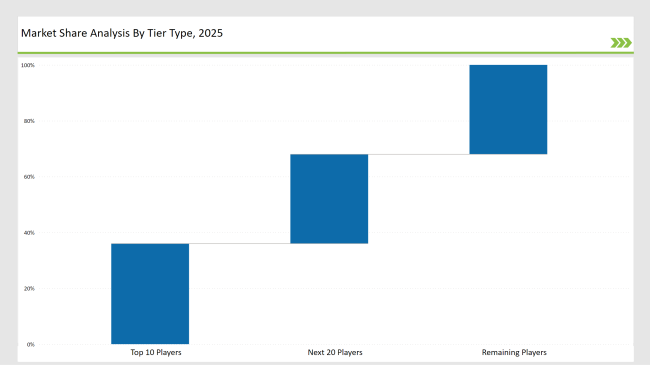

The demand for lightweight, strong, and environment-friendly packaging is increasing in the cubitainer market, thereby expanding its growth. This market is categorized into three levels of production capacity and market share. Leading companies such as Smurfit Kappa, Sealed Air, and DS Smith control 36% of the market, leveraging advanced manufacturing technologies, strong global distribution networks, and continuous innovation.

Tier 2 players, including Liqui-Box, Scholle IPN, and Rapak, hold 32% of the market. These companies offer value-added, lower-cost solutions of cubitainers customized for specific applications across different markets that meet the requirements of mid-sized enterprises. The Tier 3 players account for 32%, which includes regional and specialty manufacturers focused on applications in industries, such as pharmaceuticals, food, and industrial chemicals.

Global Market Share by Key Players

| Category | Market Share (%) |

|---|---|

| Top 3 (Smurfit Kappa, Sealed Air, DS Smith) | 20% |

| Rest of Top 5 (Liqui-Box, Scholle IPN) | 12% |

| Next 5 of Top 10 (Rapak, CDF Corporation, ChangZhou, Zacros, Optopack) | 4% |

The cubitainer market serves various industries, including:

To meet industry demands, companies focus on:

Companies are looking into advanced material technologies and environmentally friendly alternatives as a means to meet the strict environmental regulations while also keeping the consumer in line with their wants.

Manufacturers are investing into automation, quality control driven through AI, sustainable materials, to stay ahead in the game. Strategic partnerships are producing more innovations in cubitainer solutions such as efficiency, durability, among others.

Year-on-Year Leaders

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Smurfit Kappa, Sealed Air, DS Smith |

| Tier 2 | Liqui-Box, Scholle IPN, Rapak |

| Tier 3 | CDF Corporation, ChangZhou, Zacros, Optopack |

| Manufacturer | Latest Developments |

|---|---|

| Smurfit Kappa | In March 2024, expanded recyclable cubitainer solutions for multiple applications. |

| Sealed Air | In August 2023, launched lightweight, durable cubitainers for industrial packaging. |

| DS Smith | In May 2024, introduced high-strength, eco-friendly cubitainers. |

| Liqui-Box | In Nov 2023, developed ultra-flexible cubitainers for the beverage industry. |

| Scholle IPN | In Feb 2024, invested in AI-driven production systems for improved sustainability. |

| Rapak | In Jan 2024, expanded production to meet increasing global demand for liquid packaging. |

| CDF Corporation | In Apr 2024, introduced innovative, high-barrier cubitainers for chemical storage. |

| Optopack | In June 2024, developed compostable cubitainer laminates for food and beverage sectors. |

Automation, material innovations, and sustainability efforts will continue to shape the cubitainer industry. Companies are pursuing blockchain integration for better traceability, closed-loop recycling, and smart packaging solutions for efficiency and less environmental damage. Additionally, advancements in bio-based resins are making cubitainers more environmentally friendly. The increased use of AI-driven quality control systems is improving production accuracy and reducing material waste.

Leading players include Smurfit Kappa, Sealed Air, DS Smith, Liqui-Box, and Scholle IPN.

The top 3 players collectively account for approximately 20% of the global market.

The market concentration is considered medium, with top players holding 36%.

Key drivers include sustainability, automation, material innovation, and regulatory compliance.

Asia-Pacific and Latin America are expected to lead in growth, while Europe and North America focus on regulatory compliance and sustainable solutions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cubitainer Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Pet Market Share & Industry Trends

Competitive Landscape of Hob Market Share

Leading Providers & Market Share in Kegs

Market Share Distribution Among Hops Manufacturers

Market Share Distribution Among Bran Manufacturers

Leading Providers & Market Share in the Straw Industry

Assessing Okara Market Share & Industry Trends

Analyzing Market Share & Industry Trends of Chitin Providers

Examining Shrimp Market Share Trends & Industry Leaders

Analyzing Pulses Market Share & Industry Trends

Competitive Overview of Labels Companies

Market Share Insights of Leading Mezcal Manufacturers

Market Share Breakdown of the IV Bag Market

Global MDO-PE Market Share Analysis – Trends, Growth & Forecast 2025–2035

Market Share Distribution Among Lactase Providers

Market Share Distribution Among Octabin Manufacturers

Competitive Breakdown of Lactose Providers

Global Pallets Market Share Analysis – Trends, Demand & Forecast 2025–2035

Competitive Landscape of Pickles Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA