The octabin market is expanding quickly as businesses seek bulk packaging that is strong, high-volume, and cost-effective. With the growing demand in agriculture, chemicals, food processing, and industrial production, producers are turning their attention to lightweight, recyclable, and reinforced corrugated designs to increase efficiency and sustainability in the process. Businesses are employing moisture-resistant coatings, multi-wall construction, and automated folding technology to increase durability and simplify their logistics process.

Producers are making investments in artificial intelligence-based quality control, superior corrugated board design, and stacking patterns to ensure load stability and reduced waste. The sector is looking towards biodegradable octabins, bulk storage solutions designed to order, and intelligent packaging technologies that can be utilized for tracking and traceability.

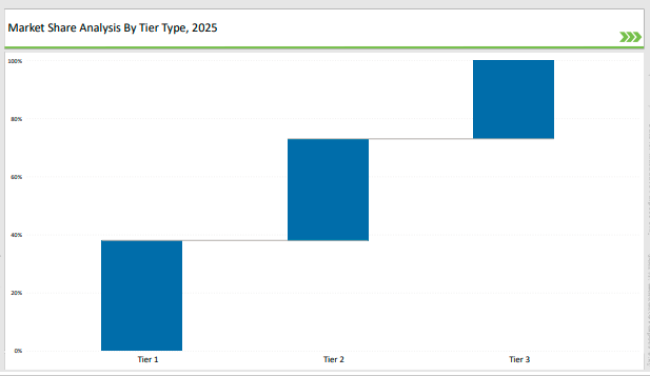

Tier 1 players, the likes of which include Smurfit Kappa, DS Smith, and Mondi Group, dominate 38% of the market due to their high-performance octabin-making capabilities, advance material technologies, and worldwide supply chain strengths.

Tier 2 players WestRock, International Paper, and Tri-Wall dominate 35% of the market, offering cost-effective and long-lasting solutions for customized bulk packaging.

Tier 3 consists of regional and niche players specializing in lightweight, digitally printed, and sustainable octabins controlling 27% of the market with a focus on localized production, innovative material applications, and solutions for particular industries.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Smurfit Kappa, DS Smith, Mondi Group) | 17% |

| Rest of Top 5 (WestRock, International Paper) | 12% |

| Next 5 of Top 10 (Tri-Wall, Rengo Co., Georgia-Pacific, GWP Group, VPK Packaging) | 9% |

The octabin industry serves multiple sectors where strength, efficiency, and sustainability are key. Companies are developing innovative packaging solutions to optimize storage and transportation. They are enhancing impact resistance by reinforcing structural designs to handle heavy loads. Additionally, businesses are incorporating advanced moisture-barrier technologies to protect products from environmental exposure.

Manufacturers are optimizing octabins with reinforced structures, sustainable materials, and smart tracking capabilities. They are integrating AI-driven load analysis to enhance stacking efficiency and reduce material usage. Companies are developing ultra-lightweight corrugated designs to lower shipping costs while maintaining durability. Additionally, businesses are incorporating tamper-evident sealing technologies to improve security during transit.

Sustainability and automation are transforming the octabin industry. Companies are incorporating AI-powered defect detection, water-based adhesives, and collapsible designs to improve reusability and cost efficiency. Businesses are developing ultra-lightweight, high-strength corrugated boards to minimize material waste. Manufacturers are introducing digital printing techniques for branding and tracking. Additionally, firms are expanding supply chain security with anti-counterfeit and tamper-evident packaging solutions. Companies are also improving impact-resistant octabins for transporting fragile goods. Businesses are integrating IoT-enabled sensors for real-time condition monitoring and inventory tracking.

Technology suppliers should focus on automation, sustainable coatings, and tracking innovations to support the evolving octabin market. Partnering with agriculture, chemical, and logistics companies will drive adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Smurfit Kappa, DS Smith, Mondi Group |

| Tier 2 | WestRock, International Paper, Tri-Wall |

| Tier 3 | Rengo Co., Georgia-Pacific, GWP Group, VPK Packaging |

Leading manufacturers are advancing octabin technology with AI-powered defect detection, sustainable adhesives, and smart tracking solutions. They are optimizing corrugated board structures to enhance durability while reducing material consumption. Additionally, companies are integrating automated folding mechanisms to streamline assembly and improve handling efficiency. Businesses are also developing high-barrier coatings to protect contents from environmental exposure and contamination.

| Manufacturer | Latest Developments |

|---|---|

| Smurfit Kappa | Launched moisture-resistant octabins in March 2024. |

| DS Smith | Developed lightweight, fully recyclable corrugated octabins in April 2024. |

| Mondi Group | Expanded RFID-enabled tracking solutions in May 2024. |

| WestRock | Released heavy-duty multi-wall octabins in June 2024. |

| International Paper | Strengthened biodegradable octabin production in July 2024. |

| Tri-Wall | Introduced collapsible high-strength octabins in August 2024. |

| Rengo Co. | Pioneered digital-printed bulk packaging in September 2024. |

The octabin market is evolving as companies invest in digital tracking, sustainable materials, and AI-powered defect detection. They are developing reinforced structural designs to improve load-bearing capacity and durability. Additionally, manufacturers are integrating smart sensors for real-time condition monitoring and damage prevention. Companies are also adopting water-based printing inks to enhance recyclability and reduce environmental impact.

Manufacturers will continue integrating smart tracking, AI-driven quality control, and sustainable coatings. Businesses will develop high-strength, ultra-light corrugated boards for cost efficiency. Companies will adopt collapsible octabin solutions to minimize storage space. Smart anti-counterfeit packaging will enhance supply chain security. RFID technology will improve inventory tracking. Additionally, firms will streamline robotic assembly to optimize production and reduce waste. Companies will also develop high-impact resistant octabins for fragile goods. Businesses will explore AI-driven predictive analytics to enhance load management and logistics efficiency.

Leading players include Smurfit Kappa, DS Smith, Mondi Group, WestRock, International Paper, Tri-Wall, and Rengo Co.

The top 3 players collectively control 17% of the global market.

The market shows medium concentration, with top players holding 38%.

Key drivers include sustainability, smart tracking, digital printing, and automation.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share & Competitive Positioning in Corrugated Octabins Market

Octabin Market by Standard & Base Discharge Type from 2024 to 2034

Corrugated Octabins Market Trends & Forecast through 2035

Competitive Overview of Pet Market Share & Industry Trends

Competitive Landscape of Hob Market Share

Leading Providers & Market Share in Kegs

Market Share Distribution Among Hops Manufacturers

Market Share Distribution Among Bran Manufacturers

Leading Providers & Market Share in the Straw Industry

Assessing Okara Market Share & Industry Trends

Analyzing Market Share & Industry Trends of Chitin Providers

Examining Shrimp Market Share Trends & Industry Leaders

Analyzing Pulses Market Share & Industry Trends

Competitive Overview of Labels Companies

Market Share Insights of Leading Mezcal Manufacturers

Market Share Breakdown of the IV Bag Market

Global MDO-PE Market Share Analysis – Trends, Growth & Forecast 2025–2035

Market Share Distribution Among Lactase Providers

Competitive Breakdown of Lactose Providers

Global Pallets Market Share Analysis – Trends, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA