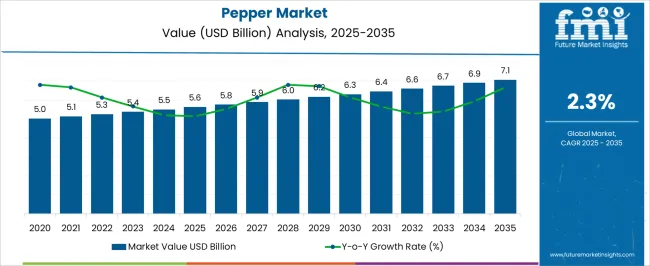

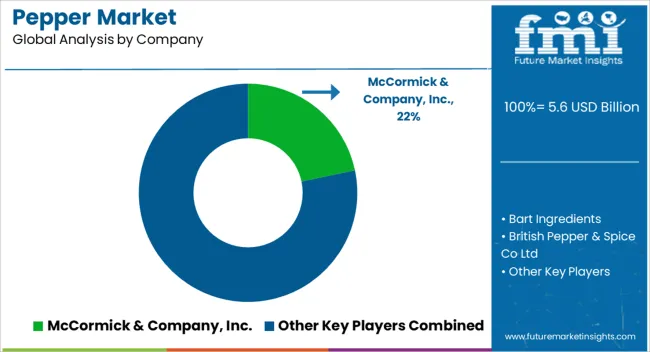

The pepper market is estimated to be valued at USD 5.6 billion in 2025 and is projected to reach USD 7.1 billion by 2035, registering a compound annual growth rate (CAGR) of 2.3% over the forecast period.

The pepper market, valued at USD 5.6 billion in 2025 and projected to reach USD 7.1 billion by 2035 at a CAGR of 2.3%, demonstrates a cost structure influenced by agricultural production, processing, distribution, and retail operations. Primary cost components are dominated by raw material procurement, as cultivation of pepper involves land preparation, labor-intensive harvesting, and adherence to crop management practices. Fluctuations in yield, climatic conditions, and quality grading directly affect procurement costs, establishing the foundational economic layer of the value chain. Processing and packaging represent the secondary cost tier, encompassing cleaning, drying, grinding, and standardization activities to meet market quality specifications.

Investments in machinery, quality control, and compliance with food safety standards contribute to the operational expenditure in this segment. Distribution costs, including transportation, storage, and cold-chain requirements where applicable, add further to the overall cost structure, particularly for exports and regional supply networks. Retail and wholesale channels represent the terminal layer, where margins reflect both logistical efficiency and brand positioning strategies.

Value-chain analysis indicates that incremental gains are primarily realized through processing efficiency, supply chain optimization, and product differentiation. Regions with mechanized post-harvest operations and integrated supply networks capture higher profitability compared with traditional, fragmented structures. The moderate CAGR of 2.3% underscores steady growth, where cost management across cultivation, processing, and distribution segments remains critical for competitive advantage and sustainable profitability within the global market.

| Metric | Value |

|---|---|

| Pepper Market Estimated Value in (2025 E) | USD 5.6 billion |

| Pepper Market Forecast Value in (2035 F) | USD 7.1 billion |

| Forecast CAGR (2025 to 2035) | 2.3% |

The pepper market represents a significant segment within the global spices and seasonings industry, emphasizing flavor enhancement, aroma, and culinary versatility. Within the broader spice market, it accounts for about 6.8%, driven by demand in household cooking, processed foods, and foodservice operations. In the black, white, and green pepper category, its share is approximately 5.4%, reflecting widespread use in domestic and industrial kitchens. Across the processed and packaged spice market, it contributes around 4.7%, supporting ready-to-use blends, seasoning mixes, and convenience food applications.

Within the international spice trade segment, it represents 3.9%, highlighting export and import flows between major producing and consuming regions. In the overall culinary ingredients ecosystem, the market contributes about 5.1%, emphasizing consistent quality, sourcing reliability, and global culinary trends. Recent developments in the pepper market have focused on quality, traceability, and product differentiation. Groundbreaking trends include organic and certified pepper, value-added blends, and pre-ground ready-to-use formats.

Key players are collaborating with agricultural cooperatives, processors, and logistics providers to enhance supply chain transparency and reduce contamination risks. Adoption of sustainable cultivation practices, climate-resilient crop varieties, and advanced drying and grading technologies is gaining traction. The packaging innovations for extended shelf life, aroma preservation, and convenience are being introduced. These advancements demonstrate how quality, traceability, and innovation are shaping the market.

The pepper market is undergoing steady expansion fueled by increasing global demand for natural spices and flavor enhancers across diverse culinary traditions. The rising popularity of ethnic cuisines, coupled with growing consumer preference for clean-label and minimally processed foods, has intensified the adoption of pepper in food and beverage formulations. The market landscape is shaped by enhanced supply chain efficiencies and the growing trend toward organic and sustainably sourced spices.

Future growth prospects are supported by ongoing innovation in pepper-based extracts and blends, addressing both culinary and pharmaceutical applications. Market dynamics are also influenced by consumer inclination towards health-promoting ingredients, as pepper is increasingly recognized for its antioxidant and digestive benefits.

With the food and beverages sector dominating end-use applications, demand for pepper is expected to remain robust across both developed and emerging economies. Regulatory frameworks supporting food safety and quality assurance are further catalyzing market development, ensuring sustainable growth for the pepper industry.

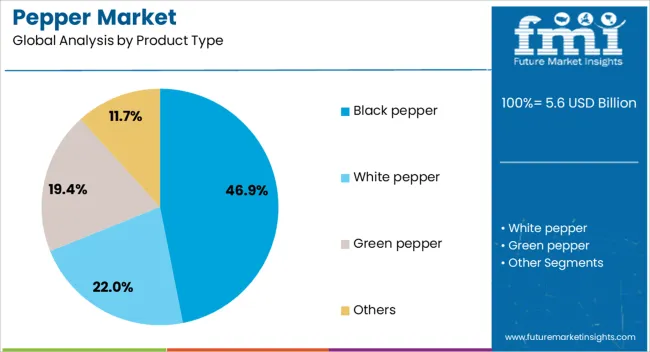

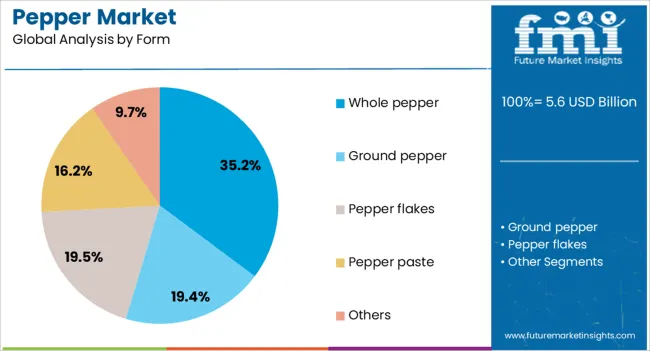

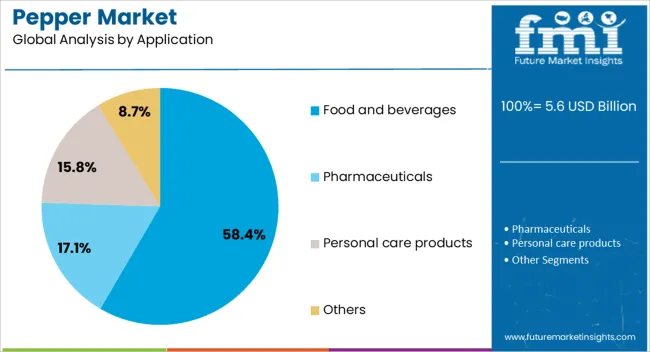

The pepper market is segmented by product type, form, application, and geographic regions. By product type, pepper market is divided into black pepper, white pepper, green pepper, and others. In terms of form, pepper market is classified into whole pepper, ground pepper, pepper flakes, pepper paste, and others. based on application, pepper market is segmented into food and beverages, pharmaceuticals, personal care products, and others. Regionally, the pepper industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The black pepper segment represents the largest share of the product type category, capturing approximately 46.9% of the market. This dominance is attributed to black pepper’s widespread culinary usage and its strong flavor profile, which complements various food preparations globally.

The segment's growth has been reinforced by consumer demand for authentic spices and natural flavor enhancers, as well as its prominent role in traditional medicine systems. Additionally, black pepper’s availability in multiple product forms and its versatility in seasoning, preservation, and health supplements have supported market expansion.

The segment’s leadership is further strengthened by advances in cultivation techniques and improved post-harvest handling that maintain quality and flavor. The sustained preference for black pepper over other variants ensures its significant contribution to the overall product mix in the pepper market.

The whole pepper segment accounts for about 35.2% of the form category, holding a significant position within the market. This segment is favored due to its longer shelf life, higher retention of essential oils, and suitability for diverse culinary applications where grinding freshness is desired.

The growth of whole pepper is driven by consumer demand for premium spices and artisanal cooking experiences. Additionally, the segment benefits from its adaptability across foodservice and home cooking environments, where freshly ground pepper is preferred for superior taste and aroma.

Market acceptance is also enhanced by the segment’s perceived naturalness and minimal processing. Supply chain improvements and efficient packaging solutions have further elevated the prominence of whole pepper within the overall product form landscape.

The food and beverages segment dominates the application category with a market share of 58.4%. This segment’s growth is propelled by extensive use of pepper as a seasoning and preservative ingredient in a wide array of food products, including processed foods, snacks, and ready-to-eat meals.

The segment is characterized by continuous innovation in product formulations aimed at enhancing flavor complexity and shelf stability. Additionally, pepper’s role as a natural antimicrobial and antioxidant agent supports its increasing application in beverages and functional foods.

Regulatory support for natural additives and rising consumer inclination towards clean-label products are also significant factors influencing this segment’s expansion. The food and beverages segment’s leading share is expected to persist owing to steady demand from both industrial and household consumption worldwide.

The market has been expanding due to its essential role as a culinary spice, food preservative, and medicinal ingredient. Increasing global consumption, evolving culinary trends, and rising demand for processed and packaged spices have driven market growth. Black, white, and green pepper variants are widely used across household, commercial, and industrial applications, including seasoning blends, ready-to-eat foods, and nutraceutical formulations. Technological advancements in harvesting, grading, and packaging have enhanced product quality and shelf life. Export-oriented production and trade have also influenced pricing and market reach. Health-conscious consumers are increasingly attracted to pepper for its antioxidant, digestive, and anti-inflammatory properties.

The widespread use of pepper as a staple ingredient in cooking has significantly propelled the market. Culinary applications span across households, restaurants, and food processing industries, where black and white pepper are employed for flavor enhancement, marination, and seasoning. Packaged and pre-ground pepper products have seen growing adoption due to convenience, hygiene, and consistent quality. Globalization of cuisines and growing interest in exotic and fusion foods have diversified demand for pepper variants. Retail channels, including supermarkets, specialty spice stores, and e-commerce platforms, have expanded accessibility to consumers. The focus on quality certifications and organic pepper products has also influenced purchasing decisions. Overall, increasing awareness of pepper’s flavor and health benefits has sustained strong household and culinary demand worldwide.

Industrial usage of pepper in processed and packaged foods has become a key driver for market expansion. Ready-to-eat meals, sauces, snacks, and seasoning blends incorporate pepper for its taste, preservative qualities, and aroma stability. Food manufacturers prioritize standardized spice formulations for consistent flavor and longer shelf life. Mechanized grinding, sieving, and packaging have enhanced efficiency and hygiene in industrial processing. Supply chain integration, including storage, transportation, and traceability, ensures quality maintenance from farm to factory. The rising global food processing industry, especially in regions like North America, Europe, and Asia-Pacific, has driven continuous demand for high-quality, industrial-grade pepper. Collaborative agreements between spice suppliers and food manufacturers have further reinforced steady supply and market penetration.

Pepper is increasingly being incorporated into nutraceuticals, dietary supplements, and functional foods due to its bioactive compound piperine and antioxidant properties. Research highlighting digestive, anti-inflammatory, and metabolism-enhancing benefits has elevated consumer interest. Powdered pepper, extracts, and encapsulated formulations are utilized in weight management, immunity, and wellness products. Pharmaceutical and dietary supplement companies are collaborating with spice producers to ensure quality, traceability, and purity of raw pepper. Health-conscious consumers and the growing nutraceutical segment have driven premium product development and specialty pepper offerings. As awareness of pepper’s therapeutic properties spreads, demand from the wellness and healthcare industries is projected to contribute substantially to overall market growth globally.

The market is heavily influenced by international trade and sustainable sourcing practices. Major producing countries such as Vietnam, India, Indonesia, and Brazil supply both raw and processed pepper to global markets. Export-oriented cultivation and trade policies impact price stability and supply security. Ethical and sustainable farming practices, including organic certification, eco-friendly pest management, and fair trade initiatives, are increasingly valued by buyers and consumers. Advanced logistics, packaging, and cold chain management have enhanced shelf life and product quality during transportation. These developments have strengthened market credibility, expanded reach across premium and conventional segments, and supported growth in both developing and developed regions worldwide.

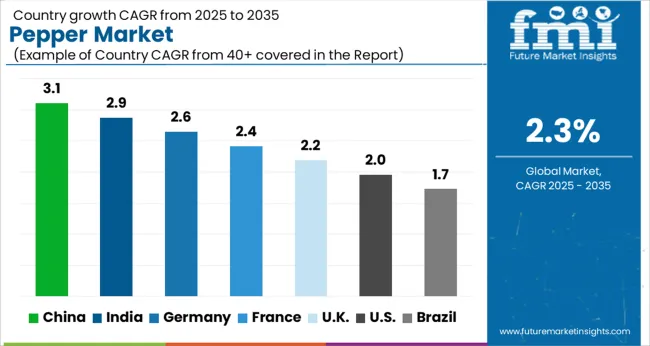

| Country | CAGR |

|---|---|

| China | 3.1% |

| India | 2.9% |

| Germany | 2.6% |

| France | 2.4% |

| UK | 2.2% |

| USA | 2.0% |

| Brazil | 1.7% |

The market is expected to grow at a CAGR of 2.3% from 2025 to 2035, driven by steady global demand for spices and seasonings. China leads with 3.1%, supported by large-scale cultivation and export activities. India follows at 2.9%, benefiting from traditional spice production and expanding processing capabilities. Germany records 2.6%, where premium and specialty pepper consumption is increasing. The UK holds 2.2%, influenced by culinary trends and retail demand. The USA registers 2.0%, shaped by consumer preference for processed and ready-to-use spice products. Market growth is supported by evolving food culture, trade dynamics, and quality-focused production practices. This report includes insights on 40+ countries; the top markets are shown here for reference.

China progressed at a 3.1% CAGR, driven by rising domestic consumption, growing food processing industry, and expansion of retail distribution networks. Demand for whole and ground pepper increased in culinary, snack, and processed food segments. Import reliance for premium quality pepper led to strengthened partnerships with exporting countries, while local processors invested in cleaning, grading, and packaging technologies to maintain quality standards. Foodservice channels, including restaurants and catering, contributed to consistent uptake. Competitive strategies emphasized quality assurance, supply chain efficiency, and traceable sourcing. Market players also leveraged packaging innovation and retail ready formats to attract urban and semi urban consumers, while maintaining cost competitiveness in mainstream markets.

India recorded a 2.9% CAGR, supported by its position as a leading producer and exporter of black and white pepper. Domestic demand was driven by processed foods, packaged spices, and ready to cook mixes. Investments in cleaning, grading, and automated packaging improved quality and shelf life. Regional distribution networks and retail expansion ensured accessibility across urban and rural markets. Export oriented strategies targeted international buyers, while quality certifications strengthened competitiveness. Promotional campaigns highlighted indigenous origin and purity, supporting premiumization trends. Local processors maintained differentiation through spice blends, value added packaging, and partnerships with retailers and foodservice operators to secure shelf presence.

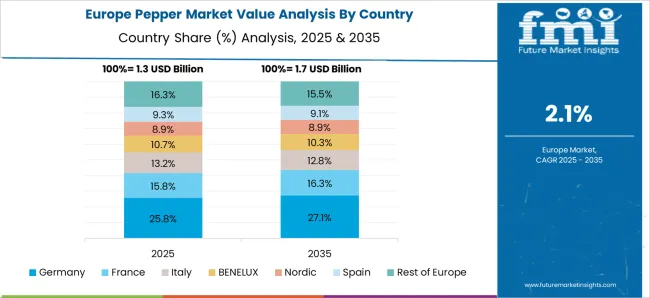

Germany achieved a 2.6% CAGR, driven by premium culinary and processed food demand. Consumers prioritized high quality, traceable, and sustainably sourced pepper. Retailers and specialty stores offered packaged and ready to use forms, including organic and certified products. Importers and distributors ensured steady supply from traditional exporting countries while local value added processors enhanced packaging and labeling to meet German standards. Competitive differentiation was achieved through quality certifications, product traceability, and innovative retail ready packaging. Seasonal demand increased during festive periods and culinary promotions. Market participants emphasized long term contracts with suppliers to maintain consistent quality, while sustainability and ethical sourcing influenced purchasing decisions among premium and health conscious consumers.

The United Kingdom advanced at a 2.2% CAGR, influenced by growing demand for packaged spices, gourmet cooking, and processed foods. Consumers sought quality assurance, traceability, and convenience. Retail expansion of packaged pepper in supermarkets and online platforms facilitated access to imported and value added variants. Competitive differentiation relied on ethical sourcing, clear labeling, and certified organic products. Promotional campaigns and festive offerings increased product visibility, while partnerships with culinary brands and foodservice chains supported adoption. Manufacturers focused on improving packaging, shelf life, and product consistency to appeal to both household and professional segments. Sustainability considerations shaped supplier selection and brand positioning.

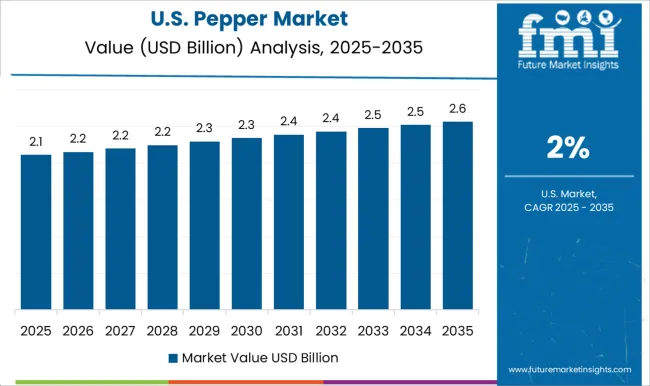

The United States grew at a 2.0% CAGR, driven by culinary, processed food, and specialty product demand. Consumers increasingly preferred high quality, organic, and traceable pepper. Retailers expanded shelf space for packaged, pre ground, and premium spice offerings. Foodservice and restaurant sectors contributed significantly to steady consumption, while importers ensured consistent supply from traditional producing countries. Competitive strategies emphasized product differentiation through packaging, certification, and promotional campaigns targeting health conscious and gourmet consumers. Long term supplier contracts and ethical sourcing practices enhanced reliability and brand reputation. Regional distribution networks supported rapid delivery and shelf availability, while manufacturers introduced innovative blends and ready to use formats to attract premium buyers.

The market has been shaped by established global suppliers and regional specialists. McCormick & Company, Inc., Olam International, and Bart Ingredients have focused on large scale sourcing, consistent quality, and broad distribution networks. Their strategies emphasize traceability, standardized grading, and supply reliability for food manufacturers and retail brands. Frontier Co-op and The Spice Hunter, Inc. have concentrated on specialty and organic segments, highlighting certified quality, flavor intensity, and sustainable farming practices.

Regional leaders including MDH Spices, Everest Spices, Catch Foods, Synthite Industries Ltd, and British Pepper & Spice Co Ltd have differentiated through locally tailored blends and value added packaging. Product brochures highlight pepper varieties, aroma retention, and grinding consistency. Attention is given to powdered and whole pepper formats, shelf life optimization, and packaging designed for convenience in both retail and industrial applications.

McCormick and Olam emphasize global sourcing and quality control, while MDH and Everest highlight regional authenticity and heritage. Competition in the market revolves around flavor profile, sourcing transparency, and product versatility. Bart Ingredients and Frontier Co-op showcase organic and single origin variants. Synthite Industries promotes integrated spice processing for industrial clients. The Spice Hunter emphasizes premium culinary experiences, while Catch Foods focuses on affordable household formats. Brochures consistently communicate aroma strength, purity, and packaging functionality. The market has evolved where quality, traceability, and product presentation are key drivers of customer preference and brand positioning.

| Items | Values |

|---|---|

| Quantitative Units | USD 5.6 billion |

| Product Type | Black pepper, White pepper, Green pepper, and Others |

| Form | Whole pepper, Ground pepper, Pepper flakes, Pepper paste, and Others |

| Application | Food and beverages, Pharmaceuticals, Personal care products, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | McCormick & Company, Inc., Bart Ingredients, British Pepper & Spice Co Ltd, Catch Foods, Everest Spices, Frontier Co-op, MDH Spices, Olam International, Synthite Industries Ltd, and The Spice Hunter, Inc. |

| Additional Attributes | Dollar sales by pepper type and application, demand dynamics across culinary, food processing, and spice blends sectors, regional trends in organic and specialty spice adoption, innovation in processing, packaging, and shelf-life extension, environmental impact of cultivation and transportation, and emerging use cases in functional foods, ready-to-cook meals, and premium seasoning products. |

The global pepper market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the pepper market is projected to reach USD 7.1 billion by 2035.

The pepper market is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in pepper market are black pepper, white pepper, green pepper and others.

In terms of form, whole pepper segment to command 35.2% share in the pepper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analysis and Growth Projections for Peppermint Oil Market

Peppermint Leaf Powder Market

Black Pepper Market Analysis - Size, Share & Forecast 2025 to 2035

White Pepper Market Analysis by Product Type, Form, Application and Distribution Channel Through 2035

Ghost Pepper Salt Market Insights - Spicy Trends & Industry Growth 2025 to 2035

Examining Market Share Trends in the Black Pepper Industry

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Smoked Black Pepper Market Trends - Flavor Innovation & Demand 2025 to 2035

Demand for Black Pepper in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA