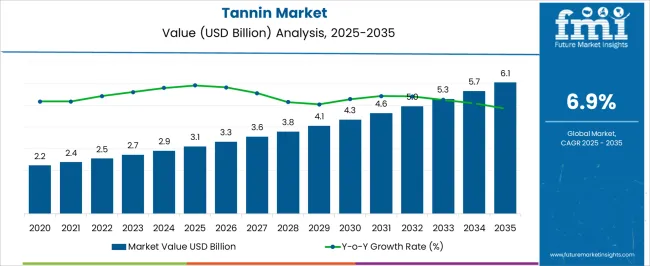

The tannin market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 6.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

The global market is projected at USD 3.1 billion in 2025 and is anticipated to reach USD 6.1 billion by 2035, expanding at a compound annual growth rate (CAGR) of 6.9% over the forecast period. A closer examination of the breakpoint analysis reveals distinct phases of market acceleration and consolidation, which provide insight into key inflection points for industry growth. In the early stage, the market grows from USD 2.2 billion to USD 2.4 billion and then USD 2.5 billion, representing a gradual increase as awareness of tannin applications in food, beverages, and leather processing steadily rises.

The intermediate phase between USD 2.7 billion and USD 3.1 billion marks the first notable breakpoint, indicating a transition toward broader industrial adoption and enhanced extraction efficiencies. As the market continues to expand from USD 3.3 billion to USD 3.8 billion, the next breakpoint highlights growing integration of tannins in nutraceuticals, pharmaceuticals, and eco-friendly coatings, which intensifies demand. The later stage of growth, spanning USD 4.1 billion to USD 6.1 billion, reflects the market entering a mature yet accelerating trajectory, supported by increased regulatory approvals for natural additives and rising global preference for plant-derived compounds.

Overall, the breakpoint analysis underscores that the tannin market exhibits measured growth in the early years, followed by notable surges at key adoption points, culminating in robust expansion by 2035, driven by diversified applications and sustained industrial utilization.

| Metric | Value |

|---|---|

| Tannin Market Estimated Value in (2025 E) | USD 3.1 billion |

| Tannin Market Forecast Value in (2035 F) | USD 6.1 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The tannin market is closely influenced by five interconnected parent markets that collectively drive its adoption and long-term growth. The largest contributor is the leather and hide processing market, which accounts for about 35% share, as tannins are essential in converting raw hides into durable and flexible leather, offering resistance to decomposition and enhancing texture. The adhesives and coatings sector contributes around 25%, as tannins are widely used in producing natural adhesives, wood resins, and protective coatings, leveraging their polymerization and binding properties. The food and beverage industry holds close to 15% influence, supported by the demand for natural preservatives, flavoring agents, and astringent components in products such as wines, teas, and juices.

The chemical intermediates and extractives market adds nearly 12%, as tannins are processed into gallic acid, catechins, and other derivatives used in pharmaceuticals, dyes, and industrial applications. The pharmaceuticals and nutraceuticals sector contributes close to 8%, as tannin-based formulations are increasingly explored for their antioxidant, antimicrobial, and anti-inflammatory properties. In an opinionated view, the distribution of market influence shows that leather processing and industrial applications form the backbone of the tannin market, while food, chemical, and pharmaceutical uses continue to expand its commercial relevance. This interconnected ecosystem indicates that the market is not reliant on a single vertical but is supported by diverse industries, ensuring sustained demand, resilience, and consistent year-on-year growth.

The tannin market is experiencing steady growth, driven by its crucial role in multiple industries, particularly leather processing, adhesives, and food applications. Rising demand for sustainable and bio-based products is accelerating the adoption of plant-based tannins, which are preferred for their renewable sourcing and reduced environmental impact. Growing awareness of eco-friendly manufacturing practices and stricter regulations on chemical tanning agents are further supporting the market expansion.

Technological advancements in extraction and purification methods are improving the efficiency and quality of tannin products, making them more suitable for diverse industrial applications. The leather industry remains a key driver, requiring high-performance tannins to ensure durability, color consistency, and resistance to microbial degradation. Increasing investments in leather manufacturing and the growing preference for high-quality finished products are contributing to market growth.

Additionally, the ability of tannins to serve as natural antioxidants and functional additives in food and beverage applications is creating opportunities for broader adoption The market is anticipated to witness sustained growth as demand for plant-based, high-performance tannins continues to rise globally.

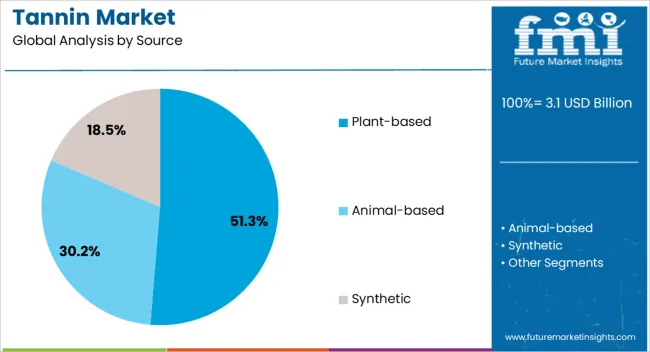

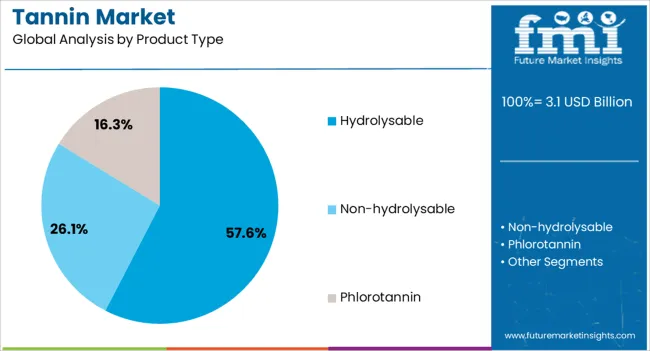

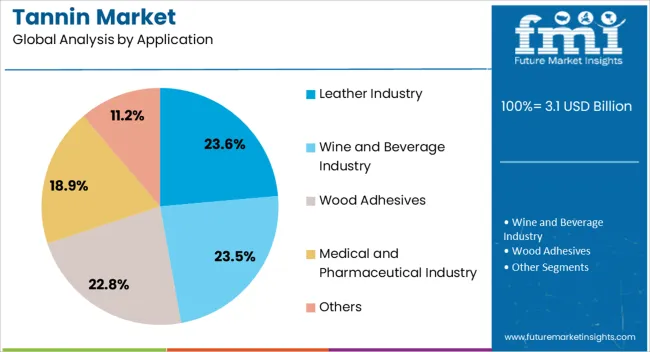

The tannin market is segmented by source, product type, application, and geographic regions. By source, tannin market is divided into plant-based, animal-based, and synthetic. In terms of product type, tannin market is classified into hydrolysable, non-hydrolysable, and phlorotannin. Based on application, tannin market is segmented into leather industry, wine and beverage industry, wood adhesives, medical and pharmaceutical industry, and others. Regionally, the tannin industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plant-based source segment is projected to hold 51.3% of the tannin market revenue share in 2025, making it the leading source type. This leadership is being driven by the sustainable and renewable nature of plant-derived tannins, which offer significant environmental advantages over synthetic alternatives. Plant-based tannins are increasingly adopted in the leather and adhesive industries due to their superior functionality, biodegradability, and compatibility with eco-conscious manufacturing standards.

The extraction of tannins from wood, bark, and other plant materials has been optimized through technological improvements, ensuring higher purity and consistency in performance. Industrial stakeholders are preferring plant-based tannins for their ability to enhance leather strength, color retention, and resistance to degradation.

Furthermore, the rising demand for natural and non-toxic ingredients in consumer products is further promoting this source type The versatility and environmental compliance of plant-based tannins are expected to sustain their dominance in the global market while aligning with evolving sustainability regulations and corporate responsibility initiatives.

The hydrolysable tannin product type segment is anticipated to account for 57.6% of the tannin market revenue share in 2025, positioning it as the leading product type. Its dominance is attributed to its high solubility and reactivity, which make it particularly suitable for applications requiring precise tanning performance, such as leather and adhesive formulations. Hydrolysable tannins are preferred for their ability to produce consistent results, enhance material durability, and improve resistance to microbial attack.

The segment is being supported by increasing demand from industrial users seeking controlled tanning reactions and superior product quality. Advanced processing techniques have allowed hydrolysable tannins to be more readily incorporated into complex formulations without compromising stability or efficiency.

As leather and related industries continue to prioritize high-performance and eco-friendly materials, hydrolysable tannins are expected to maintain their leading position The combination of functional versatility, cost-effectiveness, and regulatory compliance is reinforcing the market share of hydrolysable tannins in global industrial applications.

The leather industry application segment is projected to hold 23.6% of the tannin market revenue share in 2025, establishing it as the dominant application sector. This leadership is being driven by the consistent requirement for high-quality tanning agents that ensure leather strength, flexibility, color stability, and resistance to microbial degradation.

The growing global demand for premium leather products, particularly in fashion, automotive, and furniture industries, has reinforced the use of tannins as essential raw materials in leather processing. Manufacturers are increasingly adopting plant-based and hydrolysable tannins to meet sustainability standards and reduce environmental impact associated with synthetic chemical tanning.

Advancements in extraction and formulation processes have enhanced the performance of tannins, enabling more efficient tanning cycles and improved product consistency The leather industry’s dependence on reliable and high-performance tannins ensures that this application segment remains a key driver of growth, supporting both market expansion and innovation in environmentally sustainable leather manufacturing practices.

The tannin market is being driven by rising demand from leather and textile industries, expanding applications in food and beverages, focus on natural extraction methods, and regional market expansion. Traditional industrial uses continue to provide a strong foundation, while new applications in health-conscious and functional products diversify revenue streams. Emphasis on naturally sourced tannins aligns with consumer preference for organic and eco-friendly ingredients. Regional expansion and trade growth are enhancing supply chain stability and enabling global reach. These combined dynamics are supporting sustained growth, encouraging investment, and reinforcing the market’s relevance across multiple industrial and consumer sectors.

The market is witnessing growth due to increasing demand from the leather and textile sectors. Tannins are extensively used in leather processing to enhance durability, flexibility, and color retention. Textile manufacturers also utilize tannins in dyeing and finishing processes to improve fabric quality and resistance. Rising industrial production in emerging economies is driving higher consumption of tannins for commercial applications. As consumers seek premium leather products and durable textiles, suppliers are responding with consistent production and supply. This steady demand from traditional end-use industries is establishing a reliable foundation for market growth and encouraging investment in production technologies.

Market players are increasingly focusing on naturally sourced tannins to meet consumer preference for organic and plant-derived ingredients. Extracts from sources such as quebracho, chestnut, and acacia are gaining popularity for their effectiveness in leather processing, food, and personal care applications. Companies are investing in efficient extraction methods to improve yield, purity, and consistency. The trend toward natural formulations is also attracting attention from cosmetic and pharmaceutical segments seeking bioactive compounds. By leveraging renewable botanical sources, the market is reducing dependency on synthetic alternatives, enhancing product appeal, and creating opportunities for regional sourcing and sustainable production strategies.

Tannin producers are expanding operations to serve growing demand in North America, Europe, and Asia-Pacific regions. Export and import activities are rising as countries with abundant natural sources supply global industrial and food markets. Collaborative initiatives with local suppliers and manufacturers are improving supply chain efficiency. Regional market expansion is further driven by the increasing consumption of leather goods, beverages, and nutraceutical products. Companies are also adapting product formulations to meet regional regulatory and quality standards. These strategies are enabling global market penetration and consistent revenue growth, supporting both short-term sales and long-term strategic positioning in key international markets.

Tannins are being increasingly adopted in the food and beverage sector, particularly in wine, tea, and functional beverages. Their antioxidant properties, flavor enhancement, and natural preservation benefits are driving usage in these products. Beverage manufacturers are incorporating tannins to improve taste, shelf life, and health appeal. Tannins are being used in nutraceutical formulations and dietary supplements, creating new high-value avenues. The expansion of premium beverage consumption in urban markets is contributing to growing demand. By tapping into the food and beverage segment, tannin suppliers are diversifying applications and strengthening market stability, ensuring relevance beyond traditional industrial uses.

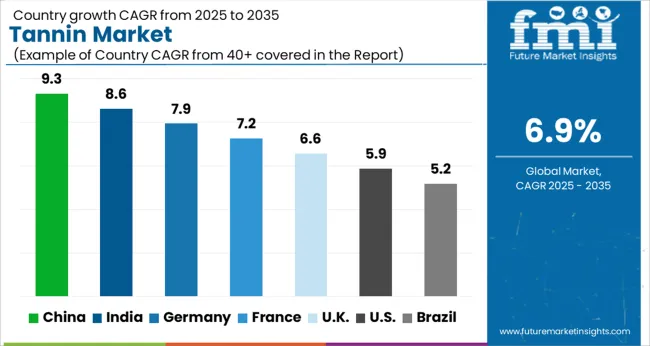

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

| USA | 5.9% |

| Brazil | 5.2% |

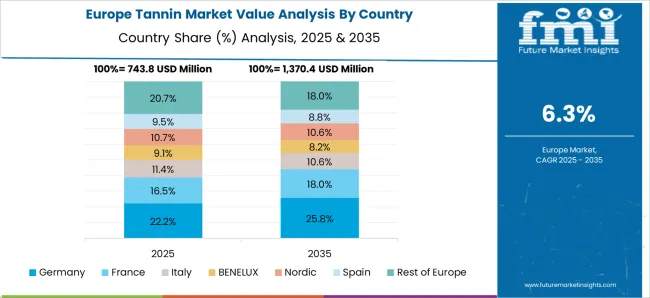

The global tannin market is projected to grow at a CAGR of 6.9% between 2025 and 2035. China and India, as leading BRICS economies, drive growth with expanding beverage industries, leather exports, and nutraceutical adoption. Germany, the UK, and the USA, representing OECD markets, emphasize high-quality leather processing, wine production, pharmaceuticals, and animal feed applications. Growth is supported by rising demand for premium wines, natural tanning agents, and bio-based ingredients in health supplements. Asia stands out as the production hub for both raw material extraction and processing, while Europe and North America maintain leadership in high-value applications, advanced research, and industrial integration. The analysis includes over 40+ countries, with the leading markets detailed below.

The tannin market in China is projected to grow at a CAGR of 9.3% from 2025 to 2035, supported by large-scale beverage production, thriving leather exports, and rising nutraceutical demand. China’s wine industry, though younger compared to European markets, is expanding rapidly, with tannins serving as critical inputs for wine quality enhancement. The country’s vast tea sector also relies heavily on natural tannin content, driving consistent consumption. Leather processing hubs benefit from tannins derived from quebracho and chestnut, strengthening China’s role as a global supplier of leather goods. Pharmaceutical companies are exploring tannin applications in herbal medicines and supplements. Government-backed initiatives for agricultural processing and bio-based industries further expand opportunities. China’s large-scale manufacturing capacity ensures competitive exports.

The tannin market in India is expected to grow at a CAGR of 8.6% between 2025 and 2035, driven by the country’s strong position in leather manufacturing, herbal medicine, and food and beverages. India is among the largest exporters of leather products, where tannins remain indispensable for tanning hides and enhancing durability. Traditional use of tannins in Ayurveda and herbal formulations is merging with modern nutraceutical trends, adding new growth momentum. The tea industry, a major export sector, also reinforces steady demand for tannin-rich extracts. Increasing investments in animal feed applications are opening new avenues, particularly in improving livestock productivity and reducing methane emissions. India’s blend of traditional applications and modern innovations ensures expanding market adoption.

Germany’s tannin market is projected to expand at a CAGR of 7.9% from 2025 to 2035, supported by its renowned wine industry, advanced leather processing sector, and pharmaceutical research. German wineries emphasize tannins for taste enhancement, preservation, and premium quality, which keeps demand steady in beverages. Leather tanning for high-end automotive interiors and fashion accessories relies heavily on natural tannins sourced from Europe and abroad. The nutraceutical industry is integrating tannins into dietary supplements targeting antioxidant and digestive benefits. Germany’s focus on bio-based materials also promotes tannin use in wood adhesives and chemicals. With its emphasis on precision, quality, and advanced applications, Germany’s market remains one of the most diversified within Europe.

The tannin market in the UK is anticipated to grow at a CAGR of 6.6% from 2025 to 2035, with wine, tea, and pharmaceuticals leading demand. While the UK is not a major wine producer, its strong wine consumption and imports generate consistent demand for tannin-based preservation and flavor stability. The nation’s long tradition of tea drinking ensures stable tannin usage, while growing herbal tea and specialty beverage markets add new layers of demand. Pharmaceutical applications are also gaining importance, with tannins being explored for therapeutic properties. Import reliance is expected to remain strong, yet the UK’s advanced processing and R&D industries are set to create tailored applications for health and industrial purposes.

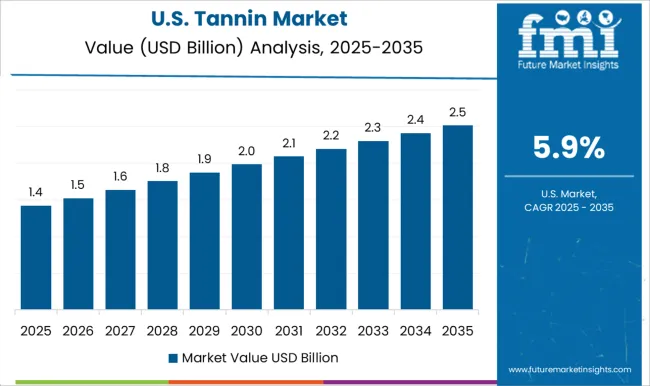

The tannin market in the USA is projected to grow at a CAGR of 5.9% from 2025 to 2035, driven by the country’s premium wine sector, leather industry, and growing nutraceutical adoption. California’s wine industry, one of the largest globally, depends heavily on tannins for flavor complexity and stability, ensuring a strong domestic base. Leather consumption in automotive interiors and high-fashion products also maintains steady tannin demand. The nutraceutical sector, fueled by rising consumer interest in antioxidants and natural compounds, is expanding tannin applications in supplements and herbal products. Animal feed producers are increasingly exploring tannins as natural additives. The USA market reflects a balance of traditional demand and emerging health-focused applications.

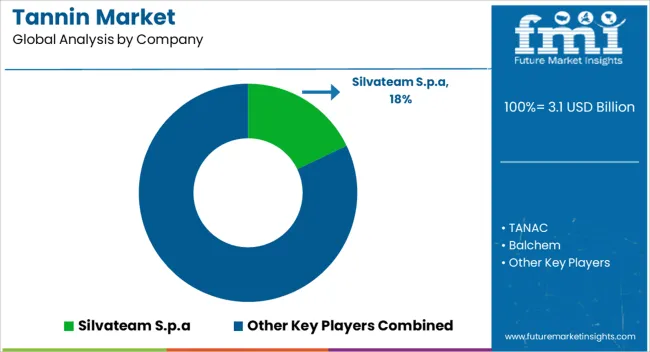

Competition in the tannin market is shaped by extraction efficiency, product purity, and application versatility. Silvateam S.p.A. leads with a broad portfolio of plant-based tannins for beverages, leather, and nutraceuticals. TANAC focuses on specialty tannins and high-quality extracts tailored for wine, beer, and food applications. Balchem competes with functional tannin ingredients targeting animal feed and health supplements, emphasizing bioactivity and consistent performance.

Laffort leverages expertise in oenological tannins for premium wine production. Polson Limited and Mimosa S.A. supply bulk tannins for leather tanning and industrial coatings, combining scale with regional distribution. Tannin Corporation and S.A. Ajinomoto OmniChem N.V. provide chemical-grade tannins for adhesives, coatings, and specialty industrial applications. W. Ulrich GmbH and EVER S.r.l. focus on customized formulations, niche markets, and plant-extracted solutions for targeted end uses. Strategies emphasize high-quality sourcing, process standardization, and application-specific solutions.

Differentiation is achieved through functional efficacy, extract purity, and compliance with food, feed, and pharmaceutical regulations. Global supply chain reliability, co-development programs with converters, and technical support are leveraged to secure long-term contracts. Manufacturers highlight eco-friendly extraction processes, batch traceability, and product consistency as competitive levers. Product brochures detail specifications such as tannin content, molecular weight, solubility, color intensity, and functional properties for beverages, leather, nutraceuticals, and industrial chemicals.

Wine and beer-grade extracts include organoleptic profiles and dosage recommendations. Leather-grade tannins specify hide penetration, flexibility improvement, and durability metrics. Animal feed products highlight protein-binding, gut health, and methane-reduction efficacy. Industrial tannins are presented with adhesive compatibility, coating performance, and polymer reinforcement data. Technical datasheets, application notes, and formulation guides are provided to support manufacturers, converters, and integrators across diverse end-use industries.

| Items | Values |

|---|---|

| Quantitative Units | USD 3.1 billion |

| Source | Plant-based, Animal-based, and Synthetic |

| Product Type | Hydrolysable, Non-hydrolysable, and Phlorotannin |

| Application | Leather Industry, Wine and Beverage Industry, Wood Adhesives, Medical and Pharmaceutical Industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Silvateam S.p.a, TANAC, Balchem, Laffort, Polson Limited, Mimosa S.A., Tannin Corporation, S.A. Ajinomoto OmniChem N.V, W. Ulrich GmbH, and EVER s.r.l |

| Additional Attributes | Dollar sales by source type, share by end-use segments, regional consumption patterns, pricing benchmarks, competitor strategies, capacity expansions, regulatory requirements, growth drivers, raw material availability, emerging applications, and consumer trends. |

The global tannin market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the tannin market is projected to reach USD 6.1 billion by 2035.

The tannin market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in tannin market are plant-based, animal-based and synthetic.

In terms of product type, hydrolysable segment to command 57.6% share in the tannin market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tanning Waters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Self-tanning Products Market Report - Growth, Demand & Forecast 2025 to 2035

Leather Tanning Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA