Molded Fiber Pulp Packaging Market Size, Share and Forecast Outlook 2025 to 2035

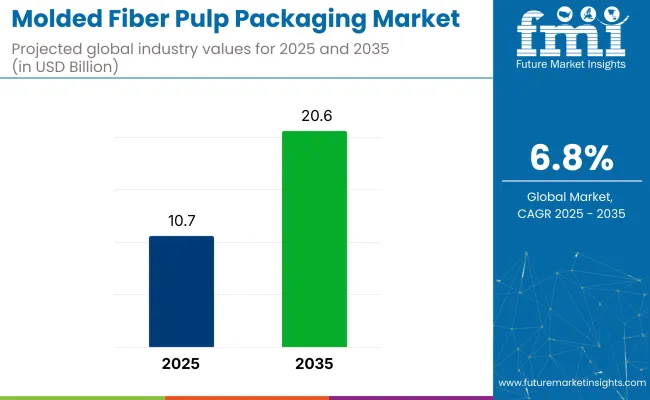

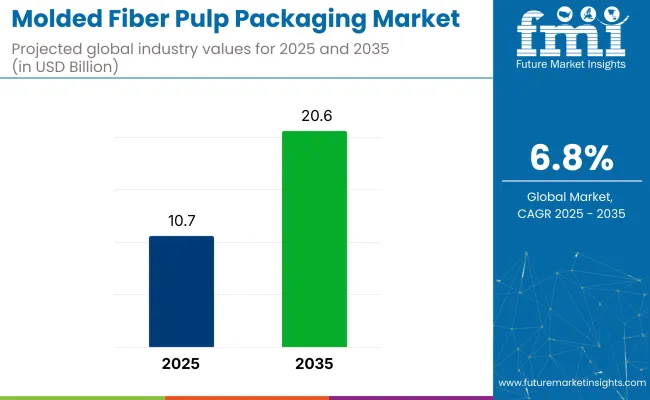

The global molded fiber pulp packaging market is likely to expand, increasing from USD 10.7 billion in 2025 to USD 20.6 billion by 2035, advancing at a CAGR of 6.8% during the forecast period. The growing emphasis on sustainability, reduction of single-use plastics, and rising environmental consciousness among both consumers and industries are key factors propelling this industry forward. The demand for biodegradable, recyclable, and compostable packaging solutions is expected to surge as global regulations targeting plastic waste intensify.

Quick Stats for the Molded Fiber Pulp Packaging Market

- Market Value (2025): USD 10.7 billion

- Forecast Value (2035): USD 20.6 billion

- Forecast CAGR (2025 to 2035): 6.8%

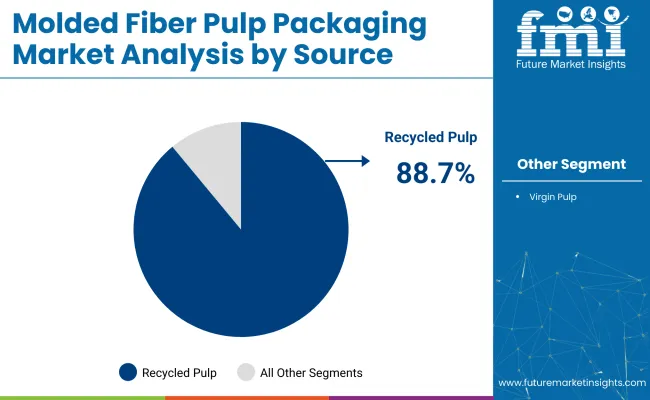

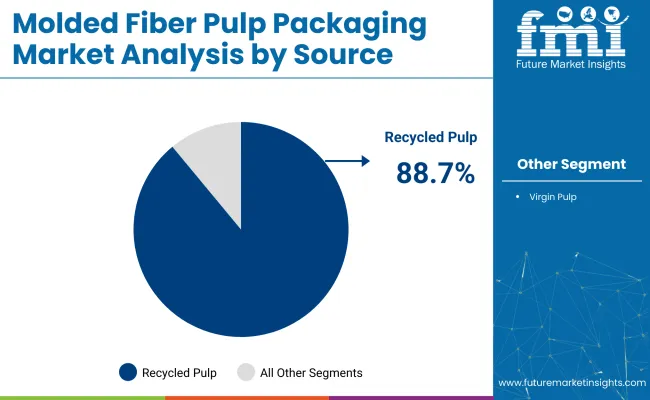

- Leading Segment in 2025: Recycled Pulp (88.7% share)

- Key Growth Region: Asia Pacific (India)

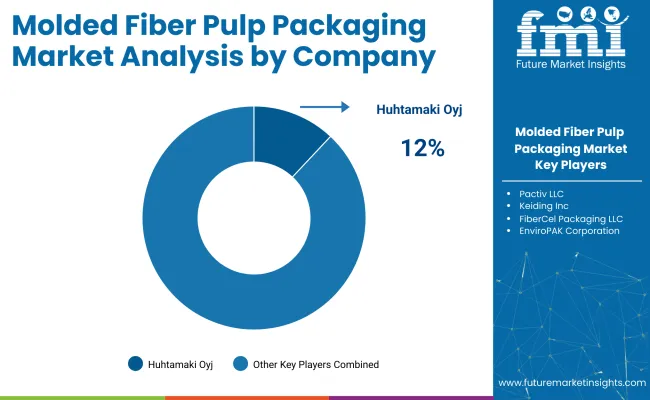

- Key Players: UFP Technologies, Inc., FiberCel Packaging LLC, Huhtamaki Oyj, Pactiv LLC, Henry Molded Products, Inc.

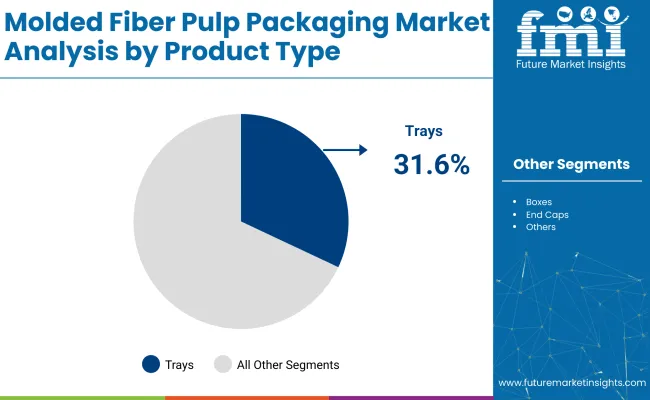

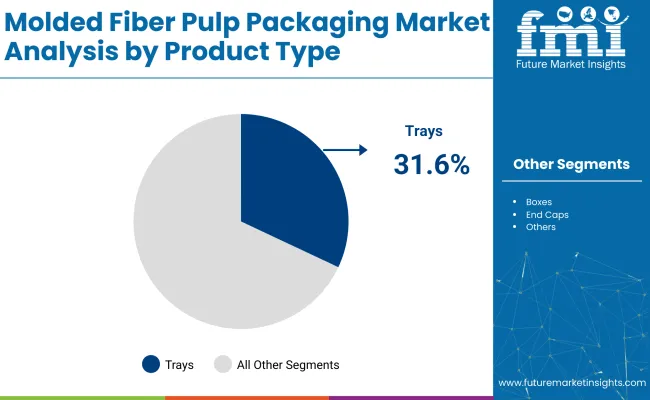

By source, recycled pulp is set to dominate the industry, accounting for approximately 88.7% of the total share in 2025. This is driven by its cost advantages, ease of availability, and lower carbon footprint compared to virgin pulp materials. In terms of product type, trays are forecast to maintain their leadership position, capturing nearly 31.6% of the industry share in 2025, primarily supported by their broad applications in food packaging, electronics, and consumer goods industries due to their strength, durability, and eco-friendly nature.

In December 2024, the United Nations Industrial Development Organization (UNIDO) released a comprehensive policy report titled “Addressing the Challenges of Plastic Pollution,” which underscores the critical role of circular economy practices in mitigating plastic pollution.

The report specifically highlights the adoption of recycled and biodegradable materials such as molded fiber pulp packaging as crucial substitutes for conventional plastics in various industrial sectors. While no industry size data was provided, the endorsement of molded fiber packaging as an environmentally sustainable and resource-efficient solution strengthens its relevance in global sustainability and waste reduction initiatives.

Analysis of Molded Fiber Pulp Packaging Market by Top Investment Segments

Recycled pulp, trays, transfer molded pulp, primary packaging, and food & beverages are anticipated to dominate the industry in 2025, as the demand for sustainability and protective packaging solutions continues to rise.

Recycled Pulp Leads Source Segment

The source segment is expected to be dominated by recycled pulp, which is projected to account for an 88.7% industry share in 2025.

- Demand is being driven by the global shift towards eco-friendly and sustainable packaging alternatives. Cost reductions and compliance with stringent regulatory requirements for sustainable materials are being ensured by manufacturers through the use of recycled pulp.

- Virgin pulp is being utilized minimally due to concerns regarding higher costs and environmental impact. Recycled pulp’s availability from post-consumer waste is being leveraged to ensure scalability and cost-efficiency in mass production.

Trays Lead Product Type Segment

The product type segment is forecasted to be led by trays, holding a 31.6% industry share in 2025.

- The versatility and protective characteristics for multiple end-use sectors are being credited for the rising demand. Applications such as egg packaging, fruit storage, and electronics protection are being served by trays due to their ability to minimize damage during handling and transit.

- Other product types, including drink carriers and clamshell containers, are being restricted to niche markets with limited overall demand. Growth in the demand for molded fiber trays is being driven by the food and beverage industry’s shift toward sturdy, biodegradable packaging that assures safety while mitigating environmental harm.

Transfer Molded Leads Molded Pulp Type Segment

Transfer molded pulp is projected to lead the molded pulp type segment with a 45% industry share in 2025.

- Egg cartons, fruit trays, and electronic protective packaging are being predominantly manufactured using this pulp type because of its durability and precise molding capability.

- Thick wall and thermoformed fiber types are being utilized in specialized or premium applications but remain constrained by higher costs and manufacturing complexity. A balanced offering of performance and affordability is being provided by transfer molded pulp, making it the preferred solution for large-scale food, consumer electronics, and retail packaging demands.

Primary Packaging Leads Application Segment

Primary packaging is anticipated to maintain its leadership in the application segment with a 55% industry share in 2025.

- The direct packaging needs of food, beverages, and electronic goods are being effectively met by molded fiber pulp, which provides cushioning, moisture resistance, and product safety during transit and storage. Secondary packaging and edge protectors are being applied in logistics and industrial settings but are not experiencing widespread use in consumer-oriented products.

- Heightened demand for biodegradable, eco-conscious primary packaging in grocery, dairy, and personal care products is being observed, as retailers emphasize sustainable substitutes for polystyrene and plastics.

Food & Beverages Lead End-Use Segment

The food & beverage sector is set to remain the leading end-use segment, forecasted to hold a 50% industry share in 2025.

- This is being driven by increased adoption of compostable and biodegradable packaging materials. Molded fiber pulp trays, clamshells, and carriers are being extensively utilized for the packaging of eggs, fruits, wine, and ready-to-eat meals owing to their environmental advantages and protective properties.

- While industries such as consumer durables, cosmetics, and automotive are employing molded pulp solutions, their utilization remains limited in comparison. The food sector’s dependence on molded fiber packaging is being reinforced by rising environmental awareness and stringent regulations aimed at reducing plastic use, which enhances both sustainability credentials and product appeal.

Top Molded Fiber Pulp Packaging Market Dynamics

Eco-friendly packaging mandates and sector diversification are driving molded fiber pulp growth. Expansion into electronics and cosmetic protection, along with food tray dominance, is being enabled by sustainable innovation and automated manufacturing.

Sustainability-Led Shift Toward Eco-Friendly Protective Packaging

- The industry is being driven by demand for sustainable alternatives to plastic. Recycled pulp sourced from paper and agricultural by-products is being converted into protective trays and clamshells. Adoption is strong in the food industry-especially for eggs and fresh produce-due to fiber’s compostable and moisture-resistant qualities.

- Regulatory bans on single-use plastics are accelerating this trend. For example, demand for molded pulp trays has dramatically increased as fast-food operators shift to biodegradable packaging. Manufacturers are innovating with transfer-molding and thick-wall processes to increase output.

Infrastructure Expansion and Industrial Diversification Prompting Market Growth

- Infrastructure development and rapid e-commerce growth are expanding molded fiber pulp packaging use beyond food. Electronics, cosmetics, and pharmaceutical brands are shifting from foam to molded fiber bumpers, inserts, and trays. Companies are investing in high-capacity production methods to meet sector-specific needs and reduce packaging weight.

- Automation and AI integration in molding processes are being adopted to enhance precision and reduce labor costs. North America is emerging as a key growth region thanks to diversification across industries. Suppliers are collaborating with OEMs to tailor solutions for fragile goods protection

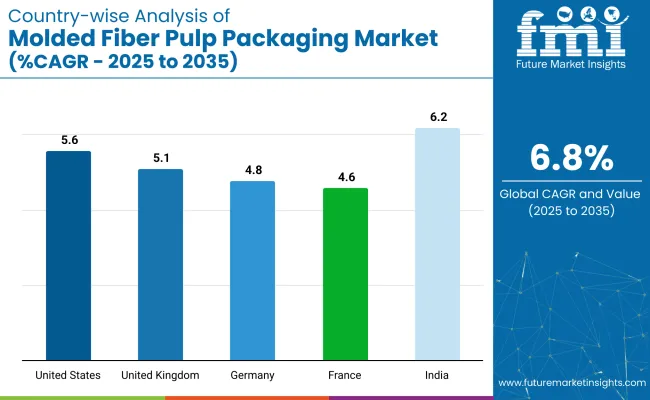

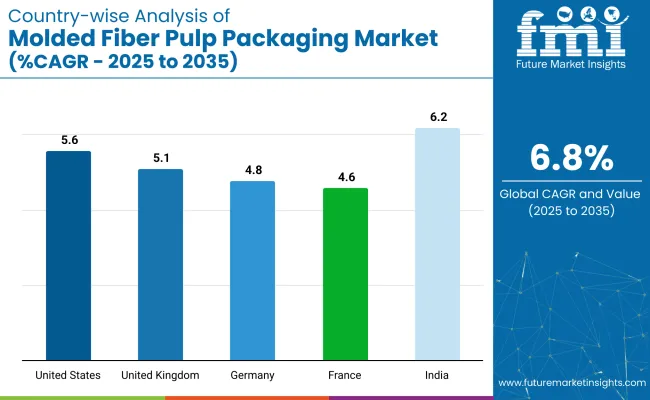

Top Countries Manufacturing, Exporting, Adopting, and Innovating Molded Fiber Pulp Packaging

The industry study identifies prominent trends across various key regions. Manufacturers in these countries can formulate strategic approaches based on advancements in sustainable packaging technology, regulatory developments, and evolving consumer preferences towards eco-friendly materials.

| Country |

CAGR (2025 to 2035) |

| United States |

5.6% |

| United Kingdom |

5.1% |

| Germany |

4.8% |

| France |

4.6% |

| India |

6.2% |

United States Molded Fiber Pulp Packaging Market Analysis

The industry in the United States is poised for steady expansion with a projected CAGR of 5.6% from 2025 to 2035.

- Demand is primarily driven by the food service industry’s transition to sustainable packaging solutions, encouraged by strict environmental regulations and consumer shifts away from plastic use. Leading players focus on innovation in biodegradable and compostable fiber products that meet high durability and versatility standards.

- Growth is bolstered by major quick-service restaurant chains adopting molded fiber trays, plates, and clamshells as part of their green packaging commitments. With extensive industrial capacity and consumer readiness to embrace sustainable alternatives, the United States holds the largest industry share in the global molded fiber pulp packaging industry.

Molded Fiber Pulp Packaging Market in United Kingdom Growth Analysis

In the United Kingdom, the molded fiber pulp packaging sector is set to register a CAGR of 5.1% during the 2025 to 2035 period.

- Government initiatives such as the Plastic Packaging Tax have catalyzed demand for sustainable alternatives in the food, healthcare, and industrial sectors. Local manufacturers are rapidly investing in machinery upgrades to produce advanced molded fiber products that are recyclable and compostable.

- The UK industry also benefits from retail giants transitioning to fiber-based packaging to meet carbon neutrality goals.

Germany Molded Fiber Pulp Packaging Market Trends

The industry in Germany is forecasted to grow at a CAGR of 4.8% from 2025 to 2035.

- The country’s highly organized recycling infrastructure and strong emphasis on industrial sustainability drive industry adoption. German manufacturers emphasize precision engineering to develop molded fiber products for electronics and consumer goods packaging.

- Corporate sustainability programs align with government eco-design directives, further supporting molded fiber adoption. A culture that values organic and environmentally friendly products provides fertile ground for the industry’s steady development in Germany.

In-depth Analysis of Molded Fiber Pulp Packaging Market in France

The industry in France is projected to record a CAGR of 4.6% between 2025 and 2035.

- Growth in this industry is being driven by the strong presence of the country’s artisanal, gourmet, and premium food sectors, where molded fiber packaging is increasingly favored for its aesthetic and eco-friendly properties.

- Manufacturers are innovating to provide visually appealing, functional packaging solutions suitable for luxury confectioneries, wines, and specialty items. Additionally, government policies aimed at reducing single-use plastics, combined with heightened consumer environmental awareness, are fostering industry demand.

Molded Fiber Pulp Packaging Market in India Growth Analysis

The industry in India is set to achieve the fastest growth rate among key countries, with a projected CAGR of 6.2% from 2025 to 2035.

- Industry expansion is supported by the government’s strict plastic reduction measures, incentives for biodegradable materials, and the shift of consumer preference towards sustainable products.

- A surge in e-commerce, electronics, and consumer durable sectors has amplified demand for molded fiber solutions that offer both protection and eco-friendliness. Domestic and international manufacturers are increasing production capacities to meet rising local demand.

Leading Molded Fiber Pulp Packaging Market Suppliers

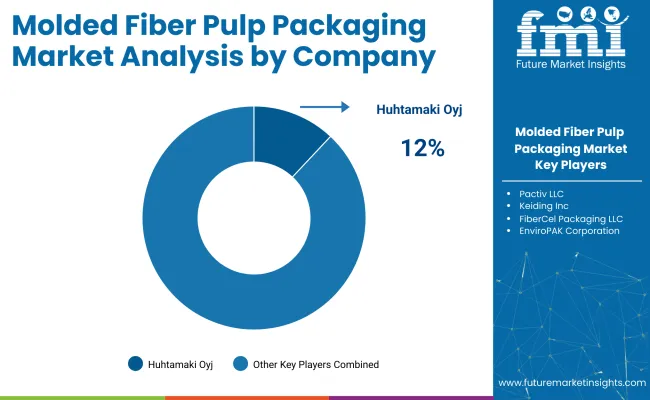

The global industry presents a moderately fragmented landscape. Prominent companies such as Huhtamaki Oyj, UFP Technologies, Inc., and Brodrene Hartmann A/S lead the industry with extensive global operations, strong R&D capabilities, and a diversified molded fiber product portfolio for foodservice, electronics, and consumer goods sectors.

Key players like FiberCel Packaging LLC, Pactiv LLC, and EnviroPAK Corporation focus on customized and sustainable packaging solutions for niche industrial and retail applications. Emerging players including Keiding, Inc. and Pacific Pulp Molding, LLC cater to regional demands, offering cost-effective, eco-friendly molded fiber products for small-scale businesses and local industries.

Recent Molded Fiber Pulp Packaging Industry News

- The 27th Annual Conference of the International Molded Fiber Association (IMFA) was held from April 30 to May 2, 2025, in Miami, gathering nearly 200 global industry leaders. The event highlighted the growing importance of molded fiber solutions in sustainable packaging, emphasizing advancements in design, manufacturing technologies, and adoption by major brands.

- In January 2025, Pactiv Evergreen earned the FSC®-Recycled certification for its molded fiber egg packaging, underscoring the company's commitment to sustainable practices. The certified packaging was showcased at the International Production & Processing Expo in Atlanta, Georgia.

Key Molded Fiber Pulp Packaging Market Players

- UFP Technologies, Inc.

- FiberCel Packaging LLC

- Huhtamaki Oyj

- Pactiv LLC

- Henry Molded Products, Inc

- EnviroPAK Corporation

- ProtoPak Engineering Corporation

- Brodrene Hartmann A/S

- Keiding, Inc.

- Pacific Pulp Molding, LLC

Report Scope - Molded Fiber Pulp Packaging Market

| Report Attributes |

Details |

| Industry Size (2025) |

USD 10.7 billion |

| Projected Industry Size (2035) |

USD 20.6 billion |

| CAGR (2025 to 2035) |

6.8% |

| Base Year for Estimation |

2024 |

| Historical Period |

2020 to 2024 |

| Projections Period |

2025 to 2035 |

| Quantitative Units |

USD billion for value and thousand tons for volume |

| Sources Analyzed (Segment 1) |

Virgin Pulp, Recycled Pulp |

| Product Types Analyzed (Segment 2) |

Trays, Drink Carriers (2 Cups, 4 Cups, 6 Cups, More than 8 Cups), Boxes, End Caps, Plates, Bowls, Cups, Bottles, Clamshell Containers |

| Molded Pulp Types Analyzed (Segment 3) |

Thick Wall, Transfer Molded, Thermoformed Fiber, Processed Pulp |

| Applications Analyzed (Segment 4) |

Primary Packaging, Secondary Packaging, Edge Protectors |

| End Uses Analyzed (Segment 5) |

Consumer Durables (Mobile Phone, Television, Laptops, Tube Light & Bulbs, Others), Food and Beverages (Egg Packaging, Fruit Packaging, Wine Packaging, Others), Cosmetics, Food Services, Healthcare, Automotive, Logistics, Others |

| Countries Covered |

United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players influencing the Industry |

UFP Technologies, Inc., FiberCel Packaging LLC, Huhtamaki Oyj , Pactiv LLC, Henry Molded Products, Inc., EnviroPAK Corporation, ProtoPak Engineering Corporation, Brodrene Hartmann A/S, Keiding , Inc., Pacific Pulp Molding, LLC |

| Additional Attributes |

Dollar sales, share by source and product type, sustainable packaging demand surge, adoption in electronics and food sectors, growth in molded thermoformed fiber solutions, shift towards recycled pulp utilization |

Key Segments Studied in the Molded Fiber Pulp Packaging Market

By Source:

By source, the industry is segmented into virgin pulp and recycled pulp.

By Product Type:

By product type, the industry is classified into trays, drink carriers, boxes, end caps, plates, bowls, cups, bottles, and clamshell containers. Drink carriers are further divided into 2 cups, 4 cups, 6 cups, and more than 8 cups.

By Molded Pulp Type:

By molded pulp type, the industry is segmented into thick wall, transfer molded, thermoformed fiber, and processed pulp.

By Application:

By application, the industry includes primary packaging, secondary packaging, and edge protectors.

By End Use:

By end use, the industry is segmented into consumer durables, food and beverages, cosmetics, food services, healthcare, automotive, logistics, and others.Consumer durables are further divided into mobile phones, televisions, laptops, tube lights & bulbs, and others.

Food and beverages include egg packaging, fruit packaging, wine packaging, and others.

By Region:

By region, the industry covers North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and Middle East & Africa.