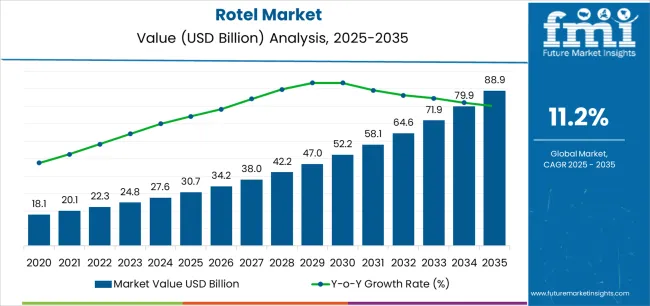

The Rotel Market is estimated to be valued at USD 30.7 billion in 2025 and is projected to reach USD 88.9 billion by 2035, registering a compound annual growth rate (CAGR) of 11.2% over the forecast period.

The Rotel market is witnessing strong growth driven by increasing interest in experiential tourism and the rising demand for combined transportation and accommodation services. Market expansion is being supported by the growing popularity of road-based travel, particularly across scenic and remote regions. Operators are focusing on enhancing comfort, safety, and convenience through upgraded fleet design and modern amenities.

The integration of digital booking systems and personalized travel packages has improved customer accessibility and engagement. Current market dynamics reflect the shift toward sustainable tourism, where Rotel services are gaining preference for offering eco-friendly, immersive travel experiences. The future outlook remains positive as international and domestic tourism continues to rebound, aided by favorable government policies and improved infrastructure.

Growth rationale is anchored on evolving consumer behavior favoring adventure and cultural exploration Continued investment in technology, route diversification, and luxury offerings is expected to strengthen market positioning and ensure steady expansion across global travel sectors.

| Metric | Value |

|---|---|

| Rotel Market Estimated Value in (2025 E) | USD 30.7 billion |

| Rotel Market Forecast Value in (2035 F) | USD 88.9 billion |

| Forecast CAGR (2025 to 2035) | 11.2% |

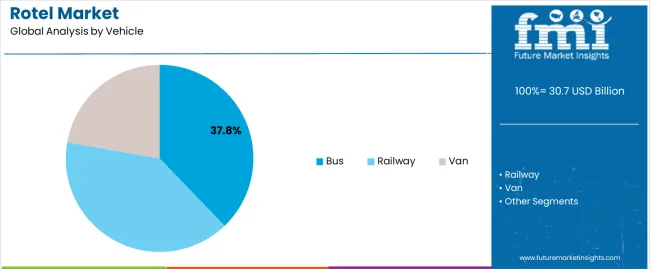

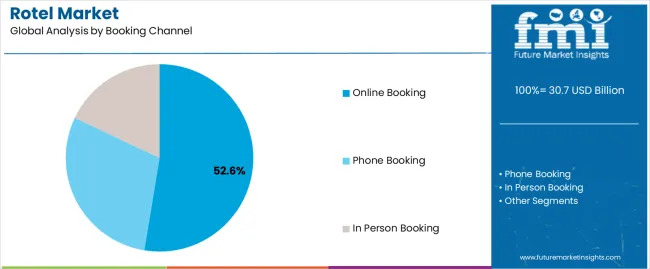

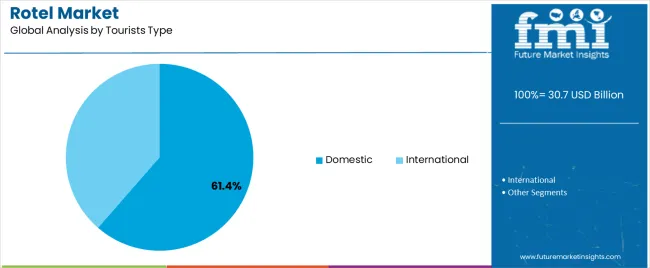

The market is segmented by Vehicle, Booking Channel, Tourists Type, Tour Type, and Age Group and region. By Vehicle, the market is divided into Bus, Railway, and Van. In terms of Booking Channel, the market is classified into Online Booking, Phone Booking, and In Person Booking. Based on Tourists Type, the market is segmented into Domestic and International. By Tour Type, the market is divided into Package Traveler, Independent Traveler, and Tour Groups. By Age Group, the market is segmented into 26-35 Years, 15-25 Years, 36-45 Years, 46-55 Years, 56-65 Years, and 66-75 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bus segment, accounting for 37.80% of the vehicle category, has maintained its dominance due to its widespread availability, operational flexibility, and cost efficiency. Buses offer high passenger capacity, comfort, and accessibility across long-distance routes, making them the preferred choice for Rotel operations.

Manufacturers and operators are incorporating advanced safety systems, energy-efficient engines, and modern interiors to enhance passenger experience. The consistent performance and low maintenance costs associated with buses have further supported their preference among service providers.

Market share has also been sustained by the ability of buses to accommodate modular sleeping and dining arrangements, aligning with the evolving concept of mobile hospitality As tourism recovery accelerates and sustainable mobility initiatives gain traction, the bus-based Rotel fleet is expected to continue leading the market through enhanced efficiency and scalability.

The online booking segment, holding 52.60% of the booking channel category, has emerged as the dominant mode due to the widespread adoption of digital platforms and mobile applications. Increasing consumer reliance on online channels for travel planning and instant reservation has driven this segment’s growth.

Integration of dynamic pricing, real-time availability, and secure payment options has strengthened user engagement. Travel aggregators and Rotel operators are leveraging artificial intelligence and data analytics to offer personalized recommendations and improve booking convenience.

The shift toward paperless transactions and digital confirmations has streamlined operations and reduced overhead costs As internet penetration expands and consumer confidence in digital transactions rises, the online booking segment is expected to retain its leadership position, offering enhanced accessibility and convenience to travelers worldwide.

The domestic tourists segment, representing 61.40% of the tourists type category, has remained the leading contributor due to increased interest in local and regional travel experiences. Economic affordability, cultural familiarity, and flexibility in short-distance travel have reinforced domestic tourism demand. Government initiatives promoting regional tourism and road-trip culture have supported market expansion.

Rotel operators have responded by tailoring itineraries that cater to domestic travelers seeking adventure, nature, and cultural immersion. The rise of remote work and shorter vacation preferences has further boosted local travel frequency.

Stable demand, coupled with the availability of affordable Rotel packages, continues to favor domestic travelers With ongoing improvements in infrastructure and promotional campaigns encouraging internal tourism, the domestic tourists segment is projected to maintain its dominance and support consistent market growth over the forecast period.

Rotels can target niche markets such as luxury travelers, adventure seekers, and eco conscious individuals who are willing to pay premium prices for unique travel experiences.

The scope for rotel rose at an 11.4% CAGR between 2020 and 2025. The global market is anticipated to witness a downwards CAGR of 11.8% over the forecast period 2025 to 2035.

The market experienced steady growth driven by factors such as increasing demand for unique travel experiences, rising disposable incomes among affluent travelers, and growing interest in luxury tourism, during the historical period.

The market saw the emergence of Rotels as a niche segment within the luxury travel industry, offering travelers the convenience of mobile accommodations combined with the comforts and amenities of a luxury hotel.

Technological advancements, such as the integration of smart features and digital innovations onboard Rotels, are expected to enhance the overall travel experience and appeal to tech savvy travelers seeking convenience and connectivity while on the road.

Consumers are seeking memorable and immersive travel experiences, driving demand for novel and unconventional accommodations such as Rotels. Integration of advanced technologies enhances the onboard experience, making Rotels more appealing to modern travelers who prioritize convenience and connectivity.

Collaboration with industry stakeholders and targeted marketing efforts help raise awareness and promote the unique offerings of Rotels to diverse market segments. Penetration into new geographic markets presents opportunities for growth and diversification, allowing Rotels to tap into emerging trends and consumer preferences.

There is a growing trend towards luxury travel experiences, where travelers seek unique and extravagant ways to explore destinations. Rotels offer a novel and opulent way to travel, combining the comforts of a hotel with the adventure of a road trip.

Compliance with various regulations and standards related to transportation, hospitality, and safety can pose challenges for Rotels operators. Regulatory requirements may vary across different jurisdictions, requiring significant resources and expertise to navigate effectively.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by India and France. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 6.3% |

| The United Kingdom | 6.9% |

| Germany | 7.4% |

| France | 9.7% |

| India | 15.4% |

The rotel market in the United States expected to expand at a CAGR of 6.3% through 2035. There is growing demand for unique forms of accommodation such as luxurious hotels on wheels, as travelers seek novel and memorable experiences.

Rotels offer a distinctive and immersive way to explore the diverse landscapes, attractions, and cultural offerings across the United States, catering to the preferences of travelers seeking unconventional and adventurous travel experiences.

The luxury travel segment is experiencing robust growth in the United States, driven by increasing disposable incomes, changing consumer preferences, and the desire for exclusive and personalized travel experiences.

Rotels Luxurious Hotels on Wheels cater to affluent travelers who value comfort, convenience, and luxury, offering premium accommodations, amenities, and services that align with the preferences of discerning travelers.

The rotel market in the United Kingdom is anticipated to expand at a CAGR of 6.9% through 2035. The United Kingdom has seen a rise in staycations and domestic travel, driven by factors such as uncertainty surrounding international travel, environmental concerns, and a desire to support local economies.

Rotels provide an attractive option for the residents of the country looking to embark on road trips and explore the scenic countryside, coastal regions, and charming towns while enjoying the comforts of luxury accommodations on wheels.

Travelers in the United Kingdom are increasingly prioritizing sustainability and eco friendliness when choosing travel accommodations, as environmental awareness grows.

Rotels operators can differentiate themselves by incorporating eco-friendly practices, energy efficient technologies, and sustainable materials into their operations, appealing to environmentally conscious travelers and aligning with the commitment of the country to sustainability and responsible tourism.

Rotel trends in Germany are taking a turn for the better. A 7.4% CAGR is forecast for the country from 2025 to 2035. Rotels provide travelers with flexibility and freedom to explore Germany at their own pace, offering convenient accommodations and transportation to popular tourist destinations as well as off the beaten path locales.

With Rotels, travelers have the flexibility to customize their itineraries, stopovers, and activities, enabling them to embark on personalized and authentic travel experiences tailored to their interests and preferences.

Germany boasts scenic routes, picturesque landscapes, and pristine natural areas that attract outdoor enthusiasts and nature lovers. Rotels allow travelers to embark on immersive journeys through national parks, scenic countryside, and charming villages in the country, providing unparalleled access to remote and scenic destinations while enjoying the comforts of luxury accommodations on wheels.

The rotel market in France is poised to expand at a CAGR of 9.7% through 2035. There has been a growing trend towards adventure tourism, where travelers seek unique and adventurous experiences. Rotels cater to this trend by offering a novel way to explore destinations off the beaten path.

Travelers may opt for sustainable travel options such as Rotels, with increasing environmental consciousness, which typically have lower environmental impacts compared to traditional hotel accommodations and transportation methods.

The rotel market in India is anticipated to expand at a CAGR of 15.4% through 2035. Indian travelers, particularly those from urban centers, have a growing affinity for luxury and comfort when it comes to travel accommodations.

Rotels Luxurious Hotels on Wheels offer premium amenities, personalized services, and opulent accommodations that cater to the preferences of affluent Indian travelers seeking a high level of comfort and convenience during their journeys.

Adventure tourism is gaining popularity among Indian travelers, especially among younger demographics seeking outdoor experiences and adrenaline fueled adventures.

Rotels operators can integrate adventure activities, nature treks, and outdoor excursions into their itineraries, offering travelers the opportunity to explore scenic landscapes, wildlife reserves, and adventure destinations while enjoying the comforts of luxury accommodations on wheels.

The below table highlights how online booking segment is projected to lead the market in terms of booking channel, and is expected to account for a share of 46.0% in 2025. Based on tour type, the package traveler segment is expected to account for a share of 39.0% in 2025.

| Category | Market Shares in 2025 |

|---|---|

| Online Booking | 46.0% |

| Package Traveler | 39.0% |

Based on booking channel the online booking segment is expected to continue dominating the rotel market. Online booking platforms offer travelers the convenience of researching, comparing, and booking rotel accommodations from anywhere with internet access.

Online platforms enable travelers to easily browse available options, view photos and descriptions, and make reservations in real time, with user friendly interfaces and intuitive booking processes, enhancing accessibility and convenience for potential guests.

Online booking channels provide Rotels operators with a platform to showcase their offerings to a global audience of potential travelers. Rotels can increase their visibility and reach travelers who may not have been aware of their services through traditional marketing channels alone, by listing their accommodations on multiple online travel agencies, booking websites, and travel aggregators, expanding their customer base and driving bookings.

In terms of tour type, the package traveler segment is expected to continue dominating the rotel market, attributed to several key factors. Package travelers seek convenience and hassle free travel experiences, where accommodations, transportation, meals, and activities are bundled into a comprehensive package.

Rotels cater to package travelers by offering all-inclusive itineraries that provide seamless and convenient travel arrangements, eliminating the need for travelers to plan and coordinate individual components of their trip.

Package travelers value the cost effectiveness and value proposition offered by packaged travel deals. Rotels Luxurious Hotels on Wheels provide package travelers with competitive pricing, bundled services, and added amenities, delivering value for money compared to piecemeal bookings of accommodations, transportation, and activities separately.

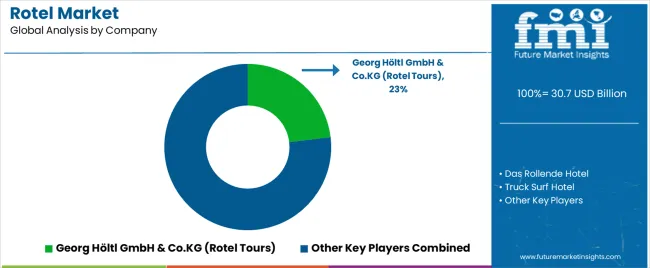

The competitive landscape of the rotel market is characterized by a diverse array of players, each vying to capture market share and differentiate themselves in the increasingly competitive luxury travel sector.

Rotels operators face both opportunities and challenges in positioning themselves as leaders in the luxurious hotels on wheels market, as the demand for unique and immersive travel experiences continues to grow globally.

Company Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 30.7 billion |

| Projected Market Valuation in 2035 | USD 88.9 billion |

| Value-based CAGR 2025 to 2035 | 11.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Vehicle Type, Booking Channel, Tourists Type, Tour Type, Age Group, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Das Rollende Hotel; Truck Surf Hotel; Radisson Blue; Georg Höltl GmbH & Co.KG (Rotel Tours); Audley Travel Group Limited; Palace on Wheels; Midnight Trains |

The global rotel market is estimated to be valued at USD 30.7 billion in 2025.

The market size for the rotel market is projected to reach USD 88.9 billion by 2035.

The rotel market is expected to grow at a 11.2% CAGR between 2025 and 2035.

The key product types in rotel market are bus, railway and van.

In terms of booking channel, online booking segment to command 52.6% share in the rotel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fluorotelomers Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA