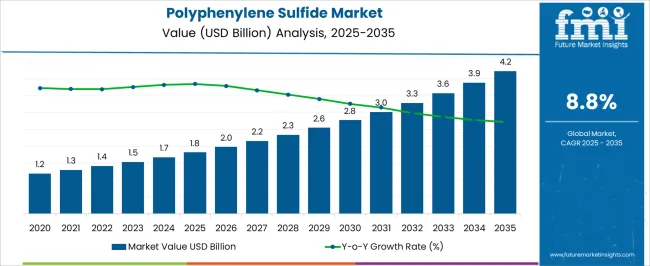

The polyphenylene sulfide market is anticipated to expand from USD 1.8 billion in 2025 to USD 4.2 billion by 2035, reflecting a robust CAGR of 8.8%. Regulatory frameworks are projected to have a significant influence on this growth trajectory, as PPS production and applications intersect with stringent environmental, chemical, and industrial standards.

Given that PPS is widely utilized in electronics, automotive, and industrial sectors, compliance with regulations governing chemical safety, emission controls, and material recycling will play a pivotal role in shaping market dynamics. The gradual increase in market value, from USD 1.8 billion to USD 4.2 billion over the forecast period, indicates that regulatory adherence is not only necessary but also incentivized, promoting the adoption of cleaner manufacturing processes and safer product formulations.

Global regulatory bodies are increasingly enforcing restrictions on hazardous substances, waste disposal, and energy consumption in polymer production, which directly impacts PPS manufacturing. Manufacturers are investing in process optimization, emission reduction technologies, and certification compliance to meet regional mandates, especially in Asia-Pacific and North America, where industrial regulations are progressively stringent. Furthermore, regulations supporting high-performance polymers in the automotive and electronics sectors are encouraging the use of PPS as a substitute for materials with higher environmental footprints.

The regulatory pressures and supportive policies are simultaneously constraining non-compliant operations and accelerating adoption of PPS in regulated industries. Compliance-driven innovation and sustainable production practices are expected to underpin growth, making regulatory impact a decisive factor in shaping the market’s competitive landscape and long-term value expansion.

The polyphenylene sulfide market represents a specialized segment within the high-performance polymer and engineering plastics industry, emphasizing thermal stability, chemical resistance, and dimensional precision. Within the overall engineering plastics market, it accounts for about 5.6%, driven by adoption in automotive, electronics, and industrial applications. In the electrical and electronics components segment, it holds nearly 6.3%, reflecting demand for connectors, switches, and insulation materials.

Across the automotive under-the-hood and structural components market, the segment captures 4.7%, supporting lightweight and heat-resistant designs. Within industrial machinery and chemical processing equipment, it represents 3.9%, highlighting corrosion and chemical resistance benefits. In the specialty polymer composites sector, it secures 2.8%, emphasizing performance enhancement in high-value applications. Recent developments in this market have focused on high-performance formulations, additive integration, and process optimization. Innovations include reinforced PPS grades with glass fiber or carbon fiber to enhance strength and dimensional stability.

Key players are collaborating with automotive OEMs and electronics manufacturers to expand adoption in under-the-hood components, connectors, and housings. Sustainable and recyclable PPS grades are gaining traction in response to regulatory pressure and environmental considerations. Process automation and precision molding techniques have improved production efficiency and reduced defect rates.

Research in nanocomposite integration and flame-retardant formulations is enhancing product performance for electronics and industrial applications. These advancements demonstrate how material performance, durability, and sustainability are driving the growth of the polyphenylene sulfide market.

| Metric | Value |

|---|---|

| Polyphenylene Sulfide Market Estimated Value in (2025 E) | USD 1.8 billion |

| Polyphenylene Sulfide Market Forecast Value in (2035 F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The polyphenylene sulfide (PPS) market is experiencing consistent growth, supported by its expanding role in high-performance engineering applications that demand exceptional thermal stability, chemical resistance, and mechanical strength. Current market dynamics are shaped by increasing adoption in automotive, electrical, and industrial components where long-term durability under extreme conditions is essential.

Supply chains have benefited from technological advances in polymer synthesis and compounding, enabling tailored material grades that meet industry-specific requirements. Regulatory trends toward lightweighting and fuel efficiency in transportation, combined with performance-driven design in electronics, are reinforcing PPS demand across multiple geographies.

While raw material price fluctuations and processing complexities present certain constraints, continuous R&D investments are enhancing production efficiency and widening application scope. Over the forecast period, the market is expected to maintain upward momentum, fueled by strategic capacity expansions, integration into next-generation mobility solutions, and its proven performance advantage over conventional engineering plastics in high-stress operating environments.

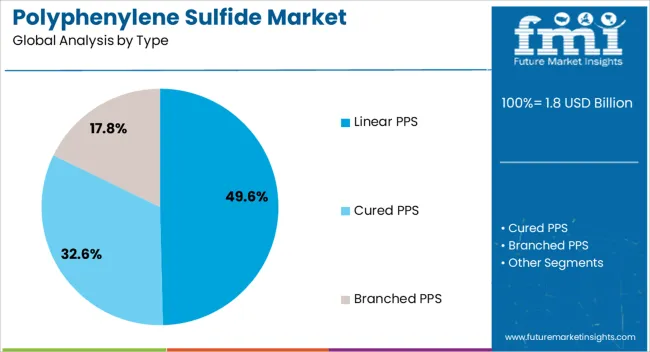

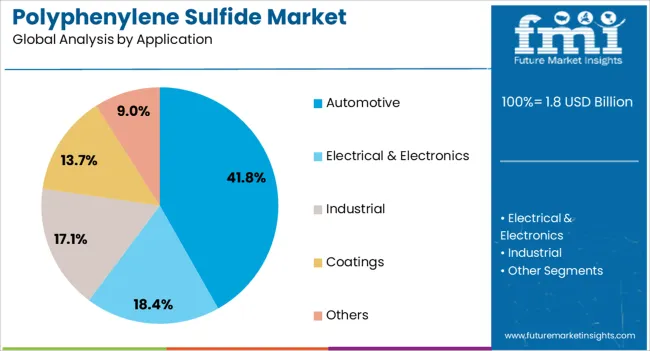

The polyphenylene sulfide market is segmented by type, application, and geographic regions. By type, polyphenylene sulfide market is divided into Linear PPS, Cured PPS, and Branched PPS. In terms of application, polyphenylene sulfide market is classified into Automotive, Electrical & Electronics, Industrial, Coatings, and Others. Regionally, the polyphenylene sulfide industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The linear PPS segment, accounting for 49.60% of the type category, is leading the market due to its superior structural integrity and dimensional stability compared to cross-linked variants. This segment benefits from its excellent processability, enabling its integration into precision-engineered components through injection molding and extrusion.

High crystallinity and low moisture absorption make linear PPS particularly suited for parts that must retain mechanical strength and shape under high heat and corrosive environments. Demand has been bolstered by its ability to deliver consistent performance across automotive, electronics, and industrial applications without significant post-processing.

Producers have capitalized on these properties by offering reinforced and lubricated grades to meet the evolving specifications of OEMs, especially in sectors where weight reduction and reliability are critical. Stable supply and process optimization have further strengthened the cost-to-performance advantage of linear PPS, ensuring its continued dominance in the type segment.

The automotive segment, representing 41.80% of the application category, has emerged as the largest consumer of PPS due to its indispensable role in producing lightweight, high-strength components capable of withstanding elevated temperatures and chemical exposure. The shift toward fuel efficiency and emissions compliance has accelerated PPS adoption in under-the-hood applications such as fuel system parts, electrical connectors, and thermal management systems.

Its resistance to automotive fluids and high dimensional stability under thermal cycling provide OEMs with a reliable material for critical components. The segment’s growth is further supported by the increasing penetration of electric and hybrid vehicles, where PPS is used in battery modules, motor housings, and high-voltage connectors.

Global automotive manufacturing hubs have integrated PPS into mass production, supported by long-term supply contracts and advancements in compounding technology that enhance its mechanical and electrical performance. This alignment with evolving automotive engineering requirements continues to reinforce PPS’s strong position in this application segment.

The market has experienced significant growth due to the material’s exceptional thermal stability, chemical resistance, and mechanical strength, making it ideal for automotive, electrical, electronics, and industrial applications. PPS is increasingly used in high-performance components such as connectors, sensors, pump parts, and engine components, where durability under harsh conditions is critical. Market expansion has been driven by rising industrial automation, the growth of electric vehicles, and stringent regulatory standards that demand materials capable of withstanding extreme temperatures and chemical exposure.

The automotive sector has emerged as a key driver of PPS demand, particularly in engine components, fuel system parts, and electric vehicle assemblies. PPS’s high heat resistance, dimensional stability, and chemical tolerance allow manufacturers to replace traditional metals and other plastics, reducing vehicle weight and enhancing fuel efficiency. Similarly, the electrical and electronics industry leverages PPS in connectors, insulating components, and semiconductor parts due to its excellent dielectric properties and flame resistance. The shift toward miniaturization, higher operating temperatures, and stricter safety standards has accelerated the replacement of conventional materials with PPS, further strengthening market growth across multiple industrial segments.

Continuous innovations in polymerization and compounding have expanded PPS’s application range. Reinforcement with glass fibers, carbon fibers, or mineral fillers has improved stiffness, dimensional stability, and mechanical strength, making PPS suitable for demanding engineering applications. Developments in extrusion, injection molding, and additive manufacturing enable precise and complex component fabrication. Improved processing techniques also allow enhanced surface finish and reduced cycle times, lowering production costs. These technological advancements have broadened PPS adoption beyond automotive and electronics into industrial machinery, chemical processing equipment, and aerospace components, demonstrating its versatility as a high-performance polymer in advanced manufacturing.

The growth of industrial automation, energy infrastructure, and transportation networks has created strong demand for PPS-based components. Chemical processing plants, semiconductor fabrication units, and power generation facilities rely on materials that can withstand high temperatures and corrosive environments, positioning PPS as a preferred choice. Infrastructure projects, including electrified transportation and renewable energy installations, have further increased demand for thermally stable, chemically resistant polymers. Expansion of manufacturing in Asia-Pacific, particularly China, India, and Southeast Asian nations, has reinforced PPS usage, as industries seek reliable, long-lasting materials that can reduce maintenance and operational downtime across critical industrial systems.

Despite its benefits, PPS adoption faces challenges such as high raw material costs, processing complexity, and dependence on specialized supply chains. Recycling and reprocessing remain limited due to chemical stability and fiber-reinforced composites. Manufacturers are focusing on optimizing production efficiency, developing bio-based alternatives, and enhancing supply chain resilience to mitigate these challenges. Regulatory pressures for environmentally responsible manufacturing also encourage the exploration of sustainable PPS grades and energy-efficient production techniques. Balancing performance, cost, and environmental compliance is expected to define long-term strategies, enabling the PPS market to expand steadily across automotive, electronics, industrial, and aerospace sectors worldwide.

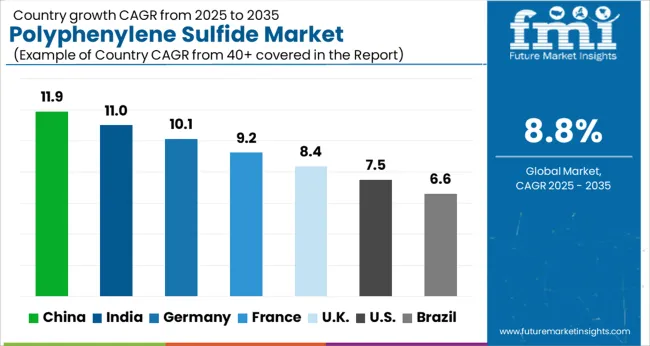

| Country | CAGR |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| France | 9.2% |

| UK | 8.4% |

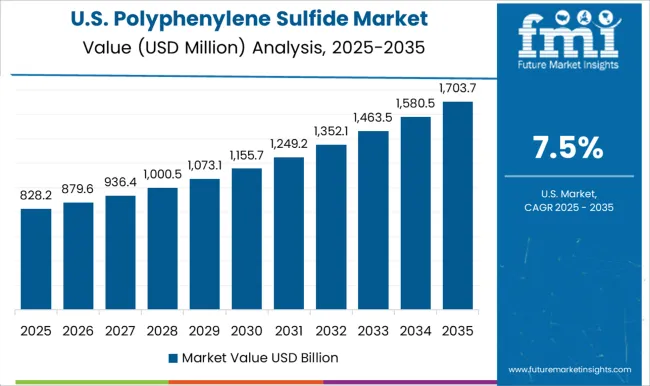

| USA | 7.5% |

| Brazil | 6.6% |

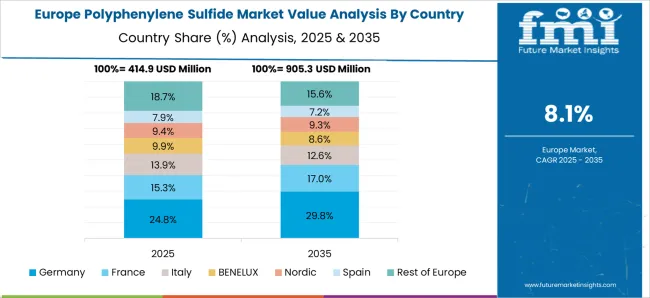

The market is projected to grow at a robust pace, driven by increasing adoption in automotive, electronics, and chemical processing applications. China leads with 11.9%, fueled by large-scale manufacturing and rising integration in high-performance components. India follows at 11.0%, supported by expanding industrial applications and growing polymer processing capabilities.

Germany records 10.1%, driven by advanced engineering and precision manufacturing in automotive and electronics sectors. The United Kingdom achieves 8.4%, focusing on research and development of high-performance polymer solutions. The United States attains 7.5%, with steady growth supported by aerospace, automotive, and industrial applications. Together, these countries represent a strategic landscape for production, scaling, and technological innovation in the PPS market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is anticipated to grow at a CAGR of 11.9%, driven by the increasing adoption of high-performance polymers in automotive, electronics, and industrial applications. Rising demand for lightweight, durable, and heat-resistant materials is supporting growth, particularly in electric vehicles and consumer electronics sectors. Manufacturers are investing in research and development to enhance polymer performance, improve thermal stability, and expand application scope.

Strategic partnerships with automotive and electronics companies are further boosting market penetration. Environmental compliance and regulatory frameworks are influencing production methods, leading to a focus on sustainable PPS manufacturing. Continuous innovation and growing domestic and export demand are positioning China as a leading contributor to the global PPS market.

India’s PPS market is projected to grow at a CAGR of 11.0%, fueled by rapid industrialization, expanding automotive production, and rising electronics manufacturing. The increasing use of PPS in electrical components, automotive parts, and industrial machinery is creating significant growth opportunities. Manufacturers are leveraging advanced polymerization techniques to produce materials with superior mechanical strength, heat resistance, and chemical stability.

Government initiatives supporting local manufacturing and exports are further strengthening market potential. The market is also driven by growing awareness of high-performance polymers’ advantages over traditional plastics. Collaboration between local producers and multinational companies is enhancing production efficiency and broadening application areas.

Germany is expected to grow at a CAGR of 10.1%, supported by strong automotive, engineering, and electronics sectors. High-performance polymers are increasingly used in engine components, electrical parts, and industrial machinery due to their durability, chemical resistance, and thermal stability. Environmental regulations and quality standards are encouraging manufacturers to adopt sustainable and eco-friendly production processes.

Research and development initiatives are focused on improving mechanical properties, chemical resistance, and process efficiency. Strategic partnerships with industrial and automotive companies are enabling manufacturers to expand market penetration. Germany’s focus on innovation, advanced manufacturing, and sustainable solutions is strengthening its position in the global PPS landscape.

The United Kingdom is projected to grow at a CAGR of 8.4%, supported by industrial demand for lightweight, heat-resistant, and chemically stable polymers. PPS is increasingly used in automotive components, electrical and electronics equipment, and industrial machinery. Manufacturers are emphasizing process optimization, product innovation, and compliance with environmental regulations to meet growing demand.

Strategic collaborations with engineering and electronics companies are expanding applications and market reach. The UK market is influenced by the demand for cost-effective, high-performance polymers in industrial and commercial applications, while sustainable manufacturing practices are shaping production strategies.

The United States market is expected to grow at a CAGR of 7.5%, driven by increasing demand for high-performance polymers in automotive, electronics, and industrial sectors. PPS is favored for applications requiring chemical resistance, thermal stability, and mechanical strength. Manufacturers are investing in advanced polymerization techniques and sustainable production practices to enhance product quality and reduce environmental impact.

Strategic partnerships and capacity expansions are helping meet regional and global demand. Adoption is further influenced by the trend toward lightweight and high-performance materials in electric vehicles, consumer electronics, and industrial machinery.

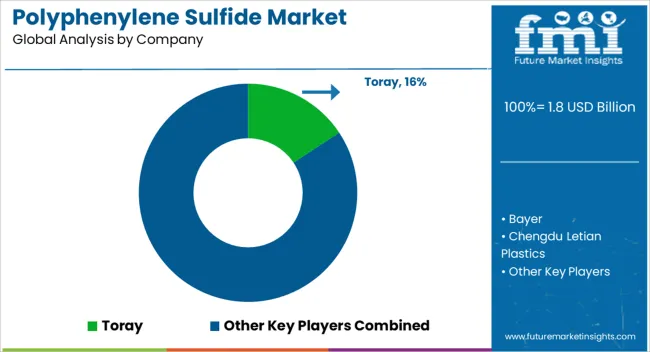

The PPS market is witnessing significant expansion due to the polymer’s excellent thermal stability, chemical resistance, and dimensional stability, which make it suitable for automotive, electrical, and industrial applications. Toray, Bayer, and SABIC are key market players, providing high-performance PPS grades designed to meet rigorous engineering requirements, particularly in lightweight and high-temperature-resistant components.

Chevron Phillips Chemical and Solvay contribute advanced PPS solutions with enhanced processability, facilitating complex molding applications while maintaining mechanical strength. Tosoh, Kureha, and Lumena offer a wide spectrum of PPS resins with tailored properties for electrical insulation, chemical handling equipment, and automotive under-the-hood components.

Chengdu Letian Plastics and FORTRAN focus on regional markets, providing cost-effective PPS solutions with competitive performance attributes. Dacel, Haohua Honghe Chemical, and Zhejiang NHU emphasize innovation in reinforced PPS composites, enabling applications that require enhanced rigidity and flame retardancy. SK Chemicals, Lion Idemitsu Composites, Jiangsu Ruitai Technology, RTP, and DIC strengthen the market by delivering specialty PPS compounds and composites that combine high durability with processing efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Type | Linear PPS, Cured PPS, and Branched PPS |

| Application | Automotive, Electrical & Electronics, Industrial, Coatings, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toray, Bayer, Chengdu Letian Plastics, FORTRAN, SABIC, Tosoh, Chevron Phillips Chemical, Solvay, Lumena, Kureha, Dacel, Haohua Honghe Chemical, Zhejiang NHU, SK Chemicals, Lion Idemitsu Composites, Jiangsu Ruitai Technology, RTP, and DIC |

| Additional Attributes | Dollar sales by polymer type and application, demand dynamics across automotive, electrical, and industrial sectors, regional trends in high-performance plastic adoption, innovation in thermal stability, chemical resistance, and lightweight design, environmental impact of production and recycling, and emerging use cases in electronics, automotive components, and industrial machinery. |

The global polyphenylene sulfide market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the polyphenylene sulfide market is projected to reach USD 4.2 billion by 2035.

The polyphenylene sulfide market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in polyphenylene sulfide market are linear pps, cured pps and branched pps.

In terms of application, automotive segment to command 41.8% share in the polyphenylene sulfide market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyphenylene Sulfide Resins Market

Polyphenylene Market Forecast Outlook 2025 to 2035

Polyphenylene Ether (PPE) Alloy Market Size and Share Forecast Outlook 2025 to 2035

Polysulfide Market Size and Share Forecast Outlook 2025 to 2035

Polysulfide Resin Market Growth & Demand 2025 to 2035

Carbon Disulfide Market - Trends & Analysis 2025 to 2035

Di-n-octyl Sulfide Market Size and Share Forecast Outlook 2025 to 2035

Molybdenum Disulfide (MoS2) Crystal Market Size and Share Forecast Outlook 2025 to 2035

Molybdenum Disulfide Market

Demand for Polysulfide in EU Size and Share Forecast Outlook 2025 to 2035

Phosphorus Pentasulfide Market Demand & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA