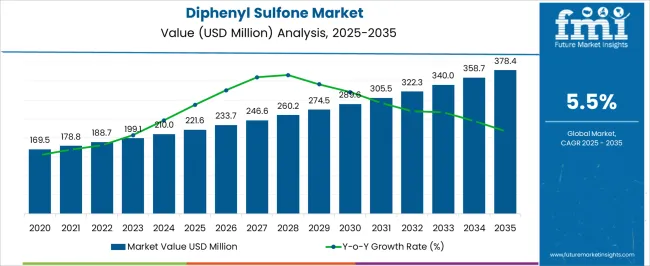

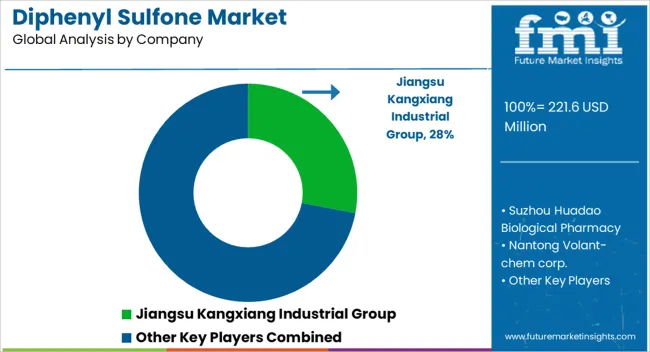

The Diphenyl Sulfone Market is estimated to be valued at USD 221.6 million in 2025 and is projected to reach USD 378.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Diphenyl Sulfone Market Estimated Value in (2025 E) | USD 221.6 million |

| Diphenyl Sulfone Market Forecast Value in (2035 F) | USD 378.4 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Diphenyl Sulfone market is experiencing steady growth due to its increasing application across high-performance polymer and solvent industries. The current market scenario is being shaped by rising demand for heat-resistant and chemically stable materials in sectors such as electronics, aerospace, and specialty plastics. Diphenyl Sulfone is being valued for its ability to improve the thermal, mechanical, and chemical properties of polymers, which is encouraging adoption in polymer composites and engineering plastics.

The market is being further driven by the expansion of industrial polymer production and the growing use of solvents in various chemical processes. Increasing industrial automation and precision manufacturing are creating demand for materials that can maintain stability under high temperature and stress.

Additionally, the rising emphasis on sustainability and energy efficiency in industrial applications is prompting companies to adopt performance-oriented chemicals like Diphenyl Sulfone The future outlook is expected to remain positive, supported by continuous innovation in polymer formulations and solvent applications that maximize material performance while reducing operational and maintenance costs.

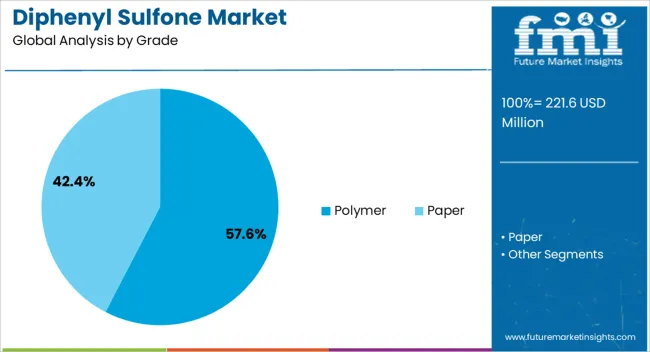

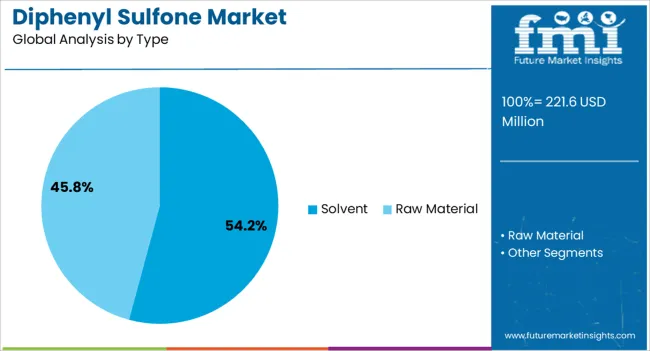

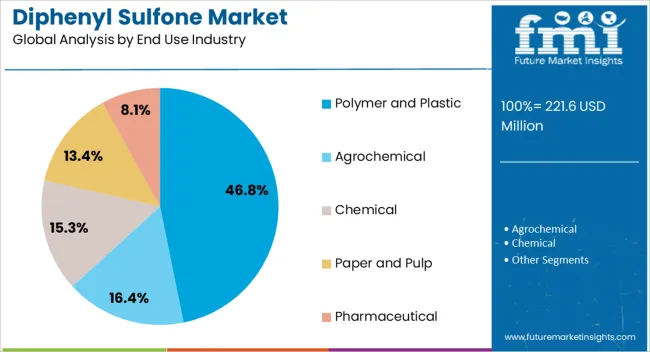

The diphenyl sulfone market is segmented by grade, type, end use industry, and geographic regions. By grade, diphenyl sulfone market is divided into Polymer and Paper. In terms of type, diphenyl sulfone market is classified into Solvent and Raw Material. Based on end use industry, diphenyl sulfone market is segmented into Polymer and Plastic, Agrochemical, Chemical, Paper and Pulp, and Pharmaceutical. Regionally, the diphenyl sulfone industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Polymer grade is projected to hold 57.60% of the Diphenyl Sulfone market revenue in 2025, making it the leading grade segment. This dominance is being attributed to its widespread use in high-performance polymer synthesis, where it enhances thermal stability, chemical resistance, and mechanical strength. The growth of this segment has been driven by the increasing demand for engineering plastics, composites, and high-temperature adhesives, which require specialized additives to maintain performance under extreme conditions.

The ability to improve polymer processability and end-use durability without compromising structural integrity has further contributed to the segment’s preference. Manufacturers are increasingly relying on polymer-grade Diphenyl Sulfone to produce materials that meet the stringent requirements of automotive, electronics, and aerospace applications.

The segment’s robust adoption is also supported by the growing global production of polymers and plastics, particularly in regions investing in advanced manufacturing and industrial expansion As polymer applications continue to diversify, the Polymer grade is expected to maintain its leading market position due to its essential role in enhancing material performance.

The Solvent type segment is estimated to account for 54.20% of the total Diphenyl Sulfone market revenue in 2025, representing the largest type classification. This growth is being driven by its high efficacy as a solvent for various high-performance polymers and specialty chemical formulations.

Solvent-grade Diphenyl Sulfone is favored for its chemical stability, high boiling point, and ability to dissolve complex polymer systems, enabling efficient production processes. The segment’s adoption is further supported by the increasing use of solvents in industrial processes such as resin production, polymer blending, and chemical synthesis.

Operational efficiency and enhanced material performance have been key factors contributing to the widespread deployment of solvent-grade Diphenyl Sulfone As industries continue to prioritize chemical processes that reduce energy consumption and improve product quality, solvent-type Diphenyl Sulfone is expected to retain its leading position, driven by both its functional properties and compatibility with diverse industrial applications.

The Polymer and Plastic end-use industry segment is projected to hold 46.80% of the Diphenyl Sulfone market revenue in 2025, making it the dominant end-use sector. This prominence is being driven by the growing demand for high-performance polymers and specialty plastics in industries such as automotive, electronics, and industrial manufacturing.

Diphenyl Sulfone is being widely adopted as an additive to enhance thermal stability, chemical resistance, and mechanical strength of polymers, allowing products to perform reliably in challenging environments. The growth of this segment has also been supported by the expansion of polymer production in emerging economies, where increased industrialization and investments in advanced manufacturing technologies are creating higher demand for performance materials.

Additionally, the ability to improve polymer processability and durability without significantly increasing costs has made Diphenyl Sulfone an attractive choice for polymer and plastic manufacturers The continued focus on lightweight, high-strength materials and eco-efficient manufacturing processes is expected to sustain growth in this end-use segment over the coming years.

Diphenyl sulfone is an organic compound containing sulfur. Diphenyl sulfone is a white powder which is soluble in organic solvents and used as a high temperature solvent. The diphenyl sulfone high temperature solvents are used in the manufacturing of polymers in the polymer and plastic industry.

The diphenyl sulfone is used in a many end use industries such as chemical, pharmaceutical, agrochemical, polymer and plastic and paper and pulp. Depending on the grade, diphenyl sulfone is categorized as paper grade and polymer grade. The paper grade diphenyl sulfone is used as a sensitizer in the thermal paper coatings as well as in the manufacturing of 3,3 diamino diphenyl sulfone. Polymer grade diphenyl sulfone is used as a solvent in the manufacturing of poly ether, ether ketone engineering plastics. The diphenyl sulfone is also used as a raw material in the manufacturing of diphenyl sulfone -3 sulfonic acid, a flame retardant.

The diphenyl sulfone of paper grade is used as a replacement of bisphenol-A in the paper and pulp industry. In Agrochemical industry, diphenyl sulfone is used as an intermediated for manufacturing pesticides.

The growing crop production is expected to create a demand for the agrochemicals in coming years, which in turn is expected to drive the sales of diphenyl sulfone. The growth of chemical industry is expected to boost the sales of diphenyl sulfone in near future owing to the application of diphenyl sulfone in bulk quantities as an intermediate in polymers and chemicals undergoing organic synthesis. The growing demand for the pharmaceutical products owing to the increasing health consciousness among the people is expected to drive the demand of diphenyl sulfone.

The growth of paper and pulp industry is also expected to help in the growth of diphenyl sulfone market in coming years. Replacement of bisphenol-A by diphenyl sulfone in the paper and pulp industry is add in the growth of the diphenyl sulfone sales in near future. The rising demand for the polymers and plastics in the developing regions is expected to upsurge the demand of diphenyl sulfone in the polymer and plastic industry.

Non economical prices of diphenyl sulfone are expected to retard the sales of diphenyl sulfone in coming years

South East Asia and Pacific region is expected to provide a lucrative opportunity for the growth of the diphenyl sulfone market in coming years. The growth of chemical, pharmaceutical, agrochemical and polymer and plastic industry in China and India owing to the economical labor and raw material cost is expected to drive the sales of diphenyl sulfone in the region.

North Americas region has witnessed a moderate growth in the paper and pulp, chemical and pharmaceutical industries in recent past. The agrochemical industry in the region is growing at high rate owing to the increasing demand form the growing crop production. The growth of these industries in North America is expected to create a platform for the growth of diphenyl sulfone in the region.

The Europe region has a strategic location in terms of geography that allows it easy access to the growing markets like Middle East and Africa, Asia and Latin America owing to which the chemical industry in the region is booming. The growth of chemical industry in Europe region is expected to boost the sales of diphenyl sulfone.

The Middle East and Africa region has reported a decent growth in the chemical and polymer industry in recent years, wherein demand from the well-established oil and gas industry is a key factor responsible for the growth. The growth of chemical industry in Middle East and Africa is thus expected to boost the sales of diphenyl sulfone in coming years

The participants involved in the diphenyl sulfone market are listed below:

The diphenyl sulfone market research report presents a comprehensive assessment of the Diphenyl sulfone market and contains thoughtful insights, facts, historical data and statistically supported and industry-validated diphenyl sulfone market data. It also contains projections using a suitable set of assumptions and methodologies. The diphenyl sulfone market research report provides analysis and information according to diphenyl sulfone market segments such as geographies, application and industry.

The diphenyl sulfone market research report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The Diphenyl sulfone market research report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The Diphenyl sulfone market research report also maps the qualitative impact of various market factors on market segments and geographies.

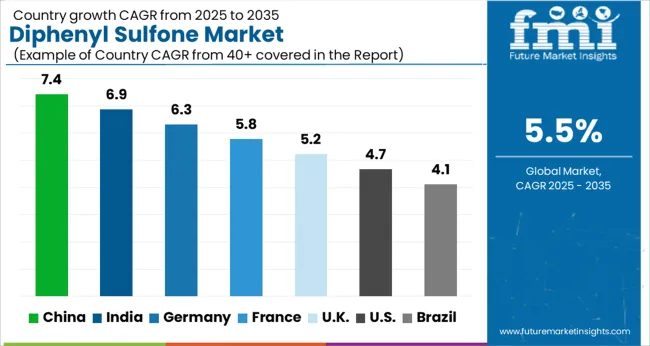

| Countries | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The Diphenyl Sulfone Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Diphenyl Sulfone Market.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%. The USA Diphenyl Sulfone Market is estimated to be valued at USD 78.1 million in 2025 and is anticipated to reach a valuation of USD 123.3 million by 2035. Sales are projected to rise at a CAGR of 4.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 10.3 million and USD 7.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 221.6 Million |

| Grade | Polymer and Paper |

| Type | Solvent and Raw Material |

| End Use Industry | Polymer and Plastic, Agrochemical, Chemical, Paper and Pulp, and Pharmaceutical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Jiangsu Kangxiang Industrial Group, Suzhou Huadao Biological Pharmacy, Nantong Volant-chem corp., Jiangsu Fute Hongye Chemical Co. Ltd., and The Dharamsi Morarji Chemical Co. Ltd.(DMCC) |

The global diphenyl sulfone market is estimated to be valued at USD 221.6 million in 2025.

The market size for the diphenyl sulfone market is projected to reach USD 378.4 million by 2035.

The diphenyl sulfone market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in diphenyl sulfone market are polymer and paper.

In terms of type, solvent segment to command 54.2% share in the diphenyl sulfone market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Methylene Diphenyl Di-isocyanate Market

Sulfone Polymers Market Growth - Trends & Forecast 2025 to 2035

Polyarylsulfone Market - Growth & Demand 2025 to 2035

Polyethersulfone (PES) Market Size and Share Forecast Outlook 2025 to 2035

Polyphenylsulfone Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA