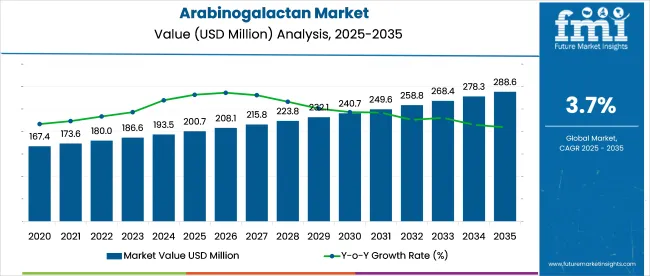

The global arabinogalactan market is forecasted to reach a value of USD 200.7 million by 2025 and is expected to grow at a CAGR of 3.7% to attain a valuation of USD 288.6 million by 2035. This steady growth trajectory is driven by expanding awareness and demand for functional dietary fibers, particularly those offering immune-modulating and gut health benefits.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 200.7 million |

| Projected Industry Value (2035F) | USD 288.6 million |

| CAGR (2025 to 2035) | 3.7% |

Arabinogalactan, a plant-derived polysaccharide predominantly sourced from larch trees, is emerging as a critical component in several health-focused industries. Its low toxicity, high solubility, and GRAS (Generally Recognized as Safe) status have made it a sought-after ingredient in nutraceuticals, pharmaceuticals, food and beverage, and personal care sectors. The global inclination toward plant-based and clean-label ingredients further reinforces the position of products as a preferred choice in various formulations.

As of 2025, arabinogalactan registers a relatively niche but growing share across its parent markets. In the functional food ingredients market, it accounts for 2.5%, driven by its use as a dietary fiber and prebiotic. Within the dietary supplements market, it represents around 1.8%, primarily due to its role in immune-support capsules and gut health formulations.

In the pharmaceutical excipients market, its share is estimated at 1.2%, used in controlled-release systems and anti-inflammatory formulations. In the animal feed additives market, it contributes about 2%, particularly in pet food and livestock gut enhancers. In the cosmetic ingredients market, its share remains low at around 0.5%, used as a moisturizer and stabilizer. Its share is small but expanding across these sectors.

The market operates through a vertically integrated structure involving raw material sourcing, processing, formulation, and distribution. The supply chain begins with the harvesting of softwood trees, primarily larch species, from North America and parts of Europe and Asia. These trees undergo extraction processes to be isolated in powder or capsule form.

Manufacturers invest in purification and standardization technologies to ensure product consistency across batches. The processedingredient is then supplied to formulation companies operating in the dietary supplement, food and beverage, cosmetic, and pharmaceutical sectors.

Distributors and retailers, including online health platforms, specialty stores, and pharmacies, further channel the final products to consumers globally. Market growth is contingent on raw material sourcing, efficient extraction technologies, and regulatory approvals, making collaboration between forestry operators, ingredient processors, and formulation brands essential for long-term industry scalability.

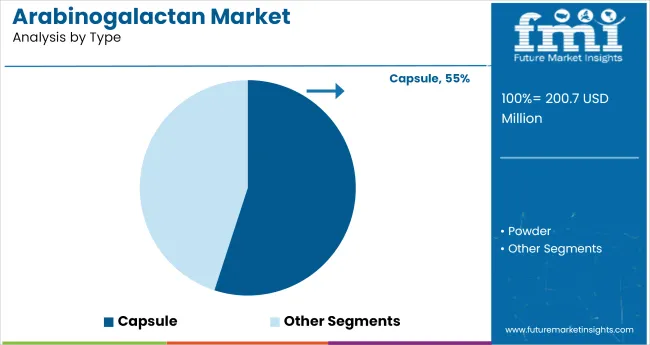

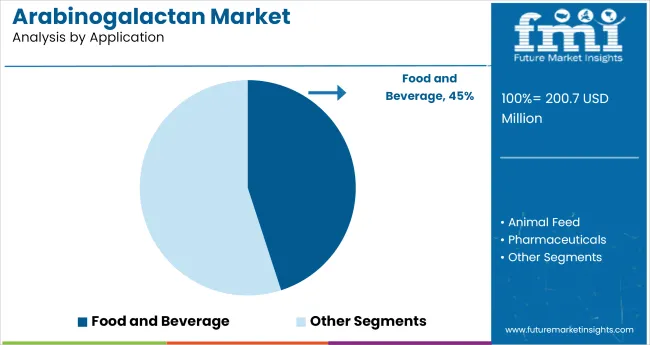

Capsules dominate the arabinogalactan market with a 55% share in 2025 due to their precise dosing, convenience, and growing demand for plant-based supplements. The food and beverage segment holds a 45% share, driven by rising use of arabinogalactan as a prebiotic and dietary fiber in functional, health-focused products across dairy, snacks, and beverages.

Capsules are the leading segment in the arabinogalactan market, accounting for 55% of the market share in 2025. Their dominance is primarily driven by the increasing demand for easy-to-consume, plant-based health supplements.

The food and beverage segment leads the arabinogalactan market with a 45% share in 2025, driven by the global shift toward functional and health-oriented food consumption.

The arabinogalactan market is driven by rising demand for plant-based, clean-label ingredients in functional foods, supplements, and pharmaceuticals. Its expanding use in animal nutrition and advanced drug delivery systems is broadening its global application scope.

Rising Demand for Functional and Plant-Based Ingredients

The market is significantly influenced by the growing preference for functional and plant-based ingredients. Consumers are increasingly seeking natural solutions for gut health, immunity, and metabolic wellness, positioningit as a high-value prebiotic fiber. Its GRAS status and plant-derived origin make it a preferred choice for clean-label formulations.

The market is also witnessing a surge in demand for vegan and gelatin-free options, especially in North America and Europe. Manufacturers are actively incorporating into health foods, supplements, and beverages to meet evolving dietary trends. This momentum is further supported by emerging clinical research confirming its anti-inflammatory, antioxidant, and immune-enhancing benefits, fueling its use in pharmaceuticals and advanced nutraceuticals.

Expansion in Animal Nutrition and Pharmaceutical Applications

The expanding use of arabinogalactan in animal feed and pharmaceuticals represents a key market dynamic. In animal nutrition, it is used as a natural prebiotic and immunity enhancer for pets and livestock, improving digestion and nutrient absorption. With rising awareness around probiotic and gut-friendly pet diets, this is gaining traction in premium feed segments.

Pharmaceutical potential is being tapped in immune-supportive supplements, liver detoxification formulas, and drug delivery systems. Its biocompatibility and ability to enhance active compound absorption make it an attractive excipient in advanced drug formulations. This dual demand from the veterinary and human healthcare sectors is widening application base globally.

India leads the market with a CAGR of 4.0%, driven by growing demand for nutraceuticals, plant-based supplements, and expanding export opportunities from 2025 to 2035. Germany follows at 3.9%, reflecting strong adoption in functional foods, pharmaceuticals, and vegan capsules. China, with a 3.6% CAGR, is witnessing increased use in traditional medicine, animal feed, and localized production.

The USA, a mature market growing at 3.5%, benefits from high supplement usage and precise formulation demand. Japan, at 3.4%, sees steady growth led by cosmetic and food applications, supported by an aging, health-conscious population. India and China belong to BRICS, while the USA, Germany, and Japan are part of the OECD and G7, highlighting a divide between high-growth emerging markets and innovation-driven developed economies.

The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.5% |

| Germany | 3.9% |

| Japan | 3.4% |

| China | 3.6% |

| India | 4.0% |

The USA arabinogalactan market is estimated to grow at a 3.5% CAGR during the study period. The market expansion in the United States is supported by the country’s mature nutraceutical sector and a strong inclination toward evidence-based dietary supplements.

Arabinogalactan is extensively incorporated in immune-support formulas and prebiotic blends, responding to increasing consumer interest in digestive health and natural alternatives to synthetic ingredients. Its application in the pharmaceutical industry is also growing due to its GRAS status and compatibility with various drug delivery systems.

Health-conscious aging populations and rising plant-based preferences are fueling demand for gelatin-free capsule forms, where arabinogalactan serves as a functional additive. Leading supplement manufacturers are integrating arabinogalactan into blends targeting immunity, liver health, and gut balance.

Germany is projected to record a 3.9% CAGR in its arabinogalactan market through 2035.Germany represents one of the most progressive markets in Europe for clean-label and plant-based dietary ingredients, making it a prime growth hub for products. The ingredient is increasingly used in functional food formulations such as fortified beverages, energy bars, and dairy alternatives.

German consumers prioritize transparent sourcing and scientifically backed health claims, making arabinogalactan an ideal fit due to its role in immunity enhancement and gut microbiota regulation. Pharmaceutical and nutraceutical firms are developing arabinogalactan-based formulations targeting inflammation and digestion, often marketed through pharmacies and wellness chains.

Germany’s strong export-driven food and supplement industry enables wider adoption of arabinogalactan-enriched products across European Union markets. The regulatory environment is also supportive of novel dietary fibers with proven safety and efficacy.

Japan anticipates a steady arabinogalactan market expansion at a CAGR of 3.4% over the next decade.Japan’s arabinogalactan market is shaped by its unique demographic structure and consumer behavior, especially the focus on longevity, digestive wellness, and anti-aging. Arabinogalactan is used in functional beverages, fermented foods, and skin-nourishing supplements, reflecting Japan’s integration of wellness in daily routines.

Demand is increasing from cosmetic companies seeking naturally derived ingredients with hydrating and emulsifying properties, which support arabinogalactan’s use in creams and serums. Japanese companies are exploring arabinogalactan’s application in liver health and metabolic support, aligning with the health needs of the aging population.

The Japanese market also values ingredients with mild flavor profiles and high solubility, which favor the product’s inclusion in food and drink without altering taste. Partnerships between local research institutions and supplement producers are also paving the way for product and premium-positioned offerings.

China’s arabinogalactan market is forecast to grow at 3.6% CAGR between 2025 and 2035.China is witnessing steady growth in arabinogalactan consumption, fueled by increased awareness around digestive health, immune function, and the benefits of natural polysaccharides. The market is being propelled by traditional medicine manufacturers and nutraceutical firms integrating arabinogalactan into herbal and botanical blends.

Functional food and beverage companies are also adopting the ingredient in fiber-rich snacks and wellness drinks, targeting urban health-conscious consumers. It is gaining acceptance as a prebiotic alternative in pediatric and adult nutrition formulas, especially amid rising concerns over gut microbiome imbalances due to dietary changes in urban areas.

Domestic production is expanding, particularly in northern China, where raw material sourcing and processing investments are underway. Cross-border e-commerce platforms are also enabling wider access to arabinogalactan-containing products from global and local brands.

India’s arabinogalactan market is set to register the highest CAGR of 4.0% during the 2025 to 2035 period. India stands out as the fastest-growing market for arabinogalactan, supported by rising demand for herbal, plant-based, and immunity-focused formulations.

The growth is further accelerated by increasing investments in dietary supplements, Ayurveda-based health products, and fortified food categories. Indian consumers are showing greater awareness of gut health and preventive nutrition, prompting manufacturers to includeit in powders, tablets, and functional snacks.

The adoption is particularly strong in urban centers where the middle-class population is actively seeking natural alternatives to synthetic fibers. In veterinary and animal feed segments, this is gaining traction as a performance enhancer and gut stabilizer for poultry and livestock. The country’s low-cost manufacturing environment and raw material sourcing capabilities make it a competitive export hub for formulations aimed at Southeast Asian and African markets.

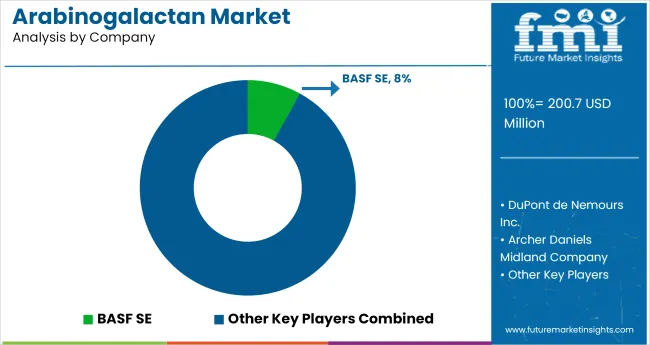

Leading players such as BASF SE, DuPont de Nemours Inc., and Archer Daniels Midland Company are strengthening their portfolios through targeted R&D and ingredients. Cargill Incorporated and Lonza are integrating products into functional nutrition lines, while Pure Encapsulations and Thorne Research Inc. focus on clean-label supplement delivery.

Eastern Europe’s Ametis JSC continues to scale extraction capacities, supporting global bulk supply. Niche wellness brands like Vetri Science Laboratories and Food Science of Vermont are advancing pet nutrition products with immune-boosting formulations.

The competitive landscape also includes other prominent players enhancing product traceability and plant-based sourcing strategies. Collectively, these firms are shaping a robust, innovation-driven supply ecosystem in the global market.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 200.7 million |

| Projected Market Size (2035) | USD 288.6 million |

| CAGR (2025 to 2035) | 3.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and volume in metric tons |

| Type Analyzed (Segment 1) | Capsule and Powder. |

| Application Analyzed (Segment 2) | Food a nd Beverage, Animal Feed, Pharmaceuticals, Cosmetics, and Others. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | BASF SE, DuPont de Nemours Inc., Archer Daniels Midland Company, Cargill Incorporated, Lonza, Pure Encapsulations, Ametis JSC, VetriScience Laboratories, Food Science of Vermont, Thorne Research Inc., and other prominent market players. |

| Additional Attributes | Dollar sales, growth rate, regional demand trends, leading applications, competitor share, pricing trends, raw material sourcing, regulatory landscape, and future opportunity hotspots. |

The industry is segmented into capsule and powder.

The industry finds applications in food and beverage, animal feed, pharmaceuticals, cosmetics, and other industries.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 200.7 million in 2025.

It is forecasted to reach USD 288.6 million by 2035.

The industry is anticipated to grow at a CAGR of 3.7% during this period.

Capsules are projected to lead the market with a 55% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 4.0%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA