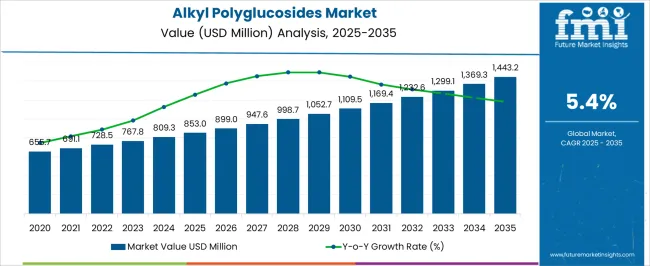

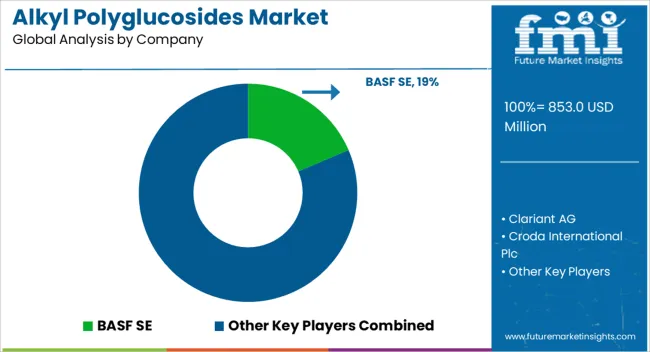

The alkyl polyglucosides market is estimated to be valued at USD 853.0 million in 2025 and is projected to reach USD 1443.2 million by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period. This growth is driven by increasing consumer demand for environmentally friendly and biodegradable surfactants, as APGs are derived from renewable resources such as glucose and fatty alcohols.

Rising awareness about sustainable personal care and cleaning products, coupled with stricter regulations on conventional chemical surfactants, is further fueling market expansion. The adoption of APGs in industries such as cosmetics, household cleaners, and industrial detergents underscores their versatility and low toxicity. Additionally, advancements in production technology are enhancing cost-effectiveness and efficiency, making APGs more accessible to manufacturers.

| Metric | Value |

|---|---|

| Alkyl Polyglucosides Market Estimated Value in (2025 E) | USD 853.0 million |

| Alkyl Polyglucosides Market Forecast Value in (2035 F) | USD 1443.2 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

The market is being shaped by heightened consumer awareness regarding sustainable products and increasing regulatory emphasis on eco-friendly chemical formulations. The rising shift from petroleum-based surfactants to bio-based alternatives is driving significant traction for Alkyl Polyglucosides in both developed and emerging markets. Advancements in green chemistry and production technologies have further enabled manufacturers to enhance product purity, performance, and cost efficiency, paving the way for broader application across industrial and personal care segments.

The market outlook remains positive as industries continue to prioritize safety, environmental compliance, and product differentiation through the use of naturally derived ingredients. Growing investment in bio-based chemical infrastructure and formulation development is expected to unlock new growth avenues in the years ahead.

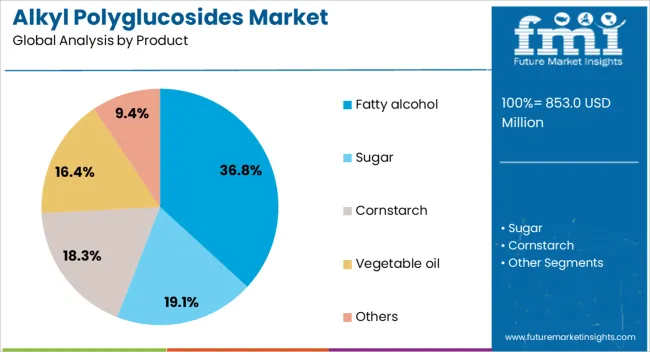

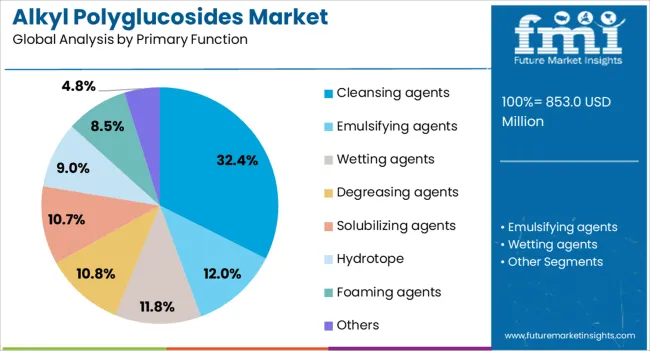

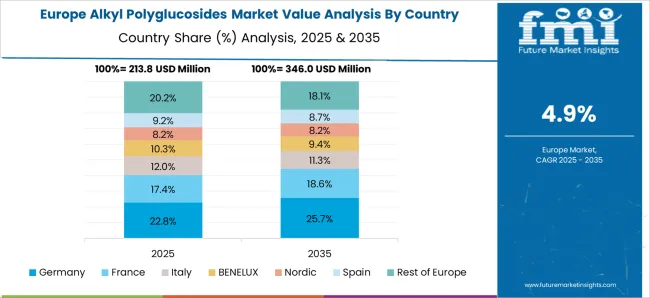

The alkyl polyglucosides market is segmented by product, primary function, application, and geographic regions. By product, the alkyl polyglucosides market is divided into Fatty alcohol, Sugar, Cornstarch, Vegetable oil, and Others. In terms of primary function, the alkyl polyglucosides market is classified into Cleansing agents, Emulsifying agents, wetting agents, Degreasing agents, Solubilizing agents, Hydrotope, Foaming agents, and Others.

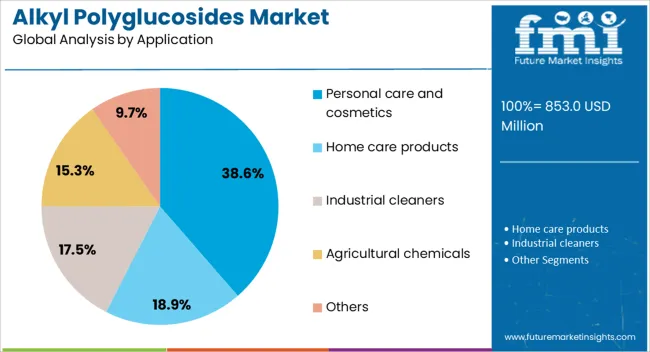

Based on application, the alkyl polyglucosides market is segmented into Personal care and cosmetics, Home care products, Industrial cleaners, Agricultural chemicals, and Others. Regionally, the alkyl polyglucosides industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fatty alcohol product segment is expected to account for 36.8% of the overall Alkyl Polyglucosides market revenue in 2025, making it the leading product category. This dominance is being supported by the strong compatibility of fatty alcohols with glucose-based structures, which allows for stable and efficient surfactant synthesis.

Fatty alcohols offer favorable emulsification and foaming properties, which are essential for the performance of Alkyl Polyglucosides in detergents and personal care formulations. The segment’s growth is being influenced by the widespread availability of fatty alcohols derived from both natural and synthetic sources, offering manufacturers flexibility in formulation and pricing.

Additionally, the use of fatty alcohols contributes to the mildness and biodegradability of the final product, making it attractive for eco-conscious brands. The increasing demand for mild, skin-friendly, and non-irritating surfactants in consumer products is further reinforcing the preference for fatty alcohol-based Alkyl Polyglucosides.

The cleansing agents primary function segment is projected to represent 32.4% of the total Alkyl Polyglucosides market revenue in 2025, establishing it as the leading functional application. This leading position is being attributed to the superior cleansing efficiency and skin compatibility of Alkyl Polyglucosides when used as primary surfactants.

These compounds are known for their mildness, low toxicity, and high biodegradability, which makes them highly suitable for formulations targeting sensitive skin and frequent-use products. The rising demand for sulfate-free and allergen-free cleaning products in both personal and household care segments is contributing to the segment’s growth.

As regulatory standards continue to favor gentle and environmentally friendly ingredients, Alkyl Polyglucosides are being increasingly chosen for cleansing applications. Their ability to produce stable foam while maintaining skin moisture is also playing a key role in expanding their use across shampoos, facial cleansers, and body washes.

The personal care and cosmetics application segment is expected to capture 38.6% of the total Alkyl Polyglucosides market revenue in 2025, positioning it as the largest application area. This dominant share is being driven by the increasing consumer preference for natural and sustainable ingredients in skincare and haircare products.

Alkyl Polyglucosides are favored in this segment due to their gentle cleansing properties, low irritation potential, and compatibility with other natural actives. The surge in demand for organic and clean-label cosmetic products is accelerating their adoption, particularly in facial cleansers, baby care, and sensitive-skin formulations.

Manufacturers are increasingly using these ingredients to meet both performance and regulatory requirements without compromising product safety. The segment’s growth is also being supported by the global expansion of the personal care industry, where product innovation, premiumization, and sustainability are core drivers influencing ingredient selection.

The alkyl polyglucosides market is shaped by growing eco-consciousness, regulatory support, and challenges in raw material sourcing. Demand for sustainable and non-toxic products is driving substantial growth in multiple industries.

The alkyl polyglucosides (APG) market is primarily driven by the increasing consumer preference for eco-friendly and non-toxic products. Rising awareness about the harmful effects of conventional chemicals in personal care and cleaning products is accelerating the demand for bio-based alternatives. In addition, APGs are gaining significant traction in the home care sector due to their effective cleaning properties coupled with mildness, making them ideal for a wide range of applications. Regulatory support for green products further enhances the market’s growth, particularly in personal care, cleaning, and industrial applications. This demand shift is pushing manufacturers to expand their portfolios with more APG-based formulations.

Consumers are increasingly favoring products that are safer for both health and the environment. This shift toward eco-conscious purchasing decisions is particularly evident in the personal care and cleaning segments. Alkyl Polyglucosides, due to their biodegradable and non-toxic properties, are becoming a go-to option in formulations for shampoos, body washes, laundry detergents, and surface cleaners. This trend is directly influenced by growing concerns regarding harmful ingredients found in traditional surfactants, such as sulfates and phosphates. The demand for these alternatives is expected to rise as eco-friendly formulations gain broader market acceptance, particularly among environmentally-conscious consumers who prioritize natural ingredients.

Stringent regulations aimed at reducing the environmental impact of chemical products are fostering the adoption of Alkyl Polyglucosides across multiple industries. The rising demand for sustainable alternatives is supported by government policies and industry guidelines encouraging the use of renewable and biodegradable materials. Many countries are enacting stricter environmental standards on surfactants used in personal care, household, and industrial products. These regulations are driving companies to adopt green chemistry principles and formulate products that comply with these standards. As such, APGs’ role is becoming increasingly important in meeting the growing regulatory requirements that focus on reducing harmful chemical footprints.

Despite the rapid growth, the Alkyl Polyglucosides market faces challenges related to the availability and cost of raw materials. The primary raw materials used in the production of APGs are derived from renewable sources like glucose and fatty alcohols. However, fluctuating prices and the inconsistent availability of these materials can impact production costs and market stability. Additionally, sourcing these materials sustainably while ensuring product quality can prove difficult for manufacturers. Addressing these supply chain complexities is crucial for maintaining competitive pricing and market share. Ongoing research and development efforts focus on improving raw material sourcing and ensuring a stable supply of high-quality inputs for APG production.

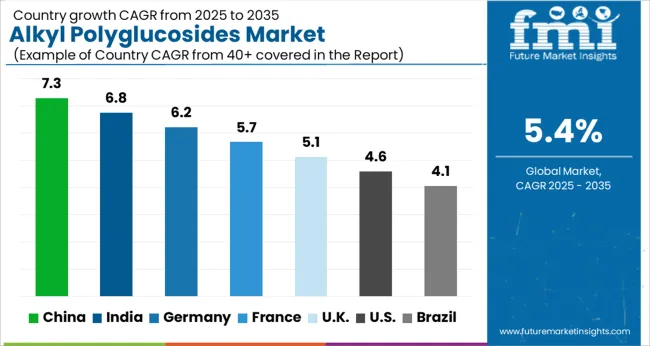

The alkyl polyglucosides (APG) market is projected to expand at a global CAGR of 5.4% from 2025 to 2035, driven by rising demand for eco-friendly and biodegradable alternatives in personal care, cleaning, and industrial applications. China leads with a CAGR of 7.3%, supported by the rapid adoption of APGs in cleaning and personal care formulations, along with significant industrial usage. India follows at 6.8%, propelled by growing consumer demand for natural and non-toxic ingredients in household products and cosmetics.

France achieves 5.7% growth, supported by higher investments in sustainable formulations and eco-conscious consumer demand. The United Kingdom records a 5.1% growth rate, fueled by a steady transition toward biodegradable ingredients in household and cleaning products. The United States posts a CAGR of 4.6%, reflecting a mature market where APGs continue to replace traditional surfactants, driven by regulatory changes and consumer preferences for safer alternatives. This analysis incorporates over 40 countries, with these five serving as key benchmarks for regional investment, competitive positioning, and strategic market planning.

China recorded a CAGR of 7.3% during 2020–2024, and the rate is projected to maintain the same momentum at 7.3% in 2025–2035. Early gains were driven by the growing adoption of APGs in cleaning products, personal care formulations, and industrial applications. The next phase will be shaped by greater regulatory pressure for eco-friendly products, an increasing preference for biodegradable ingredients, and more sustainable manufacturing practices. APGs' versatility and mild nature have made them a preferred alternative in various sectors. Additionally, partnerships between local manufacturers and international brands have been crucial in expanding APG-based solutions in the domestic market.

India posted a CAGR of 6.8% during 2020–2024, with a rise to a projected CAGR of 6.8% in 2025–2035. Early growth was attributed to increasing demand for biodegradable surfactants in personal care and household products, driven by the expanding middle class and rising environmental awareness. The next phase is expected to see a strong trajectory, supported by expanding industrial applications, particularly in cleaning agents and agriculture. As demand for greener products grows, India is likely to see more domestic manufacturing, reducing dependence on imports and further accelerating market growth. Local R&D efforts are expected to drive product innovation and new applications.

France posted a CAGR of 5.7% during 2020–2024, with a projected CAGR of 5.7% in 2025–2035. Early gains were driven by regulatory support and a rising consumer preference for natural ingredients in personal care and cleaning products. This trend is expected to continue, with APGs increasingly used in formulations that emphasize environmental responsibility. French consumers’ increasing demand for transparency in product labeling and sourcing will further propel the market. European Union regulations that promote the use of biodegradable products in consumer goods will continue to play a crucial role in expanding the APG market in France.

The United Kingdom posted a CAGR of 5.1% during 2020–2024, with a projected CAGR of 5.1% in 2025–2035. The growth during 2020–2024 was largely driven by the increasing demand for biodegradable ingredients in personal care products and household cleaning solutions. Moving forward, the market is expected to grow steadily, supported by a strong regulatory framework promoting eco-friendly formulations and increasing consumer awareness of sustainable products. Additionally, local manufacturers’ efforts to innovate and develop new, green formulations will play a significant role in sustaining market growth. The UK’s continued focus on sustainability will reinforce the adoption of Alkyl Polyglucosides across various industries.

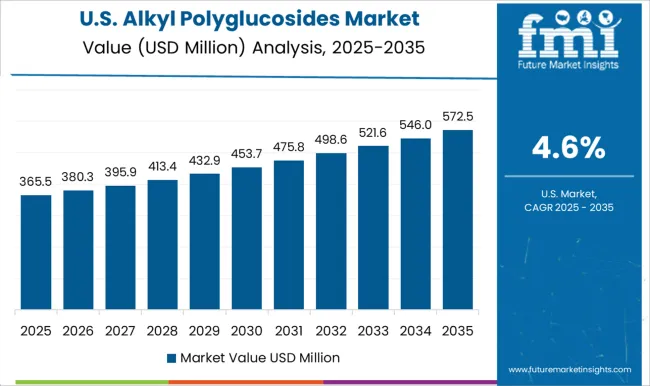

The United States experienced a CAGR of 4.6% during 2020–2024, with a projected CAGR of 4.6% from 2025–2035. The USA market growth during 2020–2024 was supported by the increasing demand for natural and safe ingredients in personal care and cleaning products. The slow growth rate in the USA is due to the maturity of the market, but steady adoption of APGs in household and industrial applications is expected to continue. Regulatory pressures for biodegradable and safer chemicals will further drive market expansion. The upcoming years will likely see steady growth, supported by innovation in green formulations and strong consumer preferences for safer, non-toxic alternatives.

The alkyl polyglucosides (APG) market is shaped by a diverse mix of key players, including major chemical companies, surfactant manufacturers, and specialized solution providers offering eco-friendly and biodegradable alternatives in personal care, cleaning, and industrial applications. BASF SE maintains a dominant position with its wide range of surfactants and chemical solutions. Clariant AG is known for its sustainable product offerings and its strong presence in the personal care sector. Croda International Plc emphasizes innovation in green chemistry and natural ingredients. Dow Chemical Company focuses on producing high-performance chemicals for industrial applications.

Galaxy Surfactants Ltd. leads in providing cost-effective APG formulations for the global market. Huntsman Corporation is a significant player, developing advanced solutions that cater to diverse industries. Kao Corporation offers eco-friendly and high-quality ingredients, particularly for personal care formulations. Stepan Company specializes in biodegradable and environmentally safe surfactants, playing a key role in expanding APG’s applications. Competitive strategies focus on expanding product portfolios, enhancing sustainability initiatives, and innovating in green chemistry to meet the growing demand for non-toxic and biodegradable ingredients in various industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 853.0 Million |

| Product | Fatty alcohol, Sugar, Cornstarch, Vegetable oil, and Others |

| Primary Function | Cleansing agents, Emulsifying agents, Wetting agents, Degreasing agents, Solubilizing agents, Hydrotope, Foaming agents, and Others |

| Application | Personal care and cosmetics, Home care products, Industrial cleaners, Agricultural chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Clariant AG, Croda International Plc, Dow Chemical Company, Galaxy Surfactants Ltd., Huntsman Corporation, Kao Corporation, and Stepan Company |

| Additional Attributes | Dollar sales projections, market share by region, growth trends, key competitors, consumer demand patterns, and regulatory impacts. |

The global alkyl polyglucosides market is estimated to be valued at USD 853.0 million in 2025.

The market size for the alkyl polyglucosides market is projected to reach USD 1,443.2 million by 2035.

The alkyl polyglucosides market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in alkyl polyglucosides market are fatty alcohol, sugar, cornstarch, vegetable oil and others.

In terms of primary function, cleansing agents segment to command 32.4% share in the alkyl polyglucosides market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alkylation Melamine-Formaldehyde Resin for Coating Market Size and Share Forecast Outlook 2025 to 2035

Alkyl Acrylate Market Size and Share Forecast Outlook 2025 to 2035

Polyalkylene Glycol Market Growth - Trends & Forecast 2025 to 2035

Fluoroalkyl Based Coatings Market Size and Share Forecast Outlook 2025 to 2035

Linear Alkylbenzene Sulfonate (LAS) Market Size and Share Forecast Outlook 2025 to 2035

Zinc Dialkyldithiophosphates Additive Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA