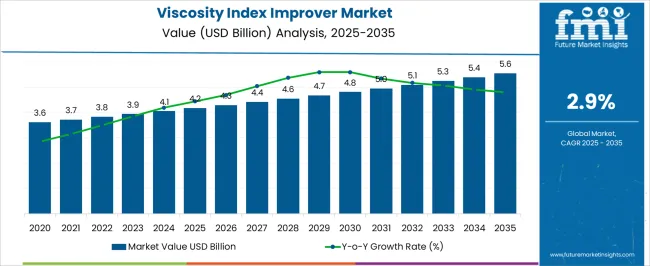

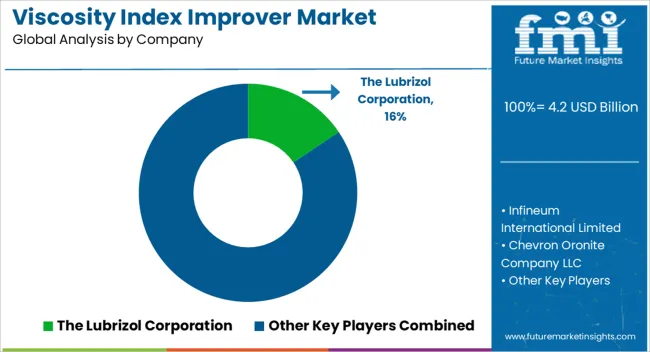

The Viscosity Index Improver Market is estimated to be valued at USD 4.2 billion in 2025 and is projected to reach USD 5.6 billion by 2035, registering a compound annual growth rate (CAGR) of 2.9% over the forecast period.

| Metric | Value |

|---|---|

| Viscosity Index Improver Market Estimated Value in (2025 E) | USD 4.2 billion |

| Viscosity Index Improver Market Forecast Value in (2035 F) | USD 5.6 billion |

| Forecast CAGR (2025 to 2035) | 2.9% |

The viscosity index improver market is expanding steadily, driven by the rising demand for high-performance lubricants across automotive and industrial sectors. Industry updates and company disclosures have emphasized that modern engines and machinery require lubricants capable of maintaining stability under extreme temperature variations. Viscosity index improvers play a critical role in ensuring that lubricants retain optimal flow characteristics, supporting engine efficiency and extending component life.

Regulatory pressures to reduce emissions and improve fuel economy have accelerated the development and adoption of advanced lubricant formulations incorporating viscosity index improvers. Additionally, the growth of the automotive sector, particularly in emerging economies, alongside rapid industrialization, has amplified consumption volumes.

Innovations in polymer chemistry and R&D investments have resulted in improvers with enhanced shear stability and oxidative resistance, improving their effectiveness in long-drain interval oils. Looking ahead, market growth will continue to be supported by stricter environmental regulations, expansion of vehicle fleets, and the increasing shift toward synthetic and semi-synthetic lubricants in both transportation and industrial applications.

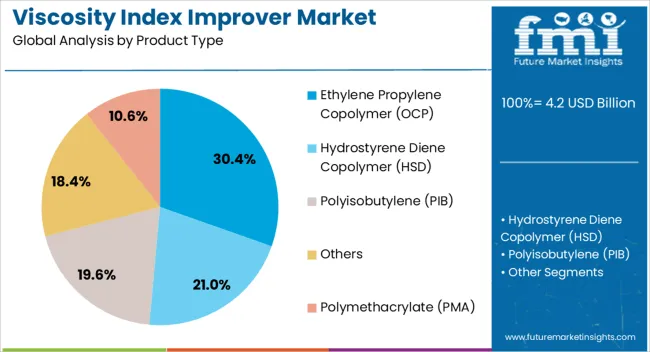

The Ethylene Propylene Copolymer (OCP) segment is projected to contribute 30.4% of the viscosity index improver market revenue in 2025, securing its position as the leading product type. This segment’s growth has been supported by OCP’s strong performance in enhancing viscosity stability under wide temperature ranges. Its compatibility with a variety of base oils and high resistance to thermal degradation have made it a preferred choice for formulating durable and efficient lubricants.

Technical evaluations have highlighted that OCP offers superior shear stability, ensuring consistent performance in heavy-duty and passenger vehicle lubricants. Additionally, OCP-based improvers have been increasingly incorporated into synthetic and semi-synthetic oils due to their ability to meet demanding automotive specifications.

Producers have expanded capacity for OCP to address growing demand from both developed and emerging markets, reflecting its established role in lubricant formulations. With ongoing advancements in polymer synthesis improving efficiency and adaptability, the OCP segment is expected to maintain its growth trajectory.

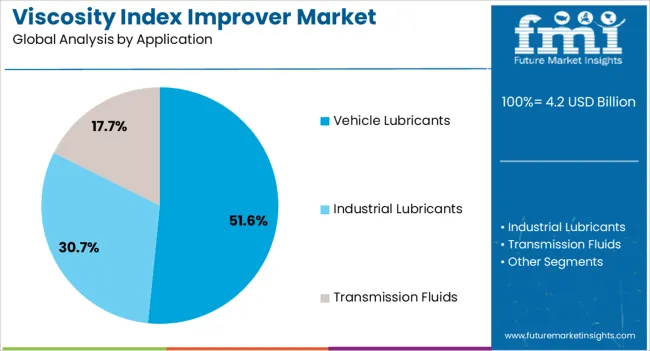

The Vehicle Lubricants segment is projected to account for 51.6% of the viscosity index improver market revenue in 2025, holding its place as the dominant application segment. Growth in this segment has been driven by the global expansion of automotive fleets and the rising need for high-quality lubricants that enhance fuel efficiency and reduce wear.

Industry reports and automotive standards have highlighted that modern engines operate under higher stress and temperature conditions, necessitating lubricants with advanced viscosity modifiers. Vehicle lubricants formulated with viscosity index improvers have been essential in meeting regulatory demands for reduced emissions and extended oil-drain intervals.

Furthermore, the popularity of synthetic lubricants in both passenger and commercial vehicles has reinforced demand for improvers that deliver superior thermal stability and long-term performance. With increasing consumer focus on vehicle reliability and efficiency, coupled with ongoing advancements in lubricant formulations, the Vehicle Lubricants segment is expected to sustain its leadership in driving the viscosity index improver market.

Demand has historically developed at a CAGR of 2.3%. However, sales have started to progress at a slightly better pace, displaying a CAGR of 2.9% from 2025 to 2035.

| Attributes | Details |

|---|---|

| Historical CAGR for 2020 to 2025 | 2.3% |

The global pandemic has disrupted businesses, causing a drop in demand and lockdown regulations. However, the viscosity index improvers industry is anticipated to develop steadily due to increased consumption. As they have a direct impact on the entire lubricant cost structure, crude oil prices have a substantial effect on the cost of manufacturing base oils, especially viscosity index improvers.

The pricing strategies and manufacturing costs of viscosity index improvers are impacted by fluctuating crude oil prices, which also influence lubricant manufacturers and end users. Geopolitical factors and the state of the world economy also influence price volatility.

The viscosity improver sector is helmed by the elevated demand for high-performance lubricants with proper viscosity, divined to provide prospects in the automotive and industrial sectors.

Manufacturers in the VII sector are extending their operations due to the increasing demand for high-quality lubricants that function at varied temperatures. This ensures proper machine operation and longevity.

Environmental consciousness encourages bio-based viscosity improvers, utilizing renewable sources like vegetable oils and esters to enhance lubricant performance and support eco-friendly initiatives.

Widespread Electronic Automotive Industry Demand for Viscosity Improvers

The automotive industry compels the viscosity index improvers sector as global vehicle production demands high-quality lubricants with effective viscosity index improvers. The production of electric cars (EVs) necessitates the use of specialty lubricants containing VIIs, which are vital for components like bearings and gears in EVs.

Modern engines, designed for high-performance vehicles, use engine oils with viscosity improvers to maintain constant lubrication over a wide temperature range. For instance, multigrade oils like 5W-30 or 10W-40 to maintain the right viscosity at both high and low temperatures use VIIs, enhancing engine protection.

The automotive industry's focus on fuel efficiency, emission reduction, and advanced powertrain development is driving a rising demand for lubricants with efficient viscosity index improvers.

Industrialization to Boost Uptake of VIIs

The development of various sectors, a significant consumer of viscosity lubricants, is mainly propelled by the infrastructural improvements of emerging economies. On top of that, the widespread use of hydraulic fluid for heavy-load equipment lubrication supports this growth.

Industrial oil and grease manufacturers are eyeing promising revenue opportunities in the automotive and metalworking sectors. This is owing to the high durability, corrosion protection, and electrical resistance offered by their products.

The viscosity improver industry is poised for growth thanks to the increasing adoption of advanced technologies such as AI and automation in end-use industries like food processing and metal manufacturing. This trend is leading to enhanced machine usage, creating demand for viscosity improvers.

Nanoparticles and Copolymer Blends Intensify the Demand for Oil Additives

Manufacturers in the oil and lubricant industry are developing engine oils with nanoparticles to reduce cold-start engine damage, enhancing vehicle efficiency and performance in light-duty industries. Industry experts estimate that by 2035, the viscosity index improvers demand for automotive is anticipated to produce nearly 1,004 kilotons of engine oil.

Manufacturers are introducing Nano-lubricant oils containing MWCNT and ZnO nanoparticles. These significantly reduce viscosity, preventing damage during cold start conditions.

Automotive manufacturers are developing hydrogenated styrene-isoprene (HSD) copolymers to improve thermal oxidation stability in engines. This development is influencing the growing demand for HSD copolymers in long-span multistage internal combustion engine oil.

Comprehensive assessments of segments of the viscosity index improver market are provided in the section that follows. While there is substantial demand for ethylene-propylene copolymer, there is projected to be an uptick in the requirement for vehicle lubricants in 2025.

| Attributes | Details |

|---|---|

| Top Product Type | Ethylene Propylene Copolymer (OCP) |

| Industry Share in 2025 | 30.4% |

OCP is set to hold a 30.4% industry share in 2025 due to augmented applications in multiple industries. Ethylene propylene copolymers are gaining popularity in various industries, including automobile parts, industrial components, and elements, showcasing their versatility and adaptability.

The VII market is shifting towards bio-based OCPs due to sustainability and environmental regulations, corresponding with the increasing demand for eco-friendly materials across various industries. OCP production is being affected by supply chain disruptions, plant shutdowns, and fluctuating crude oil prices, necessitating effective management to maintain industry supply stability.

Manufacturers in Asia Pacific are experiencing significant economic growth, a growing middle-class population, and a thriving automotive industry. This is compelling the demand for ethylene propylene copolymers (OCP).

Demand for vehicle lubricants is augmenting, and it is leading the industry with a share of 51.6% in 2025. Although multi-grade vehicle lubricants may be created without VIIs, VIIs are polymer additives that help bring viscosity variances closer together.

| Attributes | Details |

|---|---|

| Top Application | Vehicle Lubricants |

| Industry Share in 2025 | 51.6% |

Vehicle lubricants, typically oil or grease, are essential for various applications, and understanding their functions and functions is vital for effective use. Vehicle lubricants reduce friction, eliminate wear, and transmit power. Common additives include viscosity index improvers, dispersants, and friction modifiers, improving performance and performance.

The automotive industry heavily relies on engine oil as a lubricant. This is leading to increased demand for vehicle lubricants due to rising production and fleet size. Such a trend is desired to boost growth in the future.

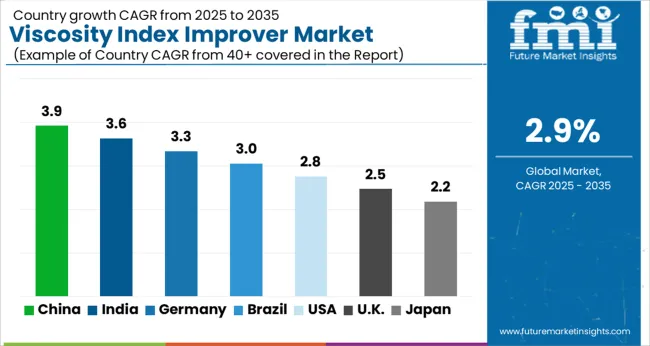

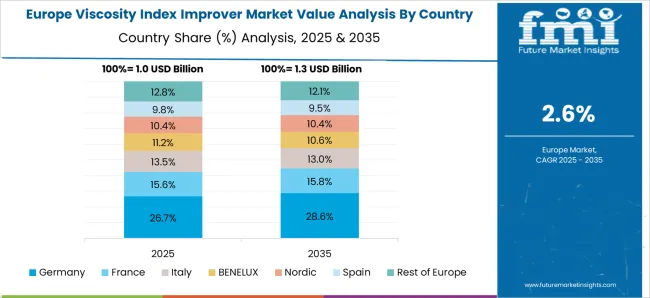

Based on the statistical data, industries in the United States and the United Kingdom are set to develop at a relative pace in the upcoming decade. Simultaneously, the VII industry in China and India is on track to hit the roof. The viscosity improvers sector in Spain is anticipated to climb gradually in the upcoming decade.

A CAGR of 1.6% is anticipated for the United States viscosity index improver market as the auto sector has been growing steadily. The need for automotive lubricants is foreseen to rise as more people buy commercial vehicles, especially light trucks and pick-up trucks. Hence, the United States is likely to continue to lead the regional industry

The need for lubricant additives such as viscosity index improvers is predicted to rise in response to increasing industrial output, greater exports of chemicals and pharmaceuticals, and developed manufacture of these goods. Future growth in the automotive sector is anticipated to result in higher lubricant usage.

Demand for viscosity improvers in Spain is estimated to develop at a CAGR of 2.2%, with auto manufacturers developing novel applications. VII additives are essential in power generation equipment, including hydraulic and turbine lubricants for specific oils, coal-fired power plants, and greases for wind and hydropower plants in Spain.

Spain's automobile sector is vital for economic growth, with OEMs prioritizing high-margin models like trucks to maintain profitability. This shift is influencing the use of high-performance lubricants in manufacturing processes.

China is on the brink of an expansion in the viscosity index improver market, with a projected CAGR of 3.2% from 2025 to 2035. Asia Pacific is experiencing a significant rise in VII industry share due to China's industrialization and infrastructure development. This has resulted in an increased demand for high-strength lubricants.

China dominates the demand for viscosity index improvers due to rising per capita disposable income and a large on-road vehicle fleet in developing economies. These factors make it a leading producer and consumer of these products.

China's urbanization of machinery is anticipated to compel lubricant demand. This is prompted by increased global consumption of viscosity improvers and the adoption of complex machinery.

The United Kingdom viscosity index improver market is projected to register a CAGR of 1.1% by 2035. This is due to its bolstering businesses and its demand for industrial lubricants. The country is predicted to experience significant growth in Europe’s industry due to the rise in high-performance engines. This necessitates the use of lubricants with appropriate viscosity, which impacts factors like wear, contamination tolerance, and energy consumption.

Lubricants are utilized in various industries like oil and gas, automotive, metal fabrication, power transmission, chemicals, and manufacturing. United Kingdom industrialization and new sectors are anticipated to compel the growth of viscosity improvers.

Demand for viscosity index improvers in India is foreseen to experience a CAGR of 4.3% from 2025 to 2035. India's rapid economic development and disposable income make it a lucrative souk for the lubricating industry.

India's high lubricating oil consumption is primarily due to the growth of industrial production, commerce, and automobiles. Increasing investments in the industrial sector also contribute to the country's growing demand for lubricating oil.

Government regulations and environmental sustainability policies in India are influencing the industry for lubricating oil additives. This is anticipated to increase demand in the forthcoming decade.

New contestants in the industry are innovative disruptors, continuously investing in research and development to provide more convenient solutions to industry verticals despite being new players.

Manufacturers, in response to the increasing demand for viscosity improvers, have strategically shifted their focus to emerging regions in recent years. This move not only meets the demand but also opens up new growth opportunities. Several key players are also focusing on increasing their production capacities, new product launches, research and development, and mergers and acquisitions.

The industry is competitive, with some companies focusing on online sales. Small-scale companies are pivotal players, transforming inputs into outputs and adapting to industry uncertainties. Numerous start-ups are involved in manufacturing and providing related services, contributing to the industry's dynamism. They are also catalysts for growth and expansion in the lubricant additives industry.

Recent Developments in the Viscosity Index Improver Market

The industry can be classified into polymethacrylate (PMA), ethylene propylene copolymer (OCP), hydrostyrene diene copolymer (HSD), polyisobutylene (PIB), and others.

Viscosity index improvers find applications as vehicle lubricants, industrial lubricants, and transmission fluids.

The industry is examined throughout key regions, including North America, Latin America, Europe, East Asia, South Asia, and Oceania, as well as the Middle East and Africa.

The global viscosity index improver market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the viscosity index improver market is projected to reach USD 5.6 billion by 2035.

The viscosity index improver market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in viscosity index improver market are ethylene propylene copolymer (ocp), hydrostyrene diene copolymer (hsd), polyisobutylene (pib), others and polymethacrylate (pma).

In terms of application, vehicle lubricants segment to command 51.6% share in the viscosity index improver market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Viscosity Reducing Agents Market Size and Share Forecast Outlook 2025 to 2035

Indexable Milling Cutters Market Size and Share Forecast Outlook 2025 to 2035

Indexable Tool Inserts Market

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

Bread Improvers Market Outlook - Growth, Demand & Forecast 2024 to 2034

Flour Improvers Market

Gluten Index Device Market Size and Share Forecast Outlook 2025 to 2035

Rotary Indexer Market Analysis - Share, Size, and Forecast 2025 to 2035

Bakery Improvers Market

Cold Flow Improvers Market Trends 2018-2027

Bread Dough Improver Market

Crude Oil Flow Improvers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA