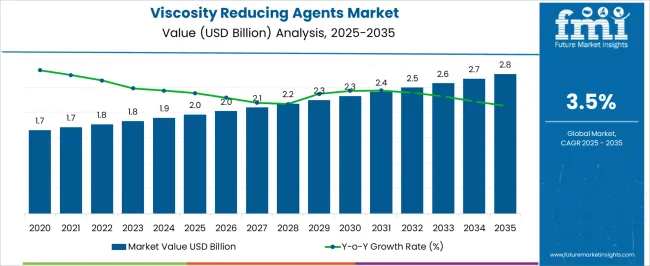

The Viscosity Reducing Agents Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Viscosity Reducing Agents Market Estimated Value in (2025 E) | USD 2.0 billion |

| Viscosity Reducing Agents Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The viscosity reducing agents market is experiencing consistent growth, driven by the rising demand for efficiency improvements across industries that rely heavily on fluid transportation and processing. Increasing applications in pipelines, refineries, and chemical processing units are creating a strong foundation for expansion. Viscosity reducing agents are being increasingly adopted as they enable smoother transportation of crude oil and heavy liquids by reducing resistance and energy requirements.

This contributes to lowering operational costs and minimizing environmental impact through reduced energy consumption. Growth is also being supported by technological advancements in chemical formulations that provide higher efficiency at lower dosages, making them more cost-effective and sustainable. The market is gaining traction in emerging economies where infrastructure development and energy exploration projects are accelerating.

Growing focus on enhancing flow assurance in oil and gas operations, coupled with the need to meet stringent energy efficiency and emission reduction standards, is expected to further shape demand As industries continue to prioritize operational efficiency and sustainability, viscosity reducing agents are positioned as a critical enabler of long-term growth.

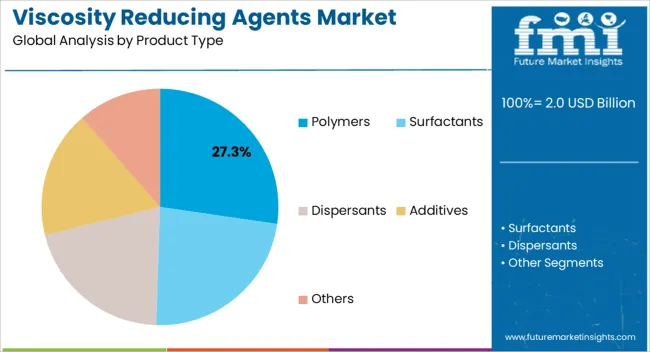

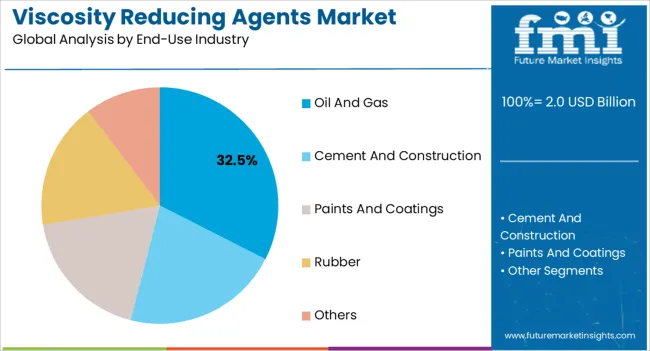

The viscosity reducing agents market is segmented by product type, end-use industry, and geographic regions. By product type, viscosity reducing agents market is divided into Polymers, Surfactants, Dispersants, Additives, and Others. In terms of end-use industry, viscosity reducing agents market is classified into Oil And Gas, Cement And Construction, Paints And Coatings, Rubber, and Others. Regionally, the viscosity reducing agents industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polymers segment is projected to account for 27.3% of the viscosity reducing agents market revenue share in 2025, making it the leading product type. This dominance is being driven by their proven ability to significantly reduce viscosity in a wide range of fluid systems, particularly in oil pipelines and industrial processes. Polymers are favored due to their high molecular weight and capacity to interact effectively with fluid molecules, thereby reducing friction and enabling smoother flow.

The ability to achieve substantial reductions in pumping pressure directly translates into lower energy costs and improved efficiency for operators. Additionally, polymer-based viscosity reducing agents offer versatility, as they can be customized for different types of crude oil, refined products, and industrial liquids.

Advances in polymer chemistry are enabling the development of agents that are more stable under extreme temperature and pressure conditions, further expanding their application scope Growing emphasis on reducing operational costs and ensuring reliable fluid transportation is reinforcing the adoption of polymers, establishing them as the preferred product type in the global market.

The oil and gas segment is anticipated to represent 32.5% of the viscosity reducing agents market revenue share in 2025, making it the leading end-use industry. Its dominance is being reinforced by the sector’s reliance on viscosity reducing agents to optimize the transportation of crude oil and refined products through extensive pipeline networks. The ability of these agents to reduce flow resistance allows for higher throughput capacity and lowers the energy intensity of pumping operations, directly impacting cost efficiency.

Increasing exploration and production activities, particularly in unconventional resources and deepwater fields, are driving the demand for advanced solutions that can maintain flow assurance under challenging conditions. Moreover, the industry is under pressure to improve environmental sustainability, and viscosity reducing agents are playing a crucial role in reducing emissions by minimizing energy consumption.

Expanding global trade in oil and petroleum products, coupled with ongoing investments in pipeline infrastructure projects across North America, the Middle East, and Asia-Pacific, is further accelerating adoption As efficiency, safety, and sustainability remain central to oil and gas operations, viscosity reducing agents are expected to remain indispensable in this segment.

Viscosity is basically the resistance offered during the flow of the fluids due to natural presence of internal friction between their particles. Fluid with high viscosity resists the motion as its molecular design offers a significant amount of internal friction. The physical significance of viscosity can be understood by the example of addition of turpentine into paints so that the paints become thinner, less viscous and suitable for further use.In various applications, high viscosity is undesirable as it reduces work efficiency.

The advancements in chemical technology and research & development in this field has led for the emergence of viscosity reducing agents, which can reduce the viscosity of the fluids without changing their chemical properties and effectiveness.

Viscosity reducing agents are also known as the drag reducing agents, the additives that reduce the turbulence and improves the flow of fluids. Viscosity reducing agents are widely used in oil pipelines to improve the flow capacity and thus improving the productivity. They also reduce energy losses in pipelines. On crude oil exploration and production sites, the raw crude oil is highly viscous and thick in nature. The process to pump this heavy crude oil from the source becomes highly energy intensive.

The addition of viscosity reducing agents reduces the viscosity of the crude oil, and in turn, the power requirement for pumping is also reduced. This lead to enhancement of the production efficiency of the plant along with decrease in production costs. Use of viscosity reducing agents also increases the overall operating life of transportation system of oil industries.

The viscosity reducing agents find their utilization across various industries as they reduce the problem of choking in pipelines and ducts and increase the transportation and process efficiency. In addition,the viscosity reducing agents are non-toxic and non-polluting in nature. Apart from their use in chemical and process industries, several test and research studies are being carried on animals if these viscosity reducing agents can be used in arteries and veins to increase the blood flow. The benefits of using viscosity reducing agents, increased pipeline throughput and energy savings, are expected to drive the demand for their market over forecast period 2025-2026.

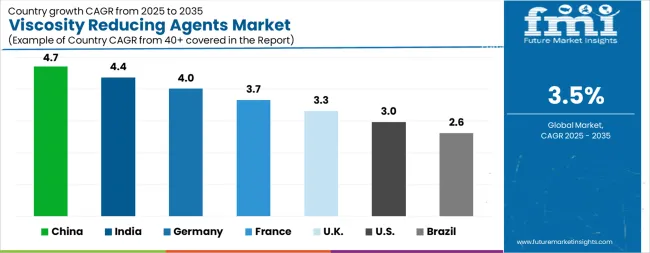

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

| USA | 3.0% |

| Brazil | 2.6% |

The Viscosity Reducing Agents Market is expected to register a CAGR of 3.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 4.7%, followed by India at 4.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 2.6%, yet still underscores a broadly positive trajectory for the global Viscosity Reducing Agents Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.0%. The USA Viscosity Reducing Agents Market is estimated to be valued at USD 705.1 million in 2025 and is anticipated to reach a valuation of USD 944.5 million by 2035. Sales are projected to rise at a CAGR of 3.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 97.6 million and USD 67.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Product Type | Polymers, Surfactants, Dispersants, Additives, and Others |

| End-Use Industry | Oil And Gas, Cement And Construction, Paints And Coatings, Rubber, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

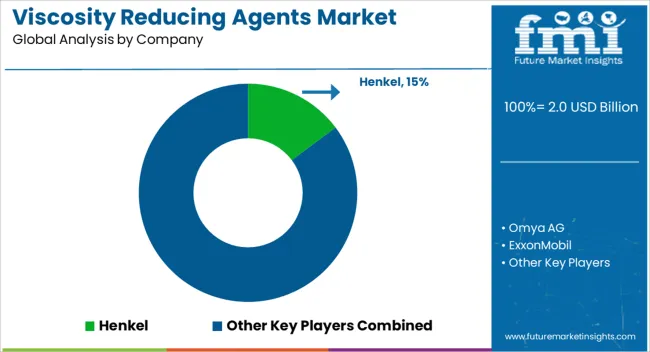

| Key Companies Profiled | Henkel, Omya AG, ExxonMobil, Rhodia Group, Lubrizol, Kao Chemicals, Sanyo Chemical Industries, Royal Dutch Shell, Toray Industries, Stepan Company, BASF, and Evonik |

The global viscosity reducing agents market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the viscosity reducing agents market is projected to reach USD 2.8 billion by 2035.

The viscosity reducing agents market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in viscosity reducing agents market are polymers, surfactants, dispersants, additives and others.

In terms of end-use industry, oil and gas segment to command 32.5% share in the viscosity reducing agents market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Material Shrinkage-reducing Agents Market Size and Share Forecast Outlook 2025 to 2035

Reducing Elbow Connector Market Size and Share Forecast Outlook 2025 to 2035

Reducing Tee Connector Market Size and Share Forecast Outlook 2025 to 2035

Viscosity Index Improver Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

Drag Reducing Agent Market Size and Share Forecast Outlook 2025 to 2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Pressure Reducing Valve Market Size and Share Forecast Outlook 2025 to 2035

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA