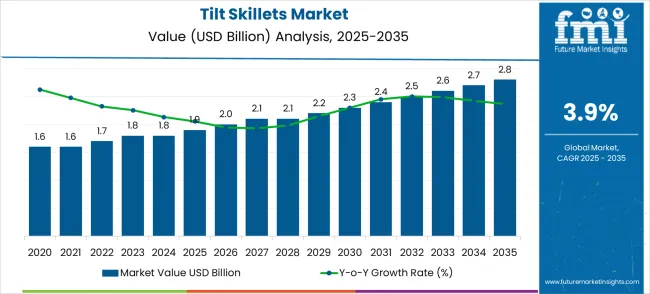

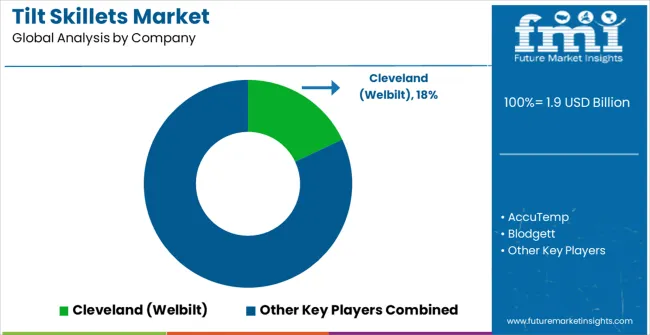

The Tilt Skillets Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

| Metric | Value |

|---|---|

| Tilt Skillets Market Estimated Value in (2025 E) | USD 1.9 billion |

| Tilt Skillets Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

Market expansion is being supported by the continuous growth of commercial foodservice operations across established and emerging markets and the corresponding need for efficient cooking equipment that ensures optimal food preparation performance and operational cost effectiveness. Modern commercial kitchen operations require sophisticated cooking systems that can deliver precise temperature control, high cooking capacity, and enhanced operational efficiency while operating under diverse food preparation requirements and operational schedules. The superior cooking versatility and capacity characteristics of high-quality tilt skillets make them essential equipment in commercial kitchens where cooking performance directly impacts food quality and operational productivity.

The growing emphasis on energy efficiency and operational cost reduction in commercial kitchens is driving demand for advanced cooking equipment from certified manufacturers with proven track records of quality and reliability in foodservice applications. Commercial kitchen operators and institutional foodservice facilities are increasingly investing in premium tilt skillets that offer extended service life while maintaining consistent cooking performance and energy efficiency. Regulatory requirements and foodservice standards are establishing performance benchmarks that favor high-quality cooking equipment with superior engineering properties and resistance to operational stresses.

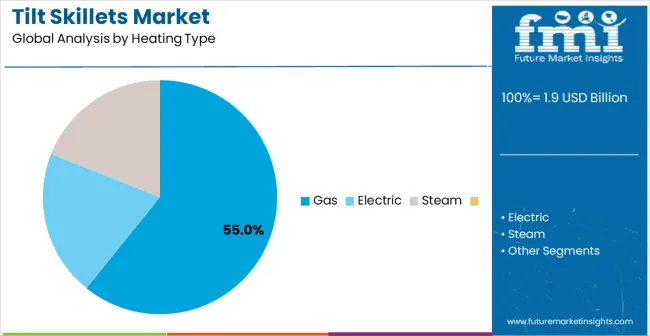

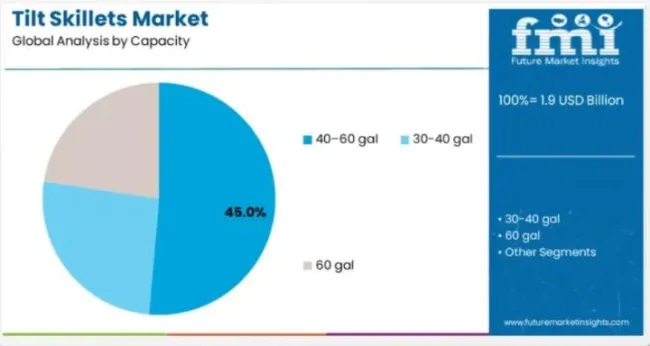

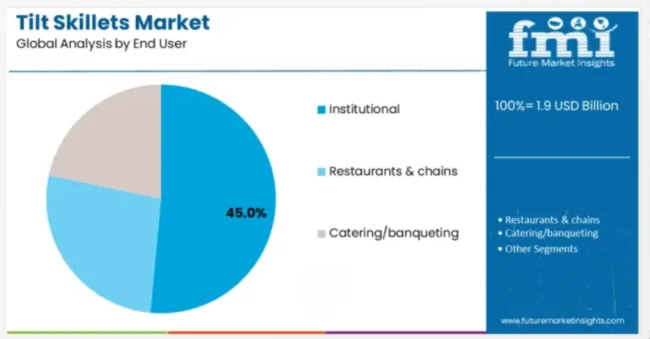

The tilt skillets market is segmented by capacity, heating type, construction, material, end user, and geographic regions. By capacity, tilt skillets market is divided into 40–60 gal, 30-40 gal, and 60 gal. In terms of heating type, tilt skillets market is classified into Gas, Electric, and Steam. Based on end user, tilt skillets market is segmented into Institutional, Restaurants & chains, Catering/banqueting. Regionally, the tilt skillets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by capacity, heating type, end user, construction material, and region. By capacity, the market is divided into 30-40 gallon, 40-60 gallon, and greater than 60 gallon configurations. Based on heating type, the market is categorized into gas, electric, and steam segments. By end user, the market is segmented into institutional, restaurants & chains, and catering/banqueting. By construction material, applications span stainless steel 304, stainless steel 316, and other liners. Regionally, the market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Gas heating configurations are projected to account for 55% of the tilt skillets market in 2025. This leading share is supported by the cost-effectiveness and rapid heating capabilities of gas systems in commercial cooking applications and the widespread preference for gas-powered equipment in professional kitchens. Gas heating tilt skillets offer excellent temperature control and operational efficiency, making them ideal for high-volume cooking operations and challenging commercial kitchen environments where performance and cost effectiveness are essential. The segment benefits from technological advancements that have improved gas burner efficiency, safety features, and temperature control systems.

Modern gas heating tilt skillets incorporate advanced burner technologies, precision-engineered temperature control components, and specialized safety mechanisms that deliver exceptional cooking performance while maintaining operational simplicity and reliability under demanding commercial kitchen conditions. These innovations have significantly improved cooking efficiency while maintaining compatibility with existing gas infrastructure and reducing operational costs through enhanced energy efficiency and precise temperature management. The commercial foodservice sector particularly drives demand for gas heating solutions, as restaurant and institutional kitchens require reliable cooking equipment that can meet stringent performance standards and cost requirements.

Medium capacity (40-60 gallon) applications are expected to represent 45% of tilt skillets demand in 2025. This significant share reflects the optimal balance of cooking volume and operational manageability for most commercial kitchen applications globally and the need for versatile cooking equipment that meets medium to high-volume preparation requirements. Medium capacity operations require consistent supplies of tilt skillets for restaurant kitchens, institutional cafeterias, and catering operations across diverse operational environments and food preparation schedules. The segment benefits from ongoing commercial foodservice growth and increasing emphasis on cooking efficiency and capacity optimization in professional kitchen operations.

Medium capacity applications demand exceptional equipment reliability to ensure consistent cooking performance throughout operational periods while meeting stringent commercial kitchen standards and food safety compliance requirements. These applications require tilt skillets that can withstand continuous operation, temperature variations, and long-term service under demanding conditions and food preparation schedules. The growing emphasis on operational efficiency and cost effectiveness, particularly in restaurant chains and institutional facilities requiring versatile cooking systems for diverse food preparation methods, drives consistent demand for high-quality medium-capacity cooking equipment.

Institutional end users are projected to account for 45% of the tilt skillets market in 2025. This substantial share is supported by the growing emphasis on efficient food preparation in schools, hospitals, corporate cafeterias, and other institutional facilities that require high-capacity cooking solutions. Institutional applications require reliable and versatile cooking equipment that can perform across varying food preparation requirements while maintaining operational efficiency and cost effectiveness. The segment benefits from the increasing complexity of institutional food preparation requirements and growing investments in the modernization of commercial kitchens.

Modern institutional applications demand tilt skillets that offer superior operational efficiency, reduced maintenance requirements, and enhanced cooking versatility to support diverse institutional food preparation requirements and operational specifications. These facilities operate under strict food safety regulations and budget constraints, requiring equipment that can adapt to different cooking applications while maintaining consistent performance and cost effectiveness. The growing emphasis on institutional food quality and operational efficiency drives demand for institutional operators who can provide comprehensive cooking solutions with proven track records of reliability and cost effectiveness.

The tilt skillets market is advancing steadily due to continuing commercial foodservice industry growth and increasing recognition of cooking equipment efficiency's importance in operational productivity and cost management. However, the market faces challenges, including raw material price volatility affecting equipment costs, increasing adoption of automated cooking systems requiring significant capital investments, and varying commercial kitchen regulations across different regional markets affecting equipment specifications. Energy efficiency requirements and commercial kitchen safety standards continue to influence equipment design and market development patterns.

The growing deployment of high-capacity cooking systems, advanced heating technologies, and energy-efficient solutions is enabling superior operational performance and enhanced cost-effectiveness in tilt skillet applications. Advanced cooking systems and energy integration provide enhanced temperature control, reduced cooking times, and improved food quality compared to traditional commercial cooking equipment. These innovations are particularly valuable for commercial kitchen operations that require reliable equipment capable of meeting high-volume food preparation and demanding operational conditions.

Modern tilt skillet manufacturers are incorporating energy-efficient heating systems and intelligent temperature control technologies that provide enhanced operational efficiency and reduced energy consumption compared to traditional cooking equipment. Integration of advanced heating controls, insulation systems, and temperature management creates opportunities for advanced cooking equipment that supports both high-performance food preparation and operational cost optimization requirements. Advanced control technologies and energy management systems also support the development of more sophisticated cooking solutions for modern commercial kitchen applications.

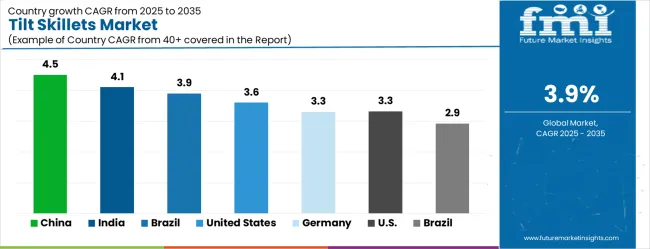

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Brazil | 3.9% |

| United States | 3.6% |

| Germany | 3.3% |

The tilt skillets market is growing steadily, with China leading at a 4.5% CAGR through 2035, driven by expanding commercial foodservice operations, increasing institutional food preparation facilities, and comprehensive restaurant industry development supporting both domestic consumption and tourism growth. India follows at 4.1%, supported by extensive hotel industry expansion, growing restaurant chains, and increasing focus on commercial kitchen modernization serving domestic and hospitality markets. Brazil records growth at 3.9%, emphasizing restaurant industry development, hospitality sector expansion, and operational excellence in commercial food preparation operations. The United States shows growth at 3.6%, focusing on equipment replacement cycles and efficiency improvements in established commercial kitchens. Germany maintains expansion at 3.3%, supported by commercial kitchen modernization and energy efficiency requirements.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from tilt skillets in China is projected to exhibit the highest growth rate with a CAGR of 4.5% through 2035, driven by the rapid expansion of commercial foodservice operations and comprehensive institutional food preparation facility development, creating substantial opportunities for commercial cooking equipment suppliers across restaurant chains, institutional kitchens, and catering sectors. The country's growing restaurant industry and expanding commercial kitchen infrastructure are creating significant demand for both traditional gas-heated and advanced energy-efficient cooking equipment. Major foodservice companies and equipment suppliers are establishing comprehensive local equipment procurement to support large-scale operations and meet growing demand for efficient commercial cooking solutions.

Revenue from tilt skillets in India is expanding at a CAGR of 4.1%, supported by extensive hotel industry development and comprehensive commercial foodservice growth, creating sustained demand for reliable cooking equipment across diverse hospitality categories and institutional segments. The country's rapid hospitality sector expansion and growing commercial kitchen capabilities are driving demand for cooking equipment that provides consistent performance while supporting cost-effective operational requirements. Commercial cooking equipment manufacturers are investing in local production facilities to support growing hospitality operations and institutional food preparation demand.

Demand for tilt skillets in Brazil is projected to grow at a CAGR of 3.9%, supported by the country's expanding restaurant industry and hospitality sector development, requiring versatile cooking equipment for commercial food preparation and catering operations. Brazilian commercial kitchen operators are implementing reliable cooking systems that support diverse food preparation techniques, operational efficiency, and comprehensive cost management. The market is characterized by a focus on operational reliability, equipment durability, and compliance with commercial kitchen performance standards.

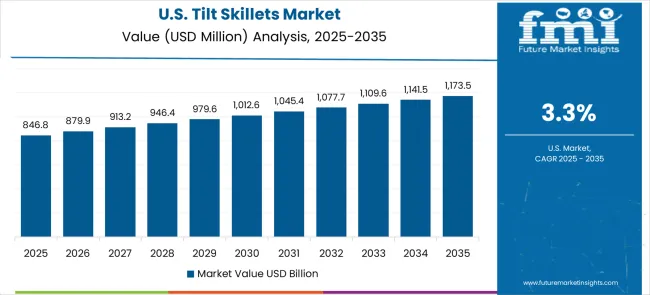

Revenue from tilt skillets in the United States is growing at a CAGR of 3.6%, driven by equipment replacement cycles in established commercial kitchens and efficiency improvement initiatives creating sustained opportunities for cooking equipment suppliers serving both restaurant chains and institutional facilities. The country's mature commercial foodservice sector and established kitchen infrastructure are creating demand for cooking equipment that supports diverse operational requirements while maintaining performance standards. Commercial kitchen operators and equipment distributors are developing procurement strategies to support operational efficiency and regulatory compliance.

Demand for tilt skillets in Germany is expanding at a CAGR of 3.3%, driven by commercial kitchen modernization programs and energy efficiency requirements, creating opportunities for cooking equipment suppliers serving both institutional and commercial foodservice sectors. The country's established commercial kitchen expertise and quality equipment standards are creating demand for high-quality cooking equipment that supports operational performance and regulatory compliance. Equipment manufacturers and foodservice suppliers are maintaining comprehensive development capabilities to support diverse commercial kitchen requirements.

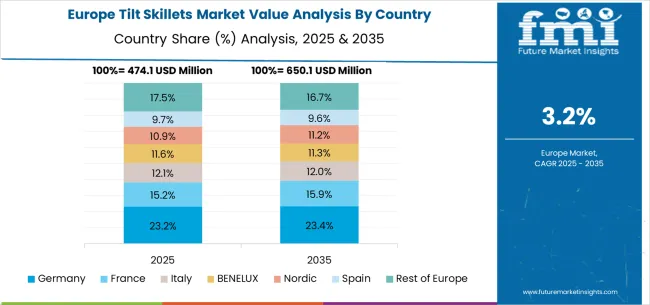

The tilt skillets market in Europe is projected to grow from USD 0.5 billion in 2025 to USD 0.7 billion by 2035, registering a CAGR of 3.4% over the forecast period. Germany is expected to maintain its leadership position with a 35.2% market share in 2025, remaining stable at 35.0% by 2035, supported by its advanced commercial kitchen equipment manufacturing sector, precision engineering capabilities, and comprehensive innovation expertise serving European and international foodservice markets.

The United Kingdom follows with a 22.8% share in 2025, projected to reach 23.1% by 2035, driven by commercial kitchen modernization programs, advanced cooking technology development capabilities, and growing focus on operational efficiency solutions for premium foodservice operations. France holds an 18.4% share in 2025, expected to maintain 18.2% by 2035, supported by culinary industry demand and advanced cooking technology applications, but facing challenges from market competition and economic considerations.

Italy commands a 12.6% share in 2025, projected to reach 12.8% by 2035, while Spain accounts for 7.3% in 2025, expected to reach 7.5% by 2035. The Netherlands maintains a 3.7% share in 2025, growing to 3.8% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 18.6% in 2025, declining slightly to 18.4% by 2035, attributed to mixed growth patterns with strong expansion in some Nordic foodservice markets balanced by moderate growth in smaller countries implementing commercial kitchen modernization programs.

The tilt skillets market is defined by competition among established commercial kitchen equipment manufacturers, specialized cooking system providers, and emerging foodservice technology firms. Companies are investing in advanced heating technology, manufacturing process optimization, quality management systems, and global distribution capabilities to deliver reliable, efficient, and cost-effective commercial cooking equipment. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

AccuTemp, operating globally, offers comprehensive commercial cooking solutions with a focus on advanced technology, operational excellence, and foodservice industry partnerships, maintaining a leading market position. Blodgett provides specialized cooking equipment with emphasis on heating efficiency and operational reliability. Cleveland (Welbilt), an American commercial cooking equipment specialist, delivers advanced cooking technologies with a focus on precision engineering and institutional foodservice applications. These leading companies demonstrate strong market presence through technological innovation and comprehensive service capabilities.

Established cooking equipment providers include Electrolux Professional, offering specialized commercial cooking solutions with a focus on operational performance and customer service excellence. Groen (Unified Brands) delivers comprehensive cooking systems with emphasis on institutional applications and technical support. MKN provides cooking equipment with a focus on European commercial kitchen applications and regional distribution networks.

Emerging market participants include Rational, Thermodyne, and Vulcan Equipment, offering specialized commercial cooking expertise, innovative technologies, and technical support across global and regional foodservice markets, with a focus on advanced cooking capabilities and operational efficiency solutions.

The tilt skillets market underpins commercial foodservice efficiency enhancement, operational cost optimization, food preparation improvement, and kitchen productivity. With commercial foodservice growth, advancing cooking technologies, and increasing energy efficiency requirements, the sector must balance equipment quality, operational performance, and cost competitiveness. Coordinated contributions from governments, foodservice associations, equipment manufacturers, commercial kitchen operators, and investors will accelerate the transition toward advanced, reliable, and highly efficient commercial cooking systems.

| Items | Values |

|---|---|

| Quantitative Units | USD 1.9 billion |

| Capacity | 30-40 gal, 40-60 gal, >60 gal |

| Heating Type | Gas, Electric, Steam |

| End User | Institutional, Restaurants & chains, Catering/banqueting |

| Construction Material | Stainless 304, Stainless 316, Other liners |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AccuTemp, Blodgett, Cleveland (Welbilt), Electrolux Professional, Groen (Unified Brands), MKN, (Blodgett), Rational, Thermodyne, Vulcan Equipment |

| Additional Attributes | Dollar sales by capacity/heating type, regional demand trends, competitive landscape, gas vs. electric heating preferences, energy management system integration, temperature control innovations, and cooking efficiency solutions driving commercial kitchen productivity, operational cost reduction, and food preparation optimization |

The global tilt skillets market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the tilt skillets market is projected to reach USD 2.8 billion by 2035.

The tilt skillets market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in tilt skillets market are 40–60 gal, 30-40 gal, 60 gal and .

In terms of heating type, gas segment to command 55.0% share in the tilt skillets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tilt tray sorter Market

Sheep Tilt Table Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Cab Tilt System Market

Skillets and Frying Pans Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA