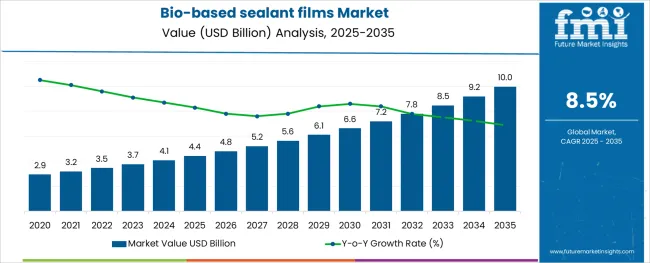

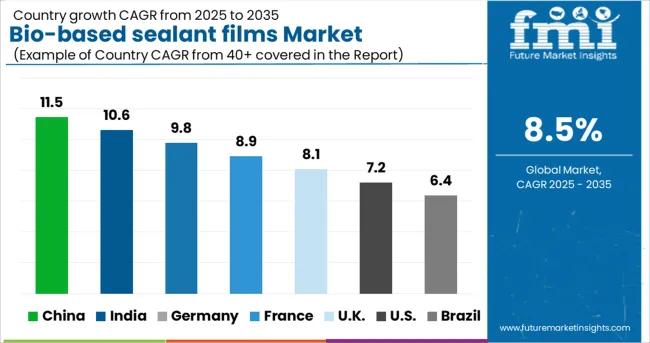

The Bio-based sealant films Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 10.0 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

The bio-based sealant films market is experiencing significant traction due to increasing regulatory pressure to reduce plastic waste, heightened consumer awareness of eco-friendly materials, and brand-led transitions toward sustainable packaging. Innovation in plant-derived polymers, compostable barrier films, and bio-based multilayer laminates has driven functionality improvements in these films without compromising sealing integrity.

Key industry players have ramped up R&D investment to deliver films with optimized sealing temperatures, oxygen barrier performance, and mechanical strength, while maintaining compostability or recyclability credentials. Food safety regulations, extended shelf life requirements, and demand for renewable packaging substrates have further propelled the market.

Regional government mandates promoting circular economy models and banning conventional single use plastics are also providing long-term growth avenues. The market outlook remains favorable as bio-based films gain ground across food, personal care, and pharmaceutical packaging segments, offering a balance between performance and environmental stewardship.

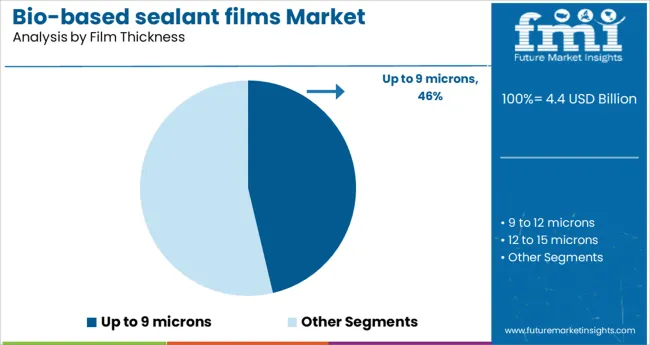

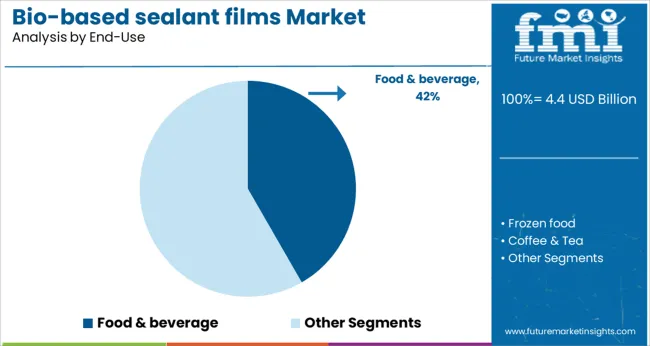

The market is segmented by Film Thickness and End-Use and region. By Film Thickness, the market is divided into Up to 9 microns, 9 to 12 microns, 12 to 15 microns, and Above 15 microns. In terms of End-Use, the market is classified into Food & beverage, Frozen food, Coffee & Tea, Snacks, Cookies & Cereal, Nutrition bars, Confectionary, Other foods, Personal care products, Retail products, Office supplies, and Promotional items. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

It is observed that films with a thickness of up to 9 microns are projected to hold 46.30% of total revenue by 2025, establishing this sub segment as the largest within the film thickness category. The preference for ultra-thin films stems from their ability to deliver adequate sealing properties while reducing material consumption and enhancing source reduction efforts.

These films are particularly favored for lightweight applications where high throughput and minimal environmental impact are priorities. Their compatibility with automated packaging lines and suitability for high speed form-fill-seal operations has further contributed to widespread adoption.

Additionally, lower raw material usage supports cost optimization and aligns with carbon footprint reduction strategies. The strong uptake of these thin films across bio-based applications underscores the industry's shift toward efficient, high-performance, and environmentally responsible packaging solutions.

The food and beverage segment is expected to account for 41.70% of total market revenue in 2025, making it the leading end use application for bio-based sealant films. This growth is largely driven by increasing demand for sustainable food packaging that meets both functional and regulatory standards.

Bio-based sealant films offer key advantages such as excellent seal strength, extended freshness retention, and reduced migration potential, which are critical for food safety and shelf life. The segment has also benefited from growing consumer preference for compostable and recyclable packaging, particularly in organic and premium product lines.

Regulatory frameworks across North America and Europe mandating eco labeled and low-impact packaging solutions have further accelerated adoption. Moreover, the ability to integrate such films into existing packaging equipment without significant modification has made them a commercially viable alternative to petroleum based films, solidifying their dominance in the food and beverage sector.

The major development in the bio-based sealant films market share is the addition of barrier properties to the films such as moisture, odor and oxygen barrier. Aluminum material is generally incorporated for barrier properties as the material is biodegradable and a high barrier material.

On the other hand, the layer of aluminum increases the weight of the packaging therefore a very thin layer is incorporated such that effective barrier is created by the bio-based sealant film. Moreover, to satisfy the requirement of transparent packaging of food products, the transparent bio-based sealant films are manufactured by the companies.

As the transparent packaging is a highly effective way of marketing the product at the point of sale, especially for food products, the introduction of transparent films has driven the bio-based sealant films market.

Also, the bio-based sealant films are food grade films that are non-toxic for direct contact with food products and therefore majorly driven by the food industry.

Bio-plastics are the bio-based plastic materials. According to European Bio-plastics Organization, the global production capacity of PLA resins was around 200 Thousand tons in 2020 and is further expected to expand with the entrance of players in the bio-plastics industry.

The bio-based sealant films market is more precisely analyzed by supply side analysis. In the initial stage, a survey is conducted with sealant film manufacturers in each key country for their production capacity. Total regional sealant film capacity for a region is estimated leading to global sealant films production.

Further, the penetration of bio-based materials in sealant films is assessed and finally arrive to the global bio-based sealant films market volume. At the end, the market numbers are validated with industry experts.

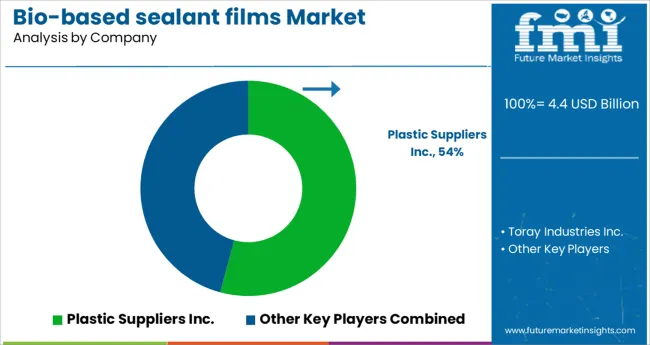

Plastic Suppliers Inc. and Toray Industries Inc. are two of the companies in the packaging industry with worldwide footprint and bio-based sealant films in their product portfolio. Other packaging film manufacturing giants might be capable of producing such films according to the client’s requirement, but Plastic Suppliers Inc. and Toray Industries Inc.

are the only companies with significant production of bio-based sealant films. Also, it takes a lot of capital investment for production of bio-based sealant films and there reducing the probability of the presence of bio-based sealant films among un-organized market packaging film manufacturers.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global bio-based sealant films market is estimated to be valued at USD 4.4 billion in 2025.

It is projected to reach USD 10.0 billion by 2035.

The market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types are up to 9 microns, 9 to 12 microns, 12 to 15 microns and above 15 microns.

food & beverage segment is expected to dominate with a 41.7% industry share in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.