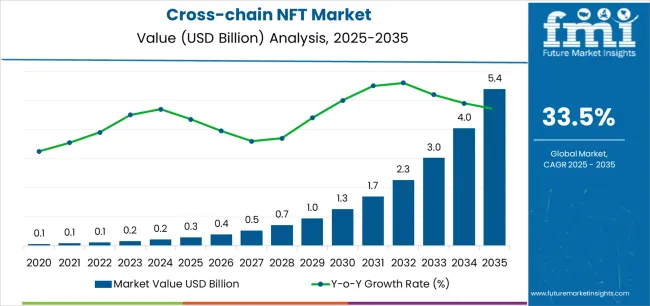

The global cross-chain NFT market is forecast to increase from USD 0.3 billion in 2025 to USD 5.4 billion by 2035, advancing at a CAGR of 33.5%. Growth reflects rising demand for interoperability as users, developers, and platforms seek to move NFT assets across multiple blockchain networks. Cross-chain frameworks address limitations of single-chain ecosystems by supporting liquidity mobility, multi-network asset verification, and wider accessibility. Developments influence adoption in interoperability technologies, including bridge protocols, multi-chain messaging layers, and interoperability-focused blockchain ecosystems such as Polkadot, Cosmos, and LayerZero.

Market expansion is supported by increasing NFT adoption across gaming, virtual real estate, digital art, and the metaverse, where assets benefit from cross-platform compatibility. Early growth from 2025 to 2030 is expected to be driven by rising DeFi integrations and multi-chain infrastructure deployment. The period from 2030 to 2035 is projected to reflect accelerated enterprise and institutional involvement, deeper multichain capability in NFT platforms, and broader standardization across blockchain networks. Regional growth remains strongest in Asia Pacific, Europe, and North America, supported by active blockchain development ecosystems and high adoption of decentralized applications. Major participants include Cosmos, Polkadot, LayerZero, Wormhole, Axelar, Avalanche, and Multichain, each contributing interoperability frameworks that enable NFT transfer and validation across heterogeneous blockchain layers.

The cross-chain NFT market is poised for substantial growth from 2025 to 2035, expanding from a market value of USD 0.3 billion in 2025 to USD 5.4 billion in 2035. Between 2025 and 2030, the market is projected to grow from USD 0.3 billion to USD 1.2 billion, representing an increase of USD 0.9 billion. This phase will account for 46.7% of the total forecast growth for the decade. The primary drivers during this period will be the increasing demand for blockchain interoperability, advancements in decentralized finance (DeFi) integrations, and the expansion of NFT use cases in sectors such as gaming, digital art, and collectibles. Platforms integrating cross-chain solutions will strengthen their market positions by offering improved liquidity, scalability, and accessibility across multiple blockchains.

From 2030 to 2035, the market is expected to grow from USD 1.2 billion to USD 5.4 billion, adding another USD 3.9 billion. This period will account for 53.3% of the overall growth for the decade. The acceleration in growth will be driven by increased adoption of cross-chain NFTs across industries, including virtual real estate, digital assets, and the metaverse. Strategic partnerships between blockchain projects and NFT platforms, alongside ongoing advancements in interoperability technologies, will further fuel this expansion. By 2035, the cross-chain NFT market is expected to be a cornerstone of the broader digital asset ecosystem, with NFTs becoming integral to various sectors, driving both user adoption and market value.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.3 billion |

| Market Forecast Value (2035) | USD 5.4 billion |

| Forecast CAGR (2025–2035) | 33.5% |

The cross-chain NFT market is growing rapidly as blockchain interoperability becomes more in demand. Traditional NFT ecosystems are often restricted to single blockchains, which limits asset transferability and liquidity. Cross-chain NFT solutions address these challenges by enabling seamless asset transfer and validation across multiple blockchain networks. This interoperability enhances market efficiency, allowing assets to flow between ecosystems, increasing their utility and value. By overcoming the limitations of single-chain ecosystems, cross-chain NFTs provide greater flexibility for users and developers, opening up new opportunities for wider adoption and broader market growth.

The rise of decentralized applications (dApps), metaverse platforms, and gaming ecosystems is further driving the demand for cross-chain NFT solutions. Developers and users are adopting interoperable systems that enable the ownership and trading of assets across multiple blockchains such as Ethereum, Polygon, Binance Smart Chain, and Solana. This functionality boosts liquidity and supports the growth of NFT value across platforms. Technological advancements in multi-chain protocols, like cross-chain bridges and interoperability frameworks, ensure secure and efficient transaction verification across networks. Despite challenges in security and regulation, collaboration between blockchain communities is advancing cross-chain NFT infrastructure, strengthening their role in the NFT ecosystem.

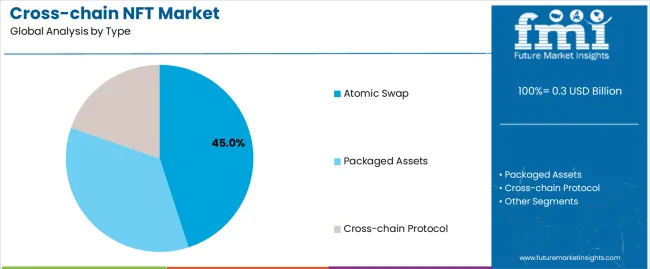

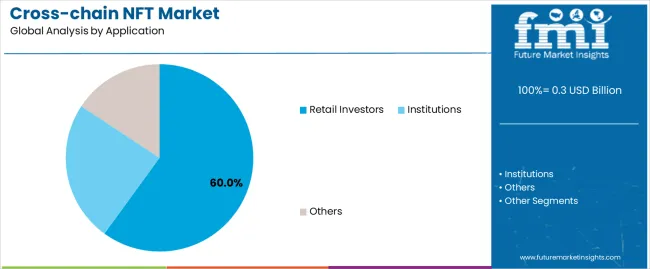

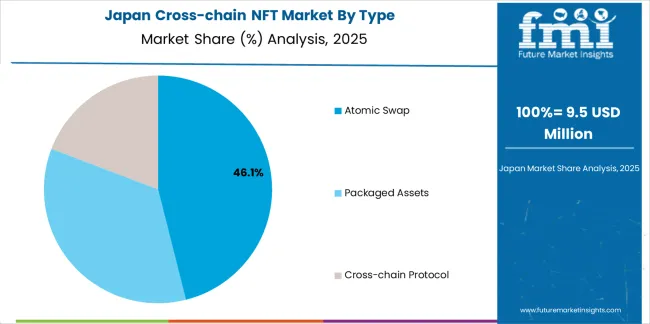

The market is segmented by type, application, and region. By type, it includes Atomic Swap, Packaged Assets, Cross-chain Protocol, and Others. In terms of application, the market is divided into Retail Investors, Institutions, and Others. Regionally, the market spans Asia Pacific, Europe, North America, Latin America, and Middle East & Africa, with each region showing varying growth dynamics and adoption levels in the cross-chain NFT space.

The atomic swap segment plays a significant role in the market, holding a 45.0% share. Atomic swaps enable users to exchange assets across different blockchain networks without the need for an intermediary. This direct peer-to-peer exchange eliminates the risks associated with centralized platforms, such as counterparty default or fraud. As blockchain technology matures, atomic swaps are becoming more essential, particularly in the context of decentralized finance (DeFi), where fast and secure transactions are a priority. The seamless integration of cross-chain functionality allows assets, such as NFTs, to be traded across various blockchains, including Ethereum, Solana, and Binance Smart Chain, without losing value or liquidity.

The growing demand for decentralized exchanges (DEXs) and trustless transaction mechanisms is driving the expansion of the atomic swap segment. With atomic swaps, users are able to trade NFTs without relying on third parties or centralized exchanges, ensuring greater privacy, security, and control over their assets. As the NFT market continues to scale and more platforms embrace cross-chain interoperability, the atomic swap segment is poised to become a key enabler of the broader NFT ecosystem. By facilitating frictionless cross-chain transactions, this segment is integral to the continued growth and development of the NFT space.

The retail investors segment dominates the market, accounting for 60.0% of the total application share. Retail investors have become a driving force in the expanding cross-chain NFT market, significantly contributing to its rapid growth. The shift toward decentralization has enabled individual investors to engage in the NFT space with more freedom and fewer barriers. Retail investors are increasingly attracted to the ability to buy, sell, and trade NFTs across multiple blockchain platforms, offering them greater flexibility and liquidity than ever before. As blockchain technology and NFTs have gained mainstream recognition, individuals are eager to capitalize on the growing opportunities within the space.

The accessibility of decentralized exchanges (DEXs) and non-custodial wallets has further fueled the growth of retail investors in the cross-chain NFT ecosystem. These platforms offer user-friendly interfaces and low transaction fees, making them more appealing to retail investors. The ability to easily move NFTs between different blockchains, facilitated by cross-chain solutions, increases the liquidity of assets and provides retail investors with enhanced opportunities to trade. With NFTs expanding into various sectors such as art, gaming, and virtual collectibles, the growing involvement of retail investors ensures the continued success and growth of the cross-chain NFT market.

The Cross-chain NFT market is driven by the increasing adoption of decentralized applications (dApps), metaverse platforms, and the need for seamless asset transfers across blockchains. Challenges include security concerns, lack of standardization, and regulatory uncertainties. Trends shaping the market include advancements in cross-chain protocols, rising institutional interest, and the expanding use of NFTs in gaming and virtual environments.

What are the Key Trends in the Cross-chain NFT Market?

Technological advancements in multi-chain protocols, such as cross-chain bridges and interoperability frameworks, are enhancing the functionality and security of cross-chain transactions. These innovations enable the seamless transfer and verification of NFTs across different blockchain platforms, boosting liquidity and expanding the market’s accessibility. Another key trend is the increasing involvement of institutional investors in the cross-chain NFT space. As more institutional players adopt cross-chain solutions, the market is expected to see greater legitimacy and adoption across industries like finance, art, and gaming. Furthermore, the growth of the metaverse and virtual environments is pushing demand for interoperable NFTs that can be utilized across various virtual worlds, further fueling the need for cross-chain functionality. As these trends continue to develop, the cross-chain NFT market is expected to experience continued growth, with expanding use cases and an increasingly diverse set of participants.

What are the Restraints of the Cross-chain NFT Market?

One of the primary obstacles is the security concerns related to cross-chain transactions. The complexities of verifying transactions across multiple networks can expose users to risks such as double-spending, fraud, and hacking. Ensuring the security and integrity of these transactions is crucial for supporting growth. Another major restraint is the lack of standardization across blockchains, which creates fragmentation and makes it difficult for developers to create universally compatible solutions. Regulatory uncertainty is also a significant concern, as governments and financial authorities are still working to establish clear guidelines for NFTs and blockchain-based assets. This lack of regulatory clarity could slow down institutional adoption and the broader integration of cross-chain NFT solutions. The technical complexity of implementing cross-chain functionality on blockchain networks could deter smaller players from entering the market, limiting the overall growth potential.

What are the Drivers of the Cross-chain NFT Market?

Traditional NFT ecosystems are often limited to single blockchains, which restricts the transferability and liquidity of assets. Cross-chain solutions overcome these barriers by enabling seamless asset movement and validation between different blockchains. The rise of decentralized applications (dApps), metaverse platforms, and gaming ecosystems has significantly contributed to this shift, as these sectors require cross-chain functionality to support their growing ecosystems. The growing adoption of decentralized finance (DeFi) solutions and the need for more flexible asset management have further fueled the demand for cross-chain NFTs. As platforms like Ethereum, Polygon, Solana, and Binance Smart Chain continue to integrate cross-chain capabilities, the market will continue to expand, offering greater liquidity and value for NFTs. This shift toward cross-chain compatibility is expected to remain a key driver as NFTs grow in popularity and adoption across industries.

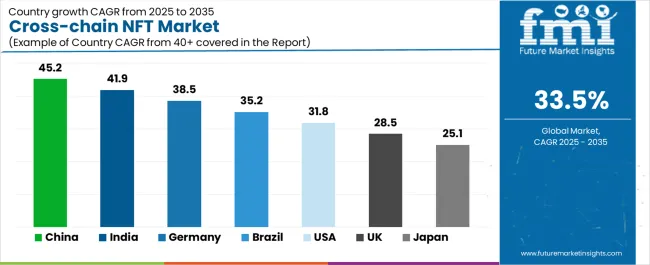

| Country | CAGR (%) |

|---|---|

| China | 45.2% |

| India | 41.9% |

| Germany | 38.5% |

| Brazil | 35.2% |

| USA | 31.8% |

| UK | 28.5% |

| Japan | 25.1% |

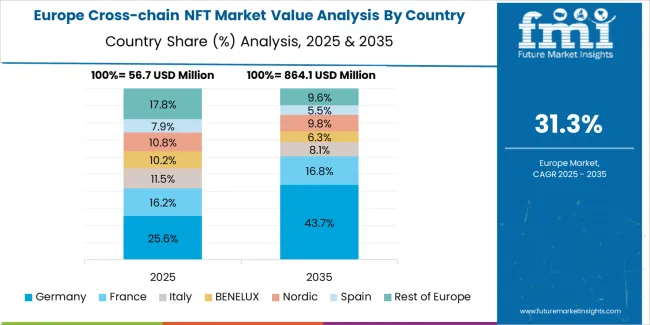

The global cross-chain NFT market is expanding rapidly, with China leading at a 45.2% CAGR through 2035, driven by its robust blockchain development, government initiatives, and large-scale digital asset adoption. India follows at 41.9%, supported by a growing technology ecosystem, increasing blockchain integration, and strong demand for NFTs in gaming and virtual environments. Germany records a 38.5% CAGR, reflecting its advanced blockchain infrastructure, strong industrial base, and emphasis on secure, decentralized solutions. Brazil grows at 35.2%, fueled by increasing digital asset awareness, government backing for blockchain initiatives, and rising retail investor interest. The USA sees a 31.8% growth, reflecting a well-established market with growing institutional interest in cross-chain solutions. The UK records 28.5%, benefiting from a solid blockchain foundation and strong adoption in fintech and digital asset sectors. Japan grows steadily at 25.1%, emphasizing technological innovation and its position as a leader in digital collectibles and NFTs.

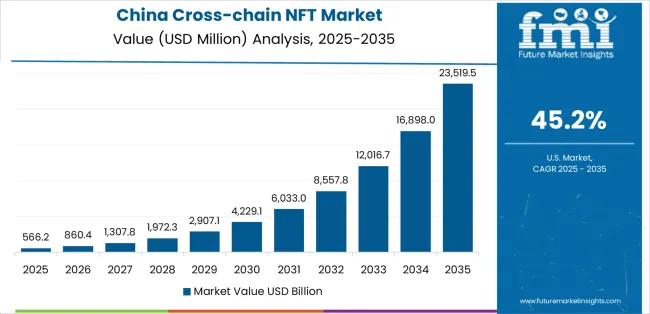

China is leading the cross-chain NFT sector with an impressive 45.2% CAGR through 2035. This growth is driven by the country’s rapid advancements in blockchain technology, strong government support for digital assets, and a large-scale push toward digital transformation in both government and private sectors. China has established itself as a global leader in blockchain development, with multiple initiatives aimed at fostering innovation in decentralized technologies. The growing adoption of cross-chain NFT solutions in industries like gaming, finance, and virtual environments is a key factor propelling China’s leadership. Blockchain integration in various sectors, including art, gaming, and entertainment, has created an ecosystem that demands seamless asset transfer and validation across different platforms. Furthermore, the Chinese government’s initiatives, such as the digital yuan and national blockchain strategies, provide a solid infrastructure for the adoption and growth of cross-chain solutions. As these technologies continue to mature and expand across regions, China’s dominance in the cross-chain NFT space is expected to continue, making it a key player in the global scene.

India is experiencing robust growth in the Cross-chain NFT sector, with a strong 41.9% CAGR projected through 2035. This growth is supported by the country’s expanding technology sector and rising demand for digital assets. India has emerged as one of the fastest-growing blockchain hubs, thanks to its large, tech-savvy population and rapidly growing startup ecosystem. Government initiatives aimed at promoting blockchain innovation further support the growth of cross-chain solutions. The adoption of NFTs in gaming, decentralized finance (DeFi), and digital collectibles is increasing across India, driving the demand for seamless asset transfers across various blockchain platforms. The country’s large and growing population of retail investors and expanding gaming and metaverse environments create strong demand for cross-chain interoperability. As India’s blockchain infrastructure continues to improve and adoption deepens, the nation is poised to become a global leader in cross-chain NFT solutions, making it a key contributor to the overall growth of the sector.

Germany is making significant strides in the cross-chain NFT sector, with a 38.5% CAGR projected through 2035. The country’s advanced blockchain infrastructure and strong industrial base play a vital role in the adoption of cross-chain solutions. Germany’s focus on secure, decentralized technologies and its position as a leader in innovation are central to its growth in this space. The German government’s favorable regulatory stance towards blockchain and cryptocurrency fosters an ecosystem that is conducive to the growth of digital assets. Additionally, Germany’s robust industrial sector, including automotive, finance, and technology, is integrating blockchain-based solutions, which in turn drives the demand for cross-chain NFTs. As the need for seamless interoperability across blockchain platforms increases, Germany’s digital economy and focus on innovation position it as a leader in this sector. The demand for cross-chain solutions in supply chain management, healthcare, and finance further supports growth, ensuring that Germany remains a key player as the sector continues to evolve.

Brazil is emerging as a significant player in the cross-chain NFT sector, with a 35.2% CAGR projected through 2035. Brazil’s rapid digital transformation and growing interest in blockchain technology are key factors driving this growth. The country has seen a surge in the adoption of digital assets, particularly NFTs, across industries such as gaming, art, and entertainment. Government-backed blockchain initiatives provide a favorable environment for the adoption of cross-chain solutions, further fueling market growth. Additionally, Brazil’s expanding middle class, tech-savvy population, and growing participation in global digital economies contribute to the rise in demand for cross-chain NFTs. The increasing interest in decentralized finance (DeFi) within Brazil further supports the growth of this sector, as users seek interoperable solutions to manage digital assets across various platforms. As Brazil continues to embrace blockchain technologies, the nation is well-positioned for continued growth in cross-chain NFTs, particularly as decentralized solutions continue to improve and gain traction.

The USA is witnessing strong growth in the cross-chain NFT sector, with a 31.8% CAGR through 2035. The USA benefits from an established technology ecosystem and serves as a global leader in blockchain development. As one of the largest markets for NFTs and digital assets, the USA plays a crucial role in the demand for cross-chain solutions. The country’s large population of tech-savvy consumers, institutional investors, and developers is a major driver of the increasing need for cross-chain interoperability. The USA is home to several major blockchain platforms and NFT marketplaces, further supporting the adoption of cross-chain solutions. With a strong emphasis on innovation and decentralized finance (DeFi), the USA continues to push for more seamless, secure, and efficient NFT transactions across multiple blockchains. The growing number of institutional players, venture capital investments, and NFT-related projects is creating a favorable environment for cross-chain adoption. As demand for NFTs across sectors like gaming, entertainment, and virtual assets continues to grow, the USA is positioned to maintain its strong role in this space.

The UK is a growing force in the cross-chain NFT sector, with a 28.5% CAGR through 2035. The UK has long been a leader in fintech and blockchain innovation, and its advancements in these areas are driving the adoption of cross-chain solutions. The country’s established financial infrastructure and strong regulatory framework for blockchain make it an attractive hub for digital asset growth. As blockchain adoption increases across sectors like finance, entertainment, and gaming, the demand for cross-chain functionality is rising. The UK emphasis on regulatory clarity and innovation ensures that the country remains a key player in the space. Additionally, its proximity to other key European markets enables cross-border collaboration, further boosting the sector’s growth. As NFTs continue to gain traction in industries like art, gaming, and entertainment, the need for secure, interoperable solutions across blockchains will drive demand. The UK strong blockchain adoption and growing interest in digital assets among businesses and consumers position it as an important contributor to the growth of cross-chain NFTs.

Japan is experiencing steady growth in the cross-chain NFT sector, with a 25.1% CAGR through 2035. Known for its technological innovation, Japan has made significant strides in integrating blockchain solutions, especially in the gaming and entertainment industries. Japan’s early adoption of blockchain technology, coupled with its focus on digital asset development, has created a favorable environment for cross-chain adoption. As NFTs become more widely used in gaming, digital collectibles, and virtual environments, the demand for cross-chain functionality is increasing. The country’s strong regulatory clarity regarding digital assets and its commitment to blockchain infrastructure further support the growth of cross-chain solutions. Japan’s position as a leader in gaming and digital collectibles gives it a unique advantage in driving the adoption of cross-chain NFTs. The country’s expertise in precision engineering and innovation in digital technologies will continue to make it a significant player in this growing sector.

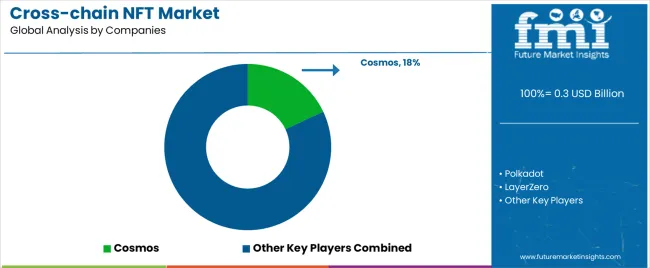

The cross-chain NFT ecosystem features a range of meaningful players, with moderate market concentration. A few key platforms, such as Cosmos and Polkadot, control a significant share of the cross-chain NFT space. Competition in the market is centered on technological capability, network interoperability, security, and user experience rather than solely on price. These platforms leverage their robust blockchain ecosystems, advanced interoperability features, and developer communities to create competitive advantages.

Market leaders like Cosmos (18%), Polkadot, and LayerZero maintain strong positions through their comprehensive cross-chain frameworks, enabling seamless communication and asset transfer across different blockchain networks. These platforms have established extensive relationships with developers and NFT platforms, creating high barriers to entry for competitors. Their ongoing development of multi-chain ecosystems and continuous improvements in blockchain interoperability keep them at the forefront of the market.

Challengers in the market, including Wormhole, Avalanche, Chainflip, and pNetwork, focus on specialized cross-chain technologies that offer unique solutions for specific use cases, such as gaming, DeFi, or NFT marketplaces. These players compete by offering advanced features like high throughput, low latency, and enhanced scalability to attract growing demand for cross-chain NFT solutions.

Emerging players like Axelar, Multichain, Enjin, O3Swap, Terra Classic, Solana, Tezos, BNB Chain, and Ronin bring innovation and competitive pressure through rapid development and specialized solutions in high-growth regions. These players leverage cost-effective solutions, blockchain flexibility, and strong regional presence in markets like India and China to capture market share. Local advantages, including regulatory compliance and cost optimization, further enable them to compete in the rapidly expanding cross-chain NFT space.

Market dynamics favor platforms that combine cutting-edge cross-chain technologies with seamless integration into various NFT ecosystems, addressing the full lifecycle from asset creation to exchange and beyond.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Atomic Swap, Packaged Assets, Cross-chain Protocol |

| Application | Retail Investors, Institutions, Others |

| End User | Retail Investors, Institutions, Other End Users |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | Cosmos, Polkadot, LayerZero, Wormhole, Avalanche, Chainflip, pNetwork, Axelar, Multichain, Enjin, O3Swap, Terra Classic, Solana, Tezos, BNB Chain, Ronin |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, cross-chain protocol specifications and developments, institutional and retail investor adoption trends. |

The global cross-chain NFT market is estimated to be valued at USD 0.3 billion in 2025.

The market size for the cross-chain NFT market is projected to reach USD 5.4 billion by 2035.

The cross-chain NFT market is expected to grow at a 33.5% CAGR between 2025 and 2035.

The key product types in cross-chain NFT market are atomic swap, packaged assets and cross-chain protocol.

In terms of application, retail investors segment to command 60.0% share in the cross-chain NFT market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

NFT Dapps Market Size and Share Forecast Outlook 2025 to 2035

NFT Lending Dapps Market Size and Share Forecast Outlook 2025 to 2035

NFT-Backed Loans Market Size and Share Forecast Outlook 2025 to 2035

NFT Analytics Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA