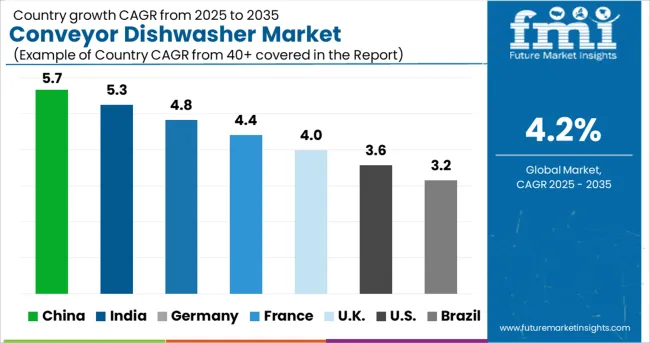

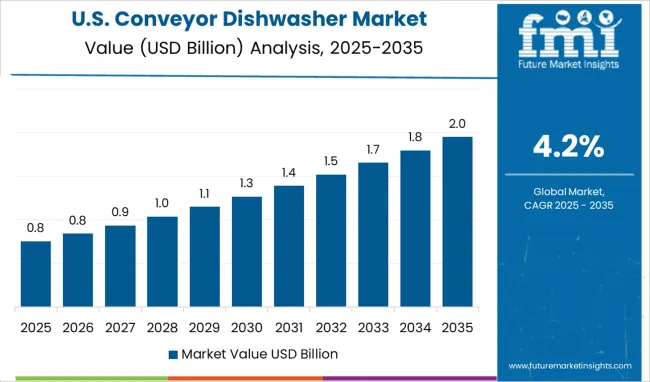

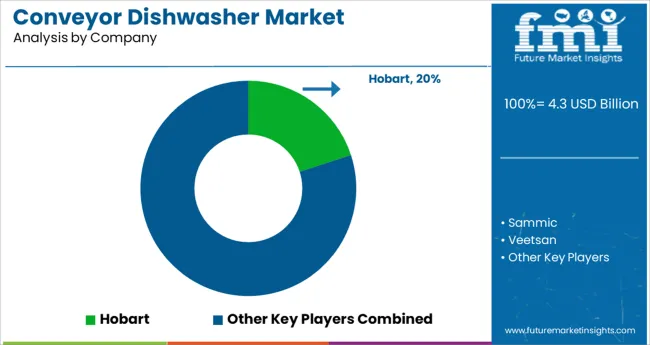

The Conveyor Dishwasher Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 6.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

The conveyor dishwasher market is witnessing sustained growth, driven by rising hygiene standards, increasing labor costs, and the expanding footprint of institutional kitchens. Demand has been supported by the hospitality and foodservice industries’ focus on efficiency, water conservation, and compliance with sanitation norms.

Manufacturers have responded with innovations in energy-efficient and high-capacity machines tailored for large-scale operations. Future growth is expected to be shaped by greater emphasis on automated solutions, integration of smart monitoring features, and replacement of outdated equipment to meet evolving regulations.

Opportunities are also emerging as smaller establishments increasingly invest in advanced dishwashing systems to enhance operational productivity and minimize environmental impact. Improved durability, lower operating costs, and customization options are paving the way for widespread adoption across both premium and mid-tier market segments.

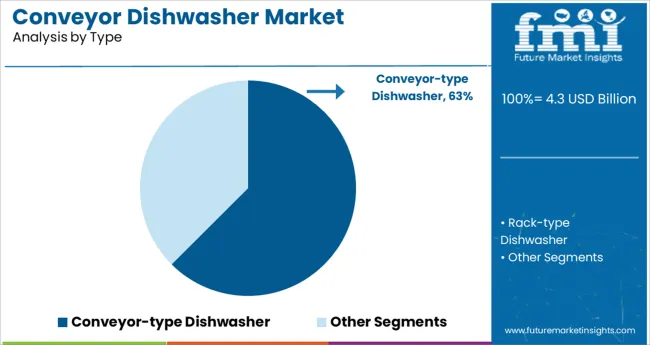

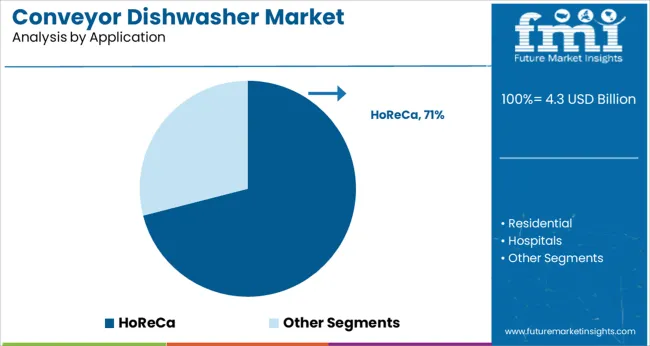

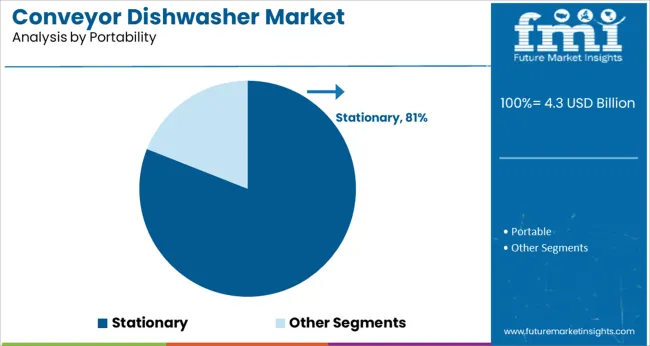

The market is segmented by Type, Application, and Portability and region. By Type, the market is divided into Conveyor-type Dishwasher and Rack-type Dishwasher. In terms of Application, the market is classified into HoReCa, Residential, Hospitals, and Other Applications. Based on Portability, the market is segmented into Stationary and Portable. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Type, Application, and Portability and region. By Type, the market is divided into Conveyor-type Dishwasher and Rack-type Dishwasher. In terms of Application, the market is classified into HoReCa, Residential, Hospitals, and Other Applications. Based on Portability, the market is segmented into Stationary and Portable. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, the conveyor type dishwasher is expected to hold 62.5% of the total market revenue in 2025, maintaining its leadership position. This dominance has been driven by its ability to process high volumes of dishware efficiently, which has proven critical for institutions operating under time and resource constraints.

The modular construction and advanced washing mechanisms have enabled superior throughput and consistent cleaning quality, making it a preferred choice among professional kitchens. Operational cost advantages stemming from water and detergent savings, combined with durability and ease of maintenance, have further reinforced its appeal.

Enhanced performance under peak loads and compatibility with evolving hygiene standards have sustained the preference for conveyor type dishwashers in demanding environments.

Segmented by application, HoReCa is projected to capture 71.0% of the conveyor dishwasher market revenue in 2025, emerging as the leading segment. This leadership has been supported by the sector’s inherent need for reliable, high-capacity dishwashing solutions to maintain uninterrupted service and meet stringent cleanliness expectations.

Large-scale food preparation in hotels, restaurants, and catering services has created consistent demand for machines that deliver speed, quality, and compliance. Investments in modern kitchen infrastructure by hospitality chains and independent establishments have fueled adoption, while the rising popularity of buffet-style dining and events has further amplified usage.

Enhanced customer expectations for hygiene and operational efficiency have positioned HoReCa as the primary driver of demand within the conveyor dishwasher market.

When segmented by portability, stationary dishwashers are forecast to account for 81.0% of the total market revenue in 2025, consolidating their role as the dominant choice. This segment’s leadership has been reinforced by its capacity to handle continuous, heavy-duty operations in fixed kitchen layouts, where mobility is less critical than performance and durability.

The ability to integrate seamlessly into existing kitchen workflows, coupled with superior stability during operation, has made stationary units more suitable for high-volume foodservice settings. Greater load capacity, improved heat retention, and reduced wear and tear compared to portable alternatives have contributed to sustained preference for stationary dishwashers.

The segment continues to benefit from its alignment with the operational requirements of institutional kitchens, supporting its commanding share in the market.

Due to their portability, free-standing conveyor dishwashers are typically preferred by commercial customers. The top of freestanding goods is typically covered with countertop materials or cutting boards, giving customers more storage space. They don't need any specific installation and are typically cheaper than built-in items. As a result, many customers find them more practical than the built-in version.

Both organic and inorganic growth tactics are being used by the players. Manufacturers of conveyor dishwashers are enhancing and broadening their product offerings or buying new businesses to bolster their market share. To offer consumers more advantages, these companies have been investing in product development and innovation. To measure the detergent level and get notifications regarding wash cycles, they have built sensors and features into the device that can be attached to cell phones. Additionally, producers are launching regionally or nationally specific items in response to customer demand.

Due to the demand for advanced kitchen appliances from big household consumers, rack-type dishwashers are anticipated to grow at a CAGR of 4.3% during the forecast period. The global household population's changing tastes in kitchen remodeling and decorating are fueling the rack-type dishwashers' segment growth. To save time from washing domestic items, professionals now tend to utilize dishwashers that are both time and energy efficient. Such a factor is also affecting the rack-type dishwasher market's expansion.

With an expected share of USD 6.6 billion in terms of sales by 6.6033, the United States is predicted to dominate the conveyor dishwasher industry. Due to the expanding production bases of well-known firms in Canada and the United States, including GE Appliances, The Samsung Group, Robert Bosch GmbH, and others, the USA region is predicted to develop at a significant rate. This is likely to encourage residents of the region to use conveyor dishwashers at a higher rate. For instance, GE Appliances invested USD 4.2 million in December 6.606.60 to increase the size of its conveyor dishwasher production facility in Ohio, United States. The region's market is also growing as energy-efficient kitchen equipment is being used.

Germany is expected to be one of the most profitable markets for conveyor dishwashers registering a market share of 5.6.6% during the forecast period. The growth of the market is being supported by Germany's high demand for conveyor dishwashers and the rapid increase in industrial capacity.

Furthermore, the United Kingdom's conveyor dishwasher market is anticipated to grow at a considerable CAGR of 6.6.5% during the forecast period. The United Kingdom government is implementing rules on industrial limitations to stabilize the market and increase competition. As a result, to gain a competitive edge in the market, both large and small enterprises are developing cutting-edge technology products. The sales of conveyor dishwashers in the United Kingdom. are anticipated to surpass USD 6.636.6.5 million by 6.6033.

The Korean conveyor dishwasher industry is expected to grow at a CAGR of 1.6.6% between 6.606.63 and 6.6033. Within the region, Korea holds a modest market share for conveyor dishwashers. The region is employing electric conveyor dishwashers more frequently as a result of its favorable government policies and rising environmental concerns, which accounts for the region's increased market share. South Korea is also predicted to offer market expansion with extra potential chances due to the region's expanding industrialization and urbanization.

The Japan conveyor dishwasher industry is expected to grow at a CAGR of 6.6.1% due to evolving consumer trends towards opting for luxury and comfortable home appliances solutions. Increasing consumer preference for modular design-based kitchen appliances also favors the Asian population's demand for such items.

The booming hospitality and food industries in the area, the development of food service establishments, and several other favorable variables are all linked to the market expansion. Conveyor dishwasher demand and popularity may expand overall due to customers' greater willingness to spend more money on high-quality kitchen electrical equipment.

Startups in the conveyor dishwasher market are concentrating on creating cutting-edge appliances to increase their revenue share and diversify their product offerings. For instance, with a newly revamped extra-large capacity dishwasher platform, GE Appliances (GEA), a Haier business, has announced the launch of a new USD 4.2 million dishwashing production line at its supersite in Louisville. As GEA boosts output to meet demand, the new dishwasher line and production increases in other product categories resulted in the addition of approximately 24.2 new positions at Appliance Park. It should be noted that this was 2024's second dishwashing investment.

Leading players are initiating the sales of conveyor dishwashers while taking into account customers' changing needs due to technical advancements and product innovations, which are expected to alter market dynamics in the coming years. The adjustments being made to conveyor dishwashers include better mechanisms for washing dishes, the creation of quieter machines, the incorporation of developed sensors and features that will allow them to connect to smartphones, and the creation of a system that will aid in keeping track of the detergent level and sending out alerts when the dishwasher cycle is about to start.

Conveyor dishwasher sales are being impacted by the growing importance of printed or online manuals, websites, advertising efforts, and other marketing communication tools. Additionally, major companies are concentrating on product innovation for conveyor dishwashers, which is projected to boost market growth. These innovations include pre-soak cycles, detachable trays, fold-down tines, adjustable racks, better spray arms, and enhanced wash and dry systems in the finished product. Demand is expected to increase in developed nations due to rising customer propensity to upgrade an outdated dishwasher or remodel their kitchen.

Bosch, a large multinational engineering and technology business based in Germany, is becoming known for its flexible dish loading and auto-programming conveyor dishwashers. Companies are emulating these developments by investing more in Research and Development (R&D) for auto programming, which uses an automatically adjusted time to flawlessly clean and dry plates. Such programming promotes water and energy conservation.

In dishwashers, variable speed choices are desired. Since conveyor dishwashers are the perfect piece of equipment for hosting large dinner parties in both household and business settings, manufacturers are expanding the number of units they produce.

Conveyor dishwashers that are both space-saving and effective are becoming more and more popular. The IFB Neptune VX Fully Electronic Dishwasher is advertised as offering the highest level of convenience and versatility for cleaning all different kinds of dishes. Manufacturers in the dishwashing industry are coming out with innovative, water-saving appliances. Newer conveyor dishwashers utilize less energy and have features like the half-load option, which allows users to load either just the top rack or just the bottom rack at a time. Manufacturers of conveyor dishwashers are increasing the production of appliances that not only wash dishes but also steam-dry them.

Leading conveyor dishwasher industry competitors are boosting their spending on cutting-edge items to meet customer wants and provide them with specialized services. Through mergers and acquisitions, manufacturers also intend to broaden their product offerings, establish a presence in several regions, and provide end customers with tailored solutions.

Some of the Key Players Operating in the Conveyor Dishwasher Market Include:

Recent Developments in the Market

| Attributes | Details |

|---|---|

| Growth Rate | CAGR of 4.2% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in billion and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | By Type, By Application, By End Use, By Portability, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East & Africa; Oceania |

| Key Countries Profiled | The USA, Canada, Brazil, Mexico, Germany, Italy, France, The United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Ali Group; Hobart; Jackson WWS; MEIKO; Winterhalter Gastronom; Sammic; Veetsan; Classeq; Comenda; Wexiodisk |

| Customization & Pricing | Available upon Request |

The global conveyor dishwasher market is estimated to be valued at USD 4.3 billion in 2025.

It is projected to reach USD 6.6 billion by 2035.

The market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types are conveyor-type dishwasher and rack-type dishwasher.

horeca segment is expected to dominate with a 71.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conveyor Belt Tracking Devices Market Size and Share Forecast Outlook 2025 to 2035

Conveyor Belt Market Size and Share Forecast Outlook 2025 to 2035

Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Conveyor Drives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Conveyor Maintenance Industry Analysis in Australia - Size, Share, and Forecast Outlook 2025 to 2035

Conveyor Dryer Market Growth, Trends & Forecast 2025 to 2035

Conveyors and Belt Loaders Market Growth - Trends & Forecast 2025 to 2035

Conveyor Ovens & Impinger Ovens Market

Conveyor Belt Materials Market

UV Conveyor Systems Market

Pack Conveyors Market Size and Share Forecast Outlook 2025 to 2035

Screw Conveyor Market Size and Share Forecast Outlook 2025 to 2035

Smart Conveyor Packaging Systems Market Analysis Size and Share Forecast Outlook 2025 to 2035

Chain Conveyors Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Screw Conveyor Industry

ASEAN Conveyor System Market Growth - Trends & Forecast 2024 to 2034

Rubber Conveyor Belt Market Size, Growth, and Forecast 2025 to 2035

Gravity Conveyor System Market Size and Share Market Forecast and Outlook 2025 to 2035

Modular Conveyor System Market

Gravity Conveyor Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA