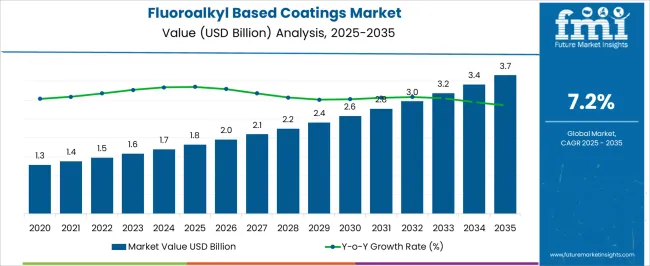

The fluoroalkyl based coatings market reaches USD 1.8 billion in 2025 and rises to USD 3.7 billion by 2035, registering a CAGR of 7.2%. During the initial phase from 2021 to 2025, the market grows from USD 1.3 billion to USD 1.8 billion, progressing through USD 1.4 billion, 1.5 billion, 1.6 billion, and 1.7 billion. Growth is driven by early adoption in architectural, automotive, and industrial coatings, where hydrophobic and anti-staining properties enhance surface protection and maintenance efficiency. This period witnesses moderate gains as specialized applications gain traction in both commercial and industrial segments.

Between 2026 and 2030, the market advances from USD 1.8 billion to USD 2.6 billion, moving through intermediate values of USD 2.0 billion, 2.1 billion, 2.2 billion, 2.4 billion, and 2.6 billion. Expansion is supported by increasing use in protective coatings for outdoor and corrosive environments, coupled with regulatory compliance requirements for high-performance surfaces. In the final phase, 2031 to 2035, the market further grows from USD 2.6 billion to USD 3.7 billion, with values of USD 2.8 billion, 3.0 billion, 3.2 billion, 3.4 billion, and 3.6 billion marking progressive gains. Wider global adoption, product innovations, and penetration into industrial, infrastructure, and consumer segments sustain compound absolute growth, demonstrating consistent momentum across applications

| Metric | Value |

|---|---|

| Fluoroalkyl Based Coatings Market Estimated Value in (2025 E) | USD 1.8 billion |

| Fluoroalkyl Based Coatings Market Forecast Value in (2035 F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The fluoroalkyl based coatings market is shaped by several parent markets that collectively define its demand across industrial, consumer, and protective applications. The specialty chemicals market plays a significant role, with fluoroalkyl coatings contributing about 12-15%. Their unique molecular structure imparts water, oil, and stain resistance, positioning them as high-value specialty formulations.

The paints and coatings market is the largest contributor, representing nearly 18-20% of the share. Here, fluoroalkyl based coatings are applied across architectural, automotive, and industrial finishes where long-term durability, non-stick surfaces, and repellency are required. The textile finishing chemicals market contributes around 8-10%, as these coatings are widely used in fabrics, outdoor gear, and upholstery to impart hydrophobic and oleophobic properties, improving both performance and lifespan.

The electronics and semiconductor materials market holds a share of about 7-9%, where fluoroalkyl coatings are used in electronic devices for dielectric stability, moisture protection, and anti-fouling functions, ensuring longer component reliability. Finally, the industrial protective coatings market contributes nearly 10-12%, leveraging fluoroalkyl based solutions in aerospace, marine, and oil and gas sectors for corrosion resistance and chemical protection under extreme conditions.

The market is witnessing steady expansion driven by increasing demand for advanced surface protection solutions across diverse industries. These coatings are valued for their exceptional hydrophobicity, oleophobicity, and chemical resistance, making them essential in applications requiring long-term performance under challenging environmental conditions. The growing focus on product durability, maintenance cost reduction, and performance enhancement is driving adoption across industrial, consumer, and infrastructure sectors.

Advancements in coating formulations and processing technologies are enabling manufacturers to meet evolving environmental and regulatory requirements without compromising performance. The market is also benefiting from rising demand in emerging economies, where infrastructure development and industrial growth are boosting the need for protective and functional coatings.

Strategic investments in research and development, along with partnerships between material suppliers and end-use industries, are fostering innovation. With increasing emphasis on sustainability and high-performance materials, fluoroalkyl-based coatings are expected to remain a preferred choice in high-value applications, supporting consistent market growth in the coming years.

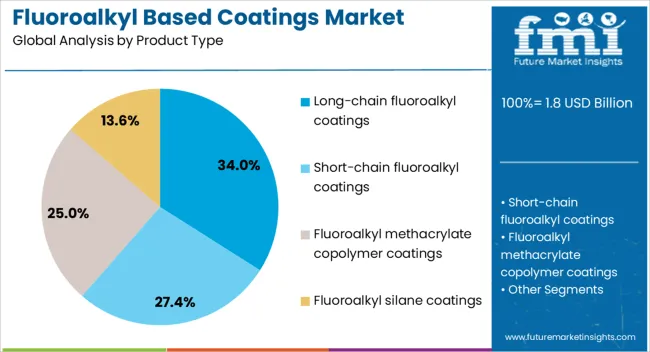

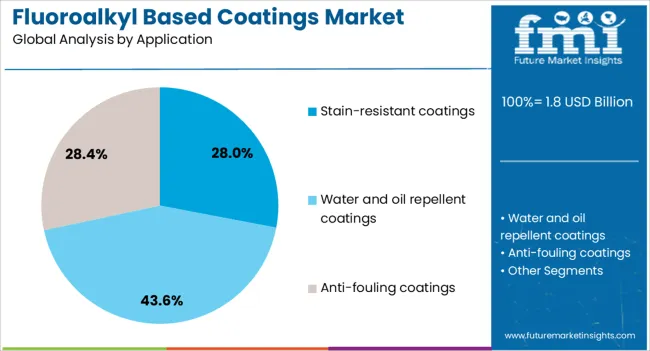

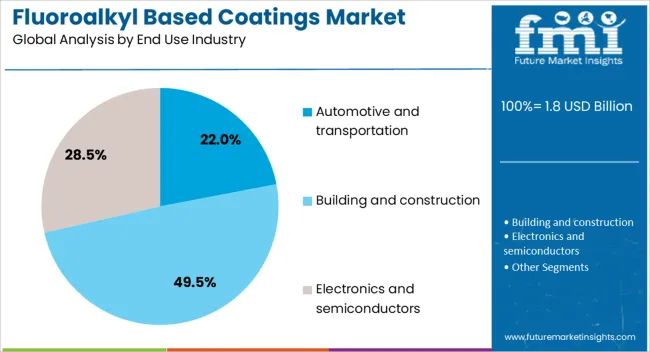

The fluoroalkyl based coatings market is segmented by product type, application, end use industry, and geographic regions. By product type, fluoroalkyl based coatings market is divided into Long-chain fluoroalkyl coatings, Short-chain fluoroalkyl coatings, Fluoroalkyl methacrylate copolymer coatings, Fluoroalkyl silane coatings, Fluoroalkyl polyester coatings, Fluoroalkyl polyurethane coatings, and Others.

In terms of application, fluoroalkyl based coatings market is classified into Stain-resistant coatings, Water and oil repellent coatings, Anti-fouling coatings, Non-stick coatings, Corrosion-resistant coatings, Electronic coatings, and Others. Based on end use industry, fluoroalkyl based coatings market is segmented into Automotive and transportation, Building and construction, Electronics and semiconductors, Textiles and apparel, Aerospace and defense, Consumer goods, Industrial equipment, Marine, and Others. Regionally, the fluoroalkyl based coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The long-chain fluoroalkyl coatings segment is projected to hold 34% of the fluoroalkyl-based coatings market revenue share in 2025, making it the leading product type. This dominance has been driven by the superior water and oil repellency characteristics offered by long-chain molecular structures, which provide enhanced performance in demanding environments.

Their high resistance to abrasion, temperature extremes, and chemical exposure has made them suitable for a wide range of industrial and consumer applications. The ability to deliver long-lasting protective properties with minimal maintenance requirements has reinforced their adoption in sectors where operational efficiency is a priority.

Manufacturers have increasingly invested in developing advanced formulations to optimize performance while addressing regulatory concerns related to fluorinated compounds As industries continue to seek coatings that combine functional excellence with durability, long-chain fluoroalkyl coatings are expected to maintain their leadership position, supported by both technological innovation and sustained end-user demand.

The stain-resistant coatings segment is expected to account for 28% of the market revenue share in 2025, positioning it as the leading application. The segment's growth has been supported by the increasing demand for surface finishes that resist staining from liquids, oils, and environmental contaminants.

These coatings are widely adopted in industries where cleanliness, aesthetics, and maintenance cost control are critical. The use of advanced fluoroalkyl chemistry enables the creation of surfaces that are easy to clean and maintain, thereby extending the service life of products and infrastructure.

Continuous improvements in formulation technologies have enhanced coating performance under varied environmental conditions, making them suitable for both indoor and outdoor applications With rising consumer expectations for product longevity and appearance retention, stain-resistant coatings are being increasingly integrated into manufacturing processes across multiple sectors, ensuring their continued market dominance.

The automotive and transportation segment is anticipated to command 22% of the market revenue share in 2025, making it the leading end-use industry. Growth in this segment has been driven by the need for coatings that enhance vehicle performance, protect surfaces from harsh environmental exposure, and improve overall durability.

Fluoroalkyl based coatings provide exceptional resistance to water, oil, road salts, and chemical contaminants, reducing maintenance costs and extending the operational lifespan of vehicles and transportation assets. Their application in exterior and interior components has been increasing as manufacturers prioritize both functional performance and aesthetic appeal.

Advances in coating technologies have enabled the development of environmentally compliant solutions without sacrificing performance, aligning with evolving automotive industry regulations. As the global transportation sector continues to expand, supported by infrastructure investments and increasing vehicle production, the demand for high-performance fluoroalkyl-based coatings in this industry is expected to remain strong.

The fluoroalkyl based coatings market is expanding, driven by demand for durable, high-performance protective applications across automotive, aerospace, construction, and electronics. Their superior resistance to moisture, chemicals, and extreme conditions supports wide adoption, though high production costs and regulatory challenges around fluorinated compounds remain significant hurdles.

Opportunities are emerging in electronics and aerospace, where reliability and precision are critical. Industry trends emphasize innovation in formulations, strategic collaborations, and regional expansion. Together, these dynamics are positioning fluoroalkyl-based coatings as essential materials in advanced protective applications worldwide.

The fluoroalkyl based coatings market is expanding due to rising demand for protective surface applications across industrial, automotive, and electronics sectors. These coatings provide excellent resistance to water, oil, chemicals, and extreme temperatures, making them highly valuable in environments where durability is essential. Automotive manufacturers use them to enhance corrosion resistance and extend the lifespan of parts, while the electronics industry applies them to protect sensitive components against moisture and contaminants. In construction, fluoroalkyl coatings are used on glass, stone, and concrete surfaces to improve appearance and long-term performance. The versatility of these coatings has positioned them as essential for applications requiring high reliability and extended service life. With industries seeking protective solutions that ensure product longevity, fluoroalkyl-based coatings are steadily gaining adoption in both consumer and industrial end-use applications.

Manufacturing requires advanced processes and specialized raw materials, which increases expenses compared to conventional coatings. This restricts adoption in price-sensitive industries or small-scale applications. Furthermore, scrutiny over potential ecological and health impacts of certain fluorochemicals has resulted in stricter regulatory frameworks across regions. Companies are required to comply with evolving chemical usage standards, increasing testing and certification costs. Disposal and waste management of fluorinated residues also add to compliance challenges. These factors create barriers for new entrants and push existing players to balance product performance with regulatory expectations. The combination of high manufacturing expenses and growing compliance obligations continues to limit widespread commercialization, confining adoption mainly to sectors where technical benefits justify higher costs.

In electronics, these coatings are applied to circuit boards, connectors, and sensors to protect against moisture, dust, and chemical exposure, thereby extending product life and reliability. Aerospace manufacturers use them for structural components exposed to harsh conditions, as they provide resistance to fuel, lubricants, and temperature extremes. The growing demand for advanced protective solutions in high-precision sectors is encouraging R&D investments to enhance coating formulations. Efforts are being made to improve adhesion, reduce thickness without compromising performance, and expand compatibility with a wider range of substrates. These innovations are unlocking potential for broader applications, reinforcing the role of fluoroalkyl coatings in critical industries where reliability, safety, and long-term performance are non-negotiable.

Companies are investing in new formulations that balance high performance with reduced environmental impact, targeting compliance with international regulations. Collaborations between coating manufacturers, chemical suppliers, and end-user industries are accelerating the development of tailored solutions for automotive, aerospace, and electronics applications. Advances in nanostructured coatings and hybrid formulations are enhancing barrier properties, durability, and application efficiency.

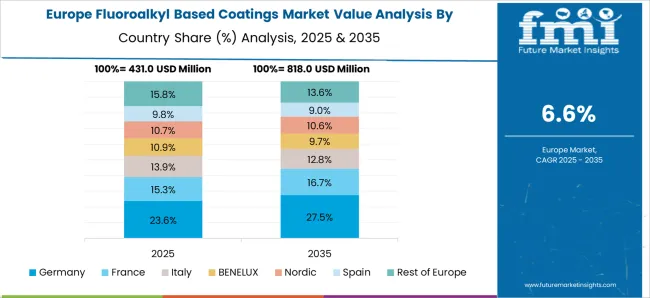

Regionally, North America and Europe are driving innovation through strong regulatory oversight and industrial demand, while the Asia Pacific shows rapid adoption due to expanding electronics and automotive manufacturing. Industry players are also emphasizing pilot-scale production and global distribution networks to strengthen market presence. These trends highlight the role of collaborative innovation and regional growth in shaping the competitive landscape of fluoroalkyl-based coatings.

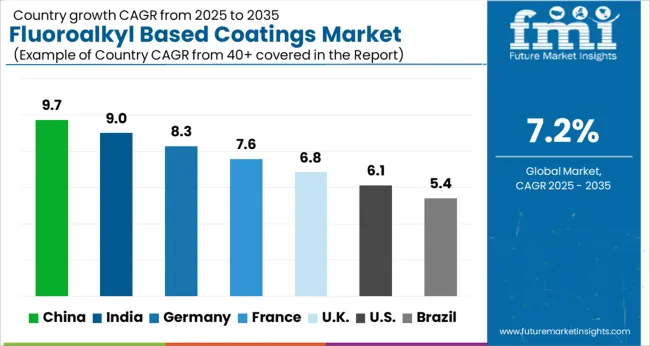

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The fluoroalkyl based coatings market is projected to grow globally at a CAGR of 7.2% between 2025 and 2035. China leads with 9.7%, followed by India at 9.0% and Germany at 8.3%, while the United Kingdom posts 6.8% and the United States records 6.1%. China and India secure the strongest growth premiums of +2.5% and +1.8% above the global baseline, supported by expanding electronics, automotive, and industrial projects. Germany maintains steady growth through its advanced engineering and automotive ecosystem. The UK and USA show moderate yet consistent performance, driven by construction, healthcare, and aerospace applications. The analysis includes over 40+ countries, with the leading markets detailed below.

China is projected to expand at a CAGR of 9.7% from 2025 to 2035 in the fluoroalkyl based coatings market. Growth is strongly driven by the rapid expansion of electronics, automotive, and construction sectors where advanced coatings are essential. In consumer electronics, demand for coatings with water- and oil-repellent properties is rising due to smartphones, displays, and precision devices. The automotive sector is increasingly adopting these coatings for scratch resistance, longevity, and superior surface protection. Government-backed industrial modernization is creating additional opportunities, as coatings are being widely applied in machinery and high-performance industrial parts. Domestic producers are scaling up production capacity, while global suppliers are entering through joint ventures.

India is forecasted to grow at a CAGR of 9.0% in the fluoroalkyl based coatings market from 2025 to 2035. Rising industrialization and infrastructure projects are fueling adoption across construction, automotive, and consumer goods. In construction, coatings are being widely used in architectural glass and building exteriors to enhance durability. The automotive industry is driving adoption due to rising demand for high-performance coatings that improve longevity and resistance to harsh weather. Electronics and packaging applications are also showing growing consumption, particularly in water- and oil-resistant layers for consumer products. Domestic companies are working with international suppliers to improve technical expertise and product quality. Government programs promoting industrial modernization and the rise of e-commerce are further amplifying market penetration.

Germany is expected to grow at a CAGR of 8.3% between 2025 and 2035 in the fluoroalkyl based coatings market. The strong industrial base and leadership in engineering drive consistent adoption of advanced coatings across sectors. Automotive OEMs are leading end-users, incorporating fluoroalkyl coatings in high-performance components for improved wear and fluid resistance. Electronics manufacturing is another significant driver, with applications in sensors, displays, and consumer devices. Industrial equipment, aerospace, and healthcare sectors are also adopting coatings for their superior barrier properties. Research institutions in Germany are working closely with manufacturers to enhance coating durability and eco-friendly formulations. Demand is further supported by stringent quality standards across automotive and industrial production.

The United Kingdom is forecasted to expand at a CAGR of 6.8% from 2025 to 2035 in the fluoroalkyl based coatings market. Growth is supported by applications in construction, automotive, and healthcare. In construction, demand for water- and oil-resistant coatings in glass, tiles, and building materials is increasing. Automotive manufacturers are gradually integrating advanced coatings to improve performance and longevity, especially in high-end vehicles. Healthcare and medical device industries are also showing consistent demand, as coatings provide strong protective properties. Local suppliers are collaborating with European producers to strengthen product availability, while imports play a critical role in meeting niche requirements.

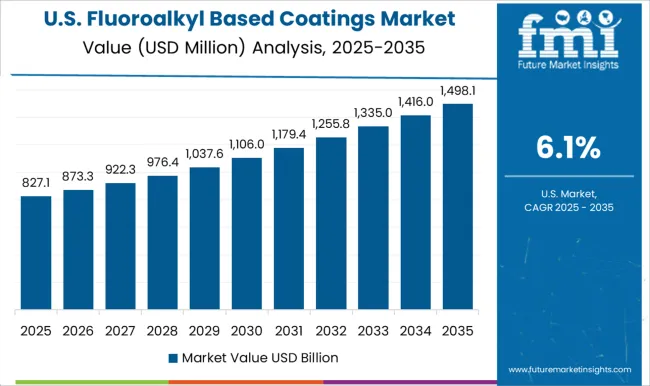

The United States is projected to grow at a CAGR of 6.1% between 2025 and 2035 in the fluoroalkyl based coatings market. The demand is being shaped by the strong presence of aerospace, healthcare, and automotive industries, which require high-performance coatings. Aerospace applications are particularly critical, where coatings provide resistance to extreme environments and enhance durability of sensitive components. The healthcare sector is adopting these coatings for diagnostic devices, surgical tools, and medical equipment due to their fluid-resistant properties. In the automotive space, premium and electric vehicles are contributing to adoption as coatings improve longevity and reduce maintenance needs. Domestic manufacturers are investing in R&D to develop advanced coating formulations, while global companies continue to expand their USA presence.

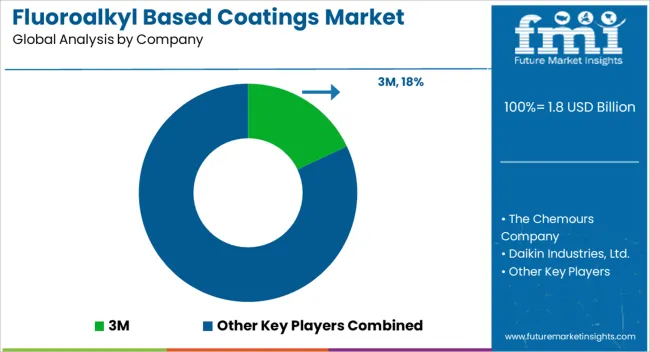

In the fluoroalkyl based coatings market, competition is built on performance differentiation, regulatory compliance, and end-use versatility. 3M has long been a key player with fluoropolymer and fluorosurfactant technologies, supplying coatings that deliver stain resistance, oil and water repellency, and durability for textiles, packaging, and industrial applications. The Chemours Company emphasizes high-performance fluoropolymer coatings under brands such as Teflon, positioning itself strongly in cookware, automotive, and aerospace segments where non-stick and chemical resistance are critical. Daikin Industries, Ltd. and AGC Inc. compete through extensive fluorochemical portfolios, offering coatings tailored for electronics, construction, and energy sectors, backed by strong R&D pipelines and global distribution. PPG Industries, Inc. integrates fluoroalkyl technologies into its industrial and architectural coatings, highlighting weatherability, corrosion protection, and surface repellency as key differentiators.

Solvay S.A. and Arkema S.A. extend their competitive strength with advanced fluoropolymer coatings for automotive, electronics, and specialty industries, with strategies focused on innovation and regulatory adaptation. BASF SE leverages its broad chemical expertise to blend fluoroalkyl performance into multifunctional coatings, targeting packaging, consumer goods, and industrial protection. AkzoNobel N.V. emphasizes high-performance architectural coatings where repellency and durability are critical, while Whitford Corporation competes with specialized non-stick coating systems widely adopted in cookware and food processing equipment. Other regional and niche manufacturers add competition by offering application-specific coatings tailored for textiles, paper, or niche industrial surfaces.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Product Type | Long-chain fluoroalkyl coatings, Short-chain fluoroalkyl coatings, Fluoroalkyl methacrylate copolymer coatings, Fluoroalkyl silane coatings, Fluoroalkyl polyester coatings, Fluoroalkyl polyurethane coatings, and Others |

| Application | Stain-resistant coatings, Water and oil repellent coatings, Anti-fouling coatings, Non-stick coatings, Corrosion-resistant coatings, Electronic coatings, and Others |

| End Use Industry | Automotive and transportation, Building and construction, Electronics and semiconductors, Textiles and apparel, Aerospace and defense, Consumer goods, Industrial equipment, Marine, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, The Chemours Company, Daikin Industries, Ltd., AGC Inc., PPG Industries, Inc., Solvay S.A., Arkema SA, BASF SE, AkzoNobel N.V., Whitford Corporation, and Other manufacturers |

| Additional Attributes | Dollar sales by product type (fluoroalkyl, PTFE, other fluoropolymers), application (automotive, industrial, construction, consumer goods), and form (liquid, powder, film). Demand dynamics are influenced by increasing adoption of protective coatings, chemical resistance requirements, and regulatory compliance. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, driven by industrial expansion and infrastructure development. |

The global fluoroalkyl based coatings market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the fluoroalkyl based coatings market is projected to reach USD 3.7 billion by 2035.

The fluoroalkyl based coatings market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in fluoroalkyl based coatings market are long-chain fluoroalkyl coatings, _pfoa-based coatings, _pfos-based coatings, _others, short-chain fluoroalkyl coatings, _pfhxa-based coatings, _pfbs-based coatings, _others, fluoroalkyl methacrylate copolymer coatings, _fluoroalkyl acrylate coatings, _fluoroalkyl methacrylate coatings, _hybrid fluoroalkyl copolymer coatings, fluoroalkyl silane coatings, _mono-functional fluoroalkyl silanes, _multi-functional fluoroalkyl silanes, _fluoroalkyl silane hybrid coatings, fluoroalkyl polyester coatings, fluoroalkyl polyurethane coatings and others.

In terms of application, stain-resistant coatings segment to command 28.0% share in the fluoroalkyl based coatings market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Si-based Hall Effect Sensors Market Size and Share Forecast Outlook 2025 to 2035

AI-based 3D reconstruction Tools Market Size and Share Forecast Outlook 2025 to 2035

AI based Triage Tools Market Size and Share Forecast Outlook 2025 to 2035

Ph Based Lip Balm Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Driving Systems (L2 to L5) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biobased And Synthetic Polyamides Market Size and Share Forecast Outlook 2025 to 2035

AI-based Research Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

AI-based Atrial Fibrillation AFib Detection Market Size and Share Forecast Outlook 2025 to 2035

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

AI-based Surgical Robots Market Size and Share Forecast Outlook 2025 to 2035

Biobased Degreaser Market Size and Share Forecast Outlook 2025 to 2035

pH Based Lipstick Market Size and Share Forecast Outlook 2025 to 2035

Biobased Biodegradable Plastic Market Growth - Trends & Forecast 2025 to 2035

Biobased Propylene Glycol Market Growth - Trends & Forecast 2025 to 2035

AI-based Clinical Trials Solution Provider Market Trends – Growth & Forecast 2024-2034

Biobased Transformer Oil Market

Bio-based Cutlery Market Size and Share Forecast Outlook 2025 to 2035

CO2-based Polycarbonate Polyol Market Size and Share Forecast Outlook 2025 to 2035

Bio Based Paraxylene Market Size and Share Forecast Outlook 2025 to 2035

Oat-based Snacks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA