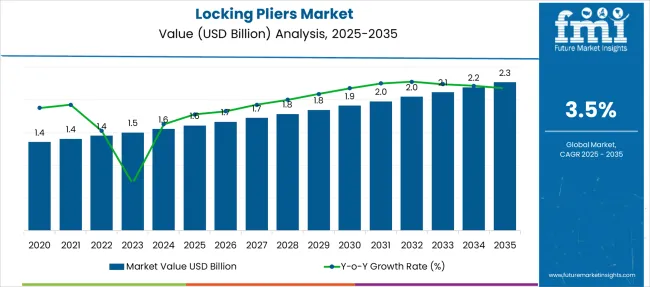

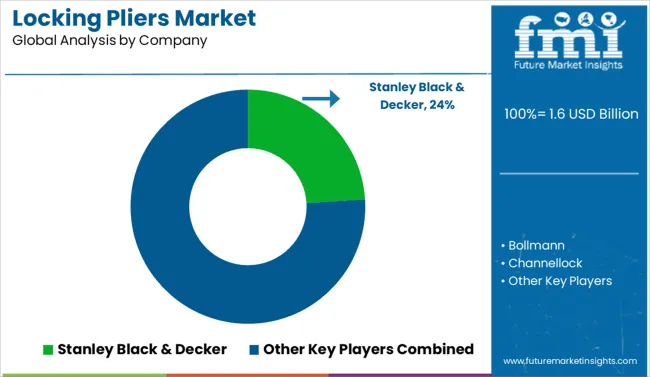

The Locking Pliers Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Locking Pliers Market Estimated Value in (2025E) | USD 1.6 billion |

| Locking Pliers Market Forecast Value in (2035F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The locking pliers market is experiencing sustained growth as demand for versatile hand tools rises across automotive repair, construction, metalworking, and DIY applications. The shift toward higher durability, ergonomic design, and cost-effective solutions has influenced purchasing behavior, positioning locking pliers as essential equipment for both professional and consumer use.

Growth has been supported by increasing investments in infrastructure projects, expanding automotive maintenance needs, and rising consumer interest in home improvement activities. Future prospects are expected to be bolstered by advancements in material technologies, enhanced grip mechanisms, and distribution through e-commerce and organized retail channels.

Manufacturers are focusing on innovation, competitive pricing, and user-friendly designs to capture emerging opportunities, while regulatory emphasis on workplace safety and tool standards is expected to further elevate product quality and adoption.

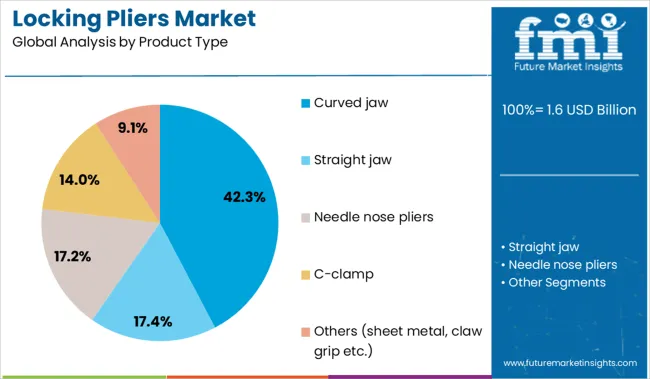

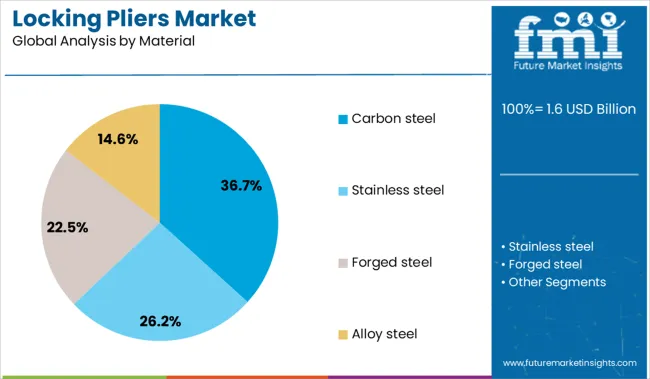

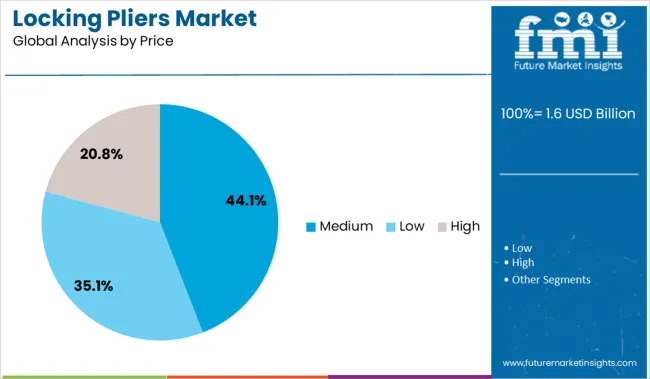

The locking pliers market is segmented by product type, material, price, end user, and distribution channel and geographic regions. The locking pliers market is divided by product type into Curved jaw, Straight jaw, Needle nose pliers, C-clamp, and Others (sheet metal, claw grip, etc.). The locking pliers market is classified by material into Carbon steel, Stainless steel, Forged steel, and Alloy steel. Based on the price of the locking pliers, the market is segmented into Medium, Low, and High. The end user of the locking pliers market is segmented into Industrial & manufacturing, Automotive, Construction, Home improvement, Electrical, and Others (woodworking, plumbing, etc.). The distribution channel of the locking pliers market is segmented into Indirect sales and Direct sales. Regionally, the locking pliers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, the curved jaw segment is projected to hold 42.3% of the total market revenue in 2025, establishing itself as the leading product type. This dominance is attributed to the superior versatility of curved jaws, which allow users to grip a wide variety of shapes including round, flat, and irregular surfaces.

The ability of curved jaws to distribute clamping force more evenly has enhanced their utility in both heavy-duty industrial tasks and precision repair work. Enhanced design features that improve torque application and user comfort have made curved jaw pliers more appealing to professionals and hobbyists alike.

Manufacturers have prioritized this segment due to its strong demand across multiple end-use scenarios, and its adaptability to evolving user requirements has reinforced its leadership in the market.

Segmented by material, the carbon steel segment is expected to account for 36.7% of the locking pliers market revenue in 2025, maintaining its position as the leading material segment. The prevalence of carbon steel is driven by its optimal balance of strength, durability, and affordability, which makes it well-suited for manufacturing robust and reliable pliers.

Its ability to withstand significant mechanical stress without deformation has positioned it as the preferred choice for both industrial and domestic applications. Manufacturers have continued to improve corrosion resistance and surface finishing techniques, further enhancing the performance and longevity of carbon steel pliers.

Its widespread availability and cost-effectiveness have allowed it to dominate the material segment while meeting the expectations of a broad range of users.

When segmented by price, the medium segment is forecast to capture 44.1% of the market revenue in 2025, solidifying its leadership among price categories. This prominence has been supported by a favorable balance between quality and affordability that appeals to both professional users and value-conscious consumers.

Medium-priced locking pliers have successfully combined durable construction, ergonomic features, and reliable performance without the premium cost associated with high-end products. This segment has benefited from growing demand in emerging economies and mid-tier professional markets, where budget constraints coexist with the need for dependable tools.

The medium price point has emerged as the optimal choice for users seeking long-lasting performance at a reasonable investment, ensuring its sustained dominance in the market.

Steady demand for reliable locking tools continues, driven by industrial maintenance needs and home mechanics. Future growth centers on ergonomic design, multi-function variants, retail partnerships, and DIY media outreach.

Mechanics, technicians, and hobbyists rely on locking pliers for secure grip, leverage, and hands‑free hold during maintenance, welding, and metalworking. Demand is fueled by industrial sectors such as automotive repair, heavy machinery servicing, and HVAC assembly, where tool precision and durability matter. These pliers deliver tight torque and locking force that ordinary wrenches or grips cannot match, reducing manual fatigue and improving job accuracy. As maintenance cycles become tighter, reliability of pliers that consistently hold under stress becomes essential. Frequent replacements of wear parts—adjustment screws and replaceable jaws—reflect the value placed on repair-friendly tools. This dynamic positions locking pliers as essential core items in toolkits across professional and home workshop settings.

There is opportunity in introducing locking pliers with ergonomic handles, torque control markers, and multi‑function designs that offer jaw swap capability or integrated wire cutting and clamping features. Brands focusing on folding or compact storage systems can appeal to tradespeople and DIY users with limited space. Growth is also possible through collaborations with retail rental services, maker spaces, and vocational training workshops to promote tool trials. Online workshops or video-guided repairs featuring locking pliers increase familiarity and encourage purchases. Offering starter kits tied to automotive or home improvement kits introduces locking pliers as part of value bundles. Engaging DIY influencers and promoting tool care tips supports user trust and repeat usage.

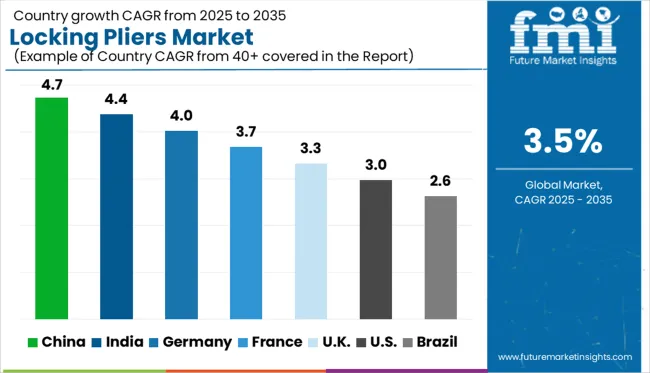

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

| USA | 3.0% |

| Brazil | 2.6% |

The global locking pliers market is projected to grow at a CAGR of 3.5% between 2025 and 2035, supported by the rising demand in DIY applications, automotive repair, and industrial maintenance. Within the BRICS economies, China leads with a 4.7% CAGR, driven by high-volume tool production, increasing domestic consumption, and global exports. India follows at 4.4%, fueled by the rapid expansion of manufacturing clusters, growing retail hardware distribution, and industrialization. Germany, an OECD member, is forecast at 4.0%, underpinned by precision engineering and professional tool use. Meanwhile, the UK (3.3%) and US (3.0%) reflect demand stability, with incremental innovation and a focus on ergonomic designs for consumer and trade segments. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China will advance its locking pliers market at a CAGR of 4.7%, driven by industrial growth, manufacturing upgrades, and rising exports. As domestic infrastructure scales, demand from construction and factory maintenance surges nationwide. Compared to the United Kingdom, Chinas hand tool demand is heavily tied to primary industrial production, not only renovation or repairs. The surge in vocational training across provinces further boosts professional tool consumption across sectors. Chinese firms are rapidly closing the quality gap with established Western brands, increasing both domestic and international competitiveness. Price-sensitive customers still dominate the entry-level market, but premium segments are gradually growing. Standardization efforts across the supply chain are also improving export reliability and safety.

India is set to register a CAGR of 4.4% in its locking pliers market, fueled by rapid urbanization, MSME activity, and increased household tool use. In contrast to Germany, which emphasizes tool precision and product durability, Indian consumers prioritize affordability and versatility above all. The market benefits from robust distribution across both offline retail and digital commerce platforms, which are increasing tool availability in Tier 2 and Tier 3 cities. Local manufacturing continues to receive policy incentives under the Make in India initiative. Toolkits for electrical repairs and plumbing are increasingly purchased by middle-income households. National hardware chains are expanding in urban centers, adding structure to a once fragmented market.

Germany is projected to see a CAGR of 4% in locking pliers sales, underpinned by strong demand from engineering, construction, and automotive sectors. German buyers prioritize durability, ergonomics, and long-term value, unlike India, where price sensitivity dominates consumer choices. Market expansion is increasingly linked to innovation, such as advanced gripping systems, anti-slip features, and tool customization for specific applications. High expectations for certification, workplace safety, and product traceability continue to shape tool design. Distribution networks remain formal and professional, with retail supported by bulk orders and industrial procurement teams. German toolmakers continue investing in R&D for ergonomics and materials. Digitization of supply chains is another key enabler of consistency.

The United Kingdom is anticipated to grow its locking pliers segment at a CAGR of 3.3%, reflecting moderate market maturity and stable demand from tradespeople. In contrast to Chinas volume-led expansion, the UK market values consistent performance and moderate pricing levels. Retail channels are well-developed and diversified, yet DIY trends have plateaued over recent years. Growth now depends on retrofitting activity, heritage property maintenance, and green building upgrades. Tool subscription services and rental models are gradually emerging in dense cities like London, Birmingham, and Manchester. Digital-first retailers are carving out new customer segments. Workforce certification requirements also influence tool buying decisions in commercial projects.

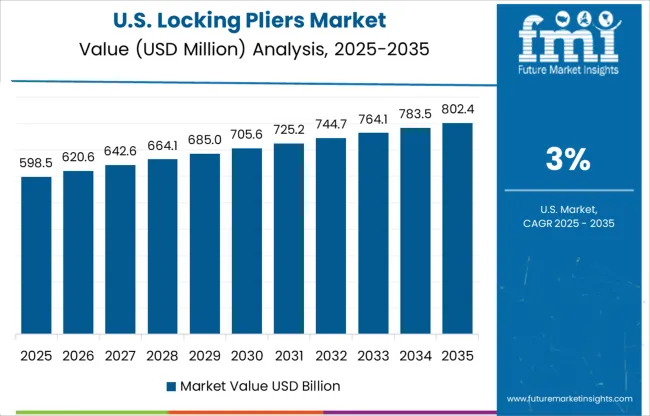

The United States is forecasted to grow at a CAGR of 3%, the lowest among the five countries studied in this analysis. With a saturated tool ownership base, new growth is driven mainly by replacement cycles rather than expansion in industrial applications. Unlike India, where the market is still emerging and expanding, US buyers are long-time users who focus on brand loyalty, ergonomic upgrades, and improved durability. Home improvement stores continue to dominate distribution, though online channels are rapidly gaining market share. Contractor-grade tools see better retention when bundled with warranties. Price fluctuations tied to raw material costs also influence purchase behavior. Brand perception remains a key driver in this mature market.

The locking pliers market is moderately consolidated, with a few dominant players holding notable shares and numerous regional and specialty brands adding to the competitive mix. Stanley Black & Decker leads the market with its IRWIN Vise-Grip brand, renowned for durability, ergonomic design, and global distribution. Other major brands such as Channellock, Knipex, Milwaukee Tool, and Snap-On are recognized for premium build quality and professional-grade tools. Mid-tier players like Crescent Tools, Klein Tools, and Grip-on serve both industrial and DIY markets with reliable offerings. Emerging brands and manufacturers from Asia, like Deli Group, provide competitive pricing, intensifying market competition. Key success factors include product innovation, material quality, pricing strategy, and brand legacy.

On September 27, 2023, Channellock, Inc. launched 13 new CHANNELLOCK Professional Locking Pliers featuring forged steel jaws, durable epoxy coating, high-performance grips, and a one-handed release lever, designed specifically for trades professionals.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Product Type | Curved jaw, Straight jaw, Needle nose pliers, C-clamp, and Others (sheet metal, claw grip etc.) |

| Material | Carbon steel, Stainless steel, Forged steel, and Alloy steel |

| Price | Medium, Low, and High |

| End User | Industrial & manufacturing, Automotive, Construction, Home improvement, Electrical, and Others (woodworking, plumbing etc.) |

| Distribution Channel | Indirect sales and Direct sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Stanley Black & Decker, Bollmann, Channellock, Crescent Tools, Deli Group, Grip-on, Klein Tools, Knipex, Milwaukee Tool, Snap-On, Sonic Tools, Strong Hand Tools, Toptul, Vermont American, and Wurth |

| Additional Attributes | Dollar sales by plier type, material composition, and end-user segment; regional demand driven by industrial maintenance, DIY activity, and automotive repair trends; innovation in ergonomic grip design, multi-functionality, and corrosion resistance; cost dynamics shaped by raw material prices and manufacturing scale; environmental impact related to tool longevity and recyclability; and emerging use cases in compact toolkits, precision tasks, and modular hand tool systems. |

The global locking pliers market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the locking pliers market is projected to reach USD 2.3 billion by 2035.

The locking pliers market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in locking pliers market are curved jaw, straight jaw, needle nose pliers, c-clamp and others (sheet metal, claw grip etc.).

In terms of material, carbon steel segment to command 36.7% share in the locking pliers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Locking Intramedullary Nail System Market Size and Share Forecast Outlook 2025 to 2035

Flocking Tape Market Size, Share & Forecast 2025 to 2035

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

Interlocking Boxes Market Growth & Forecast 2025 to 2035

Leading Providers & Market Share in Interlocking Boxes

Self-Locking Nuts Market

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Water Blocking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Self - Locking Trays Market Size and Share Forecast Outlook 2025 to 2035

Blue Light Blocking Glasses Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Blue Light Blocking Glasses Market Share & Industry Leaders

Child Resistant Locking Pouches Market from 2025 to 2035

Demand for Metal Locking Plate and Screw System in USA Size and Share Forecast Outlook 2025 to 2035

Revolutionary Moisture Locking Systems Market Size and Share Forecast Outlook 2025 to 2035

Surgical Pliers Market

Needle Nose Pliers Market Size and Share Forecast Outlook 2025 to 2035

Bird Feeding & Water Suppliers Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA