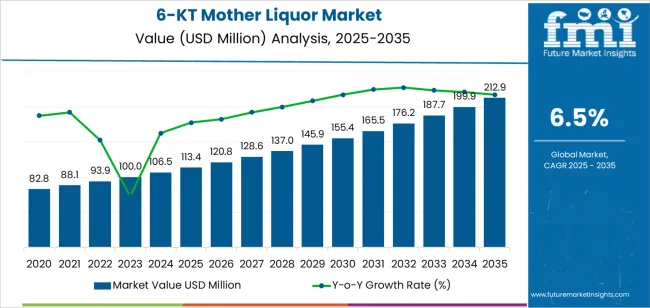

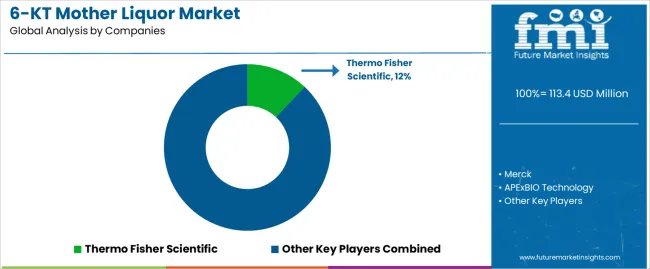

The 6-KT mother liquor market is valued at USD 113.4 million in 2025 and is projected to reach USD 212.9 million by 2035, expanding at a CAGR of 6.5%. The increase of USD 99.5 million reflects growing use of cytokinins in plant growth regulation, tissue culture propagation, and plant developmental biology research. The ≥98% purity grade holds the largest share due to its suitability for routine plant physiology experiments and cost-sensitive agricultural research programs, while higher-purity grades are gaining traction in molecular plant biology and pharmaceutical-aligned biotechnology labs that require tighter batch consistency and analytical documentation.

Scientific research represents the dominant demand segment, driven by expanding academic and institutional plant biology programs, crop improvement research, and the rise of precision tissue culture propagation. Agricultural applications are also increasing as producers adopt regulated growth processes to enhance crop performance, stress tolerance, and propagation efficiency. East Asia leads global demand growth due to strong agricultural research funding and expanding biotechnology capacity in China and India, while Europe and North America maintain steady demand through established research infrastructures. Competitive dynamics favor biochemical suppliers with advanced purification systems, strong documentation practices, and localized distribution capabilities that ensure reagent stability and reliable technical support.

From 2030 to 2035, the market is forecast to grow from USD 189.7 million to USD 212.9 million, adding another USD 426.9 million, which constitutes 84.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of precision agriculture applications requiring advanced plant growth regulators, the development of sustainable farming technologies and biological crop enhancement methods, and the growth of specialized applications for horticultural optimization and tissue culture propagation. The growing adoption of biotechnology approaches and molecular plant science will drive demand for 6-KT mother liquor with enhanced purity specifications and application-specific formulations.

Between 2020 and 2025, the 6-KT mother liquor market experienced steady growth, driven by increasing plant science research standards and growing recognition of 6-KT mother liquor as essential biochemical reagents for enhancing plant development studies and agricultural productivity research across scientific research and agriculture applications. The market developed as plant scientists and agricultural researchers recognized the potential for 6-KT mother liquor technology to regulate plant growth processes, improve tissue culture success rates, and support crop improvement objectives while meeting stringent purity requirements. Technological advancement in purification methods and analytical verification began emphasizing the importance of maintaining chemical purity and biological activity in research and agricultural applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 113.4 million |

| Forecast Value in (2035F) | USD 212.9 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

Market expansion is being supported by the increasing global demand for plant growth regulators driven by agricultural productivity requirements and expanding plant biotechnology research activities, alongside the corresponding need for high-purity biochemical reagents that can enhance experimental reproducibility, enable precise growth regulation, and maintain consistent biological activity across scientific research, agricultural development, and horticultural applications. Research scientists and agricultural researchers are increasingly focused on implementing 6-KT mother liquor solutions that can improve tissue culture outcomes, optimize plant development studies, and provide reliable cytokinin activity in controlled experimental conditions.

The growing emphasis on sustainable agriculture and biotechnology innovation is driving demand for 6-KT mother liquor that can support crop improvement research, enable advanced plant propagation techniques, and ensure comprehensive plant hormone studies. Research institutions' preference for biochemical reagents that combine high purity with documented biological activity and batch consistency is creating opportunities for innovative 6-KT mother liquor implementations. The rising influence of precision agriculture development and molecular plant biology is also contributing to increased adoption of 6-KT mother liquor that can provide superior growth regulation capabilities without compromising experimental validity or agricultural application effectiveness.

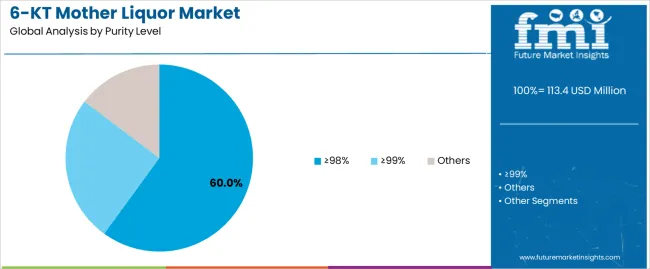

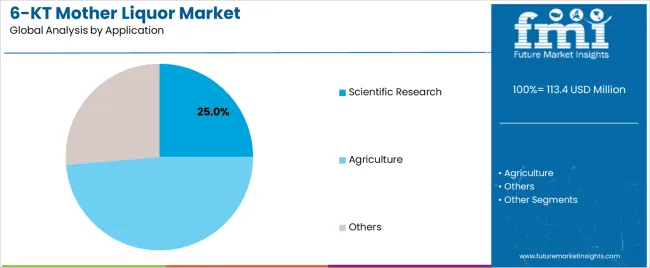

The market is segmented by purity level, application, and region. By purity level, the market is divided into ≥98%, ≥99%, and others. Based on application, the market is categorized into scientific research, agriculture, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

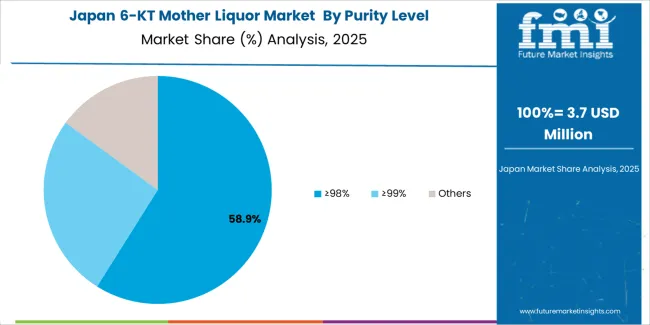

The ≥98% purity level segment is projected to maintain its leading position with 60% market share in the 6-KT mother liquor market in 2025, reaffirming its role as the preferred purity specification for general research applications and cost-effective agricultural studies. Research laboratories and agricultural scientists increasingly utilize ≥98% purity 6-KT mother liquor for its superior cost-performance balance, excellent biological activity characteristics, and proven effectiveness in standard research protocols while maintaining adequate purity for most experimental requirements. The ≥98% purity specification's proven effectiveness and application versatility directly address the industry requirements for accessible research reagents and practical agricultural applications across diverse plant science research environments and crop development programs.

This purity level segment forms the foundation of mainstream plant growth regulator research, as it represents the specification with the greatest contribution to research accessibility and established utilization record across multiple scientific applications and agricultural sectors. Research funding investments in plant science programs continue to strengthen adoption among university laboratories and agricultural research centers. With experimental requirements demanding reliable biological activity and budget considerations, ≥98% purity 6-KT mother liquor aligns with both performance objectives and cost management requirements, making it the central component of comprehensive plant hormone research strategies.

The scientific research application segment is projected to represent the 25% market share of 6-KT mother liquor demand in 2025, underscoring its role as the primary driver for 6-KT mother liquor adoption across plant biology laboratories, agricultural research institutions, and biotechnology research facilities. Research scientists prefer 6-KT mother liquor for scientific studies due to its exceptional growth regulation capabilities, documented biological activity, and ability to support diverse experimental protocols while enabling plant development research and molecular biology studies. Positioned as essential biochemical reagents for plant science research, 6-KT mother liquor offers both experimental reliability advantages and research application benefits.

The segment is supported by continuous innovation in plant biotechnology research and the growing availability of high-purity cytokinin compounds that enable superior experimental outcomes with enhanced reproducibility and expanded research capabilities. Research institutions are investing in comprehensive biochemical reagent programs to support increasingly sophisticated plant biology studies and biotechnology development requirements. As plant science research complexity advances and agricultural biotechnology expands, the scientific research application will continue to dominate the market while supporting advanced cytokinin utilization and plant development research optimization strategies.

The 6-KT mother liquor market is advancing steadily due to increasing demand for plant growth regulators driven by agricultural productivity pressures and growing adoption of plant biotechnology research methodologies that require specialized biochemical compounds providing enhanced growth regulation characteristics and experimental reliability benefits across scientific research, agricultural development, and horticultural applications. However, the market faces challenges, including high production costs for ultra-pure specifications, regulatory constraints regarding agricultural chemical usage and approval processes, and technical requirements related to stability maintenance and proper storage conditions. Innovation in purification technologies and formulation development continues to influence product development and market expansion patterns.

The growing plant biotechnology research sector is driving demand for specialized cytokinin compounds that address research requirements including precise growth regulation, tissue culture optimization, and molecular biology applications for crop improvement studies. Plant science research requires high-purity 6-KT mother liquor configurations that deliver consistent biological activity across experimental protocols while maintaining chemical stability and cost-effectiveness. Research institutions are increasingly recognizing the experimental advantages of 6-KT mother liquor utilization for plant development studies and agricultural innovation, creating opportunities for specialized purity grades specifically developed for advanced biotechnology research applications.

Modern agricultural operations are incorporating precision agriculture technologies and sustainable farming methods to enhance crop productivity, optimize resource utilization, and support comprehensive environmental stewardship objectives through targeted plant growth regulator applications and biological crop enhancement approaches. Leading agricultural companies are developing formulated plant growth regulator products, implementing precision application strategies, and advancing agronomic practices that maximize crop yield and minimize environmental impact. These technologies improve agricultural sustainability while enabling new cultivation opportunities, including controlled environment agriculture, organic farming systems, and resource-efficient crop production. Advanced agricultural integration also allows producers to support comprehensive sustainability objectives and market differentiation beyond traditional farming practices.

The expansion of molecular plant biology research and pharmaceutical development studies is driving demand for ultra-high-purity 6-KT mother liquor with stringent quality specifications and comprehensive analytical documentation. These advanced research applications require specialized reagent grades with purity exceeding standard specifications that enable cutting-edge scientific investigations, creating premium market segments with differentiated value propositions. Manufacturers are investing in advanced purification technologies and quality assurance systems to serve emerging high-precision research applications while supporting innovation in plant molecular biology, drug discovery research, and fundamental cytokinin biochemistry studies.

| Country | CAGR (2025-2035) |

|---|---|

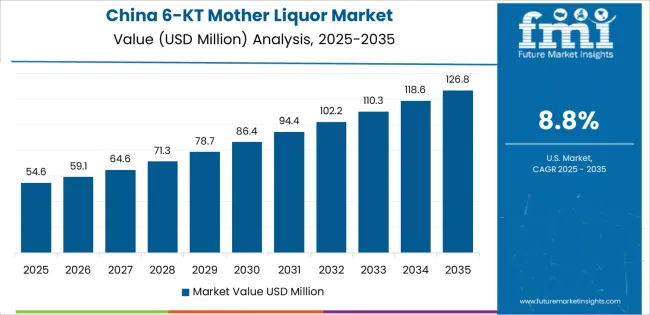

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| Brazil | 6.8% |

| USA | 6.2% |

| UK | 5.5% |

| Japan | 4.9% |

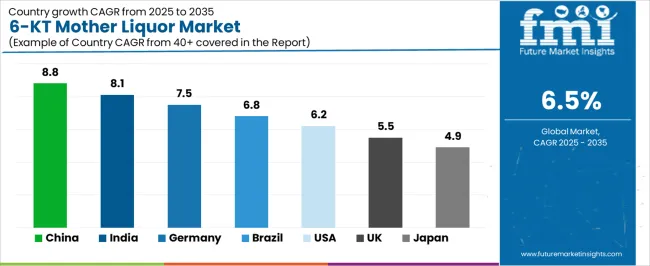

The 6-KT mother liquor market is experiencing solid growth globally, with China leading at an 8.8% CAGR through 2035, driven by expanding agricultural research infrastructure, growing biotechnology sector development, and increasing domestic production of biochemical reagents for plant science applications. India follows at 8.1%, supported by growing agricultural research investments, expanding crop science programs, and rising adoption of plant growth regulators in horticultural development. Germany shows growth at 7.5%, emphasizing plant biotechnology research excellence, agricultural innovation leadership, and high-purity biochemical manufacturing capabilities. Brazil demonstrates 6.8% growth, supported by expanding agricultural research programs, growing crop improvement initiatives, and increasing adoption of biotechnology approaches in tropical agriculture. The United States records 6.2%, focusing on advanced plant biology research, agricultural biotechnology development, and precision agriculture innovation. The United Kingdom exhibits 5.5% growth, emphasizing plant science research and agricultural biotechnology programs. Japan shows 4.9% growth, supported by plant biotechnology research excellence and precision agriculture development.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from 6-KT mother liquor in China is projected to exhibit exceptional growth with a CAGR of 8.8% through 2035, driven by expanding agricultural research infrastructure and rapidly growing biotechnology sector development supported by government agricultural modernization initiatives and scientific research investment programs. The country's massive agricultural research scale and increasing emphasis on domestic biochemical production are creating substantial demand for 6-KT mother liquor solutions. Major biochemical manufacturers and research institutions are establishing comprehensive production and research capabilities to serve both domestic markets and export opportunities.

Revenue from 6-KT mother liquor in India is expanding at a CAGR of 8.1%, supported by growing agricultural research investments, expanding crop science programs, and increasing adoption of plant growth regulators in horticultural development across research and agricultural sectors. The country's developing agricultural research capabilities and crop improvement priorities are driving adoption of advanced biochemical reagents throughout plant science research operations. Leading biochemical suppliers and research institutions are establishing distribution and research collaboration capabilities to address growing domestic demand.

Revenue from 6-KT mother liquor in Germany is expanding at a CAGR of 7.5%, supported by the country's emphasis on plant biotechnology research excellence, agricultural innovation leadership, and advanced biochemical manufacturing capabilities. The nation's plant science research sophistication and chemical industry expertise are driving demand for high-specification 6-KT mother liquor solutions. Leading biochemical manufacturers and research institutions are investing extensively in advanced purification technologies and specialized research applications.

Revenue from 6-KT mother liquor in Brazil is expanding at a CAGR of 6.8%, supported by expanding agricultural research programs, growing crop improvement initiatives, and increasing adoption of biotechnology approaches in tropical agriculture across research and production sectors. The nation's agricultural research priorities and tropical crop expertise are driving demand for plant growth regulator solutions. Agricultural research institutions and biochemical suppliers are investing in research program development and product availability to serve growing demand.

Revenue from 6-KT mother liquor in the United States is expanding at a CAGR of 6.2%, supported by the country's focus on advanced plant biology research, agricultural biotechnology development capabilities, and precision agriculture innovation programs. The nation's comprehensive research infrastructure and agricultural biotechnology leadership are driving demand for high-quality 6-KT mother liquor solutions. Biochemical suppliers and research institutions are investing in product quality enhancement and research support capabilities to serve both academic and commercial markets.

Revenue from 6-KT mother liquor in the United Kingdom is expanding at a CAGR of 5.5%, driven by the country's plant science research programs, agricultural biotechnology development initiatives, and research excellence in crop science. The UK's research institution strength and agricultural innovation focus are driving demand for quality 6-KT mother liquor solutions. Biochemical suppliers and research institutions are establishing comprehensive programs for research reagent provision and scientific collaboration.

Revenue from 6-KT mother liquor in Japan is expanding at a CAGR of 4.9%, supported by the country's plant biotechnology research excellence, precision agriculture development programs, and strong emphasis on quality and reliability in research reagents. Japan's research sophistication and agricultural technology leadership are driving demand for high-specification 6-KT mother liquor products. Research institutions and biochemical companies are investing in specialized capabilities for advanced plant science applications.

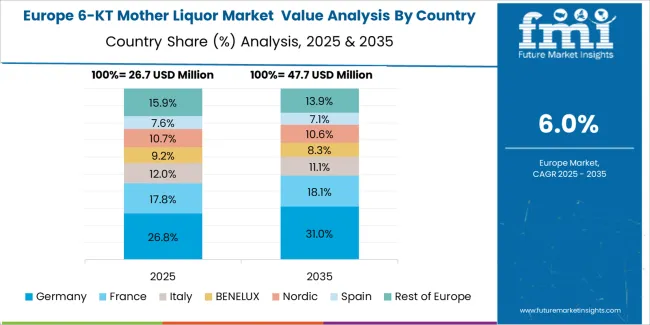

The 6-KT mother liquor market in Europe is projected to grow from USD 25.2 million in 2025 to USD 136.9 million by 2035, registering a CAGR of 6.5% over the forecast period. Germany is expected to maintain leadership with a 28.7% market share in 2025, moderating to 27.9% by 2035, supported by plant biotechnology research excellence, biochemical manufacturing capabilities, and strong agricultural research infrastructure.

The United Kingdom follows with 19.8% in 2025, projected at 19.3% by 2035, driven by plant science research programs, agricultural biotechnology development, and research institution excellence. France holds 16.4% in 2025, reaching 16.8% by 2035 on the back of agricultural research infrastructure and crop science programs. Italy commands 13.6% in 2025, rising slightly to 13.9% by 2035, while Spain accounts for 10.2% in 2025, reaching 10.5% by 2035 aided by horticultural research expansion and agricultural innovation programs. The Netherlands maintains 6.1% in 2025, up to 6.3% by 2035 due to plant biotechnology research and agricultural innovation capabilities. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 5.2% in 2025 and 5.3% by 2035, reflecting steady advancement in plant science research and agricultural biotechnology programs.

The 6-KT mother liquor market is characterized by competition among established biochemical suppliers, specialty chemical manufacturers, and research reagent companies. Companies are investing in purification technology development, quality assurance enhancement, product portfolio expansion, and application technical support to deliver high-purity, reliable, and well-documented 6-KT mother liquor solutions. Innovation in analytical verification methods, stability enhancement technologies, and custom formulation capabilities is central to strengthening market position and competitive advantage.

Thermo Fisher Scientific maintains strong market presence, offering comprehensive biochemical reagent solutions with focus on research applications, quality assurance systems, and global distribution capabilities across life science sectors. Merck provides high-purity chemical products with emphasis on pharmaceutical and research grade specifications, featuring comprehensive quality documentation. APExBIO Technology delivers specialized biochemical compounds focusing on research applications and biological screening. Santa Cruz Biotechnology offers diverse research reagent portfolio with emphasis on life science applications. Gold Biotechnology provides biochemical products for research and industrial applications. Cayman Chemical emphasizes high-purity biochemical standards and research compounds. Carl Roth offers laboratory chemicals and biochemical reagents for research applications. Adooq Bioscience provides specialized biochemical compounds for research purposes.

Additional manufacturers including Tokyo Chemical Industry, Biosynth, Caisson Labs, Biosharp, Yeasen Biotechnology, Beyotime Biotechnology, Shanghai Maokang Biotechnology, Dalian Meilunbio, Beijing Biorigin, and others contribute to market diversity with specialized product offerings serving specific research requirements and regional markets.

6-KT mother liquor represents a specialized biochemical reagent segment within plant science and agricultural applications, projected to grow from USD 113.4 million in 2025 to USD 212.9 million by 2035 at an 6.5% CAGR. These high-purity cytokinin compounds primarily ≥98% and ≥99% purity configurations for research applications serve as critical biochemical tools in plant biology research, agricultural development programs, and tissue culture applications where enhanced growth regulation, experimental reproducibility, and biological activity consistency are essential. Market expansion is driven by increasing plant biotechnology research, growing agricultural productivity requirements, expanding precision agriculture development, and rising demand for plant growth regulators across research, agricultural, and horticultural sectors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 113.4 million |

| Purity Level | ≥98%, ≥99%, Others |

| Application | Scientific Research, Agriculture, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Thermo Fisher Scientific, Merck, APExBIO Technology, Santa Cruz Biotechnology, Gold Biotechnology, Cayman Chemical, Carl Roth, Adooq Bioscience |

| Additional Attributes | Dollar sales by purity level and application category, regional demand trends, competitive landscape, technological advancements in purification methods and quality assurance, stability enhancement development, agricultural application innovation, and research protocol optimization |

The global 6-kt mother liquor market is estimated to be valued at USD 113.4 million in 2025.

The market size for the 6-kt mother liquor market is projected to reach USD 212.9 million by 2035.

The 6-kt mother liquor market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in 6-kt mother liquor market are ≥98%, ≥99% and others.

In terms of application, scientific research segment to command 25.0% share in the 6-kt mother liquor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemotherapy-Induced Nausea And Vomiting Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Chemotherapy Induced Anemia Market Trends and Forecast 2025 to 2035

Chemotherapy-Induced Oral Mucositis Market – Growth & Forecast 2025 to 2035

Chemotherapy-Induced Myelosuppression Treatment Market Growth - Forecast 2025 to 2035

Chemotherapy Induced Thrombocytopenia Market

Liquor Flavored Ice Cream Market Size and Share Forecast Outlook 2025 to 2035

Liquor Confectionery Market Insights - Indulgent Sweets & Alcohol-Infused Treats 2025 to 2035

Liquor Flavored Cigars Market

Glass Liquor Bottle Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Liquor Market Analysis by Segments Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA