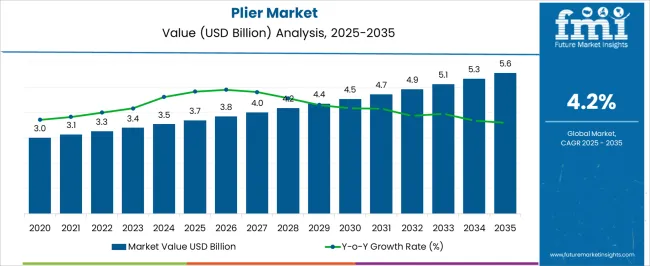

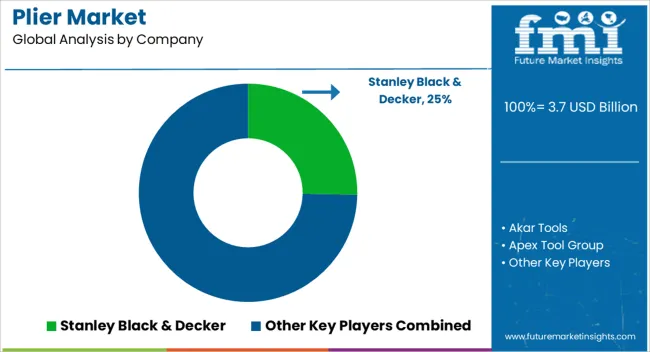

The plier market is estimated at USD 3.7 billion in 2025 and is anticipated to reach USD 5.6 billion by 2035, advancing at a CAGR of 4.2%. Elasticity of growth in this industry is strongly correlated with macroeconomic indicators such as construction activity, industrial output, and household consumption. Periods of economic expansion, characterized by rising infrastructure investments and manufacturing productivity, directly stimulate demand for pliers across professional and household segments.

Conversely, during phases of slower GDP growth or tightened consumer spending, demand elasticity becomes more evident as purchases shift toward low-cost alternatives and replacement cycles extend. Trade policies and tariffs also shape global dynamics, particularly in markets where import penetration is high. Inflationary pressures influence both material costs and pricing strategies, creating ripple effects across distribution channels. Employment growth in construction and mechanical trades further impacts tool demand, as workforce expansion typically leads to higher tool usage.

Currency fluctuations play a secondary but notable role, affecting international trade competitiveness and supplier margins. The market’s resilience is built on its essential utility; however, its responsiveness to macroeconomic cycles suggests that stability in construction, industrial production, and consumer spending will remain crucial drivers of long-term growth elasticity.

| Metric | Value |

|---|---|

| Plier Market Estimated Value in (2025 E) | USD 3.7 billion |

| Plier Market Forecast Value in (2035 F) | USD 5.6 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The plier market is shaped by several interconnected parent categories that define its overall growth trajectory and adoption scope. The hand tools sector contributes the largest share at about 42%, as pliers remain a core component in toolkits for construction workers, electricians, and general repair professionals. The automotive repair and maintenance segment accounts for nearly 24%, with pliers being indispensable for fastening, gripping, and component adjustments across vehicle servicing operations.

The industrial manufacturing sector represents close to 15%, as assembly lines, machinery upkeep, and production facilities rely heavily on durable pliers for precision tasks. The DIY and household improvement category contributes around 11%, supported by rising consumer interest in self-repair and small-scale home maintenance activities. The remaining 8% comes from specialty domains such as aerospace maintenance, defense applications, and niche crafts where pliers are used in limited but high-precision roles. This layered distribution highlights that the plier industry is not a stand-alone domain but an integral part of larger ecosystems spanning construction, automotive, industrial, and consumer-focused repair work. Its growth is anchored by the utility-based role pliers play across diverse environments, making the segment resilient while being responsive to both professional and consumer-driven demand cycles.

The Plier market is experiencing steady growth driven by increasing industrialization, expanding construction activities, and rising demand for versatile hand tools across various sectors. The market outlook remains positive as manufacturers continue to innovate with ergonomic designs and high-quality materials that improve tool durability and user comfort.

The growing focus on automation and precision work in electrical, automotive, and manufacturing industries has further accelerated the adoption of specialized pliers. Increasing investments in infrastructure development and DIY culture in emerging economies are also contributing to market expansion.

As industries strive for efficiency and safety, the demand for reliable and multifunctional pliers is expected to grow, supporting the market’s continued evolution.

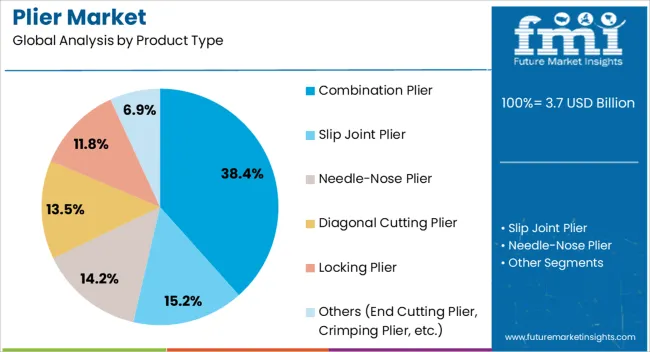

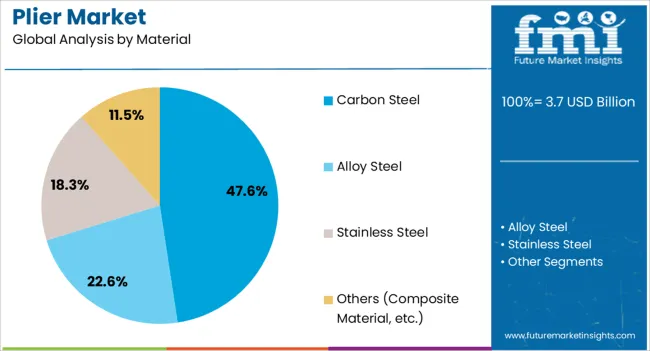

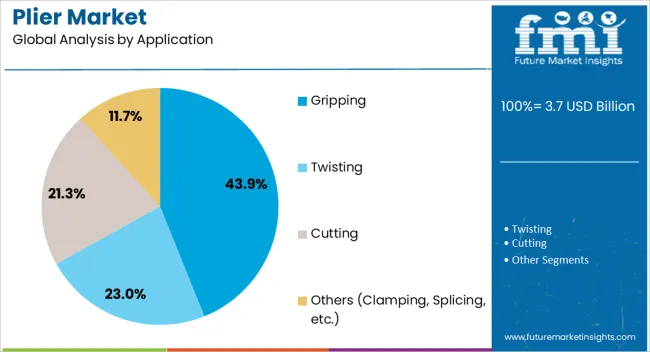

The plier market is segmented by product type, material, application, end use, distribution channel, and geographic regions. By product type, plier market is divided into Combination Plier, Slip Joint Plier, Needle-Nose Plier, Diagonal Cutting Plier, Locking Plier, and Others (End Cutting Plier, Crimping Plier, etc.). In terms of material, plier market is classified into Carbon Steel, Alloy Steel, Stainless Steel, and Others (Composite Material, etc.). Based on application, plier market is segmented into Gripping, Twisting, Cutting, and Others (Clamping, Splicing, etc.). By end use, plier market is segmented into Professionals, Commercial, DIY Individuals, Industrial, and Others (Jewelry and Crafting, etc.). By distribution channel, plier market is segmented into Offline and Online. Regionally, the plier industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The combination plier segment is projected to hold 38.4% of the Plier market revenue share in 2025, establishing it as the leading product type. This prominence is attributed to the multifunctionality of combination pliers, which allows for gripping, cutting, and bending tasks within a single tool.

Their adaptability across various applications makes them highly valued in electrical work, automotive repair, and general maintenance. The widespread preference for combination pliers is supported by their ease of use and cost efficiency, reducing the need for multiple separate tools.

Their robust construction and ergonomic designs have further enhanced user experience, driving the segment’s strong market position.

The carbon steel segment is expected to command 47.6% of the Plier market revenue share in 2025, making it the dominant material type. Carbon steel is favored due to its superior strength, hardness, and wear resistance, which are essential for the durability and performance of pliers in demanding industrial and construction environments.

The material’s cost-effectiveness compared to stainless steel and alloy alternatives has also supported its widespread adoption. Additionally, advancements in heat treatment processes have improved the quality of carbon steel pliers, enhancing their longevity and reliability.

The balance between performance and affordability makes carbon steel the preferred choice among manufacturers and end users alike.

The gripping application segment is anticipated to hold 43.9% of the Plier market revenue share in 2025, emerging as the largest application category. The segment’s growth is being driven by the essential role gripping pliers play in various industries, including electrical, automotive, and construction, where secure handling of objects is critical.

Gripping pliers are extensively used for holding, twisting, and tightening components, making them indispensable tools in assembly and repair operations. The increased emphasis on workplace safety and precision handling has further elevated the demand for gripping pliers.

Their versatility and effectiveness in diverse operational scenarios contribute to the sustained expansion of this application segment.

The plier market is driven by construction, automotive servicing, DIY activities, and competitive product differentiation. Brands that prioritize ergonomics, quality, and affordability are expected to strengthen market positioning.

The plier market has gained steady traction from the construction and industrial sectors where reliable hand tools remain indispensable. Pliers are widely used for gripping, cutting, bending, and fastening, making them essential in electrical work, plumbing, and metal fabrication. As infrastructure development and industrial expansion continue, contractors and technicians are prioritizing durable and ergonomic designs that enhance efficiency. Demand is reinforced by tool standardization policies in large projects, ensuring consistent procurement of certified tools. Manufacturers are responding by offering specialized variants such as long-nose, locking, and insulated pliers to address sector-specific needs. This expansion across professional segments highlights how construction and industrial adoption remains the backbone of overall market momentum.

The automotive repair and maintenance industry has created significant opportunities for plier adoption, as vehicle servicing depends heavily on precision hand tools. Pliers are used in applications ranging from wire handling and hose adjustments to fastening and component disassembly. With rising vehicle ownership and periodic servicing requirements, workshops and garages maintain high-volume demand for versatile plier sets. Specialized variants designed for automotive use, such as hose clamp pliers and snap-ring pliers, are being adopted to improve service quality. Growth in aftermarket servicing and independent garages is further supporting adoption across both developed and emerging markets. The automotive segment will remain a critical growth driver as vehicles become increasingly complex and require dependable tools.

The DIY trend has created fresh avenues for the plier market as households increasingly invest in self-repair and home improvement activities. Pliers are considered an essential tool in domestic toolkits, favored for their versatility and ease of use in common repair tasks. Hardware retailers and e-commerce platforms are expanding plier availability, offering consumers both basic and specialized models at affordable prices. Rising interest in home-based projects such as furniture repairs, gardening equipment maintenance, and small electrical fixes has added to consistent retail demand. Marketing campaigns that target hobbyists and casual users highlight affordability, durability, and ergonomic features, making pliers more accessible to a wider audience. This segment, while smaller, adds resilience to the overall market structure.

Competition in the plier market is shaped by quality, ergonomics, and cost efficiency. Established manufacturers focus on heat-treated steel, non-slip grips, and precision engineering to differentiate their offerings. Regional players compete through affordable models that appeal to price-sensitive buyers, while premium brands emphasize professional-grade durability and long service life. E-commerce distribution has leveled the field, allowing smaller brands to gain exposure through competitive pricing and bundled toolkits. Market advantage increasingly lies in offering pliers tailored for specific industries such as electrical, plumbing, or automotive use. Companies that balance affordability with certified quality and reliable distribution channels will secure greater market presence and long-term loyalty from professional and household buyers alike.

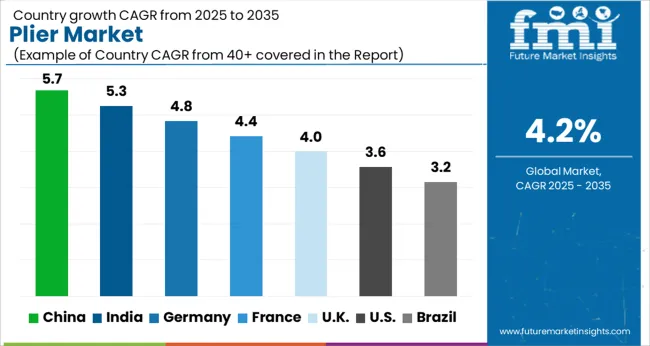

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

| USA | 3.6% |

| Brazil | 3.2% |

The global plier market is projected to expand at a CAGR of 4.2% between 2025 and 2035, supported by steady demand across construction, automotive servicing, and household repair activities. China leads with a CAGR of 5.7%, fueled by large-scale industrial output, infrastructure projects, and a strong domestic manufacturing base for hand tools. India follows at 5.3%, benefiting from rising construction activity, expanding automotive servicing needs, and the popularity of DIY home repair solutions. Germany, with 4.8% CAGR, is driven by strict quality standards, widespread use in industrial manufacturing, and demand for professional-grade tools. France records 4.4%, supported by renovation activity, small workshop demand, and preference for durable hand tools. The UK, at 4.0%, sees adoption from retrofitting projects, consumer DIY culture, and consistent professional usage. The USA, with 3.6% CAGR, progresses steadily due to a mature housing and construction market where replacement cycles and premium tool brands play a dominant role. Asia dominates in terms of volume growth, while Europe and North America maintain steady adoption through regulatory compliance, industrial requirements, and premium product preferences. The analysis covers 40+ countries, with the most influential contributors highlighted below.

The plier market in China is projected to grow at a CAGR of 5.7% from 2025 to 2035, making it the fastest-expanding hub for hand tools globally. Growth is supported by large-scale construction projects, automotive manufacturing, and rapid industrial output. Domestic tool manufacturers leverage scale, cost efficiency, and extensive distribution networks, while international brands focus on premium-grade tools for professional applications. The DIY segment, though smaller, is rising due to expanding e-commerce platforms such as JD.com and Alibaba, which provide broader accessibility. Industrial workshops and infrastructure contractors remain the largest buyers, with demand tied to both new projects and maintenance cycles. China will continue to anchor global growth, blending volume-driven domestic adoption with export competitiveness.

Competition in the plier market is influenced by a combination of durability, ergonomic comfort, pricing approaches, and distribution strategies that span both professional and household applications. Global leaders such as Stanley Black & Decker and Apex Tool Group set the tone for competition with their broad product lines, brand reputation, and extensive global distribution that makes them preferred choices for contractors, industrial buyers, and DIY enthusiasts alike. Premium-focused companies like Snap-on and Klein Tools concentrate on professional-grade pliers, building their reputation on quality, reliability, and strong aftersales service, making them staples in industrial workshops and trade-based sectors. German manufacturers including Knipex Tools and Rennsteig Werkzeuge distinguish themselves with high precision, strong certifications, and advanced engineering, carving out leadership in specialized categories where reliability is essential. In South Asia and emerging economies, Taparia Tools, Akar Tools, and CHISEN Tools gain ground by supplying cost-effective models that cater to rising domestic demand and expanding infrastructure projects. Japanese companies such as MARUTO HASEGAWA KOSAKUJO, TOP KOGYO, Tsunoda Corporation, and TOPTUL emphasize craftsmanship and compact innovation, underpinned by strong local and regional distribution networks. Niche specialists like Lisle Corp in automotive tools and Park Tool in bicycle repair equipment highlight how brand focus on specific applications can carve out dedicated customer bases. Competitive advantage in the future will belong to manufacturers that effectively combine affordability with certified quality, offer ergonomic designs that meet evolving consumer preferences, and expand aggressively across multi-channel platforms, including e-commerce. Companies that balance localized production with international brand reach, while diversifying into specialized plier categories for automotive, electrical, and home repair applications, will achieve consistent growth and long-term consumer loyalty in an increasingly fragmented market.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 Billion |

| Product Type | Combination Plier, Slip Joint Plier, Needle-Nose Plier, Diagonal Cutting Plier, Locking Plier, and Others (End Cutting Plier, Crimping Plier, etc.) |

| Material | Carbon Steel, Alloy Steel, Stainless Steel, and Others (Composite Material, etc.) |

| Application | Gripping, Twisting, Cutting, and Others (Clamping, Splicing, etc.) |

| End Use | Professionals, Commercial, DIY Individuals, Industrial, and Others (Jewelry and Crafting, etc.) |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Stanley Black & Decker, Akar Tools, Apex Tool Group, CHISEN Tools, Klein Tools, Knipex Tools, Lisle Corp, MARUTO HASEGAWA KOSAKUJO, Park Tool, Rennsteig Werkzeuge, Snap-on, Taparia Tools, TOP KOGYO, TOPTUL, and Tsunoda Corporation |

| Additional Attributes | Dollar sales, share, demand by end-use sectors, competitor strategies, pricing trends, distribution networks, regional growth hotspots, consumer preferences, replacement cycles, and e-commerce penetration. |

The global plier market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the plier market is projected to reach USD 5.6 billion by 2035.

The plier market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in plier market are combination plier, slip joint plier, needle-nose plier, _straight nose plier, _bent nose plier, diagonal cutting plier, locking plier and others (end cutting plier, crimping plier, etc.).

In terms of material, carbon steel segment to command 47.6% share in the plier market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Supplier Contract Management Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Supplier Quality Management Applications Market Share

Supplier Quality Management Applications Market Outlook 2025 to 2035

UK Supplier Quality Management Applications Market Analysis – Demand, Trends & Forecast 2025-2035

USA Supplier Quality Management Applications Market Insights – Trends, Demand & Growth 2025-2035

Locking Pliers Market Size and Share Forecast Outlook 2025 to 2035

Japan Supplier Quality Management Applications Market Trends – Size, Share & Outlook 2025-2035

Surgical Pliers Market

Photomultiplier Tube Accessories Market Size and Share Forecast Outlook 2025 to 2035

Germany Supplier Quality Management Applications Market Trends – Growth, Share & Outlook 2025-2035

Needle Nose Pliers Market Size and Share Forecast Outlook 2025 to 2035

Hair Bond Multiplier Market Size and Share Forecast Outlook 2025 to 2035

GCC Countries Supplier Quality Management Applications Market Growth – Demand, Trends & Forecast 2025-2035

Silicon Photomultiplier Market Size and Share Forecast Outlook 2025 to 2035

Bird Feeding & Water Suppliers Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA