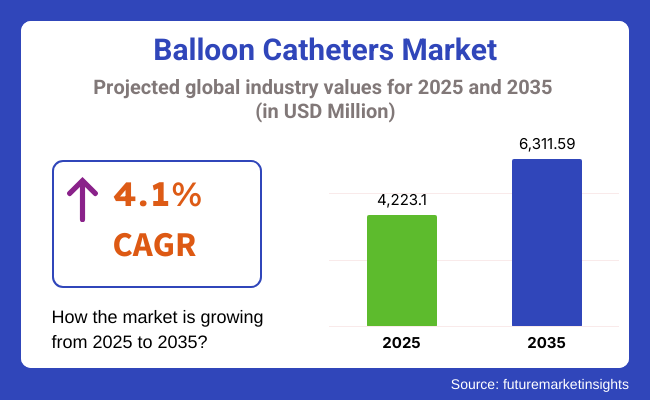

The global balloon catheter Market is estimated to be valued at USD 4,223.10 million in 2025 and is projected to reach USD 6,311.59 million by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

This growth is primarily driven by the increasing prevalence of cardiovascular diseases, the aging population, and the rising demand for minimally invasive procedures. Balloon catheters have become essential tools in the treatment of vascular diseases, particularly with the shift from conventional therapies to percutaneous transluminal angioplasty (PTA) and percutaneous coronary intervention (PCI).

Advancements in catheter technology, including the development of drug-eluting and high-pressure balloons, are further contributing to market expansion. Additionally, the growing adoption of these devices in emerging economies, coupled with favorable reimbursement policies, is expected to bolster market growth in the coming years.

Leading manufacturers in the balloon catheter market, such as Medtronic, Boston Scientific, and Cagent Vascular, are actively engaged in product innovation and strategic collaborations to enhance their market presence. In February 2025, Cagent Vascular announced the launch of the Serranator SL-PRO™, a novel PTA serration balloon catheter designed for pedal intervention and challenging tibial disease.

This device utilizes proprietary stainless steel micro-serration technology to create linear, interrupted scoring along the endoluminal surface, facilitating predictable and controlled lumen gain with minimal dissection. Dr. Carol Burns, CEO of Cagent Vascular, stated “We are committed to consistently developing and advancing solutions for physicians treating PAD patients, and winning the fight against this debilitating disease.

With over 20,000 procedures now completed and a growing library of clinical data, Serranator has proven itself to be a valuable tool in this fight. The Serranator SL-PRO is a purpose-built tool for pedal intervention, and with it, the Serranator product family can now treat from hip to toe”. These product launches, along with ongoing research and development efforts, are influencing market growth.

The North American balloon catheter market is expected to witness a steady growth over the forecast period. This growth is attributed to the high prevalence of cardiovascular diseases, advanced healthcare infrastructure, and increased adoption of minimally invasive procedures.

Furthermore, fa. vorable reimbursement policies and continuous technological advancements are supporting market expansion in the region. In Europe, the driven by the rising geriatric population and the increasing incidence of peripheral artery diseases. The region's emphasis on early diagnosis and treatment, along with the implementation of supportive healthcare policies, is fostering market growth.

In 2025, the drug-coated balloon (DCB) catheters segment is expected to account for 37.5% of the total revenue in the balloon catheter market, making it the leading product type. This dominance can be attributed to the segment’s increasing adoption in peripheral artery disease (PAD) and in-stent restenosis (ISR) treatments, where sustained drug delivery without a permanent implant is preferred.

DCBs have been favored due to their ability to deliver antiproliferative agents such as paclitaxel directly to the arterial wall, reducing neointimal hyperplasia while minimizing inflammation or mechanical injury. Their clinical superiority in reducing restenosis rates, along with improved patient outcomes in high-risk populations like diabetics and the elderly, has been consistently documented in peer-reviewed trials and health technology assessments. Furthermore, regulatory approvals and positive reimbursement frameworks in key markets like the USA, Germany, and Japan have further propelled their utilization.

Recent product advancements, including low-profile balloons and rapid drug release formulations have enabled more complex lesion access and enhanced procedural efficiency, thereby boosting physician confidence and adoption.

In 2025, the coronary artery disease (CAD) application segment is projected to account for approximately 35% of the overall revenue in the balloon catheter market, positioning it as the dominant clinical indication. This leadership can be attributed to the global rise in the prevalence of cardiovascular diseases, driven by sedentary lifestyles, aging populations, increasing obesity rates, and comorbidities such as diabetes and hypertension.

As per 2024 data from the European Society of Cardiology, CAD remains the leading cause of death worldwide, thereby sustaining high procedural volumes for percutaneous coronary interventions (PCIs). Balloon catheters, including plain old balloon angioplasty (POBA), drug-coated, and cutting balloons, are routinely utilized for lesion preparation and stent delivery, especially in complex anatomies like bifurcations and calcified plaques. Additionally, early detection of CAD through advanced imaging techniques and national-level screening programs has expanded the pool of patients eligible for catheter-based revascularization.

Technological innovations such as high-pressure and scoring balloon designs, along with integration of imaging modalities like IVUS and OCT, have significantly improved procedural safety and efficacy. Furthermore, supportive reimbursement policies and growing penetration of interventional cardiology centers in emerging markets have contributed to expanded access. As healthcare facilities increasingly prioritize minimally invasive cardiovascular treatments, the use of balloon catheters in CAD is expected to remain central to clinical workflows and long-term disease management.

Challenges

The balloon catheter market is confronted with a number of challenges which include high procedural expenses and limited reimbursement policies limit patient access to new balloon catheters. Physicians are still concerned about the threat of restenosis and thrombosis despite drug-coated balloons (DCBs). Regulatory barriers and long approval times hinder the market introduction of new products. Alternative treatment options, including stents and atherectomy devices, increase competition.

Raw material shortages and supply chain disruptions affect manufacturing and availability of products. With increasing demand for affordable solutions, manufacturers are required to trade off innovation against affordability while upholding high efficacy and safety standards.

Opportunities

The Balloon Catheters Market presents significant growth opportunities, especially with the growing uptake of drug-coated balloons (DCBs) and specialty balloons to treat challenging coronary and peripheral vascular lesions. As healthcare systems remain in the direction of minimally invasive interventions, demand for advanced balloon catheters that promote procedural success and minimize complications is on the rise.

Emerging economies, especially the Asia-Pacific and Latin American regions, offer considerable growth opportunities as healthcare expenditures increase, cardiovascular disease burden grows, and access to interventional therapies is enhanced. Companies that emphasize cost-efficient, high-performance solutions and secure regulatory clearances will have a competitive edge.

Strategic alliances between medical device firms and healthcare providers will further promote the uptake of next-generation balloon catheters. Growing product lines with specialty balloons to treat calcified or complex lesions will continue to drive market penetration and solidify the position of balloon catheters in vascular disease treatment.

Market Outlook

The Balloon Catheters Market is experiencing healthy growth due to USA healthcare providers shifting their preference toward the use of balloon catheters in percutaneous coronary interventions (PCI) and peripheral vascular interventions (PVI) for patients with coronary artery disease (CAD) and peripheral vascular disease (PVD).

Manufacturers are likely to offer superior coated and niche-use balloon catheters, thus, improving the rate of successful outcomes for the said procedures. New devices will be passed through the regulatory channels, and this will, in turn, speed up market growth and innovation.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

The growth of the Balloon Catheters Market in Germany is associated with the increasing application of minimally invasive techniques in the treatment of coronary artery disease (CAD) and peripheral vascular disease (PVD). Development of highly advanced drug-coated and specialty balloon catheters by the manufacturers will lead to better procedural success and will shorten complications. Continued implementation of favorable reimbursement policies will enable hospitals and specialty clinics to expand their use of these cost-effective treatments.

Regulatory authorities are set to accelerate the product approval processes, resulting in a rapid entry of the products into the market and the availability of a wider variety. Access to the latest balloon catheters technologies is expected to be further enhanced by the country's strong healthcare infrastructure, thus, fortifying the market growth in the years to come.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.9% |

Market Outlook

Japan's balloon catheter market is fueled by expanding the use of minimally invasive procedures to treat coronary artery disease (CAD) and peripheral vascular disease (PVD). Companies are creating sophisticated drug-coated and specialty balloon catheters, enhancing procedural success and lowering restenosis rates.

Hospitals and Catheterization labs will increase their utilization of balloon catheters as government-supported healthcare programs encourage early treatment and sophisticated treatment modalities. Regulatory authorities will speed up product approvals to enable next-generation balloon catheter technologies to be launched in the market sooner. Japan's demographic aging and high incidence of cardiovascular diseases will fuel demand further, while technological advances and robust healthcare infrastructure will provide impetus to market growth

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.3% |

Market Outlook

Balloon Catheters Market in China is by driving the demand for minimally invasive coronary artery disease and peripheral vascular disease treatment. There will be increased investment in drug-coated and specialty balloon catheters, enhancing procedure efficiency and minimizing restenosis risk. Government healthcare reform and increased investments in cardiovascular care will facilitate increased patient access to advanced interventional procedures.

Regulatory agencies will simplify the approval process to facilitate quicker entry into the market for new balloon catheter technology. With increasing demand fueled by the nation's aging population and high rates of cardiovascular disease, hospitals and specialty clinics will utilize balloon catheters more extensively. Domestic producers also will solidify their foothold, further promoting competition and lower-cost solutions addressing China's rising healthcare demands

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.5% |

Market Outlook

India's balloon catheter market is witnessing significant growth due to high adoption across hospitals and catheterization labs as premature CAD increases and non-stent-based treatments become popular. Manufacturers are working towards introducing affordable, high-performance balloon catheters for tier-2 and tier-3 cities.

The CDSCO will speed up approval process and domestic players are making use of "Make in India" initiative to minimize import dependence, driving affordable and accessible interventional therapy.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.4% |

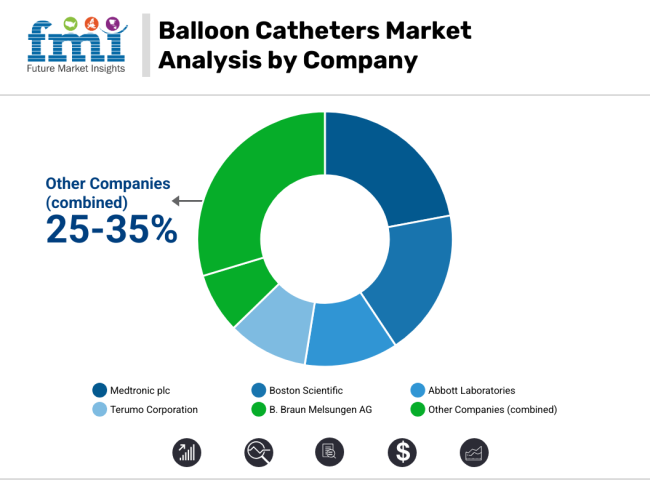

The market for balloon catheter is highly competitive with the thrust from rising demand for minimally invasive interventions, innovative design developments in catheters, and wide use of drug-coated as well as high-pressure balloon catheters.

Market players are pumping investments into emerging materials, greater deliverability, and better patient outcomes to drive competition. Established medical device firms, cardiovascular solution providers, as well as young catheter technology companies, have influenced the ever-changing dynamics of balloon catheter solutions.

Medtronic plc (22-26%)

A dominant player in the balloon catheter market, Medtronic leads with high-performance catheter solutions designed for enhanced clinical outcomes.

Boston Scientific (18-22%)

A leader in interventional cardiology, Boston Scientific integrates cutting-edge technology in balloon catheter systems to optimize treatment efficacy.

Abbott Laboratories (10-14%)

A key innovator in balloon catheter technology, Abbott specializes in drug-coated balloons for improved vascular interventions.

Terumo Corporation (8-12%)

A strong competitor in endovascular treatments, Terumo focuses on high-compliance balloon catheters with superior deliverability.

B. Braun Melsungen AG (5-9%)

A major provider of vascular access solutions, B. Braun enhances patient safety with high-quality balloon catheter products.

Other Key Players (25-35% Combined)

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

These companies focus on expanding the reach of balloon catheter solutions, offering competitive pricing and cutting-edge innovations to meet diverse cardiovascular and endovascular treatment needs.

Table 1: Global Value (US$ million) Forecast by Region, 2017 to 2033

Table 2: Global Volume (Units) Forecast by Region, 2017 to 2033

Table 3: Global Value (US$ million) Forecast by Product, 2017 to 2033

Table 4: Global Volume (Units) Forecast by Product, 2017 to 2033

Table 5: Global Value (US$ million) Forecast by Raw Material, 2017 to 2033

Table 6: Global Volume (Units) Forecast by Raw Material, 2017 to 2033

Table 7: Global Value (US$ million) Forecast by Indication, 2017 to 2033

Table 8: Global Volume (Units) Forecast by Indication, 2017 to 2033

Table 9: Global Value (US$ million) Forecast by End User, 2017 to 2033

Table 10: Global Volume (Units) Forecast by End User, 2017 to 2033

Table 11: North America Value (US$ million) Forecast by Country, 2017 to 2033

Table 12: North America Volume (Units) Forecast by Country, 2017 to 2033

Table 13: North America Value (US$ million) Forecast by Product, 2017 to 2033

Table 14: North America Volume (Units) Forecast by Product, 2017 to 2033

Table 15: North America Value (US$ million) Forecast by Raw Material, 2017 to 2033

Table 16: North America Volume (Units) Forecast by Raw Material, 2017 to 2033

Table 17: North America Value (US$ million) Forecast by Indication, 2017 to 2033

Table 18: North America Volume (Units) Forecast by Indication, 2017 to 2033

Table 19: North America Value (US$ million) Forecast by End User, 2017 to 2033

Table 20: North America Volume (Units) Forecast by End User, 2017 to 2033

Table 21: Latin America Value (US$ million) Forecast by Country, 2017 to 2033

Table 22: Latin America Volume (Units) Forecast by Country, 2017 to 2033

Table 23: Latin America Value (US$ million) Forecast by Product, 2017 to 2033

Table 24: Latin America Volume (Units) Forecast by Product, 2017 to 2033

Table 25: Latin America Value (US$ million) Forecast by Raw Material, 2017 to 2033

Table 26: Latin America Volume (Units) Forecast by Raw Material, 2017 to 2033

Table 27: Latin America Value (US$ million) Forecast by Indication, 2017 to 2033

Table 28: Latin America Volume (Units) Forecast by Indication, 2017 to 2033

Table 29: Latin America Value (US$ million) Forecast by End User, 2017 to 2033

Table 30: Latin America Volume (Units) Forecast by End User, 2017 to 2033

Table 31: Eastern Europe Value (US$ million) Forecast by Country, 2017 to 2033

Table 32: Eastern Europe Volume (Units) Forecast by Country, 2017 to 2033

Table 33: Eastern Europe Value (US$ million) Forecast by Product, 2017 to 2033

Table 34: Eastern Europe Volume (Units) Forecast by Product, 2017 to 2033

Table 35: Eastern Europe Value (US$ million) Forecast by Raw Material, 2017 to 2033

Table 36: Eastern Europe Volume (Units) Forecast by Raw Material, 2017 to 2033

Table 37: Eastern Europe Value (US$ million) Forecast by Indication, 2017 to 2033

Table 38: Eastern Europe Volume (Units) Forecast by Indication, 2017 to 2033

Table 39: Eastern Europe Value (US$ million) Forecast by End User, 2017 to 2033

Table 40: Eastern Europe Volume (Units) Forecast by End User, 2017 to 2033

Table 41: Western Europe Value (US$ million) Forecast by Country, 2017 to 2033

Table 42: Western Europe Volume (Units) Forecast by Country, 2017 to 2033

Table 43: Western Europe Value (US$ million) Forecast by Product, 2017 to 2033

Table 44: Western Europe Volume (Units) Forecast by Product, 2017 to 2033

Table 45: Western Europe Value (US$ million) Forecast by Raw Material, 2017 to 2033

Table 46: Western Europe Volume (Units) Forecast by Raw Material, 2017 to 2033

Table 47: Western Europe Value (US$ million) Forecast by Indication, 2017 to 2033

Table 48: Western Europe Volume (Units) Forecast by Indication, 2017 to 2033

Table 49: Western Europe Value (US$ million) Forecast by End User, 2017 to 2033

Table 50: Western Europe Volume (Units) Forecast by End User, 2017 to 2033

Table 51: APEJ Value (US$ million) Forecast by Country, 2017 to 2033

Table 52: APEJ Volume (Units) Forecast by Country, 2017 to 2033

Table 53: APEJ Value (US$ million) Forecast by Product, 2017 to 2033

Table 54: APEJ Volume (Units) Forecast by Product, 2017 to 2033

Table 55: APEJ Value (US$ million) Forecast by Raw Material, 2017 to 2033

Table 56: APEJ Volume (Units) Forecast by Raw Material, 2017 to 2033

Table 57: APEJ Value (US$ million) Forecast by Indication, 2017 to 2033

Table 58: APEJ Volume (Units) Forecast by Indication, 2017 to 2033

Table 59: APEJ Value (US$ million) Forecast by End User, 2017 to 2033

Table 60: APEJ Volume (Units) Forecast by End User, 2017 to 2033

Table 61: Japan Value (US$ million) Forecast by Country, 2017 to 2033

Table 62: Japan Volume (Units) Forecast by Country, 2017 to 2033

Table 63: Japan Value (US$ million) Forecast by Product, 2017 to 2033

Table 64: Japan Volume (Units) Forecast by Product, 2017 to 2033

Table 65: Japan Value (US$ million) Forecast by Raw Material, 2017 to 2033

Table 66: Japan Volume (Units) Forecast by Raw Material, 2017 to 2033

Table 67: Japan Value (US$ million) Forecast by Indication, 2017 to 2033

Table 68: Japan Volume (Units) Forecast by Indication, 2017 to 2033

Table 69: Japan Value (US$ million) Forecast by End User, 2017 to 2033

Table 70: Japan Volume (Units) Forecast by End User, 2017 to 2033

Table 71: MEA Value (US$ million) Forecast by Country, 2017 to 2033

Table 72: MEA Volume (Units) Forecast by Country, 2017 to 2033

Table 73: MEA Value (US$ million) Forecast by Product, 2017 to 2033

Table 74: MEA Volume (Units) Forecast by Product, 2017 to 2033

Table 75: MEA Value (US$ million) Forecast by Raw Material, 2017 to 2033

Table 76: MEA Volume (Units) Forecast by Raw Material, 2017 to 2033

Table 77: MEA Value (US$ million) Forecast by Indication, 2017 to 2033

Table 78: MEA Volume (Units) Forecast by Indication, 2017 to 2033

Table 79: MEA Value (US$ million) Forecast by End User, 2017 to 2033

Table 80: MEA Volume (Units) Forecast by End User, 2017 to 2033

Figure 1: Global Value (US$ million) by Product, 2023 to 2033

Figure 2: Global Value (US$ million) by Raw Material, 2023 to 2033

Figure 3: Global Value (US$ million) by Indication, 2023 to 2033

Figure 4: Global Value (US$ million) by End User, 2023 to 2033

Figure 5: Global Value (US$ million) by Region, 2023 to 2033

Figure 6: Global Value (US$ million) Analysis by Region, 2017 to 2033

Figure 7: Global Volume (Units) Analysis by Region, 2017 to 2033

Figure 8: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Value (US$ million) Analysis by Product, 2017 to 2033

Figure 11: Global Volume (Units) Analysis by Product, 2017 to 2033

Figure 12: Global Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 13: Global Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 14: Global Value (US$ million) Analysis by Raw Material, 2017 to 2033

Figure 15: Global Volume (Units) Analysis by Raw Material, 2017 to 2033

Figure 16: Global Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 17: Global Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 18: Global Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 19: Global Volume (Units) Analysis by Indication, 2017 to 2033

Figure 20: Global Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 21: Global Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 22: Global Value (US$ million) Analysis by End User, 2017 to 2033

Figure 23: Global Volume (Units) Analysis by End User, 2017 to 2033

Figure 24: Global Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 25: Global Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 26: Global Attractiveness by Product, 2023 to 2033

Figure 27: Global Attractiveness by Raw Material, 2023 to 2033

Figure 28: Global Attractiveness by Indication, 2023 to 2033

Figure 29: Global Attractiveness by End User, 2023 to 2033

Figure 30: Global Attractiveness by Region, 2023 to 2033

Figure 31: North America Value (US$ million) by Product, 2023 to 2033

Figure 32: North America Value (US$ million) by Raw Material, 2023 to 2033

Figure 33: North America Value (US$ million) by Indication, 2023 to 2033

Figure 34: North America Value (US$ million) by End User, 2023 to 2033

Figure 35: North America Value (US$ million) by Country, 2023 to 2033

Figure 36: North America Value (US$ million) Analysis by Country, 2017 to 2033

Figure 37: North America Volume (Units) Analysis by Country, 2017 to 2033

Figure 38: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Value (US$ million) Analysis by Product, 2017 to 2033

Figure 41: North America Volume (Units) Analysis by Product, 2017 to 2033

Figure 42: North America Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 43: North America Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 44: North America Value (US$ million) Analysis by Raw Material, 2017 to 2033

Figure 45: North America Volume (Units) Analysis by Raw Material, 2017 to 2033

Figure 46: North America Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 47: North America Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 48: North America Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 49: North America Volume (Units) Analysis by Indication, 2017 to 2033

Figure 50: North America Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 51: North America Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 52: North America Value (US$ million) Analysis by End User, 2017 to 2033

Figure 53: North America Volume (Units) Analysis by End User, 2017 to 2033

Figure 54: North America Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 55: North America Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 56: North America Attractiveness by Product, 2023 to 2033

Figure 57: North America Attractiveness by Raw Material, 2023 to 2033

Figure 58: North America Attractiveness by Indication, 2023 to 2033

Figure 59: North America Attractiveness by End User, 2023 to 2033

Figure 60: North America Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Value (US$ million) by Product, 2023 to 2033

Figure 62: Latin America Value (US$ million) by Raw Material, 2023 to 2033

Figure 63: Latin America Value (US$ million) by Indication, 2023 to 2033

Figure 64: Latin America Value (US$ million) by End User, 2023 to 2033

Figure 65: Latin America Value (US$ million) by Country, 2023 to 2033

Figure 66: Latin America Value (US$ million) Analysis by Country, 2017 to 2033

Figure 67: Latin America Volume (Units) Analysis by Country, 2017 to 2033

Figure 68: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Value (US$ million) Analysis by Product, 2017 to 2033

Figure 71: Latin America Volume (Units) Analysis by Product, 2017 to 2033

Figure 72: Latin America Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 73: Latin America Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 74: Latin America Value (US$ million) Analysis by Raw Material, 2017 to 2033

Figure 75: Latin America Volume (Units) Analysis by Raw Material, 2017 to 2033

Figure 76: Latin America Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 77: Latin America Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 78: Latin America Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 79: Latin America Volume (Units) Analysis by Indication, 2017 to 2033

Figure 80: Latin America Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 81: Latin America Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 82: Latin America Value (US$ million) Analysis by End User, 2017 to 2033

Figure 83: Latin America Volume (Units) Analysis by End User, 2017 to 2033

Figure 84: Latin America Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 85: Latin America Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 86: Latin America Attractiveness by Product, 2023 to 2033

Figure 87: Latin America Attractiveness by Raw Material, 2023 to 2033

Figure 88: Latin America Attractiveness by Indication, 2023 to 2033

Figure 89: Latin America Attractiveness by End User, 2023 to 2033

Figure 90: Latin America Attractiveness by Country, 2023 to 2033

Figure 91: Eastern Europe Value (US$ million) by Product, 2023 to 2033

Figure 92: Eastern Europe Value (US$ million) by Raw Material, 2023 to 2033

Figure 93: Eastern Europe Value (US$ million) by Indication, 2023 to 2033

Figure 94: Eastern Europe Value (US$ million) by End User, 2023 to 2033

Figure 95: Eastern Europe Value (US$ million) by Country, 2023 to 2033

Figure 96: Eastern Europe Value (US$ million) Analysis by Country, 2017 to 2033

Figure 97: Eastern Europe Volume (Units) Analysis by Country, 2017 to 2033

Figure 98: Eastern Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Eastern Europe Value (US$ million) Analysis by Product, 2017 to 2033

Figure 101: Eastern Europe Volume (Units) Analysis by Product, 2017 to 2033

Figure 102: Eastern Europe Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 103: Eastern Europe Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 104: Eastern Europe Value (US$ million) Analysis by Raw Material, 2017 to 2033

Figure 105: Eastern Europe Volume (Units) Analysis by Raw Material, 2017 to 2033

Figure 106: Eastern Europe Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 107: Eastern Europe Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 108: Eastern Europe Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 109: Eastern Europe Volume (Units) Analysis by Indication, 2017 to 2033

Figure 110: Eastern Europe Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 111: Eastern Europe Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 112: Eastern Europe Value (US$ million) Analysis by End User, 2017 to 2033

Figure 113: Eastern Europe Volume (Units) Analysis by End User, 2017 to 2033

Figure 114: Eastern Europe Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 115: Eastern Europe Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 116: Eastern Europe Attractiveness by Product, 2023 to 2033

Figure 117: Eastern Europe Attractiveness by Raw Material, 2023 to 2033

Figure 118: Eastern Europe Attractiveness by Indication, 2023 to 2033

Figure 119: Eastern Europe Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Attractiveness by Country, 2023 to 2033

Figure 121: Western Europe Value (US$ million) by Product, 2023 to 2033

Figure 122: Western Europe Value (US$ million) by Raw Material, 2023 to 2033

Figure 123: Western Europe Value (US$ million) by Indication, 2023 to 2033

Figure 124: Western Europe Value (US$ million) by End User, 2023 to 2033

Figure 125: Western Europe Value (US$ million) by Country, 2023 to 2033

Figure 126: Western Europe Value (US$ million) Analysis by Country, 2017 to 2033

Figure 127: Western Europe Volume (Units) Analysis by Country, 2017 to 2033

Figure 128: Western Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Western Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Western Europe Value (US$ million) Analysis by Product, 2017 to 2033

Figure 131: Western Europe Volume (Units) Analysis by Product, 2017 to 2033

Figure 132: Western Europe Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 133: Western Europe Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 134: Western Europe Value (US$ million) Analysis by Raw Material, 2017 to 2033

Figure 135: Western Europe Volume (Units) Analysis by Raw Material, 2017 to 2033

Figure 136: Western Europe Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 137: Western Europe Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 138: Western Europe Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 139: Western Europe Volume (Units) Analysis by Indication, 2017 to 2033

Figure 140: Western Europe Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 141: Western Europe Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 142: Western Europe Value (US$ million) Analysis by End User, 2017 to 2033

Figure 143: Western Europe Volume (Units) Analysis by End User, 2017 to 2033

Figure 144: Western Europe Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: Western Europe Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: Western Europe Attractiveness by Product, 2023 to 2033

Figure 147: Western Europe Attractiveness by Raw Material, 2023 to 2033

Figure 148: Western Europe Attractiveness by Indication, 2023 to 2033

Figure 149: Western Europe Attractiveness by End User, 2023 to 2033

Figure 150: Western Europe Attractiveness by Country, 2023 to 2033

Figure 151: APEJ Value (US$ million) by Product, 2023 to 2033

Figure 152: APEJ Value (US$ million) by Raw Material, 2023 to 2033

Figure 153: APEJ Value (US$ million) by Indication, 2023 to 2033

Figure 154: APEJ Value (US$ million) by End User, 2023 to 2033

Figure 155: APEJ Value (US$ million) by Country, 2023 to 2033

Figure 156: APEJ Value (US$ million) Analysis by Country, 2017 to 2033

Figure 157: APEJ Volume (Units) Analysis by Country, 2017 to 2033

Figure 158: APEJ Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: APEJ Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: APEJ Value (US$ million) Analysis by Product, 2017 to 2033

Figure 161: APEJ Volume (Units) Analysis by Product, 2017 to 2033

Figure 162: APEJ Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 163: APEJ Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 164: APEJ Value (US$ million) Analysis by Raw Material, 2017 to 2033

Figure 165: APEJ Volume (Units) Analysis by Raw Material, 2017 to 2033

Figure 166: APEJ Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 167: APEJ Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 168: APEJ Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 169: APEJ Volume (Units) Analysis by Indication, 2017 to 2033

Figure 170: APEJ Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 171: APEJ Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 172: APEJ Value (US$ million) Analysis by End User, 2017 to 2033

Figure 173: APEJ Volume (Units) Analysis by End User, 2017 to 2033

Figure 174: APEJ Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 175: APEJ Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 176: APEJ Attractiveness by Product, 2023 to 2033

Figure 177: APEJ Attractiveness by Raw Material, 2023 to 2033

Figure 178: APEJ Attractiveness by Indication, 2023 to 2033

Figure 179: APEJ Attractiveness by End User, 2023 to 2033

Figure 180: APEJ Attractiveness by Country, 2023 to 2033

Figure 181: Japan Value (US$ million) by Product, 2023 to 2033

Figure 182: Japan Value (US$ million) by Raw Material, 2023 to 2033

Figure 183: Japan Value (US$ million) by Indication, 2023 to 2033

Figure 184: Japan Value (US$ million) by End User, 2023 to 2033

Figure 185: Japan Value (US$ million) by Country, 2023 to 2033

Figure 186: Japan Value (US$ million) Analysis by Country, 2017 to 2033

Figure 187: Japan Volume (Units) Analysis by Country, 2017 to 2033

Figure 188: Japan Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Japan Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Japan Value (US$ million) Analysis by Product, 2017 to 2033

Figure 191: Japan Volume (Units) Analysis by Product, 2017 to 2033

Figure 192: Japan Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 193: Japan Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 194: Japan Value (US$ million) Analysis by Raw Material, 2017 to 2033

Figure 195: Japan Volume (Units) Analysis by Raw Material, 2017 to 2033

Figure 196: Japan Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 197: Japan Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 198: Japan Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 199: Japan Volume (Units) Analysis by Indication, 2017 to 2033

Figure 200: Japan Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 201: Japan Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 202: Japan Value (US$ million) Analysis by End User, 2017 to 2033

Figure 203: Japan Volume (Units) Analysis by End User, 2017 to 2033

Figure 204: Japan Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 205: Japan Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 206: Japan Attractiveness by Product, 2023 to 2033

Figure 207: Japan Attractiveness by Raw Material, 2023 to 2033

Figure 208: Japan Attractiveness by Indication, 2023 to 2033

Figure 209: Japan Attractiveness by End User, 2023 to 2033

Figure 210: Japan Attractiveness by Country, 2023 to 2033

Figure 211: MEA Value (US$ million) by Product, 2023 to 2033

Figure 212: MEA Value (US$ million) by Raw Material, 2023 to 2033

Figure 213: MEA Value (US$ million) by Indication, 2023 to 2033

Figure 214: MEA Value (US$ million) by End User, 2023 to 2033

Figure 215: MEA Value (US$ million) by Country, 2023 to 2033

Figure 216: MEA Value (US$ million) Analysis by Country, 2017 to 2033

Figure 217: MEA Volume (Units) Analysis by Country, 2017 to 2033

Figure 218: MEA Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Value (US$ million) Analysis by Product, 2017 to 2033

Figure 221: MEA Volume (Units) Analysis by Product, 2017 to 2033

Figure 222: MEA Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 223: MEA Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 224: MEA Value (US$ million) Analysis by Raw Material, 2017 to 2033

Figure 225: MEA Volume (Units) Analysis by Raw Material, 2017 to 2033

Figure 226: MEA Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 227: MEA Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 228: MEA Value (US$ million) Analysis by Indication, 2017 to 2033

Figure 229: MEA Volume (Units) Analysis by Indication, 2017 to 2033

Figure 230: MEA Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 231: MEA Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 232: MEA Value (US$ million) Analysis by End User, 2017 to 2033

Figure 233: MEA Volume (Units) Analysis by End User, 2017 to 2033

Figure 234: MEA Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 235: MEA Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 236: MEA Attractiveness by Product, 2023 to 2033

Figure 237: MEA Attractiveness by Raw Material, 2023 to 2033

Figure 238: MEA Attractiveness by Indication, 2023 to 2033

Figure 239: MEA Attractiveness by End User, 2023 to 2033

Figure 240: MEA Attractiveness by Country, 2023 to 2033

The global Balloon Catheters industry is projected to witness CAGR of 3.4% between 2025 and 2035.

The global Balloon Catheters industry stood at USD 4,033.5 million in 2024.

The global Balloon Catheters industry is anticipated to reach USD 6,311.59 million by 2035 end.

China is expected to show a CAGR of 3.8% in the assessment period.

The key players operating in the global Balloon Catheters industry are Medtronic plc,Boston Scientific, Abbott Laboratories, Terumo Corporation, B. Braun Melsungen AG, Cardinal Health, Cook Medical, Merit Medical Systems, Asahi Intecc, and Biotronik.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.