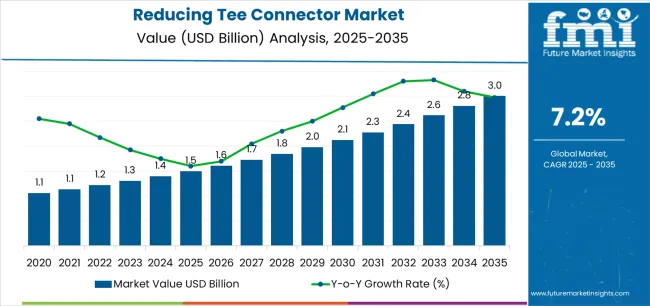

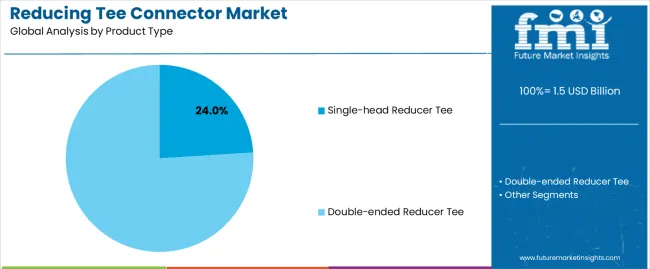

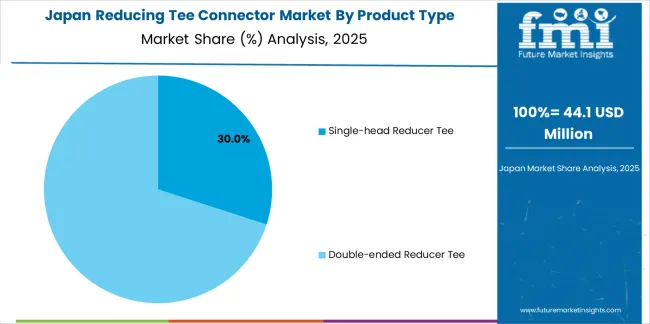

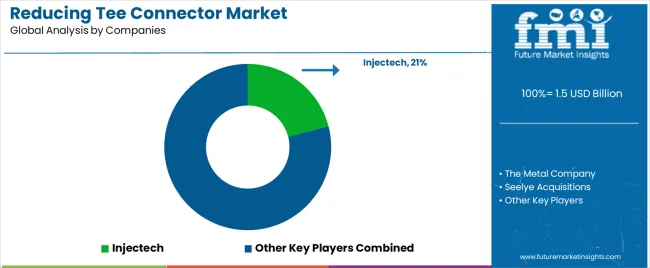

The reducing tee connector market is expected to expand from USD 1.5 billion in 2025 to USD 2.9 billion by 2035, at a CAGR of 7.2%, with the majority of structural growth driven by performance differences across product types and application segments. The single-head reducer tee segment, with a 24% share, is the backbone of global installations due to its suitability for standard branch connections that require a single-diameter transition. Contractors prefer this configuration for its availability across common pressure classes, its compatibility with diverse piping materials, and its ability to maintain predictable flow characteristics without complicating system layout. Its dominance is reinforced by widespread use in municipal distribution networks, commercial buildings, and industrial process lines, where single-point branching forms the most common engineering pattern.

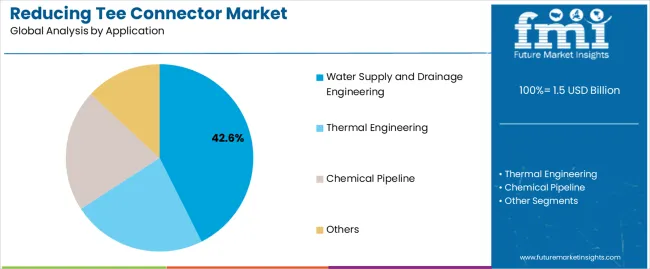

The double-ended reducer tee segment serves more complex piping geometries requiring two-step diameter transitions or differential branching. Although smaller in share, this segment remains critical in space-restricted systems, thermal engineering loops, and specialized chemical pipelines where multi-directional reduction supports compact installation and pressure-balancing requirements. Across applications, water supply and drainage engineering, with a 42.6% share, leads global demand due to extensive utilization in municipal grids, utility upgrades, irrigation channels, and high-volume building plumbing systems. The fitting’s ability to handle service line takeoffs, accommodate diameter changes, and maintain distribution efficiency reinforces its role as a core component of water infrastructure. Thermal engineering, chemical pipelines, and industrial utility networks follow as process-intensive facilities adopt standardized reducing tee configurations to simplify design, minimize fabrication steps, and improve installation certainty across large-scale piping environments.

From 2030 to 2035, the market is forecast to grow from USD 1.9 billion to USD 2.9 billion, adding another USD 1.0 billion, which constitutes 69.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of industrial automation requiring sophisticated process piping systems, the development of corrosion-resistant materials extending fitting service life in aggressive environments, and the growth of modular piping systems incorporating standardized components for rapid installation. The growing adoption of building information modeling and digital fabrication technologies will drive demand for reducing tee connectors with enhanced dimensional accuracy and comprehensive technical documentation.

Between 2020 and 2025, the reducing tee connector market experienced steady growth, driven by increasing recognition of reducing tee fittings as essential components in space-constrained piping layouts and growing acceptance of standardized pipe fittings as cost-effective solutions for complex piping configurations requiring diameter transitions and branch connections. The market developed as piping engineers and system designers recognized the potential for reducing tee technology to eliminate multiple fittings, simplify installation procedures, and optimize material costs while maintaining pressure ratings and flow characteristics. Technological advancement in manufacturing processes and material science began emphasizing the critical importance of maintaining dimensional tolerances and ensuring leak-free connections in demanding industrial and municipal applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.5 billion |

| Forecast Value in (2035F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

Market expansion is being supported by the increasing global infrastructure investment driven by urbanization trends and aging facility replacement requirements, alongside the corresponding need for efficient pipe fittings that can enable diameter transitions at branch connections, optimize space utilization in congested installations, and reduce material costs across various municipal water systems, industrial process piping, HVAC distribution, and chemical plant applications. Modern piping engineers and system designers are increasingly focused on implementing reducing tee connector solutions that can simplify piping layouts, minimize welding requirements, and ensure reliable performance in diverse operating conditions.

The growing emphasis on installation efficiency and project cost optimization is driving demand for standardized reducing tee fittings that can eliminate custom fabrication, reduce labor requirements, and ensure consistent quality through factory-manufactured components meeting industry standards. Contractors' preference for versatile fittings that combine diameter reduction and branch connection functionality within single components is creating opportunities for innovative reducing tee implementations. The rising influence of modular construction methods and prefabricated piping assemblies is also contributing to increased adoption of reducing tee connectors that can accelerate installation schedules without compromising system performance or regulatory compliance.

The market is segmented by product type, application, and region. By product type, the market is divided into single-head reducer tee and double-ended reducer tee. Based on application, the market is categorized into water supply and drainage engineering, thermal engineering, chemical pipeline, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The single-head reducer tee segment is projected to maintain its leading position in the reducing tee connector market in 2025 with a 24.0% market share, reaffirming its role as the preferred product configuration for standard branch connections requiring single diameter reduction at one outlet position. Piping contractors and system designers increasingly utilize single-head reducer tees for their straightforward application in common branching scenarios, cost-effective pricing compared to double-reduction alternatives, and proven effectiveness in maintaining flow characteristics while accommodating equipment connections of different sizes. Single-head reducer tee technology's proven effectiveness and application versatility directly address the piping requirements for typical branch configurations and standard equipment connections across diverse industrial and commercial installations.

This product segment forms the foundation of conventional piping system design, as it represents the fitting type with the greatest utilization frequency and established availability across multiple material specifications and pressure ratings. Construction industry investments in standardized components and efficient installation methods continue to strengthen adoption among contractors and facility owners. With piping systems predominantly requiring single diameter transitions at branch points and procurement practices favoring readily available standard components, single-head reducer tees align with both technical requirements and supply chain efficiency objectives, making them the central component of comprehensive pipe fitting inventories.

The water supply and drainage engineering application segment is projected to represent the largest share of reducing tee connector demand in 2025 with a 42.6% market share, underscoring its critical role as the primary driver for reducing tee adoption across municipal water distribution, wastewater collection, building plumbing, and irrigation systems requiring branch connections with diameter transitions. Water system engineers prefer reducing tee connectors for municipal and building applications due to their ability to accommodate service line connections, optimize main line sizing, and ensure code-compliant installations while supporting efficient flow distribution and pressure maintenance. Positioned as standard components for water infrastructure construction, reducing tee connectors offer both functional versatility and installation efficiency benefits.

The segment is supported by continuous growth in urban water infrastructure investment and the expanding requirements for building plumbing systems serving increasingly complex commercial and residential developments. Additionally, water utilities and building owners are investing in comprehensive infrastructure renewal programs replacing aging water mains and upgrading distribution systems with modern materials and fittings. As urban populations expand globally and water conservation regulations drive system optimization, the water supply and drainage engineering application will continue to dominate the market while supporting infrastructure modernization and sustainable water management strategies.

The reducing tee connector market is advancing steadily due to increasing infrastructure development driven by urbanization and industrial expansion requiring extensive piping systems with efficient branch connection solutions, and growing adoption of standardized pipe fittings reducing project costs through elimination of custom fabrication and field modifications across diverse municipal infrastructure, industrial process systems, and commercial building applications. However, the market faces challenges, including price competition from low-cost manufacturers affecting profit margins, material cost volatility impacting pricing stability, and substitution risks from alternative piping configurations utilizing separate fittings for diameter reduction and branching functions. Innovation in corrosion-resistant materials and advanced manufacturing techniques continues to influence product development and market differentiation patterns.

The accelerating global urbanization and corresponding infrastructure development requirements are driving substantial demand for pipe fittings including reducing tee connectors as essential components in water distribution networks, wastewater collection systems, and industrial facility construction supporting urban population growth and economic development. Government infrastructure programs and private construction projects are implementing comprehensive piping systems requiring extensive fitting inventories with reducing tee connectors enabling efficient layout design, accommodating equipment connections, and optimizing material utilization throughout complex distribution networks. Construction contractors are increasingly recognizing the cost advantages of standardized reducing tee fittings compared to field fabrication alternatives, creating sustained market demand as infrastructure investment accelerates in emerging economies and developed markets address aging infrastructure replacement needs. Urban development initiatives continue to generate pipeline construction activity supporting reducing tee connector consumption across residential, commercial, and industrial sectors.

Modern pipe fitting manufacturers are incorporating advanced materials including stainless steel alloys, duplex stainless steels, and specialized corrosion-resistant plastics that extend service life in aggressive chemical environments, high-temperature applications, and corrosive water conditions requiring superior material performance beyond conventional carbon steel and standard plastic fittings. Leading manufacturers are developing reducing tee connectors with enhanced metallurgical properties, improved surface treatments, and specialized coatings that address specific application challenges including seawater exposure, chemical processing, and elevated temperature services. These material innovations improve reliability while enabling market expansion into demanding applications previously requiring expensive exotic materials or frequent component replacement, including offshore platforms, desalination facilities, and chemical processing plants. Advanced material integration also allows manufacturers to differentiate product offerings and command premium pricing in markets valuing long-term performance over initial acquisition cost.

The advancement of automated manufacturing technologies, computer numerical control machining, and comprehensive quality control systems is driving production of reducing tee connectors with enhanced dimensional accuracy, consistent wall thickness, and reliable pressure ratings supporting demanding application requirements and stringent code compliance. Manufacturers are investing in advanced production equipment, non-destructive testing capabilities, and statistical process control that ensure product conformance to international standards, minimize defect rates, and support certification requirements for critical applications. These manufacturing improvements create opportunities for differentiated product positioning emphasizing quality assurance, traceability documentation, and liability protection appealing to contractors and facility owners prioritizing system reliability and regulatory compliance. Successful quality demonstration enables market penetration in applications where fitting failure consequences justify premium pricing for verified performance and comprehensive technical support.

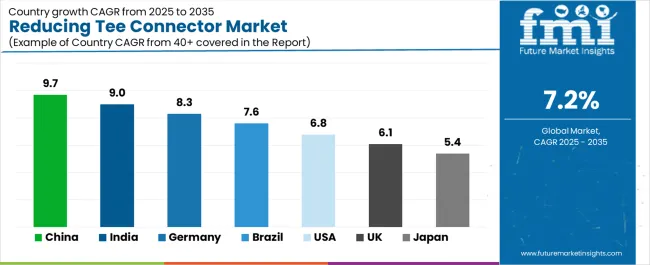

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| Brazil | 7.6% |

| United States | 6.8% |

| United Kingdom | 6.1% |

| Japan | 5.4% |

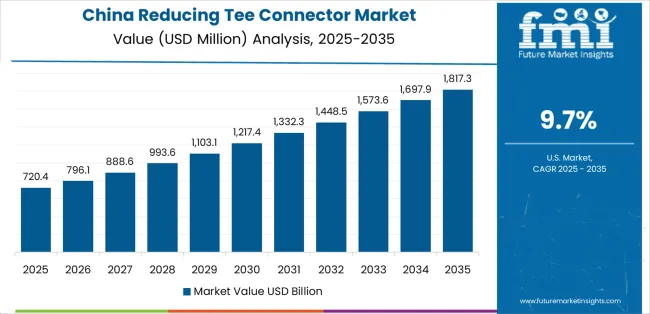

The reducing tee connector market is experiencing solid growth globally, with China leading at a 9.7% CAGR through 2035, driven by massive infrastructure investment, extensive industrial construction, and comprehensive urbanization requiring extensive piping system installation. India follows at 9.0%, supported by expanding urban water infrastructure, growing industrial capacity, and government infrastructure development initiatives. Germany shows growth at 8.3%, emphasizing infrastructure modernization, industrial facility upgrades, and comprehensive building construction. Brazil demonstrates 7.6% growth, supported by urban infrastructure development, industrial expansion, and water system improvements. The United States records 6.8%, focusing on aging infrastructure replacement, industrial facility maintenance, and building construction activity. The United Kingdom exhibits 6.1% growth, emphasizing infrastructure renewal and building services installation. Japan shows 5.4% growth, supported by infrastructure maintenance requirements and industrial facility operations.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

Revenue from reducing tee connectors in China is projected to exhibit exceptional growth with a CAGR of 9.7% through 2035, driven by massive infrastructure investment under national development programs, extensive industrial construction supporting manufacturing expansion, and comprehensive urbanization requiring water supply systems, wastewater collection networks, and industrial process piping throughout major cities and industrial zones. The country's enormous construction volume and continuous infrastructure development are creating unprecedented demand for pipe fittings including reducing tee connectors. Major piping component manufacturers and distribution networks are establishing comprehensive supply capabilities to serve construction and industrial markets.

Revenue from reducing tee connectors in India is expanding at a CAGR of 9.0%, supported by ambitious urban infrastructure development programs, expanding industrial capacity under Make in India initiatives, and growing building construction serving residential and commercial property development. The country's infrastructure investment and industrial expansion are driving pipe fitting demand throughout diverse construction sectors. Manufacturers and distributors are establishing market presence through domestic production and comprehensive distribution networks.

Revenue from reducing tee connectors in Germany is expanding at a CAGR of 8.3%, supported by comprehensive infrastructure maintenance programs, industrial facility modernization initiatives, and advanced building construction incorporating sophisticated building services systems. The nation's emphasis on quality standards and technical specifications are driving demand for precision-manufactured pipe fittings meeting stringent requirements. Manufacturers and suppliers maintain strong market presence through quality-focused product offerings and technical support capabilities.

Revenue from reducing tee connectors in Brazil is expanding at a CAGR of 7.6%, supported by urban infrastructure development addressing service gaps, industrial construction supporting economic development, and building construction serving growing metropolitan populations. The nation's infrastructure needs and economic growth are driving pipe fitting demand across construction and industrial sectors. Distributors and manufacturers are investing in market development addressing diverse regional requirements.

Revenue from reducing tee connectors in the United States is expanding at a CAGR of 6.8%, supported by aging infrastructure replacement requirements, industrial facility maintenance and upgrades, and continuous building construction activity serving commercial and residential property development. The nation's mature infrastructure and established industrial base are driving consistent pipe fitting demand. Manufacturers and distributors maintain extensive market presence through comprehensive product lines and distribution networks.

Revenue from reducing tee connectors in the United Kingdom is expanding at a CAGR of 6.1%, supported by infrastructure renewal programs, building construction activity, and industrial facility operations requiring pipe fitting components for maintenance and construction applications. The UK's infrastructure needs and construction activity are driving stable pipe fitting demand. Distributors and manufacturers maintain market presence through established supply relationships and product availability.

Revenue from reducing tee connectors in Japan is growing at a CAGR of 5.4%, driven by comprehensive infrastructure maintenance requirements, industrial facility operations demanding reliable components, and building construction incorporating sophisticated mechanical systems. Japan's emphasis on quality and reliability are supporting demand for precision-manufactured pipe fittings meeting stringent specifications. Manufacturers and distributors maintain market presence through quality-focused offerings and technical support.

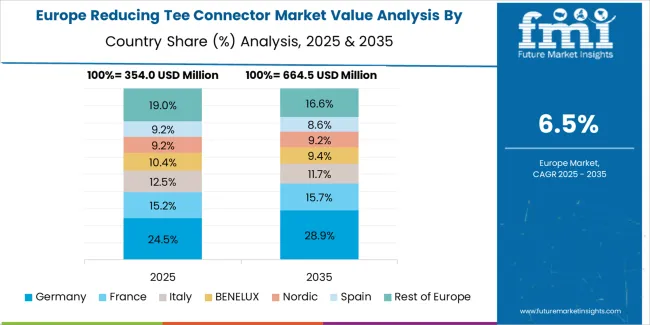

The reducing tee connector market in Europe is projected to grow from USD 398.6 million in 2025 to USD 748.3 million by 2035, registering a CAGR of 6.5% over the forecast period. Germany is expected to maintain leadership with a 28.4% market share in 2025, moderating to 27.6% by 2035, supported by industrial infrastructure, building construction, and comprehensive quality standards.

France follows with 19.2% in 2025, projected at 19.7% by 2035, driven by infrastructure investment, industrial facilities, and building construction activity. The United Kingdom holds 15.8% in 2025, expected to reach 16.3% by 2035 supported by infrastructure renewal and building services markets. Italy commands 13.4% in 2025, rising slightly to 13.8% by 2035, while Spain accounts for 10.6% in 2025, reaching 11.1% by 2035 aided by construction activity and infrastructure development. Poland maintains 4.9% in 2025, up to 5.3% by 2035 due to industrial expansion and infrastructure investment. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 7.7% in 2025 and 6.2% by 2035, reflecting varied infrastructure development and industrial activity across diverse national markets.

The reducing tee connector market is characterized by competition among established pipe fitting manufacturers, industrial distribution companies, and specialized piping component suppliers. Companies are investing in manufacturing efficiency, material innovation, quality assurance systems, and distribution network expansion to deliver reliable, cost-competitive, and readily available reducing tee connector solutions. Innovation in corrosion-resistant materials, precision manufacturing processes, and comprehensive technical documentation is central to strengthening market position and competitive advantage.

Injectech leads as a pipe fitting manufacturer offering comprehensive reducing tee connector products with emphasis on material quality, dimensional accuracy, and industry standard compliance. The Metal Company provides industrial pipe fittings with focus on material variety and application expertise. Seelye Acquisitions offers piping components and fittings serving industrial and commercial markets. Tefen specializes in plastic pipe fittings and fluid handling components. Newport provides industrial piping products including reducing tee connectors. Business Key focuses on pipe fitting distribution and supply.

LeakyPipe offers specialized pipe fittings and irrigation components. The Southern Valve and Fitting provides comprehensive valve and fitting products. Hansen Products specializes in industrial piping components and fittings. Argco offers pipe fittings and industrial supplies. ERA focuses on pipe fitting manufacturing and distribution. PipingNow provides online pipe fitting sales and technical resources. Fluid Power specializes in hydraulic and pneumatic fittings. Shurjoint offers mechanical pipe joining systems and fittings. Hansen provides industrial piping components. Belden focuses on pipe fitting products. Galvanized specializes in galvanized pipe fittings. LASCO Fittings offers comprehensive plastic and metal pipe fittings.

Reducing tee connectors represent an essential piping component segment within construction and industrial sectors, projected to grow from USD 1.5 billion in 2025 to USD 2.9 billion by 2035 at a 7.2% CAGR. These specialized pipe fittings, primarily single-head and double-ended reducer tee configurations for diameter transition and branch connection, serve as fundamental components in piping systems where space optimization, installation efficiency, and reliable fluid distribution are required across municipal water infrastructure, industrial process piping, building mechanical systems, and chemical plant applications. Market expansion is driven by accelerating urbanization requiring extensive water infrastructure, growing industrial construction demanding sophisticated process piping, increasing emphasis on installation cost reduction through standardized components, and rising adoption of corrosion-resistant materials extending system service life in demanding environments.

How Standards Organizations Could Strengthen Product Quality and Industry Practices?

How Industry Associations Could Advance Market Development and Technical Knowledge?

How Manufacturers Could Drive Quality and Market Leadership?

How Contractors and Engineers Could Optimize System Performance and Project Success?

How Research Institutions Could Enable Technical Advancement?

How Distributors and Supply Chain Partners Could Support Market Efficiency?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.5 billion |

| Product Type | Single-head Reducer Tee, Double-ended Reducer Tee |

| Application | Water Supply and Drainage Engineering, Thermal Engineering, Chemical Pipeline, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Injectech, The Metal Company, Seelye Acquisitions, Tefen, Newport, Business Key |

| Additional Attributes | Dollar sales by product type and application category, regional demand trends, competitive landscape, technological advancements in manufacturing processes, material innovation, quality assurance systems, and distribution network development |

The global reducing tee connector market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the reducing tee connector market is projected to reach USD 3.0 billion by 2035.

The reducing tee connector market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in reducing tee connector market are single-head reducer tee and double-ended reducer tee.

In terms of application, water supply and drainage engineering segment to command 42.6% share in the reducing tee connector market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reducing Elbow Connector Market Size and Share Forecast Outlook 2025 to 2035

Drag Reducing Agent Market Size and Share Forecast Outlook 2025 to 2035

Pressure Reducing Valve Market Size and Share Forecast Outlook 2025 to 2035

Viscosity Reducing Agents Market Size and Share Forecast Outlook 2025 to 2035

Material Shrinkage-reducing Agents Market Size and Share Forecast Outlook 2025 to 2035

Teeth Whitening Market Size and Share Forecast Outlook 2025 to 2035

Teeth Whitening Pens Market - Growth, Demand & Trends 2025 to 2035

Teen Room Décor Market Analysis – Growth & Demand Forecast 2025 to 2035

Teeth Desensitizer Market Analysis by Product Type, Form, Distribution Channels and Region 2025 to 2035

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Roll-on Tube Market Size and Share Forecast Outlook 2025 to 2035

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Steel Salvage Drums Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Reinforced Polyethylene Pipe Market Size and Share Forecast Outlook 2025 to 2035

Steerable Needle Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Market Size and Share Forecast Outlook 2025 to 2035

Steel Strapping Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Steel Studs Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA