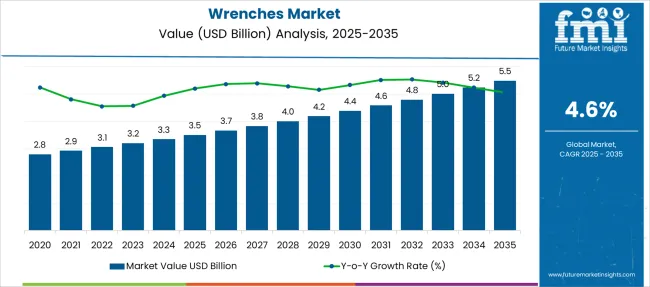

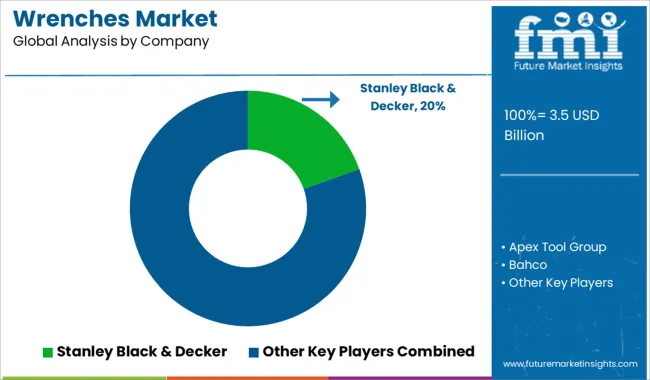

The Wrenches Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 5.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Metric | Value |

|---|---|

| Wrenches Market Estimated Value in (2025 E) | USD 3.5 billion |

| Wrenches Market Forecast Value in (2035 F) | USD 5.5 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The wrenches market is expanding steadily due to the ongoing demand for reliable hand tools across various industrial and automotive sectors. The growing emphasis on precision and durability in mechanical repairs and assembly has driven the need for high-quality wrench products. Increasing automotive production and maintenance activities have contributed significantly to market growth.

Technological improvements in material processing have enhanced the strength and corrosion resistance of steel wrenches, making them more popular among end users. Furthermore, expanding infrastructure projects and the rise of DIY culture in emerging markets have broadened the consumer base.

Future growth is expected to be supported by innovations in ergonomic design and multifunctional tools that increase user efficiency. Segment growth is expected to be led by adjustable wrenches in product type, steel wrenches in material, and the automotive sector as the primary application area.

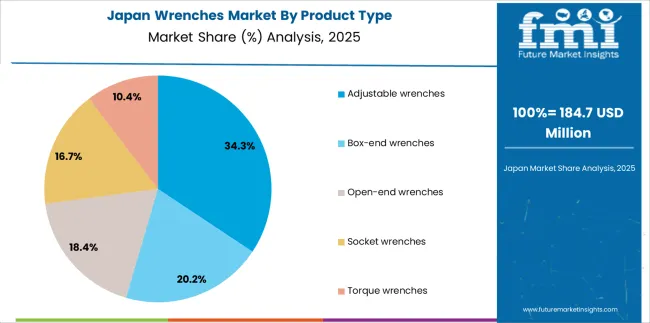

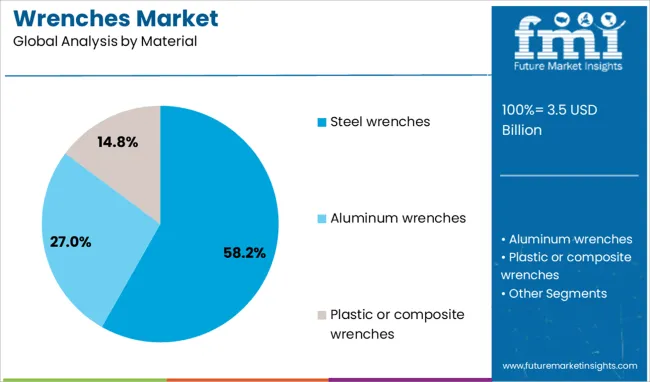

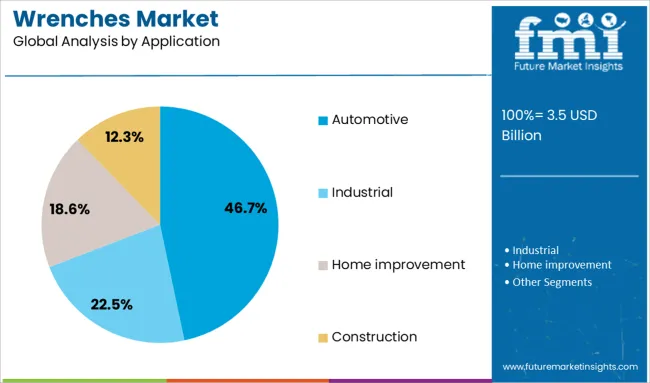

The wrenches market is segmented by product type, material, application, and distribution channel and geographic regions. By product type of the wrenches market is divided into Adjustable wrenches, Box-end wrenches, Open-end wrenches, Socket wrenches, and Torque wrenches. In terms of material of the wrenches market is classified into Steel wrenches, Aluminum wrenches, and Plastic or composite wrenches. Based on application of the wrenches market is segmented into Automotive, Industrial, Home improvement, and Construction. By distribution channel of the wrenches market is segmented into Offline and Online. Regionally, the wrenches industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The adjustable wrenches segment is projected to hold 34.8% of the wrenches market revenue in 2025, maintaining its position as the leading product type. Its versatility and ability to fit a wide range of bolt and nut sizes have made it a preferred choice for both professional mechanics and hobbyists.

The adjustable mechanism allows for quick and flexible use across different applications, reducing the need for multiple wrench sizes. This adaptability is especially valued in automotive repair and maintenance where varied fasteners are encountered.

The segment has benefitted from improvements in jaw precision and handle comfort, enhancing user experience. As demand for efficient and cost-effective tools increases, adjustable wrenches are expected to sustain their dominance.

The steel wrenches segment is expected to contribute 58.2% of the market revenue in 2025, establishing it as the dominant material type. Steel’s high tensile strength and durability have made it the material of choice for wrenches, particularly in heavy-duty applications.

The material's resistance to wear and corrosion extends tool lifespan and reduces replacement costs. Advances in steel alloys and heat treatment processes have further improved wrench performance and reliability.

Users in automotive and industrial sectors prioritize steel wrenches for their robustness and ability to withstand demanding work environments. The growing trend toward professional-grade hand tools has also supported the segment’s growth. Steel wrenches are anticipated to remain central to the market due to their trusted performance.

The automotive application segment is projected to account for 46.7% of the wrenches market revenue in 2025, reinforcing its position as the leading application area. The automotive industry’s reliance on precision hand tools for vehicle assembly, repair, and maintenance has driven demand for specialized wrenches.

The segment benefits from the ongoing growth of vehicle production worldwide and increased focus on aftermarket servicing. Automotive repair shops and manufacturing units require wrenches that offer reliability and ease of use for a variety of components.

Additionally, the rise of electric vehicles and advanced automotive technologies has created opportunities for new tool adaptations. With continuous investments in automotive infrastructure and maintenance, this application segment is expected to maintain strong demand for wrenches.

Wrenches are hand tools designed to grip, tighten, or loosen nuts, bolts, and fasteners. They are commonly manufactured from carbon steel, alloy steel, or chrome vanadium with various handle types such as fixed, adjustable, torque, or pneumatic. These tools are used across industries, including automotive repair, construction, manufacturing, and maintenance services. Demand is driven by the need for reliable mechanical fastening tools that deliver torque accuracy and grip performance. Manufacturers providing durability, ergonomic design, and corrosion resistance have been well-positioned. Sets offering size variety, storage solutions, and modular extension capability continue to affect procurement decisions among professional users and tool suppliers.

Growth in wrench usage has been supported by the expansion of industrial activities and increased equipment maintenance cycles across sectors. Automotive and heavy machinery service operations require precise torque application and tool reliability. Construction projects and mechanical assembly operations have relied on wrenches for fastening tasks. Preventive maintenance programs in industrial facilities have reinforced demand for quality tool sets that support long working hours. Technicians and repair professionals have consistently sought wrenches with solid grips, calibrated torque ratings, and high resistance to wear. Suppliers offering comprehensive sets and ergonomic handles aimed at reducing fatigue have met user expectations for performance, reliability, and efficiency.

Market expansion has been constrained by intense competition from low-cost imports, affecting pricing dynamics. Entry-level wrench variants are widely available at lower price points, which challenges premium segment suppliers in terms of margin retention. Inconsistency in materials and manufacturing standards among low-price competitors has sometimes led to durability issues, erosion of user confidence, and increased return rates. High labor and production costs for premium wrenches have limited adoption in cost-sensitive markets. Warranty and after‑sales support requirements have raised the operating burden for small tool makers. Variability in measurement standards and calibration requirements across regions has complicated specification alignment for users sourcing tools in global supply markets.

Opportunities are being identified in modular wrench sets featuring quick-swap extensions, ratchet adapters, and compact tool storage systems. Growth within the professional trades segment has spurred demand for branded solutions tied to performance assurances and service packages. Partnerships with industrial maintenance services, construction contractors, and OEMs for supplying tool kits have enabled recurring procurement contracts. Private label solutions for retail brand chains and specialized repair kits for application‑specific tasks such as HVAC, plumbing, and automotive diagnostics have broadened use cases. Bundling wrenches with torque testers or tool storage racks may improve the value proposition. Education programs that highlight tool quality, best practices for using tools, and safety tips are being used to support brand adoption among skilled tradespeople.

Demand has been shifting toward wrenches that feature ergonomic grip designs to reduce hand strain and improve torque application comfort. Tools integrating digital torque displays or preset click mechanisms are gaining popularity for applications that require precision. Modular tool systems that allow for expansion or adaptation to different fastener sizes are increasingly adopted. Surfaces featuring corrosion-resistant coatings and matte finishes have become standard in industrial settings. Use of lightweight alloy or composite materials for portable wrench sets is gradually growing. Branding emphasis on durability testing, lifetime warranty coverage, and product traceability continues to shape supplier offering development. Tool kits with color-coded and metric/imperial markings are favored for ease of use.

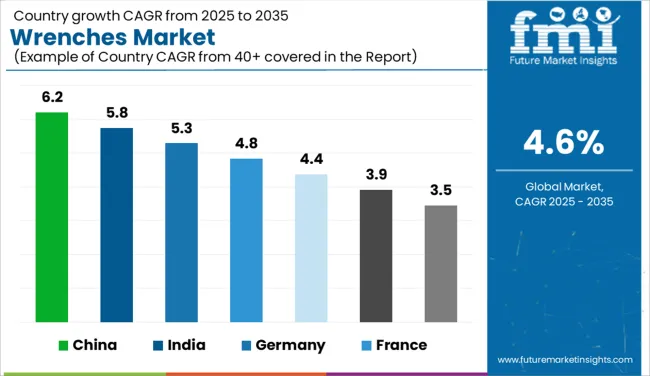

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

The wrenches market is projected to grow at a CAGR of 4.6% between 2025 and 2035, supported by expanding automotive servicing, industrial assembly requirements, and home-improvement trends. China leads at 6.2% CAGR, fueled by demand in large-scale manufacturing and automotive repair sectors. India follows at 5.8%, driven by rapid growth in aftermarket services and infrastructure projects. Among developed economies, Germany posts 5.3%, emphasizing precision-engineered tools for industrial applications, while the United Kingdom records 4.4%, with adoption supported by home-improvement and DIY activities. The United States grows at 3.9%, reflecting steady tool demand across automotive maintenance, aerospace, and energy industries. The analysis includes over 40 countries, with the top five detailed below.

China is forecasted to grow at a 6.2% CAGR, supported by large-scale automotive manufacturing and industrial assembly operations. Major automotive OEMs and component suppliers rely heavily on torque-controlled and adjustable wrenches to maintain quality in production lines. The growing construction sector further drives demand for heavy-duty wrenches, particularly for HVAC and mechanical installations. Domestic tool manufacturers are introducing quick-adjust and corrosion-resistant wrench designs to cater to export markets and meet international standards. E-commerce platforms strengthen product accessibility, enabling professional and DIY consumers to purchase high-quality tools nationwide.

India is projected to grow at a 5.8% CAGR, driven by increasing demand from automotive repair services, expanding infrastructure, and small-scale industrial units. The surge in two-wheeler and passenger car ownership amplifies the need for maintenance tools, particularly torque and combination wrenches. Domestic tool brands are innovating with ergonomic handle designs and cost-effective material compositions to enhance durability and user comfort. Partnerships between online distributors and hardware chains are improving penetration across tier-two and tier-three cities. The growing DIY trend in urban households also supports retail demand for multi-functional wrench kits.

Germany is expected to post a 5.3% CAGR, fueled by high-precision applications in industrial manufacturing and the automotive sector. Demand for torque-controlled and digitally calibrated wrenches is rising as industries adopt stricter fastening accuracy standards. Manufacturers are introducing sensor-equipped wrenches for real-time torque monitoring in aerospace and automotive assembly lines. Premium hand tool brands are expanding product assortments to cater to both professionals and DIY enthusiasts, emphasizing durability and ergonomic grip technology. Specialty online platforms and industrial supply chains ensure strong availability of premium tool kits for domestic and export markets.

The United Kingdom is forecasted to grow at a 4.4% CAGR, supported by increased adoption of DIY repair tools and automotive maintenance kits. Compact wrench sets with ratcheting and quick-adjust mechanisms are gaining popularity among household users for home repairs. Automotive service centers remain key consumers of torque wrenches for precision engine work. Tool brands are focusing on lightweight alloy-based designs to improve user comfort in confined spaces. E-commerce platforms and hardware chains are expanding promotional offers, boosting consumer accessibility for mid-range and premium-grade wrench assortments.

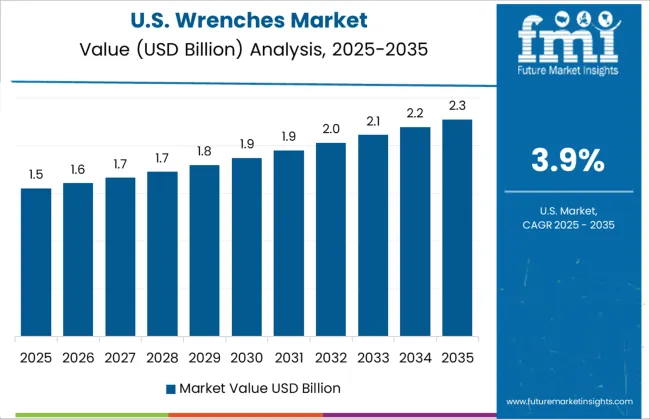

The United States is projected to grow at 3.9% CAGR, driven by strong demand in automotive repair facilities, aerospace manufacturing, and industrial maintenance sectors. Torque wrenches remain critical for aviation and defense applications requiring precise fastening. Automotive workshops continue to adopt digital torque and ratcheting wrenches for modern engine systems. Manufacturers are introducing smart tools with integrated electronic torque feedback systems for improved accuracy. Hardware stores and online platforms are enhancing distribution with bundled tool sets for both professional technicians and DIY enthusiasts, ensuring broad market accessibility.

The wrenches market is highly competitive, featuring globally recognized tool manufacturers such as Stanley Black & Decker, Apex Tool Group, Bahco, Beta, Channellock, Facom, GearWrench, Hazet, Irwin, Klein, Knipex, Mac, Matco, Proto, and Snap-on. Stanley Black & Decker and Snap-on lead the market with extensive product portfolios and strong brand loyalty across professional and industrial segments. Apex Tool Group and GearWrench focus on ergonomically designed wrenches with torque-enhancing features, while Bahco and Beta emphasize precision-engineered hand tools for automotive and maintenance applications.

European brands such as Facom and Hazet are well-regarded for high-quality torque wrenches and specialty tools used in aerospace and heavy industries. Klein and Knipex dominate electrical and specialty wrench segments, offering insulated and multifunctional designs for safety-critical environments. Mac, Matco, and Proto cater primarily to professional mechanics through direct-to-user distribution and service van models, ensuring accessibility and brand engagement. The market is driven by demand from automotive repair, industrial maintenance, construction, and energy sectors, with growing adoption of combination wrenches, adjustable wrenches, and torque-controlled variants. Competitive differentiation hinges on product durability, ergonomic design, precision calibration, and corrosion resistance. High entry barriers exist due to established brand equity and distribution networks of incumbent players.

Strategic initiatives include digital torque wrenches with IoT integration for data logging, lightweight composite materials, and expansion into emerging markets through localized manufacturing. Future growth will be influenced by rising DIY trends, automation-assisted assembly tools, and customization for specific industrial applications.

Manufacturers are also shifting toward lightweight materials and ergonomic designs to reduce operator strain. Modular wrench systems are gaining popularity, allowing customization for specific tasks. Integrated sensors for predictive maintenance and performance monitoring are enhancing reliability, making wrenches more intelligent and adaptable to modern operational requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Product Type | Adjustable wrenches, Box-end wrenches, Open-end wrenches, Socket wrenches, and Torque wrenches |

| Material | Steel wrenches, Aluminum wrenches, and Plastic or composite wrenches |

| Application | Automotive, Industrial, Home improvement, and Construction |

| Distribution channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Stanley Black & Decker, Apex Tool Group, Bahco, Beta, Channellock, Facom, GearWrench, Hazet, Irwin, Klein, Knipex, Mac, Matco, Proto, and Snap-on |

| Additional Attributes | Dollar sales by wrench type (adjustable, combination, torque, ratcheting) and application sector (automotive, industrial maintenance, construction, aerospace), with demand fueled by increased vehicle ownership and global infrastructure development. Regional dynamics indicate strong market share in North America and Europe driven by professional tool usage, while Asia-Pacific sees rapid growth from expanding industrialization. Innovation trends include digital torque monitoring, anti-slip grip designs, and lightweight alloys for improved efficiency and operator comfort. |

The global wrenches market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the wrenches market is projected to reach USD 5.5 billion by 2035.

The wrenches market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in wrenches market are adjustable wrenches, box-end wrenches, open-end wrenches, socket wrenches and torque wrenches.

In terms of material, steel wrenches segment to command 58.2% share in the wrenches market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Pipe Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Lithium Battery Shear Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA