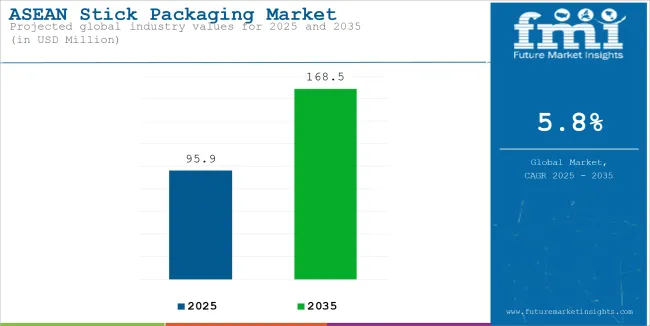

The market of stick packaging size is estimated to be worth USD 95.9 million in 2025 and is anticipated to reach a value of USD 168.5 million by 2035. Sales are projected to rise at a CAGR of 5.8% over the forecast period between 2025 and 2035. The revenue generated by stick packaging in 2024 was USD 91.9 million.

In the ASEAN countries, stick packaging has very high usage in the food and beverages industry. Food and beverage will capture over 62% of the stick packaging market by 2035. The market has evolved now, and it sees people demanding more ease and convenience of serving in single packets.

Therefore, stick packs became popular for instant drinks, snacks, and sauces. Portability and ease facilitated by stick packaging not only comply with consumer needs but also challenge brands to design more innovative shapes that can also add more appeal to the customer experience.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 91.9 million |

| Estimated Size, 2025 | USD 95.9 million |

| Projected Size, 2035 | USD 168.5 million |

| Value-based CAGR (2025 to 2035) | 5.8% |

In the end use segment, stick packaging solutions in food and beverages industry are likely to account for over 62% of the market share over the forecast period. Stick packaging is suitable for maintaining the freshness of products in hot, humid climates by saving almost the entire product like powdered drinks and sauces.

With the sustainability mindset, eco-friendly stick packs are also in their own demand. This green-up phase of packaging adds value to the product and enhances the user experience, making stick packaging all the more favored in ASEAN's burgeoning food and beverage sector.

The market of stick packaging will grow with profitable prospects in the forecast period, as it is expected to offer an incremental opportunity of USD 76.7 million and will increase 1.8 times the existing value by 2035.

Urbanization and Lifestyle Changes boost market growth

The pace at which urbanization in ASEAN nations changes consumer behavior has increased among individuals living life on the go, mainly in towns such as Bangkok, Jakarta, and Manila, so that one will find products, especially sticky packaged ones to meet the demanding lives of businesspeople, students, and commuters in this regard, providing a way of easy on-the-go access with no nuisance associated with stick packaging.

Modern retail formats, such as convenience stores, vending machines, and kiosks, have helped to fuel the demand for stick packs, as such formats meet the requirements of the urban consumer. Further, "grab-and-go" food and beverage is a fast-growing trend, and stick packaging is well suited to this trend. From single-serve coffee to powdered drinks or snacks, convenience, as well as reduced waste, will always help to match up with the urban populace in ASEAN.

Expanding Food and Beverage Industry Pushes the Market Growth

Consumers increasingly seek convenient options, such as instant coffee, tea mixes, powdered soups, and sauces for which stick packaging is ideal. Its single-serving portions reduce waste and maintain freshness, which is especially crucial in ASEAN's hot and humid climate. Stick packaging is also well-suited to the region's preference for portion-controlled and ready-to-eat products.

Moreover, health-aware consumers are stimulating demand for stick-packed supplements and snacks, given the increasing interest of consumers in trends towards fitness and wellness. Thus, with a food and beverage sector that stands out as an engine of growth for ASEAN economies, innovations such as stick packaging play important roles in responding to the manufacturing and consumer imperatives.

The Price Sensitivity of Consumers in ASEAN May Restrict the Market Growth

Hurdles in the case of stick packaging for ASEAN markets is that of price sensitivity on the part of the consumer. Consumers in countries like Indonesia, Vietnam, and the Philippines are particularly price-sensitive, making it harder to sell the stick-packaged format at higher costs due to more advanced materials and manufacturing processes used in producing such packaging formats.

In rural areas, consumers tend to buy in bulk due to low purchasing power. The manufacturer will have to find a way to balance between cost and profitability, which can be a limitation to the market penetration of stick packaging. Cheap alternatives may appeal to price-conscious buyers, and the growth of stick packaging may be slowed down in regions where cost is the most important consideration for purchases.

The ASEAN market of stick packaging recorded a CAGR of 4.2% during the historical period between 2020 and 2024. Market growth of stick packaging was positive as it reached a value of USD 91.9 million in 2024 from USD 77.4 million in 2020.

The market of stick packaging was witnessing steady growth between 2020 and 2024 due to the continuously increasing consumer demand for online shopping. Online shopping increases requirements for compact and easy-to-ship food and beverage, as well as medical care, packaging; hence, the best answer is lightweight, space-saving sticks. Furthermore, rapid urbanization in ASEAN countries brings about lifestyles that increasingly have to be adapted to on-the-go living, in which convenient single-serve options fit well into everyday routines.

In the assessment period, ASEAN demand for stick packaging is expected to grow strongly. The drivers for this are mainly growth of food and beverages industry, rapid growth of E-commerce and online retail and growing interest in Sustainable and Eco-friendly Solutions

Tier 1 companies comprise market leaders with significant market share in ASEAN market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Thai Plastic Pack Co., Ltd., PT. Pura Barutama, Jindasiam Packaging Co., Ltd., Asia Packaging Solutions

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide ASEAN reach. Prominent companies in tier 2 include Sunpack corporation, PT. Packindo, InnoPack, Tetra Pak Philippines

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

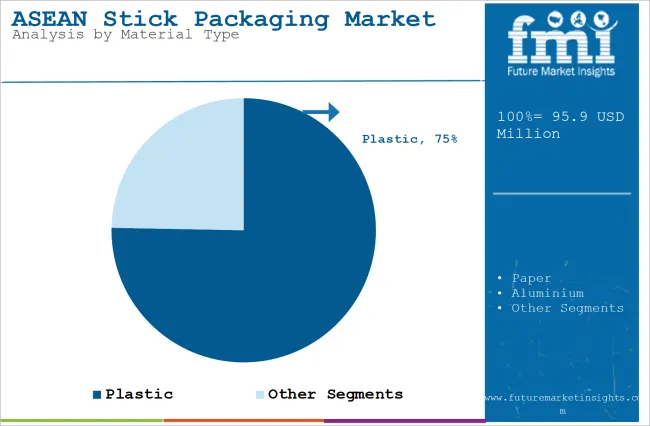

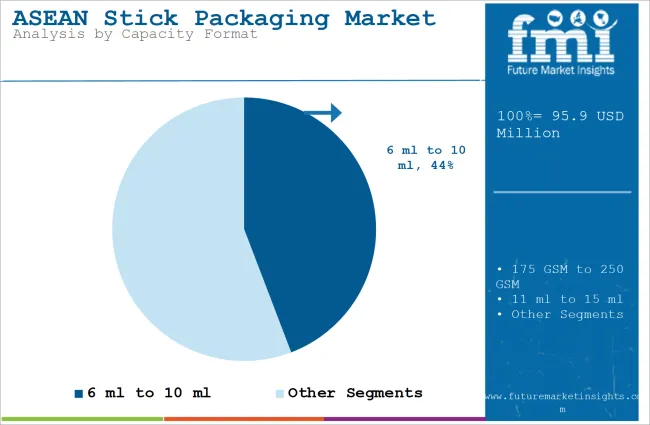

The section contains information about the leading segments in the industry. In terms of material type, plastic is estimated to account for a share of 75.3% by 2035. By capacity formats, 6 ml to 10 ml are projected to dominate by holding a share of 44.2% by the end 2035.

| Material Type | Market Share (2035) |

|---|---|

| Plastic | 75.3% |

Plastic, as a packaging material, provides a perfect option for the demand for convenience products, such as snacks, beverages, and sauces. Plastic stick packs are light, easy to handle, and help maintain the freshness of the product vital aspect, considering the hot and humid climate of ASEAN countries.

In addition, plastic is flexible in size, design, and color, depending on the type of product and branding of the product, and it still remains the main material used by most companies as it is affordable and widely available within the region despite the growing knowledge of sustainability.

| Capacity Format | Market Share (2035) |

|---|---|

| 6 ml to 10 ml | 44.2% |

In the ASEAN region, the 6 ml to 10 ml capacity segment makes up the largest share of the market in stick packaging. This range is popular for a wide variety of products, such as single-serving beverages, sauces, instant coffee, and snacks. It is the perfect blend of size with convenience for consumers who are on-the-go.

This capacity is perfect for daily consumption and is widely utilized in ready-to-drink products and powdered beverages, which are frequently consumed throughout ASEAN. The driving factor behind this consumption of smaller, portable sizes is the busy lifestyle and preference for convenient, single-serve products. Hence, this remains the favorite capacity both among the manufacturers as well as among the consumers in the region, mainly between 6 ml and 10 ml.

Key players of stick packaging industry are developing and launching new products in the market. They are integrating with different firms and extending their geographical presence. Few of them are also collaborating and partnering with local brands and start-up companies for new product development.

Key Developments in Stick Packaging Market

In terms of material, the stick packaging industry is divided into plastic, paper, aluminum, Others

In terms of capacity, the stick packaging industry is segmented into up to 5 ml, 6 ml to 10 ml, 11 ml to 15 ml, above 15 ml

The stick packaging market includes solid, powder, liquid

Some of end users in the stick packaging include food and beverage, pharmaceutical and nutraceuticals, personal care and cosmetics and other industrial

Key countries of Indonesia, Thailand, Malaysia, Philippines, Vietnam, Myanmar, Singapore, rest of ASEAN are covered.

The stick packaging industry is projected to witness CAGR of 5.8% between 2025 and 2035.

The ASEAN stick packaging industry stood at USD 91.9 million in 2024.

ASEAN stick packaging industry is anticipated to reach USD 168.5 million by 2035 end.

The key players operating in the stick packaging industry are Thai Plastic Pack Co., Ltd. , PT. Pura Barutama, Jindasiam Packaging Co., Ltd., Asia Packaging Solutions

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stick Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Stick Packaging Solutions

Stick Pack Packaging Machine Market

ASEAN Sachet Packaging Market Analysis – Size, Share & Forecast 2025-2035

USA Stick Packaging Market Analysis – Growth, Trends & Forecast 2025-2035

Japan Stick Packaging Market Insights – Size, Demand & Trends 2025-2035

Germany Stick Packaging Market Analysis – Demand, Size & Growth Forecast 2025-2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

MEA Stick Packaging Machines Market Growth – Trends & Forecast 2023-2033

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA