The stick packaging market is being shaped by the demand for convenient, portable, and sustainable solutions, with innovation and consumer-centric design being prioritized by leading companies such as Amcor, Huhtamaki, and Constantia Flexibles. Advanced materials and formats are being developed to serve the food & beverages, pharmaceuticals, and personal care industries, ensuring both functionality and eco-consciousness are addressed. Through the use of recyclable films and lightweight laminates, improved usability and regulatory alignment are being achieved across key sectors.

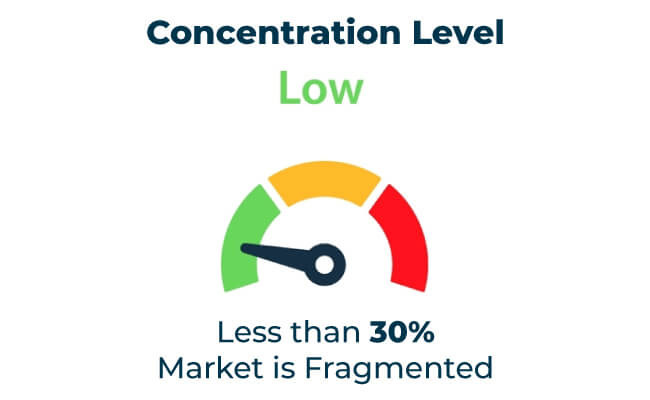

A moderate level of market concentration—where approximately 27% of the share is held by top-tier players—has been observed, suggesting a competitive yet stable landscape. High-performance materials and branding enhancements are being introduced by Tier 1 companies, while Tier 2 and Tier 3 players are being relied upon to meet localized needs and deliver cost-efficient solutions. Rapid growth is being witnessed in the plastic stick segment, driven by increased consumer preference for hygienic, single-use, and on-the-go packaging.

Shelf life and visual appeal are being extended through the adoption of advanced printing and barrier technologies. Regulatory and sustainability objectives are being met through strategic partnerships formed between converters and end-use industries, often with pricing competitiveness being maintained. Continued leadership is being demonstrated by Amcor, Huhtamaki, and Constantia Flexibles through advancements in material science and environmental stewardship, while regional manufacturers are ensuring agility and innovation at the grassroots level. This multi-tiered structure is ensuring that the stick packaging market remains resilient, responsive, and positioned for long-term advancement.

Global Market Share & Industry Share (%), 2025E

| Category | Industry Share (%) |

|---|---|

| Top 3 (Amcor, Huhtamaki, Proampac LLC) | 15% |

| Rest of Top 5 (Sonoco, Constantia Flexibles) | 7% |

| Next 5 of Top 10 (Uflex, Glenroy Inc, Catalent Inc, HWR Packaging LLC, Berry Global) | 5% |

Type of Player & Industry Share (%), 2025E

| Type of Player | Industry Share (%) |

|---|---|

| Top 10 | 27% |

| Next 20 | 20% |

| Rest | 53% |

Year-over-Year Leaders

Light Weight and Eco Friendly Materials

Bio-plastics, recyclable films, and paper-based laminates are the most widely used materials in stick packaging. The products fit the international goals for sustainability.

Customization and Design Innovations

Advanced printing technologies enable high-quality designs that cater to customization preferences. This gives better and enhanced brand awareness and consumer attention.

Smart Packaging Integration

Smart stick packaging solutions equipped with QR codes and track-and-trace features are gaining popularity, offering enhanced functionality and transparency.

It has changed industry faces with its carbon-neutral manufacturing and circular economy business model. Sturdy research is being pursued into material sciences using products, like plant-based plastic and recycling-friendly mono-material, which do wonders in markets.

Some trending sustainability phenomena

Regional Compliance

E-commerce and international trade have also generated further export growth opportunity. The product with the scope for export growth are lightweight and cheaper stick packs. High-growth locations for export-oriented manufacturers include the Middle East & Africa and South America, where the demand for single-serve products is growing.

Future of stick packaging will emerge based on material innovations, efficiency of the supply chain, and acceptability of digital technologies. Organizations that align themselves with these new directions will actually frame the shape of the future for the industry and take up the race to the most environmentally friendly packaging solutions.

| Tier | Key Companies |

|---|---|

| Tier 1 | Amcor, Huhtamaki, Constantia Flexibles |

| Tier 2 | Glenroy, Mondi Group |

| Tier 3 | UFlex, ProAmpac |

The stick packaging market is all set to be transformed as consumers continue to look for sustainable, convenient, and customizable solutions. Companies investing in eco-friendly materials, technological innovation, and regional expansion will lead the evolution of the market.

Key Definitions and Terminology

Research Methodology

The primary research involved a combination of primary interviews, secondary data analysis, and industry-specific modelling. The data was cross-validated with market experts and industry stakeholders to validate the accuracy and relevance of the data.

Scope of Market Definition

The scope of the market for stick packaging includes flexible, single-serve packaging solutions, which are derived from plastic, paper, and bio-based materials. Non-flexible and bulk packaging formats are excluded from the scope.

The global stick packaging market is projected to witness a CAGR of 4.6% between 2025 and 2035

The global stick packaging market is expected to reach USD 2.3 Billion by 2035

The share of top 10 players is 27% in the global stick packaging market.

Amcor Plc, Huthamaki and Proampac LLC are few of the leading manufacturers of stick packaging

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stick Packaging Market Size and Share Forecast Outlook 2025 to 2035

Stick Pack Packaging Machine Market

Lipstick Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Lipstick Market

USA Stick Packaging Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Stick Packaging Market Report – Trends & Innovations 2025-2035

Japan Stick Packaging Market Insights – Size, Demand & Trends 2025-2035

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

Ampoule Sticker Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Ampoule Sticker Labeling Machine Suppliers

Germany Stick Packaging Market Analysis – Demand, Size & Growth Forecast 2025-2035

Twist Up Stick Container Market Size and Share Forecast Outlook 2025 to 2035

Portable Stick Market Analysis - Trends & Forecast 2025 to 2035

Deodorant Stick Market – Trends, Growth & Forecast 2025 to 2035

Custom Lipstick Shade Market Growth – Demand & Forecast 2024-2034

Eye Shadow Stick Market Analysis - Size, Share, and Forecast 2025 to 2035

3D-Printed Stickers & Labels Market Growth – Trends & Forecast 2024-2034

Key Companies & Market Share in the Eye Shadow Stick Sector

Market Share Breakdown of 3D-Printed Stickers & Labels Manufacturers

pH Based Lipstick Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA