The Europe Oral Clinical Nutrition Supplement market is set to grow from an estimated USD 3,913.7 million in 2025 to USD 5,969.4 million by 2035, with a compound annual growth rate (CAGR) of 4.3% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 3,913.7 million |

| Projected Europe Value (2035F) | USD 5,969.4 million |

| Value-based CAGR (2025 to 2035) | 4.3% |

The growth trajectory of the European oral clinical nutrition market is expected to witness a parabolic rise primarily propelled by the swelling of the number of cases of disease-related malnutrition (DRM) and the chronic disease statistics that traditionally have been on the fast rise, as well as more people of advanced age demanding special diets.

Oral clinical nutrition products have increasingly gained prominence to compensate for the deficiency of nutrients in oncology, renal, liver, and diabetes patients who are on drug therapy. The sector is booming as a result of the surge in health spending, increased physician recognition, and the newfound need for characterized nutrition blends for specific conditions.

The gaps between the nutritional manufacturing and biotechnology industries and formulation technologies are being closed, thanks to the qualitative and quantitative of micro politics that are significantly varied, depending upon the geographical area and season of the year.

Nutritional science and biotechnology are the cornerstones that are introducing new forms of products that maximize the nutrients' bioavailability, are pleasant in taste, and are easy to take for the patients.

The growth of home healthcare services as well as outpatient nutrition therapy is the other side of the coin, thus furthering the market's expansion, since people are more interested in OTC (over-the-counter) than prescription oral clinical nutrition.

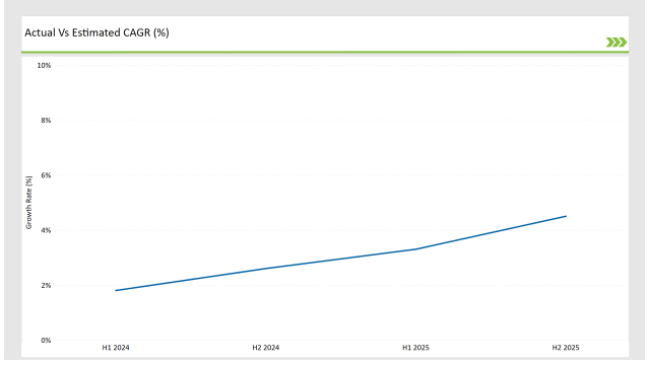

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Oral Clinical Nutrition Supplement market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 1.8% (2024 to 2034) |

| H2 2024 | 2.6% (2024 to 2034) |

| H1 2025 | 3.3% (2025 to 2035) |

| H2 2025 | 4.5% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Oral Clinical Nutrition Supplement market, the sector is predicted to grow at a CAGR of 1.8% during the first half of 2024, with an increase to 2.6% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.3% in H1 but is expected to rise to 4.5% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Product Innovation - Nutricia introduced a next-generation specialized formula with improved bioavailability for patients with renal disorders, ensuring better protein absorption. |

| March-24 | Strategic Partnerships - Nestlé Health Science partnered with leading European hospitals to develop customized oral nutrition plans for oncology and diabetes patients. |

| February-24 | Expansion of Distribution - Abbott Laboratories expanded its oral nutrition product line into pharmacy chains across Germany and France, increasing accessibility to OTC formulations. |

| January-24 | Sustainability Initiatives - Fresenius Kabi launched eco-friendly packaging for its liquid oral nutritional supplements, reducing the carbon footprint of clinical nutrition solutions. |

Increasing Prevalence of Chronic Diseases Driving Market Growth

The increased chronic disease rate, which corresponds to the most common cases of cancer, diabetes, and renal disorders, is the prime reason for the uptick in the European oral nutrition market. Patients with such types of diseases are usually vulnerable to possible nutritional deficiencies, loss of muscle, and digestive problems, as a result, they often demand special nutritional support that is clinically based. As a result, among elderly people, and especially patients on long-term treatment, malnutrition that is related to diseases has become a serious health problem.

Nutricia, Fresenius Kabi, and Nestlé Health Science are some of the companies that are formulating nutritional solutions that are specifically targeted to the dietary requirements of patients suffering from cancer-related malnutrition intake, kidney failure, and liver diseases. Personalized nutrition and nutrigenomics are other technologies that have a significant contribution to the development of the clinical nutrition plan, which will in turn improve the treatment outcome and protocol compliance of the patients.

As healthcare providers and hospitals are increasingly becoming aware of the need for complementary oral clinical nutrition during the therapy process the demand for standard and tailored formulas keeps on increasing. Additionally, the governments and healthcare authorities in various European countries are also initiating programs to reimburse clinical nutrition, which, in turn, is stimulating market growth.

Innovations in the Formulation and Delivery of Oral Clinical Nutrition

Newer technologies in the food industry, medical products, and genetic engineering are changing the way vitamin and mineral foods are manufactured and sold. New formats are being experimented with by a new age of clinical nutrition, such as the switch from traditional powdered nutrients to liquid or semi-solid nutrients, which are more bioavailable and thus, will be absorbed more quickly by the patients and also ensure better adherence.

Companies like Abbott Laboratories and Fresenius Kabi are pushing forward microencapsulation and lipid-based nutrient carriers intending to raise the bioavailability of proteins, amino acids, and micronutrients. In addition, combining plant-based and hypoallergenic formulas is now gaining popularity as it suits patients who have digestive problems and dietary restrictions.

Smart packaging has made a move into the market with innovations of single-serve liquid bottles and resealable pouches which are making oral clinical nutrition delivery much more user-friendly, mostly to the elderly and those receiving care at home. Furthermore, nutrition tracking platforms powered by AI technology are coming out, enabling healthcare providers to oversee the intake of patient nutrition from a distance and make necessary changes to the formulations.

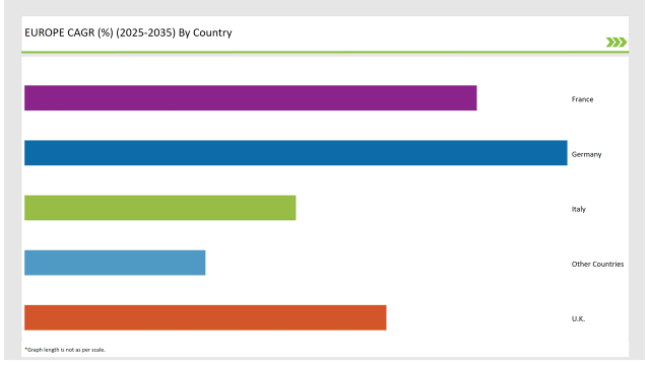

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 30% |

| Italy | 15% |

| UK | 20% |

| France | 25% |

| Other Countries | 10% |

Germany is the leading oral clinical nutrition market in Europe boldly supported by developed healthcare infrastructure, a high chronic disease rate, and a rapidly growing geriatric population. The country shows a record of one of the highest disease-related malnutrition (DRM) rates in hospitalized and long-term care patients, thereby providing a strong basis for the demand for standard and specialized clinical nutrition formulas.

The strong presence of the companies Fresenius Kabi and Nestlé Health Science in Germany is demonstrated by the provision of personalized oral nutritional solutions for both hospital and outpatient use.

The German healthcare system further backs up the scheme by making remuneration available for oral prescription-based nutritional products, thus, improving the availability of these products to patients who have to go through long-term treatment.

In France, there has been an upsurge in the demand for prescription-based and OTC oral clinical nutrition products, mainly motivated by the growing recognition of the role that clinical nutrition plays in disease management. The two main factors the aged population combination and the growth of oncology-related malnutrition the biggest drivers of the market.

Companies like Abbott Laboratories and Nutricia have enlarged their distribution networks in France making oral clinical nutrition products broadly available in pharmacies and healthcare facilities.

Moreover, the national nutrition programs targeting residents and chronically ill people have included the utilization of standardized oral nutritional supplements (ONS) in the nutrition program. France is also being perceived as a digital health integration hub with the likes of tele-nutrition gaining influence.

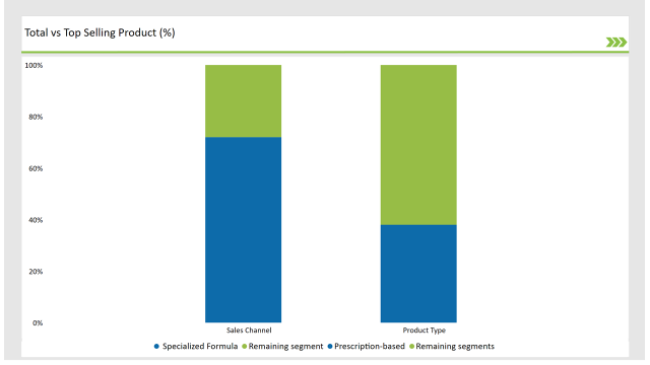

% share of Individual Categories Product Type and Sales Channel in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Specialized Formula) | 38% |

| Remaining segments | 62% |

Rapid Growth of Specialized Formula Sector

The specialized formula segment is showing fast growth and captures a large market share. This type of formula is specially formulated for patients who have a chronic condition such as diabetes, cancer-related malnutrition, and liver disease, while standard formulas are not functional.

Nutricia and Fresenius Kabi are the companies that apply the disease-specific nutrition model enriched with protein-targeted blends, probiotics, and enzymes that aid the digestion and absorption of nutrients. These products are fast gaining acceptance in both hospital and outpatient care settings, as more and more clinical studies back up the benefits of personalized oral nutrition.

| Main Segment | Market Share (%) |

|---|---|

| Sales Channel (Prescription-based) | 72% |

| Remaining segments | 28% |

Prescription-Based Sales of Oral Clinical Nutrition

Prescription-based oral nutrition is the main sales channel despite the existence of other sales channels which include pharmacies, e-commerce, and retail health stores.

These sales are being made in hospitals, outpatient clinics, and long-term care facilities following the nutrition plans prescribed by physicians. Countries like Germany, France, and the UK are the ones who have put in place the reimbursement policy of prescription-based oral nutrition, thus enhancing the patient's access to specialized dietary formulations.

Nevertheless, OTC (over-the-counter) oral clinical nutrition has also gained popularity, specifically among self-managed patients, health-conscious consumers, and patients recovering from the operations. The companies that are making moves in this segment include Abbott and Nestlé Health Science, which are broadening their OTC product ranges as part of making clinical nutrition available through pharmacies, e-commerce platforms, and retail health stores.

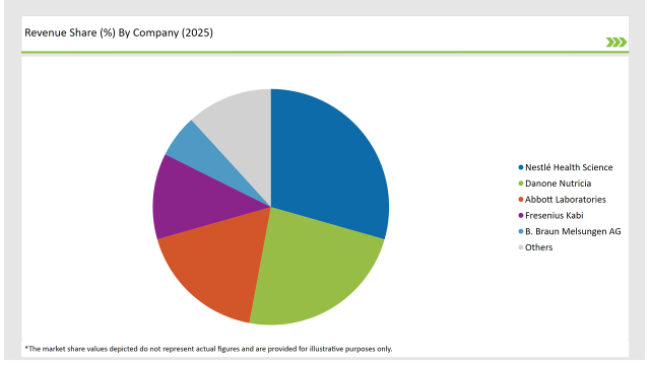

2025 Market share of Europe Oral Clinical Nutrition Supplement manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Nestlé Health Science | 25% |

| Danone Nutricia | 20% |

| Abbott Laboratories | 15% |

| Fresenius Kabi | 10% |

| B. Braun Melsungen AG | 5% |

| Others | 10% |

Note: The above chart is indicative in nature

The market of oral clinical nutrition in Europe consists of top players including Fresenius Kabi, Nutricia (Danone), Abbott Laboratories, and Nestlé Health Science, these companies hold considerable market shares. These companies are concentrating on product innovation, strategic alliances, and broadening their digital nutrition solutions.

The competition in this area is largely propelled by technological innovations in nutrition formulation, governmental endorsement for clinical nutrition reimbursement, and the incorporation of AI-directed dietary management systems. New entrants in the market are also pursuing and addressing specific market segments such as plant-based oral clinical nutrition and modified formulations for rare diseases.

As per Product Type, the industry has been categorized into Standard Formula, and Specialized Formula.

As per Indication, the industry has been categorized into Disease-Related Malnutrition (DRM, Renal Disorders, Hepatic Disorders, Oncology Nutrition, Diabetes, and Others.

As per Form, the industry has been categorized into Liquid, Semi-solid, and Powder.

As per Sales Chanel, the industry has been categorized into Prescription-based, and Over-the-Counter.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Oral Clinical Nutrition Supplement market is projected to grow at a CAGR of 4.3% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 5,969.4 million.

Key factors driving the European oral clinical nutrition market include the increasing prevalence of chronic diseases and malnutrition, along with a growing aging population that requires specialized nutritional support. Additionally, rising awareness of the importance of nutrition in healthcare and advancements in product formulations are contributing to market growth.

Germany, and France, are the key countries with high consumption rates in the European Oral Clinical Nutrition Supplement market.

Leading manufacturers include Nestlé Health Science, Danone Nutricia, Abbott Laboratories, Fresenius Kabi, and B. Braun Melsungen AG known for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Oral Clinical Nutrition Supplements

Oral Clinical Nutrition Supplement Market Trends - Growth & Forecast 2025

UK Oral Clinical Nutrition Supplement Market Report – Size, Demand & Forecast 2025-2035

USA Oral Clinical Nutrition Supplement Market Report – Trends, Growth & Forecast 2025-2035

ASEAN Oral Clinical Nutrition Supplement Market Insights – Trends, Demand & Growth 2025-2035

Australia Oral Clinical Nutrition Supplement Market Trends – Growth, Demand & Innovations 2025-2035

Latin America Oral Clinical Nutrition Supplement Market Report – Growth, Demand & Forecast 2025-2035

Oral Clinical Nutrition Desserts Market Analysis - Size, Growth, and Forecast 2025 to 2035

Oral Clinical Nutritional Cream and Pudding Market Analysis by Product Type and Distribution Channel Through 2035

Clinical Nutrition Market Insights – Trends & Forecast 2025 to 2035

Europe Sports Nutrition Market Analysis – Growth, Demand & Forecast 2025-2035

Clinical Avian Nutrition Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Comprehensive Analysis of Europe Pet Food Supplements Market by Nature, Form, Pet Type and Distribution Channel through 2035

Supplements And Nutrition Packaging Market

Europe Pet Dietary Supplement Market Trends – Growth, Demand & Outlook 2025-2035

Multi Nutritional Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Europe Prenatal Vitamin Supplement Market Analysis – Size, Share & Forecast 2025-2035

Western Europe Dietary Supplements Market Analysis by Ingredients, Form, Application, and Country Through 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Viscosupplementation Industry Analysis in Europe - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA