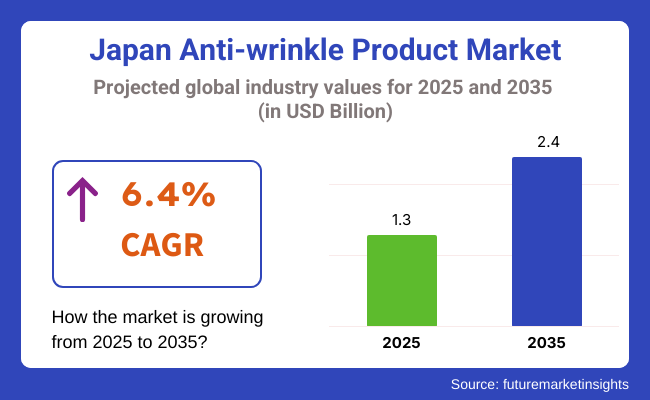

The Japan anti-wrinkle product market is poised to register a valuation of USD 1.3 billion in 2025. The industry is slated to grow at 6.4% CAGR from 2025 to 2035, witnessing USD 2.4 billion by 2035. The market growth has been driven by a number of important factors, all of which are consistent with the country's demographic profile, cultural inclinations, and innovations in skincare science.

Among these, one of the most influential is Japan's aging population. With one of the world's highest life expectancies, Japan boasts a huge and increasing elder consumer segment that is extremely age-conscious and looking for ways to keep their skin looking young.

With the increasing population above the age of 65 years, there has been a growing need for anti-aging and anti-wrinkle treatments that help combat skin issues caused by aging, such as sagging, wrinkles, and loss of skin elasticity.

Another growth driver is the prevalence of very strong culture toward beauty and skin care. Japanese society attaches great importance to looking young, and skincare regimens form part of the daily routines for many people. The nation's beauty market is renowned for its precision in skincare, with great emphasis on both innovation and effectiveness.

Anti-wrinkle creams are formulated with the latest technology, frequently combining components like collagen, hyaluronic acid, and herbal extracts, which are recognized for their skin-renewing properties. Japanese consumers are extremely particular regarding skincare products, which has driven ongoing improvements and high standards of anti-aging treatments.

The expansion of online retail and e-commerce has brought about greater accessibility for anti-wrinkle products among a wider segment of consumers. With the advantage of home shopping and easy comparisons across brands and products, Japanese consumers are keener to look into new solutions and spend money in high-quality skincare products.

Also, heightened concern about skincare importance, fuelled by beauty bloggers and social media influencers, has sped up the demand for anti-wrinkle solutions from various age segments. This intersection of demographic, cultural, and technological conditions is driving the growth of Japan's anti-wrinkle product market.

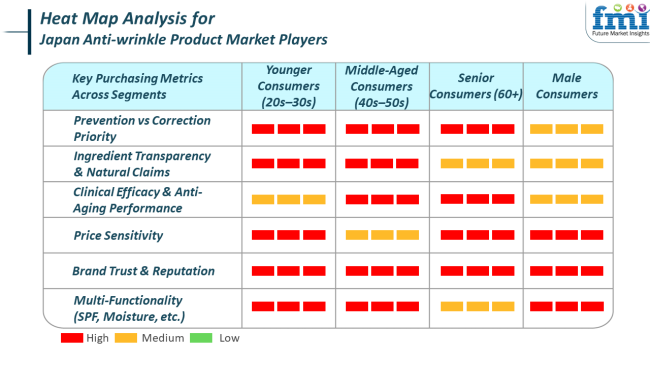

The market for anti-wrinkle products is experiencing different trends in different end-use segments that are being motivated by lifestyle and demographic reasons. Young consumers (usually aged 20s to 30s) are showing greater concern about prevention than about correction and instead opt for more light, natural products containing elements such as antioxidants and peptides to enhance skin quality and slow signs of aging.

Conversely, older consumers (50+ years) have the stronghold in the market for targeted anti-wrinkle solutions, looking for sophisticated solutions to deeper wrinkles, sagging, and age spots. They prefer clinically tested, high-performance formulas, typically featuring ingredients like retinol, hyaluronic acid, and collagen.

The men's skincare category is also on the rise, with men turning to multifunctional anti-wrinkle products that offer moisturizing, anti-aging, and sun protection in a single, easy-to-use package. In terms of purchasing, each segment values different criteria. Younger consumers consider ingredients and product transparency, with a bias for natural, environmentally friendly formulations.

Older consumers value effectiveness and evident results, while many choose traditional brands and dermatologist-approved products. Easy-to-use packaging and calming skin-friendly formulations are also priorities for this group. Men's tastes are towards functional, hassle-free products with clear, down-to-earth packaging.

Across segments, the popularity of anti-wrinkle products is driven most significantly by personal needs, with a focus on product effectiveness, usability, and the particular benefits for which each group looks when choosing a skincare routine.

Between 2020 and 2024, the anti-wrinkle product market has witnessed some major changes, primarily due to alterations in consumer trends, improvements in technology, and general societal movements. Among the most fundamental changes has been more emphasis on sustainability and clean beauty.

Consumers have become more aware of the ingredients in their skin care products, seeking natural, cruelty-free, and eco-friendly products. This change has made brands evolve, using plant-based ingredients, biodegradable packaging, and cleaner production processes.

In addition, the e-commerce revolution has altered the pattern of shopping for anti-wrinkle products, with increased online purchases and direct-to-consumer business growth. Social media and influencer marketing have also played a key role in driving consumer preferences and propelling the growth of new products.

Forward to 2025 to 2035, the market for anti-wrinkle products will continue to develop with technology, personalization, and increased knowledge of skin science.A major future trend is the use of artificial intelligence and customized skincare.

Brands will increasingly provide more customized solutions, using AI to scan individual skin types and prescribe particular anti-aging products. In addition, the emphasis will shift from wrinkle reduction to encompassing global skin health strategies, e.g., enhancing skin barrier function and overall rejuvenation.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Throughout this time, there was a tremendous increase in demand for clean and sustainable beauty products, with customers giving importance to natural, cruelty-free ingredients and sustainable packaging. Brands embraced greener production and product formulation practices. | By 2025 to 2035, AI and machine learning integration will allow brands to provide hyper-personalized skincare solutions. Customers will utilize AI-powered tools to examine skin conditions and get personalized anti-wrinkle products, thus making skincare routines more accurate and efficient. |

| The pandemic catalyzed e-commerce growth, with increasing number of consumers buying anti-wrinkle products online. The era was marked by the growth of direct-to-consumer models and influencer marketing, fueling sales and discovery. | The future decade will find the growth of at-home devices like LED masks, microcurrent devices, and other high-technology devices intended to maximize the efficacy of topical anti-wrinkle products. These devices will be an everyday part of skin care routines. |

| Social media and influencers played a major role in influencing consumer choices, with beauty influencers leading trends and product endorsements. This resulted in fast adoption of new anti-aging products. | During 2025 to 2035, the market will be more concerned with overall skin health, going beyond wrinkle reduction to encompass overall skin rejuvenation, strengthening the skin barrier, and increasing skin vitality. Products will be formulated to support healthier, younger-looking skin at every level. |

| The COVID-19 pandemic resulted in increased self-care practices, where more people have spent money on skincare as part of well-being while in lockdowns. Anti-wrinkle creams experienced booming demand during these times. | A greater trend will be towards gender-inclusive and gender-neutral skincare products. There will be more anti-wrinkle products offered that are all skin types, tones, and inclinations by brands, depicting a wider, more diverse interpretation of beauty. |

The Japanese anti-wrinkle product market, although growing steadily,witnesses risks. The main problem is market saturation and fierce competition. Japan boasts a mature skincare market with a myriad of domestic and foreign brands contesting market share.

This intense competition deters new players from entering the market and exerts a pressure on incumbent brands to innovate and differentiate their products continually. Furthermore, the expectations of consumers in Japan are very high regarding product quality, effectiveness, and safety, so any blunder-formulation, branding, or marketing-wise-can immediately destroy trust and influence brand reputation.

In Japan, creams and moisturizers are the best-selling and most favored form of anti-wrinkle products. This can be attributed to both the cultural skincare rituals and the particular requirements of the aging population. Japanese customers tend to adopt multi-step skincare routines, with moisturizers and creams at the core of the process, hydrating and guarding the skin.

These products are commonly seen as being needed to preserve skin elasticity and ward off the appearance of fine lines and wrinkles. In addition, Japanese consumers prefer products that provide both instant hydration and long-term anti-aging effects, which creams and moisturizers are optimally formulated to provide.

These products are rich in high-performance ingredients such as hyaluronic acid, retinol, and collagen-substances that are very effective in dealing with age-related skin issues. Cleansers, though necessary in the broader skincare routine, are widely less dominant within the anti-wrinkle segment since they are generally washed off and not designed to provide long-term anti-aging benefits.

Yet, anti-aging facial cleansers and light cleansing oils are drawing focus for their skin barrier protective benefits, particularly among older consumers with dry or sensitive skin. Nonetheless, these tend to be considered supplementary to leave-on products such as creams, and not standalone solutions for wrinkles.

In Japan, herbal and natural anti-wrinkle products are highly popular in the market and widely available because they fit into traditional Japanese beauty philosophies and consumer tastes. Japanese skincare culture has long accepted the concept of mild, skin-friendly ingredients from nature-like green tea, rice bran, camellia oil, and seaweed-which are renowned for their antioxidant and rejuvenating properties.

They not only are viewed as effective but are also perceived to be familiar and culturally congruent, re-affirming the trust on consumers. Consumers in Japan correlate herbal or natural formulation with purity, safety, and fewer side effects, making them particularly essential for anti-aging products where users will stay committed for several years. Accordingly, brands using natural extracts and ancient ingredients resonate effectively with customers to this date.

Japan anti-wrinkle skincare market is a vibrant mix of long-standing multinational players and niche entrepreneurial players, both serving the changing needs of an increasingly aged and skincare-focused consumer base. As one of the most advanced skincare markets in the world, Japan provides rich potential for both legacy beauty companies and upstart specialist players.

Multinational behemoths like Kao Corporation, Procter & Gamble, and Beiersdorf AG lead the pack with their sophisticated product portfolios, scientific breakthroughs, and robust brand value. These firms generally provide anti-aging creams, serums, and moisturizers that are scientifically designed to minimize wrinkles, stimulate collagen growth, and enhance skin texture, while still having mass appeal through established retail and online channels.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Pola Orbis Holdings Inc | 15-20% |

| Kao Corporation | 8-12% |

| FANCL Corporation | 5-7% |

| Procter & Gamble (SK-II) | 6-9% |

| DECENCIA Inc. | 3-5% |

| Beiersdorf AG | 4-6% |

| Henkel AG | 2-4% |

| Clarins Group | 3-4% |

| Avon Products Inc. | 2-3% |

| Allergan PLC | 2-3% |

| ARK Skincare | 1-2% |

| Alma Secret Company | 1-2% |

| Biomod Concepts, Inc. | 1-2% |

| Company Name | Key Offerings/Activities |

|---|---|

| Pola Orbis Holdings Inc | A market leader in high-end anti-wrinkle care, with "Wrinkle Shot", Japan's first authority-approved quasi-drug anti-wrinkle product. POLA brands specialize in penetration serums and long-term wrinkle alleviation. |

| Kao Corporation | It provides functional anti-aging skin care through the Curél and Sofina brands, emphasizing barrier restoration, moisturization , and protection against fine lines. It has robust R&D and mass availability. |

| FANCL Corporation | Recognized for preservative-free skin care; their anti-wrinkle lines feature vitamin C derivatives and collagen boosters, targeting sensitive-skin consumers. |

| Procter & Gamble (SK-II) | Sells luxury anti-aging skin care featuring PITERA™, a bio-ingredient that minimizes wrinkles and enhances radiance. Upscale, science-driven brand favored by mature consumers. |

| DECENCIA Inc. | A subsidiary of POLA Orbis focusing on hypoallergenic anti-aging products, with deep hydration and anti-inflammatory properties suitable for sensitive or reactive skin. |

| Beiersdorf AG | With its NIVEA and Eucerin brands, Beiersdorf offers affordable anti-wrinkle offerings that balance price with effectiveness. Widely accepted among consumers looking for daily moisturizers that exhibit firming action. |

| Henkel AG | Provides anti-aging products through its beauty care division, such as serums and night treatments, that aim to restore suppleness and minimize deep wrinkles. Powerful in drugstore channels. |

| Clarins Group | Luxury skincare company with plant-based anti-aging products, including the Double Serum and Extra-Firming brands. Targets consumers who prefer natural but effective anti-wrinkle solutions. |

| Avon Products Inc. | Provides affordably priced anti-aging products like the Anew brand, targeting middle-aged women. Recognized for using retinol and peptides in affordable formats. |

| Allergan PLC | Well-known for its clinical wrinkle-reducing products, including topical forms of its aesthetics products (e.g., Botox-alternative creams) and dermatologist-recommended brands. |

| ARK Skincare | UK brand providing age-specific anti-wrinkle products with bioactive peptides and antioxidants. Aims at educated, ingredient-conscious consumers seeking a holistic solution. |

| Alma Secret Company | Spanish natural skincare company providing anti-aging creams containing botanical extracts, vitamins, and hyaluronic acid. Targets consumers seeking clean and sustainable skincare. |

The Japanese anti-wrinkle skincare market is mature and rapidly evolving, driven by a culturally embedded skincare ritual, an aging population, and a consumer base that is both ingredient-aware and trend-aware.

Long-standing giants such as PolaOrbis, Kao, and Procter & Gamble continue to dominate with scientific innovation, trusted formulas, and wide product ranges that appeal to a wide range of consumers-from the everyday drugstore shopper to the luxury beauty aficionado. These firms bank on brand allegiance, high-performance ingredients, and long-standing consumer confidence.

In terms of product type, the market is classified into creams & moisturizers, cleansers, and other products.

With respect to nature, the industry is classified into natural/herbal, synthetic, and organic.

Based on end-user, the industry is bifurcated into men and women.

By sales channel, the industry is classified into pharmacies, specialty outlets, supermarkets/hypermarkets, convenience stores, beauty stores, e-retailers, and others.

Based on region, the market is classified into Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and the rest of Japan.

The industry is expected to reach USD 1.3 billion in 2025.

The industry is projected to witness USD 2.4 billion by 2035.

The industry is projected to witness 6.4% CAGR during the study period.

Creams & moisturizers are widely purchased.

Leading companies include Kao Corporation, FANCL Corporation, Procter & Gamble, Pola Orbis Holdings Inc, DECENCIA Inc., ARK Skincare, Alma Secret Company, Allergan PLC, Clarins Group, Biomod Concepts Inc., Beiersdorf AG, Henkel AG, and Avon Products Inc.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Region, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 11: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 12: Kanto Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 13: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 14: Kanto Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 15: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 16: Kanto Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 17: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 18: Kanto Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 19: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 20: Chubu Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 21: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 22: Chubu Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 23: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 24: Chubu Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 25: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 26: Chubu Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 27: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 28: Kinki Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 29: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 30: Kinki Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 31: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 32: Kinki Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 33: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 34: Kinki Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 35: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 36: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 37: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 38: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 39: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 40: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 41: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 42: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 43: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 44: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 45: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 46: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 47: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 48: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 49: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 50: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 51: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 52: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 53: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 54: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 55: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 56: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 57: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 58: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Region, 2018 to 2033

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 11: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 15: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 19: Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 23: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 26: Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 27: Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 28: Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 29: Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 31: Kanto Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 32: Kanto Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 33: Kanto Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 34: Kanto Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 35: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 36: Kanto Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 37: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 38: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 39: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 40: Kanto Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 41: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 42: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 43: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 44: Kanto Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 45: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 46: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 47: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 48: Kanto Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 49: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 50: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 51: Kanto Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 52: Kanto Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 53: Kanto Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 54: Kanto Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 55: Chubu Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 56: Chubu Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 57: Chubu Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 58: Chubu Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 59: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 60: Chubu Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 61: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 62: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 63: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 64: Chubu Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 65: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 66: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 67: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 68: Chubu Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 69: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 70: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 71: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 72: Chubu Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 73: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 74: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 75: Chubu Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 76: Chubu Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 77: Chubu Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 78: Chubu Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 79: Kinki Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 80: Kinki Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 81: Kinki Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 82: Kinki Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 83: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 84: Kinki Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 85: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 86: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 87: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 88: Kinki Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 89: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 90: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 91: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 92: Kinki Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 93: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 94: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 95: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 96: Kinki Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 97: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 98: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 99: Kinki Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 100: Kinki Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 101: Kinki Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 102: Kinki Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 103: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 104: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 105: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 106: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 107: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 108: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 109: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 110: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 111: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 112: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 113: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 114: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 115: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 116: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 117: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 118: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 119: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 120: Kyushu & Okinawa Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 121: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 122: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 123: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 124: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 125: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 126: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 127: Tohoku Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 128: Tohoku Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 129: Tohoku Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 130: Tohoku Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 131: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 132: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 133: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 134: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 135: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 136: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 137: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 138: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 139: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 140: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 141: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 142: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 143: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 144: Tohoku Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 145: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 146: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 147: Tohoku Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 148: Tohoku Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 149: Tohoku Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 150: Tohoku Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 151: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 152: Rest of Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 153: Rest of Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 154: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 155: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 156: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 157: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 158: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 159: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 160: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 161: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 162: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 163: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 164: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 165: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 166: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 167: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 168: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 169: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 170: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 171: Rest of Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 172: Rest of Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 173: Rest of Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 174: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Structured Product Label Management Market Outlook – Size, Share & Innovations 2025-2035

Japan Hyaluronic Acid Products Market Analysis – Growth, Applications & Outlook 2025-2035

Japan Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Professional Hair Care Products in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Tracheal Tubes and Airway Products in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Bagasse Tableware Product in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Product Tour Software for SaaS Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Product Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA