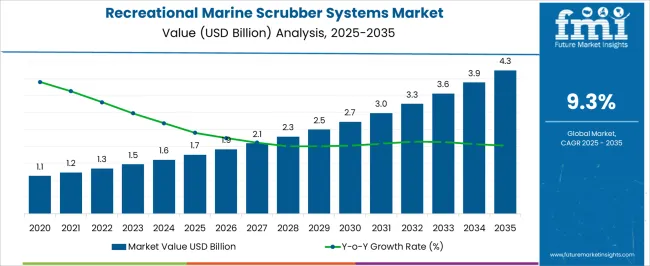

The Recreational Marine Scrubber Systems Market is projected to grow from an estimated USD 1.7 billion in 2025 to USD 4.3 billion by 2035, reflecting a compound annual growth rate (CAGR) of 9.3%. The year-on-year (YoY) growth pattern indicates steady and accelerating demand within the forecast period. Examining the annual data, the market increases incrementally from USD 1.7 billion in 2025 to USD 2.5 billion by 2029. This phase reflects consistent moderate growth, averaging around 11-12% annual increases, signaling increasing adoption of scrubber technology in recreational marine vessels driven by environmental regulations and emission control requirements.

From 2030 onwards, growth momentum strengthens further, with values rising from USD 2.7 billion to USD 4.3 billion by 2035. This period reflects a clear upward trajectory in YoY increments, showcasing expanding market penetration and likely advancements in scrubber efficiency and affordability. The annual growth rates during these later years remain robust, indicating sustained market enthusiasm and investment. The data reflects a reliable growth trend with no significant fluctuations or slowdowns. The steady YoY increases demonstrate ongoing opportunities for manufacturers and investors. The market growth aligns well with increasing environmental awareness and tightening marine emission standards, which are key drivers sustaining the positive growth outlook over the coming decade.

| Metric | Value |

|---|---|

| Recreational Marine Scrubber Systems Market Estimated Value in (2025 E) | USD 1.7 billion |

| Recreational Marine Scrubber Systems Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 9.3% |

The recreational marine scrubber systems market is experiencing notable traction due to tightening international emission norms and the rising adoption of emission control technologies in leisure maritime vessels. Regulatory frameworks such as IMO 2020 and EU Green Deal targets are pushing yacht owners and luxury marine fleet operators to invest in exhaust gas cleaning systems to comply with sulfur emission limits.

The market is also being shaped by advancements in compact, vessel-compatible scrubber technologies that can be retrofitted without altering hull integrity or performance. Environmental stewardship among high-net-worth individuals and premium charter operators has increased the demand for onboard green technologies, aligning with corporate sustainability messaging.

Future market growth is expected to be supported by rising luxury yacht production, retrofit incentives, and the integration of scrubber systems with smart onboard monitoring platforms to ensure real-time emissions tracking and compliance.

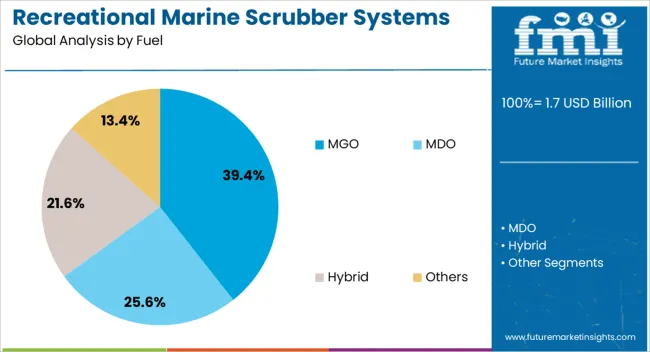

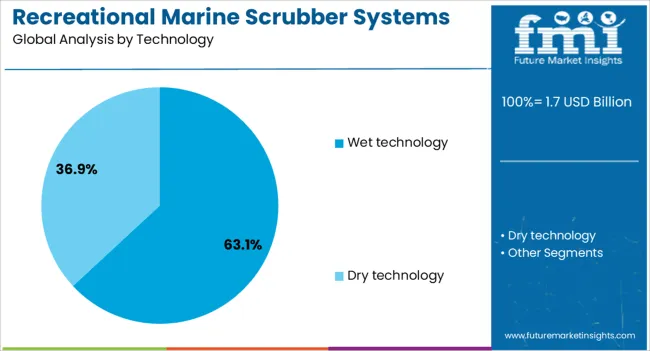

The recreational marine scrubber systems market is segmented by fuel, technology, and region. By fuel, the market is divided into MGO, MDO, hybrid, and others. In terms of technology, it is classified into wet technology and dry technology. Regionally, the recreational marine scrubber systems industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Marine gas oil (MGO) is expected to lead the fuel segment with 39.4% of the total market revenue share in 2025. This leadership is being driven by its lower sulfur content compared to heavy fuel oil, which enables easier compliance with international marine emissions regulations.

MGO’s compatibility with a wide range of engine types, especially in the recreational boating segment, has supported its usage across yachts and leisure vessels. The reduced need for pre-treatment systems when using MGO makes it an attractive option for operators aiming to minimize onboard space consumption.

Additionally, the rising costs and logistical complexities associated with high-sulfur fuel availability have further shifted preference toward MGO. As emission standards become more stringent and operational simplicity remains a key consideration for leisure vessels, MGO continues to dominate as the preferred clean-burning marine fuel.

Wet scrubber technology is projected to contribute 63.1% of the revenue share in the market by 2025, making it the dominant technology type. This segment’s prominence stems from its high efficiency in removing sulfur oxides and particulate matter from exhaust gases in real-time operation. Wet scrubbers have proven effective in maintaining compliance with stringent maritime emission limits, particularly for vessels operating in emission control areas (ECAs).

Their ability to operate continuously without requiring exhaust gas bypass or fuel switching has improved system reliability and reduced long-term maintenance demands. The compact design adaptability of wet scrubbers has allowed integration into space-constrained recreational vessels without compromising vessel performance.

Moreover, increased manufacturer focus on hybrid wet systems and closed-loop variants with freshwater circulation is enabling operators to meet both emission and wastewater discharge standards. These factors continue to reinforce wet technology’s lead in the marine emission control space.

The recreational marine scrubber systems market has been expanding as the maritime sector faces increasing pressure to comply with stricter environmental regulations aimed at reducing sulfur oxide and particulate emissions from vessel exhaust. Recreational boats, including yachts and small passenger crafts, are progressively adopting scrubber systems to meet emission standards without compromising performance. Growing environmental awareness among boat owners and operators is driving demand for cleaner propulsion technologies. Innovations in compact, efficient, and low-maintenance scrubber designs tailored for smaller vessels have enhanced market acceptance.

Stricter international and regional regulations on sulfur emissions, such as IMO’s MARPOL Annex VI, have compelled recreational marine operators to adopt scrubber technologies to comply with environmental standards. The push for cleaner marine air quality has intensified enforcement of emission limits in coastal and protected waters where recreational boating is prevalent. These regulatory frameworks mandate significant reductions in sulfur oxides, prompting boat manufacturers and owners to retrofit existing vessels or install scrubbers in new builds. Compliance not only avoids penalties but also aligns with increasing consumer demand for environmentally responsible boating, making scrubbers a necessary investment for sustainable recreational marine operations.

Advancements in scrubber system technology have focused on miniaturization, energy efficiency, and ease of maintenance to meet the unique needs of recreational vessels. Compact designs optimize limited onboard space without sacrificing scrubbing performance. Improved water treatment modules and filtration systems reduce operational complexity and environmental impact. Automation and smart monitoring features enable real-time performance tracking and simplify user operation. Noise and vibration reduction technologies have been incorporated to maintain comfort levels onboard. These innovations increase the feasibility of scrubber installation on diverse vessel types, broadening market reach and supporting adoption among environmentally conscious boat owners.

Growing environmental consciousness among recreational boaters and the broader marine community has become a significant driver for scrubber system adoption. Awareness campaigns and industry initiatives highlight the impact of vessel emissions on marine ecosystems and human health, influencing purchasing decisions. Owners increasingly prioritize green technologies to reduce their environmental footprint and support ocean conservation efforts. This shift in consumer behavior is complemented by incentives from governments and marine associations promoting cleaner boating practices. The positive perception of scrubber-equipped vessels enhances brand image and resale value, creating further incentives for market growth in this environmentally focused segment.

Despite benefits, the recreational marine scrubber systems market faces hurdles related to high upfront costs, complex installation processes, and space limitations on smaller vessels. Retrofitting existing boats with scrubbers requires careful engineering to integrate systems without affecting stability or usability. Maintenance demands and operational expenses can also deter some owners. Additionally, variability in regional regulations and lack of uniform standards sometimes cause uncertainty in investment decisions. Manufacturers are addressing these issues by developing modular, plug-and-play solutions and offering flexible financing options to reduce barriers. Continued innovation aimed at lowering costs and simplifying installation is critical for expanding market penetration in the recreational marine sector.

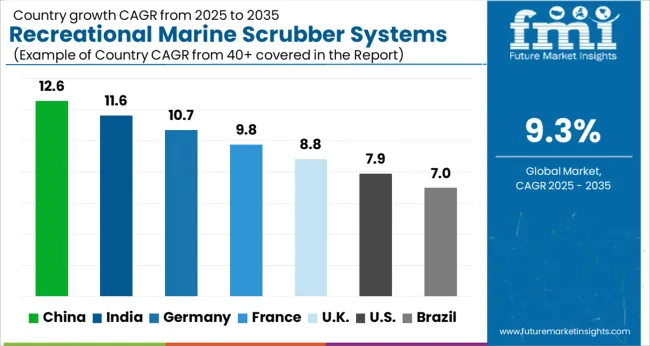

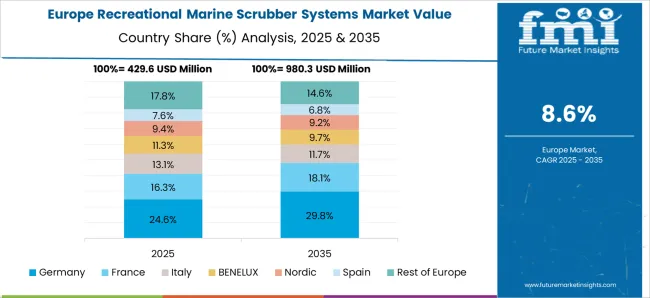

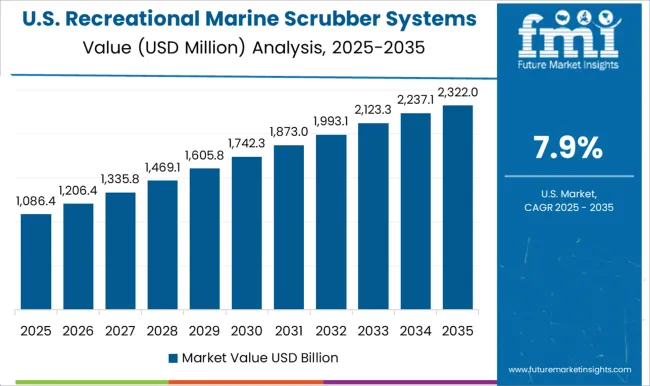

The market is projected to grow at a CAGR of 9.3% between 2025 and 2035, driven by increasing environmental regulations, rising demand for cleaner marine vessels, and advancements in emission control technologies. China leads with a 12.6% CAGR, supported by a growing fleet of recreational boats and government incentives for pollution reduction. India follows at 11.6%, fueled by expanding maritime leisure activities and regulatory compliance. Germany, growing at 10.7%, benefits from technological innovation and strong environmental policies. The UK, at 8.8%, experiences increasing adoption in coastal recreational boating, while the USA, with a 7.9% CAGR, reflects ongoing upgrades in marine emission controls and environmental awareness. This report includes insights on 40+ countries; the top markets are shown here for reference.

The industry in China is expected to expand at a CAGR of 12.6% from 2025 to 2035, led by government initiatives targeting emission reductions in coastal waters. Domestic manufacturers such as Wison Group and Shanghai Marine Equipment are investing in advanced scrubber technologies to comply with increasingly strict environmental regulations. The growth is also driven by a rising number of leisure vessels and yachts operating in major ports including Shanghai and Shenzhen. Partnerships between marine equipment producers and environmental agencies accelerate the development of effective exhaust gas cleaning systems. The increasing emphasis on cleaner maritime operations positions China as a key player in Asia Pacific marine technology advancements.

India is projected to witness a CAGR of 11.6% in the recreational marine scrubber systems market from 2025 to 2035, supported by expanding coastal tourism and tighter marine pollution controls. The market benefits from growing interest in boating and yacht ownership in key regions like Mumbai and Goa. Indian manufacturers collaborate with international firms to develop affordable and efficient scrubber units tailored to local marine environments. Regulatory enforcement at major ports continues to stimulate demand for emission control technologies. Enhanced environmental awareness among recreational boat owners also drives market adoption, while government support for cleaner maritime practices boosts the overall market outlook.

Germany is expected to grow at a CAGR of 10.7% through 2035, fueled by strict European emission regulations and demand for environmentally friendly leisure vessels. Manufacturers focus on developing highly efficient scrubber units compliant with IMO and EU standards. Increasing yacht ownership combined with investments in marina infrastructure upgrades are boosting adoption. Leading companies invest in research to improve system reliability under varying operational conditions. The market growth is further supported by Germany’s commitment to green maritime technology and its position as a hub for marine innovation in Europe.

The United Kingdom market for recreational marine scrubber systems is projected to expand at a CAGR of 8.8% from 2025 to 2035, driven by government efforts to improve water quality and growing popularity of leisure boating. Demand is rising as boat owners seek to comply with environmental regulations targeting air and water pollution in marinas and coastal areas. British manufacturers are developing compact, efficient scrubber solutions suited for diverse recreational vessels. Investments in marina monitoring and cleaner marine infrastructure also encourage uptake. The market reflects a growing consumer preference for environmentally responsible boating without compromising vessel performance.

The market in the United States is expected to grow at a CAGR of 7.9% through 2035, led by increasing boating activity and tighter emission control requirements. The market is supported by advances in durable and low-maintenance scrubber technologies suitable for various types of watercraft. Regulatory agencies have implemented stricter emission limits for vessels operating in both coastal and inland waters. Collaborations between equipment manufacturers and boat builders focus on tailored solutions addressing the needs of the large US recreational boating community. These efforts contribute to gradual adoption and steady market expansion.

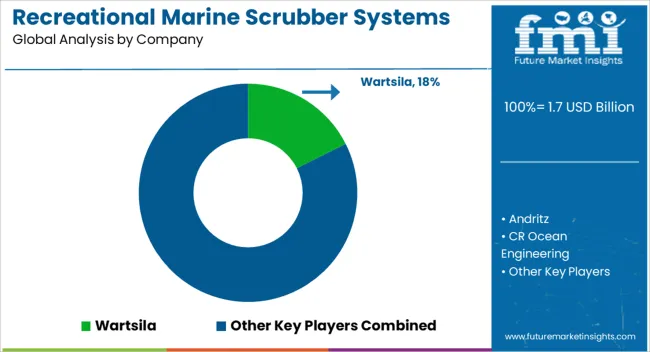

The market is shaped by key players offering advanced solutions to reduce emissions and comply with maritime environmental regulations. Wartsila is a leading provider with a broad portfolio of exhaust gas cleaning systems designed for yachts and leisure vessels, focusing on efficiency and compact design. Andritz and CR Ocean Engineering supply innovative scrubber technologies that address specific recreational marine needs, emphasizing low water and energy consumption.

Damen Shipyards Group integrates scrubber systems into new builds and retrofit projects, leveraging its shipbuilding expertise to optimize system performance. DuPont contributes through specialized materials and coatings that enhance scrubber durability and corrosion resistance. Fuji Electric and Hitachi Energy bring electrical and automation capabilities that improve system monitoring and control. Keppel and KwangSung offer tailored solutions targeting regional markets, combining cost-effective designs with compliance to emission standards.

Mitsubishi Heavy Industries and SAACKE focus on high-reliability systems suited for diverse marine environments. VDL AEC Maritime develops compact scrubber units designed specifically for smaller vessels, including recreational yachts. The market is driven by increasing regulatory pressure on marine emissions, requiring continuous product development and integration expertise. Entry barriers include complex engineering requirements, certification processes, and the need for close collaboration with shipbuilders and vessel owners. These factors favor established manufacturers with proven technologies and global service networks.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Fuel | MGO, MDO, Hybrid, and Others |

| Technology | Wet technology and Dry technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wärtsilä; ANDRITZ; CR Ocean Engineering; Damen Shipyards Group; Fuji Electric Co., Ltd.; Hitachi Energy; Keppel; Mitsubishi Heavy Industries, Ltd.; SAACKE GmbH; VDL AEC Maritime |

| Additional Attributes | Dollar sales by scrubber type and vessel size, demand dynamics across recreational yachts, fishing boats, and small commercial vessels, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in compact filtration technology, hybrid scrubber systems, and automated monitoring, environmental impact of emissions reduction, waste management, and water discharge treatment, and emerging use cases in eco-friendly marina operations, compliance with evolving maritime regulations, and integration with hybrid propulsion systems. |

The global recreational marine scrubber systems market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the recreational marine scrubber systems market is projected to reach USD 4.3 billion by 2035.

The recreational marine scrubber systems market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in recreational marine scrubber systems market are mgo, mdo, hybrid and others.

In terms of technology, wet technology segment to command 63.1% share in the recreational marine scrubber systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Systems Market

Marine Ventilation Systems Market

Marine Engine Cooling Systems Market

Marine Selective Catalytic Reduction Systems Market Growth – Trends & Forecast 2025 to 2035

Marine Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA