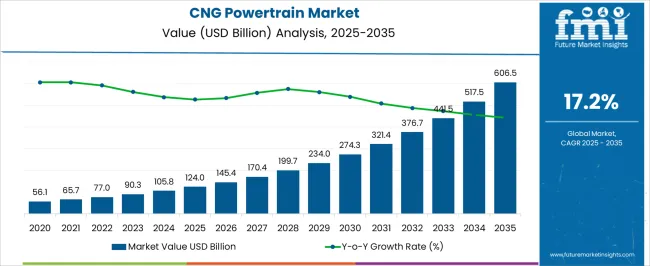

The CNG Powertrain Market is estimated to be valued at USD 124.0 billion in 2025 and is projected to reach USD 606.5 billion by 2035, registering a compound annual growth rate (CAGR) of 17.2% over the forecast period. During the early adoption phase (2020–2024), the market expanded from USD 56.1 billion to USD 105.8 billion as automotive manufacturers and fleet operators explored compressed natural gas (CNG) as a cleaner alternative to conventional fuels. Early adoption was driven by regulatory pressures to reduce emissions, rising fuel costs, and incentives for sustainable transportation.

Pilot programs focused on technical feasibility, vehicle performance, and refueling infrastructure, while cost and limited adoption slowed large-scale deployment. From 2025 to 2030, the market enters a scaling phase, with revenues increasing from USD 124.0 billion to approximately USD 274.3 billion. Accelerated adoption was supported by broader infrastructure development, declining costs of CNG powertrain components, and growing government policies favoring alternative fuels.

Commercial and public transportation fleets are increasingly integrating CNG-powered vehicles, driving volume growth. Between 2030 and 2035, the market transitions into consolidation, reaching USD 606.5 billion by 2035. Leading manufacturers strengthened market positions through strategic partnerships, technological standardization, and optimized supply chains.

Growth stabilized, with incremental innovations focused on efficiency, emission reduction, and durability. The market matured into a competitive, technologically advanced, and sustainable segment of the automotive industry, moving from early adoption to scaling and finally to a fully consolidated phase.

| Metric | Value |

|---|---|

| CNG Powertrain Market Estimated Value in (2025 E) | USD 124.0 billion |

| CNG Powertrain Market Forecast Value in (2035 F) | USD 606.5 billion |

| Forecast CAGR (2025 to 2035) | 17.2% |

The CNG powertrain market is witnessing sustained momentum as global regulatory bodies tighten emissions norms and promote clean mobility alternatives. Surging fuel cost volatility and efforts to reduce dependence on petroleum-based fuels have contributed to greater CNG adoption across multiple automotive segments.

Government incentives, infrastructure investment in CNG refueling stations, and fleet transition strategies by commercial operators have further accelerated the market. OEMs are increasingly integrating advanced CNG engine technologies with electronic control units to improve efficiency, extend range, and reduce emissions.

The demand for retrofitting solutions and dual-fuel configurations is also on the rise. Innovation in CNG injection systems and rising consumer awareness regarding cost-efficiency and environmental benefits are expected to support long-term growth across passenger and commercial vehicle segments.

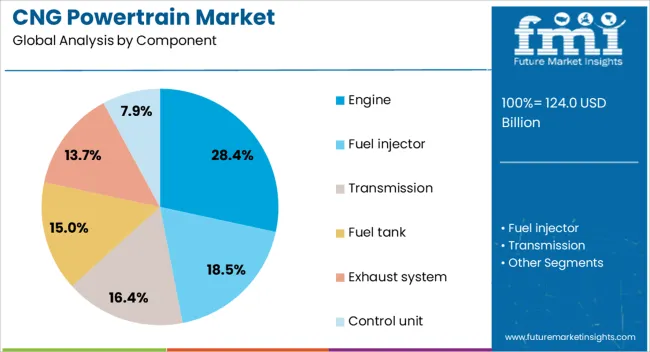

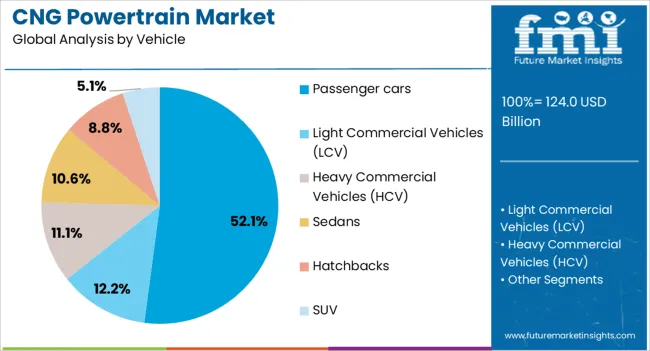

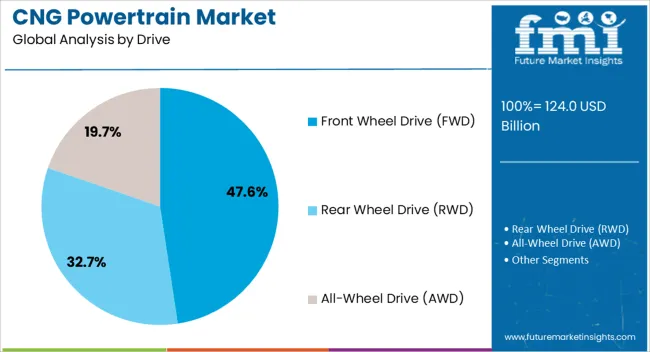

The CNG powertrain market is segmented by component, vehicle, drive, fuel, application, and geographic regions. By component, the CNG powertrain market is divided into Engine, Fuel injector, Transmission, Fuel tank, Exhaust system, and Control unit. In terms of the vehicle, the CNG powertrain market is classified into Passenger cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Sedans, Hatchbacks, and SUVs. Based on drive of the CNG powertrain market is segmented into Front Wheel Drive (FWD), Rear Wheel Drive (RWD), and All-Wheel Drive (AWD).

By fuel of the CNG powertrain market is segmented into Bi-fuel and Mono-fuel. By application of the CNG powertrain market is segmented into Transportation, Logistics, and Industrial. Regionally, the CNG powertrain industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Engine systems are projected to account for 28.40% of the total revenue share in the CNG powertrain market by 2025, establishing them as the most critical component segment. This leadership is being driven by continued advancements in combustion efficiency, cylinder configuration, and spark-ignition systems tailored for compressed natural gas fuel.

Engine optimization has become a key focus area for automakers seeking to enhance power delivery, torque output, and fuel economy under varied load conditions. The growing demand for factory-fitted CNG variants and integrated turbocharged solutions has further increased reliance on specialized engine assemblies.

Additionally, reduced carbon emissions and favorable lifecycle cost metrics have strengthened the preference for CNG-optimized power units in both passenger and commercial vehicle production lines.

Passenger cars are anticipated to hold 52.10% of the CNG powertrain market revenue in 2025, making them the dominant vehicle segment. This segment’s growth has been supported by increasing consumer demand for affordable clean mobility options, especially in urban regions facing high fuel costs and pollution control regulations.

National and regional authorities have introduced purchase incentives, registration benefits, and lower operating taxes for CNG-powered passenger vehicles, accelerating adoption. OEMs are expanding their factory-installed CNG offerings across hatchback, sedan, and compact SUV categories.

Enhanced mileage performance, extended engine life, and reduced environmental impact have resonated with environmentally conscious consumers, further anchoring this segment’s growth trajectory.

Front Wheel Drive (FWD) configurations are expected to contribute 47.60% of the overall market share in 2025, positioning them as the leading drivetrain segment in the CNG powertrain space. Their dominance is being reinforced by their compatibility with compact and mid-sized vehicles, which constitute a significant portion of the CNG vehicle fleet.

FWD systems provide better fuel efficiency and packaging flexibility, allowing for optimized under-hood space for CNG cylinders and fuel lines. Reduced mechanical complexity and lower production costs have made FWD the preferred layout among OEMs developing affordable eco-friendly vehicle options.

As urban mobility shifts toward compact and energy-efficient vehicles, the demand for CNG-powered FWD platforms is expected to remain elevated.

The CNG powertrain market is expanding as transportation and logistics sectors seek cleaner alternatives to conventional diesel and petrol engines. Compressed Natural Gas (CNG) systems reduce emissions, provide cost-effective fuel solutions, and meet increasingly stringent environmental regulations. Rising demand for commercial vehicles, buses, and light-duty trucks with lower operating costs is driving adoption. Manufacturers focus on engine efficiency, durability, and fuel storage innovations, supporting broader deployment of CNG-powered vehicles in urban and long-haul applications globally.

CNG powertrains significantly lower carbon dioxide, nitrogen oxide, and particulate emissions compared to traditional fuels. This environmental benefit appeals to public transport authorities, fleet operators, and logistics companies aiming to comply with emission standards. Reduced pollutants contribute to cleaner urban air and lower overall environmental impact. Vehicles powered by CNG engines also face fewer restrictions in low-emission zones, making them an attractive option for municipal fleets. Adoption increases as governments promote cleaner fuel initiatives and provide incentives for low-emission vehicles, encouraging fleet transitions to CNG-powered solutions.

CNG offers lower fuel costs compared to diesel or gasoline, reducing overall fleet operating expenses. Stable natural gas prices allow operators to plan budgets with predictable fuel expenditures. Powertrains optimized for CNG achieve efficient fuel consumption while maintaining engine performance under heavy load conditions. Maintenance costs are also reduced due to cleaner combustion and reduced engine wear. Cost advantages appeal to commercial operators in buses, taxis, and last-mile delivery vehicles, supporting wider market penetration and encouraging manufacturers to expand CNG-compatible vehicle offerings.

Wider adoption of CNG powertrains depends on the availability of fueling infrastructure. Expansion of refueling stations along highways, urban centers, and fleet depots is crucial to ensure operational continuity. Governments and private players are investing in station networks, pipelines, and storage solutions to enhance accessibility. Improved infrastructure reduces range anxiety and operational interruptions, increasing confidence among fleet operators and consumers. As refueling networks grow, the CNG powertrain market experiences accelerated adoption across both commercial and passenger vehicle segments.

CNG engines require specialized designs to handle high-pressure gas safely while maintaining performance comparable to conventional powertrains. Innovations in cylinder materials, fuel injectors, and pressure regulation enhance power output and durability. Storage solutions, including lightweight composite cylinders, improve vehicle payload capacity and safety. Manufacturers focusing on optimizing engine performance and storage efficiency meet the needs of commercial operators who require high reliability and extended operational range. Efficient and robust CNG powertrain systems strengthen market confidence and support adoption in various transport applications globally.

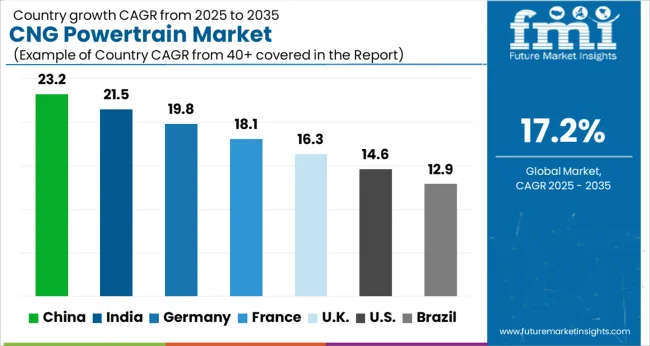

The global CNG powertrain market is projected to grow at a CAGR of 17.2%, driven by increasing adoption of alternative fuel vehicles and demand for cleaner transportation solutions. China leads the market with a growth rate of 23.2%, supported by government initiatives and expansion in commercial vehicle fleets. India follows at 21.5%, fueled by rising focus on reducing vehicular emissions and expanding public transport networks.

Germany shows steady growth at 19.8%, leveraging its automotive manufacturing expertise and transition toward cleaner fuel options. The UK and USA record moderate growth rates of 16.3% and 14.6%, respectively, reflecting growing adoption in commercial and fleet vehicles. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the CNG powertrain market with a 23.2% growth rate, driven by strict emission norms and government incentives for clean fuel vehicles. Urban air pollution concerns push adoption in commercial and public transport fleets. Automotive manufacturers invest heavily in research and development of efficient CNG engines. Infrastructure expansion, including CNG refueling stations, supports widespread adoption.

Cost savings compared to conventional fuels attract logistics and fleet operators. Technological advancements improve engine performance, fuel efficiency, and durability. Rising demand for eco-friendly vehicles in urban centers further fuels growth. Strategic partnerships between manufacturers and energy suppliers enhance market penetration. Export opportunities for CNG vehicles to neighboring countries create additional revenue streams.

CNG powertrain market in India grows at 21.5%, fueled by rising urban pollution and government policies favoring natural gas vehicles. Auto manufacturers focus on developing cost-effective CNG engines for passenger and commercial vehicles. Expansion of CNG refueling infrastructure supports market penetration. Fleet operators adopt CNG vehicles to reduce operational costs and emissions.

Consumer awareness about sustainable transport encourages adoption. Collaboration between OEMs and gas suppliers ensures reliable fuel availability. Technological advancements enhance engine performance, fuel efficiency, and emissions control. Government incentives, including subsidies and tax benefits, further accelerate adoption. Urban centers witness higher demand due to stricter emission standards.

Germany shows a 19.8% growth rate, driven by strong environmental regulations and the country’s focus on sustainable transport. Compared to the UK, Germany emphasizes performance, safety, and efficiency in CNG engines. Government incentives, including subsidies and tax benefits, encourage adoption in commercial and passenger vehicles. Automotive manufacturers invest in R&D for durable, high-performance CNG engines. Infrastructure development, including refueling networks, supports market expansion. Rising consumer awareness about emission reduction and eco-friendly vehicles boosts demand. Export of CNG vehicles to other European markets further enhances growth. Technological innovations improve engine efficiency and emission control systems. Fleet operators increasingly adopt CNG vehicles to meet environmental standards.

The UK market grows at 16.3%, driven by government policies encouraging low-emission vehicles. Compared to the USA, the UK emphasizes efficiency, reliability, and sustainability in CNG engines. Fleet operators in urban areas adopt CNG vehicles to reduce emissions and operational costs. Expansion of CNG refueling stations supports adoption.

Automotive manufacturers invest in R&D to improve engine performance and fuel economy. Consumer awareness regarding sustainable transportation encourages market growth. Government incentives, including subsidies and tax benefits, further accelerate adoption. Collaboration between OEMs and energy suppliers ensures reliable fuel supply.

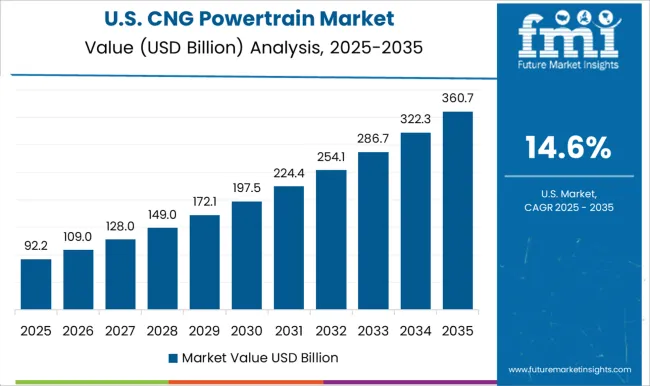

The USA market grows at 14.6%, driven by rising adoption in commercial and municipal fleets seeking cost savings and emission reductions. Compared to China, the USA focuses on durable and high-performance CNG powertrains for heavy-duty vehicles. Infrastructure development, including refueling stations, supports expansion.

Government incentives, tax benefits, and environmental regulations encourage adoption. OEMs invest in R&D to improve fuel efficiency and engine durability. Technological innovations reduce emissions and optimize performance. Urban centers and fleet operators increasingly switch to CNG vehicles. Collaboration between energy providers and automotive manufacturers ensures fuel reliability.

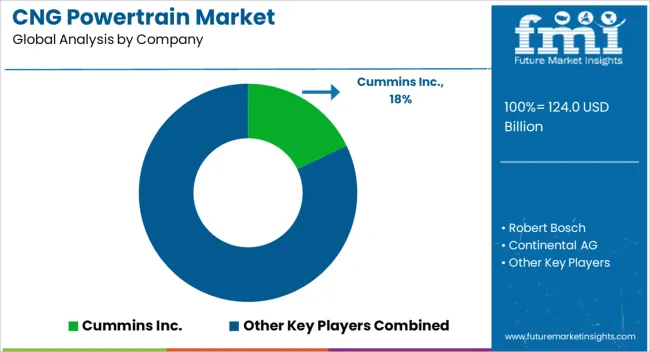

The competitive dynamics of the CNG powertrain market are increasingly defined by strategic positioning within a tightening regulatory and cost-sensitive mobility landscape. OEMs have reframed CNG powertrains from an alternative to a compliance-critical solution, embedding them into urban fleet bids where diesel phaseouts are imminent. Competition has shifted away from vehicle models alone toward lifecycle economics, with predictable cost per kilometer, guaranteed servicing, and performance warranties used as primary levers to win contracts from municipalities and logistics firms. The ability to lock operators into bundled service and fuel arrangements is emerging as a decisive advantage.

Tier-one suppliers are transforming the component tier into the true competitive battleground. Innovations in lightweight composite cylinders and high-pressure injection systems are directly influencing range and durability metrics, while telematics-enabled ECUs have repositioned the fuel system as a connected, data-governed asset. Ownership of intellectual property in lightweight storage and dual-fuel calibration is strengthening supplier leverage in negotiations, as procurement increasingly prioritizes uptime analytics over engine specifications. Regional dynamics further fragment the ecosystem. In India, adoption is catalyzed by subsidies, yet competitive control often rests with those able to bind vehicle procurement with fuel distribution rights. In Latin America, dominance lies with retrofit providers, where competitive edge is determined by rapid navigation of safety certifications across fragmented jurisdictions. Europe, constrained by uneven CNG corridor infrastructure, has seen OEMs forced into co-investment partnerships with energy utilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 124.0 Billion |

| Component | Engine, Fuel injector, Transmission, Fuel tank, Exhaust system, and Control unit |

| Vehicle | Passenger cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Sedans, Hatchbacks, and SUV |

| Drive | Front Wheel Drive (FWD), Rear Wheel Drive (RWD), and All-Wheel Drive (AWD) |

| Fuel | Bi-fuel and Mono-fuel |

| Application | Transportation, Logistics, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cummins Inc., Robert Bosch, Continental AG, Ford Motor Company, General Motors Company, Honda Motor Company, Stellantis, Tata Motors Limited, Volkswagen AG, and Volvo Group |

| Additional Attributes | Dollar sales by type including spark-ignition engines, dual-fuel engines, and fully CNG engines, application across commercial vehicles, passenger vehicles, and buses, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing adoption of cleaner fuels, government incentives for natural gas vehicles, and rising environmental regulations. |

The global CNG powertrain market is estimated to be valued at USD 124.0 billion in 2025.

The market size for the CNG powertrain market is projected to reach USD 606.5 billion by 2035.

The CNG powertrain market is expected to grow at a 17.2% CAGR between 2025 and 2035.

The key product types in CNG powertrain market are engine, fuel injector, transmission, fuel tank, exhaust system and control unit.

In terms of vehicle, passenger cars segment to command 52.1% share in the CNG powertrain market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA