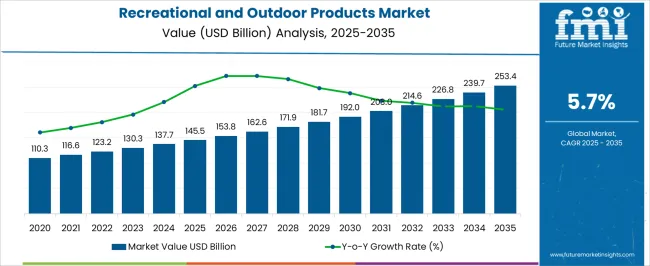

The recreational and outdoor products market is projected to grow from USD 145.5 billion in 2025 to USD 253.4 billion by 2035, representing a CAGR of 5.7%. This growth corresponds to an absolute dollar opportunity of USD 107.9 billion over the decade. Expansion is driven by rising consumer interest in outdoor activities, sports, and leisure products. Companies can capitalize on this growth by expanding product portfolios, optimizing distribution channels, and strengthening retail and e-commerce presence.

Over the next ten years, the USD 107.9 billion opportunity highlights a strong growth trajectory for the recreational and outdoor products market. By 2035, revenue will be supported by both new product introductions and the replacement of existing equipment across various segments, including camping, sports, and leisure. The CAGR of 5.7% indicates a consistent and profitable expansion, enabling firms to scale operations efficiently and strengthen regional reach.

Companies can focus on aligning sales, distribution, and service strategies with market demand to maximize returns. The absolute growth potential provides clear incentives for businesses to maintain operational efficiency while capturing incremental revenue throughout the forecast period.

| Metric | Value |

|---|---|

| Recreational and Outdoor Products Market Estimated Value in (2025 E) | USD 145.5 billion |

| Recreational and Outdoor Products Market Forecast Value in (2035 F) | USD 253.4 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

In the early growth phase of the recreational and outdoor products market, revenue expands steadily from USD 145.5 billion in 2025, reflecting a CAGR of 5.7%. Growth during this period is primarily driven by initial adoption of outdoor and sports equipment across consumer and commercial segments. Companies focus on establishing distribution networks, building brand presence, and forming partnerships with retailers and e-commerce platforms.

The absolute dollar opportunity in this phase is moderate, allowing firms to refine production, optimize operations, and respond to market feedback. Early growth provides a foundation for scaling while maintaining manageable risk and steady revenue capture. In the late growth phase, approaching 2035 and a market size of USD 253.4 billion, the recreational and outdoor products market experiences more pronounced revenue expansion due to broader adoption and replacement of existing products. Market strategies shift toward scaling production, expanding regional reach, and leveraging established customer networks.

The absolute dollar opportunity in this stage is significant, representing most of the USD 107.9 billion growth over the decade. Companies benefit from operational efficiencies and stronger brand recognition, ensuring the 5.7% CAGR translates into consistent and profitable growth.

The recreational and outdoor products market is growing steadily as consumers increasingly prioritize health, wellness, and nature-based leisure activities. Rising disposable incomes, urban fatigue, and awareness of active lifestyles are driving investments in gear and equipment that support recreational pursuits.

Product innovation, such as lightweight materials and multi-use functionality, has made outdoor activities more accessible to beginners and enthusiasts alike. Retailers are also benefiting from digital channels that personalize product discovery and support niche community needs.

Additionally, macro trends such as domestic travel and solo excursions have bolstered market penetration across regions.

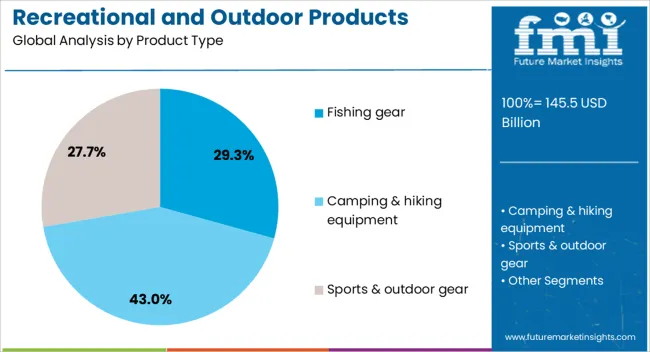

The recreational and outdoor products market is segmented by product type, price, end use, distribution channel, and geographic regions. By product type, recreational and outdoor products market is divided into Fishing gear, Camping & hiking equipment, Sports & outdoor gear, and Outdoor electronics.

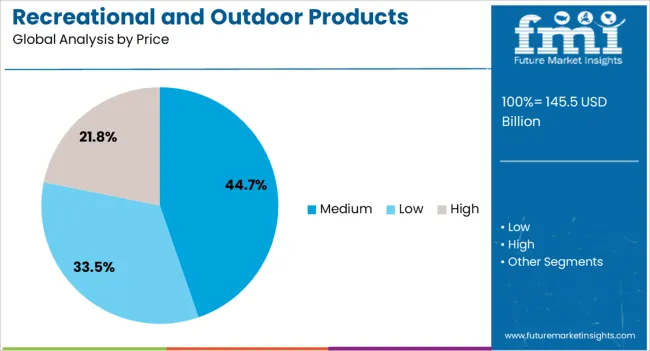

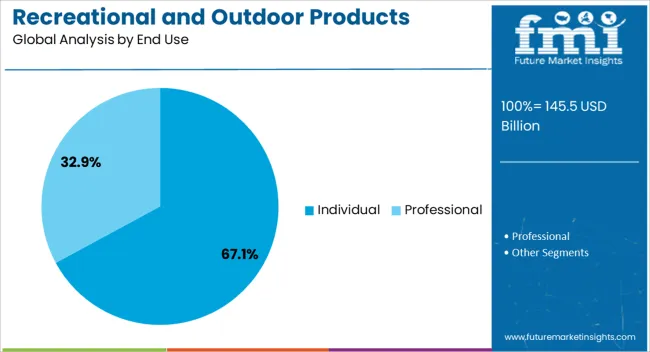

In terms of price, recreational and outdoor products market is classified into Medium, Low, and High. Based on end use, recreational and outdoor products market is segmented into Individual and Professional. By distribution channel, recreational and outdoor products market is segmented into Online and Offline. Regionally, the recreational and outdoor products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Fishing gear leads the product type segment with a 29.30% share in 2025, reflecting its popularity across age groups and geographies. The segment benefits from a broad consumer base ranging from casual weekend fishers to sport fishing professionals.

Advances in rod sensitivity, reel mechanics, and bait technology have further fueled purchases. Growing interest in sustainable outdoor food sourcing and catch-and-release practices has also enhanced the appeal of fishing gear.

Moreover, the accessibility of fishing in both urban and rural environments supports consistent demand year-round.

Medium-priced products are expected to dominate the market in 2025 with a 44.70% share, driven by their balance between quality and affordability. This segment serves both new entrants and seasoned users who seek durable, branded gear without the premium markup.

The medium price tier also benefits from multi-channel distribution strategies, particularly online platforms and specialty retail stores. It attracts repeat buyers who prioritize longevity and functionality but are price-conscious.

As innovation scales and competition rises, the medium price bracket is becoming the sweet spot for both manufacturers and consumers.

The individual segment is anticipated to hold a dominant 67.10% share of the market by 2025, underscoring the rising trend of solo or self-planned recreational activity. This is propelled by flexible work schedules, personal wellness goals, and the appeal of nature-based escapism.

Gear customization, compact product formats, and direct-to-consumer models have all supported this end-user group.

Additionally, social media-driven outdoor challenges and influencer-led brand promotion continue to expand individual engagement in recreational activities, making this the core demand generator in the market.

The recreational and outdoor products market is expanding as consumers increasingly engage in outdoor activities, fitness, camping, hiking, and adventure sports. Products include tents, backpacks, bicycles, kayaks, outdoor apparel, footwear, and leisure equipment. Growth is fueled by rising awareness of health and wellness, urban outdoor recreation, and eco-tourism trends.

Manufacturers offering durable, lightweight, and multi-functional products with innovative designs, sustainable materials, and enhanced safety features are well-positioned to capture market opportunities. E-commerce platforms and specialty retail stores further support distribution, while government initiatives promoting outdoor recreation and active lifestyles contribute to market expansion globally.

Market growth is constrained by the high costs of premium recreational and outdoor products and seasonal fluctuations in demand. Advanced equipment, such as lightweight tents, performance apparel, and high-end bicycles, requires durable materials and precision manufacturing, increasing retail prices. Consumer spending may decline during off-season periods or in regions with unfavorable climates. Additionally, maintenance and safety considerations for specialized equipment, like kayaks or climbing gear, may limit adoption among casual users. Manufacturers are addressing these challenges by offering modular designs, multi-season products, financing options, and promotional campaigns to encourage year-round engagement and broaden accessibility across recreational enthusiasts and outdoor adventurers.

Market trends are influenced by smart gear integration, sustainable materials, and connected outdoor products. GPS-enabled wearable devices, smart bicycles, and fitness trackers enhance outdoor experiences by providing performance data, navigation, and safety alerts. Eco-friendly fabrics, recycled plastics, and biodegradable materials appeal to environmentally conscious consumers. Integration with mobile apps allows users to track activities, plan routes, and monitor environmental conditions. These trends highlight the growing consumer demand for technology-driven, sustainable, and multifunctional outdoor equipment, promoting enhanced performance, convenience, and safety while supporting eco-tourism and responsible recreational practices worldwide.

Opportunities arise from rising participation in outdoor leisure activities, adventure tourism, and fitness trends. Urbanization, increased disposable income, and social media influence are encouraging outdoor recreation, camping, hiking, and cycling. Tourism growth in natural parks, coastal regions, and adventure destinations is driving demand for high-quality recreational products. Manufacturers offering durable, versatile, and ergonomic equipment that caters to professional adventurers and casual users can capitalize on this growth. Retailers providing bundled kits, e-commerce availability, and brand customization are also well-positioned. Expansion in emerging markets with growing middle-class populations and government initiatives promoting active lifestyles further enhances market potential globally.

Market growth is restrained by intense competition, counterfeit products, and safety-related concerns. Numerous brands compete on price, design, and functionality, affecting profit margins for premium products. Low-quality or imitation outdoor gear may fail to meet durability or safety standards, reducing consumer trust. Equipment failures during activities such as climbing, kayaking, or cycling pose liability risks and can limit adoption among cautious consumers. Supply chain disruptions for specialized materials and components can also affect production and availability. Until manufacturers ensure product quality, compliance with safety standards, and brand differentiation, adoption may remain concentrated among experienced outdoor enthusiasts, professional adventurers, and premium consumers.

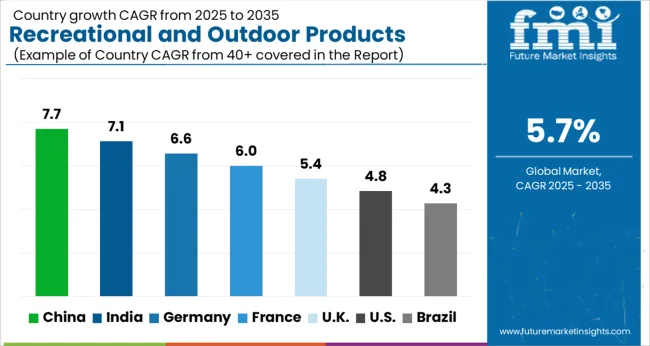

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The global recreational and outdoor products market is projected to grow at a CAGR of 5.7% through 2035, driven by demand across camping, hiking, and leisure sports segments. Among BRICS nations, China has been recorded with 7.7% growth, where production and distribution of tents, backpacks, portable gear, and outdoor furniture have been extensively carried out by companies such as Decathlon, Naturehike, and KingCamp. India has been observed at 7.1%, supported by rising adoption in adventure sports, trekking, and recreational tourism sectors. In the OECD region, Germany has been measured at 6.6%, where production for hiking equipment, outdoor apparel, and leisure accessories has been steadily maintained. The United Kingdom has been noted at 5.4%, reflecting consistent use in recreational activities and sports clubs, while the USA has been recorded at 4.8%, with deployment in camping, outdoor leisure, and sporting goods being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The market for recreational and outdoor products in China is expanding at a CAGR of 7.7%, driven by increasing leisure activities, urban outdoor recreation, and tourism development. Manufacturers supply camping gear, sports equipment, outdoor furniture, and water sports products to meet rising consumer demand. Government initiatives promoting tourism, public parks, and recreational infrastructure support market adoption. Pilot projects in urban parks, tourist destinations, and outdoor sports events demonstrate benefits including improved user experience, increased activity participation, and higher safety standards. Collaborations between manufacturers, tourism operators, and outdoor recreation associations are enhancing product durability, ergonomics, and performance. Growing interest in health-focused outdoor activities and domestic tourism continues to drive the Chinese recreational and outdoor products market.

The market for recreational and outdoor products in India is growing at a CAGR of 7.1%, supported by increasing domestic tourism, outdoor sports adoption, and urban leisure activities. Manufacturers provide camping equipment, sports gear, outdoor furniture, and adventure products for commercial and personal use. Government initiatives promoting tourism, adventure sports, and urban recreational facilities foster adoption. Pilot projects in urban parks, tourist spots, and sports clubs demonstrate operational benefits including enhanced safety, better user experience, and increased participation in outdoor activities. Collaborations between product manufacturers, tourism boards, and outdoor sports associations are advancing product quality, durability, and ergonomics. Expanding domestic tourism and lifestyle-driven leisure activities continue to drive growth in the Indian market.

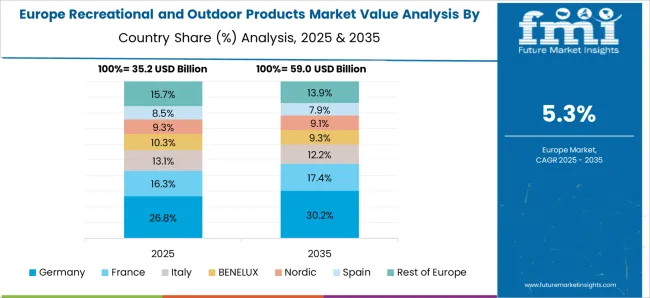

The market for recreational and outdoor products in Germany is recording a CAGR of 6.6%, driven by outdoor sports culture, tourism, and public park development. Manufacturers supply high-quality camping gear, outdoor furniture, cycling equipment, and water sports products for commercial and consumer use. Government programs supporting sustainable tourism, recreational infrastructure, and outdoor activity promotion encourage adoption. Pilot deployments in urban parks, tourist attractions, and recreational clubs demonstrate benefits including increased participation in outdoor activities, enhanced safety, and better user satisfaction. Collaborations between manufacturers, outdoor associations, and tourism operators are improving product durability, ergonomics, and environmental sustainability. Germany’s strong outdoor culture and emphasis on recreational infrastructure support continued market growth.

The market for recreational and outdoor products in the United Kingdom is growing at a CAGR of 5.4%, supported by urban leisure trends, outdoor sports participation, and domestic tourism. Manufacturers supply camping gear, sports equipment, outdoor furniture, and adventure products for both commercial and personal applications. Government initiatives promoting tourism, public parks, and urban recreational facilities encourage adoption. Pilot projects in parks, sports clubs, and tourist sites demonstrate operational benefits including improved user experience, higher participation, and safer outdoor activities. Collaborations between manufacturers, tourism boards, and outdoor associations enhance product quality, durability, and design. Rising consumer interest in health-focused and recreational activities continues to drive the UK market.

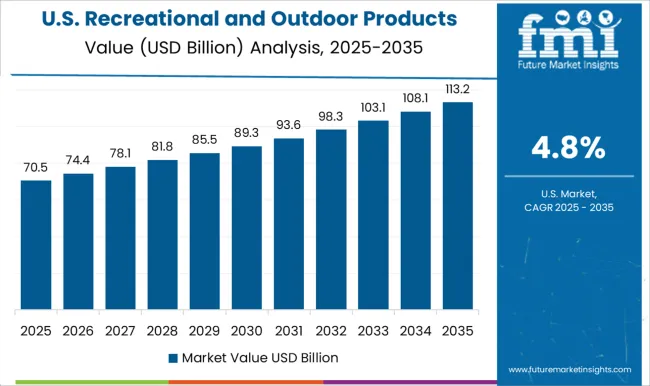

The market for recreational and outdoor products in the United States is expanding at a CAGR of 4.8%, fueled by outdoor sports, domestic tourism, and lifestyle-driven leisure activities. Manufacturers provide camping gear, outdoor furniture, adventure equipment, and water sports products for commercial and residential use. Government initiatives promoting national parks, outdoor recreation, and tourism development encourage adoption. Pilot deployments in parks, sports clubs, and adventure programs demonstrate benefits including enhanced safety, increased participation, and improved user experience. Collaborations between manufacturers, tourism boards, and outdoor recreation associations enhance product durability, ergonomics, and usability. Expanding interest in health-focused and recreational activities continues to drive the USA recreational and outdoor products market.

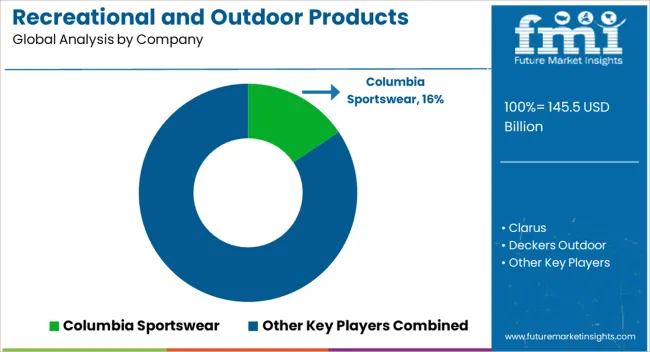

The recreational and outdoor products market is highly competitive, with global and regional players offering a diverse range of equipment, apparel, and gear for camping, hiking, adventure sports, and leisure activities. Key competitive factors include product innovation, durability, material quality, design, brand reputation, and distribution network coverage.

Major players such as The North Face, Columbia Sportswear, Patagonia, Decathlon, and REI Co-op focus on innovation in lightweight materials, weather-resistant fabrics, and multifunctional gear to appeal to outdoor enthusiasts. Regional and niche brands, including MSR, Kelty, and YETI, compete through specialized products such as camping stoves, high-performance tents, and insulated coolers. Competition is also shaped by e-commerce growth, omnichannel retail strategies, and the integration of sustainability-focused materials without compromising performance. Seasonal demand, product customization, and collaborations with outdoor events or adventure programs are further influencing market positioning. Companies leverage brand loyalty, innovative product features, and after-sales support to strengthen their share and differentiate in a market increasingly driven by lifestyle trends and experiential outdoor activities.

| Item | Value |

|---|---|

| Quantitative Units | USD 145.5 Billion |

| Product Type | Fishing gear, Camping & hiking equipment, Sports & outdoor gear, and Outdoor electronics |

| Price | Medium, Low, and High |

| End Use | Individual and Professional |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Columbia Sportswear, Clarus, Deckers Outdoor, Foot Locker, Garmin, Johnson Outdoors, Marmot, Newell Brands, Patagonia, REI, Sporting Goods Corporation, The North Face, Topgolf Callaway Brands, Wolverine Worldwide, and Yeti |

| Additional Attributes | Dollar sales by type including camping gear, sports equipment, and leisure accessories, application across outdoor sports, adventure tourism, and home recreation, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising outdoor activities, increasing health and fitness awareness, and growing demand for innovative and durable recreational products. |

The global recreational and outdoor products market is estimated to be valued at USD 145.5 billion in 2025.

The market size for the recreational and outdoor products market is projected to reach USD 253.4 billion by 2035.

The recreational and outdoor products market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in recreational and outdoor products market are fishing gear, outdoor apparel & footwear, hiking boots, outdoor jackets, outdoor pants, others (gloves, hats etc.), camping & hiking equipment, tents, sleeping bags, backpacks, hiking poles, camping stoves, others (lanterns etc.), sports & outdoor gear, bicycles, skateboards, paddle boards, skiing & snowboarding equipment, climbing equipment, others (kayaks etc.), outdoor electronics, gps systems, headlamps, solar-powered chargers, outdoor smartwatches, others (fitness trackers etc.) and others (equestrian products etc.).

In terms of price, medium segment to command 44.7% share in the recreational and outdoor products market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recreational Marine Scrubber Systems Market Size and Share Forecast Outlook 2025 to 2035

Recreational Boating Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Recreational Oxygen Equipment Suppliers

Recreational Aquasports Market Growth – Trends & Forecast 2025-2035

Recreational Boat Market

Kids Recreational Services Market by Activity Type, Service Type, and Region - Forecast to 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA