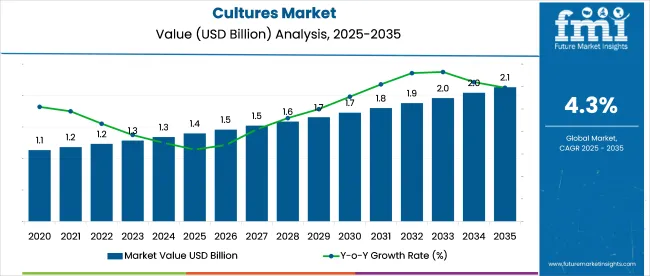

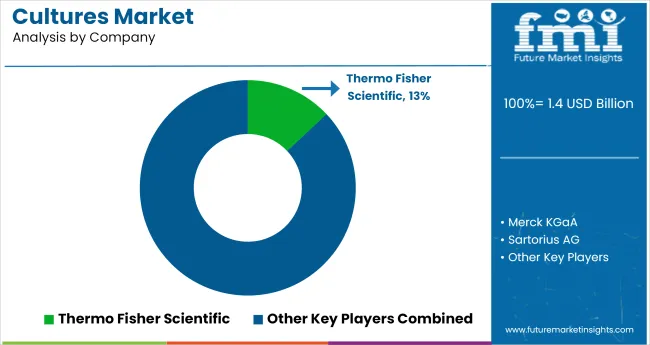

The global cultures market is projected to grow from USD 1.4 billion in 2025 to USD 2.1 billion by 2035, expanding at a CAGR of 4.3% over the forecast period. Between 2020 and 2024, the global cultures market expanded from USD 1.13 billion to USD 1.35 billion, supported by rising demand in fermented dairy, probiotic beverages, and meat preservation.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 1.4 billion |

| Market Size (2035) | USD 2.1 billion |

| CAGR (2025 to 2035) | 4.3% |

In 2020, growth remained focused on traditional applications such as yogurt and soft cheese. By 2021, with the market reaching USD 1.18 billion, functional foods rebounded across North America and Western Europe. In 2022, at USD 1.23 billion, cultures began gaining traction in non-dairy fermented beverages and plant-based protein blends.

China and South Korea led the uptrend in 2023, pushing global value to USD 1.29 billion. New applications in shelf-life extension and bio-preservation contributed to the 2024 market size of USD 1.35 billion. The 2025 baseline of USD 1.40 billion reflects broader industrial use across clean-label categories.

From 2026 to 2034, average annual growth of 4.3% will be driven by innovation in multifunctional and synbiotic cultures. By 2035, the market is projected to reach USD 2.1 billion, supported by regulatory clarity and wider use in non-dairy and shelf-stable functional products.

The industry accounts for varying levels of share within its parent markets, with the most significant presence in the functional food ingredients market, where it accounts for approximately 12-15% due to its widespread use in probiotic-rich and fermented foods. In the fermentation ingredients market, it contributes around 10-12%, as they form a foundational input for fermentation across dairy, beverage, and biotech sectors.

Within the microbial products market, it represents about 8-10%, driven by their role in industrial microbiology and bioprocessing. Their share in the broader food & beverage additives market is smaller, around 4-6%, due to the vast range of other additives. In the biotechnology market, it occupies roughly 3-5%, mostly within pharmaceutical and research applications.

From a supply chain perspective, the market spans a highly integrated process starting with microbial strain identification and cultivation, followed by scale-up fermentation under tightly controlled environments. These cultures are then processed (freeze-dried or liquid), stabilized, and packaged for distribution.

Raw material sourcing (growth media, substrates), R&D, strain banking, and quality control play crucial upstream roles, while downstream segments include distribution to food processors, pharmaceutical companies, or research institutions. Cold-chain logistics and regulatory compliance are critical enablers of consistent supply, especially in the food and pharma sectors. Stakeholders across the value chain, ranging from bio-ingredient suppliers to end-product manufacturers, collaborate closely to maintain efficacy, strain viability, and safety.

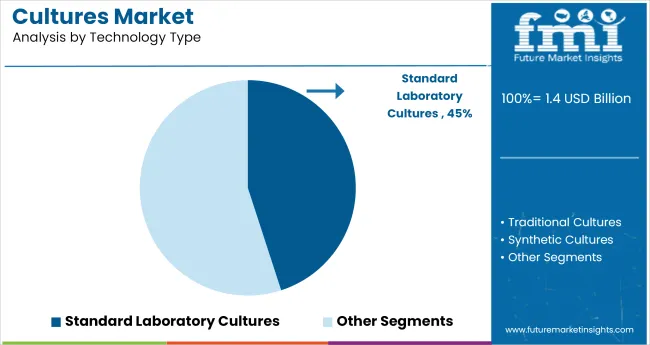

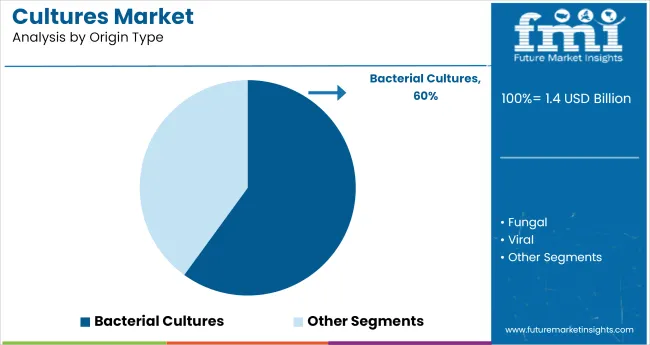

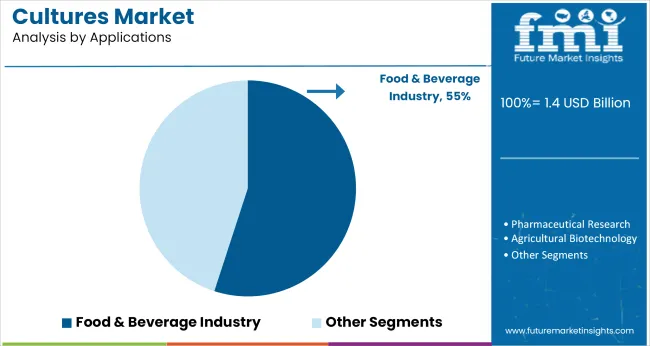

Standard laboratory cultures dominate the market due to their reliability, cost-efficiency, and widespread use in industrial and research settings. Bacterial cultures lead by type, with a 60% share, driven by their versatility in food, pharma, and biotech. The food & beverage industry remains the top application, holding over 55% share, fueled by rising demand for probiotic and clean-label fermented products.

Standard laboratory cultures lead the global market with a projected market share of 45% in 2025, primarily due to their proven reliability, cost-effectiveness, and deep-rooted presence across industrial and research applications.

Bacteria lead the market with a projected 60% market share in 2025, driven by their exceptional versatility, adaptability, and extensive use across food, pharmaceutical, and environmental industries.

Food and beverages lead with over 55% of the total market share in 2025. This dominance is primarily driven by the surging demand for probiotic-rich, fermented, and clean-label products that enhance digestive health, immunity, and wellness.

Strain customization is driving culture market differentiation by improving fermentation efficiency, product stability, and enabling tailored applications, especially in dairy and probiotics. Clean-label trends are accelerating culture adoption as food manufacturers reduce preservatives and enhance consumer trust with natural, live microbial solutions.

Strain Customization Drives Market Differentiation

Global producers are increasingly investing in proprietary microbial strains tailored for specific end-use applications such as enhanced flavor profiles, faster fermentation times, and improved shelf stability. Major culture suppliers in Europe and North America report that over 40% of new client requests in 2024 to 2025 focus on application-specific customization, particularly in dairy and plant-based sectors.

Tailored strains have enabled regional food processors in Southeast Asia to reduce curdling time by 19%, while North American probiotic drink manufacturers recorded a 16% rise in colony-forming unit (CFU) stability over 60-day storage. These functional upgrades are enabling premium positioning, regional taste adaptation, and IP protection for formulators.

Clean-Label Alignment Boosts Culture Adoption Across F&B

Shifting consumer preferences toward clean-label and additive-free products are accelerating the use of natural microbial products for preservation and functional benefits. In 2025, food manufacturers in Germany and Japan reported a 22% reduction in synthetic preservative usage after integrating protective products in fresh dairy and ready-to-eat meals.

Label simplification using "live active cultures" has improved consumer trust scores by 18% in key supermarket audits. This dynamic is particularly evident in plant-based yogurt and kimchi segments, where product developers leverage the product to meet both taste and clean-label criteria without compromising shelf life or safety.

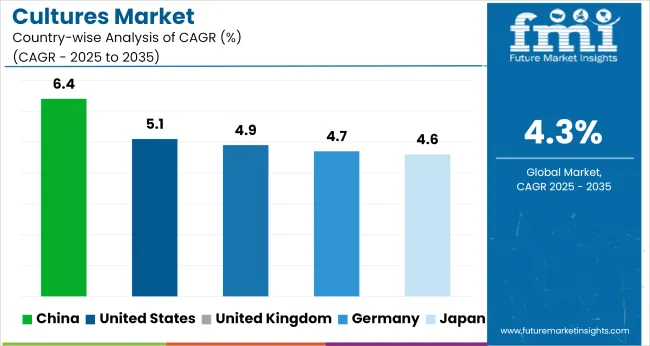

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

| United Kingdom | 4.9% |

| Germany | 4.7% |

| China | 6.4% |

| Japan | 4.6% |

A global CAGR of 4.3%, BRICS countries like Japan and China are expected to outpace the average, posting growth rates of 4.6% and 6.4% respectively. These above-average gains reflect strong demand for customized microbial strains in functional dairy, fermented beverages, and plant-based applications. India is scaling up local strain banks and licensing models for tiered supply contracts, while China is expanding pilot facilities focused on dual-function products for flavor and preservation.

OECD economies are growing below the global average. Germany is projected at 4.7% and the United Kingdom at 4.9%, as regulatory standardization and ingredient cost pressures temper experimentation. These markets are emphasizing yield-stability and shelf-life extension over innovation cycles. ASEAN countries, led by Indonesia and Thailand, are growing near 4.7% with demand tied to regional players producing cost-efficient curd, kombucha, and soy fermentation.

The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The USA culture market stood at 3.9% between 2020 and 2024, and the market is projected to accelerate to a CAGR of 5.1% from 2025 to 2035, driven by customized microbial solutions and rising demand for fermented, functional, and gut-health-focused products. In the 2020 to 2024 period, market growth was steady but hindered by the saturation of conventional dairy and yogurt categories and high reliance on established strains.

After 2024, demand is rising due to innovation, probiotic-enhanced beverages, and the rise of plant-based and hybrid fermented products. Leading USA dairy brands are also expanding their microbial sourcing strategies to enhance product differentiation.

The USA regulatory environment for novel strains has become more streamlined, encouraging faster commercialization cycles and partnerships with academic institutions. Export demand for American-formulated functional dairy products is also helping domestic producers grow faster.

The UK culture market grew at a CAGR of 3.4% from 2020 to 2024, expanding below-average growth due to trade uncertainty and limited innovation investment post-Brexit. From 2025 to 2035, the market is forecast to grow at a significantly improved CAGR of 4.9%, owing to government support for food innovation hubs and expanded consumer demand for clean-label fermented foods.

The 2020 to 2024 period saw limited growth as import/export complexities and regulatory divergence from the EU disrupted the flow of microbial strains and delayed product development. Many local food processors prioritized reformulation over innovation during the COVID and inflation years.

From 2025 onward, the market is projected to rebound, driven by a resurgence in functional yogurt, probiotic drinks, and plant-based fermented alternatives, supported by UK-based culture manufacturers investing in R&D and supply chain localization. Consumers are also more health-conscious, creating stronger tailwinds for products in the health-oriented category.

Germany’s culture market expanded at a modest 3.5% CAGR during 2020 to 2024, slightly behind the global average, mainly due to regulatory conservatism and market saturation in traditional dairy. From 2025 to 2035, the market is expected to grow faster at a CAGR of 4.7%, supported by evolving consumer preferences, rising demand for natural probiotics, and government-led initiatives for bio-based food production.

The earlier period’s lower growth stemmed from slow adoption of new microbial strains, stringent EFSA health claim regulations, and cautious B2B investment in food tech. However, Germany’s robust research infrastructure and cross-collaboration between academia and the private sector are now stimulating the product value chain.

The 2025 to 2035 acceleration will also be fueled by demand for organic fermented foods, vegan yogurt, and cultured cheeses. Export-oriented German producers are also embracing smart fermentation for higher shelf-life and nutrition delivery.

China’s cultural market grew at a robust CAGR of 5.6% from 2020 to 2024, outperforming the global average of 4.3%, supported by rapid urbanization, rising middle-class incomes, and growing awareness of gut health. The market is forecast to climb even higher with a CAGR of 6.4% from 2025 to 2035, as demand intensifies for personalized nutrition, premium probiotic beverages, and domestically developed culture strains.

During the earlier phase, the fast penetration of dairy and yogurt in second-tier cities, along with cross-border e-commerce of functional foods, accelerated demand for the product. By 2025, China is projected to lead in both volume and application diversity, with strong uptake in dairy, plant-based drinks, supplements, and fermented snacks. Local companies are also investing heavily in biotech fermentation infrastructure and indigenous strain development to reduce reliance on imports.

Japan’s cultural market grew at a relatively modest CAGR of 3.3% between 2020 and 2024, constrained by demographic stagnation and a highly saturated dairy segment. The market is forecast to grow at a healthier CAGR of 4.6% between 2025 and 2035, driven by innovation in elderly nutrition, personalized fermented beverages, and bioactive functional foods.

The earlier period’s slow growth was attributed to limited product launches beyond yogurt and miso, coupled with an aging population that decreased per capita consumption. Post to 2025, cultural preferences for wellness and longevity are aligning with new microbiome research to create demand for targeted probiotics and functional fermented beverages.

Japanese manufacturers are also exploring fermentation-based delivery systems for nutraceuticals and cosmeceuticals, opening new B2B and B2C growth opportunities. Collaborations between universities and legacy food companies are fostering next-gen strain development.

In the cultures market, leading companies such as Thermo Fisher Scientific, Merck KGaA, and DuPont de Nemours are advancing through precision strain development, integrated bioprocessing tools, and broad-spectrum culture media portfolios.

Firms like Lonza Group, Sartorius AG, and Danaher Corporation support both industrial and research-grade applications, offering scalability and compliance-driven solutions. These players are leveraging their biotechnology infrastructure and global reach to serve food, pharmaceutical, and environmental sectors with tailored microbial solutions and regulatory-backed innovation.

Mid-tier players, including Sigma-Aldrich, BD, GenScript Biotech, and Bio-Rad Laboratories, are enhancing competitiveness through rapid prototyping, gene synthesis, and robust QC capabilities. Novozymes A/S and Charles River focus on enzymes and biosecurity services, while Promega and Shimadzu are expanding analytical platforms, helping customers meet complex formulation needs.

Recent Cultures Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.4 billion |

| Projected Market Size (2035) | USD 2.1 billion |

| CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Technology Type Analyzed (Segment 1) | Standard Laboratory Cultures, Traditional Cultures, and Synthetic Cultures. |

| Origin Type Analyzed (Segment 2) | Bacterial, Fungal, Viral, Algal, and Protozoan. |

| Applications Analyzed (Segment 3) | Food & Beverage Industry, Pharmaceutical Research, Agricultural Biotechnology, Industrial Biotechnology, Environmental Solutions, and Others. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Thermo Fisher Scientific, Merck KGaA, Sartorius AG, Evonik Industries, Danaher Corporation, Charles River Laboratories, DuPont de Nemours, Lonza Group, Sigma-Aldrich, BD (Becton, Dickinson and Company), GenScript Biotech Corporation, Bio-Rad Laboratories, Promega Corporation, Shimadzu Corporation, and Novozymes A/S |

| Additional Attributes | Dollar sales, share, demand trends by application and region, leading competitors, pricing benchmarks, growth drivers, regulatory outlook, and end-user preferences shaping formulation needs. |

The industry is segmented into standard laboratory cultures, traditional cultures, and synthetic cultures.

The industry is segmented into bacterial, fungal, viral, algal, and protozoan.

The industry finds applications in the food & beverage industry, pharmaceutical research, agricultural biotechnology, industrial biotechnology, environmental solutions, and others.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 1.4 billion in 2025.

It is forecasted to reach USD 2.1 billion by 2035.

The industry is anticipated to grow at a CAGR of 4.3% during this period.

Bacterial cultures are projected to lead the market with a 60% share in 2025.

Asia Pacific, particularly China, is expected to be the key growth region with a projected growth rate of 6.4%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Starter Cultures Market Analysis by Microorganism Type, Type, Form, Growth Temperature, Application, Composition, and Region Through 2035

Ripening Cultures Market Analysis by Type, Form, Application, Distribution Channel, and Region Forecast Through 2035

Specialty Cultures Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Meat Starter Cultures Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Protective Cultures Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA