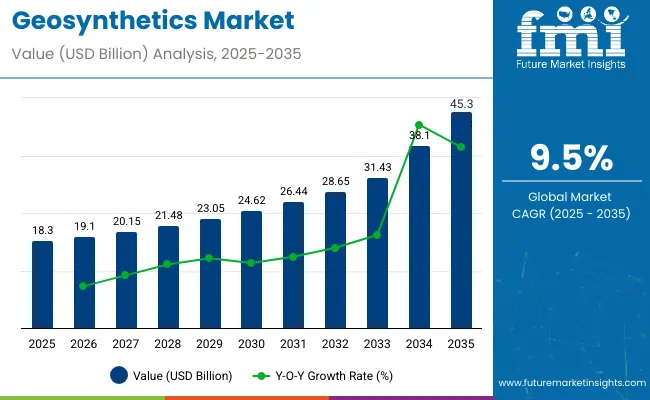

The global geosynthetics market is projected to be valued at USD 18.3 billion in 2025 and reach USD 45.3 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period. Demand growth is being shaped by infrastructure expansion, waste containment requirements, and increasing regulatory pressure on construction and environmental performance standards.

| Metrics | Value |

|---|---|

| Industry Size (2025E) | USD 18.3 Billion |

| Industry Value (2035F) | USD 45.3 Billion |

| CAGR (2025 to 2035) | 9.5% |

Geosynthetics, including geotextiles, geomembranes, geogrids, and geonets, are being deployed across applications such as roadways, railways, landfills, mining, and coastal engineering. In transportation infrastructure, these products are being used to enhance soil stability and prevent erosion, enabling longer service life of paved and unpaved surfaces. The USA Department of Transportation (DOT) has issued technical guidance on the use of geotextiles in highway construction under FHWA specifications, supporting their adoption in federal and state-funded road projects.

In landfill construction, geosynthetics are being applied in base liners and capping systems to meet containment and leachate control requirements. According to data published by the Solid Waste Association of North America (SWANA), the adoption of geomembranes in landfill applications has grown in response to stricter state-level permitting requirements for municipal solid waste (MSW) facilities.

The construction sector in China and India is witnessing an expansion in the use of geosynthetics due to government investment in road building and erosion control. In 2023, the Ministry of Road Transport and Highways (MoRTH) in India endorsed the use of geotextiles under the Bharatmala project to stabilize slopes and improve drainage in hilly terrain. Similar initiatives have been launched in the European Union under the Green Infrastructure Strategy, encouraging the use of geosynthetics to meet flood control and soil reinforcement objectives.

In the oil and gas sector, geomembranes are being deployed in containment ponds and secondary spill prevention systems. Producers such as Solmax and Atarfil have reported increased demand from North American shale operators seeking to reduce surface water contamination risks.

Investments in product development by key manufacturers are supporting broader deployment. Manufacturers including TenCate, NAUE, and Fibertex have released new woven and non-woven geotextile products with improved permeability and tensile strength for high-load applications.

Demand is expected to remain supported by continued infrastructure investment, stricter environmental regulations, and broader adoption across civil engineering and waste containment projects.

The geosynthetics market is governed by stringent regulations to ensure product safety, environmental protection, and performance reliability across various applications such as construction, environmental remediation, and infrastructure development. Regulatory bodies in different regions set standards for material quality, durability, and environmental compliance.

The geosynthetics market is governed by a comprehensive certification framework that ensures product quality, safety, and performance across various applications. Key standards and certifications such as ASTM International and ISO 9001 provide guidelines for testing, manufacturing, and quality management. Specialized certifications from the Geosynthetic Institute (GSI) validate compliance with industry-specific requirements. Additionally, regulatory marks like CE for the European market and NSF certification for water-related uses further guarantee that geosynthetic products meet stringent safety and environmental standards, fostering trust and reliability among users worldwide.

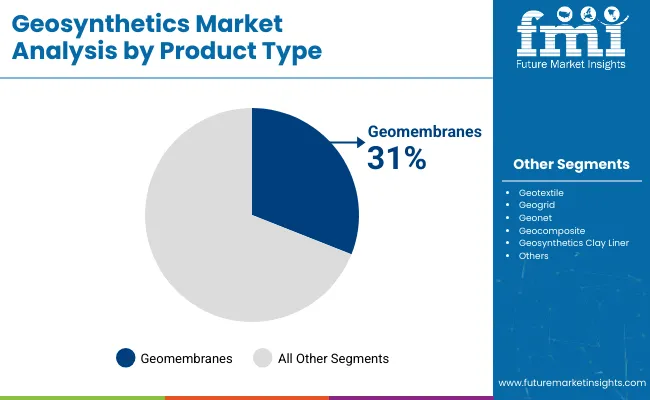

Geomembranes are estimated to account for approximately 31% of the global geosynthetics market share in 2025 and are projected to grow at a CAGR of 9.6% through 2035. These impermeable sheets are extensively used in landfill liners, mining leach pads, wastewater treatment facilities, and water reservoirs to prevent fluid migration and soil contamination.

The segment continues to benefit from stringent environmental regulations and global investments in waste management and water infrastructure. Advancements in multi-layered geomembrane structures and the integration of barrier-enhancing additives are further strengthening their use in long-term containment and geotechnical stability applications.

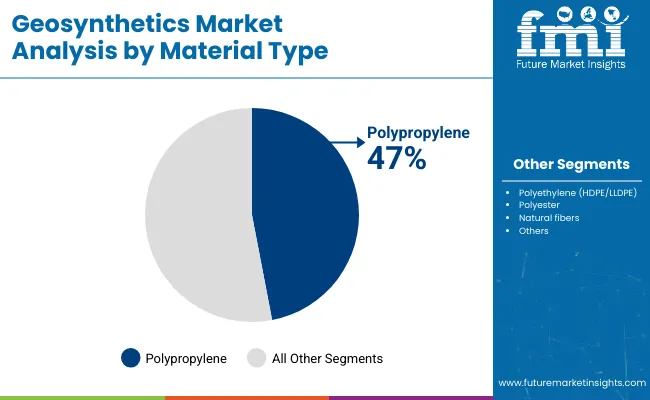

Polypropylene is projected to hold approximately 47% of the global geosynthetics market share in 2025 and is expected to grow at a CAGR of 9.7% through 2035. This thermoplastic polymer is widely used in geotextiles, geogrids, and geocomposites due to its high tensile strength, UV resistance, and inert behavior in chemically aggressive environments.

Polypropylene-based geosynthetics are commonly applied in road construction, coastal protection, and erosion control systems. As infrastructure development accelerates in emerging economies and governments emphasize the use of long-life, sustainable materials, polypropylene remains the preferred choice for geotechnical engineering and civil construction projects.

Potential challenges in the Geosynthetics Market include uneven raw material, strict rules & regulations and various quality in places. Geosynthetics are produced from polymeric materials, for example, polyethylene, polypropylene, etc., and their prices are associated with the price of crude oil, leading to the fluctuation of prices.

Besides that, strict environment legislation specific to plastic-based materials is a magnet for market growth, thereby pushing suppliers to create sustainable substitutes. Moreover, the industry faces challenges relating to uncoordinated international testing and performance certifications, posing challenges for global companies to navigate different and divergent regulations.

It is important for companies to conduct research to have bio-based geosynthetics as alternative solutions, optimize raw material procurement strategies and recommend uniform global standards that adequately streamline compliance processes.

Geosynthetics Market the increasing need for geosynthetics in infrastructure projects and environmental sustainability creates new growth opportunities for the market. Geosynthetics are essential during the construction of structures as they are used for soil stabilization, drainage systems, control of erosion, protection of landfill, etc.

The increasing investments of governments across the globe in smart city development, transportation networks and water management projects will drive geosynthetics adoption. Linked to this, the movement towards sustainable construction materials has driven greater interest in geosynthetics, which can be produced from both recycled and biodegradable polymers.

In this evolving market, companies that innovate in product durability, green geosynthetics, and digital monitoring technologies for geotechnical applications will gain a competitive advantage.

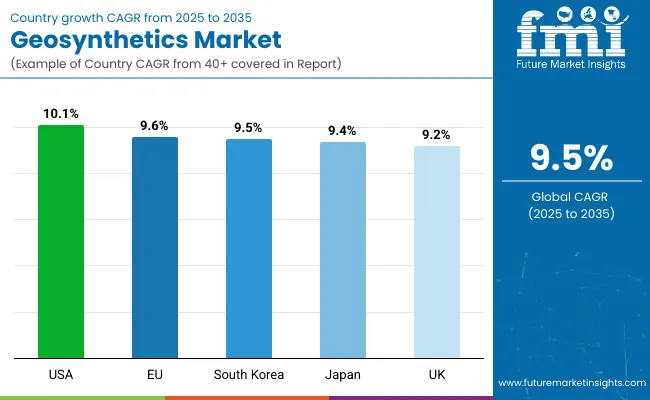

The USA geosynthetics market is at a high growth phase owing to rising investments in modernization of infrastructures, broader environmental regulations, and greater demand for erosion control solutions. Increased spending for highway, flood management, and soil stabilization projects under the Bipartisan Infrastructure Law (BIL) will lead to an incremental growth in demand for geosynthetics such as geotextiles, geogrids and geomembranes.

Another driving factor is the waste management sector, wherein geosynthetics are used for landfill liners and hazardous waste containment and groundwater protection. Furthermore, coastal protection initiatives and climate resilience projects are creating new avenues for application of geosynthetics in shoreline stabilization reasons.

The USA market is projected to increase strongly with continued federal funding of sustainable infrastructure and innovation of high-performance geosynthetics.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.1% |

The United Kingdom geosynthetics market is projected to grow on account of increasing adoption of sustainable construction materials, rising applications for flood protection projects as well as growing use of geosynthetics in transportation infrastructure. Extensive soil, water and storage-based applications using advanced geosynthetics systems have also been recognized and recommended in the UK government's National Infrastructure Strategy throughout rail, road and urban draining projects.

The waste management sector has also experienced an increased adoption of geosynthetics, especially in landfill liners and capping systems. This will solely be used to reduce carbon footprints in construction like the United Kingdom thereby increasing the use of recycled and biodegradable geosynthetics materials.

Investment in green infrastructure and climate adaptation solutions are expected to grow steadily in the UK geosynthetics market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.2% |

The growth of the geosynthetics market in Europe is driven by stringent environmental regulations, increasing infrastructure projects, and growing use of geosynthetics for, erosion control and water management applications. Some of the prominent market-supported nations are based on Germany, Italy & France putting forth an exponential growth of geosynthetics applicative practices in road construction, railways, and coastal defence tasks.

EU initiatives like the circular economy action plan and green deal are pushing the use of a more sustainable, recyclablable geosynthetics particularly, in the waste management and construction sectors. As a pioneer in engineering and environmental sustainability, Germany is making significant investments in geogrids, geomembranes, and geocells to be used for slope stabilization, landfill protection, and flood mitigation.

The EU geosynthetics market is expected to perform well due to this market growth, as geosynthetics materials are getting advanced with each passing day with the increasing use in climate resilience projects.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 9.6% |

Growth of the Japanese geosynthetics industry is driven by increasing investment in disaster preparedness, upgrade of infrastructure, and environmental safeguards. Japan’s chronic earthquakes, typhoons, and landslides have driven the demand for geosynthetics in slope stabilization, embankment reinforcement, and coastal protection projects.

As part of urban development and smart city projects, geotextiles and geogrids are capturing their place in the Japanese construction industry by improving durability and minimizing maintenance costs. The country's emphasis on sustainable waste management is boosting geosynthetic use in landfill containment and wastewater treatment applications.

Japanese geosynthetics market will be growing steadily due to the continuous developments in earthquake resistant infrastructures and climate adaptation solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.4% |

The South Korea Geosynthetics market is growing at a steeper pace and to reach its full potential, the market is driven primarily by government investments in the infrastructure, increased applications in the mining and land reclamation and growing demand for sustainable construction solutions that reduce the environment.

Smart Infrastructure and Green New Deal initiatives from the South Korean government are helping to drive the use of geosynthetics for roads, tunnels and embankment reinforcement.

The mining industry, which relies heavily on geomembranes and geotextiles for tailings and environment solutions, is also a significant contributor. The growing industrial waste management also fuels the demand for geosynthetics liners and drainage solutions with better performances.

South Korean geosynthetics market is forecast to showcase their bright spot with continued infrastructure upgrades and climate resilience expands.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.5% |

Key players are introducing specialized product lines to serve infrastructure projects, providing cost-effective and durable solutions in geotextiles, geogrids, and erosion control. Manufacturers are focusing on quality control, maintaining local inventories, and offering responsive technical support to meet the growing needs of contractors and engineering firms. The market is also witnessing a shift towards applications in soil stabilization, separation, filtration, and reinforcement for road, rail, and coastal infrastructure projects.

The overall market size for Geosynthetics Market was USD 18.3 Billion in 2025.

The Geosynthetics Market expected to reach USD 45.3 Billion in 2035.

The demand for the Geosynthetics Market will be driven by the growing construction and infrastructure development, increasing use in waste management, water conservation, and soil reinforcement projects. Environmental concerns and the need for sustainable materials in civil engineering will further fuel market growth.

The top 5 countries which drives the development of Geosynthetics Market are USA, UK, Europe Union, Japan and South Korea.

Geotextiles and Geomembranes Drive Market to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Geosynthetics Industry Analysis in South Asia Growth - Trends & Forecast 2025 to 2035

Demand for Geosynthetics in South Asia Size and Share Forecast Outlook 2025 to 2035

Reinforcement Geosynthetics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA