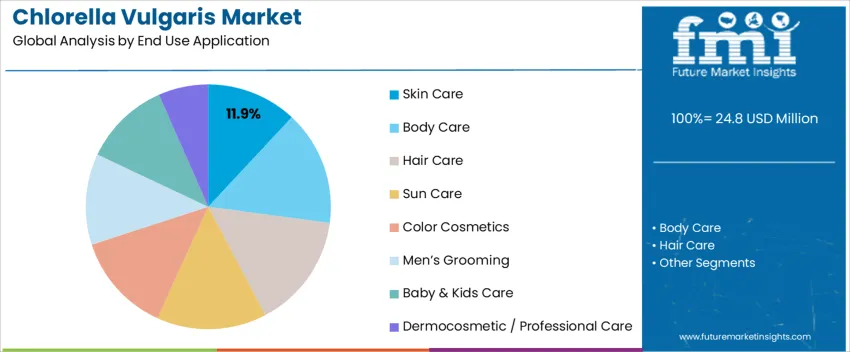

In 2025, the chlorella vulgaris market is valued at USD 24.8 million and is expected to reach USD 63.2 million by 2035 at a CAGR of 9.8%. Early expansion is driven by steady uptake across dietary supplements, functional beverages, and personal care formulations, with natural protein and chlorophyll content guiding product positioning. Powder accounts for the largest share of production due to its ease of standardization, blending, and encapsulation in nutraceutical manufacturing. Cosmetics demand is anchored in skin care at 11.9% share, supported by use in masks, creams, and cleansing products. Food and beverage brands focus on detox, immunity, and plant nutrition labeling. Supply availability depends on controlled algae cultivation systems, where consistency of biomass quality governs large-scale procurement decisions.

From 2030 onward, market growth reflects diversification across product formats and depth of end use rather than simple volume expansion. Market value rises from about USD 39.6 million in 2030 toward USD 63.2 million by 2035 as liquid solutions, emulsions, and high-active concentrates gain wider use in dermocosmetic and professional care formulations. Hair care, sun care, and baby care segments contribute incremental demand through antioxidant and conditioning applications. Key suppliers include BASF SE, Croda International, Evonik Industries, Symrise, Dow, Ashland, Clariant, and Seppic, as well as regional formulators. Competitive positioning focuses on cultivating yield stability, cell wall disruption efficiency, pigment retention, and controlled heavy metal limits. Long-term value growth remains tied to formulation performance, regulatory acceptance, and cost-managed photobioreactor scale-up.

The global Chlorella vulgaris market grows from USD 24.8 million in 2025 to USD 36.1 million by 2030, generating an absolute expansion of USD 11.3 million in the first half of the forecast period. This phase is shaped by rising integration of chlorella into dietary supplements, functional beverages, and powdered nutrition formats positioned around detox support, protein intake, and micronutrient density. Growth is also supported by expanding use in sports nutrition and medical nutrition where algal proteins and chlorophyll content are valued for recovery and metabolic support. During this phase, demand is driven mainly by ingredient standardization, capsule and powder production scaling, and private-label expansion across health-focused retail channels.

From 2030 to 2035, the market advances from USD 36.1 million to USD 63.2 million, adding a larger USD 27.1 million in the second half of the decade. This back-weighted acceleration reflects stronger penetration of chlorella into fortified foods, personalized nutrition programs, and export-oriented nutraceutical manufacturing. Demand also deepens across pharmaceutical-grade formulations and functional animal nutrition platforms where algal bioactives support immune and gut health positioning. As large-scale photobioreactor production expands and purity benchmarks improve, Chlorella vulgaris shifts from a specialty supplement ingredient into a structurally integrated bio-nutrition input, driving sustained global value growth through 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 24.8 million |

| Forecast Value (2035) | USD 63.2 million |

| Forecast CAGR (2025 to 2035) | 9.8% |

The Chlorella vulgaris market developed from its early positioning as a nutrient dense microalgae used in dietary supplements and health foods. Initial adoption was driven by interest in natural protein sources, chlorophyll content, and micronutrient density within wellness focused consumer groups. As production technologies improved, chlorella moved from niche health stores into broader supplement, functional food, and beverage formulations. Its powdered and tablet forms gained steady acceptance due to ease of dosing and long shelf life. Food and feed manufacturers also began using chlorella as a natural colorant, protein enhancer, and nutritional fortifier, which expanded its commercial relevance beyond consumer supplements into industrial ingredient supply chains.

Future growth of the Chlorella vulgaris market will be shaped by rising demand for plant based nutrition, alternative protein sources, and functional ingredients for both human and animal consumption. As sustainability concerns influence protein sourcing, chlorella offers a high yield biomass option with limited land requirement. Expansion is expected in sports nutrition, medical nutrition, aquaculture feed, and pet nutrition segments. Barriers include high production and drying costs, strong taste and odor that limit formulation flexibility, and the need for strict contamination control during cultivation. Regulatory scrutiny around health claims and quality consistency will continue to influence how aggressively chlorella expands across food, nutrition, and feed markets.

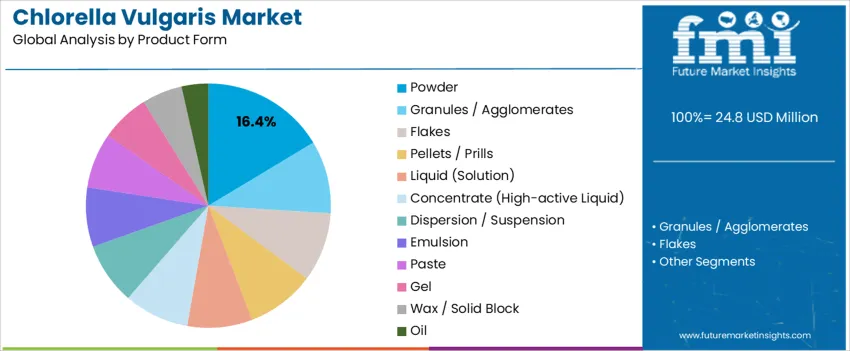

The demand for Chlorella vulgaris is structured by end use application and product form. Skin care accounts for 11.9% of total demand, followed by body care, hair care, sun care, color cosmetics, men grooming, baby and kids care, and dermocosmetic and professional care. By product form, powder represents 16.4% of total consumption, followed by granules and agglomerates, flakes, pellets and prills, liquid solutions, high active concentrates, dispersions and suspensions, emulsions, pastes, gels, wax or solid blocks, and oils. Demand behavior is shaped by bioactive retention, formulation stability, moisture sensitivity, shelf life performance, and compatibility with cosmetic manufacturing processes.

Skin care accounts for 11.9% of total Chlorella vulgaris demand due to its functional role in antioxidant protection, detoxification support, and cellular repair positioning. Chlorella contains chlorophyll, peptides, vitamins, and trace minerals that support skin conditioning and protection from oxidative stress. These properties support its use in facial serums, creams, anti aging formulations, cleansing products, and hydrating masks where pollution defense and skin renewal are core formulation goals.

Skin care formulations favor chlorella due to its water dispersibility and compatibility with both emulsified and gel based systems. Its green pigment also supports natural appearance positioning in botanical cosmetic lines. Controlled extraction methods help stabilize active components for consistent performance across production batches. These formulation reliability, ingredient functionality, and consumer acceptance factors sustain skin care as the leading end use segment within Chlorella vulgaris demand.

Skin care manufacturing also requires predictable ingredient sourcing and standardized bioactive content. Chlorella offers relatively stable cultivation output under controlled production conditions. This consistency supports long term formulation planning and large scale production schedules. These supply reliability and performance consistency factors further reinforce skin care leadership.

Powder accounts for 16.4% of total Chlorella vulgaris demand due to its superior storage stability, transport efficiency, and formulation dosing precision. Powdered chlorella integrates efficiently into dry blending, tablet compression, capsule filling, and cosmetic premix systems where moisture control is required. Low water activity reduces microbial growth risk and supports extended shelf life under ambient storage conditions.

Powder form also enables consistent dispersion across creams, gels, and water based cosmetic formulations when properly hydrated during processing. It supports accurate bioactive standardization across production batches. Packaging options such as lined fiber drums and barrier protected bags preserve pigment stability and nutrient integrity during shipping and warehousing. These stability, logistics efficiency, and formulation control advantages position powder as the leading product form within Chlorella vulgaris demand.

Powdered chlorella also supports centralized ingredient distribution and contract manufacturing supply chains. Reduced volume compared with liquid formats improves freight utilization. These handling efficiency and cost control factors further strengthen the position of powder in the overall product form structure.

Global demand for chlorella vulgaris is shaped by its dense intracellular nutrient profile rather than its identity as a green food. It is valued for concentrated chlorophyll, nucleic acids, and complete amino acid content that support cellular metabolism rather than surface-level wellness appeal. Users consume it in compressed tablet and powder form as a daily micronutrient delivery system. This positioning aligns chlorella with internal detox metabolism, oxygen transport support, and mitochondrial function. Demand is anchored in physiological efficiency and nutrient density per gram, not in culinary versatility or flavor integration.

Chlorella vulgaris production depends on sealed photobioreactors and fermentation tanks that isolate growth from open environmental contamination. This controlled cultivation allows year-round output independent of seasonal ocean or weather volatility. Light spectrum control, nutrient feed precision, and CO₂ injection regulate growth velocity and biochemical composition. These systems require high capital investment and continuous energy input, which shapes supply economics. Output expands through reactor scaling rather than land acquisition. This industrial biology model sets chlorella apart from coastal aquaculture or field-grown algae and makes scalability a function of engineering capacity.

Chlorella vulgaris adoption faces biological constraints tied to cell wall rigidity and individual digestive sensitivity. The tough cellulose-like wall requires mechanical cracking for nutrient absorption. Inadequate processing reduces bioavailability and increases gastrointestinal discomfort. Some users experience detox-related reactions such as nausea and fatigue, which affects long-term adherence. Heavy metal accumulation risk also requires strict water and nutrient purity control during growth. These physiological and processing sensitivities restrict mass casual consumption and keep chlorella positioned within disciplined supplement routines rather than everyday food incorporation.

Future demand for chlorella vulgaris is shifting toward performance recovery, immune system priming, and closed-loop life-support nutrition research. Athletes apply it for oxidative stress management and red blood cell support. Immune-focused formulations integrate chlorella for macrophage activation and detox enzyme stimulation. Space nutrition programs study chlorella for oxygen generation and complete nutrient recycling in closed environments. These high-specification use cases move demand away from general wellness branding and toward biofunctional system design in extreme performance and survival contexts.

| Country | CAGR (%) |

|---|---|

| India | 13.2% |

| China | 12.2% |

| Japan | 11.3% |

| UK | 10.3% |

| Germany | 9.3% |

| USA | 8.3% |

The Chlorella vulgaris industry is recording strong global expansion, led by India at a 13.2% CAGR. Growth in India is supported by rising demand for algae based dietary supplements, functional foods, and plant derived protein sources. China follows at 12.2%, driven by large scale microalgae cultivation, expanding nutraceutical manufacturing, and export oriented supply chains. Japan at 11.3% reflects steady consumption of chlorella in health supplements, beverages, and specialty nutrition products rooted in long standing microalgae usage. The UK and Germany, at 10.3% and 9.3%, show consistent growth linked to rising adoption of natural supplements, plant based diets, and clean label nutrition. The USA, at 8.3%, reflects a mature but steadily expanding market supported by sports nutrition, wellness supplements, and functional ingredient demand.

Expansion in India is progressing at a CAGR of 13.2% through 2035 for Chlorella vulgaris demand, driven by fast growth in dietary supplements, plant based protein nutrition, and detox positioned wellness products. Urban consumers adopt chlorella powders and tablets for immunity support and micronutrient intake. Functional beverage brands integrate chlorella into green blends and nutrition shots. Imports dominate supply due to limited local algae cultivation. Demand remains formulation led and trend supported, shaped by rising health awareness, expanding gym culture, and strong growth in online wellness retail distribution.

Growth in China reflects a CAGR of 12.2% through 2035 for Chlorella vulgaris utilization, supported by large scale algae farming, pharmaceutical excipient use, and functional food manufacturing. Chlorella is processed into tablets, protein powders, animal nutrition additives, and cosmetic ingredients. Domestic photobioreactor capacity ensures cost efficiency and volume reliability. Export oriented facilities supply global nutraceutical brands. Demand remains production driven and volume oriented, aligned with industrial fermentation output, controlled raw material pricing, and steady expansion of algae based ingredients across food, feed, and personal care manufacturing sectors.

Demand in Japan is increasing at a CAGR of 11.3% through 2035 for Chlorella vulgaris usage, sustained by long standing supplement consumption habits, medical nutrition integration, and preventive healthcare focus. Chlorella is used widely in tablets, drinks, and clinical recovery nutrition. Elderly care nutrition programs also apply chlorella for micronutrient support. Domestic producers operate controlled cultivation facilities. Demand stays consumption driven and medically anchored, supported by aging population nutrition needs, pharmacy led distribution, and consistent clinical endorsement across hospitals and wellness clinics.

Growth in the UK is advancing at a CAGR of 10.3% through 2035 for Chlorella vulgaris demand, supported by plant based diet growth, detox nutrition trends, and premium supplement retail. Chlorella is used in green powders, immune blends, and vegan protein mixes. Health influencers and sports nutrition brands support consumer awareness. Imports dominate supply due to limited domestic algae production. Demand remains retail driven and lifestyle oriented, shaped by rising vegan adoption, steady gym membership growth, and strong online supplement sales across urban consumer markets.

Growth in Germany reflects a CAGR of 9.3% through 2035 for Chlorella vulgaris consumption, driven by organic supplement manufacturing, regulated functional foods, and pharmacy grade wellness products. Chlorella is applied in detox capsules, immune support blends, and micronutrient formulations. Strict ingredient certification and labeling rules guide sourcing. Imports remain the primary raw material channel. Demand stays quality focused and regulation aligned, supported by preventive healthcare traditions, controlled dosage supplementation, and steady penetration of algae based nutrition across mainstream pharmacy and organic retail channels.

Expansion in the United States is moving at a CAGR of 8.3% through 2035 for Chlorella vulgaris demand, supported by functional beverage development, sports nutrition integration, and immune support supplement consumption. Chlorella appears in superfood powders, detox drinks, and protein blends. Coastal wellness markets lead adoption, with steady expansion into mass market retail. Imports supply most raw material. Demand remains innovation driven and application diverse, shaped by green nutrition trends, steady wellness brand activity, and broader acceptance of algae based superfoods across mainstream consumer channels.

Global demand for Chlorella vulgaris is rising as consumers and manufacturers increasingly prioritise natural, nutrient-dense, plant-based nutrition and wellness solutions. Chlorella is rich in protein, vitamins, minerals, antioxidants and essential fatty acids. Its wide nutritional profile makes it attractive for dietary supplements, functional foods, beverages, and fortified products. Growing awareness of digestive health, immune support and preventive nutrition supports its adoption. Shifts toward vegetarianism, veganism and plant-based diets in many markets further propel interest in microalgae as a sustainable protein and micronutrient source. Increasing demand for clean-label, natural-ingredient and eco-friendly products benefits Chlorella-based formulations.

Key global firms influencing the Chlorella vulgaris market include BASF SE, Croda International, Evonik Industries, Symrise (including IFF/Givaudan actives), Dow Inc., Ashland, Clariant and smaller ingredient specialists such as Seppic, Lubrizol, Lonza and Inolex. Large ingredient-producers like BASF and Evonik supply bulk algal biomass, extracts or flours. Formulation-oriented suppliers such as Croda, Symrise, Ashland and Clariant adapt Chlorella for use in supplements, functional foods, beverages and personal-care applications. Niche biotech firms supply high-purity or custom extracts for value-added or specialty products. Together they support supply-chain scale, quality standardisation, regulatory compliance and diversified application across global food, nutraceutical and wellness industries.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| End-Use Applications | Skin Care, Body Care, Hair Care, Sun Care, Color Cosmetics, Men’s Grooming, Baby & Kids Care, Dermocosmetic / Professional Care |

| Product Forms | Powder, Granules/Agglomerates, Flakes, Pellets/Prills, Liquid (Solution), Concentrate (High-active Liquid), Dispersion/Suspension, Emulsion, Paste, Gel, Wax / Solid Block, Oil |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, USA, Canada, Mexico, Brazil, Chile, Saudi Arabia, Turkey, South Africa, plus 40+ additional countries globally |

| Key Companies Profiled | BASF SE, Croda International, Evonik Industries, Symrise (incl. IFF/Givaudan actives), Dow Inc., Ashland, Clariant, Seppic, Lubrizol, Lonza, Inolex |

| Additional Attributes | Dollar by sales breakdown by region, country, end-use, and product form; global growth projections; multi-sector adoption (cosmetic, nutraceutical, functional food); extract bioactivity profiling; iodine and polyphenol standardization; contract harvesting; vertical integration; supply chain stability; regulatory compliance; sensory and bioavailability performance |

The global chlorella vulgaris market is estimated to be valued at USD 24.8 million in 2025.

The market size for the chlorella vulgaris market is projected to reach USD 63.2 million by 2035.

The chlorella vulgaris market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in chlorella vulgaris market are skin care, body care, hair care, sun care, color cosmetics, men’s grooming, baby & kids care and dermocosmetic / professional care.

In terms of product form , powder segment to command 16.4% share in the chlorella vulgaris market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chlorella Market Size and Share Forecast Outlook 2025 to 2035

Chlorella Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Chlorella Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA