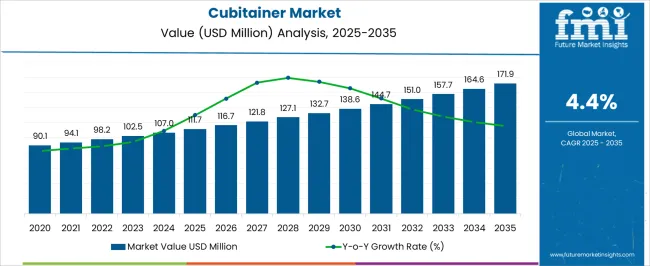

The Cubitainer Market is estimated to be valued at USD 111.7 million in 2025 and is projected to reach USD 171.9 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Cubitainer Market Estimated Value in (2025E) | USD 111.7 million |

| Cubitainer Market Forecast Value in (2035F) | USD 171.9 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The cubitainer market is gaining strong traction due to its highly functional design, offering collapsibility, low weight, and cost-effective liquid storage for a range of industrial applications. The demand for sustainable and flexible packaging formats is rising as manufacturers aim to optimize logistics, reduce storage costs, and enhance environmental compliance. Regulatory emphasis on reducing plastic waste and improving material recyclability has also contributed to the increased use of cubitainers made from eco-compatible resins.

The market has been positively influenced by the growing need for safe handling and transportation of both hazardous and non-hazardous fluids, especially in the chemical and pharmaceutical industries. Advancements in molding technologies and improvements in chemical resistance have further expanded cubitainer application scopes.

Market participants are continuously investing in product customization, including spout designs and tamper-evident features, to address safety, hygiene, and ease-of-use concerns With expanding trade of liquid concentrates, reagents, and disinfectants globally, the cubitainer format is expected to witness sustained adoption across both established and emerging economies.

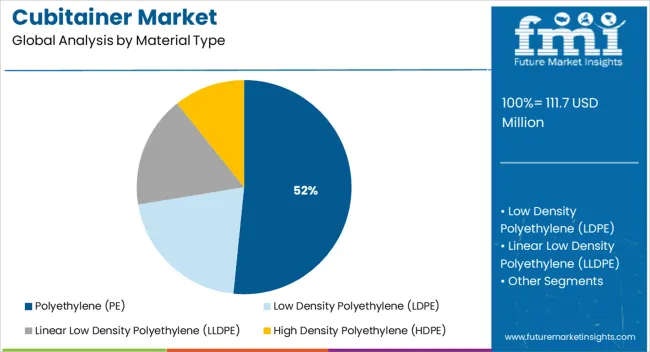

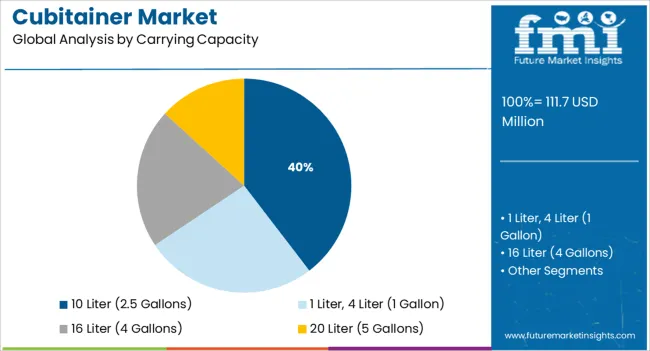

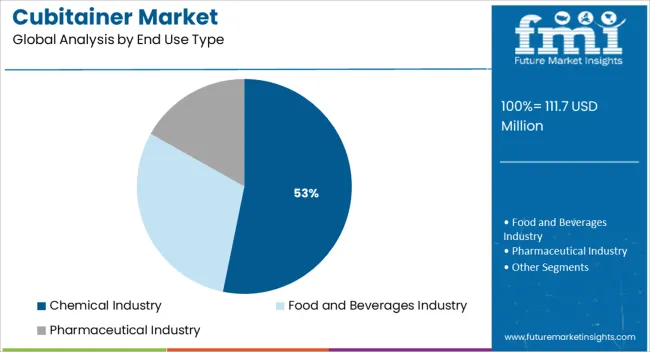

The market is segmented by Material Type, Carrying Capacity, and End Use Type and region. By Material Type, the market is divided into Polyethylene (PE). In terms of Carrying Capacity, the market is classified into 10 Liter (2.5 Gallons), 1 Liter, 4 Liter (1 Gallon), 16 Liter (4 Gallons), and 20 Liter (5 Gallons). Based on End Use Type, the market is segmented into Chemical Industry, Food and Beverages Industry, and Pharmaceutical Industry. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyethylene is expected to account for 51.6% of the total revenue share in the cubitainer market in 2025, emerging as the most dominant material type. This leading position is driven by the material’s superior chemical resistance, flexibility, and durability, which are essential for storing a wide range of industrial and chemical liquids. Polyethylene offers ease of manufacturing and consistent quality during blow molding processes, making it the preferred choice for large-scale production.

Its lightweight properties contribute to cost savings in transportation and handling, which has been a critical factor in its widespread adoption. The ability to maintain structural integrity under varying temperature and pressure conditions makes polyethylene well-suited for long-distance shipping and industrial usage.

Moreover, its compatibility with both food-grade and non-food-grade applications has supported its use across diverse sectors Growing initiatives to enhance recyclability and reduce the carbon footprint of packaging have also played a role in reinforcing polyethylene's market dominance in this segment.

The 10 liter capacity segment is projected to hold 39.6% of the cubitainer market revenue share in 2025, positioning it as the most utilized capacity configuration. The segment’s strength lies in its balance between volume, portability, and cost-efficiency, making it suitable for a wide array of industrial and commercial uses. This carrying capacity is optimal for one-person handling, reducing labor requirements and improving logistics in mid-volume packaging operations.

The 10 liter format has gained preference among manufacturers and end users dealing with chemical reagents, lubricants, and cleaning agents due to its stackability, ease of dispensing, and compatibility with standard shelving units. Its moderate size allows for better inventory rotation and efficient consumption rates in production environments.

The segment has also benefited from regulatory trends that promote safe packaging volumes for hazardous liquids, where 10 liter containers often fall within preferred handling thresholds These factors combined have reinforced its adoption across supply chains that value efficiency, safety, and ergonomics.

The chemical industry is projected to contribute 53.2% of the overall revenue share in the cubitainer market in 2025, establishing it as the largest end use sector. This dominance is being driven by the industry’s requirement for cost-effective, chemically resistant, and secure liquid packaging solutions. The rise in demand for solvents, reagents, industrial acids, and cleaning agents has necessitated packaging formats that support high chemical compatibility while ensuring transport safety.

Cubitainers provide this by offering a collapsible, space-efficient design with strong barrier properties that prevent leaks and contamination. The segment’s growth has also been supported by the increasing global trade of chemical concentrates, which require durable secondary packaging solutions.

Adoption has further expanded due to regulatory mandates around safe chemical handling, which cubitainers fulfill through tamper-evident closures, spill-proof dispensers, and labeling flexibility As chemical manufacturers focus on optimizing distribution and minimizing environmental impact, cubitainers have emerged as a preferred alternative to rigid and bulky packaging systems.

With manufacturers increasing their focus on Reduce, Reuse, and Recycle, cubitainer has become one of the most sought-after products for both the manufacturers and end customers.

To tap into the sustainable market, the manufacturers are making the best use of the fully recyclable property of cubitainers. So, the focus has been on developing the closed-loop recycling form of cubitaners.

Taking this into account, some manufacturers have devised an innovative step-by-step process to manufacture recyclable cubitainers.

The process starts with molding, wherein a cubutainer of the required shape is manufactured.

This step is followed by filling the cubitainer with the required liquid. During the filling process, there are chances that some foreign substance might be present. So, the filling is followed by sorting, where these foreign materials are removed.

Next, the spouts are removed from the body. It is necessary to remove these spouts, as the presence of spouts would make the cubitainers non-recyclable. After that, the cubitainers are subjected to grinding, post which these are washed to form flakes.

The washing is preceded by drying using a dehydrator. The dried flakes no longer contain the sliminess which was felt when the flakes were wet.

Subsequently, we would be pelleting the dried flakes with an extruder. Finally, the cubitainers are molded using recycled pellets.

After this, in the form of testing, the recycled cubitainers are compared with a virgin raisin cubitainer. Finally, after this, the recycled cubitainer is sold to the end customer.

Apart from that, the manufacturers have been laying special emphasis on developing cubitainers that are collapsible in nature and are made up of Polyethylene. The specialty of using such collapsible containers is that these meet the level 3 classification for contaminant-free sample containers.

Apart from that, there is a consistent effort from manufacturers to develop cubitainers of various capacities. This has been done in an effort to cover the broader market. Furthermore, manufacturers are employing the latest technologies in their value chain to develop tougher and more versatile versions of cubitainers.

The rising demand for durable, and portable packaging solutions is expected to boost the demand for cubitainer. Moreover, the demand further increases owing to the changing lifestyle and food habits of the major population, which leads to the growing use of packaged liquid food products.

A key feature of cubitainers is the ability to customize them. Manufacturers in the cubitainer market are leaning towards the production of rigid and flexible cubitainers and offering a range of configuration options to their customers, which is expected to boost the global cubitainer market size. They are also concentrating on smart manufacturing processes such as artificial intelligence (AI), Internet of Things (IoT), and robotics.

Cubitainers further have a high demand which is attributed to its low shipping costs compared to the standard plastic pails, due to its lightweight. Moreover, owing to its non-toxic feature, manufacturers prefer cubitainers for alcoholic and non-alcoholic beverages, as it maintains the quality of the liquid and prevents contamination.

The reusability and eco-friendly nature are likely to contribute towards the global cubitainer market growth as concerns and controlling programs regarding the reduction of the use and disposal of numerous packaging materials have increased. Moreover, the adoption of cubitainer is estimated to grow as manufacturers operate in-sync with the requirements of the FDA.

There are several alternatives to cubitainers available in the market. These include rigid open head pails, bag-in-box, and blow-moulded tight head pails. These alternative options provide similar or better features than that of cubitainers, which is likely to impede the global cubitainer market growth.

Conversely, as new players continue to enter the cubitainer market, the quality, costs, and environment sustainability becomes the lookout to be considered in future production of cubitainers. Furthermore, the development of multi-purpose and high-quality cubitainers are being highly focused on by manufacturers, by laying emphasis on various inspections and certification procedures to ensure exquisite quality of the product.

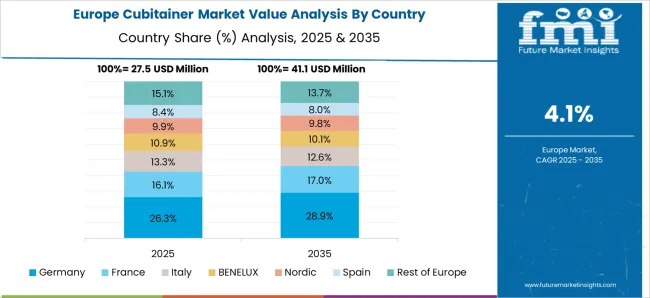

Europe holds the largest share of the cubitainer market with a revenue of 19%. This is attributed to the increasing demand for packaged liquid food and the presence of key cubitainer manufacturers. Cubitainers are preferred over other packaging types by an increasing number of manufacturers and producers from various industries. This is because of its lucrative and eco-friendly nature, which is anticipated to surge its demand and sales of cubitainer in this region.

The lightweight and space efficiency of cubitainers are the key features that maintain its high demand amongst various end users. The growing environmental concerns due to global warming are compelling manufacturers to not only make the cubitainers eco-friendly by facilitating polyethylene terephthalate (PET) barrier, high density polyethylene (HDPE), low density polyethylene (LDPE), and linear low density polyethylene (LLDPE).

Start-up companies are also contributing to the cubitainer market growth by incorporating various innovative strategies to improve the features of cubitainers, and possibly increase its applications and demand amongst several end users.

The cubitainer market is fragmented and the competition between players is poised to increase over the forecast period. Manufacturers are primarily focusing on the development of cubitainers by improving their quality and provide them with several purposes.

The Most Recent Developments Surging the Popularity of Cubitaners:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.4% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments covered | Material Type, Carrying Capacity, End User and Region. |

| Regional scope | North America; Western Europe, Eastern Europe, Middle East, Africa, ASEAN, South Asia, Rest of Asia, Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Changshun Plastic Co. Ltd., Zacros America Inc., ChangZhou HengQi Plastic Co. Ltd., The Cary Company, Changzhou Sanjie Plastic Products Co. Ltd., Fujimori KOGYO Co. Ltd., RPC Promens and SEKISUI SEIKEI Co. Ltd., Koizumi Jute Mills Ltd., United States Plastic Corporation, Avantor Performance Materials Inc., Quality Environmental Containers, Cole-Parmer, Berlin Packaging, etc. |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global cubitainer market is estimated to be valued at USD 111.7 million in 2025.

The market size for the cubitainer market is projected to reach USD 171.9 million by 2035.

The cubitainer market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in cubitainer market are polyethylene (pe), _low density polyethylene (ldpe) and _high density polyethylene (hdpe).

In terms of carrying capacity, 10 liter (2.5 gallons) segment to command 39.6% share in the cubitainer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights for Cubitainer Suppliers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA