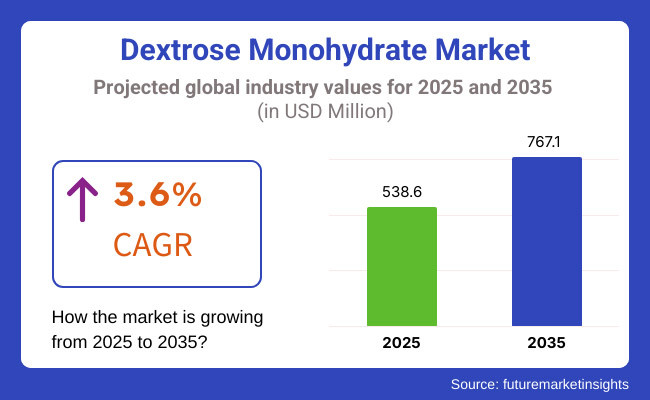

The global dextrose monohydrate market is currently valued at around USD 538.6 million in 2025, and is anticipated to progress at a CAGR of 3.6% to reach USD 767.1 million by 2035.

This projected trajectory underscores a moderate but consistent demand shift toward cost-effective sweetening and texturizing agents, particularly within the processed food and nutraceutical sectors. Industry stakeholders have observed that dextrose monohydrate’s dual functionality-as both an energy source and a formulation stabilizer-continues to anchor its relevance across multiple value chains, especially in food manufacturing, pharmaceuticals, and beverages.

Notably, the food and beverage industry is positioned as the largest consumer base, commanding over 41.2% market share in 2025. This dominance is not arbitrary-it has been largely influenced by formulators seeking more predictable and scalable sweetening alternatives amid fluctuating sucrose prices and increasing consumer aversion toward artificial sweeteners.

Furthermore, global food processors have shown greater inclination toward clean-label and GRAS-certified ingredients, placing dextrose monohydrate in a favorable light due to its well-established safety profile and digestibility.

Several manufacturers are also leveraging the ingredient's technical advantages such as high solubility, rapid fermentability, and low hygroscopicity to enhance shelf-life and consistency in applications ranging from sports nutrition and tablets to sauces, bakery fillings, and confections. Additionally, the surge in glucose-based IV solutions and tablet formulations has bolstered demand from the pharmaceutical domain, further widening the market’s footprint.

Although the projected CAGR is not exponential, the market has demonstrated resilience against macroeconomic pressures and raw material volatility. Industry leaders such as Cargill, Ingredion, Roquette, and Tereos have continued to invest in optimized processing capabilities and regional distribution networks to support tailored customer formulations, thereby consolidating their market share and product portfolios.

By 2035, this moderately expanding landscape is expected to become more innovation-driven, with applications aligning more closely with evolving consumer expectations for transparent, functional, and formulation-efficient ingredients.

The food and beverage segment accounts for the largest share of the global dextrose monohydrate market at 41.2% in 2025, supported by a steady CAGR of 3.6% through 2035. This segment has remained the anchor of demand, driven by cost-efficiency imperatives and the continued shift toward formulation transparency across processed food categories.

Dextrose monohydrate has been favored by formulators seeking consistency, clean-label compatibility, and broad functional benefits-especially as pressure mounts to replace artificial sweeteners and manage ingredient costs amid volatile sucrose pricing.

Its widespread adoption in food and beverage processing reflects not only its energy-yielding potential but also its capacity to enhance stability, solubility, and shelf-life performance. These benefits remain critical in scaling processed food production while ensuring flavor, texture, and regulatory compliance.

Over the coming decade, global food manufacturers are expected to deepen reliance on dextrose monohydrate as part of their formulation toolkit, especially in regions where price sensitivity and reformulation cycles are accelerating.

Moreover, as interest rises in low-GI and functional carbohydrate blends, opportunities may emerge to reposition dextrose monohydrate through co-ingredient strategies. Its strategic position is therefore likely to shift from merely a bulking agent to a formulation enabler that balances nutrition, taste, and clean-label claims.

The pharmaceutical segment is expected to register a steady CAGR of 3.4% from 2025 to 2035, accounting for approximately 26.8% of global dextrose monohydrate consumption by 2035. Although trailing food and beverage in volume, this segment plays a disproportionately critical role in value capture due to the technical rigor and compliance requirements embedded within pharmaceutical formulations.

Dextrose monohydrate’s status as a pharmacopeia-grade ingredient, combined with its GRAS designation and favorable metabolic profile, has enabled its sustained use in intravenous (IV) therapies, oral dosage forms, and pediatric rehydration products.

Its high solubility, chemical purity, and rapid absorption characteristics offer substantial formulation advantages, particularly in glucose-based infusion solutions and effervescent or chewable tablets where rapid bioavailability is essential. With the expanding demand for parenteral nutrition and rising chronic disease burden-especially in aging populations across Asia and Latin America-its inclusion as an excipient and energy substrate is likely to intensify.

Moreover, as pharmaceutical companies pursue manufacturing optimization and supply chain resilience, the importance of standardized, bioavailable ingredients such as dextrose monohydrate will continue to rise. Strategic investments by key suppliers into GMP-aligned production facilities and regional distribution networks are expected to solidify this segment’s role as a stable, technically intensive growth pillar.

Challenge: Fluctuating Raw Material Prices and Regulatory Constraints

Industrial production of dextrose monohydrate depends mainly on corn starch because raw material price changes appear due to environmental factors and logistical problems and international trade policies. Manufacturers face uncertain costs because changes in corn production levels influence both supply and prices in the market.

Trial facilities for food safety and pharmaceutical regulations compel businesses to spend significant resources on quality assessment and testing alongside certification expenses. Manufacturers who want to enter new markets face meeting the changing global standards for regulation as their primary challenge.

Opportunity: Growing Demand in Food, Pharmaceuticals, and Animal Nutrition

The rising market demand for dextrose monohydrate throughout food and beverage sectors creates an attractive growth possibility. Manufacturers use dextrose monohydrate as a primary sweetening component in both energy drinks and confectionery products and sweeteners so its market demand continues to increase.

The pharmaceutical industry depends on dextrose monohydrate for developing intravenous fluids and oral rehydration solutions to increase its market penetration. Animal feed manufacturers depend on dextrose monohydrate as an animal-friendly carbohydrate ingredient which supports its manufacturing demand in the agricultural industry.

The market appeal increases due to innovative production methods of non-GMO and organic dextrose which focus on meeting the needs of health-conscious consumers and premium product segments.

The USA dextrose monohydrate market is anticipated to expand at a steady rate, owing to application within food & beverage, pharmaceuticals & animal feed segments. An increase in demand for low-calorie sweeteners and energy-boosting ingredients in processed foods and sports nutrition products is one of the primary factors driving the growth of this market. Demand is also being fuelled by the growing adoption of natural sugar alternatives in the confectionery and bakery applications.

The pharmaceutical industry accounts for another major segment of the dextrose monohydrate market as it is used as an intravenous source of energy in medical treatments as well as an excipient to prepare drug formulations. The USA biofuel industry also drives market growth, where dextrose is a major feedstock in ethanol production.

As manufacturers focus on clean-label and plant-derived ingredients, production plants are heavily investing in corn-derived dextrose monohydrate, ensuring an uninterrupted market surge.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

The UK dextrose monohydrate market is showing positive trends over the years and will grow more during the forecast period due to its diverse usage in sports nutrition, bakery, and pharmaceutical industries. Demand for low-calorie and natural sweeteners is driven by an increasingly health-conscious consumer base, leading to dextrose being harnessed as preferred ingredient in sugar-free food products and sugar-reduced food items.

The pharmaceutical and intravenous nutrition sectors are also growing, thus propelling industry demand. In addition, with increasingly strict government regulations on sugar consumption, food manufacturers are investigating for this type of products dextrose-based alternatives for use in beverages and functional foods.

Moreover, the growing livestock and poultry industries are contributing to the increasing use of dextrose monohydrate in the formulation of animal feed, which is anticipated to boost the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.5% |

Segments analysis of the European Union dextrose monohydrate market: The European Union dextrose monohydrate market is classified into the industries such as Food, Pharmaceutical, and Fermentation. The market in Germany, France and Italy is driven by the high demand for bakery, confectionery and dairy applications using dextrose as sweetener and fermentation substrate.

The market growth is being driven by a shift in the food manufacturing industry to make the move away from traditional sucrose as a sweetening agent, to dextrose-based sweeteners, as companies come to terms with changing regulations under the EU Sugar Reduction Strategy.

In addition, in Europe there is a growing bioethanol industry that uses dextrose monohydrate as fermentation feedstock. The growing pharmaceuticals industry is also acting as a driver for the market’s upward momentum, due to the wide range of applications of dextrose in IV solutions and medical formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.7% |

With growing applications in health supplements, medical formulations, and functional food products, the demand for dextrose monohydrate is on the rise in Japan. Dextrose is a key ingredient for lesser-known pharmaceutical and IV fluids, which have been in higher demand among the country’s aging population.

Other than that, the dextrose-based sweeteners are being used to bring sugar-reduced and functional food products in Japan which becomes one of the reasons paving the way for emerging sugar alternatives for food processing.

The market is driven by specific applications of dextrose, especially in the bio-based chemical industry, where it is used as a substrate in fermentation processes. The adoption of biofuel in ethanol manufacturing is also being promoted by sustainable production efforts.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.6% |

South Korea dextrose monohydrate market is growing with increasing demand filled in confectionery, dairy and processed food. Dextrose's market share is driven by the increasing knowledge of sugar substitutes, especially in the sphere of sports and energy beverages, where it is used as a natural sweetener.

The pharmaceutical industry is another major driver of the industry since the drug and intravenous fluids formulation include dextrose broadly. Furthermore, it is being used as a core component in bio-based chemical and pharmaceutical production within the bio-manufacturing and fermentation industries.

This rise in demand for fermented-grade dextrose in ethanol production is further buoyed by the growth of South Korea's biofuel sector as a result of progressive government sustainability policies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

Cargill, Incorporated (18-22%)

Cargill has emerged as the market leader in dextrose monohydrate with high-purity products for the food, pharmaceuticals, and industrial markets. The group's sustainable sourcing of raw materials and innovative refining ensures its market leadership in the field.

Archer Daniels Midland Co (ADM) (15% to 19%)

ADM / dextrose-based sweeteners & fermentation solutions.ADM manufactures dextrose-based sweeteners and fermentation solutions with a focus on efficiency, cost-effectiveness and a consistent high quality product for food and beverage manufacturers.

Ingredion Incorporated (12-16%)

Ingredion produces dextrose products based on starch and serves customers in the confectionery, bakery, and energy supplement sectors. It focuses on clean-label and non-GMO solutions.

Tereos Group (8-12%)

Tereos provides food-grade dextrose monohydrate to the food and beverage industry, and can offer tailored formulations to fit specific ramifications of the food market.

Roquette Frères (5-9%)

Roquette supplies food and pharmaceutical dextrose monohydrate with stringent compliance with all the global quality and safety standards.

Other Main Players (30-40% Combined)

Pricing scenarios and unique perspectives towards diverse industries are offered by other players in the dextrose monohydrate market:

The overall market size for Dextrose Monohydrate Market was USD 538.6 Million in 2025.

The Dextrose Monohydrate Market is expected to reach USD 767.1 Million in 2035.

The growing demand from the food and beverage industry, increasing utilization in pharmaceuticals and healthcare applications, and rising adoption in animal feed formulations fuel the Dextrose Monohydrate Market during the forecast period.

The top 5 countries which drives the development of Dextrose Monohydrate Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Food Grade Dextrose Monohydrate to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 22: Western Europe Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 28: Eastern Europe Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 46: Middle East and Africa Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Grade, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Grade, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Grade, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Grade, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 63: Western Europe Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Grade, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 81: Eastern Europe Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Grade, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Grade, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Grade, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Grade, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 117: East Asia Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Grade, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Grade, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Grade, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dextrose Syrup Market

Polydextrose Market Analysis - Size, Share & Forecast 2025 to 2035

Polydextrose Industry Analysis in Korea – Growth & Consumer Demand 2025 to 2035

Polydextrose Industry Analysis in Japan – Demand & Market Trends 2025 to 2035

Polydextrose Industry Analysis in Western Europe Growth, Trends and Forecast from 2025 to 2035

Polydextrose Ingredients Market Trends - Functional Benefits 2025 to 2035

Smoked Dextrose Market Trends - Flavor Enhancements & Demand 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Demand for Polydextrose in the EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA