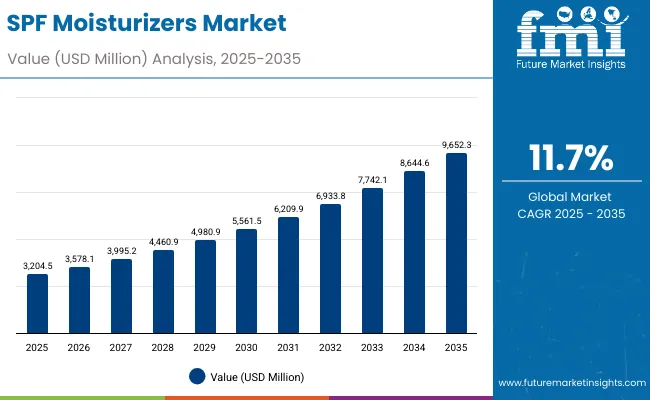

The SPF Moisturizers Market is expected to record a valuation of USD 3,204.5 million in 2025 and USD 9,652.3 million in 2035, with an increase of USD 6,447.8 million, which equals a growth of over 193% over the decade. The overall expansion represents a CAGR of 11.7% and a 3X increase in market size.

SPF Moisturizers Market Key Takeaways

| Metric | Value |

|---|---|

| SPF Moisturizers Market Estimated Value in (2025E) | USD 3,204.5 million |

| SPF Moisturizers Market Forecast Value in (2035F) | USD 9,652.3 million |

| Forecast CAGR (2025 to 2035) | 11.7% |

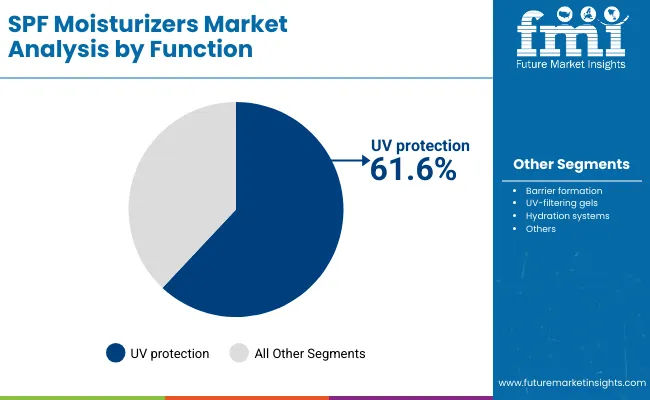

During the first five-year period from 2025 to 2030, the market increases from USD 3,204.5 million to USD 5,561.5 million, adding USD 2,357 million, which accounts for more than one-third of the total decade growth. This phase records steady adoption of daily-use SPF moisturizers in markets such as the USA, Germany, and the UK, where dermatologists strongly recommend broad-spectrum coverage. UV protection continues to dominate, capturing more than 60% of functional demand, as consumers increasingly adopt moisturizers with SPF as a staple of morning skincare routines. In this period, creams and lotions dominate because of ease of use, trusted formulation bases, and higher availability in pharmacies and mass retail.

The second half from 2030 to 2035 contributes USD 4,090.8 million, equal to nearly two-thirds of total growth, as the market jumps from USD 5,561.5 million to USD 9,652.3 million. This acceleration is powered by rapid expansion in emerging markets such as China and India, where CAGR exceeds 20%. Multi-functional formulations that combine UV protection with hydration, anti-aging, and blue light protection capture strong momentum, especially in urban centers. E-commerce and specialty beauty stores grow rapidly, fueled by younger buyers prioritizing clean-label, dermatologist-tested, and vegan products. Asia-Pacific overtakes Europe in growth contribution, while the USA remains the largest single market in absolute value.

From 2020 to 2024, the SPF Moisturizers Market grew steadily, moving from a smaller niche within skincare to a mainstream daily-use product. Growth was driven by hardware-equivalent factors in skincare: strong product innovation in creams/lotions, dermatologist-backed claims, and regulatory pushes for sun safety in Western markets. During this period, the competitive landscape was dominated by USA and European personal care brands, controlling more than 70% of global revenue. Neutrogena, Olay, and Eucerin captured consumer trust through mass retail and pharmacy distribution, while new entrants such as Supergoop! disrupted with digital-first, lifestyle-driven messaging. Competitive differentiation relied on dermatological trust, SPF accuracy, and clean formulations, while vegan and blue light protection claims were emerging but not yet mainstream.

Demand for global SPF Moisturizers is set to expand strongly from USD 3,204.5 million in 2025, and the revenue mix will gradually shift toward multi-functional claims. Traditional leaders face rising competition from Asia-Pacific players and clean-beauty challengers offering e-commerce-first distribution, vegan-friendly formulations, and digital influencer partnerships. Major multinational players are pivoting to hybrid portfolios that combine pharmacy-grade products with lifestyle-oriented marketing. The competitive advantage is moving away from SPF-only positioning to ecosystem strength hydration, anti-aging, blue light protection, and sustainability creating recurring revenue through both direct-to-consumer models and retail partnerships.

Advances in sunscreen technology, formulation science, and consumer awareness have significantly improved product adoption, allowing for more efficient daily skincare routines. SPF moisturizers are gaining popularity due to their suitability as two-in-one productscombining sun protection with essential hydration. The rise of broad-spectrum formulations has contributed to enhanced protection and long-term skin health, backed by dermatological studies. Industries such as pharmaceuticals, dermatology, and cosmetic retail are driving demand for SPF moisturizers that integrate seamlessly into existing skincare workflows.

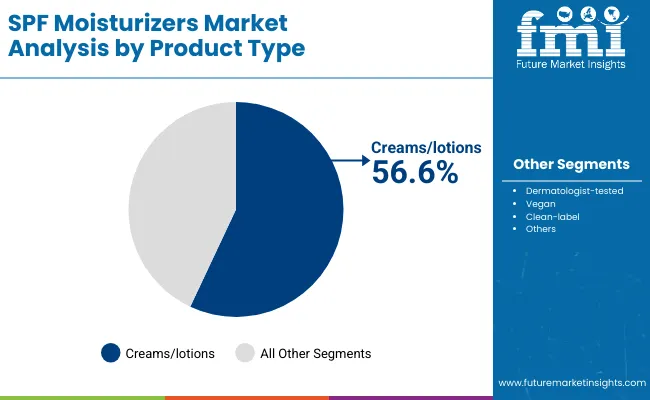

Expansion of e-commerce distribution and rising adoption in emerging markets have fueled growth. Clean-label, dermatologist-tested, and vegan claims are expected to open new application areas, particularly among Gen Z and millennial consumers. Segment growth is expected to be led by creams/lotions in product types, UV protection in functions, and broad-spectrum in claims due to their universality and adaptability across consumer demographics.

The market is segmented by function, product type, channel, claim, and region. Functions include UV protection, hydration, anti-aging, and blue light protection, highlighting the core elements driving adoption. Product types include creams/lotions, serums, gels, and sticks to cater to different consumer routines. Based on channel, the segmentation includes pharmacies, e-commerce, mass retail, and specialty beauty stores. In terms of claims, categories encompass broad-spectrum, clean-label, dermatologist-tested, and vegan. Regionally, the scope spans North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa, with country-level analysis for the USA, China, India, Japan, Germany, and the UK.

| Product Type | Value Share% 2025 |

|---|---|

| Creams/lotions | 56.6% |

| Others | 43.4% |

The creams/lotions segment is projected to contribute more than half of the SPF Moisturizers Market revenue in 2025, maintaining its lead as the dominant product type. This is driven by ongoing demand for traditional, easy-to-apply formats that are compatible with daily routines. Dermatologist endorsements and consumer trust in lotion-based products continue to fuel adoption.

The segment’s growth is also supported by innovations in lightweight textures, hybrid formulations that combine anti-aging peptides with SPF, and distribution through both pharmacies and e-commerce. As serums and sticks gradually rise in appeal, creams/lotions are expected to retain their role as the backbone of global SPF moisturizers, especially among older demographics and mass-market consumers.

| Function | Value Share% 2025 |

|---|---|

| UV protection | 61.6% |

| Others | 38.4% |

The UV protection function is forecasted to hold more than 60% of the market share in 2025, led by its essential role in preventing sunburn, pigmentation, and long-term skin aging. These moisturizers are favored for their daily practicality and core dermatological recommendation.

Growing consumer knowledge of SPF’s role in reducing skin cancer risk further enhances trust and demand. The segment’s growth is bolstered by heightened awareness campaigns in both developed and developing markets, often supported by dermatological associations. As consumers increasingly demand multi-functional benefits, UV protection will continue to anchor the SPF Moisturizers Market, even as hydration and blue light protection accelerate growth rates.

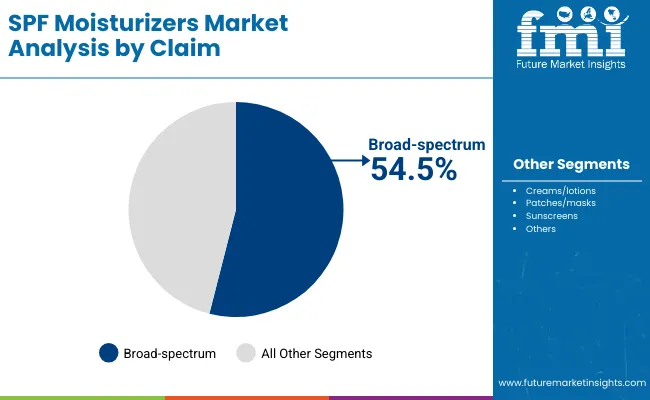

| Claim | Value Share% 2025 |

|---|---|

| Broad-spectrum | 54.5% |

| Others | 45.5% |

The broad-spectrum segment is projected to account for more than half of the SPF Moisturizers Market revenue in 2025, establishing it as the leading claim type. This claim is preferred for its ability to protect against both UVA and UVB rays, which are associated with premature skin aging and skin cancer.

Its suitability across climates and skin types has made it popular globally, particularly in the USA, Europe, and Asia-Pacific. Developments in formulation science have enabled broad-spectrum SPF moisturizers that are lightweight, non-greasy, and compatible with sensitive skin. Given its universal importance, broad-spectrum claims are expected to maintain their leading role while clean-label and vegan claims steadily gain traction among younger, eco-conscious buyers.

Rising Demand for Multi-Functional Daily-Use Products

One of the strongest drivers in the SPF Moisturizers Market is the increasing consumer preference for multi-functional skincare products that combine sun protection, hydration, anti-aging, and blue light protection in a single formulation. This shift is particularly evident in urban populations across the USA, China, and India, where time-constrained lifestyles push buyers to streamline skincare routines.

For example, in the USA, UV protection dominates with a 63.1% share of the market function in 2025, but consumers are increasingly purchasing products that also contain hyaluronic acid, peptides, or antioxidants. In Asia-Pacific, multifunctional SPF moisturizers are positioned as preventive skincare solutions against both photoaging and environmental stressors, which resonates with younger consumers who are conscious of long-term skin health. This preference drives premiumization and supports CAGR growth beyond the global average in India (23.7%) and China (22.2%).

Expansion of E-commerce and Direct-to-Consumer (D2C) Channels

E-commerce is becoming a critical driver of the SPF Moisturizers Market. In China, creams/lotions already account for 57.6% of sales in 2025, with cross-border e-commerce platforms boosting premium imports from brands like La Roche-Posay and Shiseido. Direct-to-consumer models adopted by Supergoop! and EltaMD in the USA demonstrate how brands can capture younger demographics by building trust through educational content and influencer partnerships.

E-commerce enables brands to introduce clean-label and vegan claims effectively to Gen Z and millennial consumers who prefer transparent, ingredient-driven purchases. This channel not only expands geographic reach but also provides companies with data-driven insights into consumer preferences, accelerating product innovation cycles. By 2035, online-first strategies are expected to account for more than 40% of incremental growth globally.

Price Sensitivity in Emerging Markets

While India and China are expected to record the fastest CAGR (23.7% and 22.2% respectively), price sensitivity remains a major barrier to adoption. Average SPF moisturizer products from premium brands often cost up to 5-10 times more than standard moisturizers without SPF, limiting penetration in middle-income demographics. In India, where rapid urbanization drives awareness, local consumers often resort to sunscreen-only products due to lower cost per use. This restrains wider adoption of SPF moisturizers unless companies tailor affordable SKUs or sachet-style packs. Without localized pricing strategies, penetration outside metro and Tier-1 cities will remain low, restricting full market potential.

Regulatory and Labeling Complexity

Another significant restraint is the stringent regulatory landscape around SPF claims, labeling, and testing standards. In the USA, the FDA mandates strict proof of broad-spectrum coverage, while in Europe, the Cosmetics Regulation requires clear UVA/UVB ratios. In Asia, China’s National Medical Products Administration (NMPA) enforces approval pathways that can delay product launches by several months. These differing regional standards complicate global product rollouts and add compliance costs for multinational players. Smaller and indie brands face even greater challenges, as meeting SPF testing requirements requires investment in clinical studies, limiting their ability to scale globally. This regulatory fragmentation creates market entry barriers and slows innovation timelines.

Shift Toward Clean-Label, Vegan, and Dermatologist-Tested Claims

Clean-label, vegan, and dermatologist-tested claims are rapidly shaping the competitive narrative of the SPF moisturizers market. While broad-spectrum continues to dominate with 54.5% share in 2025, the fastest growth comes from the "others" category, which includes vegan and dermatologist-tested claims. Younger buyers, particularly in Europe and the USA, actively seek cruelty-free and plant-based formulations. Brands like CeraVe and Eucerin leverage dermatologist endorsements to strengthen clinical credibility, while niche players market transparency and sustainability as key differentiators. This trend not only expands consumer trust but also encourages legacy brands to reformulate with eco-conscious packaging and reef-safe UV filters.

Asia-Pacific Outpacing Mature Markets in Growth and Innovation

A major trend is the rising dominance of Asia-Pacific markets especially China, Japan, and India in shaping innovation and market momentum. While the USA remains the largest single market in value, its CAGR (10.1%) is nearly half that of India and China. Japan is also projected to grow at 18.8%, driven by demand for texture-specific formats like gels and sticks. Asian consumers are leading demand for non-greasy, fast-absorbing, and hybrid-texture SPF moisturizers that blend seamlessly into daily skincare. Innovations in lightweight serums and travel-friendly stick formats are first launched in Asia before expanding to Western markets. By 2035, the regional share of China and Japan combined will climb from 19.8% to over 24%, reflecting this eastward shift in innovation and consumer influence.

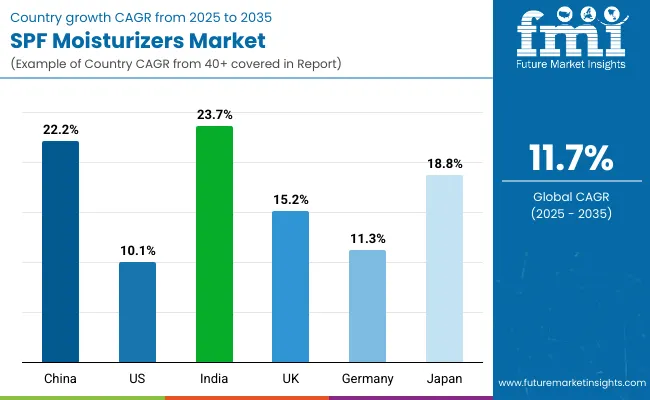

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 22.2% |

| USA | 10.1% |

| India | 23.7% |

| UK | 15.2% |

| Germany | 11.3% |

| Japan | 18.8% |

The SPF Moisturizers Market is witnessing highly uneven growth trajectories across countries, with emerging economies far outpacing mature markets. India leads with a CAGR of 23.7% between 2025 and 2035, reflecting rapid urbanization, rising disposable incomes, and heightened awareness of sun-induced skin damage. The growing influence of dermatologists, along with the aspirational adoption of premium skincare, positions India as one of the most dynamic markets for SPF moisturizers.

China follows closely with a CAGR of 22.2%, supported by strong e-commerce penetration, cross-border beauty imports, and rising consumer preference for multifunctional skincare formats such as creams/lotions and serums. Japan, at 18.8%, stands out in Asia-Pacific for its innovation-driven demand, where texture-specific preferences and cultural emphasis on sun protection ensure robust expansion.

In comparison, mature Western markets are expanding at a steadier pace. The USA records a CAGR of 10.1%, reflecting a stable but saturated base where growth is anchored by multifunctional claims such as hydration and blue light protection rather than pure SPF adoption. Germany and the UK demonstrate mid-level growth rates of 11.3% and 15.2% respectively, with demand heavily influenced by dermatologist-tested and clean-label formulations. In Europe, stricter regulatory frameworks and established consumer awareness maintain consistent adoption, but growth is slower compared to Asia. The gap between mature and emerging markets underlines the shift in global momentum toward Asia-Pacific, where India, China, and Japan are expected to contribute the bulk of incremental revenues over the next decade.

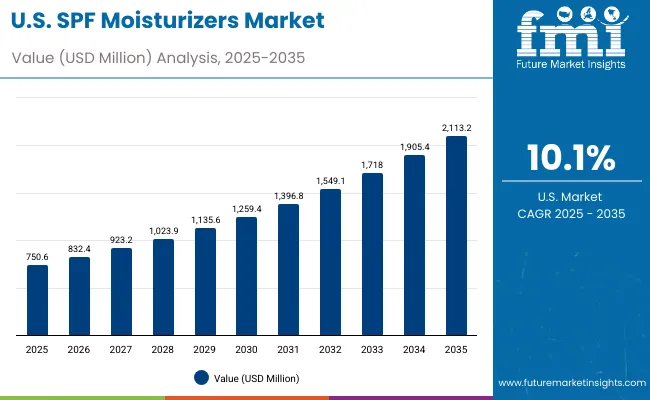

| Year | USA SPF Moisturizers Market (USD Million) |

|---|---|

| 2025 | 750.6 |

| 2026 | 832.4 |

| 2027 | 923.2 |

| 2028 | 1,023.9 |

| 2029 | 1,135.6 |

| 2030 | 1,259.4 |

| 2031 | 1,396.8 |

| 2032 | 1,549.1 |

| 2033 | 1,718.0 |

| 2034 | 1,905.4 |

| 2035 | 2,113.2 |

The SPF Moisturizers Market in the United States is projected to grow at a CAGR of 10.1%, led by strong consumer awareness and consistent dermatologist recommendations. UV protection accounts for over 63% of functional demand in 2025, reflecting a market where sun care and skincare routines have already converged. Growth is being driven by the rise of hybrid formats that combine SPF with hydration and blue light protection, catering to remote workers and urban consumers. E-commerce and pharmacy channels remain critical for distribution, while specialty beauty retailers are driving premium launches. Service-oriented dermatology chains and influencer-backed digital campaigns are accelerating consumer education on year-round SPF use.

The SPF Moisturizers Market in the United Kingdom is expected to grow at a CAGR of 15.2%, supported by strong interest in clean-label and vegan formulations. British consumers, particularly millennials and Gen Z, are adopting SPF moisturizers as a part of preventive skincare rather than seasonal use. Retailers are investing in AR-powered platforms that help consumers test textures virtually, while high-street pharmacies continue to dominate sales volume. Premiumization is being fueled by European dermocosmetic brands like La Roche-Posay and Eucerin, which have built credibility through dermatologist endorsements. Heritage concerns are also pushing brands toward eco-friendly packaging and reef-safe UV filters, aligning with consumer preference for sustainable beauty.

India is witnessing the fastest growth in the SPF Moisturizers Market, with a forecast CAGR of 23.7% through 2035. Rising awareness of sun-induced skin damage, combined with urbanization and income growth, is driving adoption beyond metro cities into Tier-2 and Tier-3 markets. Localized products that address oily skin, humid climates, and natural ingredient preferences are gaining traction. Price sensitivity remains a barrier, but sachets and smaller pack sizes have boosted accessibility. Educational campaigns by dermatologists and social media influencers are also expanding adoption, especially among younger consumers. The integration of SPF moisturizers into men’s grooming and unisex skincare lines is creating additional growth opportunities.

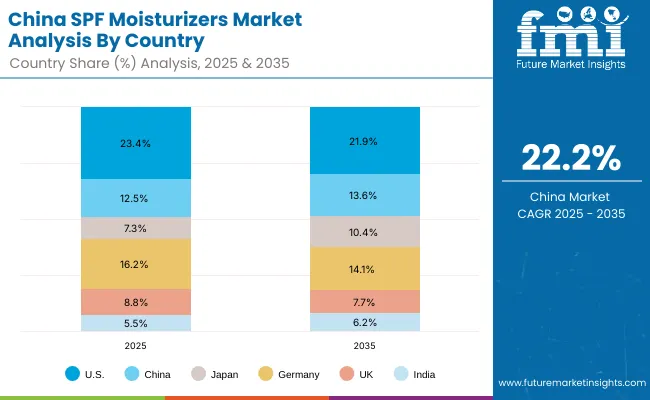

| Countries | 2025 Share (%) |

|---|---|

| USA | 23.4% |

| China | 12.5% |

| Japan | 7.3% |

| Germany | 16.2% |

| UK | 8.8% |

| India | 5.5% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 21.9% |

| China | 13.6% |

| Japan | 10.4% |

| Germany | 14.1% |

| UK | 7.7% |

| India | 6.2% |

The SPF Moisturizers Market in China is expected to grow at a CAGR of 22.2%, among the highest worldwide. Growth momentum is powered by cross-border e-commerce, aggressive marketing by premium brands, and increasing awareness of photoaging and skin health. Domestic and international players are leveraging influencer ecosystems and live-streaming platforms to push SPF moisturizers as daily essentials. Municipal-level campaigns on skin cancer awareness and the cultural emphasis on fair, youthful skin are further accelerating uptake. Innovation in stick and serum formats caters to male consumers and younger demographics seeking portable, lightweight options. Affordable local alternatives are also expanding accessibility across Tier-2 and Tier-3 cities.

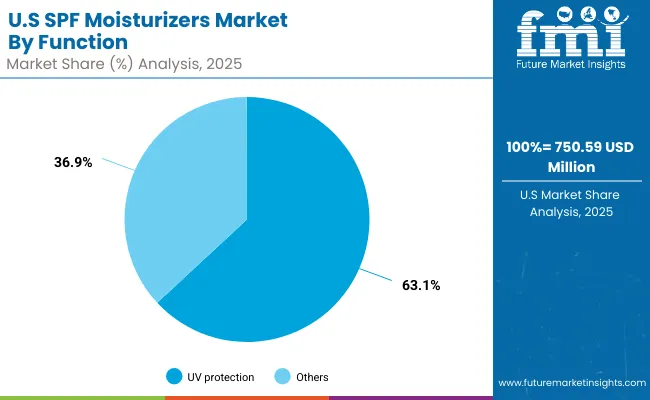

| USA by Function | Value Share% 2025 |

|---|---|

| UV protection | 63.1% |

| Others | 36.9% |

The SPF Moisturizers Market in the USA is projected at USD 750.55 million in 2025. UV protection dominates with 63.1%, while other functional claims contribute 36.9%, reflecting the steady convergence of moisturization with broad-spectrum sun defense. This clear tilt toward UV protection stems from heightened dermatological awareness, clean-label shifts, and the widespread adoption of SPF 30-50 as part of daily skincare routines. Consumers increasingly prefer lightweight, non-greasy formats that sit well under makeup and support sensitive skin safety.

Growing demand for hybrid skincare that addresses hydration, brightening, and barrier repair alongside SPF is a major catalyst, as brands position moisturizers not just as sun care but as an all-in-one solution. Additionally, dermatologist endorsements, fragrance-free variants, and tinted moisturizer launches are strengthening premiumization trends. As lifestyle-driven sun exposure grows, USA consumers are expected to remain loyal to multifunctional SPF moisturizers.

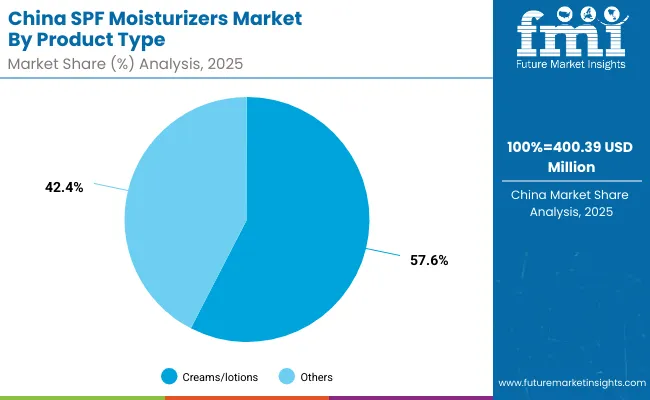

| China by Product Type | Value Share% 2025 |

|---|---|

| Creams/lotions | 57.6% |

| Others | 42.4% |

The SPF Moisturizers Market in China is valued at USD 400.40 million in 2025, with creams and lotions leading at 57.6%, followed by other formats at 42.4%. The preference for cream-based textures is a direct outcome of consumer inclination toward hydrating, brightening, and pollution-defense formulations. These formats provide a balance of hydration and sun protection, aligning with urban skincare routines in tier-1 and tier-2 cities.

This advantage positions creams and lotions as the dominant choice in humid climates, where lightweight yet long-lasting protection is critical. Other product forms, including gels, sticks, and serums, are expanding in niche channels, particularly among younger demographics seeking portability and on-the-go reapplication. As clean-label regulations strengthen, opportunities lie in dermatologist-tested, blue-light defense, and sensitive-skin variants that integrate SPF seamlessly into daily skincare.

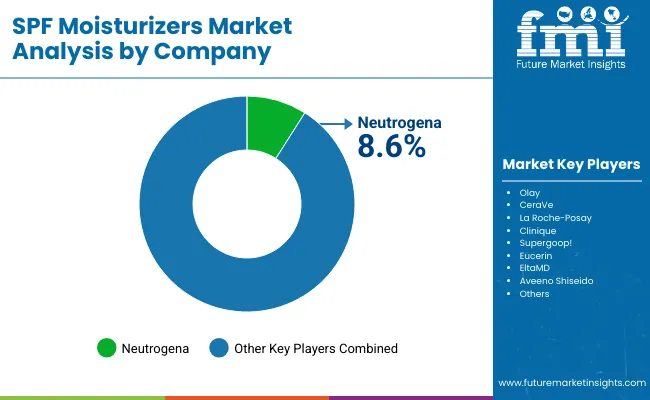

The SPF Moisturizers Market is moderately fragmented, with multinational leaders, mass-market brands, and regional specialists competing for consumer attention. Global skincare leaders such as Neutrogena hold measurable share, anchored in dermatologist-backed claims, broad-spectrum credibility, and deep distribution across pharmacies and retail chains. Their strategies emphasize lightweight textures, high-SPF innovations, and clinical positioning.

Mid-sized and emerging brands leverage K-beauty and C-beauty aesthetics, introducing hybrid moisturizers with brightening, barrier-support, and anti-pollution properties. These brands are accelerating adoption through e-commerce exclusives, refillable packaging, and influencer-driven education, making them relevant to digitally active consumer bases.

Competitive differentiation is shifting from SPF strength alone to integrated ecosystems that include hybrid claims (hydration + SPF + brightening), sensitive-skin validation, and subscription or refill models. This shift ensures recurring revenue and stronger brand loyalty in both Western and Asian markets.

Key Developments in SPF Moisturizers Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3204.5 Million |

| Component | UV protection, Hydration, Anti-aging, Blue light protection |

| Range | Creams/lotions, Serums, Gels, Sticks |

| Technology | Broad-spectrum, Clean-label, Dermatologist-tested, Vegan |

| Type | Pharmacies, E-commerce, Mass retail, Specialty beauty stores |

| End-use Industry | Personal care, Premium cosmetics, Dermocosmetics, Mass-market skincare |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Neutrogena, Olay, CeraVe, La Roche- Posay, Clinique, Supergoop !, Eucerin, EltaMD, Aveeno, Shiseido |

| Additional Attributes | Dollar sales by function, product type, channel, and claim; adoption trends in hybrid skincare (hydration + SPF); rising demand for fragrance-free and sensitive-skin-safe formulas; premiumization via tinted and anti-aging SPF; subscription/refill models; AI-personalized recommendations; regional demand influenced by sun-awareness campaigns; innovations in lightweight textures and photostable filter systems. |

The SPF Moisturizers Market is estimated to be valued at USD 3204.5 million in 2025.

The market size for the SPF Moisturizers Market is projected to reach USD 9652.29 million by 2035.

The SPF Moisturizers Market is expected to grow at a 11.7% CAGR between 2025 and 2035.

The key product types in SPF Moisturizers Market are creams/lotions, serums, gels, and sticks.

In terms of Creams/lotions segment is expected to command 56.6% share in the SPF Moisturizers Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

SPF Boosters Market Size and Share Forecast Outlook 2025 to 2035

Smart SPF Complexes Market Size and Share Forecast Outlook 2025 to 2035

Specific Pathogen Free Animals (SPF) Market

Argan Oil Moisturizers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hemp Seed Oil Moisturizers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ceramide-Infused Moisturizers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Peptide-Infused Tinted Moisturizers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA