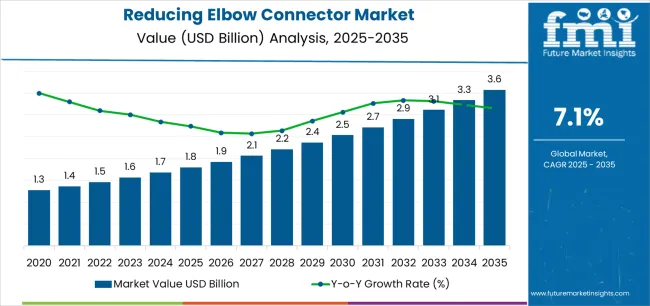

The global reducing elbow connector market is expected to grow from USD 1.8 billion in 2025 to approximately USD 3.5 billion by 2035, recording an absolute increase of USD 1.8 billion over the forecast period. This translates into a total growth of 98.6%, with the reducing elbow connector market forecast to expand at a CAGR of 7.1% between 2025 and 2035. The overall reducing elbow connector market size is expected to grow by nearly 2.0X during the same period, supported by increasing global demand for plumbing system components, the growing adoption of efficient piping solutions in water infrastructure applications, and rising construction activity, which is driving professional pipe fitting procurement across various residential, commercial, and industrial building projects.

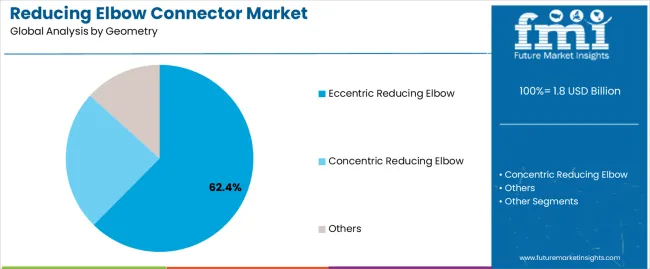

The reducing elbow connector market trajectory reflects accelerating infrastructure development, particularly in emerging markets, where water supply network expansion and building construction drive consistent demand for pipe fittings. Eccentric reducing elbows continue to dominate installations where air pocket elimination and drainage optimization require offset piping transitions. Concentric reducing elbows remain concentrated in applications where symmetrical flow characteristics and space efficiency determine fitting selection.

Regional growth patterns demonstrate particular strength in Asian markets, where expanding urban infrastructure and residential construction drive consistent reducing elbow consumption. European markets maintain steady growth through building renovation requirements and plumbing system modernization, while North American markets show increasing activity in commercial construction leveraging standardized plumbing specifications. Construction industry professionalization and plumbing code compliance requirements continue to support demand for certified pipe fitting systems with proven performance records.

Technology advancement in manufacturing processes, material science, and joining methods continues to improve fitting reliability while reducing installation complexity. The integration of push-fit connection systems and press-fit technologies enhances installation efficiency for residential and commercial applications. Manufacturers are developing corrosion-resistant materials and improved sealing designs to reduce system maintenance requirements and extend service life.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.8 billion |

| Market Forecast Value (2035) | USD 3.5 billion |

| Forecast CAGR (2025-2035) | 7.1% |

| INFRASTRUCTURE DEVELOPMENT | CONSTRUCTION REQUIREMENTS | REGULATORY & QUALITY STANDARDS |

|---|---|---|

| Water Infrastructure Expansion | Professional Installation Standards | Plumbing Code Compliance |

| Continuous expansion of water supply networks across emerging markets driving demand for reliable pipe fitting components and transition solutions. | Modern construction requiring certified pipe fittings delivering proven connection reliability and performance documentation. | Regulatory requirements establishing fitting performance benchmarks favoring tested products with approval certifications. |

| Urban Development Growth | System Efficiency Demands | Material Safety Standards |

| Growing emphasis on residential construction and commercial building development creating demand for plumbing system components. | Contractors investing in pipe fittings offering consistent installation procedures while maintaining project efficiency and flow optimization. | Quality standards requiring material certifications and manufacturing documentation for potable water system applications. |

| Building Renovation Activity | Reliability and Warranty Standards | Environmental Compliance |

| Superior flow transition characteristics and space optimization making reducing elbows essential for plumbing system design applications. | Certified manufacturers with proven performance records required for comprehensive plumbing system warranty provision and insurance compliance. | Lead-free requirements and material sustainability standards driving need for compliant pipe fitting materials and manufacturing processes. |

| Category | Segments Covered |

|---|---|

| By Geometry | Eccentric Reducing Elbow, Concentric Reducing Elbow, Others |

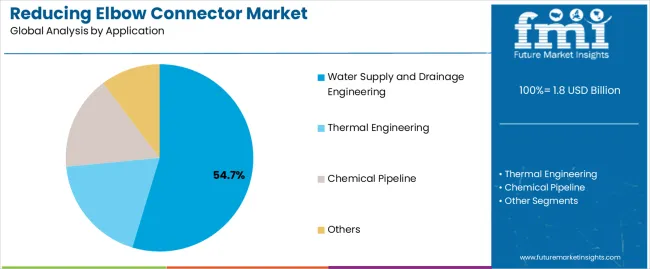

| By Application | Water Supply and Drainage Engineering, Thermal Engineering, Chemical Pipeline, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Eccentric Reducing Elbow |

|

| Concentric Reducing Elbow |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Water Supply and Drainage Engineering |

|

| Thermal Engineering |

|

| Chemical Pipeline |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Urban Infrastructure Development | Material Cost Volatility | Push-Fit Connection Innovation |

| Global urbanization and water supply network expansion driving pipe fitting consumption across established and emerging markets. | Copper and plastic resin price fluctuations affecting fitting manufacturing costs and project budget predictability. | Integration of push-fit connection systems and tool-free installation methods improving contractor productivity and reducing labor requirements. |

| Residential Construction Growth | Installation Skill Requirements | Corrosion-Resistant Materials |

| Housing development programs and residential building activity requiring comprehensive plumbing system components and transition fittings. | Proper fitting installation and joint preparation requiring trained plumber networks limiting market accessibility in developing regions. | Development of lead-free brass alloys and advanced polymer materials providing enhanced corrosion resistance and regulatory compliance. |

| Building Code Compliance | Alternative Technology Competition | Modular Plumbing Systems |

| Plumbing code requirements and potable water standards mandating certified pipe fittings for building system applications. | PEX piping systems and manifold distribution reducing traditional copper fitting consumption in residential applications. | Prefabricated plumbing modules and standardized fitting assemblies reducing on-site installation time and improving quality control. |

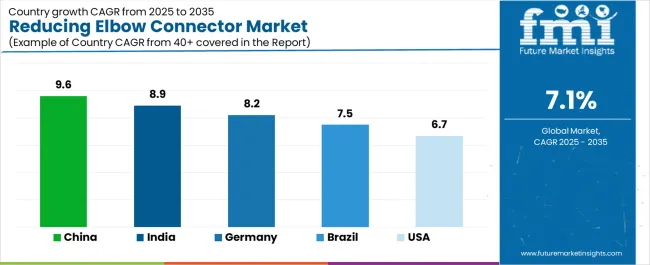

| Country | CAGR (2025-2035) |

|---|---|

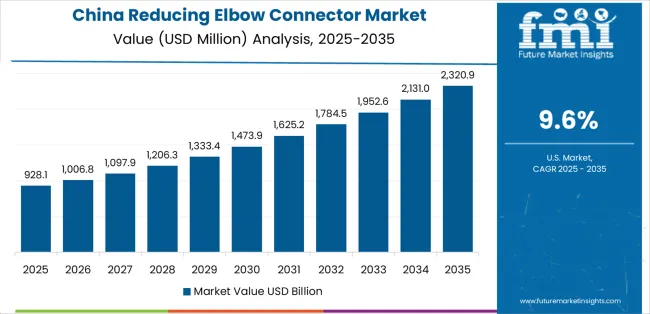

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| Brazil | 7.5% |

| United States | 6.7% |

Revenue from reducing elbow connectors in China is projected to exhibit strong growth with a market CAGR of 9.6% through 2035, driven by expanding urban water supply networks and comprehensive residential construction infrastructure creating substantial opportunities for pipe fitting suppliers across municipal water systems, building plumbing operations, and industrial facility sectors. The country's extensive infrastructure development programs and expanding construction capabilities are creating significant demand for both eccentric and concentric reducing elbow configurations. Major construction contractors and plumbing material distributors are establishing comprehensive pipe fitting procurement programs to support large-scale building operations and meet growing plumbing system quality standards.

Urban water infrastructure development programs are supporting widespread adoption of reducing elbows across municipal projects, driving demand for cost-effective pipe fittings. Residential construction expansion initiatives and commercial building development are creating substantial opportunities for fitting suppliers requiring reliable connection performance and competitive manufacturing costs. Regional construction growth and provincial building code development are facilitating adoption of certified pipe fitting systems throughout major urban regions.

Revenue from reducing elbow connectors in India is expanding with a CAGR of 8.9% through 2035, supported by extensive residential construction activity and comprehensive urban infrastructure development creating sustained demand for pipe fittings across diverse building categories and water supply segments. The country's rapidly growing construction industry and expanding plumbing system capabilities are driving demand for reducing elbows that provide consistent connection reliability while supporting cost-effective installation requirements. Building developers and plumbing contractors are investing in pipe fitting supply relationships to support growing project volumes and system quality requirements.

Urban residential development expansion and commercial construction capability development are creating opportunities for reducing elbows across diverse application segments requiring reliable performance and competitive material costs. Water supply infrastructure modernization and building plumbing standard advancement are driving investments in pipe fitting supply chains supporting connection reliability requirements throughout major metropolitan regions. Quality certification programs and material compliance development are enhancing demand for approved reducing elbow systems throughout Indian construction markets.

Demand for reducing elbow connectors in Germany is projected to grow at a CAGR of 8.2% through 2035, supported by the country's leadership in building services engineering and advanced plumbing technologies requiring precision-manufactured pipe fittings for residential and commercial applications. German plumbing contractors are implementing reducing elbows that support comprehensive technical approvals, installation reliability, and stringent quality protocols. The market is characterized by focus on connection integrity, material compliance, and adherence to DIN standards and drinking water regulations.

Construction industry investments are prioritizing pipe fittings that demonstrate superior connection reliability and material quality while meeting German building protection and environmental standards. Building services engineering leadership programs and installation quality initiatives are driving adoption of certified reducing elbows that support comprehensive plumbing system approaches and performance verification. Research and development programs for eco-friendly materials are facilitating adoption of environmentally responsible pipe fitting technologies throughout major construction centers.

Revenue from reducing elbow connectors in the United States is growing with a CAGR of 6.7% through 2035, driven by residential construction programs and commercial building development creating sustained opportunities for pipe fitting suppliers serving both new construction projects and renovation contractors. The country's extensive plumbing infrastructure and expanding building activity are creating demand for reducing elbows that support diverse system requirements while maintaining code compliance standards. Plumbing wholesalers and building material distributors are developing supply strategies to support contractor networks and project accessibility.

Residential construction programs and commercial building development are facilitating adoption of reducing elbows capable of supporting diverse plumbing system requirements and competitive installation costs. Building code compliance and material certification standards are enhancing demand for approved pipe fittings that support installation reliability and warranty provision. Green building construction expansion and water conservation system development are creating opportunities for efficient pipe fitting capabilities across American construction markets.

Demand for reducing elbow connectors in Brazil is projected to grow with a CAGR of 7.5% through 2035, driven by urban infrastructure development and construction capabilities supporting residential growth and comprehensive water supply applications. The country's expanding construction sector and growing plumbing material market segments are creating demand for pipe fittings that support operational performance and connection reliability standards. Construction contractors and plumbing material suppliers are maintaining comprehensive product availability to support diverse project requirements.

Urban infrastructure programs and residential construction development are supporting demand for reducing elbows that meet contemporary connection reliability and material quality standards. Water supply network expansion and building construction programs are creating opportunities for pipe fittings that provide comprehensive system transition support. Building regulation development and material specification enhancement programs are further driving demand for certified pipe fitting solutions across Brazilian construction markets.

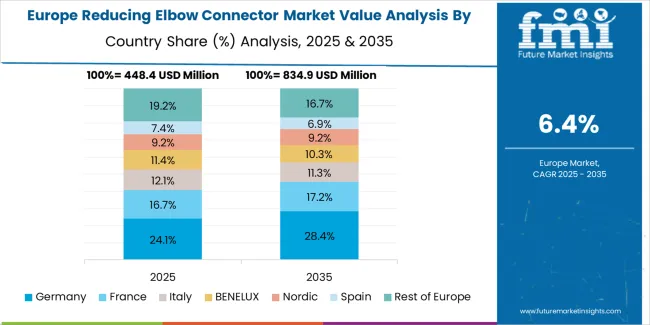

The reducing elbow connector market in Europe is projected to grow from USD 534.7 million in 2025 to USD 1,061.2 million by 2035, registering a CAGR of 7.1% over the forecast period. Germany is expected to maintain its leadership position with a 28.4% market share in 2025, projected to reach 29.1% by 2035, supported by its extensive building construction activity and comprehensive plumbing infrastructure modernization programs.

The United Kingdom follows with a 24.6% share in 2025, expected to reach 25.2% by 2035, driven by residential construction growth and building renovation requirements. France holds a 18.7% share in 2025, projected to reach 19.1% by 2035 due to water infrastructure investment. Italy commands a 13.8% share, while Spain accounts for 9.2% in 2025. The Rest of Europe region is anticipated to maintain its collective share at approximately 5.3% through 2035, reflecting established market patterns in Eastern European construction markets and Nordic building development programs.

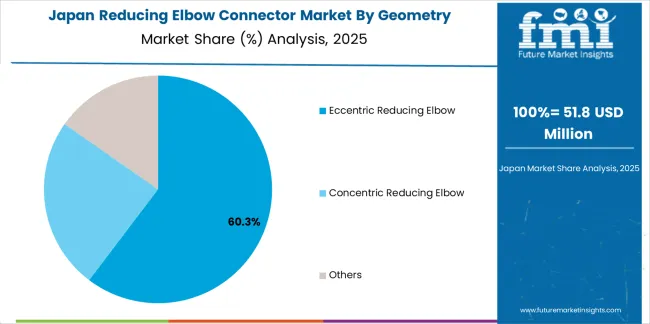

Japanese reducing elbow connector operations reflect the country's emphasis on earthquake-resistant plumbing systems and space-efficient building design. Major plumbing manufacturers including TOTO and LIXIL maintain rigorous fitting qualification processes requiring extensive seismic performance testing, pressure cycle verification, and comprehensive material certification documentation. This creates barriers for fitting suppliers but ensures system reliability in earthquake-prone environments.

The Japanese market demonstrates preference for compact fitting designs suitable for residential construction with limited mechanical space. Companies require specific connection methods that address quick installation procedures and maintenance accessibility in confined spaces. Performance specifications emphasize leak prevention and vibration resistance, driving demand for advanced sealing technologies and reinforced construction.

Regulatory oversight through the Ministry of Land, Infrastructure, Transport and Tourism emphasizes potable water safety standards and building code compliance requirements. The plumbing certification system supports fitting specification through material approval processes, creating advantages for suppliers with comprehensive testing documentation and local technical support capabilities.

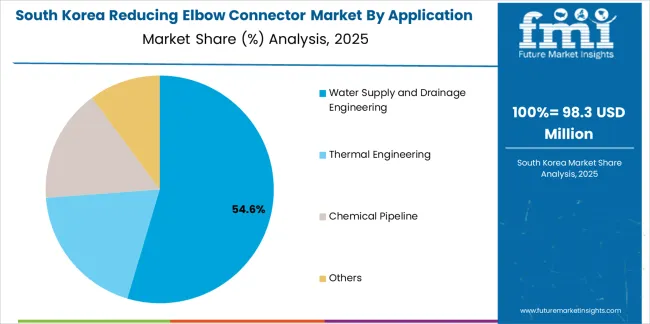

South Korean reducing elbow connector operations reflect the country's modern high-rise construction practices and district heating system infrastructure. Major construction companies including GS Engineering & Construction and Daelim Industrial drive pipe fitting procurement strategies, establishing relationships with certified suppliers to support large-scale residential tower projects and commercial development programs.

The Korean market demonstrates growing adoption of press-fit connection systems in multi-family residential construction where installation efficiency affects project schedules. Companies integrate reducing elbows with comprehensive building mechanical systems, requiring suppliers to provide technical support for system design and pressure drop calculations. This sophistication creates demand for engineered fittings with documented performance characteristics.

Regulatory frameworks emphasize energy efficiency and building mechanical system performance standards. Korea Energy Agency oversight establishes system efficiency requirements that favor optimized fitting geometries with minimal pressure loss. This benefits suppliers with computational fluid dynamics capabilities and performance verification testing for flow optimization.

Profit pools are consolidating around established pipe fitting manufacturers with comprehensive product portfolios and distribution network coverage. Value is migrating from commodity brass fittings to engineered connection systems offering push-fit installation, corrosion resistance enhancements, and technical support services that reduce contractor installation time and improve system reliability. Several archetypes set the pace: global plumbing component manufacturers defending share through brand recognition and plumbing contractor relationships; regional brass foundries offering cost-competitive fittings through local manufacturing; polymer fitting specialists capturing market share with lead-free alternatives and installation efficiency advantages; and distribution consolidators providing inventory management and contractor credit services.

Switching costs remain low due to product standardization and interchangeable specifications, creating intense price competition in commodity segments. However, contractor brand preferences, distributor relationships, and plumbing code approvals create barriers for new entrants lacking established market presence. Material certification requirements and potable water approvals favor suppliers with comprehensive testing documentation and regulatory compliance capabilities.

Consolidation continues as larger plumbing manufacturers acquire regional fitting producers to expand product lines and geographic coverage. Distribution partnerships accelerate market penetration in fragmented contractor networks where product availability and credit terms determine supplier selection. Push-fit technology adoption is disrupting traditional brass fitting markets, requiring manufacturing investment that pressures smaller foundries lacking capital for technology development.

Market dynamics favor suppliers who can demonstrate product reliability through plumbing code approvals, offer comprehensive product ranges that simplify contractor ordering, and maintain distribution networks that ensure product availability for immediate project needs. Price competition intensifies in residential construction segments where fitting specifications are standardized, while industrial and commercial applications offer opportunities for premium positioning through material quality and technical support. Establish plumbing contractor relationships with training programs and technical support for specification assistance; develop push-fit connection systems and installation efficiency innovations for market differentiation; invest in distribution network expansion and inventory management systems for contractor accessibility.

| Items | Values |

|---|---|

| Quantitative Units | USD 1.8 billion |

| Geometry | Eccentric Reducing Elbow, Concentric Reducing Elbow, Others |

| Application | Water Supply and Drainage Engineering, Thermal Engineering, Chemical Pipeline, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, United Kingdom, France, United States, and other 40+ countries |

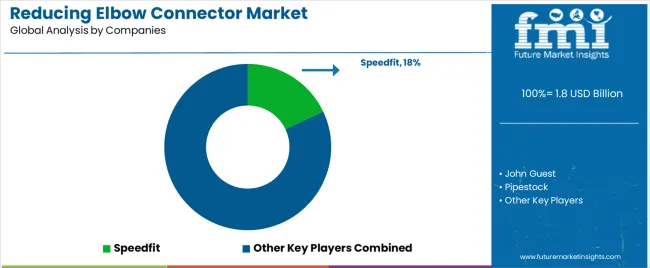

| Key Companies Profiled | Speedfit, John Guest, Pipestock, The Pipe Fittings, Finolex Pipes, Vacuforce, MISUMI Corporation, Eldon James Corporation, Hawle, Seelye Acquisitions, Prochem, ERA Group, Carclips, Nature's Water, RLBS, LBS Worldwide, Tefen, Washtech Limited, Argco, Grainger, Flowtech, Micro Matic |

| Additional Attributes | Dollar sales by geometry/application, regional demand (NA, EU, APAC, LATAM, MEA), competitive landscape, residential vs commercial adoption, installation method integration, and product innovations driving connection reliability, installation efficiency, and material compliance |

The global reducing elbow connector market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the reducing elbow connector market is projected to reach USD 3.6 billion by 2035.

The reducing elbow connector market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in reducing elbow connector market are eccentric reducing elbow, concentric reducing elbow and others.

In terms of application, water supply and drainage engineering segment to command 54.7% share in the reducing elbow connector market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reducing Tee Connector Market Size and Share Forecast Outlook 2025 to 2035

Drag Reducing Agent Market Size and Share Forecast Outlook 2025 to 2035

Pressure Reducing Valve Market Size and Share Forecast Outlook 2025 to 2035

Viscosity Reducing Agents Market Size and Share Forecast Outlook 2025 to 2035

Material Shrinkage-reducing Agents Market Size and Share Forecast Outlook 2025 to 2035

Elbow Fixation Systems Market

Heel And Elbow Suspension Market Size and Share Forecast Outlook 2025 to 2035

Connector Market Size and Share Forecast Outlook 2025 to 2035

Connector Adapter Kits Market

Connector Kits Market

RF Connectors Market Size and Share Forecast Outlook 2025 to 2035

SMP Connectors Market Size and Share Forecast Outlook 2025 to 2035

PCB Connector Market Size and Share Forecast Outlook 2025 to 2035

Gas Connectors and Gas Hoses Market - Safety, Demand & Market Outlook 2025 to 2035

Cable Connectors and Adapters Market Analysis by Application, Product, Type and Region: Forecast from 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Connector and Transformer Market Size and Share Forecast Outlook 2025 to 2035

Aviation Connector Market

Global Luer Lock Connector Market Analysis – Size, Share & Forecast 2024-2034

Automotive Connectors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA