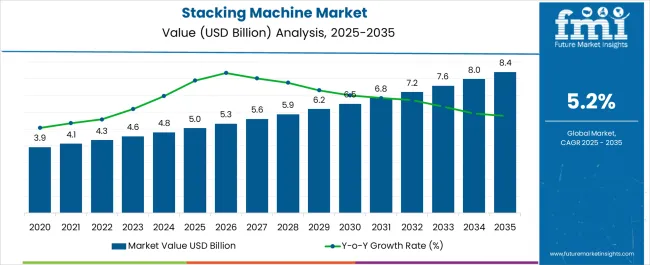

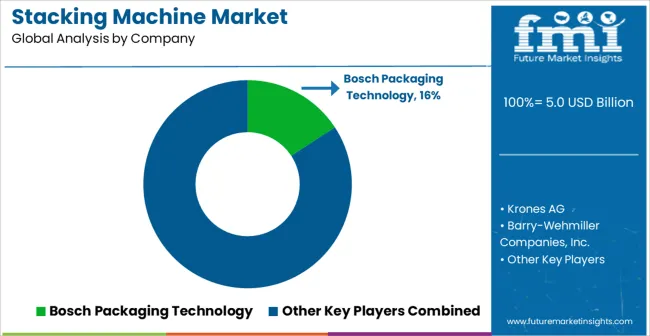

The Stacking Machine Market is estimated to be valued at USD 5.0 billion in 2025 and is projected to reach USD 8.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Stacking Machine Market Estimated Value in (2025 E) | USD 5.0 billion |

| Stacking Machine Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The Stacking Machine market is experiencing robust growth, driven by the increasing demand for automation and efficiency in packaging and production processes across multiple industries. Rising adoption of automated solutions is being fueled by the need to enhance throughput, reduce labor costs, and maintain consistent product quality. Technological advancements in machine design, robotics integration, and control systems are enabling higher precision, faster operation, and adaptability across various packaging formats.

The market is further supported by the growing emphasis on lean manufacturing, operational efficiency, and sustainable production practices. Food and beverage, pharmaceutical, and consumer goods sectors are increasingly investing in automated stacking machines to streamline end-to-end processes and improve productivity.

Continuous innovation in capacity, speed, and flexibility allows manufacturers to meet evolving production requirements and reduce downtime As industries continue to prioritize cost-effectiveness, productivity, and quality assurance, the Stacking Machine market is expected to sustain growth, driven by technological integration, increasing automation adoption, and expansion of industrial infrastructure globally.

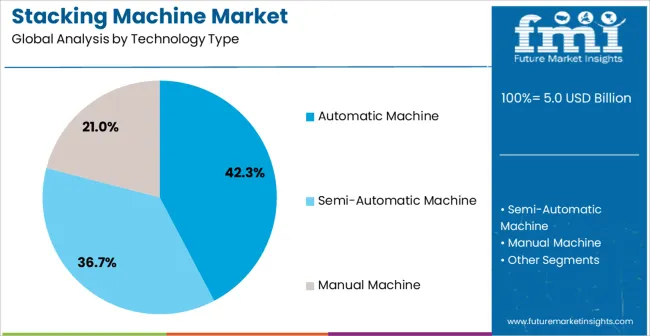

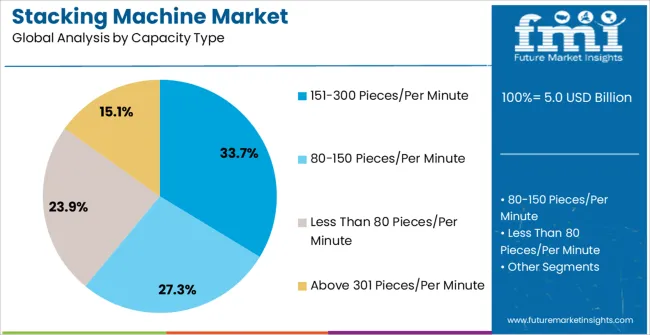

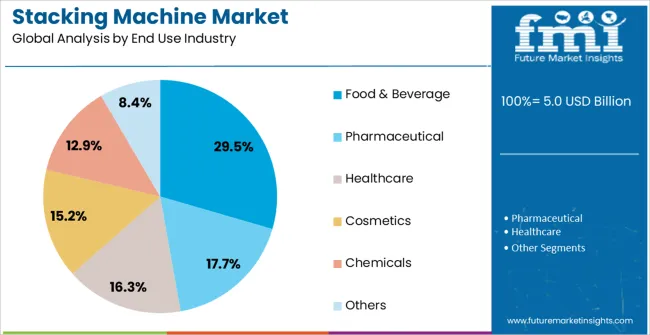

The stacking machine market is segmented by technology type, capacity type, end use industry, and geographic regions. By technology type, stacking machine market is divided into Automatic Machine, Semi-Automatic Machine, and Manual Machine. In terms of capacity type, stacking machine market is classified into 151-300 Pieces/Per Minute, 80-150 Pieces/Per Minute, Less Than 80 Pieces/Per Minute, and Above 301 Pieces/Per Minute. Based on end use industry, stacking machine market is segmented into Food & Beverage, Pharmaceutical, Healthcare, Cosmetics, Chemicals, and Others. Regionally, the stacking machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic machine segment is projected to hold 42.3% of the market revenue in 2025, establishing it as the leading technology type. Growth in this segment is being driven by the rising need for fully automated stacking operations that improve speed, accuracy, and consistency while reducing human error and labor dependency. Automatic machines allow for seamless integration into existing production lines, enabling high-throughput stacking and real-time monitoring of operations.

Advanced sensors, robotics, and control systems enhance precision, reliability, and operational efficiency, supporting industries with large-scale packaging requirements. The ability to handle varied product types and packaging formats without extensive reconfiguration further strengthens adoption.

Manufacturers are increasingly prioritizing automatic machines due to their scalability, ease of maintenance, and potential for cost savings over manual or semi-automatic systems As production demands increase across sectors like food and beverage, pharmaceuticals, and consumer goods, the automatic machine segment is expected to maintain its leading position, driven by efficiency, adaptability, and technological innovation.

The 151-300 pieces per minute capacity segment is expected to account for 33.7% of the market revenue in 2025, making it the leading capacity category. Its growth is being driven by the increasing need for high-speed stacking solutions in medium to large-scale production environments, where efficiency and throughput are critical. This capacity range offers an optimal balance between speed, accuracy, and operational reliability, making it suitable for industries with variable production volumes and packaging formats.

The ability to maintain consistent performance at moderate-to-high speeds reduces production bottlenecks and minimizes downtime. Integration with automated production lines and advanced control systems allows real-time monitoring and seamless workflow management.

Growing adoption in sectors such as food and beverage, consumer goods, and pharmaceuticals is further enhancing market demand As manufacturers continue to optimize production efficiency, reduce labor dependency, and meet growing output requirements, the 151-300 pieces per minute capacity segment is expected to remain the dominant category, supported by operational versatility and reliable performance.

The food and beverage segment is projected to hold 29.5% of the market revenue in 2025, establishing it as the leading end-use industry. Its growth is being driven by the rising demand for packaged and processed foods, beverages, and ready-to-consume products, which require efficient stacking and packaging solutions. Automation in stacking operations enables high throughput while maintaining product integrity and hygiene, which is critical in the food and beverage sector.

The ability to handle diverse product sizes, shapes, and packaging formats without manual intervention enhances operational efficiency and reduces labor costs. Increasing investments in smart manufacturing, automation technologies, and quality control systems further support adoption in this sector.

Regulatory compliance related to food safety, hygiene, and packaging standards is also promoting the use of reliable stacking machines As the global demand for processed and packaged food continues to rise, the food and beverage segment is expected to maintain its leadership, driven by operational efficiency, consistency, and the need to meet high production volumes with minimal errors.

The worldwide stacking machine industry is being stimulated by a rise in infrastructure investments internationally

The domain of stacking machines continues to broaden as companies opt for cutting-edge technology and specialist problem solvers to recognize and enhance stacking practices. The rising manufacturing of pharmaceutical drugs is catapulting the packaging stacking machine industry forward.

Material-handling machines are structured with varying lifting capacities for material handling in the construction, work sites, and maintenance implementations. Furthermore, advanced stacking machines have ultrasonic waves, which have aided in the greatest frequency production capacity by expanding the stacking machine pace.

According to our research, one well segment that demonstrates significant improvement in the packaging machinery supply chain is palletizing. During the projected timeframe, the market for stacking machines is estimated to provide a remunerative growth opportunity for packaging machinery automakers. Furthermore, stacking machines' lower costs when compared to other conventional material handling equipment increase their notoriety among end-users.

Organizations must also overcome several challenges in order to adopt market growth, such as inappropriate handling of materials of a stacking machine, which can pose a risk to an employee who works in the packaging sector. Furthermore, increased regulatory pressure from North American provincial legislatures on the use of packaging machinery is causing a backlash against stacking machine manufacturers.

Stacking machine demand is increasing as a consequence of high economic development in Asia-Pacific countries such as China, India, Japan, Malaysia, and Australia, as these countries are predicted to augment sales growth owing to an increase in residential construction. Furthermore, the construction market in China, India, and other Southeast Asian countries is constantly expanding, due to a significant amount of ongoing projects for infrastructure development.

Packaging machinery consists of filling, labelling, cleaning, FFS, cartooning, wrapping, palletizing which altogether consist of approximately US$ 45 Bn. The global packaging machinery is expected to witness a CAGR of 5.4 percent during the forecast period. One such segment which is showcasing a promising growth in packaging machinery market is palletizing.

Subsequently stacking machine of products is tricky and requires gentle processing to keep the product safe while creating a systematized means of production, which is a part of palletizing process. Manufacturers of global stacking machine opt for innovative technology equipment and expert problem solving specialist to identify and improve stacking practice.

The growing production of pharmaceutical drugs is driving the development of packaging stacking machine market. Also, modern stacking machine have ultrasonic sensors which has aided to increasing the output production capacity by fastening the speed of stacking machine. Overall the countries of Germany, Italy, and China are expected to represent a high demand for stacking machine market during the forecast period.

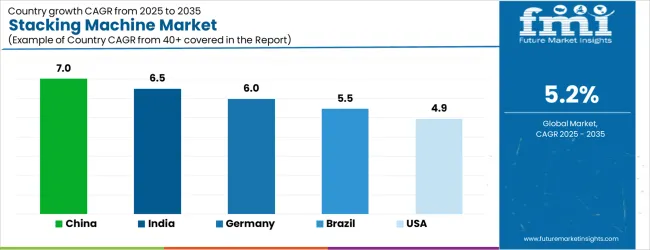

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| Brazil | 5.5% |

| USA | 4.9% |

| UK | 4.4% |

| Japan | 3.9% |

The Stacking Machine Market is expected to register a CAGR of 5.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.0%, followed by India at 6.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.9%, yet still underscores a broadly positive trajectory for the global Stacking Machine Market.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.0%. The USA Stacking Machine Market is estimated to be valued at USD 1.9 billion in 2025 and is anticipated to reach a valuation of USD 1.9 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 266.6 million and USD 130.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.0 Billion |

| Technology Type | Automatic Machine, Semi-Automatic Machine, and Manual Machine |

| Capacity Type | 151-300 Pieces/Per Minute, 80-150 Pieces/Per Minute, Less Than 80 Pieces/Per Minute, and Above 301 Pieces/Per Minute |

| End Use Industry | Food & Beverage, Pharmaceutical, Healthcare, Cosmetics, Chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch Packaging Technology, Krones AG, Barry-Wehmiller Companies, Inc., IMA Group, Coesia S.p.A., GEA Group, ProMach, Inc., Fuji Machinery Co., Ltd., Multivac Group, Syntegon Technology GmbH, and Tetra Pak International S.A. |

The global stacking machine market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the stacking machine market is projected to reach USD 8.4 billion by 2035.

The stacking machine market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in stacking machine market are automatic machine, semi-automatic machine and manual machine.

In terms of capacity type, 151-300 pieces/per minute segment to command 33.7% share in the stacking machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Container Stacking Machine Market by Automation & System Type Through 2035

Market Leaders & Share in the Container Stacking Machine Industry

Enveloping & Stacking Machine Market Size and Share Forecast Outlook 2025 to 2035

Bottom Stacking Cone Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA