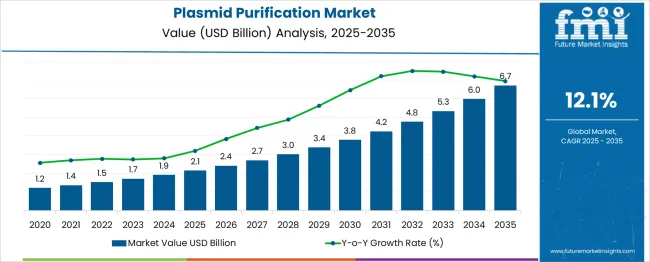

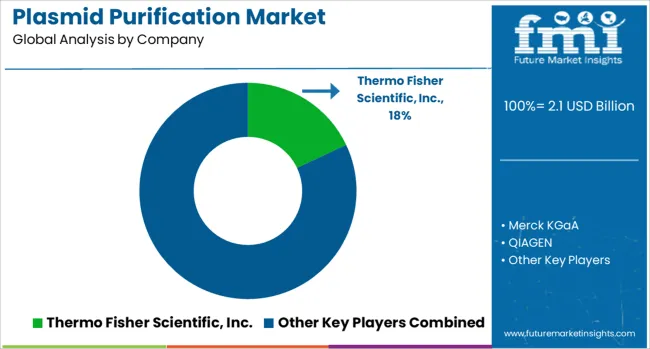

The global plasmid purification market is likely to reach from USD 2.1 billion in 2025 to approximately USD 6.7 billion by 2035, recording an absolute increase of USD 4.56 billion over the forecast period. This translates into a total growth of 213.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 12% between 2025 and 2035. The market size is expected to grow by nearly 3.13X during the same period, supported by the increasing adoption of gene therapy research, growing biotechnology sector investments, and rising demand for high-quality plasmid DNA in pharmaceutical development programs.

Quick Stats for Plasmid Purification Market

Between 2025 and 2030, the market is projected to expand from USD 2.1 billion to USD 4.2 billion, resulting in a value increase of USD 2.1 billion, which represents 46.1% of the total forecast growth for the decade. This phase of growth will be shaped by increasing gene therapy research activities, expanding biotechnology sector investments, and growing demand for high-purity plasmid DNA in clinical applications. Research institutions and biotechnology companies are investing in advanced purification technologies and automated systems to improve yield, purity, and consistency of plasmid preparations.

From 2030 to 2035, the market is forecast to grow from USD 4.3 billion to USD 6.7 billion, adding another USD 2.5 billion, which constitutes 53.9% of the ten-year expansion. This period is expected to be characterized by technological advancement in purification methodologies, development of specialized purification systems for clinical applications, and increasing adoption of plasmid-based therapeutics in medical practice. The growing emphasis on personalized medicine and cell therapy applications will drive demand for sophisticated purification solutions and quality assurance systems.

Between 2020 and 2025, the plasmid purification market experienced substantial expansion driven by increasing research funding for gene therapy, growing biotechnology sector development, and rising awareness of plasmid DNA applications in vaccine development and therapeutic research. The market developed as research institutions recognized the importance of high-quality plasmid preparations for reliable experimental results and successful therapeutic development programs.

| Parameter | Value |

| Market Value (2025) | USD 2.1 billion |

| Market Forecast Value (2035) | USD 6.7 billion |

| Market Forecast CAGR (2025–2035) | 12.09% |

Market expansion is being supported by the increasing adoption of gene therapy research and the corresponding demand for high-purity plasmid DNA preparations that meet stringent quality requirements for clinical applications and therapeutic development. Modern biotechnology research relies on consistent, high-quality plasmid DNA for gene expression studies, protein production, and therapeutic development programs that require reliable and reproducible results. The growing complexity of genetic engineering applications and expanding regulatory requirements for therapeutic plasmid DNA are creating steady demand for advanced purification technologies and quality assurance systems.

The expanding biotechnology sector and increasing investment in personalized medicine are driving demand for specialized plasmid purification solutions that can accommodate diverse research requirements and clinical applications. Academic research institutions and pharmaceutical companies are developing sophisticated genetic therapies, vaccine platforms, and cell engineering applications that require precise control over plasmid quality and purity. Additionally, growing regulatory emphasis on therapeutic plasmid quality and safety is encouraging adoption of validated purification systems and comprehensive quality control protocols.

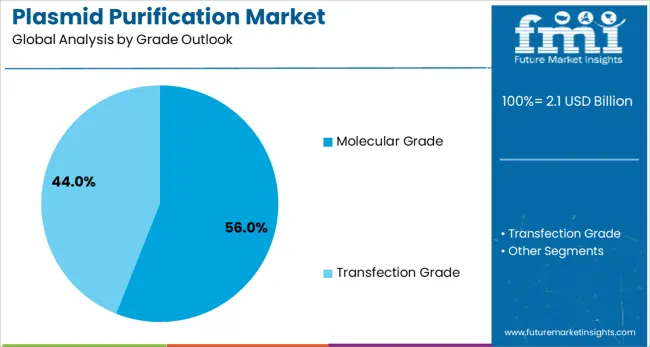

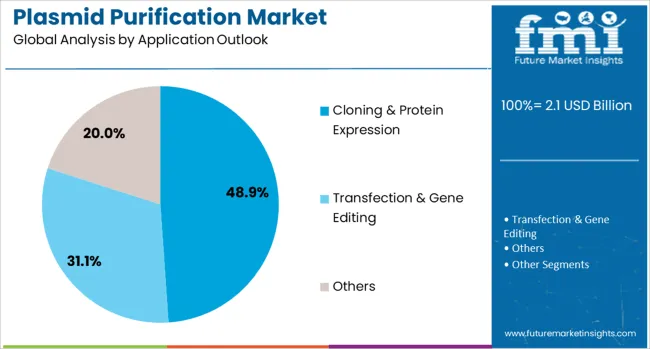

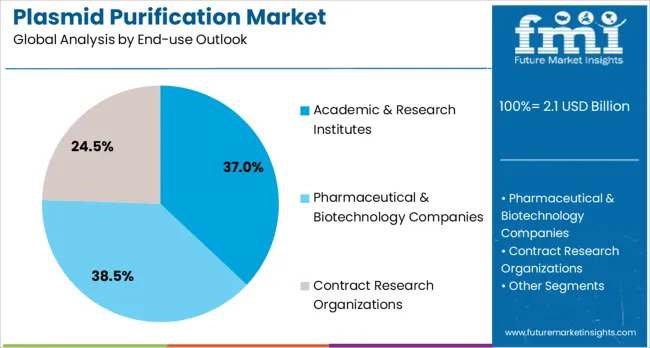

The market is segmented by product & service, grade, application, end-use, and region. By product & service, the market is divided into products, instruments, kits & reagents, and services. Based on grade, the market is categorized into molecular grade, transfection grade, and others. In terms of application, the market is segmented into cloning & protein expression, transfection & gene editing, and others. By end-use, the market is classified into academic & research institutes, pharmaceutical & biotechnology companies, and contract research organizations. Regionally, the market is divided into China, India, Germany, France, UK, USA, and Brazil.

Molecular grade is projected to account for 56.0% of the plasmid purification market in 2025. This leading share is supported by the widespread adoption of molecular grade plasmid DNA for research applications, cloning experiments, and basic molecular biology procedures that require reliable purity and consistent performance. Molecular grade plasmid preparations provide excellent quality for routine laboratory applications while maintaining cost effectiveness for high-volume research programs. The segment benefits from established purification protocols, comprehensive product availability, and extensive application experience across academic and commercial research settings.

Cloning & protein expression applications are expected to represent 48.9% of plasmid purification demand in 2025. This dominant share reflects the fundamental importance of plasmid DNA in molecular cloning procedures, recombinant protein production, and genetic engineering applications that require high-quality vector systems. Modern biotechnology research increasingly relies on sophisticated cloning strategies and protein expression systems that utilize plasmid vectors for gene manipulation and protein production. The segment benefits from growing biotechnology research activities, expanding protein therapeutics development, and increasing adoption of recombinant protein technologies across pharmaceutical and research applications.

Academic & research institutes are projected to contribute 37.0% of the market in 2025, representing universities, government research laboratories, and non-profit research organizations conducting fundamental and applied biotechnology research. These institutions maintain extensive molecular biology research programs that require consistent supplies of high-quality plasmid DNA for diverse experimental applications. Academic research facilities typically utilize plasmid purification systems for teaching programs, basic research projects, and collaborative studies with pharmaceutical companies, creating strong demand for reliable purification technologies and comprehensive technical support.

The plasmid purification market is advancing rapidly due to increasing gene therapy research, growing biotechnology sector investment, and rising demand for high-quality plasmid DNA in therapeutic applications. The market faces challenges including complex regulatory requirements for therapeutic plasmids, high costs associated with clinical-grade purification systems, and technical challenges related to large-scale purification processes. Quality assurance requirements and standardization efforts continue to influence product development and market acceptance patterns.

The growing implementation of automated plasmid purification systems is enabling improved yield, consistency, and throughput while reducing manual labor requirements and contamination risks in laboratory and production environments. Advanced automated systems incorporate sophisticated purification protocols, real-time monitoring capabilities, and integrated quality control measures that ensure reliable results and regulatory compliance. These technological improvements support scaling from research applications to clinical production while maintaining cost effectiveness and operational efficiency.

Biotechnology companies and research institutions are increasingly adopting clinical-grade purification systems that meet regulatory requirements for therapeutic plasmid DNA production and ensure consistent quality for clinical applications. Clinical-grade purification technologies incorporate comprehensive quality assurance protocols, validated purification methods, and extensive documentation systems that support regulatory submissions and clinical trials. This trend toward clinical applications are driving demand for sophisticated purification equipment and specialized technical expertise that can deliver pharmaceutical-quality plasmid preparations.

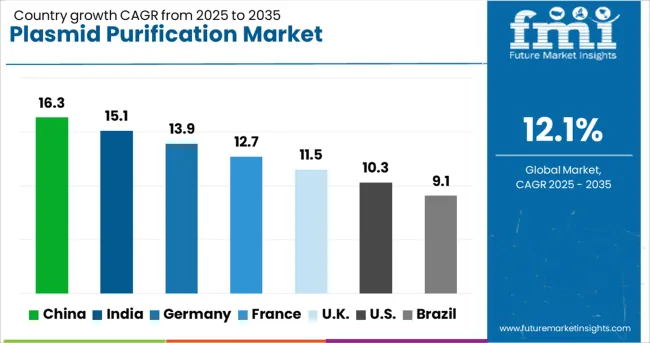

| Country | CAGR (2025-2035) |

| China | 16.3% |

| India | 15.1% |

| Germany | 13.9% |

| France | 12.6% |

| UK | 11.4% |

| USA | 10.3% |

| Brazil | 9.0% |

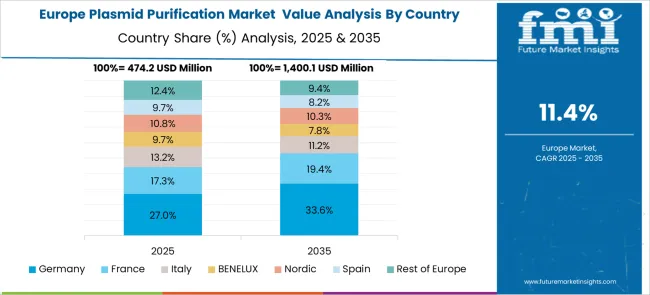

The market demonstrates varied growth patterns across key countries, with China leading at a 16.32% CAGR through 2035, driven by massive biotechnology sector investment, expanding gene therapy research programs, and comprehensive government support for biotechnology development. India follows at 15.11%, supported by growing pharmaceutical industry, increasing research infrastructure development, and expanding biotechnology education programs. Germany maintains strong growth at 13.90%, emphasizing advanced biotechnology research and pharmaceutical development capabilities. France advances at 12.69%, focusing on gene therapy research and biotechnology innovation programs. The UK grows at 11.49%, supported by established pharmaceutical industry and comprehensive research infrastructure. The USA shows steady growth at 10.28%, driven by mature biotechnology sector and extensive therapeutic development activities. Brazil records solid growth at 9.07%, benefiting from expanding research capabilities and increasing biotechnology investment.

Revenue from plasmid purification in China is projected to exhibit the highest growth rate with a CAGR of 16.3% through 2035, driven by massive government investment in biotechnology research, expanding pharmaceutical development programs, and comprehensive support for genetic medicine initiatives. The country's biotechnology modernization programs prioritize advanced research capabilities and therapeutic development platforms that require high-quality plasmid purification systems and technical expertise. Major research institutions and pharmaceutical companies are investing in sophisticated purification technologies and automated systems to support growing gene therapy research and clinical development activities.

Revenue from plasmid purification in India is expanding at a CAGR of 15.1%, supported by growing pharmaceutical industry, increasing biotechnology research activities, and expanding educational programs in molecular biology and genetic engineering. The country's developing biotechnology sector includes research institutions, pharmaceutical companies, and contract research organizations that require reliable plasmid purification capabilities for diverse research and development applications. Academic institutions and research facilities are gradually adopting advanced purification technologies and establishing comprehensive molecular biology research programs.

Demand for plasmid purification in Germany is projected to grow at a CAGR of 13.9%, supported by the country's emphasis on advanced biotechnology research, pharmaceutical development excellence, and comprehensive gene therapy research programs. German research institutions and pharmaceutical companies maintain sophisticated molecular biology capabilities and quality assurance systems that require high-performance purification technologies and specialized technical expertise. The market is characterized by technological innovation, stringent quality standards, and integration of advanced automation systems that support clinical-grade purification applications.

Demand for plasmid purification in France is expanding at a CAGR of 12.6%, driven by gene therapy research programs, biotechnology innovation initiatives, and comprehensive pharmaceutical development activities requiring high-quality plasmid DNA preparations. French research institutions focus advanced molecular biology research and therapeutic development programs that utilize sophisticated purification technologies and quality control systems. The market benefits from established research infrastructure, technological innovation, and growing emphasis on personalized medicine applications utilizing genetic therapies.

Demand for plasmid purification in the UK is projected to grow at a CAGR of 11.4%, driven by established pharmaceutical industry, comprehensive research infrastructure, and advanced biotechnology development programs requiring reliable plasmid purification capabilities. British research institutions and pharmaceutical companies maintain sophisticated molecular biology research programs and therapeutic development activities that utilize advanced purification technologies and quality assurance systems. The market is supported by research excellence programs, industry collaboration initiatives, and comprehensive regulatory framework supporting biotechnology development.

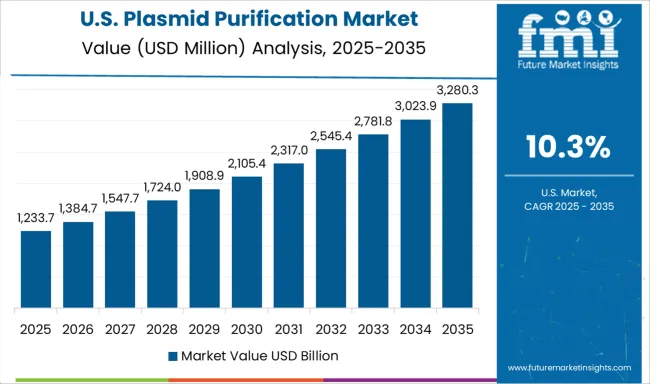

Demand for plasmid purification in the USA is expanding at a CAGR of 10.3%, supported by mature biotechnology sector, extensive therapeutic development activities, and comprehensive research infrastructure serving academic institutions and pharmaceutical companies. American biotechnology companies maintain sophisticated purification capabilities and quality assurance systems that support diverse research applications and clinical development programs. The market benefits from established regulatory framework, extensive research funding, and comprehensive technology development programs that support biotechnology innovation and therapeutic advancement.

Demand for plasmid purification in Brazil is projected to grow at a CAGR of 9.0%, driven by expanding research capabilities, increasing biotechnology investment, and developing molecular biology research infrastructure across academic institutions and emerging biotechnology companies. Brazilian research facilities are gradually adopting advanced purification technologies and establishing comprehensive molecular biology research programs that support therapeutic development and basic research applications. The market is supported by research infrastructure development, educational program expansion, and increasing recognition of biotechnology importance for pharmaceutical development.

The plasmid purification market is defined by competition among specialized life sciences companies, biotechnology equipment manufacturers, and comprehensive laboratory solution providers. Companies are investing in product innovation, automation technologies, quality assurance systems, and comprehensive service offerings to deliver reliable purification solutions that meet diverse research requirements and regulatory standards. Strategic partnerships, technological advancement, and global distribution capabilities are central to strengthening market positions and supporting customer research needs.

Thermo Fisher Scientific, Inc., USA-based, offers comprehensive plasmid purification solutions with focus on innovation, quality assurance, and integrated laboratory systems serving global research and clinical markets. Merck KGaA, Germany, provides specialized purification technologies with emphasis on quality, performance, and comprehensive technical support. QIAGEN, Netherlands, delivers automated purification systems with focus on efficiency, consistency, and regulatory compliance. Takara Bio, Japan, focuses on specialized molecular biology products and purification technologies.

Promega Corporation, USA, focuses on innovative purification solutions and comprehensive product portfolios for research applications. Zymo Research, USA, provides specialized purification kits and technologies with focus on ease of use and reliable performance. MP BIOMEDICALS, USA, offers cost-effective purification solutions and laboratory reagents. New England Biolabs, USA, delivers specialized molecular biology products and purification systems. MCLAB, USA, focuses on custom purification services and specialized applications. Applied Biological Materials Inc., Canada, provides comprehensive molecular biology solutions and purification technologies.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Product & Service Outlook | Products, Instruments, Kits & Reagents, Services |

| Grade Outlook | Molecular Grade, Transfection Grade, Others |

| Application Outlook | Cloning & Protein Expression, Transfection & Gene Editing, Others |

| End-use Outlook | Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Contract Research Organizations |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Key Companies Profiled | Thermo Fisher Scientific Inc, Merck KGaA, QIAGEN, Takara Bio, Promega Corporation, Zymo Research, MP Biomedicals, New England Biolabs, MCLAB, Applied Biological Materials Inc |

| Additional Attributes | Dollar sales by product type, grade category, and end-use sector, regional demand trends across key markets, competitive landscape with established life sciences companies and specialized purification providers, customer preferences for automated versus manual purification systems, integration with laboratory information management systems and quality control protocols, innovations in high-throughput purification technologies and clinical-grade preparation methods, and adoption of comprehensive quality assurance programs with enhanced regulatory compliance and documentation capabilities. |

Product & Service

Grade

Application

End-use

Region

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

The global plasmid purification market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the plasmid purification market is projected to reach USD 6.7 billion by 2035.

The plasmid purification market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in plasmid purification market are products, instruments, kits & reagents and services.

In terms of grade outlook, molecular grade segment to command 56.0% share in the plasmid purification market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA