cognitive health supplements targeting global markets. A strong focus on research and development is driving advanced applications in personalized medicine and functional nutrition.

The phospholipid market in Japan is projected to grow at a CAGR of 9.2%, driven by rising demand for cognitive health products and advanced pharmaceutical formulations. Domestic companies are incorporating phospholipids into supplements targeting aging populations, while pharmaceutical firms are focusing on liposomal drug delivery technologies. Japan’s emphasis on health and wellness across sectors such as cosmetics, functional foods, and precision medicine is expanding the application scope of phospholipids.

The phospholipid market is moderately consolidated, characterized by established ingredient suppliers with varying levels of extraction expertise and application specialization. Cargill Inc. and Lipoid GmbH dominate the pharmaceutical-grade segment, supplying high-purity phospholipids for advanced drug delivery systems and therapeutic formulations. Their competitive advantage lies in advanced purification technologies and strong regulatory compliance capabilities.

Avanti Polar Lipids Inc. differentiates itself through research-grade solutions, offering specialized phospholipid variants and custom synthesis services for pharmaceutical research and biotechnology applications. Bunge Ltd. and Wilmar International Ltd. focus on large-scale production and cost-efficient extraction processes to meet rising demand for food-grade and nutraceutical phospholipids in mainstream markets.

Regional manufacturers such as Kewpie Corporation and VAV Life Sciences leverage local market knowledge and specialized formulations to maintain quality consistency and ensure reliable supply chains for domestic pharmaceutical and nutraceutical firms. Meanwhile, established chemical companies like DowDuPont are investing in phospholipid production capabilities to strengthen and diversify their specialty ingredient portfolios.

Entry barriers remain high due to challenges in purification technology optimization, stringent regulatory compliance, and quality standardization across pharmaceutical and nutraceutical applications. Competitive advantage is increasingly determined by purity levels, regulatory certifications, and demonstrated efficacy across therapeutic and functional food domains.

Key Developments in the Phospholipid Market

In September 2024, Avanti Polar Lipids rebranded as Avanti Research under Croda, expanding its focus on lipid molecules and tools for therapeutic lipid delivery. This change improves global access to its phospholipid products for pharmaceutical and biotech research.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Source | Soy, Eggs, and Others |

| Form | Powder and Granule |

| Application | Nutrition & Supplements, Pharmaceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, and 40+ countries |

| Key Companies Profiled | Avanti Polar Lipids, Inc., Bunge Ltd., Cargill, Inc., DowDuPont, Inc., Kewpie Corporation, Lasenor Emul SL, Lecico GmbH, Lipoid GmbH, Wilmar International Ltd, and VAV Life Sciences Pvt. Ltd. |

| Additional Attributes | Dollar sales by source and application sector, growing usage in drug delivery and nutraceutical applications for pharmaceutical and wellness products, stable demand in functional food and cosmetic applications, innovations in extraction technology and purification methods improve purity, bioavailability, and regulatory compliance |

The global phospholipid market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the phospholipid market is projected to reach USD 6.0 billion by 2035.

The phospholipid market is expected to grow at a 11.6% CAGR between 2025 and 2035.

Soy is expected to lead the source type with 44.0% market share in phospholipid market in 2025.

In terms of application, nutrition and supplements segment to command 42% share in the phospholipid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analysis and Growth Projections for Krill Oil Phospholipid Business

Lecithin and Phospholipids Market Analysis by Product Type, Form, Nature, Function and Application Through 2035

Skin-Barrier Strengthening Phospholipids Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA