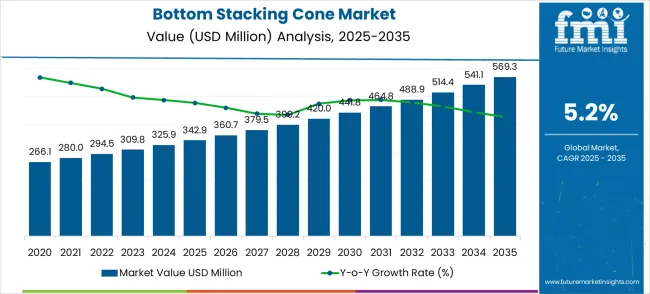

The bottom stacking cone market is valued at USD 342.9 million in 2025 and is anticipated to reach USD 569.3 million by 2035, representing a forecast CAGR of 5.2% over the decade. This growth trajectory indicates a steady upward trend in market demand, driven by increasing automation in packaging, rising adoption of bottom stacking solutions in ice cream and frozen dessert manufacturing, and the need for enhanced storage and logistics efficiency.

The base value, projected value, and CAGR collectively indicate that the market is on a consistent growth trajectory, with no signs of stagnation or decline, reflecting long-term stability and incremental expansion across key applications. The global bottom-stacking cone market is projected to grow from USD 342.9 million in 2025 to approximately USD 569.3 million by 2035, recording an absolute increase of USD 226.4 million over the forecast period.

This translates into a total growth of 66.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.2% between 2025 and 2035. The overall market size is expected to grow by nearly 1.7X during the same period, supported by increasing global shipping volumes, growing container port infrastructure development, and rising adoption of advanced container handling technologies requiring specialized securing equipment for safe container stacking operations.

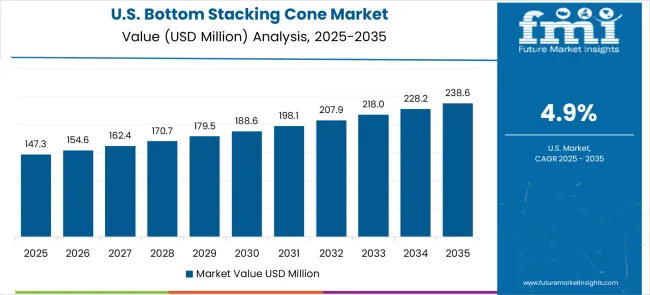

Analyzing year-on-year data, the market rises from USD 342.9 million in 2025 to USD 399.2 million by 2027, contributing nearly 15% of the cumulative growth in the initial three years. Early-stage growth is primarily supported by investments in modern manufacturing lines and the adoption of stacking cone solutions in high-demand regions, particularly North America and Europe. The linear growth in these initial years, with YoY increments averaging USD 18–20 million, demonstrates the importance of gradual market penetration and the steady acceptance of bottom stacking technologies among producers.Between 2025 and 2030, the bottom stacking cone market is projected to expand from USD 342.9 million to USD 441.8 million, resulting in a value increase of USD 98.9 million, which represents 43.7% of the total forecast growth for the decade.

This phase of growth will be shaped by expanding global trade volumes, increasing container port automation, and growing adoption of standardized container securing systems. Marine equipment manufacturers are expanding their bottom stacking cone portfolios to address the growing demand for reliable container securing solutions with enhanced durability and safety characteristics.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 342.9 million |

| Forecast Value in (2035F) | USD 569.3 million |

| Forecast CAGR (2025 to 2035) | 5.2% |

From 2028 onward, the market shows accelerated expansion, reaching USD 514.4 million by 2033 and USD 569.3 million by 2035. This mid-to-late period contributes approximately 60% of the total cumulative growth over the decade, indicating stronger adoption rates driven by innovation in cone materials, packaging sustainability initiatives, and efficiency improvements in supply chain management. Annual growth increments rise to USD 25–28 million, focusing the ratio of contribution to total market value in the latter half of the forecast period. This stage also reflects the increasing importance of regional manufacturing hubs, particularly in Asia Pacific, where rising demand for ice cream products and frozen desserts drives adoption.

Trendline analysis suggests a nearly linear trajectory for the market, with steady annual increases reflecting consistent demand growth. Minor deviations in 2026 and 2031 correspond to supply-side adjustments and fluctuations in raw material availability. The market demonstrates a positive long-term trend, with the combination of CAGR, YoY growth, and linear trendline visualization confirming a robust, sustained expansion pattern supported by operational efficiencies, regional market expansion, and incremental technological adoption.From 2030 to 2035, the market is forecast to grow from USD 441.8 million to USD 569.3 million, adding another USD 127.5 million, which constitutes 56.3% of the overall ten-year expansion. This period is expected to be characterized by widespread deployment of next-generation port automation systems, integration with smart container tracking technologies, and development of advanced material solutions for enhanced marine environment durability. The growing demand for efficient container handling and port productivity optimization will drive adoption of sophisticated bottom stacking cones with improved performance and operational reliability characteristics.

Between 2020 and 2025, the bottom stacking cone market experienced steady growth, driven by increasing containerization of global trade and growing recognition of the importance of proper container securing systems in maritime transportation safety. The market evolved as shipping companies and port operators recognized the critical role of bottom stacking cones in preventing container movement and ensuring cargo safety during transportation and storage. Progress in materials technology and standardization established the foundation for more reliable and durable container securing solutions across various marine and terminal applications.

Market expansion is being supported by the continuous growth of global containerized trade and the corresponding demand for reliable container securing systems that can ensure cargo safety and operational efficiency in marine environments. Modern shipping companies and port operators are increasingly focused on securing equipment that can withstand harsh marine conditions while providing consistent performance and safety reliability. The proven capability of bottom stacking cones to deliver effective container positioning, secure stacking, and operational safety makes them essential components of comprehensive container handling systems.

The growing emphasis focus on port automation and operational efficiency is driving demand for standardized container securing solutions that can support automated handling systems and optimize cargo throughput. Industry preference for securing equipment that can integrate with existing container handling infrastructure while providing enhanced durability and maintenance efficiency is creating opportunities for advanced bottom stacking cone development. The rising influence of international maritime safety regulations and container securing standards is also contributing to increased adoption of certified securing equipment across different shipping and terminal operations.

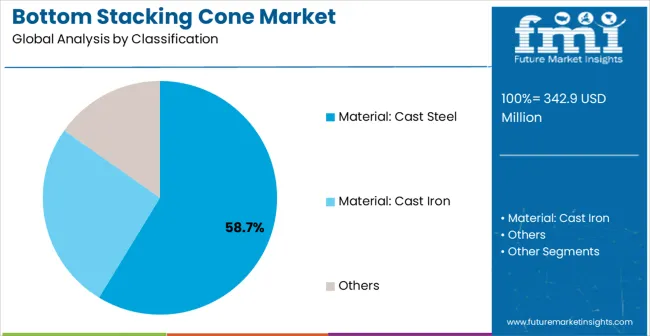

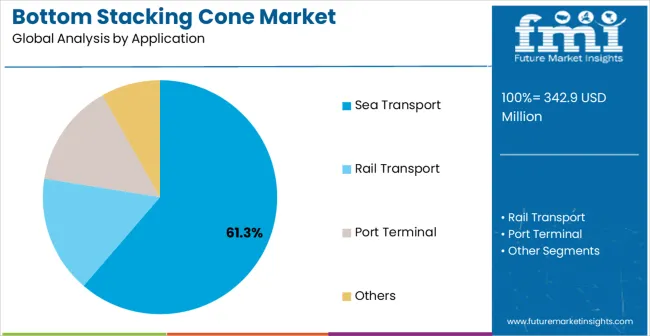

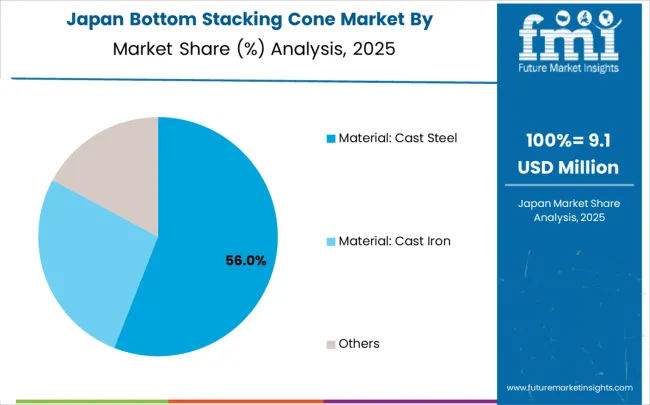

The market is segmented by classification, application, and region. By classification, the market is divided into material: cast steel, material: cast iron, and others. Based on application, the market is categorized into sea transport, rail transport, port terminal, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The material: cast steel classification is projected to account for 58.7% of the bottom stacking cone market in 2025, reaffirming its position as the category's dominant material choice. Marine equipment engineers increasingly recognize the superior strength-to-weight ratio and corrosion resistance properties provided by cast steel construction for demanding marine applications. This classification addresses the most challenging operational requirements while providing essential durability and safety characteristics.

This classification forms the foundation of most commercial shipping and port terminal applications, as it represents the most reliable and performance-oriented approach for container securing equipment. Materials development and manufacturing optimization continue to strengthen confidence in cast steel bottom stacking cone performance. With increasing recognition of the importance of long-term durability and operational reliability, cast steel solutions align with both current performance requirements and maintenance optimization objectives. Their superior mechanical properties across multiple operating conditions ensures sustained market dominance, making them the central growth driver of bottom stacking cone adoption.

Sea transport applications are projected to represent 61.3% of bottom stacking cone demand in 2025, underscoring highlighting their role as the primary application driving market development. Shipping companies recognize that maritime container transportation requires the most reliable and durable securing equipment to ensure cargo safety during ocean voyages and harsh weather conditions. Sea transport applications demand exceptional corrosion resistance and mechanical strength that bottom stacking cones are uniquely positioned to deliver.

The segment is supported by the continuous expansion of global containerized shipping requiring comprehensive securing systems and the increasing adoption of larger container vessels with enhanced stacking capacity requirements. Additionally The , maritime transportation is increasingly implementing standardized securing protocols that can optimize both cargo safety and operational efficiency. As understanding of maritime container securing requirements advances, sea transport applications will continue to serve as the primary commercial driver, reinforcing their essential position within the marine equipment market.

The bottom stacking cone market is advancing steadily due to increasing global containerized trade and growing emphasis focus on maritime safety standards. However T, the market faces challenges including fluctuating steel prices, competition from alternative securing methods, and varying international standards across different regions. Innovation in materials technology and design optimization continue to influence product development and market expansion patterns.

The growing implementation of automated port systems is creating enhanced opportunities for standardized bottom stacking cone integration with robotic container handling equipment. Advanced automated terminals require precise positioning equipment that can interface with automated crane systems and container handling robots. Smart terminal technologies provide opportunities for integrated securing systems that can optimize both operational efficiency and cargo safety.

Modern marine equipment companies are incorporating specialized alloy compositions, advanced coating systems, and corrosion-resistant treatments to enhance bottom stacking cone performance and service life in marine environments. These technologies improve saltwater resistance, enable extended maintenance intervals, and provide enhanced durability throughout extended service periods. Advanced material integration also enables optimized weight characteristics and improved handling efficiency.

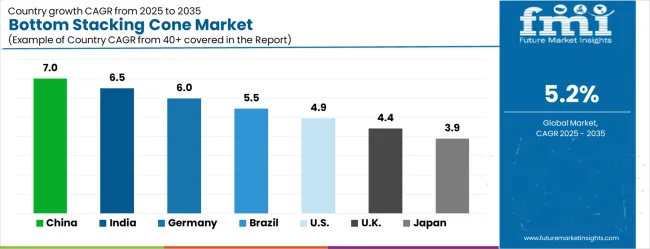

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| Brazil | 5.5% |

| USA | 4.9% |

| UK | 4.4% |

| Japan | 3.9% |

The global market is projected to grow at a CAGR of 5.2% between 2025 and 2035, driven by increasing demand in industrial packaging and efficient material handling solutions. China leads with 7.0% growth, supported by expanding manufacturing sectors and adoption of advanced packaging technologies. India follows at 6.5%, reflecting rising industrial production and growing need for optimized storage and transportation solutions. Germany records 6.0%, driven by demand for high-quality industrial components and precision-engineered packaging systems. Brazil is projected at 5.5%, supported by gradual industrial expansion and modernization of manufacturing processes. The United States grows at 4.9% with steady demand for durable and efficient stacking solutions, while the United Kingdom expands at 4.4% and Japan at 3.9%, reflecting moderate adoption and consistent use in industrial applications.The bottom stacking cone market is experiencing solid growth globally, with China leading at a 7.0% CAGR through 2035, driven by massive port infrastructure expansion, growing container throughput volumes, and government support for maritime industry development. India follows at 6.5%, supported by expanding port modernization programs, increasing container trade volumes, and growing investment in maritime infrastructure. Germany shows growth at 6.0%, emphasizing precision marine engineering and comprehensive port technology solutions. Brazil records 5.5% growth, focusing on expanding port capacity and growing containerized trade. The USA shows 4.9% growth, representing steady demand from established maritime operations and port infrastructure.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

China is projected to grow at a CAGR of 7.0% from 2025 to 2035, driven by the rising demand for bulk packaging solutions in food, confectionery, and frozen dessert sectors. The bottom stacking cone design is increasingly preferred for its space-efficient storage, reduced transport costs, and convenience in retail displays. Domestic manufacturers are adopting advanced injection molding and thermoforming technologies to improve production speed and cone durability. Growth is supported by expanding ice cream, snack, and bakery industries, along with increasing penetration of modern retail formats. Collaborations with international packaging solution providers enhance material quality and design innovation. The market is further strengthened by government support for manufacturing infrastructure and growing adoption of automated production systems in confectionery factories.

India is projected to grow at a CAGR of 6.5% from 2025–2035, fueled by demand from ice cream parlors, bakery chains, and street food vendors. Bottom stacking cones are preferred for efficient storage, reduced breakage during transport, and streamlined serving in high-volume outlets. Manufacturers are investing in cost-effective production methods and lightweight materials to improve supply chain efficiency. Expansion is further supported by increasing organized retail penetration and growth of frozen dessert consumption in metro and tier-2 cities. Collaborations between domestic suppliers and global packaging technology firms facilitate innovation in design and material properties. Consumer preference for hygienic and stackable cones continues to drive market adoption.

Germany is expected to grow at a CAGR of 6.0% from 2025–2035, supported by demand from premium confectionery and ice cream manufacturers. Bottom stacking cones are favored for uniformity, efficient transport, and optimized storage in automated production facilities. Domestic producers emphasize recyclable materials, quality compliance with EU packaging standards, and innovative designs for food safety. Growth is strengthened by rising demand in retail and specialty dessert outlets. Adoption is also encouraged by manufacturers integrating high-speed stacking and packaging automation to reduce operational costs and improve productivity. Collaboration with research institutions enables development of lightweight, eco-friendly cones suitable for mass production.

Brazil is projected to grow at a CAGR of 5.5% from 2025–2035, driven by adoption in ice cream parlors, retail dessert chains, and bakery outlets. Bottom stacking cones are favored for space-efficient storage, transport resilience, and hygienic handling in high-volume consumption environments. Local manufacturers focus on cost-effective materials and durability, while collaborations with international packaging technology firms improve quality standards. Adoption is accelerated by increasing urban consumption of frozen desserts and the expansion of organized retail networks. Government support for small and medium enterprises in food packaging strengthens market penetration. Consumer preference for stackable and reusable cones contributes to growth in retail and commercial channels.

The United States market is projected to grow at a CAGR of 4.9% during 2025–2035, driven by high demand in ice cream parlors, frozen dessert chains, and bakeries. Bottom stacking cones are preferred for storage efficiency, uniform shape, and reduced breakage during handling and transport. Domestic manufacturers focus on lightweight and food-safe materials compatible with high-volume automated production lines. Growth is further supported by expansion of retail chains, ice cream trucks, and specialty dessert outlets. Adoption is encouraged by innovations such as flavored and biodegradable cones, as well as collaborations with foodservice companies to improve packaging efficiency.

The United Kingdom is expected to grow at a CAGR of 4.4% during 2025–2035, driven by adoption in ice cream parlors, bakeries, and dessert chains. Bottom stacking cones are preferred for hygienic handling, efficient storage, and ease of transport in high-volume operations. Manufacturers focus on eco-friendly materials and lightweight designs suitable for automated production. Growth is strengthened by increasing retail consumption of frozen desserts, expansion of premium dessert outlets, and government regulations promoting food safety. Collaborative innovation between local manufacturers and international packaging technology providers enhances design features and material performance.

Japan is projected to grow at a CAGR of 3.9% from 2025–2035, reflecting steady demand in ice cream parlors, bakeries, and dessert outlets. Bottom stacking cones are valued for space-efficient storage, hygienic handling, and reduced breakage in high-volume operations. Manufacturers focus on quality control, lightweight materials, and stackable designs suitable for automated packaging lines. Market growth is further supported by adoption in convenience stores, retail dessert chains, and specialty cafes. Collaborations with international suppliers ensure high-quality raw materials and innovative designs, enhancing product performance and shelf appeal. Consumer preference for stackable and visually appealing cones contributes to steady market growth.

Revenue from bottom stacking cones in China is projected to exhibit solid growth with a CAGR of 7.0% through 2035, driven by unprecedented port infrastructure expansion and comprehensive government support for maritime industry development and container handling capacity enhancement. The country's dominant position in global shipping and massive port development projects are creating substantial opportunities for container securing equipment adoption. Major domestic and international marine equipment companies are establishing comprehensive manufacturing and supply capabilities to serve the rapidly expanding maritime market.

Government initiatives supporting maritime industry development and substantial investment in port infrastructure are driving steady adoption of container securing equipment throughout major coastal ports and shipping facilities.

Port expansion projects and container throughput growth are supporting increased deployment of bottom stacking cone systems among leading port operators and shipping companies nationwide.

Revenue from bottom stacking cones in India is expanding at a CAGR of 6.5%, supported by comprehensive port modernization programs, increasing container trade volumes, and growing investment in maritime infrastructure development. The country's strategic coastal position and commitment to trade facilitation are driving demand for advanced container handling equipment. International marine equipment companies and domestic manufacturers are establishing partnerships to serve the growing demand for port and shipping technologies.

Rising investment in port modernization and maritime infrastructure development are creating significant opportunities for container securing equipment across major ports and shipping operations.

Growing government support for maritime industry development and trade facilitation is supporting increased adoption of standardized container securing systems among port operators and shipping companies.

Revenue from bottom stacking cones in Germany is projected to grow at a CAGR of 6.0%, supported by the country's leadership in marine engineering and comprehensive expertise in port technology solutions. German port operators and marine equipment companies consistently invest in advanced container handling technologies and maritime safety systems. The market is characterized by engineering excellence, comprehensive quality standards, and established relationships between equipment suppliers and maritime operators.

Marine engineering leadership and port technology excellence are supporting continued investment in advanced container securing equipment throughout leading ports and shipping companies.

Research institution collaboration and engineering excellence are facilitating advancement of marine equipment applications while ensuring superior performance and safety characteristics.

Revenue from bottom stacking cones in Brazil is projected to grow at a CAGR of 5.5% through 2035, driven by expanding port capacity, increasing containerized trade volumes, and growing focus on maritime infrastructure modernization. Brazilian port operators are increasingly recognizing the importance of reliable container securing equipment in achieving operational efficiency and cargo safety.

Port capacity expansion and maritime trade growth are supporting increased deployment of container securing systems across diverse port applications and shipping operations.

Growing collaboration between international marine equipment companies and local port operators is enhancing technology adoption and supporting development of domestic maritime capabilities.

Revenue from bottom stacking cones in the USA is projected to grow at a CAGR of 4.9%, supported by established maritime infrastructure, comprehensive port operations, and continued investment in container handling efficiency. American port operators and shipping companies maintain consistent adoption of standardized container securing equipment through established operational protocols and safety requirements.

Maritime industry maturity and port operational excellence are driving continued utilization of container securing equipment throughout leading ports and shipping operations.

Safety regulation compliance and industry standards are supporting steady demand for bottom stacking cones while maintaining performance and safety standards.

Revenue from bottom stacking cones in the UK is projected to grow at a CAGR of 4.4% through 2035, supported by established maritime industry and comprehensive port operational frameworks. British port operators emphasize reliable container securing equipment within established operational frameworks that prioritize safety and efficiency.

Maritime industry expertise and port operational standards are supporting consistent adoption of container securing systems across established port facilities and shipping operations.

Industry best practices and safety compliance requirements are maintaining established demand patterns while supporting continued utilization of certified securing equipment.

Revenue from bottom stacking cones in Japan is projected to grow at a CAGR of 3.9% through 2035, supported by the country's leadership in precision marine engineering and comprehensive approach to port technology solutions. Japanese port operators and marine equipment companies emphasize quality-driven adoption of container securing equipment within established frameworks that prioritize technical excellence and operational reliability.

Advanced marine engineering capabilities and precision manufacturing expertise are supporting continued utilization of high-quality container securing equipment across leading ports and maritime operations.

Industry collaboration and comprehensive safety standards are maintaining excellence in marine equipment applications while supporting established operational relationships and technical expertise.

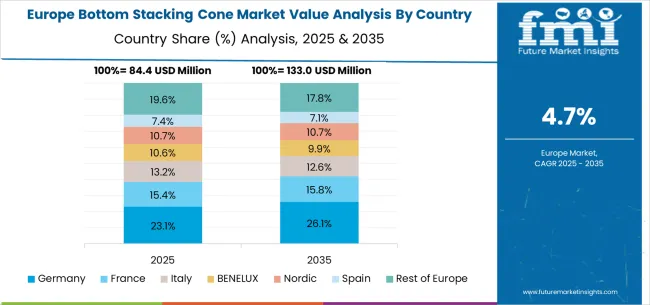

The bottom stacking cone market in Europe is projected to expand steadily through 2035, supported by established maritime industries, comprehensive port operations, and ongoing modernization of container handling infrastructure. Germany will continue to lead the regional market, accounting for 28.6% in 2025 and rising to 29.3% by 2035, supported by strong marine engineering capabilities, advanced port infrastructure, and comprehensive maritime technology expertise. The United Kingdom follows with 19.7% in 2025, maintaining 19.8% by 2035, driven by established maritime industry, comprehensive port operations, and consistent demand patterns.

France holds 16.8% in 2025, edging up to 17.1% by 2035 as port operators expand container handling capabilities and demand grows for reliable securing equipment. Italy contributes 12.4% in 2025, remaining stable at 12.6% by 2035, supported by maritime industry strength and growing adoption of standardized securing systems. Spain represents 9.1% in 2025, moving upward to 9.3% by 2035, underpinned by expanding port operations and increasing container trade volumes.

Nordic countries together account for 8.7% in 2025, maintaining their position at 8.8% by 2035, supported by advanced maritime initiatives and consistent demand from established shipping operations. The Rest of Europe represents 4.7% in 2025, declining slightly to 3.1% by 2035, as larger markets capture greater focus and established maritime infrastructure advantages.

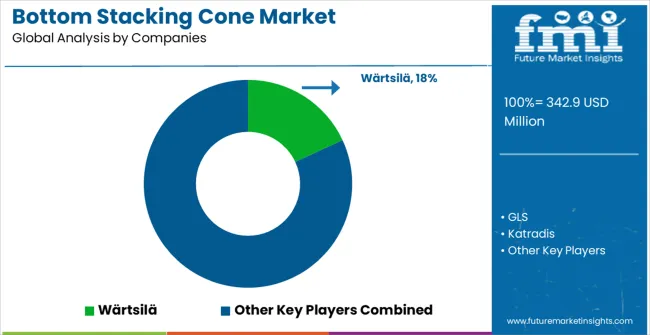

The market is competitive, driven by precision engineering, material durability, and operational reliability for bulk cargo and container handling. Wärtsilä and GLS lead with advanced manufacturing capabilities, robust material construction, and global distribution networks. Their competitive edge lies in high-load capacity cones, corrosion resistance, and compliance with international maritime standards, positioning them as preferred suppliers for large shipping lines and port operators. Product brochures emphasize load ratings, stack compatibility, and ease of installation, catering to both container terminals and heavy industrial users.

Katradis, Container Technics, and Hi-sea Marine compete by offering cost-efficient solutions with modular designs, faster production cycles, and tailored configurations for regional ports and shipping companies. Katradis focuses on high-precision stacking alignment and durability, while Container Technics emphasizes rapid deployment and minimal maintenance requirements. SEC Bremen, Jinbo Marine, and ILS differentiate through specialized alloys, anti-corrosion coatings, and enhanced structural stability for challenging marine environments.

DAWSON, LIG Marine Machinery, Deyuan Marine, and Weitong Marine strengthen their position by serving niche markets with customized cone sizes, lightweight options, and flexible delivery timelines. Brochures highlight tensile strength, compatibility with multiple container types, and operational safety under heavy loads. The competitive landscape is defined by engineering precision, material performance, and adherence to international maritime regulations. Leading manufacturers invest in R&D for higher load capacities, improved coatings, and ergonomic designs, while regional players focus on affordability and responsive client service, maintaining their relevance in the bottom stacking cone market.The bottom stacking cone market is characterized by competition among specialized marine equipment companies, established maritime technology providers, and innovative container handling solution manufacturers. Companies are investing in advanced materials development, design optimization, strategic partnerships, and manufacturing excellence to deliver high-performance, reliable, and cost-effective bottom stacking cone solutions. Technology development, quality assurance, and customer service strategies are central to strengthening competitive advantages and market presence.

Wärtsilä leads the market with significant expertise in marine technology solutions, offering comprehensive bottom stacking cone products with focus on durability optimization and maritime applications. GLS provides established marine equipment capabilities with emphasis on container handling systems and port infrastructure solutions. Katradis focuses on specialized marine hardware with comprehensive rope and rigging expertise. Container Technics delivers advanced container handling technologies with strong focus on port and terminal applications.

Hi-sea Marine operates with focus on marine equipment manufacturing and comprehensive maritime solutions. SEC specializes in marine engineering and equipment supply with emphasis on port applications. Bremen Jinbo Marine provides comprehensive marine equipment solutions with focus on container handling systems. ILS, DAWSON, LIG Marine Machinery, Deyuan Marine, and Weitong Marine provide diverse manufacturing approaches and regional market access strategies to enhance overall market development and maritime equipment availability.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 342.9 mMillion |

| Classification | Material: Cast Steel, Material: Cast Iron, Others |

| Application | Sea Transport, Rail Transport, Port Terminal, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | Wärtsilä, GLS, Katradis, Container Technics, Hi-sea Marine, SEC, Bremen Jinbo Marine, ILS, DAWSON, LIG Marine Machinery, Deyuan Marine, Weitong Marine |

| Additional Attributes | Dollar sales by material type and application, regional adoption trends, competitive landscape, maritime industry partnerships, integration with container handling systems, innovations in materials and design, durability analysis, and operational safety optimization strategies |

The global bottom stacking cone market is estimated to be valued at USD 342.9 million in 2025.

The market size for the bottom stacking cone market is projected to reach USD 569.3 million by 2035.

The bottom stacking cone market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in bottom stacking cone market are material: cast steel, material: cast iron and others.

In terms of application, sea transport segment to command 61.3% share in the bottom stacking cone market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA