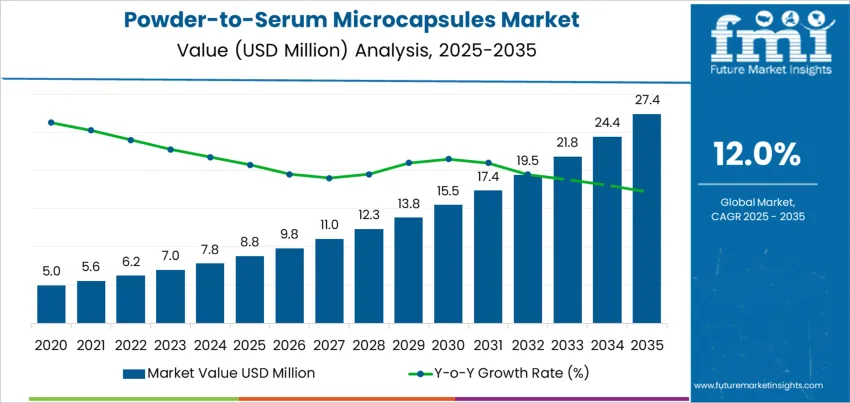

The global powder-to-serum microcapsules market is projected to reach USD 27.4 million by 2035, recording an absolute increase of USD 18.6 million over the forecast period. The market is valued at USD 8.8 million in 2025 and is set to rise at a compound annual growth rate (CAGR) of 12.0% during the assessment period. The overall market size is expected to grow by nearly 3.1 times during the same period, driven by increasing demand for advanced skincare and cosmetic formulations that deliver superior performance, enhanced stability, and controlled release. As consumers seek more effective and stable skincare products, powder-to-serum technologies are gaining traction across premium skincare brands. However, challenges like high production costs and regulatory hurdles may pose some risks to market growth.

The powder-to-serum microcapsules market is benefiting from the growing trend of encapsulating active ingredients in cosmetics to protect them from degradation and improve their efficacy. These microcapsules allow for precise delivery of ingredients such as antioxidants, vitamins, and peptides, ensuring better penetration into the skin. The increasing focus on "clean" beauty and the demand for personalized skincare solutions are also contributing to the growing adoption of powder-to-serum microcapsules in the cosmetics industry. As innovation continues and the regulatory environment evolves, the market is expected to see continued growth, particularly in targeted skin treatments like anti-aging, acne, and skin rejuvenation products.

Between 2025 and 2030, the powder-to-serum microcapsules market is projected to grow from USD 8.8 million to USD 13.8 million, creating an absolute expansion of USD 5.0 million. This phase of growth will be driven by increasing consumer demand for advanced skincare formulations that offer enhanced stability, targeted ingredient delivery, and improved product efficacy. The growth is supported by technological advancements in encapsulation techniques that ensure long-lasting and effective release of active ingredients in skincare products. Companies are investing in research and development to enhance the precision of ingredient delivery, allowing for better results in anti-aging, skin rejuvenation, and other skin concerns. As the demand for non-invasive, high-performance skincare products continues to rise, powder-to-serum microcapsules are expected to become a staple in premium skincare brands.

From 2030 to 2035, the market is expected to grow from USD 13.8 million to USD 27.4 million, adding another USD 13.6 million, which constitutes 53.3% of the total forecast growth. During this period, the market will benefit from the continued innovation of encapsulation technologies and expanding applications in both skincare and cosmetic products. The growing trend of personalized skincare and increasing consumer preference for stable and effective active ingredients will drive market expansion. Strategic collaborations between skincare manufacturers and ingredient suppliers will support the continued growth of powder-to-serum microcapsules, as companies push forward with product innovations designed to meet evolving consumer needs.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 8.8 million |

| Market Forecast Value (2035) | USD 27.4 million |

| Forecast CAGR (2025-2035) | 12.0% |

The powder-to-serum microcapsules market is growing as demand increases for innovative, highly effective skincare solutions that offer convenient, on-demand product activation. These microcapsules are typically used in cosmetics and skincare products, where the powder is activated by contact with liquid, transforming into a serum that delivers potent active ingredients directly to the skin. This technology allows for precise delivery, maintaining ingredient stability and providing enhanced skincare performance. The ability to store and deliver active ingredients in a controlled, fresh form appeals to consumers seeking high-quality, customizable skincare products.

Advancements in encapsulation technology, particularly in powder-to-serum formulations, have driven the market’s growth. Innovations that enhance the efficiency of ingredient activation and improve the stability of sensitive compounds contribute to the increasing adoption of these microcapsules. The growing trend of personalized skincare has fueled interest in these innovative products, as consumers seek tailored solutions for their unique skin needs. The powder-to-serum microcapsules provide flexibility, enabling a more adaptable approach to skincare, which resonates with both consumers and manufacturers.

Despite these drivers, challenges such as the complexity of manufacturing and the relatively high cost of powder-to-serum systems may restrict their widespread adoption, particularly in mass-market products. Regulatory concerns over the efficacy and safety of encapsulated ingredients may present barriers to entry in certain markets. Ongoing innovations in formulation techniques and rising consumer interest in high-performance skincare are expected to foster sustained growth in the powder-to-serum microcapsules market.

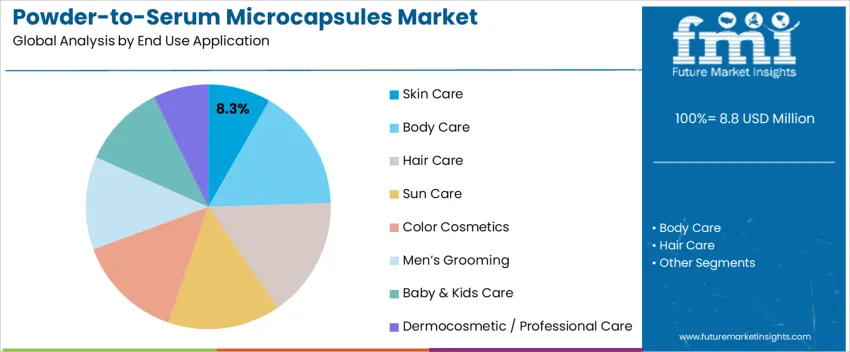

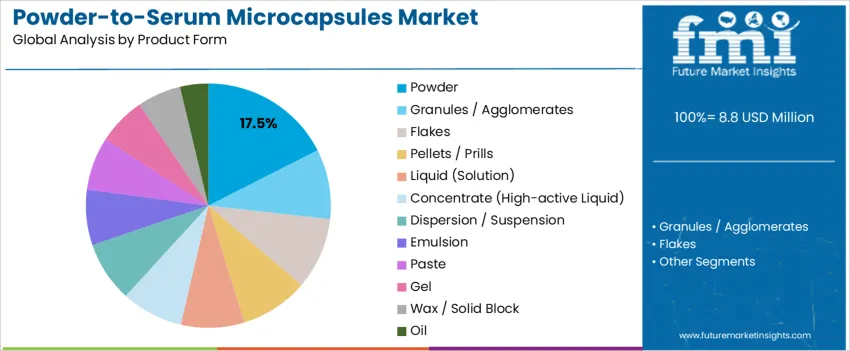

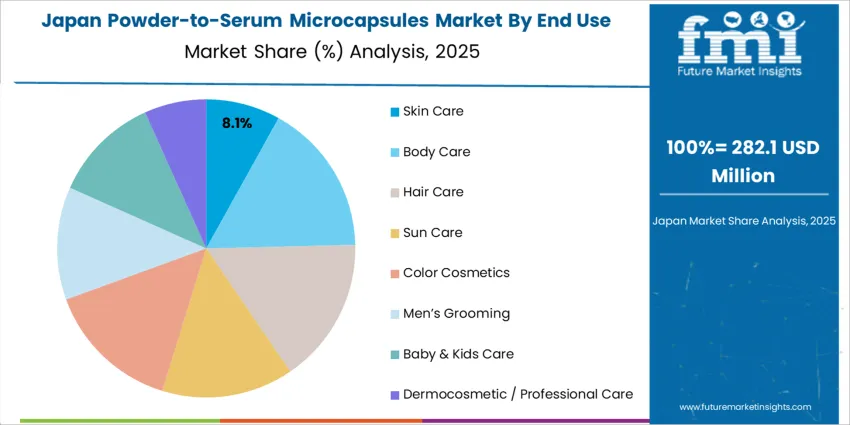

Global demand for powder-to-serum microcapsules is influenced by end use applications and product form, with notable concentrations in East Asia, Western Europe, and North America. Skin care leads with an 8.3% share, driven by the growing preference for innovative delivery systems that enhance skin penetration and active ingredient effectiveness. Other key segments include body care, hair care, sun care, color cosmetics, men’s grooming, baby and kids care, and dermocosmetic or professional care, with demand across both mass and professional channels. On the product form side, powders capture a 17.5% share, alongside granules/agglomerates, flakes, pellets/prills, liquid solutions, high-active liquid concentrates, dispersions, emulsions, pastes, gels, wax/solid blocks, and oils.

Skin care accounts for 8.3% of global powder-to-serum microcapsule usage, supported by the growing adoption of microencapsulation technology for enhanced delivery of active ingredients in skincare formulations. These microcapsules are commonly used in serums, toners, and moisturizers, where their controlled release of active ingredients, such as vitamins, peptides, and antioxidants, provides sustained effects while minimizing irritation. Demand is particularly strong in South Korea, Japan, the USA, and Western Europe, where dermocosmetics and professional skin care innovations are key drivers. Powder-to-serum microcapsules enhance the stability and bioavailability of sensitive ingredients, enabling formulations that offer targeted, efficient skin treatment. Ongoing product development in countries like France, Germany, and the USA continues to explore microencapsulation to deliver high-performance products within regulated frameworks, making it a sought-after technology for premium skincare products.

Powder form holds a 17.5% share of global powder-to-serum microcapsule demand, largely due to its excellent stability, moisture control, and ease of handling in formulations. Powders provide precise dosing, allowing for controlled ingredient release, and ensure consistent quality across a variety of product forms such as emulsions, gels, and masks. This form is particularly effective in large-scale production across regions like Asia, Europe, and North America. Powders also offer logistical advantages, such as reduced leakage risk and lower refrigeration requirements during shipping, making them ideal for global distribution. Manufacturers prefer powders for their compatibility with automated blending systems and predictable product quality retention across varying climate conditions. Regulatory documentation and microbial specifications are well-established for powdered inputs, reinforcing powder as the dominant product form for powder-to-serum microcapsules.

The powder-to-serum microcapsules sector is shaped by a rising demand for innovative skin care solutions that offer both convenience and enhanced product stability. This unique technology allows consumers to activate serums, creams, and other skincare products by mixing powder and liquid components at the point of use, ensuring the freshness and potency of the active ingredients. The technology enables encapsulation of active ingredients, protecting them from degradation due to light, air, or heat. It also allows for precise dosing and controlled release, improving the performance of skincare products. With the increasing consumer preference for clean, high-performance formulations and the desire for personalized skin care, powder-to-serum microcapsules are becoming an appealing choice for premium skincare brands and consumers seeking tailored, effective solutions.

The global demand for powder-to-serum microcapsules is driven by the growing interest in fresh, highly potent skincare products. As consumers demand more personalized and effective skincare solutions, powder-to-serum products offer the advantage of activating fresh formulations by mixing powder and liquid at the point of use. This ensures that active ingredients remain stable and effective. Microencapsulation technology enhances ingredient protection, allowing for a controlled release, which improves product absorption and efficacy. The rise in clean beauty and consumer preference for customizable products further boosts the adoption of powder-to-serum solutions, particularly in high-end or niche skincare markets. The ability to combine different ingredients for targeted skin care also increases the appeal of these products.

While powder-to-serum microcapsules offer significant benefits, their adoption faces challenges in terms of production complexity and cost. The process of encapsulating active ingredients and developing microcapsules requires advanced technologies and precise manufacturing, which can increase production costs. These higher costs may limit the affordability of powder-to-serum products, particularly for budget-conscious consumers. The market for such innovative products is still emerging, and educating consumers on the advantages of activating ingredients at the point of use remains a challenge. Achieving consistent quality and stability across different product lines requires stringent quality control, which adds to the complexity of production and may hinder mass-market adoption.

Key trends shaping the powder-to-serum microcapsules market include the growing preference for clean and customizable beauty products. Consumers are increasingly looking for products that offer fresh and potent ingredients, and powder-to-serum microcapsules allow for just that by activating the active ingredients at the point of use. The trend of personalization is also playing a significant role, as brands create tailored formulations to meet specific skin care needs, such as anti-aging, hydration, or acne treatment. Technological advancements in encapsulation methods, such as liposomal and polymer-based carriers, are enhancing the stability and delivery of active ingredients. The rise of sustainable packaging and eco-conscious consumer preferences are pushing for more innovative, waste-reducing solutions in the skincare industry, which powder-to-serum products can meet.

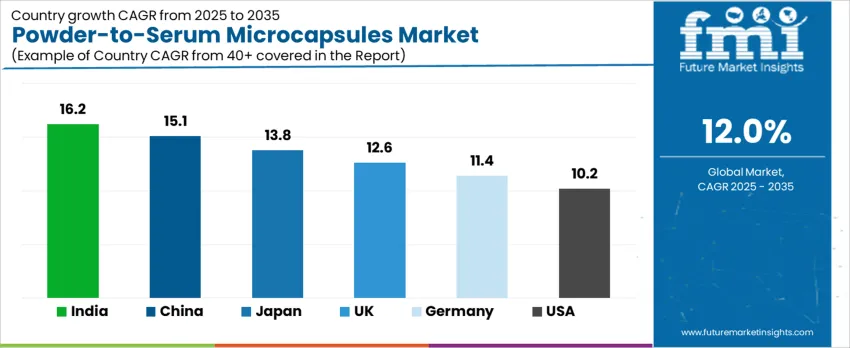

| Country | CAGR (%) |

|---|---|

| India | 16.2% |

| China | 15.1% |

| Japan | 13.8% |

| UK | 12.6% |

| Germany | 11.4% |

| USA | 10.2% |

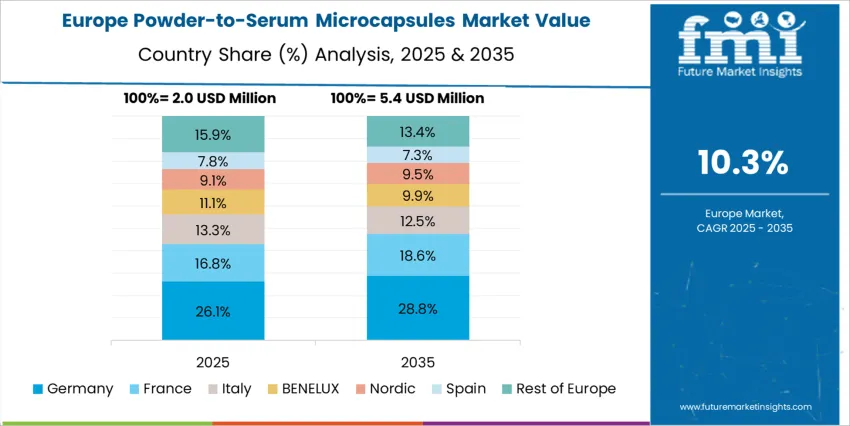

The powder-to-serum microcapsules market is experiencing robust global growth, with India leading at a 16.2% CAGR, driven by increasing consumer interest in advanced skincare solutions that offer improved formulation stability and delivery. China follows with a 15.1% CAGR, supported by a growing middle class and the rise of innovative beauty products. Japan is growing at 13.8%, bolstered by strong demand for high-quality skincare treatments. The UK and Germany show steady growth at 12.6% and 11.4%, respectively, with a rising interest in skincare innovations. In the USA, the market is growing at a 10.2% CAGR, driven by consumer demand for new skincare technologies and personalized beauty solutions.

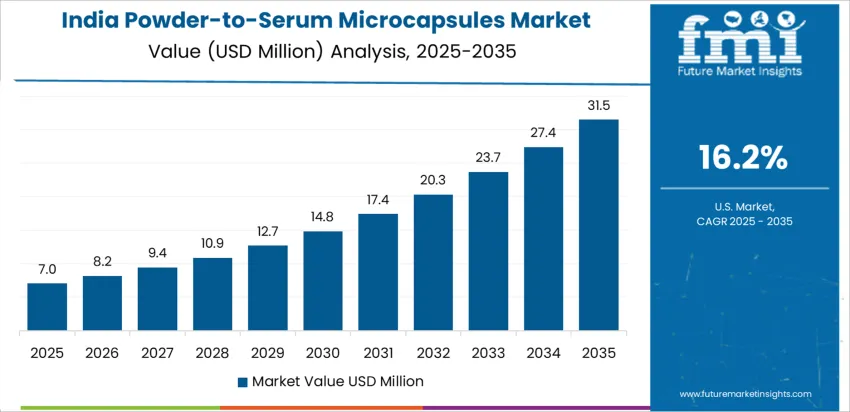

India’s powder-to-serum microcapsules market is experiencing strong growth, with a projected 16.2% CAGR through 2035. This growth is driven by the increasing demand for innovative skincare formulations that deliver active ingredients with enhanced stability and targeted delivery. Rising disposable incomes and a growing middle class are encouraging consumers to invest in premium skincare products. The country’s rapid urbanization and a heightened focus on beauty and wellness are also fueling demand for advanced skincare solutions. E-commerce platforms are expanding access to these products, making them more widely available to a broader audience. As consumers become more aware of the benefits of skincare innovations, including powder-to-serum microcapsules, the market is expected to continue its upward trajectory, offering greater convenience and efficacy in skincare routines.

China’s powder-to-serum microcapsules market is growing at a 15.1% CAGR through 2035. This growth is primarily driven by the expanding middle class and increasing consumer investment in innovative beauty and skincare products. The growing demand for advanced skincare formulations that provide enhanced ingredient stability and controlled release has made powder-to-serum microcapsules a popular choice. China’s e-commerce platforms are playing a significant role in improving product accessibility and increasing market reach. The rise of beauty-conscious consumers, coupled with a focus on effective skincare innovations, continues to fuel the demand for microencapsulation technology. With growing awareness of skincare benefits, including anti-aging and skin rejuvenation, China’s powder-to-serum microcapsules market is expected to thrive, further propelled by the increasing interest in high-quality, personalized beauty products.

Japan’s powder-to-serum microcapsules market is growing at a 13.8% CAGR through 2035. The demand for these products is largely driven by Japan’s strong skincare culture and the population’s preference for high-quality, scientifically backed formulations. Powder-to-serum microcapsules provide enhanced stability and precise ingredient delivery, making them particularly appealing for anti-aging and targeted skincare treatments. Japan’s aging population is also a key factor, with an increasing demand for skincare products that address specific concerns such as wrinkles and pigmentation. The focus on personalized beauty and the trust in advanced skincare technologies further contributes to the market’s growth. Japan’s robust retail infrastructure and consumer loyalty to proven skincare solutions ensure continued demand for these innovative products in the coming years.

The UK’s powder-to-serum microcapsules market is expanding at a 12.6% CAGR through 2035, fueled by rising consumer interest in innovative skincare solutions. These products, which deliver active ingredients with greater precision and stability, are particularly popular due to their ability to enhance the effectiveness of skincare routines. The growing awareness of personalized skincare and the increasing focus on beauty and wellness contribute to the market’s growth. In the UK, consumers are becoming more conscious of the benefits of controlled release and advanced formulations, which has driven demand for powder-to-serum microcapsules. E-commerce platforms and retail stores are making these products more accessible, supporting continued growth. With the rise of science-backed beauty technology, the UK market for powder-to-serum microcapsules is expected to grow steadily in the coming years.

Germany’s powder-to-serum microcapsules market is growing at a 11.4% CAGR through 2035. The demand for these products is driven by Germany’s focus on high-quality, scientifically developed skincare solutions that offer enhanced delivery of active ingredients. As consumers increasingly seek more effective ways to address skin concerns, such as aging and pigmentation, powder-to-serum microcapsules have become an attractive option. Germany’s skincare market places a strong emphasis on product efficacy and innovation, which aligns with the growing preference for advanced technologies. With a focus on personalized beauty and anti-aging treatments, the demand for powder-to-serum microcapsules is expected to rise. The country’s strong retail infrastructure, combined with consumer trust in proven beauty technologies, will continue to support the market’s growth.

The USA’s powder-to-serum microcapsules market is growing at a 10.2% CAGR through 2035, driven by consumer demand for advanced skincare solutions that offer enhanced efficacy and ingredient stability. These products are gaining popularity due to their ability to deliver active ingredients more effectively, with controlled release mechanisms that provide long-lasting results. As consumers increasingly seek personalized skincare and innovative beauty solutions, powder-to-serum microcapsules offer the precision and effectiveness desired. The market is also supported by the growing availability of these products through retail chains and e-commerce platforms, which improve product access. Despite the market’s maturity, ongoing innovation in skincare technologies continues to drive steady growth, and the USA’s demand for high-performance beauty products remains strong.

The demand for powder-to-serum microcapsules is increasing due to their ability to offer innovative and versatile skincare solutions. These microcapsules, which transform from powder form to a serum when activated, provide targeted delivery of active ingredients, ensuring that they remain stable and effective until application. As consumers look for advanced skincare products with prolonged stability, enhanced performance, and ease of use, powder-to-serum microcapsules are gaining popularity, particularly in anti-aging and moisturizing formulations. The convenience and precise delivery offered by these microcapsules, along with their ability to protect sensitive ingredients from degradation, are key drivers of their growth in the beauty and cosmetics market.

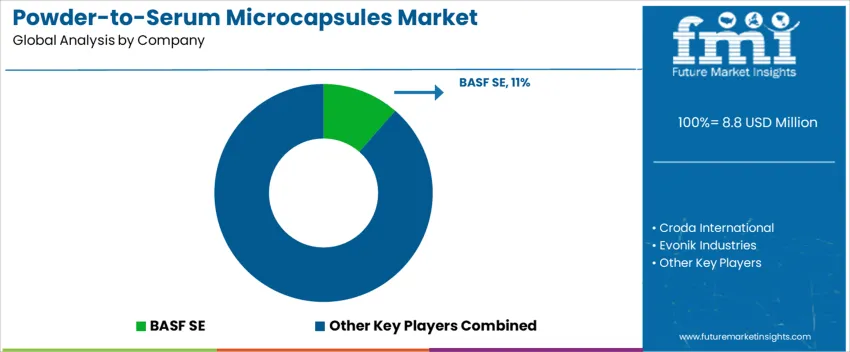

Key players shaping the powder-to-serum microcapsules market include BASF SE, Croda International, Evonik Industries, Symrise (including IFF/Givaudan active ingredient businesses), Dow Inc., Ashland, Clariant, and Seppic. BASF SE leads the market with a significant share of 11.4%, leveraging its expertise in microencapsulation technologies to provide high-quality, stable formulations. These industry leaders focus on developing microcapsules that improve the delivery and effectiveness of active ingredients, catering to the growing demand for innovative skincare solutions. Smaller, specialized companies also contribute to the market by offering customized microencapsulation solutions tailored to specific consumer needs.

The growth of the powder-to-serum microcapsules market is driven by advancements in microencapsulation technologies that ensure the stability and efficacy of active ingredients until they are applied to the skin. The ability to preserve and activate ingredients upon use increases the effectiveness of skincare products, addressing consumer demand for high-performance beauty solutions. As the desire for innovative, convenient, and effective skincare continues to rise, powder-to-serum microcapsules are expected to see continued growth across the beauty and personal care industries.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| End Use Application | Skin Care, Body Care, Hair Care, Sun Care, Color Cosmetics, Men’s Grooming, Baby & Kids Care, Dermocosmetic / Professional Care |

| Product Form | Powder, Granules / Agglomerates, Flakes, Pellets / Prills, Liquid (Solution), Concentrate (High-active Liquid), Dispersion / Suspension, Emulsion, Paste, Gel, Wax / Solid Block, Oil |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | USA, China, Japan, South Korea, India, Germany, UK, France, Italy, Brazil, Argentina, Mexico, Saudi Arabia, South Africa, Russia, others |

| Key Companies Profiled | BASF SE, Croda International, Evonik Industries, Symrise (including IFF/Givaudan actives), Dow / Dow Inc., Ashland, Clariant, Seppic |

| Additional Attributes | Dollar by sales by end use application and product form; regional CAGR and growth outlook; multi-strain formulation adoption; clinical validation and regulatory compliance tracking; distribution channels including retail, DTC, e-commerce, and institutional buyers; product form prevalence in powders, liquids, and emulsions; regional preference for strain libraries; supply chain logistics for cold chain and ambient stability; strain survivability, CFU consistency, and shelf-life performance; innovation trends including prebiotic/postbiotic combinations, non-dairy matrices, and personalized nutrition; competitive positioning of global vs regional suppliers. |

The global powder-to-serum microcapsules market is estimated to be valued at USD 8.8 million in 2025.

The market size for the powder-to-serum microcapsules market is projected to reach USD 27.4 million by 2035.

The powder-to-serum microcapsules market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types in powder-to-serum microcapsules market are skin care, body care, hair care, sun care, color cosmetics, men’s grooming, baby & kids care and dermocosmetic / professional care.

In terms of product form , powder segment to command 17.5% share in the powder-to-serum microcapsules market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymeric Microcapsules Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA