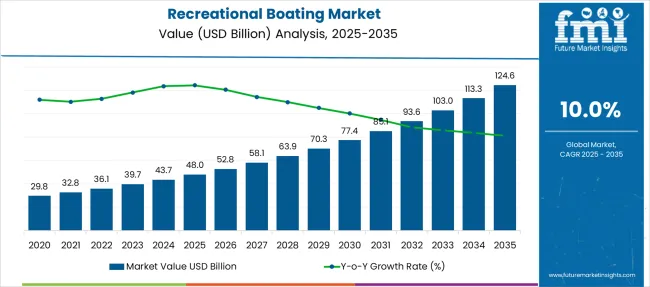

The Recreational Boating Market is estimated to be valued at USD 48.0 billion in 2025 and is projected to reach USD 124.6 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. Despite an attractive 10% CAGR, this market reflects strong correlation to discretionary income trends. The valuation moves from USD 52.8 billion in 2026 to USD 124.6 billion by 2035, creating a USD 71.8 billion absolute gain in nine years. Early phase shows double-digit YoY expansion till 2030, then slows gradually post-2032, signaling cyclicality after a consumer spending peak. Incremental annual growth beyond 2030 narrows to USD 10–12 billion, compared to USD 14 billion pre-2030.

Luxury boat adoption and rental platforms drive an early surge. However, macro factors like fuel pricing and leisure budgets affect elasticity, introducing risk to consistent gains. Premiumization remains the profitability lever as unit margins counterbalance potential demand softening in the late decade.

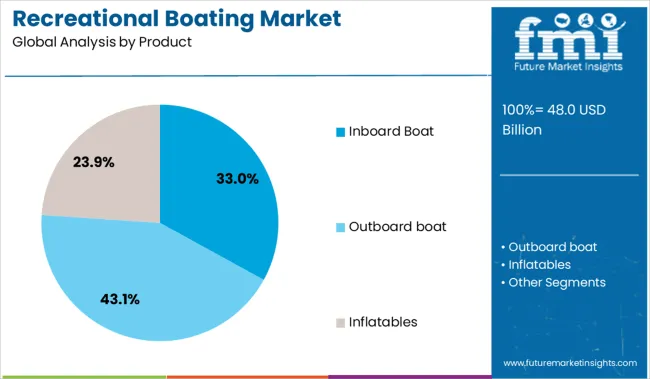

Inboard boats dominate with 33.0% share in 2025, favored for their performance and suitability for water sports and premium leisure experiences. North America continues to lead the market, driven by well-established boating culture and extensive marina infrastructure, while Asia-Pacific emerges as the fastest-growing region, supported by rising tourism, coastal development, and growing participation in recreational water activities. Europe remains a significant contributor due to its strong yacht manufacturing base and demand for luxury marine vessels.

The market’s incline is expected to accelerate beyond 2028 as connected boating technology, GPS-enabled navigation systems, and app-based vessel management become standard features.

| Metric | Value |

|---|---|

| Recreational Boating Market Estimated Value in (2025E) | USD 48.0 billion |

| Recreational Boating Market Forecast Value in (2035F) | USD 124.6 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The recreational boating market is experiencing steady expansion, fueled by rising disposable incomes, increased participation in leisure marine activities, and strong interest in outdoor lifestyles. Enhanced marina infrastructure, coupled with supportive government policies for coastal and inland water tourism, is creating a favorable environment for boat ownership and charter services.

Technological advancements in navigation systems, onboard electronics, and safety features have improved consumer confidence and operating ease, encouraging first-time buyers to enter the market. The growing popularity of boating as a recreational pursuit, especially in post-pandemic outdoor lifestyle trends, is reinforcing demand across both developed and emerging economies.

Sustainability trends, including the introduction of eco-efficient engines and recyclable hull materials, are further influencing purchasing decisions. As manufacturers invest in modular boat designs and connected marine solutions, the market is set to benefit from greater accessibility and a more diversified customer base.

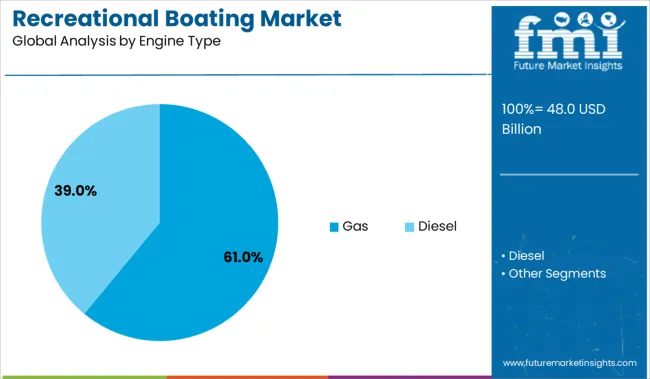

The recreational boating market is segmented by product, engine type, and region. By product, it includes inboard boats categorized by horsepower ranges such as below 200 hp, 201 to 500 hp, 501 to 1000 hp, and above 1000 hp, as well as outboard boats, inflatables, and other watercraft types. In terms of engine type, the segmentation comprises gas-powered and diesel-powered engines, catering to different performance and efficiency preferences. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Inboard boats are projected to account for 33.0% of the overall market revenue in 2025, making them the leading product segment. This dominance is being shaped by the segment’s suitability for a wide range of recreational applications, including cruising, water skiing, and wakeboarding.

Inboard propulsion systems are valued for their balanced weight distribution and reduced exterior equipment, offering improved safety and smoother ride dynamics. The compact engine layout enhances cabin space and aesthetic design, aligning with consumer preferences for premium features and comfort.

Additionally, reduced maintenance requirements and higher resale value have strengthened their appeal among frequent and long-distance boaters. As coastal and lakefront leisure destinations continue to grow in popularity, inboard boats are positioned to maintain strong traction across both personal and rental markets.

Gas-powered engines are expected to dominate the recreational boating market with a 61.0% revenue share in 2025. This leadership is driven by their affordability, wide availability, and lower upfront costs compared to diesel and electric alternatives.

Gas engines offer high power-to-weight ratios and quick acceleration, which are desirable traits for recreational activities such as water sports and cruising. Enhanced compatibility with a variety of boat types, from runabouts to pontoon boats, has made gas engines the go-to choice for both individual buyers and fleet operators.

Moreover, recent improvements in fuel efficiency, emissions control, and compliance with marine safety regulations have extended the segment’s lifecycle advantage. As demand grows for high-performance yet accessible boating experiences, gas engine configurations are expected to remain the preferred option for a majority of users.

Demand for boating is rising as leisure spending rebounds and coastal infrastructure improves. Growth prospects lie in compact electric vessels, marina partnerships and service-based ownership models targeting emerging boating communities.

Recreational boating is gaining new appeal beyond traditional yacht owners. Entry-level boats for day cruising, fishing, and watersport enthusiasts are attracting younger buyers. Boating clubs, shared ownership schemes, and boat rental platforms are making water access easier while reducing upfront costs.

Port and marina developments in coastal cities and lakeside areas, along with coordinated boating events and festivals, are drawing new users into the boating community. Safety training programs, online booking systems and mobile-first charter platforms further simplify boat access. As more households see boating as a leisure lifestyle choice rather than a one-time investment, demand for smaller vessels with easy maintenance and versatile use is growing rapidly.

The market offers growth by integrating onboard connectivity features such as navigation apps, weather updates and companion services into recreational vessels. Electric and hybrid propulsion systems appeal to environmentally aware users and regions with noise or emissions restrictions.

Implementing lease or subscription-based ownership models that include docking, insurance and maintenance packages can attract users who prefer minimal hassle. Partnerships between boat builders, marina operators and water sport service providers enable bundled offerings such as charter plus instructor access.

Advancements in lightweight materials and modular boat design also reduce costs and improve transportability. These combined innovations enable new customer segments to enter boating with greater convenience and affordability.

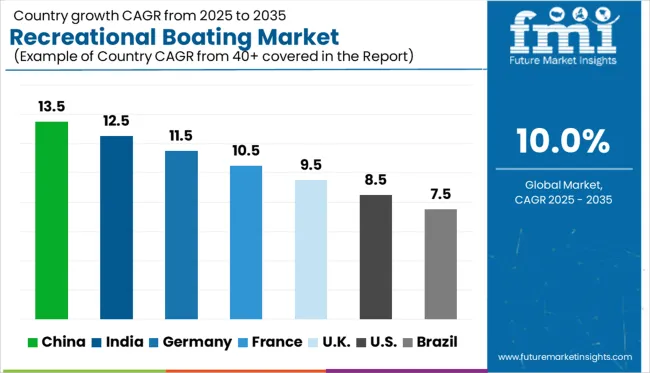

| Countries | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

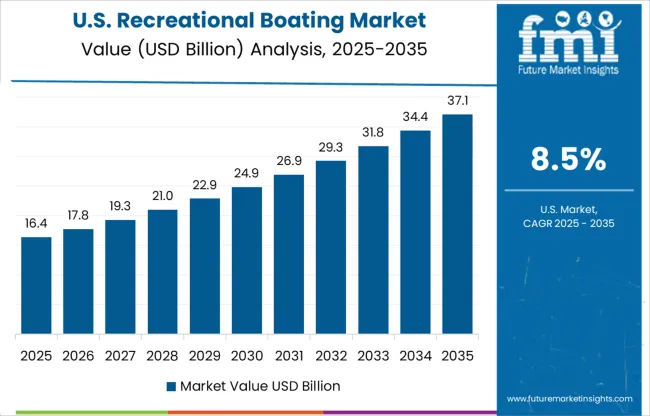

| USA | 8.5% |

| Brazil | 7.5% |

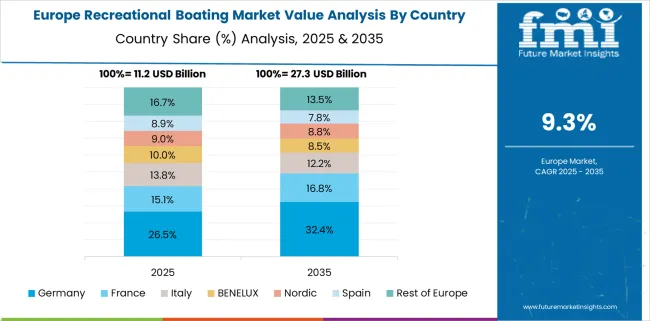

The global recreational boating market is projected to register a CAGR of 10% from 2025 to 2035, driven by rising leisure spending, marine tourism, and coastal development initiatives. China leads with a 13.5% CAGR, propelled by luxury boat ownership, marina infrastructure expansion, and the participation of the emerging middle class.

India follows closely at 12.5%, supported by coastal tourism, nautical clubs, and increasing disposable income in metro regions. Germany, part of the OECD, records an 11.5% CAGR through strong boat manufacturing, inland waterways, and premium segment growth. France sees a 10.5% CAGR driven by its rich maritime heritage and yacht chartering demand.

The UK shows a slightly lower 9.5% CAGR, reflecting mature demand. The USA, with 8.5%, sees stable growth via sport fishing and recreational cruising. This report covers a detailed analysis of 40+ countries, and the top countries have been shared as a reference.

China is estimated to advance at a 13.5% CAGR, the fastest growth in the global recreational boating market. Rising interest in leisure watercraft among affluent households and coastal tourism operators is generating consistent YoY gains. The government is easing marina access restrictions in select regions, allowing private ownership and charter activity to increase. Domestic boatbuilders are focusing on smaller vessels under 30 feet to meet entry-level demand.

Most boating activity remains concentrated near economic zones, including Guangdong, Zhejiang, and Hainan, where marina development is accelerating. China is also investing in inland waterway infrastructure, supporting growth in river cruising and small-yacht segments. Recreational boating is evolving from a niche hobby to an aspirational lifestyle, especially among younger buyers.

India is anticipated to grow at a 12.5% CAGR, with YoY momentum coming from domestic tourism, hospitality integration, and water-based recreation in key coastal states. Demand is rising for personal watercraft and speedboats as hospitality chains offer bundled boating experiences. Coastal infrastructure upgrades in states like Kerala, Goa, and Maharashtra are enabling short-distance leisure routes.

Domestic manufacturers are launching fiberglass boats for first-time users in partnership with marine service providers. State tourism departments are actively promoting backwater and harbor tours, stimulating small-scale boat purchases. While luxury yacht sales remain minimal, the middle-tier boating category is showing strong annual volume gains. This market remains capacity-constrained but highly responsive to organized tourism.

Germany is projected to grow at an 11.5% CAGR, with strong YoY growth linked to lake and river-based boating across Bavaria, Brandenburg, and Mecklenburg. The market is driven by private ownership of sailboats and small cabin cruisers used on inland waters. Licensing reforms and expanded mooring availability are encouraging new hobbyists to enter the segment.

Demand is shifting toward low-maintenance vessels suited for multi-day recreational use. Domestic production remains focused on high-quality fiberglass cruisers, while import volumes for trailerable boats are also rising. Charter models around the Danube and Rhine are gaining traction, especially in the summer months. Germany is emerging as a balanced market with both ownership and rental demand increasing steadily.

The United States is advancing with a 8.5% CAGR, recording solid YoY gains through lakeside recreation, coastal cruising, and towable sports boats. Ownership is rising among families seeking weekend water activities, particularly in states with strong lakefront access like Florida, Michigan, and Texas.

Jet boats, pontoons, and cabin cruisers dominate mid-tier sales, while luxury yachts remain concentrated in coastal marinas. Charter services and shared ownership are also gaining momentum as users look for lower-cost entry points. The market benefits from robust dealer networks and widespread boat financing availability, making personal watercraft more accessible across income groups.

The United Kingdom is growing at a 9.5% CAGR, with YoY improvement anchored in sailing clubs, marina developments, and holiday boating routes across southern England and Scotland. Powerboats under 35 feet remain the top choice for private owners, with trailerable boats gaining popularity due to storage flexibility. Inland boating is rising steadily along the Thames, Broads, and northern canals.

Boat hire companies are expanding fleets to meet seasonal tourism demand, while sailing schools are increasing beginner enrollments. Despite limited warm-weather months, interest in leisure boating is extending into spring and autumn, particularly through shared ownership and co-charter models that reduce entry barriers.

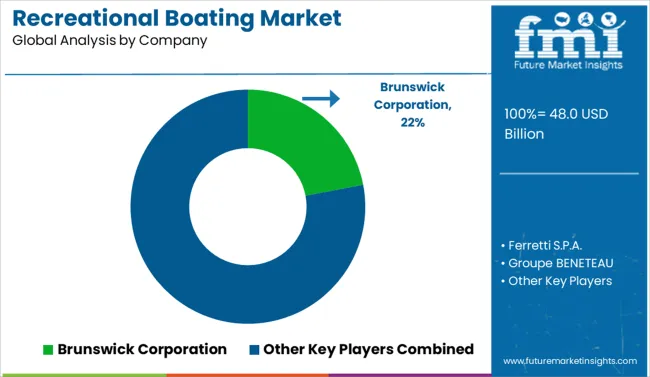

The recreational boating market is moderately consolidated, with a few dominant players and a mix of specialty and regional manufacturers contributing to a diverse landscape. Brunswick Corporation leads the market with a strong portfolio of brands such as Sea Ray, Bayliner, and Mercury Marine, covering a broad spectrum from entry-level boats to premium models and engines.

Close competitors like Groupe BENETEAU and Ferretti S.P.A. dominate the European segment, focusing on luxury yachts and sailing vessels, while Malibu Boats, Inc. and MasterCraft Boat Company, Inc. cater to the high-performance and tow sports categories in North America.

Polaris Inc., through its Bennington brand, targets the growing pontoon boat market. Yamaha holds a strong position with its jet boats and marine engines, leveraging its global brand recognition and technological edge in propulsion systems.

On April 24, 2025, MarineMax reported record Q2 FY2025 revenue of USD 631.5 million, up 8.3% year-over-year. Same-store sales rose 11%, with adjusted EBITDA at USD 30.9 million, reflecting strategic growth in high-margin sectors as mentioned in BusinessWire

| Item | Value |

|---|---|

| Quantitative Units | USD 48.0 Billion |

| Product | Inboard Boat, 201 to 500 hp, Below 200 hp, 501 to 1000 hp, Above 1000 hp, Outboard boat, Type, horsepower, Inflatables, and horsepower |

| Engine Type | Gas and Diesel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Brunswick Corporation, Ferretti S.P.A., Groupe BENETEAU, Malibu Boats, Inc., MasterCraft Boat Company, Inc., Polaris Inc., and Yamaha |

| Additional Attributes | Dollar sales by boat type, propulsion system, and end-user income segment; regional demand driven by tourism growth, waterfront development, and lifestyle shifts; innovation in electric propulsion, smart navigation, and eco-friendly hull materials; cost dynamics shaped by fuel prices, maintenance, and mooring availability; environmental impact from emissions and water pollution; and emerging use cases in boat-sharing platforms, eco-tourism, and hybrid marine systems. |

The global recreational boating market is estimated to be valued at USD 48.0 billion in 2025.

The market size for the recreational boating market is projected to reach USD 124.6 billion by 2035.

The recreational boating market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in recreational boating market are inboard boat , 201 to 500 hp, below 200 hp, 501 to 1000 hp, above 1000 hp, outboard boat, type, horsepower, inflatables and horsepower.

In terms of engine type, gas segment to command 61.0% share in the recreational boating market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recreational and Outdoor Products Market Size and Share Forecast Outlook 2025 to 2035

Recreational Marine Scrubber Systems Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Recreational Oxygen Equipment Suppliers

Recreational Aquasports Market Growth – Trends & Forecast 2025-2035

Recreational Boat Market

Kids Recreational Services Market by Activity Type, Service Type, and Region - Forecast to 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA