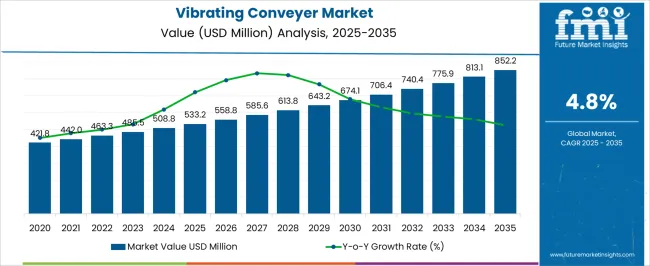

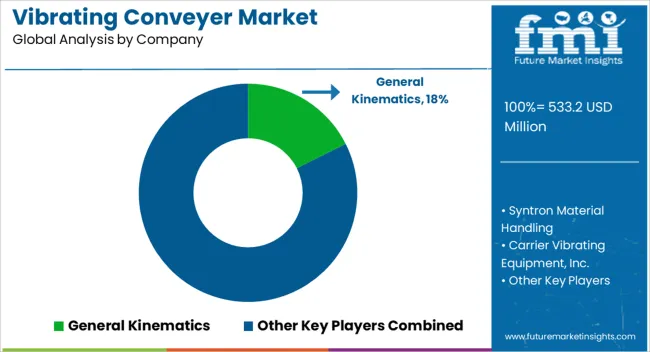

The vibrating conveyer market is estimated to be valued at USD 533.2 million in 2025 and is projected to reach USD 852.2 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The vibrating conveyer market, anticipated at USD 533.2 million in 2025 and projected to reach USD 852.2 million by 2035, is expected to advance at a CAGR of 4.8%, supported by steady industrial adoption across multiple sectors. Between 2021 and 2025, the market grows from USD 421.8 million to USD 533.2 million, accounting for the early phase of expansion driven by demand in food processing, mining, chemicals, and metallurgy. Annual increments such as USD 442.0 million in 2022, USD 463.3 million in 2023, and USD 485.5 million in 2024 highlight consistent momentum, underscoring the increasing reliance on bulk material handling systems capable of efficiently transporting abrasive, fragile, or hot materials.

From 2026 to 2030, the market rises from USD 558.8 million to USD 674.1 million, contributing nearly one-third of the projected growth. This phase benefits from rising automation across supply chains, strong adoption of energy-efficient conveyor designs, and expanding use in hygienic environments such as food and beverage production. Between 2031 and 2035, the market expands from USD 706.4 million to USD 852.2 million, representing the consolidation phase where smart monitoring, predictive maintenance, and customized designs become mainstream. Overall, the vibrating conveyer market demonstrates a balanced trajectory, with growth driven by modernization of industrial operations and the demand for durable, reliable, and efficient conveying solutions worldwide.

| Metric | Value |

|---|---|

| Vibrating Conveyer Market Estimated Value in (2025 E) | USD 533.2 million |

| Vibrating Conveyer Market Forecast Value in (2035 F) | USD 852.2 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

The vibrating conveyer market occupies a defined niche within the broader material handling and processing equipment sector, representing approximately 10–12% of the global conveyor systems category. Within the overall industrial handling and bulk material movement segment, vibrating conveyers account for nearly 8–10%, driven by demand from industries such as food processing, mining, chemicals, pharmaceuticals, and construction materials. In the bulk solids and granular material handling applications, the share is estimated at 6–8%, supported by requirements for efficient, controlled, and continuous material flow, as well as high throughput and reduced manual handling. Within automated production lines and integrated plant operations, vibrating conveyers capture around 4–6%, highlighting their role in process efficiency, precise feed rates, and reduced downtime. Growth is fueled by increasing industrial automation, emphasis on process optimization, and rising adoption of hygienic and corrosion-resistant designs in sensitive sectors.

Technological refinements, including adjustable vibration frequency, energy-efficient motors, and modular design, have enhanced versatility and installation flexibility across diverse plant layouts. Despite challenges such as high upfront costs, space constraints, and competition from belt or screw conveyers, the vibrating conveyer segment maintains relevance through application-specific designs, energy-efficient operation, and improved material handling efficiency. Regional adoption is strongest in Asia-Pacific and Europe due to expanding industrial production and infrastructure development, while North America shows steady uptake in process industries requiring precise material transport and metering

The market is witnessing steady growth, driven by increasing automation in material handling across various industries. Rising demand in the food & beverage sector for efficient, hygienic, and low-maintenance conveying systems is a significant growth driver.

Additionally, technological advancements in drive mechanisms are improving energy efficiency and operational performance.

Expansion in sectors such as mining, pharmaceuticals, and packaging is further boosting demand, supported by the adoption of vibration-based systems for precise, continuous, and dust-free transportation of bulk materials.

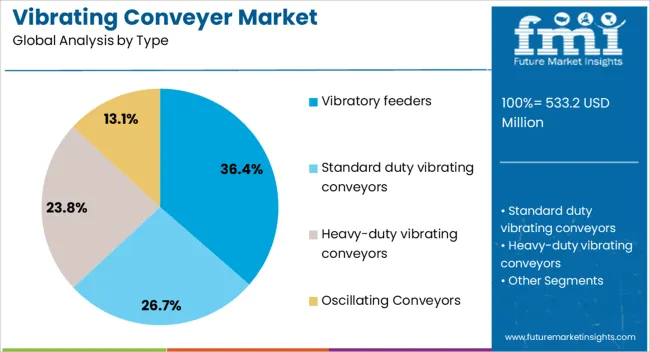

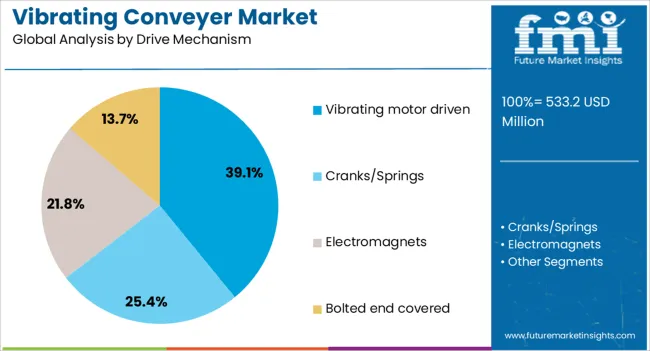

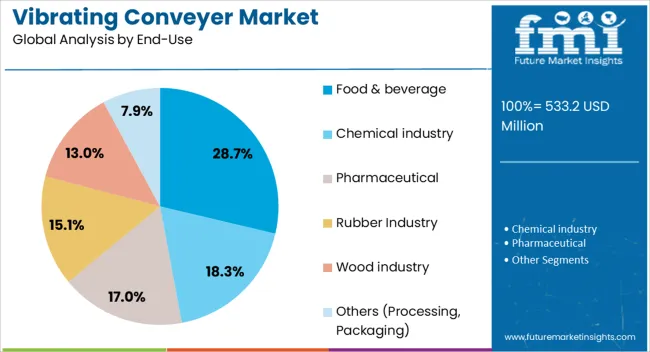

The vibrating conveyer market is segmented by type, drive mechanism, end-use, distribution channel, and geographic regions. By type, vibrating conveyer market is divided into vibratory feeders, standard duty vibrating conveyors, heavy-duty vibrating conveyors, and oscillating Conveyors. In terms of drive mechanism, vibrating conveyer market is classified into vibrating motor driven, cranks/springs, electromagnets, and bolted end covered. Based on end-use, vibrating conveyer market is segmented into food & beverage, chemical industry, pharmaceutical, rubber Industry, wood industry, and others (Processing, Packaging). By distribution channel, vibrating conveyer market is segmented into direct and indirect. Regionally, the vibrating conveyer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Vibratory feeders are anticipated to hold 36.40% of the market share by 2025, making them the dominant type within the vibrating conveyor landscape. Their ability to regulate material flow rate with precision and operate efficiently in continuous processing environments has made them popular in various industries. These feeders reduce spillage and downtime, improving operational throughput. Their adaptability across different particle sizes and materials, including powders, granules, and larger aggregates, supports wide-scale deployment. Moreover, their compatibility with automation and integration into production lines adds to their attractiveness in both legacy and modern plant setups.

The vibrating motor driven segment is forecast to contribute 39.10% of the total market by 2025, emerging as the leading drive mechanism. These systems are favored for their straightforward design, reliability, and ease of maintenance. Their consistent amplitude control and energy efficiency make them particularly effective for heavy-duty or high-volume material handling. Industries such as mining, aggregates, and bulk food processing favor vibrating motor-driven systems for their scalability and ruggedness. Growing preference for low-maintenance conveyors with long service life is also reinforcing the dominance of this segment in both greenfield and brownfield industrial projects.

Food & beverage applications are expected to account for 28.70% of the vibrating conveyer market in 2025, leading among end-use industries. The segment benefits from rising demand for hygienic, corrosion-resistant, and easy-to-clean conveyor systems that align with food safety regulations. Vibrating conveyors offer gentle handling of fragile or irregular food items while minimizing residue buildup and cross-contamination risks. Their suitability for both dry and moist materials such as snacks, grains, meat, and frozen foods has expanded their relevance. As the food industry shifts toward automation and continuous production, vibrating conveyors are becoming essential components in maintaining product integrity and optimizing throughput.

Vibrating conveyers are gaining traction due to rising industrial automation, sector-specific hygiene requirements, construction material handling needs, and operational refinements. Continuous improvements in design, energy efficiency, and precision control are supporting broader adoption globally.

The demand for vibrating conveyers is rising as industries adopt automated material handling solutions to improve process efficiency and reduce manual labor requirements. Food processing, pharmaceuticals, chemicals, and mining sectors rely on vibrating conveyers for controlled and continuous material flow. High throughput, precise feed rates, and reduced downtime are critical factors for industrial operators, prompting replacement of conventional belt and screw conveyors with vibrating solutions. Automation systems integrated with vibrating conveyers enable seamless coordination with batching, sorting, and weighing processes, ensuring consistent production schedules. Vendors are responding with modular and energy-efficient designs, adjustable vibration frequencies, and durable materials that support long operational life, while compliance with hygiene and corrosion standards further drives adoption in sensitive industries.

Vibrating conveyers are increasingly utilized in the food and pharmaceutical sectors where hygiene, contamination control, and precise material dosing are paramount. These industries require easy-to-clean designs, corrosion-resistant materials, and controlled vibration to handle powders, granules, and bulk solids. Continuous processing lines benefit from seamless integration of vibrating conveyers, which improve efficiency and reduce product loss during transfer. Growing adoption of packaged and processed foods, alongside expansion of pharmaceutical production facilities, is driving demand. Industry operators are seeking conveyers that support gentle material handling, minimizing breakage and maintaining product quality. Vendors are supplying stainless steel and sanitary designs with customizable vibration frequency and amplitude to meet strict industry requirements while supporting productivity and compliance.

The construction and bulk material handling sectors are witnessing increased utilization of vibrating conveyers to transport sand, gravel, cement, and aggregates efficiently. Mining operations, cement plants, and concrete batching facilities benefit from controlled and high-volume material flow, reducing bottlenecks and minimizing manual intervention. Vibrating conveyers provide faster throughput compared to traditional belt systems, ensuring continuity in production lines. Energy-efficient motors and adjustable vibration parameters enable operators to handle varying particle sizes and densities without compromising efficiency. Regional construction activity, industrial plant upgrades, and process modernization contribute to market growth. Conveyers designed for rugged conditions and harsh environments are preferred, offering durability, minimal maintenance, and reliable performance under continuous operational stress.

Refinements in vibration control, modular design, and material construction are expanding the market reach of vibrating conveyers. Adjustable frequency, amplitude control, and energy-efficient motors support diverse industrial applications while minimizing operational costs. Corrosion-resistant, easy-to-clean, and sanitary conveyers cater to strict regulatory requirements in sensitive sectors. Modular conveyers allow customization for complex plant layouts, while innovations in drive systems reduce maintenance downtime and increase reliability. Manufacturers are investing in R&D to optimize energy use and ensure stable, precise material handling. Adoption of smart monitoring and feedback systems further enhances operational control, enabling predictive maintenance and reducing unplanned interruptions. These refinements strengthen the role of vibrating conveyers as a central component in industrial material handling systems.

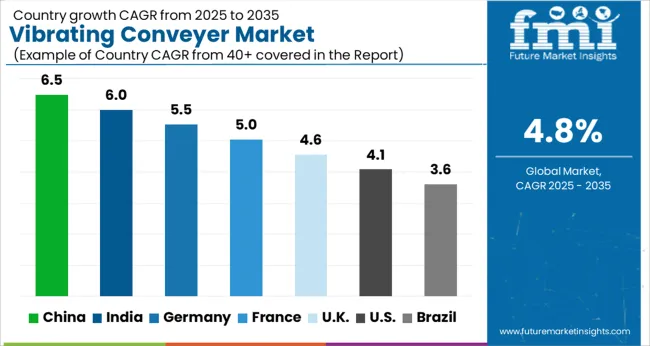

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

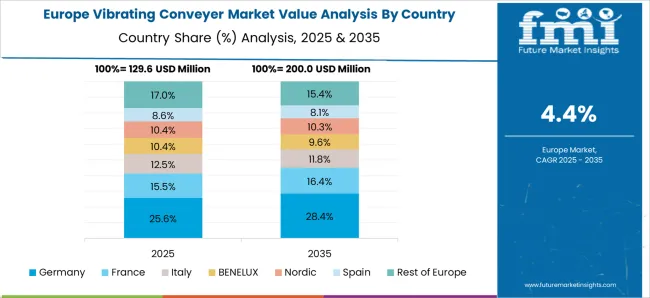

The vibrating conveyer market is projected to grow globally at a CAGR of 4.8% between 2025 and 2035, supported by industrial automation, food processing, pharmaceutical production, and bulk material handling applications. China leads with a CAGR of 6.5%, driven by expanding manufacturing hubs, growing mining operations, and large-scale food and pharmaceutical processing facilities. India follows at 6.0%, fueled by rising industrialization, increased adoption of automated material handling systems, and expanding pharmaceutical and chemical sectors. France records 5.0%, supported by industrial upgrades, logistics optimization, and adoption in manufacturing plants. The United Kingdom grows at 4.6%, influenced by warehouse modernization, construction material handling, and industrial plant automation. The United States posts 4.1%, shaped by established industrial facilities, retrofit projects, and integration of precision material handling solutions. The analysis spans more than 40 countries, with these five serving as benchmarks for dollar sales, regional share, production scaling, and strategic deployment of vibrating conveyer systems in global industrial operations.

China is expected to record a 6.5% CAGR during 2025–2035, up from approximately 5.4% between 2020–2024, surpassing the global benchmark of 4.8%. Early growth was supported by expanding manufacturing hubs, rising bulk material handling requirements, and rapid adoption in food and pharmaceutical processing. Post-2025, acceleration is anticipated through large-scale industrial automation projects, increased mining and construction material transport, and adoption of vibration conveyer systems in advanced processing plants. Investments in domestic production facilities, alongside international partnerships for high-capacity systems, are strengthening supply reliability and technological performance.

India is projected to grow at a 6.0% CAGR from 2025–2035, rising from 5.0% during 2020–2024, above the global average. Initial growth was driven by early industrialization, adoption of automated material handling systems, and expanding pharmaceutical and chemical production units. Between 2025 and 2035, the market is expected to gain momentum due to increased investments in factory modernization, industrial logistics optimization, and expansion of warehouse and bulk transport operations. Local manufacturers are scaling production capacity, enhancing distribution networks, and integrating vibration conveyers into multi-sector industrial processes to meet rising domestic and export demand.

France is expected to achieve a 5.0% CAGR during 2025–2035, rising from 4.2% between 2020–2024, reflecting gradual modernization in manufacturing and material handling industries. Early growth was shaped by adoption in food processing, packaging, and industrial production facilities. From 2025 onward, further acceleration is anticipated through logistics optimization, integration of vibration conveyers in automated assembly lines, and industrial plant upgrades. Domestic suppliers, supported by European collaboration, are introducing high-efficiency, durable conveyer solutions, while regulatory standards and efficiency-focused initiatives in processing industries enhance market adoption.

The UK is projected to record a 4.6% CAGR between 2025–2035, rising from 3.9% between 2020–2024, slightly below China and India but above the global average of 4.8%. Early growth was influenced by warehouse modernization, industrial retrofits, and demand for bulk material handling in construction and manufacturing sectors. The 2025–2035 period is expected to accelerate due to increased investment in factory automation, higher adoption of vibration conveyers for food, pharmaceutical, and logistics operations, and integration with precision material handling systems. Local production and supplier networks are being optimized to reduce lead times and meet evolving industrial needs.

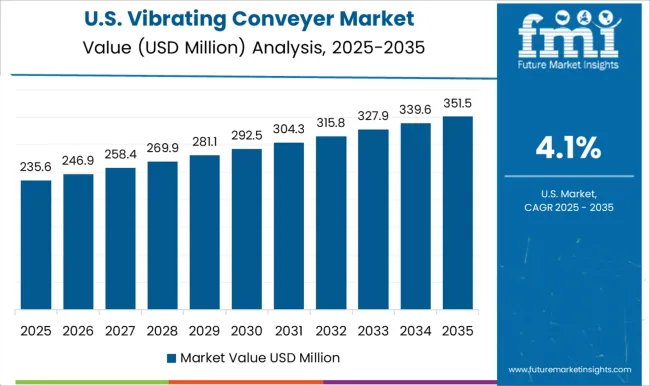

The USA is anticipated to grow at a 4.1% CAGR during 2025–2035, rising from 3.5% between 2020–2024, slightly below the global baseline of 4.8%. Early growth was shaped by retrofit projects in manufacturing plants, integration of vibration conveyers in food processing, chemical, and packaging industries, and increasing automation of warehouse operations. Future growth is expected to be supported by modernization of industrial plants, adoption of high-precision conveyer solutions, and strategic partnerships between domestic suppliers and equipment manufacturers. Investments in advanced vibration conveyer systems for bulk and delicate material handling further strengthen market adoption.

The vibrating conveyer market is shaped by a combination of global leaders and specialized equipment manufacturers, competing on precision, durability, and system integration capabilities. General Kinematics maintains a strong position with a wide portfolio of vibratory and mechanical conveyer solutions, emphasizing high-capacity material handling, modular design, and industry-specific customization. Syntron Material Handling leverages decades of experience in bulk handling and automated vibratory systems, offering tailored solutions for food, chemical, and mineral processing industries. Carrier Vibrating Equipment, Inc. focuses on heavy-duty industrial conveyers with robust performance for high-throughput operations, while Key Technology, Inc. emphasizes sorting, feeding, and process efficiency in food and packaging applications.

Eriez Manufacturing Co. provides innovative vibratory feeders and conveyer solutions with specialized alloys and automation integration for mining, pharmaceuticals, and food sectors. Kinergy Corporation focuses on energy-efficient, low-maintenance vibrating systems optimized for precision handling and bulk material transfer. ACTION Equipment Company, Inc. delivers cost-effective, modular conveyer systems targeting mid-scale industrial and manufacturing clients. Competitive strategies across the market include enhancing system reliability, expanding modular and automated solutions, improving service and spare parts availability, and building strong distributor and OEM relationships. Manufacturers strive to increase share and dollar sales by delivering high-performance solutions with minimal downtime, adaptability across industries, and optimized life-cycle value.

| Item | Value |

|---|---|

| Quantitative Units | USD 533.2 million |

| Type | Vibratory feeders, Standard duty vibrating conveyors, Heavy-duty vibrating conveyors, and Oscillating Conveyors |

| Drive Mechanism | Vibrating motor driven, Cranks/Springs, Electromagnets, and Bolted end covered |

| End-Use | Food & beverage, Chemical industry, Pharmaceutical, Rubber Industry, Wood industry, and Others (Processing, Packaging) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | General Kinematics, Syntron Material Handling, Carrier Vibrating Equipment, Inc., Key Technology, Inc., Eriez Manufacturing Co., Kinergy Corporation, and ACTION Equipment Company, Inc. |

| Additional Attributes | Dollar sales, regional share, demand by industry (food, mining, chemicals), growth by country, competitive landscape, product trends, automation adoption, maintenance cost, and regulatory compliance. |

The global vibrating conveyer market is estimated to be valued at USD 533.2 million in 2025.

The market size for the vibrating conveyer market is projected to reach USD 852.2 million by 2035.

The vibrating conveyer market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in vibrating conveyer market are vibratory feeders, standard duty vibrating conveyors, heavy-duty vibrating conveyors and oscillating conveyors.

In terms of drive mechanism, vibrating motor driven segment to command 39.1% share in the vibrating conveyer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vibrating Screen Market Size and Share Forecast Outlook 2025 to 2035

Vibrating Screen Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Vibrating Gravity Feeder Market Size and Share Forecast Outlook 2025 to 2035

Vibrating Feed Conveyors Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA