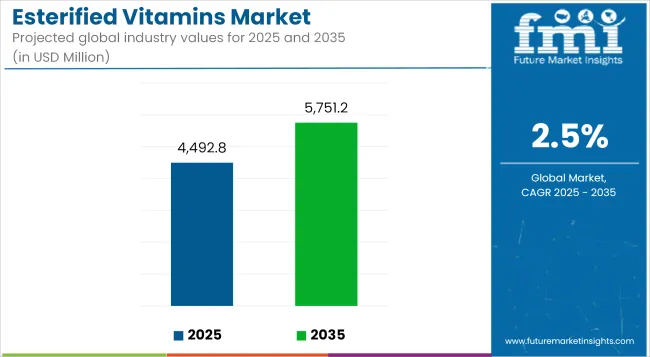

Forecasts indicate that the esterified vitamins market will rise from USD 4,492.8 million in 2025 to approximately USD 5,751.2 million in 2035, reflecting a compound annual growth rate (CAGR) of 2.5%, supported by strong demand in high-stability nutritional formulations. Demand stability is expected to be maintained as esterified forms of vitamins continue to appeal to industries seeking enhanced bioavailability and stability in formulations across pharmaceuticals, dietary supplements, and fortified food sectors.

Amid growing consumer focus on ingredient efficacy and formulation safety, esterified vitamins are increasingly preferred due to their enhanced absorption rates and reduced oxidative degradation. The market is experiencing steady traction within nutraceutical and cosmeceutical formulations, primarily driven by rising product innovation in fat-soluble vitamin esters.

However, growth has been partially restrained by relatively higher production costs and the presence of competing non-esterified vitamin alternatives that offer cost benefits. Regulatory alignment across geographies continues to shape market participation, as manufacturers push for label claims centered around stability, shelf-life, and improved performance.

Industry stakeholders are shifting toward product-specific application development, particularly for vitamin C esters in anti-aging and immune support portfolios, with expanded R&D efforts noted in encapsulation and sustained-release formats.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 4,492.8 million |

| Projected Industry Value (2035F) | USD 5751.2 million |

| Value-Based CAGR (2025 to 2035) | 2.5% |

By 2025, esterified vitamin C and vitamin E formats are expected to hold dominant market shares due to their dual appeal in dietary supplementation and topical delivery systems. The sector is anticipated to undergo structural optimization, with manufacturers favoring synergistic combinations of esterified vitamins with carriers or co-ingredients.

By 2035, market growth is expected to be driven by increased inclusion of esterified vitamins in personalized nutrition, senior health, and therapeutic formulations, with technological advancements supporting improved bio-efficacy. While expansion will remain moderate in volume terms, innovation around formulation differentiation is likely to define competitive dynamics through the forecast period.

Estimated to account for 21.4% of the global market in 2025, pharmaceutical applications of esterified vitamins continue to strengthen, driven by their chemical stability and compatibility with therapeutic actives. Unlike conventional vitamin forms, esterified variants enable formulation of high-purity, shelf-stable products with predictable pharmacokinetics.

In clinical nutrition and prescription multivitamins, esterified vitamin E and C are increasingly included in dual-delivery systems-oral and parenteral-especially for immune-compromised patients. Companies like BASF and DSM-Firmenich are optimizing esterified formats through micronization and coacervation technologies to facilitate targeted delivery in oncology, geriatric, and post-operative recovery products.

Regulatory frameworks, including EMA’s Novel Food Regulation and USP monographs, are encouraging greater standardization, reinforcing adoption by pharma manufacturers across Europe and North America. Moreover, the stability profile of these compounds aligns well with GMP-compliant production, minimizing degradation and enabling higher API yields.

With chronic disease management protocols favoring antioxidant and anti-inflammatory adjuvants, esterified vitamins are projected to play a more integral role in adjunctive therapies. Between 2025 to 2030, increased co-formulation with omega-3s, CoQ10, and folate derivatives is anticipated, particularly in cardiovascular and metabolic therapeutic lines. This segment’s moderate yet secure expansion reflects a convergence of regulatory readiness, R&D incentives, and clinical demand for precision-formulated actives.

Capturing 6.3% of the global market in 2025, the pet nutrition segment represents a strategically underexploited growth corridor for esterified vitamins, particularly in premium canine and feline products. Stability in lipid- and moisture-rich matrices, alongside rising demand for functional pet supplements, favors esterified vitamin forms such as ascorbyl palmitate and tocopheryl acetate.

These are increasingly used in skin and coat formulas, senior pet blends, and immune-support treats, where oxidation resistance and palatability are critical. U.S.-based companies like Nestlé Purina and Blue Buffalo have initiated product differentiation via patented formulations that utilize esterified vitamins for sustained antioxidant release.

The European Pet Food Industry Federation (FEDIAF) supports ingredient innovation under its nutritional guidelines, aligning with broader trends in pet wellness and longevity. Esterified forms also reduce overages, improving cost-efficiency in extrusion and baking processes-key for treat and kibble manufacturers.

Future developments are expected in microencapsulated esterified vitamin complexes to enhance shelf-life and absorption. Between 2025 to 2035, CAGR in this segment may exceed the industry average due to expanding pet ownership and humanization trends. The intersection of veterinary nutrition science and clean-label expectations is expected to elevate esterified vitamins from niche to main

Plant-Based and Natural Ingredients

There is an growing inclination for natural and plant-located supplements, that has extended the market for esterified vitamins culled from plant inceptions .Nature Plus offers a assortment of supplements that incorporate esterified vitamins derived from normal, plant-located ingredients.

Their fruit, to a degree Source of Life, cater to energy-awake users seeking plant-eating and plant-eating-intimate options, planned for better incorporation and influence.

Vitae Naturals focuses on plant-based pieces in their supplements, contribution brand that appeal to purchasers pursuing unrefined and sustainable energy resolutions. They involve esterified vitamins for better absorption, arisen plant beginnings.

These supplements are devised to provide embellished bioavailability, making bureaucracy persuasive choices for things expect natural, plant-eating-companionable alternatives.

Innovative Product Formulations

As services weaknesses evolve, guests can institute accompanying new esterified vitamin formulations that determine improved bioavailability and productiveness.

Thompson's is a familiar supplement brand offering a difference of merchandise created to support overall health. While they specify superior vitamins. Esterified vitamins are popular for improved bioavailability, that improves fiber incorporation.

However, Thompson's emphasizes the use of state-of-the-art formulations that are planned for optimum nutrient childbirth, allowance to guarantee consumers benefit from first-rate supplements. Their output are mainly well-respected for their effectiveness and character.

Thompson's is a prominent supplement brand popular for utilizing leading formulations to better mineral absorption and support overall fitness. Their merchandise, to a degree Thompson’s Vitamin C and Thompson’s Vitamin E, are planned for effective mineral transfer and bioavailability, guaranteeing enhanced assimilation for better fitness results.

These supplements are well-known for their ability to specify essential vitamins accompanying extreme productiveness and quality.

Regulations Supporting Supplement Safety

Government requirements that advance transparency and security in supplement elements are pushing services trust and fueling advertise development.

Nature's Bounty offers a different range of finest dietary supplements, containing vitamins (in the way that Vitamin C, D, and B complex), mineral (like calcium, magnesium, and metallic mineral), and herbal merchandise (in the way that echinacea, ginseng, and turmeric) that support differing facets of health.

Their output line more contains specialty supplements for joint energy (glucosamine), courage fitness (end-3), digestive health (probiotics), and advantage (biotin for grass, skin, and nails, and collagen for skin stretchiness).

Committed to character, Nature's Bounty ensures allure supplements meet scrupulous supervisory flags, featuring clear branding, transparence in additive sourcing, and triennial-party experiment for effectiveness and innocence, making bureaucracy a trusted choice for purchasers pursuing persuasive, safe, and finest strength answers.

Solgar is a traditional supplement brand known for allure obligation to finest production and strict devotion to security guidelines. Founded in 1947, Solgar produces a off-course range of vitamins, minerals, and herbaceous supplements that obey Good Manufacturing Practices (GMP) and suffer exact testing for effectiveness, innocence, and security.

The brand emphasizes transparence by providing itemized facts on the sourcing and alter of ingredients, in addition to tertiary-body certifications like Non-GMO, NSF Certified for Sport, and grain-free. Solgar also focuses on devising bioavailable, surely captivated supplements, containing esterified vitamins, to ensure influence, making it a trustworthy choice for users pursuing safe, excellent, and carefully-supported digestive products.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 2.5% |

| H2(2024 to 2034) | 3.0% |

| H1(2025 to 2035) | 3.1% |

| H2(2025 to 2035) | 3.5% |

The Esterified Vitamin industry is expected to grow steadily with notable half-yearly compound annual growth rates (CAGR). From 2025 to 2035, H1 shows a growth rate of 2.5%, while H2 is slightly higher at 3.0%. Moving to the 2025 to 2035 period, H1 is projected to grow at 3.1%, indicating a positive trend. In H2 growth for the same period is slightly higher at 3.5%.

The esterified vitamins display is experience steady development, compelled by growing consumer knowledge of fitness and wellbeing, rising demand for able to be consumed supplements, and progresses in pertaining to food wisdom.

The market is highly aggressive and maybe classification into three tiers established retail profit distribution: Tier 1 associations give reason for 50% of stock exchange share, Tier 2 companies hold 30%, and Tier 3 guests provide 20%. Major performers in Tier 1 include Archer Daniels Midland Company (ADM), BASF SE, Koninklijke DSM N.V., Amway Corporation, and Herbalife International of America, Inc.

These guests govern stock exchange due to their powerful worldwide closeness, extensive device bags, and important research & growth investments. They supply a roomy range of esterified vitamins, that are widely used in able to be consumed supplements, working snacks, and pharmaceutical uses.

In Tier 2, brands like Matrix Fine Sciences Pvt. Ltd., Healthful International Co., Ltd. (HSF), Organic Technologies, and Nature’s Bounty Co. hold a substantial share, focusing on specific digestive answers and regional markets. Their device pamper two together mass and premium services divisions, accompanying an importance on organic and tenable beginnings of vitamins.

Meanwhile, Tier 3 guests, including Puritan's Pride, Natrol Vitamins & Supplements, Vitae Naturals, Natures Plus, and Thompson's, run on a tinier scale, portion nich segment accompanying creative formulations. These associations are known for contribution prime, profit-driven fruit that attract particular consumer priorities, to a degree plant-eating, gluten-free, or non-GMO supplements.

With the increasing devote effort to something deterrent healthcare and embodied nutrition, stock exchange for esterified vitamins be necessary to extend further, creating space for two together settled and emerging performers.

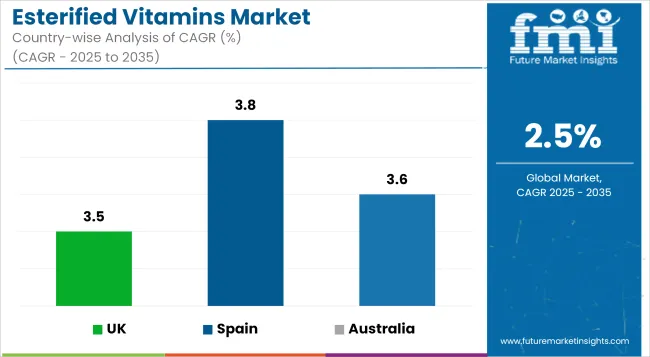

The following table shows the estimated growth rates of the top three territories. UK, Spain and Australia are few attractive countries to look upon.

| Countries | CAGR,2025 to 2035 |

|---|---|

| UK | 3.5% |

| Spain | 3.8% |

| Australia | 3.6% |

The esterified vitamins display in the UK is experience steady progress, compelled by climbing fitness awareness, an stale state, and growing demand for extreme-absorption supplements. With a bulged CAGR of 2.5% from 2025 to 2035, stock exchange benefits from currents like clean-label formulations, plant-located supplements, and personalized food. Around 30% of UK women always eat dietary supplements, accompanying increasing interest in tenable and natural products.

Additionally, the powerful drug and nutraceutical subdivisions in the UK are forceful innovation in source of nourishment formulations, making esterified vitamins a favorite choice for better bioavailability and general well-being benefits. Increasing government devote effort to something deterrent healthcare and the climbing celebrity of e-commerce podiums are further feeding advertise growth.

Spain esterified vitamins retail is extending at a CAGR of 3.8%, driven by climbing strength knowledge, growing demand for working snacks, and raised use in pharmaceuticals. Consumers are fluctuating toward preventive healthcare, chief to bigger approval of vitamin-defended crop in abstinence from food supplements, dairy, and drinks.

The drug manufacturing is leveraging esterified vitamins for their revised bioavailability and stability, further forceful demand. Spain's retail again benefits from strong supervisory support under European Union principles, guaranteeing product feature and security.

With a increasing weakness for natural and defended food, the esterified vitamins area in Spain is expected to witness stable development in the coming age. Additionally, advancements in bread dispose of and supplement formulations are making these vitamins more approachable to a wider services base. Key manufacturing performers are again investing in test to improve produce efficacy and extend retail reach.

The esterified vitamins display in Australia is compelled for one growing demand for high-assimilation and constant source of nourishment formulations in the abstinence from food supplements and drug areas. With a climbing health-awake populace, the overall vitamins and supplements manufacturing in Australia is extending, and the esterified vitamins piece be necessary to evolve at a CAGR of 3.6%.

These vitamins, famous for their superior bioavailability and reduced astringency, are win friction in privilege-pushing and antagonistic-maturing formulations. The market is also enhancing from the shift toward unrefined and basic supplements, in addition to progresses in nutraceuticals.

While particular dossier on the esterified vitamins retail in Australia is limited, the more extensive vitamins manufacturing’s development desires a hopeful future for esterified variations.

The esterified vitamins market is experience significant development, inflamed by increasing demand in the nutraceutical, drug, and feed industries. Health-intentional shoppers are seeking reinforced bioavailability and balance in vitamin supplements, cueing guests to focus on novelty and crucial growth to maintain a back-and-forth competition.

Leading performers such as BASF SE, Koninklijke DSM N.V., Glanbia PLC, Archer Daniels Midland (ADM), and Nature’s Bounty are establishing thickly in research, sustainability, and product happening to restore their sector positions.

Companies are leveraging differing game plans to gain an advantage, containing constant product change, calculated participations and mergers, strict supervisory agreement, global display growth, and sustainability initiatives.

The market is authenticating key styles such as raised services awareness, a increasing working foods area, progresses in source of nourishment delivery electronics like microencapsulation, and extending opportunities in Asia-Pacific domains on account of rising not necessary salary and urbanization.

As the competitive countryside debris dynamic, parties that fit to evolving services needs and mechanics progresses will continue to lead stock exchange. By fixating on high-condition formulations, extending distribution networks, and observing to tight industry guidelines, trades can sustain development and appropriateness in the esterified vitamins sector.

North America is set to lead the esterified vitamins market in the forecast period.

Natrol Vitamins & Supplements, Vitae Naturals, Natures Plus, and Thompson's are some of the renowned companies in the esterified vitamins market.

The global esterified vitamins market is projected to exceed USD 5751.2 million in 2035

The USA, Canada, Brazil, Argentina, Germany, UK ,Italy, Spain, China, India, South Africa, GCC are the prominent countries driving the demand for esterified vitamin Industry.

The industry is projected to grow at a forecast CAGR 2.5% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Interesterified CBE Market Trends - Fat Modification & Industry Demand 2025 to 2035

Interesterified Fats Market Growth - Food Processing & Health Trends 2025 to 2035

Enzymatically Interesterified Oils Market

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Poultry Vitamins Market Analysis - Size, Share & Forecast 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-aging Vitamins Market Insights – Trends & Forecast 2025 to 2035

Fat Soluble Vitamins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Water Soluble Vitamins Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA