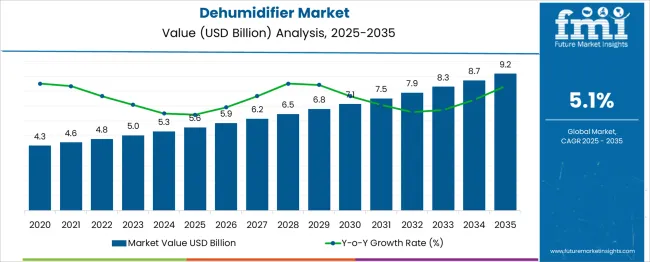

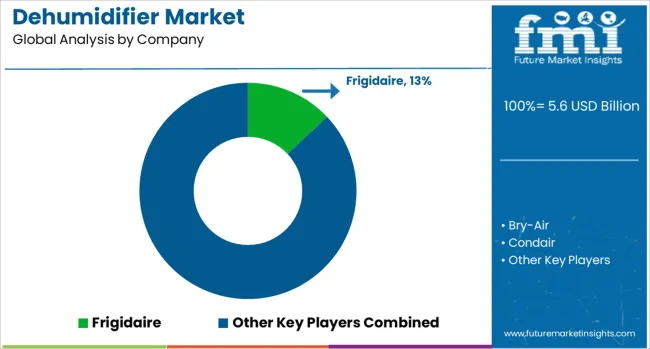

The Dehumidifier Market is estimated to be valued at USD 5.6 billion in 2025 and is projected to reach USD 9.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. This growth is driven by rising awareness of indoor air quality, increased demand in residential and industrial applications, and growing concerns about moisture-related damage and health issues. From 2025 to 2026, the market is expected to grow from USD 5.6 billion to 5.9 billion, marking a YoY growth of approximately 5.4%.

Through 2030, continued urbanization, climate variability, and rising humidity levels in densely populated regions support steady adoption, pushing the market to around USD 6.8 billion. During this phase, annual growth ranges between 5.1% and 5.4%, reflecting consistent demand from both emerging and developed markets. Between 2030 and 2035, the market continues to expand, driven by technological innovations such as energy-efficient and smart dehumidifiers.

Increased usage in commercial buildings, data centers, and healthcare facilities accelerates the trend, pushing the market to USD 9.2 billion by 2035. This year-on-year performance highlights the market’s stable and reliable growth trajectory, with consumer lifestyle changes and industrial quality control needs playing a central role in long-term demand.

| Metric | Value |

|---|---|

| Dehumidifier Market Estimated Value in (2025 E) | USD 5.6 billion |

| Dehumidifier Market Forecast Value in (2035 F) | USD 9.2 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

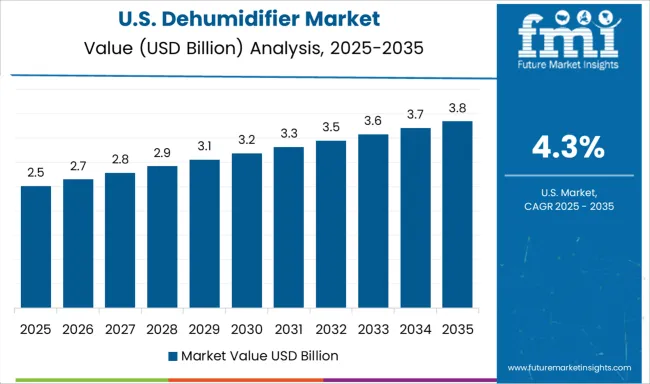

The Dehumidifier market demonstrates a gradual acceleration pattern from 2025 to 2035, characterized by consistent year-on-year gains with mild increases in annual absolute growth, but no sharp inflection points or major slowdowns. From 2025 to 2030, the market grows from USD 5.6 billion to 6.8 billion, adding around USD 0.3 to 0.4 billion annually. This period reflects stable early-stage acceleration, driven by increased consumer demand for home comfort systems, particularly in humid and flood-prone regions. Urbanization, awareness about mold and allergens, and expanding residential construction in Asia-Pacific and North America contribute to this steady climb. Between 2030 and 2035, the market sees a slightly higher pace of acceleration, with annual increments rising from USD 0.4 billion to 0.5 billion. This shift is driven by broader adoption in commercial and industrial sectors such as food processing, data centers, and pharmaceuticals, where humidity control is critical. Additionally, energy-efficient and smart-connected dehumidifiers spur replacement demand in mature markets. While the growth is not explosive, the dehumidifier market maintains a healthy and slowly accelerating trajectory, with no significant deceleration observed across the forecast period. The pattern reflects a mature yet expanding market, supported by both residential upgrades and expanding industrial use cases.

The dehumidifier market is registering sustained expansion, driven by rising awareness of indoor air quality, increasing incidences of moisture-related damage, and rapid urbanization in high-humidity regions. Growing consumer health consciousness and concerns over mold, dust mites, and allergens are pushing residential and commercial segments to adopt efficient humidity control systems.

The construction of airtight, energy-efficient buildings has also increased demand for proper humidity regulation. Technological improvements such as quieter motors, energy-efficient compressors, and smart control features are enhancing product appeal.

Governments in humid-climate regions are encouraging better building ventilation and environmental comfort standards, indirectly supporting demand for dehumidification units. The market is also being shaped by rising e-commerce availability, growing DIY adoption, and increased use in warehouses, data centers, and healthcare environments where moisture control is mission-critical

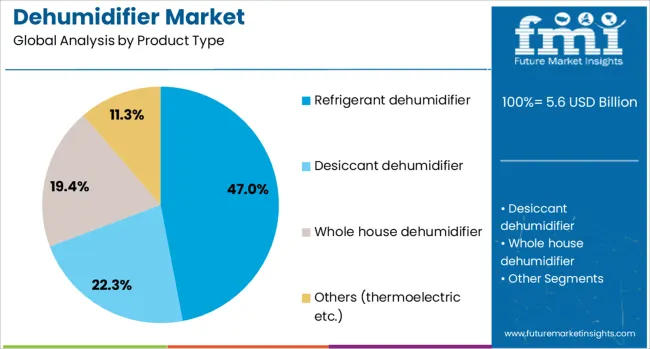

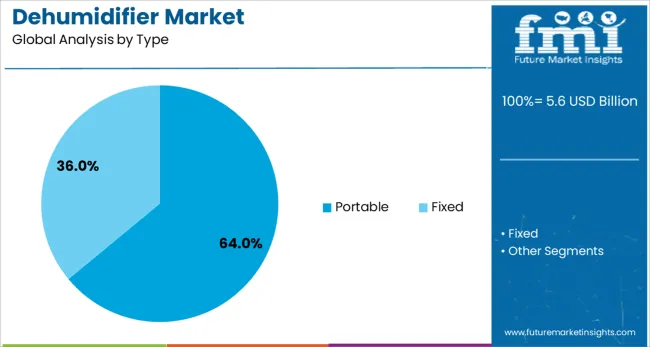

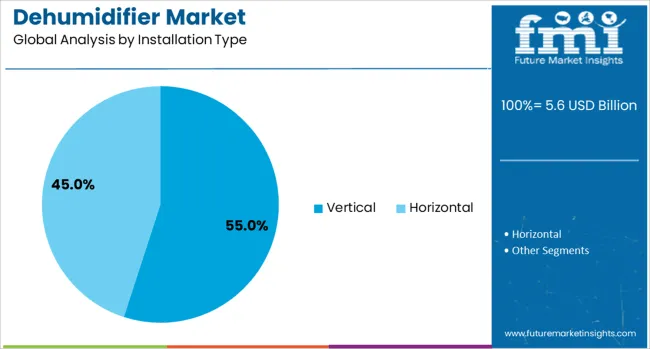

The dehumidifier market is segmented by product type, installation type, coverage area, moisture removal capacity, end user, and geographic regions. By product type, the dehumidifier market is divided into Refrigerant dehumidifiers, Desiccant dehumidifiers, whole-house dehumidifiers, and Others (thermoelectric, etc.). In terms of type, the dehumidifier market is classified into Portable and Fixed. Based on the installation type, the dehumidifier market is segmented into Vertical and Horizontal. The coverage area of the dehumidifier market is segmented into 1501 to 2000 sq. ft, Below 1500 sq. ft, 2001 to 3000 sq. ft, 3001 to 4000 sq. ft, and Above 4000 sq. ft. By moisture removal capacity of the dehumidifier market is segmented into 51 to 100 pt, Less than 50 pt, 101 to 150 pt, and Above 151 pt. The end users of the dehumidifier market are segmented into Residential, Commercial, and Industrial. Regionally, the dehumidifier industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Refrigerant dehumidifiers are expected to contribute 47.0% of the total revenue share in the market by 2025, making them the leading product type segment. This leadership is attributed to their higher energy efficiency and superior performance in moderate to high humidity conditions, which aligns with the needs of both residential and commercial users.

The technology's proven effectiveness in removing large moisture volumes per day and compatibility with programmable thermostats has supported widespread adoption. Manufacturing advancements have reduced noise levels and bulk, while enhancing refrigerant efficiency to comply with environmental regulations.

These systems are increasingly favored for applications requiring high-capacity moisture extraction in climate-controlled zones such as basements, warehouses, and laboratories. Their affordability and scalability across small and large spaces have further contributed to segment dominance

Portable dehumidifiers are projected to hold 64.0% of the total market revenue in 2025, establishing them as the dominant product type by usability. This segment’s prominence is underpinned by ease of mobility, plug-and-play convenience, and suitability for multi-room usage.

Increased consumer preference for low-maintenance and cost-effective moisture management has led to a sharp rise in portable unit installations in households and small offices. The lack of permanent installation or ducting makes them ideal for renters and temporary setups.

Compact designs with caster wheels, automatic shut-off, and digital humidity sensors are contributing to wider market acceptance. As seasonal humidity variations intensify, portable solutions are being viewed as flexible tools for localized comfort and mold prevention

Vertical installation is anticipated to account for 55.0% of the dehumidifier market revenue in 2025, leading over other configurations. This configuration’s popularity is being supported by its space-efficient footprint, which is particularly well-suited for areas with limited horizontal space such as closets, corners, and equipment rooms.

Manufacturers are favoring vertical designs to meet growing consumer demand for units that fit seamlessly into residential and commercial environments without compromising capacity. Additionally, vertical orientation improves air intake and outflow directionality, enhancing overall operational efficiency.

As demand increases for aesthetic and space-saving indoor air solutions, the vertical installation model continues to gain traction across both developed and emerging markets

The dehumidifier market is experiencing steady growth driven by rising awareness of indoor air quality, moisture control, and property protection. These appliances are gaining popularity in both residential and commercial settings, especially in areas with high humidity. Demand is influenced by consumer preference for compact, low-noise, and energy-efficient models. Product reliability, ease of use, and long-term performance are key buying considerations. While growth is strong, supply challenges, maintenance needs, and regional compliance issues shape how brands position themselves in a competitive environment.

Many buyers underestimate the maintenance requirements of dehumidifiers, leading to dissatisfaction over time. Filters need cleaning, tanks require regular emptying, and coils must be checked to avoid performance drops. Lack of awareness about humidity levels or incorrect usage often limits efficiency. In commercial settings, misuse or neglect can lead to mold growth or system wear. Brands that provide user-friendly guides, smart alerts, and responsive service networks gain loyalty by addressing post-purchase challenges and reducing the risk of improper handling.

A growing number of consumers are purchasing dehumidifiers to manage dampness, protect stored items, and improve indoor comfort. Basements, bathrooms, laundry areas, and bedrooms are frequent zones of concern. Mold prevention, odor reduction, and reduced allergy triggers are often key motivators. In commercial buildings, storage spaces, data centers, and food processing areas are also adopting fixed units to maintain stable environments. As more people recognize the link between moisture control and health or asset protection, interest in smart and quiet models is expanding.

Regulatory guidelines for dehumidifiers vary significantly by region, particularly regarding energy labeling, refrigerant use, and appliance safety. Some markets require third-party testing before retail sale, while others have evolving rules around chemical components and disposal. These differences can cause confusion or delay product entry. Vendors must navigate changing approval processes and ensure compliance with both environmental and consumer safety standards. Companies that invest in region-specific documentation and offer clear product labeling improve their ability to meet regulatory expectations without market disruption.

Production of dehumidifiers relies on compressors, coils, fans, and sensors, many of which are imported from specialized suppliers. Disruptions in supply chains, component delays, or increased shipping costs can impact product availability and lead times. In particular, seasonal demand spikes may overwhelm logistics planning. Manufacturers that secure alternate sourcing, maintain parts inventories, and communicate expected timelines transparently are better prepared to respond to market needs. These efforts also reduce the risk of backorders or negative customer sentiment during high-demand periods.

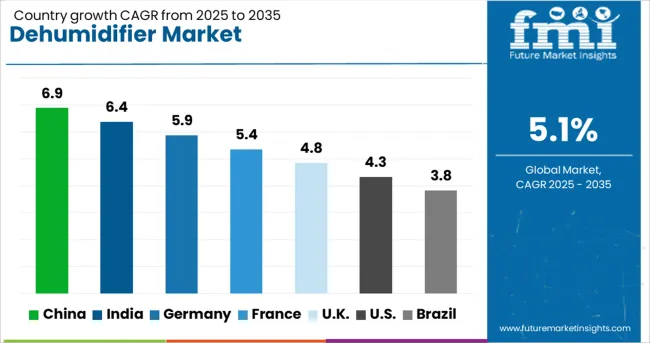

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global dehumidifier market is projected to grow at a CAGR of 5.1% through 2035, supported by rising concerns over indoor air quality, humidity control, and energy-efficient climate systems. Among BRICS nations, China leads with 6.9% growth, driven by robust manufacturing capabilities, growing residential demand, and expansion in commercial HVAC systems. India follows at 6.4%, fueled by increasing urbanization, monsoon-related humidity challenges, and adoption in healthcare and hospitality sectors. Within the OECD region, Germany reports 5.9% growth, reflecting technological innovation, energy efficiency regulations, and use in industrial applications. The United States, a mature market growing at 4.3%, emphasizes smart home integration, environmental standards, and product reliability. These countries showcase varied drivers from infrastructure needs to sustainability goals shaping global market dynamics. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Across China, the rising demand for better indoor air quality and humidity control has driven the dehumidifier market to grow at a CAGR of 6.9%. In cities like Guangzhou and Shenzhen, known for high humidity levels, homeowners and businesses alike are investing in efficient moisture control solutions. The industrial sector particularly electronics and pharmaceuticals requires precise humidity regulation, pushing adoption in factory floors and clean rooms. Local appliance manufacturers are innovating with smart, multifunctional dehumidifiers that also purify air and adapt to changing weather conditions. Online platforms like JD.com and Tmall have made high-tech models accessible to a broader consumer base, while real estate developers are adding centralized systems in high-rise residential complexes. Government-backed efforts to improve indoor environments in schools and offices are also driving long-term demand.

In India, the push toward healthier homes and workplaces is driving notable growth in the dehumidifier sector, with a CAGR standing at 6.4%. Coastal and monsoon-heavy regions such as Kerala, West Bengal, and Tamil Nadu are seeing increasing demand from families looking to prevent dampness and mold in apartments. Educational institutions, hospitals, and hospitality spaces are also stepping up installations to comply with indoor environment safety protocols. Furthermore, data centers and biotech labs are emerging as high-volume buyers due to their strict humidity requirements. Indian consumers are opting for compact, energy-efficient units that can serve dual purposes—such as drying clothes indoors during extended rainy seasons. Affordable models from both domestic and international brands are becoming more common across retail and e-commerce platforms.

In Germany, a country known for its attention to engineering and environmental balance, the dehumidifier market is growing steadily with a CAGR of 5.9%. Towns with older architecture and frequent rainfall such as Hamburg and Cologne are experiencing widespread adoption of dehumidifiers to combat mold and dampness. Historic museums, libraries, and galleries are investing in precision dehumidification systems to preserve valuable artifacts and documents. On the residential side, energy-conscious homeowners are choosing silent, automated units designed to integrate with passive housing systems. The manufacturing sector also utilizes industrial-grade units in areas where product quality depends on controlled humidity. Sustainability and compliance with EU energy efficiency directives are central themes in both product design and consumer choice.

Across the United Kingdom, the dehumidifier market is experiencing upward momentum, growing at a CAGR of 4.8%. The country’s naturally damp climate, especially in coastal areas and older brick homes, makes moisture control a recurring necessity. British households are investing in modern dehumidifiers not only to combat mold but also to dry laundry indoors more efficiently. Local councils and housing associations are increasingly deploying units in public housing to meet tenant wellness standards. The integration of dehumidifiers in home retrofitting programs often bundled with ventilation and insulation upgrades is also growing. On the commercial side, schools, libraries, and healthcare buildings are adopting compact systems for improved environmental health. Consumer preferences lean toward quiet, stylish, and energy-certified models that blend seamlessly into contemporary living spaces.

In the United States, the demand for dehumidifiers continues to climb, with a CAGR of 4.3%, largely driven by climate variability and indoor air quality awareness. The Southeast, including Florida and Georgia, remains a hotspot for residential dehumidifier sales due to consistently high humidity and hurricane-related moisture issues. Large homes with basements often install whole-house or crawl-space systems to prevent mold and improve energy efficiency. The commercial segment is seeing strong adoption in agriculture, indoor cannabis cultivation, and archival storage. Advanced models featuring app connectivity, remote monitoring, and integration with HVAC systems are gaining popularity, especially in smart homes. Post-flood restoration services and insurance-driven installations have also contributed to the rise in short-term rentals of industrial-grade dehumidifiers.

The 5-Isopropyl-m-xylene market is a niche segment within the broader aromatic hydrocarbons and specialty intermediates industry, serving applications in organic synthesis, material science, and pharmaceutical R&D. This compound, valued for its unique substituted xylene structure, is primarily used in research environments and as a chemical intermediate in fine chemical development. The dehumidifier market serves a wide range of end-users from residential households to large-scale industrial and commercial facilities where controlling indoor humidity is essential for comfort, health, and equipment longevity. Market dynamics are influenced by climatic conditions, building designs, and indoor air quality requirements, with suppliers offering portable units, whole-house systems, and industrial-grade solutions tailored to varying capacity needs and operating environments.

Frigidaire, Whirlpool, GE Appliances, LG Electronics, and Electrolux dominate the residential and light-commercial segments with plug-and-play models designed for ease of use, low maintenance, and energy efficiency. These companies compete on design, user interface, water tank capacity, and integration with smart home systems. Honeywell, Hisense, Midea, and Sharp also serve this space, with a focus on affordability and broad retail distribution networks. In the industrial and commercial space, companies like Munters, Bry-Air, Condair, DST America, and Therma-Stor offer high-performance units designed for warehouses, data centers, and manufacturing plants.

These systems are known for their continuous operation capabilities, custom airflow configurations, and ability to manage moisture under strict environmental controls. Regional specialists like Panasonic and EMEA-based suppliers complement the landscape by offering solutions that bridge both residential and commercial needs. As adoption grows across both mature and emerging markets, suppliers delivering durability, noise control, and adaptable moisture management retain a competitive edge.

As mentioned in LEGO’s official announcement on July 10, 2025, the company unveiled the LEGO Icons Transformers Soundwave set, featuring 1,505 pieces, a functioning cassette bay, and sound effects. The set launches August 1 for LEGO Insiders and August 4 publicly. As mentioned in Hasbro’s presentation at Toy Fair 2025, the company introduced Nano‑mals interactive sensory-focused electronic pets. Launching globally in Fall 2025 at USD 19.99, the toys feature lights, over 70 sounds, and textures, encouraging imaginative play and multi-unit interaction for children.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.6 Billion |

| Product Type | Refrigerant dehumidifier, Desiccant dehumidifier, Whole house dehumidifier, and Others (thermoelectric etc.) |

| Type | Portable and Fixed |

| Installation Type | Vertical and Horizontal |

| Coverage Area | 1501 to 2000 sq. ft, Below 1500 sq. ft, 2001 to 3000 sq. ft, 3001 to 4000 sq. ft, and Above 4000 sq. ft |

| Moisture Removal Capacity | 51 to 100 pt, Less than 50 pt, 101 to 150 pt, and Above 151 pt |

| End User | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Frigidaire, Bry-Air, Condair, DST America, Electrolux, GE Appliances, Hisense, Honeywell, LG Electronics, Midea, Munters, Panasonic, Sharp, Therma-Stor, and Whirlpool |

The global dehumidifier market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the dehumidifier market is projected to reach USD 9.2 billion by 2035.

The dehumidifier market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in dehumidifier market are refrigerant dehumidifier, desiccant dehumidifier, whole house dehumidifier and others (thermoelectric etc.).

In terms of type, portable segment to command 64.0% share in the dehumidifier market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dehumidifier Market Size and Share Forecast Outlook 2025 to 2035

Portable Dehumidifiers Market Analysis & Forecast by Type, Power, Capacity, Application, Sales channels and region (2025 to 2035)

Desiccant Dehumidifiers Market Size, Growth, and Forecast 2025 to 2035

Hearing Aid Dehumidifier Market

Air Humidifier and Dehumidifier Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA