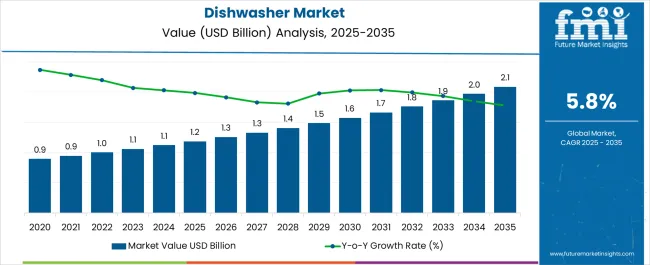

The Dishwasher Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

Kitchen designers evaluate dishwasher specifications based on capacity configurations, wash cycle versatility, and installation requirements when planning residential kitchen layouts, restaurant dish rooms, and cafeteria service areas requiring efficient dishware processing capabilities. Product selection involves analyzing rack adjustability features, spray arm coverage patterns, and filtration system effectiveness while considering noise level limitations, door clearance constraints, and plumbing connection compatibility factors necessary for seamless kitchen integration. Purchase decisions balance appliance costs against convenience value, considering water usage reduction, detergent efficiency optimization, and maintenance simplicity benefits that justify dishwasher investment through lifestyle improvement and operational cost savings.

Manufacturing operations require precision component assembly, leak testing validation, and performance verification systems that achieve residential appliance standards while maintaining cost competitiveness throughout diverse product line configurations and market segment targeting. Production coordination involves managing stainless steel fabrication, electronic control integration, and pump system assembly while addressing safety certification requirements, energy efficiency standards, and warranty obligation fulfillment specific to home appliance manufacturing. Quality assurance encompasses water pressure testing, electrical safety validation, and wash performance evaluation that ensure specification compliance while supporting Energy Star qualification and customer satisfaction expectations.

Product development involves mechanical engineers, user experience designers, and market research specialists collaborating to optimize dishwasher designs that balance cleaning effectiveness with user convenience while addressing specific market preferences and competitive differentiation opportunities. Innovation programs encompass soil sensor technology, rack design optimization, and smart connectivity features while coordinating with appliance retailers, kitchen cabinet manufacturers, and home builders. Feature enhancement includes specialized wash zones, adjustable tines, and third rack integration that improve functionality while supporting diverse dishware types and loading flexibility requirements.

Technology advancement prioritizes wash system optimization, energy consumption reduction, and user interface sophistication that improve dishwasher performance while addressing environmental concerns and operational convenience throughout residential and commercial applications. Innovation encompasses sensor technology integration, artificial intelligence optimization, and remote monitoring capabilities that enhance cleaning effectiveness while providing user customization and maintenance scheduling automation. Advanced features include sanitization cycles, hard water adaptation, and leak prevention systems that expand functionality while supporting health consciousness and property protection objectives.

Service relationships involve coordination between appliance manufacturers, authorized service providers, and parts suppliers to establish comprehensive support programs that address routine maintenance, repair services, and component replacement throughout extended ownership periods. Warranty agreements include parts coverage, labor provisions, and service response guarantees that protect consumer investments while ensuring operational reliability and customer satisfaction. Partnership development encompasses collaboration with water treatment companies, detergent manufacturers, and kitchen design professionals to deliver integrated dishwashing solutions supporting optimal performance and user experience.

| Metric | Value |

|---|---|

| Dishwasher Market Estimated Value in (2025 E) | USD 1.2 billion |

| Dishwasher Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The dishwasher market is experiencing robust growth due to increasing consumer preference for convenience, rising disposable incomes, and the adoption of smart home appliances. Growing urbanization and lifestyle changes have fueled demand for automated cleaning solutions that save both time and water.

Energy-efficient and eco-friendly models are being widely introduced, aligning with sustainability initiatives and regulatory frameworks focused on reducing energy and water consumption. The integration of advanced features such as IoT connectivity, sensor-based washing, and compact designs has further enhanced product appeal across both residential and commercial sectors.

The outlook for the market remains strong as consumer demand converges with innovation and environmental mandates, reinforcing the expansion of dishwasher adoption across global households and businesses.

The freestanding segment is expected to hold 57.30% of total revenue by 2025 within the product type category, positioning it as the most prominent choice. This dominance is attributed to its easy installation, portability, and affordability compared to built-in models.

Consumers have shown a preference for freestanding dishwashers due to their flexibility of placement and convenience in both rental and permanent housing structures. Retail penetration and availability across multiple price ranges have further supported adoption.

As households prioritize convenience and cost-effectiveness, freestanding models continue to maintain a leading position in the product type category.

According to a report issued by Future Market Insights (FMI), between 2025 and 2035, the global dishwasher market will grow at an impressive growth rate of 5.8% in comparison with the 4.2% CAGR registered between 2020 and 2025.

Various digital platforms are increasingly being used by startups and major global players to promote their products and enhance sales. There's a growing preference for stainless-steel dishwashers since they use less water and are sturdier to use.

Consumers are also shopping for products with special attributes, such as glass protection, shine boosters, rinse aid, soundproofing, and LED touch panels. This innovation is expected to increase the demand for dishwashers.

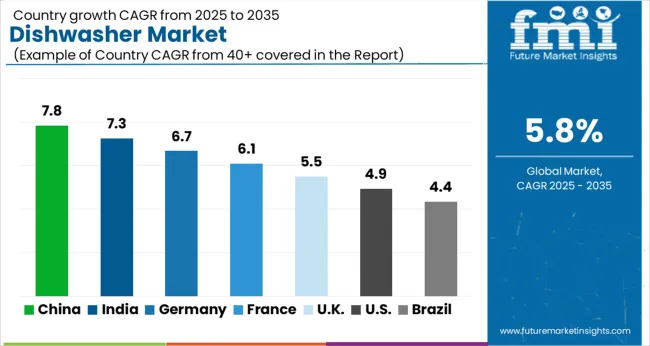

Dishwasher demand is being fueled by changing lifestyles as a result of rapid urbanization and rising spending power in developing countries such as China, Taiwan, India, and Brazil.

Working professionals' busy schedules encourage them to use kitchen equipment that helps them save time. Manufacturers in the appliance industry have benefited from the growing significance of water conservation by providing solutions that use less water than is required.

Manufacturers have been investing in product development in recent years to bring new benefits to consumers. Sensors and features have been put into the device that can be connected to cellphones for the operation of the machine.

The rising inclination towards kitchen renovation or remodeling is one of the major factors driving the smart dishwasher business forward. Kitchen renovation or remodeling is a result of changing customer habits and tastes in home décor as a result of increased urbanization. The need for smart kitchen appliances such as dishwashers is growing at an exponential rate, due to the growing popularity of modular kitchens.

In the dishwasher market, Wi-Fi-enabled smart dishwashers are a significant advancement. The Wi-Fi-enabled dishwasher allows owners to keep track of the cleaning process and start and stop cycles remotely from their phone or tablet. LG Wi-Fi-enabled smart dishwashers, for example, have built-in SmartThinQ technology that sends out smartphone alerts when the procedure is complete.

For some purchasers searching for things that simplify life, smart dishwashers are turning out to be increasingly more well-known with its ease-of-usability features. In any case, with the ascent in the extra cash of the normal family, there has been a developing interest for technology-enabled dishwashers.

All things considered, nonstop new item progresses in kitchen appliances have significantly reduced the time of activities of kitchen machines and alternatively facilitated the growth of the dishwasher market.

| Market Statistics | Details |

|---|---|

| Jan to Jun (H1), 2024 (A) | 5.1% |

| Jul to Dec (H2), 2024 (A) | 5.5% |

| Jan to Jun (H1), 2025 Projected (P) | 5.2% |

| Jan to Jun (H1), 2025 Outlook (O) | 5.7% |

| Jul to Dec (H2), 2025 Outlook (O) | 8.1% |

| Jul to Dec (H2), 2025 Projected (P) | 6.2% |

| Jan to Jun (H1), 2025 Projected (P) | 5.9% |

| BPS Change: H1, 2025 (O) to H1, 2025 (P) | (+) 52 |

| BPS Change: H1, 2025 (O) to H1, 2024 (A) | (-) 57 |

| BPS Change: H2, 2025 (O) to H2, 2025 (P) | (+) 56 |

| BPS Change: H2, 2025 (O) to H2, 2024 (P) | (-) 62 |

| Country | USA |

|---|---|

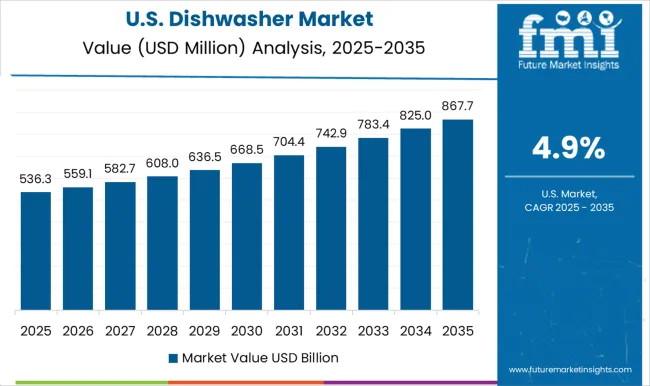

| Market Share (2025) | 31.1% |

| Market Share (2035) | 32.6% |

| BPS Analysis | (+) 159 |

| Country | China |

|---|---|

| Market Share (2025) | 4.3% |

| Market Share (2035) | 7.4% |

| BPS Analysis | (+) 313 |

| Country | India |

|---|---|

| Market Share (2025) | 2.8% |

| Market Share (2035) | 5.7% |

| BPS Analysis | (+) 289 |

Increasing demand for sustaining dishwasher solutions for commercial use, resulting in increased sales

The USA is expected to be the one of the largest consumers of commercial dishwashers by the year 2035. The market's most recent trend is a greater emphasis on sustainable cleaning technology addressing to the concerning fact that the commercial dishwashers consumes a large amount of energy. Commercial dishwashers are currently adopting to the technologies for reusing the water and energy required for dishwashing.

The number of restaurants in the USA has risen to over 1 million, and this increase is expected to transform the commercial dishwashing sector in the years to come. Higher volumes and greater efficiencies are some of the factors leading to an increasing number of restaurant and hotel establishments procuring commercial dishwashers.

Wide hotel and restaurant chains favor highly advanced commercial dishwashers since their established brands have a large consumer base. To compete in the market, major commercial dishwasher manufacturers are working to develop more innovative and energy-efficient dishwashers.

Different innovative options given by the manufacturers to customers, boosts the sale

China has been a promising market for dishwasher with a higher penetration of key players in the region. The reason being, the China's general public and economy have been modified by quick advances in assembling limit and extending customer utilization.

China's societal and economic behaviors have been altered by rapid advances in manufacturing capacity and expanding consumer consumption. China is one of the major producer of industrial and consumer goods around the world.

The Chinese government has encouraged industrial consolidation to control the industry and improve competitiveness in the global market, therefore, rapid consolidation between medium and large firms is expected. Furthermore, entrepreneurs have tried innovative ideas to fill in the void left behind by the buyers, resulting in the advancement of the industry.

Increase in disposable income of the population, boosting the dishwasher market

According to Future Market Insights, India’s dishwasher market is a prominent market with significant growth of the urbanization in the region and increased adoption of the smart kitchen appliances by the consumers’ in the region.

The growing population and changing consumer lifestyles are driving India's dishwasher market. The markets expected growth is due to the intense urbanization and rising income levels. The demand of dishwashers is on the rise as a result of growing numbers of both working women and nuclear families.

Families with restricted maid accessibility are finding new sources to help them. In the wake of the pandemic, most of the population stayed at home, cooking more and ordering less, causing a spike in demand for dishwashers. With the rise of modular kitchen concepts in India, the market is also seeing a trend toward demand for built-in dishwashers, which is contributing towards the growth of the dishwasher market in the region.

Freestanding dishwashers are gaining market share over other products

By the year 2035, the market value of freestanding dishwasher is expected to grow significantly due to the factors such as freestanding dishwasher permits the individual to move the appliance according to his/her preference and create additional room. The highest point of freestanding dishwashers is regularly canvassed in cutting sheets or ledge materials, giving unexpected cutting or prep space.

Built-in dishwashers are permanently installed in the kitchen, which means they are frequently left behind when people move, but a freestanding dishwasher can be moved anywhere. A freestanding dishwasher is usually less expensive than a built-in unit.

While both types of dishwashers have energy-saving cycles that help save money on utility bills, a freestanding dishwashers machine doesn't require any extra setup. It is normally attached to the kitchen faucet and drains into the sink. Such factors are anticipated to contribute towards the market growth.

Dishwashers have been the most widely utilized appliances at commercial spaces

Many restaurants choose to employ dishwashers for washing dishes in lieu of hiring people to wash them. One of the primary reasons is their ability to wash numerous dishes in a short timeframe. This reduces the requirement for a clean pot, as well as the need to wait for one.

Food preparation businesses ought to meet the food safety recommendations that are made by the government. Dishwashers allow business owners to ensure that their foods are hygienic and healthy. As a result, it is becoming more widespread in private industry usage.

Product Availability on E-commerce Platform

Amazon, eBay, and other online merchants have captured a significant portion of the market. In the long run, increased product availability on these online platforms will help drive up sales through such online sales channels.

Delivering a secure transaction and making restitution are straightforward with online sales. Online guarantees and defective products exchange services are appealing to the customers and are leading to the rise in sales of dishwasher on online retailing platforms.

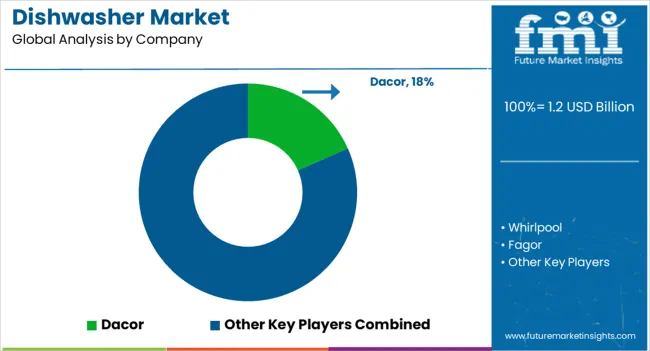

The Dishwasher Market is experiencing steady global expansion, driven by rising household income levels, rapid urbanization, and a growing inclination toward time-saving home appliances. Leading manufacturers such as Whirlpool Corporation, Robert Bosch GmbH, and LG Electronics Inc. are focusing on energy-efficient, compact, and smart dishwashers that align with evolving consumer lifestyles and modern kitchen designs. Haier Group Corporation and Electrolux AB are strengthening their global presence through innovative models equipped with advanced cleaning technologies, noise reduction systems, and enhanced water efficiency.

Miele & Cie. KG and Asko Appliances AB continue to dominate the premium segment with high-performance and durable dishwashers, while Arçelik A.Ş. and AGA Rangemaster Group Limited are expanding product accessibility in emerging economies. Fagor Electrodomésticos and Dacor are investing in smart connectivity and modular design trends to attract tech-savvy consumers.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; and MEA |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Russia, Benelux, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia, New Zealand |

| Key Segments Covered | Product Type, Application, Sales Channel, Region |

| Key Companies Profiled |

Dacor, Whirlpool Corporation, Fagor Electrodomésticos, Robert Bosch GmbH, Arçelik A.Ş., LG Electronics Inc., Haier Group Corporation, AGA Rangemaster Group Limited, Electrolux AB, Sears Holdings Corporation, Asko Appliances AB, Miele & Cie. KG. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global dishwasher market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the dishwasher market is projected to reach USD 2.1 billion by 2035.

The dishwasher market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in dishwasher market are freestanding and built-in.

In terms of application, commercial segment to command 62.8% share in the dishwasher market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dishwasher Tablets Market Size and Share Forecast Outlook 2025 to 2035

Smart Dishwasher Market

Portable Dishwasher Market Analysis - Size, Growth, and Forecast 2025 to 2035

Conveyor Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Commercial Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Residential Dishwasher Market Analysis – Growth & Forecast through 2034

Under Counter Dishwasher Market

Korea Portable Dishwasher Market Analysis - Size, Share & Trends 2025 to 2035

Japan Portable Dishwasher Market – Growth, Trends & Forecast 2025-2035

Fully Integrated Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Portable Dishwasher Market Analysis - Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA