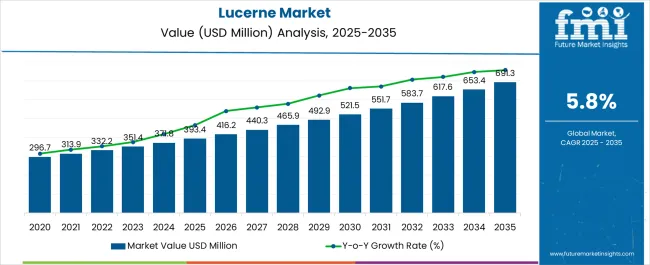

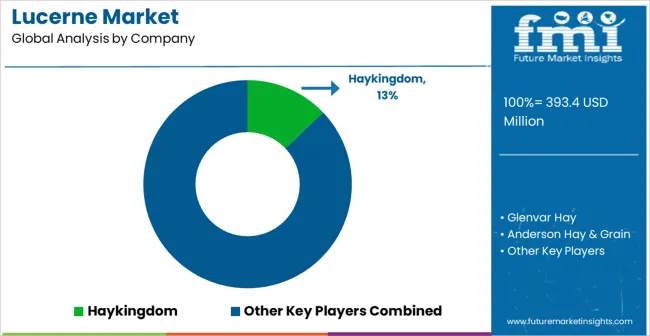

The Lucerne Market is estimated to be valued at USD 393.4 million in 2025 and is projected to reach USD 691.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Lucerne Market Estimated Value in (2025 E) | USD 393.4 million |

| Lucerne Market Forecast Value in (2035 F) | USD 691.3 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The Lucerne market is witnessing robust growth, driven by increasing demand for high-quality forage in livestock nutrition and dairy production. Lucerne is being recognized for its superior protein content, digestibility, and adaptability, making it a preferred choice for feeding ruminants such as cattle, sheep, and goats. The expansion of the dairy industry, combined with rising meat and milk consumption in both developed and emerging economies, is further supporting market growth.

Cultivation practices, including advanced irrigation, fertilization techniques, and high-yield seed varieties, are enhancing crop productivity and quality. The integration of lucerne into feed formulations is providing livestock with improved health, growth rates, and milk yield, which is encouraging adoption among commercial farms.

Sustainability trends and the focus on natural, nutrient-rich feed are also shaping the market landscape As livestock farming becomes more intensive and demand for dairy and meat products rises, the Lucerne market is expected to maintain steady expansion, supported by ongoing innovation in cultivation and processing methods.

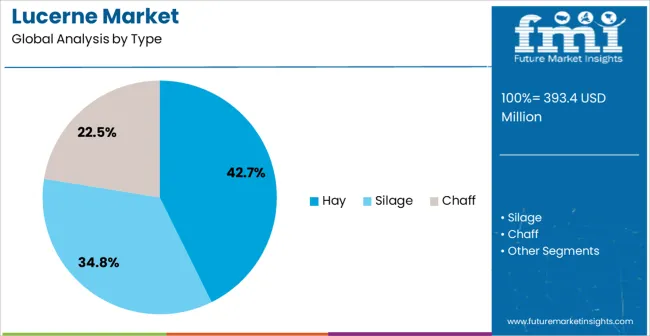

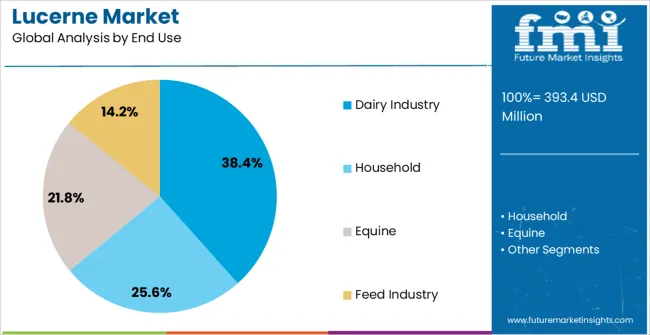

The lucerne market is segmented by type, end use, distribution channel, and geographic regions. By type, lucerne market is divided into Hay, Silage, and Chaff. In terms of end use, lucerne market is classified into Dairy Industry, Household, Equine, and Feed Industry. Based on distribution channel, lucerne market is segmented into Supermarkets, Store Based Retail, Specialty Stores, Online Retail, and Hypermarkets. Regionally, the lucerne industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hay segment is projected to hold 42.7% of the Lucerne market revenue in 2025, establishing it as the leading type. Growth in this segment is being driven by its widespread use as a primary feed for ruminants due to its high protein content, palatability, and ease of storage. Hay-based lucerne is particularly suitable for dairy cattle, providing essential nutrients that improve milk yield and quality.

The ability to harvest, dry, and store lucerne hay while retaining its nutritional value has further strengthened adoption across livestock farms. Increased mechanization and improved harvesting technologies have enhanced productivity and efficiency in hay production. Commercial farms and cooperative feed suppliers are increasingly relying on hay as a consistent and reliable feed source.

Rising awareness of the benefits of nutrient-rich forage, coupled with its cost-effectiveness compared to alternative feeds, is reinforcing the segment’s market leadership As demand for high-quality livestock nutrition continues to rise globally, the hay segment is expected to maintain dominance.

The dairy industry segment is anticipated to account for 38.4% of the Lucerne market revenue in 2025, making it the leading end-use industry. Growth is being driven by the increasing consumption of milk and dairy products, which has created demand for high-quality feed that supports optimal lactation, animal health, and productivity. Lucerne provides a rich source of protein, fiber, and essential nutrients that enhance milk yield and quality, making it highly valued by dairy farmers.

Adoption is further supported by large-scale dairy operations that require consistent and reliable feed supplies. Integration of lucerne into silage, mixed rations, and other feed formulations allows for efficient nutrient management and improved animal performance.

Sustainability considerations and the focus on natural, high-quality feed ingredients are further accelerating its use in the dairy sector As dairy production scales globally to meet growing nutritional demands, the industry’s reliance on lucerne is expected to continue driving market growth.

The supermarkets distribution channel segment is projected to hold 36.9% of the market revenue in 2025, positioning it as the leading channel. Growth in this segment is being driven by the increasing demand for packaged and branded animal feed products in urban and semi-urban areas. Supermarkets provide convenience, accessibility, and consistent product quality, which attracts commercial and small-scale livestock owners.

The availability of pre-packaged lucerne hay and feed in supermarkets ensures standardized quality and nutritional value, enhancing consumer confidence. Retail promotions, seasonal campaigns, and brand awareness initiatives further support market penetration through this channel.

Additionally, supermarkets allow for effective inventory management, product visibility, and scalability, benefiting both suppliers and end users As consumer awareness of animal nutrition grows and organized retail networks expand in emerging markets, supermarkets are expected to remain a dominant distribution channel, driving revenue and adoption of high-quality lucerne products.

The lucerne industry, also known as alfalfa, is witnessing steady growth due to several key factors. Firstly, the increasing demand for animal feed, particularly among livestock producers, serves as a primary driver.

Lucerne is prized for its high protein and nutrient content, making it a valuable component of feed formulations for dairy cows, beef cattle, sheep, and horses. As the global population continues to rise, the demand for meat and dairy products also increases, driving the need for quality feed ingredients like lucerne.

Secondly, growing awareness of sustainable agricultural practices is fueling the demand for lucerne. As consumers and governments prioritize environmental conservation and animal welfare, there is a shift towards more sustainable farming methods.

Lucerne, with its ability to fix nitrogen in the soil and reduce the need for synthetic fertilizers, aligns well with these sustainability goals. Its deep root system also helps prevent soil erosion and improves soil health, making it an attractive option for environmentally conscious farmers.

The expansion of the dairy and livestock industries in emerging economies contributes to the demand for lucerne. Countries like China, India, and Brazil are experiencing rapid urbanization and rising incomes, leading to increased consumption of animal products. Lucerne, with its nutritional benefits and versatility as a feed ingredient, plays a crucial role in supporting the growth of these industries.

Lucerne's versatility extends beyond animal feed. It is also used in soil improvement, erosion control, and as a cover crop in crop rotation systems. This multifunctionality enhances its market appeal and ensures a steady demand across various agricultural sectors.

Overall, the global industry is driven by the increasing demand for animal feed, sustainability initiatives, expansion of livestock industries, and its versatility in agricultural applications. These factors contribute to its resilience and continued growth in the global market.

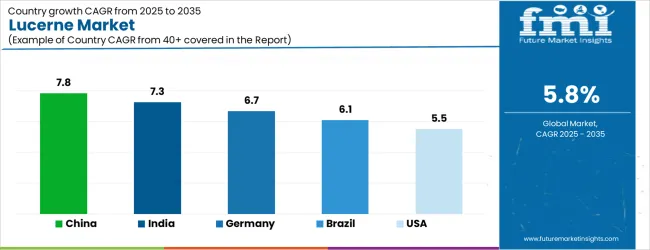

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| Brazil | 6.1% |

| USA | 5.5% |

| UK | 4.9% |

| Japan | 4.4% |

The Lucerne Market is expected to register a CAGR of 5.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.8%, followed by India at 7.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.4%, yet still underscores a broadly positive trajectory for the global Lucerne Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.7%. The USA Lucerne Market is estimated to be valued at USD 143.8 million in 2025 and is anticipated to reach a valuation of USD 143.8 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 20.3 million and USD 10.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 393.4 Million |

| Type | Hay, Silage, and Chaff |

| End Use | Dairy Industry, Household, Equine, and Feed Industry |

| Distribution Channel | Supermarkets, Store Based Retail, Specialty Stores, Online Retail, and Hypermarkets |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Haykingdom, Glenvar Hay, Anderson Hay & Grain, Alfalfa Monegros, S&W Seed, Cubeit Hay, M&C Hay, Standlee Hay, Border Valley, Gruppo Carli, ACX Global, Bailey Farms, Aldahra Fagavi, Grupo Osés, and Huishan Diary |

The global lucerne market is estimated to be valued at USD 393.4 million in 2025.

The market size for the lucerne market is projected to reach USD 691.3 million by 2035.

The lucerne market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in lucerne market are hay, silage and chaff.

In terms of end use, dairy industry segment to command 38.4% share in the lucerne market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA